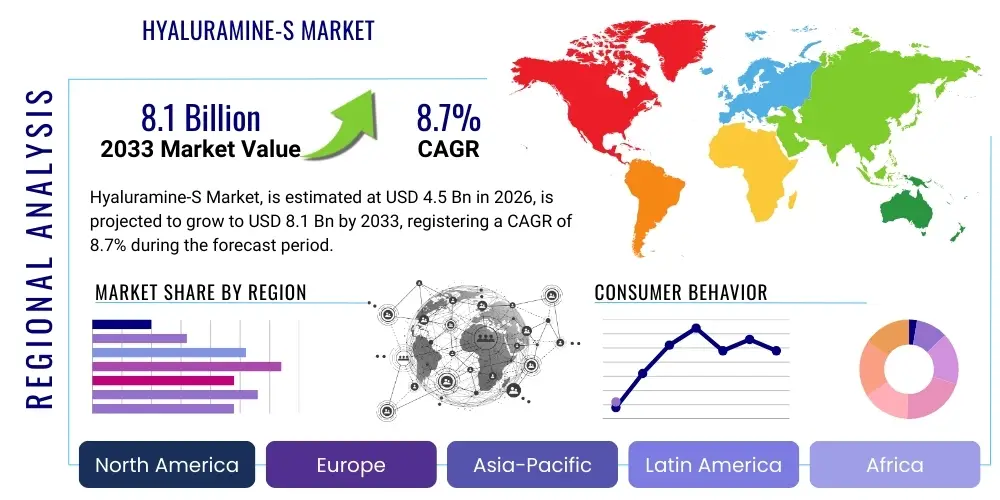

Hyaluramine-S Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434346 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hyaluramine-S Market Size

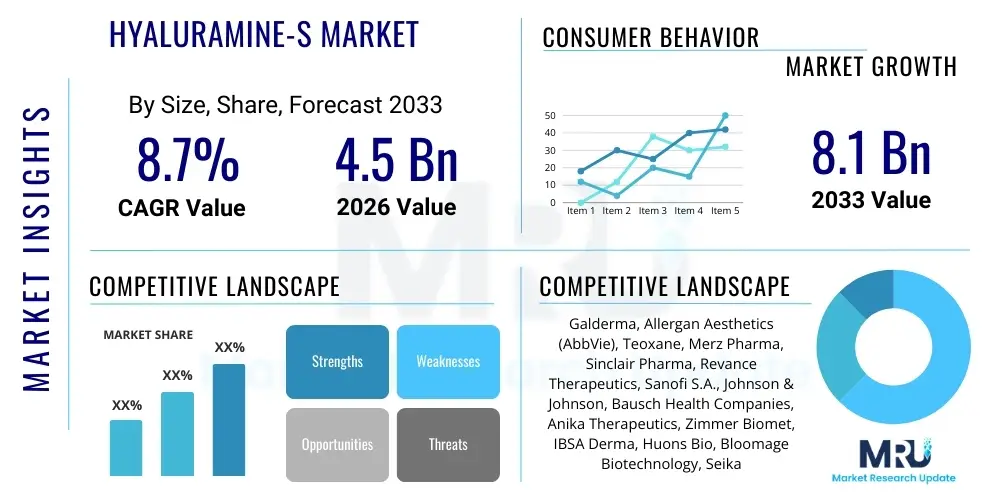

The Hyaluramine-S Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Hyaluramine-S Market introduction

Hyaluramine-S represents a cutting-edge, synthetically modified derivative of hyaluronic acid, chemically engineered for enhanced molecular stability, improved bioavailability, and targeted therapeutic efficacy across multiple clinical disciplines, especially within advanced cosmetic procedures and regenerative medicine. This novel compound leverages the inherent viscoelastic and exceptional moisture retention properties characteristic of traditional high molecular weight hyaluronates while integrating specific, proprietary amine modifications into its polymer backbone. These structural alterations are fundamentally designed to confer superior resistance to enzymatic degradation by hyaluronidase present in human tissues, thereby facilitating significantly extended retention times in biological matrices and ensuring prolonged therapeutic action. The primary functional applications of Hyaluramine-S revolve around deep tissue hydration, potent modulation of localized inflammatory responses, and acting as a structurally robust, biocompatible scaffold essential for guiding cellular proliferation and tissue repair processes. This makes Hyaluramine-S an invaluable and versatile component in specialized dermatological, orthopedic, and even ophthalmic applications, setting it apart as a premium ingredient compared to less stable, traditional hyaluronates and driving substantial adoption across global high-value end-use sectors.

The product's advanced profile yields intrinsic benefits that are critically fueling its rapid market penetration. These benefits include a remarkably reduced immune response due to its high purity and proprietary modification, superior mechanical integration into soft tissues and joint spaces, and the ability to be formulated into gels with highly precise rheological properties, such as specific viscoelasticity (G Prime) and cohesivity, essential for complex aesthetic contouring. Major applications span several high-growth sectors, primarily focusing on long-lasting dermal fillers for non-surgical facial rejuvenation, highly effective viscoelastic supplements for treating joint lubrication deficiencies associated with severe osteoarthritis, and advanced matrices for complex chronic wound healing where sustained hydration and scaffold support are paramount. The superior stability under shear stress during injection and its longer degradation half-life allow for durable and aesthetically pleasing dermal augmentation outcomes that satisfy the demanding expectations of both practitioners and patients globally, reinforcing its position as a market leader in aesthetic biomaterials.

The primary driving factors propelling the robust expansion of the Hyaluramine-S market include the continuous and steep growth of the global geriatric population, which directly translates into an amplified necessity for effective, long-term joint health solutions and highly effective anti-aging treatments across all major economies. Furthermore, substantial advancements in biotechnology and chemical synthesis techniques have enabled the development of cost-effective, large-scale production methods for high-grade, structurally consistent Hyaluramine-S, overcoming previous production bottlenecks. The pervasive consumer preference shift globally towards minimally invasive cosmetic procedures over traditional, surgically intensive interventions heavily favors products based on advanced, low-risk injectable fillers like Hyaluramine-S. Supportive regulatory approvals that facilitate the introduction of new applications and the continuous, aggressive investment in translational R&D by leading pharmaceutical and cosmetic companies to explore novel, next-generation formulations incorporating this complex compound further solidify its dominant market position and guarantee sustained demand growth throughout the comprehensive forecast period, extending from 2026 to 2033.

Hyaluramine-S Market Executive Summary

The global Hyaluramine-S market is currently experiencing a period of accelerated, dynamic growth fundamentally driven by unprecedented technological breakthroughs in aesthetic medicine and an intensified need for durable, targeted orthopedic applications. Business trends are strategically centered around vertical integration and the formation of sophisticated global alliances, characterized by essential strategic partnerships between highly specialized material producers—often those holding proprietary synthesis IP—and globally dominant pharmaceutical distributors to establish and guarantee efficient, resilient, and compliant global supply chain operations. Market dynamics are exceptionally sensitive to the premium pricing structure inherently associated with ensuring ultra-high purity levels and the necessity of safeguarding complex intellectual property protecting specific, regulatory-approved synthesis routes. This high barrier to entry results in intense, focused competition primarily among a select cohort of global key players who have successfully established proprietary manufacturing expertise and command significant, differentiated market share, necessitating continuous defensive investment in IP protection and clinical validation studies.

A critical examination of regional trends unequivocally indicates that North America and Western Europe presently hold a collective commanding lead in both consumption volume and market value. This dominance is attributed to a confluence of factors, including high average disposable incomes, sophisticated consumer bases that readily adopt premium products, and mature, established regulatory frameworks that efficiently support the market entry and adoption of advanced medical devices and procedures. Conversely, the Asia Pacific (APAC) region is strategically positioned to register the most pronounced and rapid market expansion throughout the forecast period. This rapid acceleration is substantially fueled by exponential growth in medical tourism, widespread increasing awareness regarding the proven clinical efficacy of advanced injectable treatments, significant expansion of the middle class capable of affording these premium treatments, and an acute, surging demand for effective joint health supplements among the rapidly aging regional populations, compelling strategic investment in localized, scalable manufacturing and highly efficient distribution infrastructure to capture these burgeoning opportunities effectively.

Analyzing segmentation trends reveals that the Pharmaceutical Grade segment, specifically the category dedicated to viscosupplementation for managing chronic joint conditions, maintains the preeminent position in terms of overall market share. This is largely due to the necessity, repetitive nature, and high volume required for treating the pervasive geriatric population afflicted by osteoarthritis globally. Nevertheless, the Cosmetic Grade segment is confidently projected to achieve the highest Compound Annual Growth Rate (CAGR) over the entire forecast horizon, propelled by the aggressively expanding base of younger consumers proactively opting for preventative and corrective non-surgical dermal treatments. Furthermore, the segmentation by synthesis method demonstrates a clear industry transition and preference towards advanced bio-fermentation methods over traditional chemical synthesis, primarily attributable to the consistently higher yield, superior molecular purity, enhanced consistency, and considerably reduced environmental footprint inherent to biotechnological production processes. This transition profoundly impacts the operational strategies, capital expenditure planning, and long-term sustainability goals across the entire manufacturing value chain globally.

AI Impact Analysis on Hyaluramine-S Market

Common user questions regarding the intersection of Artificial Intelligence (AI) and the Hyaluramine-S market frequently center on how AI can fundamentally accelerate the complex processes of novel derivative discovery, significantly optimize industrial production yield, and meticulously personalize treatment protocols in highly demanding clinical settings. Users are keen to understand the technical feasibility of using sophisticated machine learning and generative design algorithms to accurately predict the long-term viscoelastic stability, biocompatibility, and immunogenicity of novel Hyaluramine-S formulations long before committing to prohibitively costly and lengthy traditional clinical trials. Furthermore, there is substantial interest in the deployment of advanced AI-driven diagnostic and imaging tools that can accurately and rapidly identify the ideal patient candidates who would derive the maximum clinical benefit from Hyaluramine-S-based treatments, particularly in chronic, complex conditions such as severe osteoarthritis or profound dermal atrophy. This focus ensures optimal dosage precision, minimizes procedural risks, and drastically improves overall treatment efficacy and patient satisfaction scores. The general consensus and expectation across the industry is that AI integration will fundamentally streamline R&D cycles, dramatically lowering the financial cost of pharmaceutical innovation, and ultimately enabling truly personalized medicine by finely tailoring product specifications, such as gel density and injection volume, to individual patient biometrics, thereby transforming the precision, accessibility, and economic viability of advanced medical aesthetics and therapeutics worldwide.

- AI accelerates R&D timelines for novel Hyaluramine-S derivatives by simulating molecular docking and predicting stability profiles under various physiological conditions.

- Machine learning algorithms optimize complex bio-fermentation parameters in real-time, enhancing production yield and reducing batch-to-batch variability, ensuring consistent high-purity supply.

- Predictive analytics aids specialized dermatologists in customizing filler injection depths, volume distribution, and product choice, significantly improving aesthetic outcomes and procedural repeatability.

- AI-powered medical imaging and diagnostic tools improve the clinical selection criteria for orthopedic patients receiving viscosupplementation, maximizing therapeutic success rates and minimizing waste.

- Natural Language Processing (NLP) is strategically utilized for the rapid and comprehensive analysis of vast amounts of clinical trial data and crucial post-market surveillance concerning rare adverse events and efficacy trends.

- Integration of robotics and advanced AI-vision systems throughout the manufacturing process ensures stringent quality control, ultra-precise filling, and automated, sterile handling of sensitive pharmaceutical-grade Hyaluramine-S materials.

- Generative AI assists in designing optimized cross-linking chemistries, predicting the exact degradation kinetics required for next-generation, longer-lasting Hyaluramine-S formulations.

DRO & Impact Forces Of Hyaluramine-S Market

The Hyaluramine-S market is meticulously defined by a complex and dynamic interplay between highly compelling market drivers and several stringent operational restraints, with significant high-value opportunities continuously emerging from accelerated technological advancements and unmet clinical needs. The primary structural drivers include the inexorable expansion of the geriatric population globally, necessitating robust orthopedic solutions; the increasing worldwide acceptance and normalization of minimally invasive aesthetic injectable procedures; and continuous, aggressive investment in translational R&D which yields formulations with demonstrably superior product efficacy and extended duration of effect. However, the market encounters substantial limiting constraints, notably the extremely high manufacturing cost associated with maintaining pharmaceutical-grade purity, the absolute necessity for specialized and certified training for all practitioners administering these complex injectable treatments, and the substantial potential for varying, complex regulatory hurdles in new geographic markets, which can severely delay product introduction, restrict marketing claims, and impede rapid market penetration.

Key strategic opportunities for future growth are predominantly centered around the continuous development of next-generation, highly specialized cross-linked formulations that are engineered to offer even longer-lasting results and to facilitate entirely new applications well beyond the current scope of cosmetic and orthopedic uses. Potential high-growth areas include the strategic integration of Hyaluramine-S into advanced ophthalmic surgery procedures, its application in targeted oncology treatments leveraging its unique biocompatibility and functional drug-carrying potential, and its use in advanced wound care bio-dressings. The overarching impact forces acting upon this specialized market—including the threat of substitution, the inherent power of suppliers, the aggregated power of buyers, and the intensity of competitive rivalry—range from moderate to persistently high. Supplier power is particularly significant given the complexity and exclusivity of synthesizing regulatory-compliant, high-purity Hyaluramine-S, effectively limiting the available pool of qualified raw material suppliers and precursor chemical manufacturers globally, demanding vertically integrated supply solutions.

Buyer power is inherently diversified across the value chain; it remains strong among large, consolidated hospital procurement groups and major international distribution conglomerates, but it is typically diluted and segmented at the level of the individual clinic or aesthetic practitioner, which helps maintain relatively stable premium pricing across the distribution channel. Crucially, the threat of substitution is presently assessed as relatively low, as Hyaluramine-S offers highly distinct and superior performance advantages—particularly concerning its specialized amine modification that drastically enhances biological retention and mechanical integration—over traditional standard hyaluronic acid fillers or alternative non-hyaluronate dermal fillers like Poly-L-lactic acid or calcium hydroxylapatite. However, intense, focused competitive rivalry exists persistently among the small group of established key players who are relentlessly innovating to improve formulation rheology, extend longevity, and minimize the risk of inflammatory reactions. Successfully navigating these potent impact forces requires continuous, substantial investment in developing proprietary synthesis technology, securing extensive intellectual property rights, and generating robust, differentiated clinical data to establish clear market differentiation, uphold high barriers to entry, and secure long-term market dominance and sustainable profitability.

Segmentation Analysis

The Hyaluramine-S market is rigorously segmented based on crucial determinants including product grade, specific application area, and the method utilized for synthesis, which accurately reflects the diverse technical requirements of various end-users and the underlying complexity of the high-purity manufacturing processes. The segmentation by Product Grade is paramount, as it strictly dictates the mandatory purity and sterilization levels required, thereby determining the final intended application, clearly distinguishing between ultra-high pharmaceutical-grade material (reserved for therapeutic and orthopedic use) and highly refined cosmetic-grade material (utilized exclusively for aesthetic enhancement procedures). Application segmentation highlights the specific primary revenue streams currently generated from high-volume dermal fillers, essential viscosupplementation treatments, and specialized high-tech drug delivery systems, with each category governed by unique regulatory pathways and distinct market growth dynamics.

- By Product Grade:

- Cosmetic Grade (Aesthetics, Facial Contouring, Lip Enhancement, Anti-aging Creams and Serums)

- Pharmaceutical Grade (Therapeutics, Viscosupplementation in Orthopedics, Advanced Ophthalmic Solutions, Surgical Adhesion Barriers)

- By Application:

- Dermal Fillers and Augmentation (Mid-face Volume Restoration, Wrinkle Correction, Hand Rejuvenation)

- Viscosupplementation (Treatment of Knee, Hip, and Shoulder Osteoarthritis)

- Drug Delivery Systems (Localized and Controlled Release of Small Molecule Drugs or Biologics)

- Tissue Engineering and Regenerative Medicine (Scaffolds for Cartilage and Bone Repair)

- Advanced Wound Care and Healing Matrices

- By Synthesis Method:

- Bio-Fermentation (High Purity, Biologically Derived, Highly Scalable)

- Chemical Synthesis (Synthetic Modifications, Potential for Novel Structures)

- By End User:

- Hospitals and Specialized Clinics (Orthopedic and Dermatology Departments)

- Cosmetic Surgery Centers and Med Spas (Independent Aesthetic Practices)

- Research and Academic Institutions (Basic and Applied Research)

- Pharmaceutical and Biotechnology Companies (Bulk Material Purchasers for Formulation)

Value Chain Analysis For Hyaluramine-S Market

The comprehensive value chain for Hyaluramine-S is defined by a sequence of highly specialized, technology-intensive stages, commencing with complex upstream activities that involve the secure sourcing of highly specialized raw materials, primarily high-yield microbial strains or specific, rare chemical precursors necessary for the proprietary amine modification process. Upstream analysis critically focuses on the stringent control of proprietary technology employed for the bio-fermentation or advanced chemical synthesis of the complex Hyaluramine-S molecule, which mandates significant, ongoing capital investment in certified, highly controlled cleanroom manufacturing environments and adherence to extraordinarily rigorous quality assurance protocols (GMP) to consistently achieve globally recognized pharmaceutical-grade standards. Key suppliers operating in this foundational stage possess considerable economic leverage due to the limited, specialized availability of regulatory-approved, consistently high-purity source materials and the specialized intellectual property that strictly governs the optimal synthesis and purification pathways, making secure, efficient raw material procurement and long-term supply contracts absolutely vital for all downstream manufacturers.

Midstream activities encompass the complex processes of refinement, multi-stage purification, controlled cross-linking, stabilization, and the final aseptic filling of the finished injectable product. These sensitive steps are frequently executed either by highly specialized Contract Development and Manufacturing Organizations (CDMOs) possessing unique expertise in biomaterials, or by large, globally integrated pharmaceutical firms that leverage their internal production capacity. The subsequent distribution channel is strategically bifurcated into two primary routes: direct and indirect. Direct distribution involves major pharmaceutical and biotechnology companies supplying their products straight to large national hospital networks, specialized orthopedic centers, or high-volume aesthetic chains under highly controlled, long-term procurement agreements. Conversely, indirect distribution heavily relies on regional medical distributors and specialized supply wholesalers who manage the complex logistics, specialized cold storage requirements, and inventory management for a large network of smaller clinics, independent aesthetic centers, and retail pharmacies, ensuring broad geographical reach.

The sophisticated complexity of cold chain management, often mandatory for maintaining the molecular integrity of certain injectable Hyaluramine-S formulations, adds substantial logistical costs and organizational challenges to both the direct and indirect distribution channels, requiring highly reliable, certified, and technologically advanced transportation partners. Downstream analysis focuses intently on the actual end-user environment, primarily encompassing hospitals, highly specialized orthopedic clinics, and established cosmetic surgery centers where the product is professionally administered. Marketing campaigns are fundamentally technical and clinical in nature, targeting highly trained medical professionals who serve as critical Key Opinion Leaders (KOLs) and who significantly influence purchasing decisions. The final consumption stage is characterized by high service intensity and procedural skill, where the precise quality of the administering practitioner’s technique profoundly impacts the clinical and aesthetic outcome, thereby underscoring the absolute importance of providing comprehensive, certified professional training and high-quality product support materials by the manufacturing companies. The overall operational efficiency and safety of the entire Hyaluramine-S value chain depend critically on maintaining relentless, rigorous quality control at every single touchpoint, from the initial precursor sourcing to the final patient injection, due to the high-value, sensitive, and implanted nature of the product, thereby securing sustained profitability across the market ecosystem.

Hyaluramine-S Market Potential Customers

The primary potential customers and institutional buyers for Hyaluramine-S are highly diversified yet consistently fall within the premium segments of the medical and cosmetic sectors that place uncompromising priority on demonstrated efficacy, absolute safety, and the long-term longevity of treatment results. In the specialized therapeutic domain, the major high-volume buyers encompass large regional and national hospital groups, dedicated orthopedic surgery clinics specializing in degenerative joint conditions, and advanced sports medicine facilities that urgently require superior, durable viscosupplementation agents for effective joint restoration and cushioning against chronic wear. These sophisticated institutional buyers base their procurement decisions primarily on robust clinical evidence, eligibility for standard health insurance reimbursement, and their capacity for leveraging significant bulk purchasing power, consistently demanding rigorous, multi-year data that irrefutably supports the compound’s long-term effectiveness in managing complex chronic conditions such as moderate to severe osteoarthritis and post-trauma joint degeneration.

Within the lucrative aesthetic segment, the essential end-users are certified cosmetic dermatologists, board-certified plastic surgeons, and high-end medical spas (Med Spas) that cater to affluent clients seeking non-surgical enhancements. These professional providers purchase Hyaluramine-S predominantly in its cross-linked dermal filler formulation, specifically seeking products that offer exceptional and predictable viscoelasticity, seamless integration into delicate soft tissue structures, and markedly prolonged duration of correction compared to first-generation conventional fillers. Consumer demand driving this sector is largely motivated by the pervasive desire for subtle, highly natural-looking facial rejuvenation, structural correction, and the strong preference for non-surgical alternatives, thereby making high-performance, predictable fillers absolutely essential for maintaining competitive advantage. The purchasing decisions of these aesthetic professionals are profoundly influenced by established brand reputation, validated peer recommendations, and the comprehensive manufacturer support provided through advanced clinical training modules and high-quality patient education marketing collateral, emphasizing the unique selling points of premium quality and superior, long-lasting aesthetic outcomes.

Furthermore, major biotechnology corporations and established pharmaceutical firms represent an increasingly crucial and rapidly expanding customer segment. These entities utilize pharmaceutical-grade Hyaluramine-S as an essential structural or functional component in formulating advanced, proprietary drug delivery systems, particularly those targeting localized, sustained drug release within highly specific joint cavities or tissues, and also in the bio-fabrication of sophisticated tissue engineering constructs and bio-scaffolds. These high-level customers necessitate the procurement of Hyaluramine-S in bulk quantities, strictly compliant with rigorous global Good Manufacturing Practice (GMP) standards. Their specialized demand is driven fundamentally by expansive R&D pipelines centered on pioneering regenerative medicine and complex bio-functionalization, indicating a long-term, specialized, and high-volume need for the compound’s unique structural and crucial biological properties that efficiently facilitate cellular growth, migration, and sustained therapeutic agent release, positioning them collectively as strategic, sophisticated high-volume buyers within the technologically advanced Hyaluramine-S market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Galderma, Allergan Aesthetics (AbbVie), Teoxane, Merz Pharma, Sinclair Pharma, Revance Therapeutics, Sanofi S.A., Johnson & Johnson, Bausch Health Companies, Anika Therapeutics, Zimmer Biomet, IBSA Derma, Huons Bio, Bloomage Biotechnology, Seikagaku Corporation, Lifecore Biomedical, Croma-Pharma, Biopolymer GmbH, Shiseido Company, Laboratories Vivacy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hyaluramine-S Market Key Technology Landscape

The technological landscape of the Hyaluramine-S market is fundamentally defined by highly advanced biotechnology techniques utilized for its synthesis, sophisticated and proprietary cross-linking methods crucial for its functionalization, and innovative drug delivery platforms that strategically leverage its unique biocompatible molecular structure. The technological foundation rests upon rigorous bio-fermentation technology, which employs genetically optimized bacterial strains (typically non-pathogenic Streptococcus species) modified to produce high molecular weight hyaluronic acid precursors. These precursors are subsequently chemically or enzymatically modified through targeted amination processes—the proprietary step that defines Hyaluramine-S—to create the stable end product. This entire process necessitates exceptional, real-time control over fermentation parameters, multi-stage chromatographic purification techniques, and highly specialized sterile filtration processes to ensure the final product consistently meets the extreme purity standards and critically low endotoxin levels strictly required for regulatory approval and safe injectable pharmaceutical use. The ongoing technological challenge for manufacturers is to substantially increase commercial yield while rigorously maintaining consistent molecular uniformity, structural integrity, and reproducibility across exceptionally large-scale commercial production batches, demanding persistent, substantial investment in automated bioreactor optimization and highly efficient downstream processing technologies.

A crucial and defining technological differentiator within the market is the method employed for chemical cross-linking. Manufacturers utilize various proprietary cross-linking agents—such as Butanediol Diglycidyl Ether (BDDE), Divinyl Sulfone (DVS), or highly advanced, patented polymer matrices—to successfully create stable, rheologically tailored hydrogels. These cross-linking agents directly dictate the final product’s essential physical properties, including its viscosity, mechanical elasticity (G Prime), cohesivity, and its vital resistance to rapid enzymatic degradation by the endogenous hyaluronidase enzyme present in the human body. For the development of premium dermal fillers, the key technical goal is simultaneously maximizing the G Prime for superior lift and structural support while ensuring perfectly smooth and consistent injectability, a balance that requires extremely complex material science and rheological engineering expertise. Conversely, for viscosupplementation applications, the technological focus shifts entirely to optimizing the long-term fluid dynamics and mechanical cushioning within the afflicted joint space. Emerging cutting-edge technologies further include the innovative incorporation of nanotechnology, specifically utilizing specialized lipid nanoparticles or polymeric micelles loaded with Hyaluramine-S, designed for enhanced tissue permeability and targeted, localized delivery to specific cellular compartments, which promises to create significant therapeutic advantages beyond simple mechanical volume replacement or lubrication.

Further pervasive innovation is markedly evident in the advanced device technology supporting product delivery, particularly the implementation of pre-filled syringe systems, precise dosing mechanisms, and auto-injectors specifically engineered to safely and accurately administer high-viscosity Hyaluramine-S formulations. These sophisticated delivery systems must be chemically inert, rigorously minimizing the presence of leachables that could potentially compromise the expensive product's integrity, and must be ergonomically designed for maximum ease of use by clinicians, thereby reducing procedural time, maximizing dosing accuracy, and minimizing patient discomfort. Additionally, the strategic protection of intellectual property covering novel synthesis methodologies, specific proprietary modification points on the molecule's polymer chain, and unique, high-performance cross-linking patterns remains an absolutely vital, foundational element of the technology landscape. Companies that successfully hold proprietary technology related to non-animal sourced raw materials and efficient, highly scalable, and environmentally sustainable synthesis routes will continue to command a decisive competitive advantage, enabling them to optimally control both production cost structures and supply chain integrity, thereby solidly confirming their long-term market dominance in this technologically intensive and highly regulated market segment.

Regional Highlights

- North America: North America, particularly dominated by the United States and Canada, stands as the largest, most technologically mature, and highest-value market for Hyaluramine-S globally. This leadership is fundamentally driven by extremely high consumer awareness, widespread cultural acceptance of advanced aesthetic procedures as routine healthcare, and a robust, highly sophisticated healthcare infrastructure that facilitates the high-volume utilization of premium viscosupplementation therapies. The region benefits significantly from early and efficient regulatory approvals for both advanced aesthetic and orthopedic treatments. High average disposable incomes and massive R&D spending by domestic pharmaceutical giants ensure continuous, high-speed product innovation and pervasive, aggressive marketing campaigns strategically targeted at specialized medical professionals and key opinion leaders. The high and rising prevalence of chronic conditions like severe osteoarthritis, coupled with strong governmental and private health insurance coverage, further guarantees consistent, high-volume demand for therapeutic-grade Hyaluramine-S formulations, confirming its premier status.

- Europe: Europe maintains a substantial and strategically important market share, characterized by exceptionally stringent product quality and safety standards rigorously enforced by regulatory bodies like the European Medicines Agency (EMA). The region exhibits strong, sustained demand for high-quality, long-lasting dermal fillers and advanced orthopedic products, particularly concentrated in the economically powerful nations of Western Europe such as Germany, France, the UK, and Italy. Market expansion is effectively sustained by a large and growing geriatric population requiring joint health interventions and the established presence of sophisticated medical tourism hubs that attract international clientele. Competitive intensity is high, with established local European manufacturers focusing heavily on developing and patenting unique cross-linking technologies, emphasizing clinical differentiation, superior safety profiles, and premiumization in their regional sales and distribution strategies to effectively compete against dominant global entities.

- Asia Pacific (APAC): The APAC region is definitively projected to be the fastest-growing market globally throughout the forecast period, fueled by a confluence of accelerating factors including massive population bases, rapidly increasing disposable personal incomes, and the widespread modernization of healthcare infrastructure across key emerging economies like mainland China, India, and Indonesia. South Korea and Japan remain critically important centers for aesthetic technology innovation, research, and high cosmetic procedure adoption rates, acting as regional innovation drivers. The explosive growth in APAC is underpinned by rising public awareness of non-surgical cosmetic treatments, significant governmental investment in medical infrastructure, and an increasing regional prevalence of lifestyle-related joint disorders, collectively creating an immense, previously untapped patient base. Local and international manufacturers are increasingly adopting advanced bio-fermentation and synthesis technologies to efficiently meet the escalating regional demand while simultaneously navigating the complex and fragmented regulatory landscapes unique to each individual country.

- Latin America (LATAM): The LATAM market continues to show extremely promising, steady growth potential, concentrated predominantly within major economies such as Brazil and Mexico, which is largely driven by a strong cultural emphasis on physical appearance and beauty, coupled with rapidly growing, sustained investment in private healthcare facilities and specialized aesthetic clinics. While facing challenges related to economic volatility, currency fluctuations, and varying regulatory approval speeds across the different nations, the core underlying consumer and professional demand for cost-effective, clinically proven, and high-quality aesthetic fillers and joint supplements remains consistently robust. Market penetration and scaling efforts in LATAM rely heavily on establishing deeply effective local distribution partnerships, offering strategically competitive pricing structures accurately tailored to regional economic realities, and initially focusing intensive sales efforts on major metropolitan areas that possess high concentrations of specialized medical practitioners and aesthetic centers.

- Middle East and Africa (MEA): The MEA market remains a critical emerging region, characterized by extensive, large-scale healthcare investment, particularly within the affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), which actively support the establishment of world-class, premium cosmetic and orthopedic medical centers. Demand in this sector is highly influenced by high net worth individuals seeking the latest premium aesthetic treatments and a substantial expatriate population base accustomed to sophisticated Western medical standards and product availability. While the current market size remains comparatively smaller than North America or Europe, its growth rates are consistently high and strategically important. Major challenges include highly fragmented and often opaque regulatory structures, coupled with a high reliance on complex international imports, necessitating the implementation of robust, resilient supply chain management practices and the generation of localized clinical evidence to confidently gain trust and traction among the diverse specialized medical practitioners operating across the varied sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hyaluramine-S Market.- Galderma

- Allergan Aesthetics (AbbVie)

- Teoxane

- Merz Pharma

- Sinclair Pharma

- Revance Therapeutics

- Sanofi S.A.

- Johnson & Johnson

- Bausch Health Companies

- Anika Therapeutics

- Zimmer Biomet

- IBSA Derma

- Huons Bio

- Bloomage Biotechnology

- Seikagaku Corporation

- Lifecore Biomedical

- Croma-Pharma

- Biopolymer GmbH

- Shiseido Company

- Laboratories Vivacy

Frequently Asked Questions

Analyze common user questions about the Hyaluramine-S market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Hyaluramine-S over standard hyaluronic acid?

Hyaluramine-S is a proprietary, chemically modified derivative featuring specialized amine groups that significantly enhance molecular stability, dramatically reduce enzymatic degradation rates, and improve superior tissue integration, leading to substantially longer therapeutic and aesthetic duration compared to conventional hyaluronic acid fillers and viscosupplements.

Which application segment currently drives the largest market revenue for Hyaluramine-S?

Currently, the Viscosupplementation segment, addressing the large, persistent global incidence of chronic osteoarthritis and requiring high volumes of consistent pharmaceutical-grade product for repetitive joint injections, accounts for the largest share of market revenue for Hyaluramine-S, closely shadowed by the rapidly expanding Dermal Fillers segment.

How does the bio-fermentation synthesis method specifically impact the end product quality?

Bio-fermentation is the technologically preferred synthesis route as it reliably ensures the production of high molecular weight, superior molecular purity, and results in minimal animal-derived or chemical contaminants, yielding a pharmaceutical-grade Hyaluramine-S with a significantly reduced risk of immunogenicity, which is critically important for all sterile injectable medical applications.

What is the projected Compound Annual Growth Rate (CAGR) for the Hyaluramine-S market?

The Hyaluramine-S market is anticipated to exhibit a robust Compound Annual Growth Rate (CAGR) of 8.7% between the years 2026 and 2033. This growth is predominantly driven by increasing global adoption in non-invasive cosmetic procedures and the expanding therapeutic use in proactive orthopedic medicine across high-growth emerging economies worldwide.

Which geographic region is strategically forecasted to demonstrate the fastest market growth trajectory?

The Asia Pacific (APAC) region is decisively forecasted to achieve the highest compounded growth rate, propelled by rapid urbanization, substantial increases in disposable incomes facilitating access to advanced aesthetic treatments, and large-scale government investment in modern medical infrastructure across key powerful economies, most notably China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager