Hybrid And Electric Vehicles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434214 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hybrid And Electric Vehicles Market Size

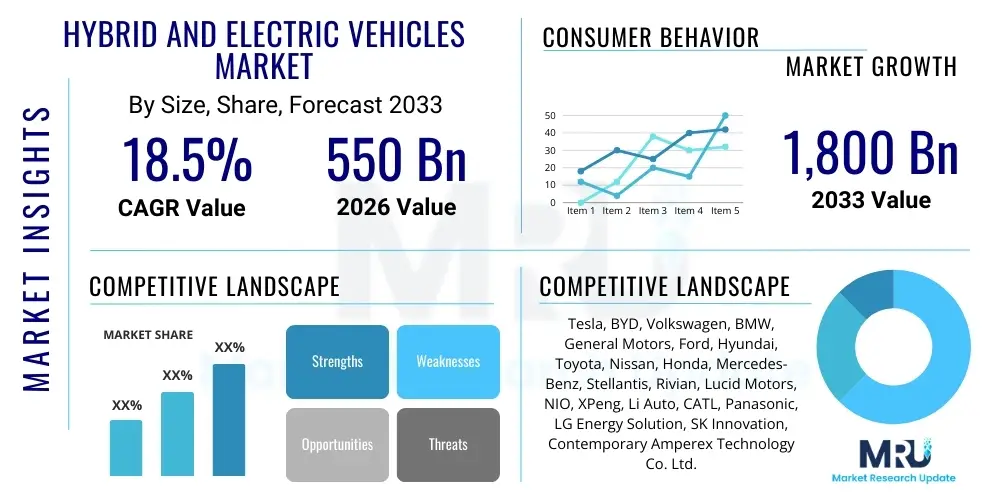

The Hybrid And Electric Vehicles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 550 Billion in 2026 and is projected to reach USD 1,800 Billion by the end of the forecast period in 2033.

Hybrid And Electric Vehicles Market introduction

The Hybrid and Electric Vehicles (H&EV) Market encompasses the global production, sales, and aftermarket services associated with vehicles utilizing electric powertrains, either fully battery-electric (BEV), plug-in hybrid electric (PHEV), or standard hybrid electric (HEV). This market segment represents a fundamental shift in automotive technology, moving away from conventional internal combustion engines (ICE) toward sustainable and lower-emission mobility solutions. The primary product offerings include passenger cars, commercial vehicles (buses and trucks), and specialized vehicles, all integrated with advanced battery systems, electric motors, power electronics, and sophisticated thermal management systems. The rapid transition is fueled by stringent governmental regulations on carbon emissions, increasing consumer awareness regarding environmental sustainability, and significant technological advancements improving battery energy density and charging speeds. Furthermore, governmental incentives, subsidies, and infrastructural development supporting charging networks globally are crucial catalysts accelerating market adoption and penetration across diverse geographical regions, especially in technologically advanced economies and emerging Asian markets.

Major applications of H&EV technology span personal transportation, public transit, and freight logistics. The benefits are multifaceted, including substantial reductions in tailpipe emissions, decreased reliance on volatile fossil fuel prices, lower operating and maintenance costs due to fewer moving parts compared to ICE vehicles, and enhanced driving performance characterized by instantaneous torque delivery. The industry is highly competitive, marked by intensive investments in R&D, particularly concerning solid-state batteries, autonomous driving integration, and smart charging solutions. Key driving factors include the global commitment to achieving net-zero emission goals, the continued decline in battery pack costs (despite recent fluctuations due to material shortages), and robust consumer demand driven by improving vehicle range and performance metrics that address historical range anxiety concerns. The market structure is undergoing transformation, with established Original Equipment Manufacturers (OEMs) rapidly electrifying their fleets while new, pure-play electric vehicle manufacturers gain significant market share, disrupting traditional automotive value chains.

The market introduction of H&EVs is intricately linked to geopolitical strategies focusing on energy independence and urban air quality improvement. The core technology involves the efficient management of electrical energy storage and deployment, often leveraging sophisticated software and connectivity features that enhance vehicle safety and user experience. Standardization efforts for charging protocols, such as CCS and NACS, are vital for facilitating seamless cross-border travel and interoperability, further supporting mass-market adoption. As infrastructure maturity increases, particularly in densely populated urban centers, the total cost of ownership (TCO) for electric vehicles continues to decrease, positioning them as financially viable alternatives to conventional vehicles. The market is also heavily influenced by material sourcing, particularly for critical battery components like lithium, cobalt, and nickel, leading to strategic vertical integration efforts by major players to secure supply chains and mitigate raw material price volatility, ensuring stable production volumes through the forecast period.

Hybrid And Electric Vehicles Market Executive Summary

The Hybrid and Electric Vehicles market is characterized by intense innovation and aggressive expansion, driven fundamentally by supportive regulatory frameworks and evolving consumer preferences favoring sustainable mobility. Key business trends include the accelerated development of dedicated Electric Vehicle (EV) platforms (skateboard architecture), significant capital expenditure directed towards gigafactories for battery production, and strategic partnerships between automotive OEMs and technology companies focusing on software-defined vehicles (SDVs) and advanced driver-assistance systems (ADAS). The market is witnessing a critical shift towards higher-performance and longer-range battery-electric vehicles (BEVs), while plug-in hybrid electric vehicles (PHEVs) continue to serve as a transitional technology in regions where charging infrastructure remains nascent. Vertical integration is becoming a prerequisite for market leadership, with players actively securing battery supply through long-term contracts and equity investments in mining and refining operations, thereby stabilizing operational costs and ensuring scalable production capacity to meet escalating global demand.

Regional trends highlight Asia Pacific (APAC), particularly China, as the dominant force in both manufacturing and consumer adoption, leveraging extensive government support, localized supply chains, and a robust domestic market. Europe is demonstrating strong growth fueled by ambitious emission reduction targets (e.g., EU's Fit for 55 package) and generous consumer purchase incentives, leading to high penetration rates, particularly in Scandinavian countries and Germany. North America, while historically slower, is experiencing rapid acceleration, primarily due to supportive legislation like the Inflation Reduction Act (IRA) in the US, which promotes domestic battery and vehicle manufacturing, stimulating local production and infrastructure build-out. Trends across all major regions emphasize the need for smart grid integration, facilitating vehicle-to-grid (V2G) capabilities and managing the increased electrical load from widespread EV charging, positioning H&EVs not just as transportation but as crucial elements of future energy ecosystems.

Segmentation trends indicate Battery Electric Vehicles (BEVs) are projected to capture the largest market share over the forecast period, owing to continuous improvements in battery technology, range capabilities, and the rollout of high-speed charging infrastructure. Within the component segment, batteries remain the highest value component, driving fierce competition among specialized battery manufacturers (e.g., CATL, LG Energy Solution). Application-wise, the passenger vehicle segment dominates; however, the commercial vehicle segment, particularly medium- and heavy-duty electric trucks and last-mile delivery vans, is gaining substantial momentum as fleet operators prioritize fuel cost savings and compliance with urban low-emission zones. Overall, the market is moving toward greater standardization, higher efficiency powertrains, and integrated digital platforms, demanding a high level of technological expertise from all participants to maintain competitive advantage in this rapidly evolving automotive landscape.

AI Impact Analysis on Hybrid And Electric Vehicles Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hybrid and Electric Vehicles Market often center on themes of range optimization, battery health prediction, autonomous driving integration, and smart manufacturing efficiency. Users are primarily concerned with how AI enhances the core competencies of EVs, specifically asking about maximizing battery lifespan and utilizing machine learning for predictive maintenance to minimize downtime and total cost of ownership (TCO). A significant volume of questions also relates to the ethical implications and safety improvements facilitated by AI-driven ADAS and autonomous systems, seeking clarity on the reliability and responsiveness of these intelligent features in diverse operational environments. Furthermore, supply chain resilience and manufacturing throughput are key areas of inquiry, exploring how AI-driven analytics can optimize gigafactory operations, improve quality control in battery cell production, and forecast raw material demand volatility, ultimately influencing vehicle affordability and availability for the end consumer.

The application of AI is revolutionizing EV design and operational efficiency, extending far beyond the vehicle itself into the entire ecosystem, including charging management and grid interaction. AI algorithms are essential for optimizing the Battery Management System (BMS), utilizing real-time data to precisely control charging and discharging cycles, thereby mitigating degradation and extending the effective usable life of the high-voltage battery pack. In driving dynamics, AI underpins energy recuperation strategies, dynamically adjusting regenerative braking based on traffic patterns and route topography to maximize energy efficiency and actual driving range. This predictive capability directly addresses consumer range anxiety, transforming raw battery capacity into predictable, usable mileage. The integration of AI also significantly enhances the user experience through personalized infotainment systems, voice-activated controls, and predictive navigation that identifies optimal charging stops based on vehicle state-of-charge and real-time charger availability, creating a highly interconnected and intuitive driving environment.

In the manufacturing sector, AI-driven automation and predictive analytics are drastically improving the speed and quality of EV production, particularly in complex battery assembly. Machine learning models analyze sensor data from production lines to detect microscopic defects in battery cells before they become failures, ensuring higher safety standards and lower recall rates. On the retail and sales side, AI analyzes vast datasets of consumer behavior and regional preferences to optimize sales forecasts, inventory management, and personalized marketing campaigns for specific EV models. This data-driven approach allows OEMs to efficiently allocate production resources and customize vehicle features according to localized market demand, minimizing wastage and enhancing profitability. Ultimately, AI acts as a fundamental enabler for scalability, safety, and performance, ensuring the H&EV market can meet aggressive growth targets while maintaining high levels of product quality and innovation.

- AI-Powered Battery Management Systems (BMS) for extended battery life and range optimization.

- Predictive Maintenance using machine learning to reduce vehicle downtime and TCO.

- Autonomous Driving (AD) and Advanced Driver-Assistance Systems (ADAS) enhanced by deep learning algorithms.

- Optimization of EV charging infrastructure planning and smart grid integration (V2G/V2H).

- AI-driven manufacturing analytics improving quality control and efficiency in battery gigafactories.

- Personalized in-car experience and infotainment systems powered by user behavior data analysis.

- Supply chain resilience and forecasting for critical raw materials (lithium, cobalt, nickel).

DRO & Impact Forces Of Hybrid And Electric Vehicles Market

The Hybrid and Electric Vehicles Market is powerfully influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and adoption trajectory. Key drivers include stringent global regulatory mandates imposing tight emission standards, such as the EU's phase-out of ICE vehicle sales and similar targets in China and the US, forcing automotive manufacturers to prioritize electrification. Government incentives, encompassing tax credits, subsidies, and non-monetary benefits like access to priority lanes, significantly lower the initial purchase barrier for consumers. Technological advancements, particularly the steady increase in battery energy density leading to longer driving ranges and the parallel decrease in battery production costs, further enhance the commercial viability and appeal of H&EVs. The increasing corporate focus on Environmental, Social, and Governance (ESG) criteria drives major fleet operators to transition to electric commercial vehicles, establishing H&EVs as central to sustainable business strategies. These drivers create a compelling momentum towards sustainable mobility solutions.

However, the market faces notable restraints that temper the pace of growth. The most prominent restraint is the persistent, though improving, lack of ubiquitous charging infrastructure, especially in rural areas and along major transport corridors, contributing to range anxiety among potential buyers. High upfront vehicle costs, despite decreasing battery prices, remain a significant hurdle, particularly in price-sensitive emerging markets where ICE vehicles are still considerably cheaper. Additionally, supply chain bottlenecks for essential battery raw materials (lithium, nickel, cobalt) and geopolitical dependencies pose substantial risks to production scalability and introduce price volatility, complicating long-term planning for OEMs. Technical challenges related to fast charging, battery longevity under extreme weather conditions, and the standardization of charging connectors also represent technical restraints that must be systematically addressed to ensure seamless mass-market integration and long-term customer satisfaction. The current electricity grid capacity in some regions also represents a potential bottleneck as V2G technologies become more prevalent.

Opportunities within the H&EV market are abundant and focus heavily on innovation and market expansion. The development and commercialization of next-generation battery technologies, such as solid-state batteries, promise breakthroughs in energy density, safety, and charging speed, potentially eliminating current range limitations. The expanding application scope into medium- and heavy-duty trucking, marine, and aviation sectors offers vast untapped market potential beyond traditional passenger vehicles. Furthermore, the burgeoning ecosystem surrounding H&EVs, including vehicle-to-everything (V2X) communication, smart charging networks, and advanced data monetization services (e.g., predictive maintenance subscriptions), offers lucrative avenues for revenue diversification for both established players and technology startups. Leveraging circular economy principles for battery recycling and repurposing (second-life applications) also presents a major opportunity for sustainable resource management and cost reduction, strengthening the overall sustainability profile of the market and ensuring compliance with future environmental legislation.

Impact Forces Summary:

The Hybrid and Electric Vehicles market is subject to intense impact forces derived from regulatory pressure and technological evolution. Global mandates establishing phase-out dates for ICE vehicles create a non-negotiable demand pull (Driver). Conversely, geopolitical risks affecting critical mineral supply chains exert significant upward pressure on input costs (Restraint). The rapid pace of battery innovation, specifically in silicon anodes and solid-state chemistry, acts as a pivotal enabling force (Opportunity), promising disruptive changes to vehicle performance and cost structure. The most dominant impact force is the converging pressure from governments, consumers, and technology providers, resulting in an accelerated industry transformation where electrification is no longer an option but a strategic imperative for long-term viability. The market's future growth hinges on the successful mitigation of infrastructure and supply constraints while capitalizing on advanced battery development and sophisticated software integration.

Segmentation Analysis

The Hybrid and Electric Vehicles market is segmented based on the degree of electrification (Type), the core technological components involved, and the specific vehicle application. Understanding these segmentations is critical for market participants to tailor their product strategies, manufacturing capacities, and regional market entry approaches. The segmentation by Type is particularly crucial as it reflects the current state of technology adoption and the regulatory environment, differentiating between fully electric solutions and transitional hybrid technologies. Component segmentation, meanwhile, highlights the areas of highest investment and technological bottleneck, such as battery chemistry and power electronics, which dictate vehicle performance and cost.

The shift within segmentation is dynamic; for instance, while Hybrid Electric Vehicles (HEVs) historically provided an entry point into electrification, the market momentum is strongly favoring Battery Electric Vehicles (BEVs) due to improving infrastructure and superior performance characteristics. The application segmentation demonstrates that although Passenger Vehicles remain the volume driver, the electrification of Commercial Vehicles, driven by fleet economics and regulatory compliance (especially in urban centers), presents the fastest-growing opportunity. Detailed segmentation analysis helps stakeholders identify high-growth niches, allocate R&D funding effectively, and anticipate the competitive intensity within specific product categories, ensuring optimized resource deployment across the extensive H&EV value chain.

- By Type:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

- By Component:

- Battery (Lithium-ion, Solid-state)

- Motor (AC Induction, Permanent Magnet Synchronous)

- Power Electronics (Inverters, Converters)

- Charging Infrastructure (AC Charging, DC Fast Charging)

- Controller/ECU

- By Application:

- Passenger Vehicles (Sedan, SUV, Hatchback)

- Commercial Vehicles (Bus, Light Commercial Vehicle, Heavy-duty Truck)

- By Vehicle Class:

- Luxury and Premium Vehicles

- Mid-Priced and Affordable Vehicles

Value Chain Analysis For Hybrid And Electric Vehicles Market

The H&EV value chain is complex and resource-intensive, starting from the upstream extraction and refining of critical raw materials (lithium, cobalt, nickel) required for battery production. Upstream analysis involves mining companies, chemical processing firms, and specialized material suppliers who face increasing pressure regarding ethical sourcing and environmental sustainability. This stage dictates the stability and cost of the most expensive component of an EV: the battery cell. Securing long-term supply agreements and establishing transparent, vertically integrated supply chains for these materials is a key differentiator for OEMs seeking cost advantage and guaranteed production volumes, moving away from relying solely on spot market purchases which introduces significant financial volatility.

The midstream involves cell manufacturing, battery pack assembly, and the production of electric motors and power electronics. This phase requires high capital investment in gigafactories and advanced automation technologies. Downstream analysis encompasses vehicle assembly by OEMs, distribution channels, sales, and aftermarket services. Traditional distribution channels involve dealership networks, but there is a growing trend towards direct-to-consumer sales models, popularized by new market entrants like Tesla, which offer greater control over pricing and customer experience. Indirect channels, such as third-party fleet sales and leasing companies, also play a significant role in penetrating the commercial vehicle segment and introducing H&EVs to large corporate buyers, contributing substantially to overall market volume.

The value chain extends into the service and end-of-life phases, covering charging infrastructure installation and management, maintenance, and battery recycling or repurposing. Direct interaction with customers through proprietary charging networks (e.g., Tesla Supercharger network) provides a competitive advantage and a crucial data source for optimizing infrastructure planning. The importance of the recycling segment (Reverse Logistics) is rapidly increasing due to regulatory mandates regarding battery materials recovery and the economic incentive of recapturing high-value metals. Effective management across this entire value chain, from mining to recycling, is essential for achieving sustainability goals and managing the substantial capital expenditure required to transition the global automotive industry to an electric future.

Hybrid And Electric Vehicles Market Potential Customers

Potential customers for the Hybrid and Electric Vehicles Market span a wide range of demographic and commercial entities, segmented primarily by their motivation for adopting electrification. For passenger vehicles, the key end-users are early adopters driven by technological novelty and environmental consciousness, followed by mass-market consumers motivated by lower running costs, government incentives, and increasing charging convenience. These mass-market buyers, often found in affluent urban and suburban areas, prioritize range, safety, and brand familiarity. Geographically, consumers in highly regulated markets (Western Europe, China, North America) represent the core demand base, heavily influenced by localized policies aimed at improving urban air quality and reducing carbon footprints.

On the commercial side, significant potential customers include large corporate and government fleet operators (e.g., postal services, municipal transit authorities, delivery companies). These buyers are primarily motivated by the long-term Total Cost of Ownership (TCO) savings derived from reduced fuel expenditure and lower maintenance requirements, often outweighing the higher initial purchase price. Logistics companies focusing on last-mile delivery find electric vans essential for navigating zero-emission zones. Furthermore, taxi and ride-sharing operators are critical potential customers as they operate high-mileage vehicles where the financial benefits of electric efficiency accrue rapidly. Institutional buyers are increasingly prioritizing sustainability in procurement, making H&EVs a mandated part of their vehicle replacement strategies, driving substantial bulk orders for both light and heavy commercial electric vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Billion |

| Market Forecast in 2033 | USD 1,800 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, BYD, Volkswagen, BMW, General Motors, Ford, Hyundai, Toyota, Nissan, Honda, Mercedes-Benz, Stellantis, Rivian, Lucid Motors, NIO, XPeng, Li Auto, CATL, Panasonic, LG Energy Solution, SK Innovation, Contemporary Amperex Technology Co. Ltd. (CATL), Samsung SDI, Northvolt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid And Electric Vehicles Market Key Technology Landscape

The technology landscape of the Hybrid and Electric Vehicles Market is centered around continuous innovation in energy storage and powertrain efficiency. Lithium-ion battery technology, specifically nickel-manganese-cobalt (NMC) and lithium iron phosphate (LFP) chemistries, currently dominate the market, with R&D efforts focused on increasing energy density (to improve range) and improving thermal stability (for safety and faster charging). Significant advancements are being made in cell-to-pack (CTP) and cell-to-chassis (CTC) designs, which increase volumetric efficiency by integrating cells directly into the vehicle structure, thereby maximizing battery capacity within a given footprint. The development of advanced thermal management systems (TMS), utilizing sophisticated liquid cooling loops, is crucial for maintaining optimal battery operating temperatures, which is essential for rapid charging speeds and extending overall battery life, particularly in extreme climates.

Beyond current lithium-ion technology, the most critical emerging technological frontier is the solid-state battery (SSB). SSBs replace the flammable liquid electrolyte with a solid conductive material, promising a significant leap in energy density, reduced charging times, and dramatically improved safety characteristics. Many leading automotive OEMs and battery manufacturers are heavily investing in pilot production lines, anticipating commercial viability within the latter half of the forecast period. Concurrently, advancements in power electronics, specifically the adoption of silicon carbide (SiC) semiconductors, are fundamentally enhancing the efficiency of inverters and converters. SiC allows for higher switching frequencies and reduces energy losses compared to traditional silicon-based components, enabling lighter, more compact, and more efficient powertrains, directly contributing to improved vehicle performance and energy efficiency.

The market is also witnessing a convergence of electrification with digitalization and software-defined vehicle architecture. Over-the-Air (OTA) software update capabilities are becoming standard, allowing manufacturers to remotely enhance performance, troubleshoot issues, and introduce new features post-sale. The integration of advanced sensor suites (LiDAR, radar, cameras) is essential for enabling higher levels of automated driving (Level 3 and beyond), which are closely tied to the electric platform. Furthermore, the development of sophisticated Battery Management Software (BMS) utilizing AI for predictive diagnostics and real-time state-of-charge calculation is critical. This holistic approach ensures that technological innovation spans not only hardware components but also the intelligent software layer that governs the vehicle’s operation, connectivity, and interaction with the charging ecosystem.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC remains the global epicenter for the Hybrid and Electric Vehicles market, largely spearheaded by China. China’s dominance is attributable to aggressive government support through subsidies, mandatory quotas for new energy vehicles (NEVs), and extensive domestic manufacturing capacity, making it both the largest producer and consumer market globally. The region benefits from localized, vertically integrated supply chains, particularly for battery production (led by CATL and BYD). Other high-growth nations, such as South Korea, Japan, and India, are increasingly adopting H&EV strategies, focusing on infrastructure build-out and leveraging local manufacturing prowess, ensuring APAC maintains its leadership position throughout the forecast period, especially in the affordable and high-volume segments.

- Europe’s Policy-Driven Growth: Europe exhibits the highest penetration rate of H&EVs relative to total vehicle sales, driven by the European Union’s ambitious climate targets, including the Fit for 55 package which aims for massive CO2 reductions. Strong consumer incentives, favorable tax structures, and the establishment of widespread urban low-emission zones are powerful catalysts. Countries like Norway, Germany, and the UK have seen rapid adoption, particularly of BEVs and PHEVs. The region is actively promoting local gigafactory development (e.g., Northvolt) to reduce reliance on Asian battery suppliers and aims to control the entire electric vehicle value chain, positioning Europe as a leader in premium and technologically advanced H&EV manufacturing and consumption.

- North American Acceleration: North America is experiencing a significant market inflection point, driven primarily by favorable US government policies such as the Inflation Reduction Act (IRA), which provides substantial tax credits linked to domestic manufacturing and battery sourcing. This legislation is catalyzing massive investments in US-based battery and assembly plants by both domestic (Ford, GM, Tesla) and foreign OEMs. While consumer adoption rates were historically slower compared to Europe and China, the shift toward electric trucks and SUVs, coupled with large-scale public and private charging infrastructure investments, is rapidly closing the gap. Canada and Mexico are also integrating into the continental supply chain, strengthening the region's long-term production capability and market potential.

- Latin America, Middle East, and Africa (LAMEA) Potential: LAMEA represents an emerging market characterized by significant long-term potential but slower initial uptake due to infrastructural challenges and higher import duties. Countries in Latin America (Brazil, Mexico) are focusing on fleet electrification and localized production of hybrid technologies as a transitional step. The Middle East, particularly the UAE and Saudi Arabia, is strategically investing in H&EV manufacturing and technology as part of economic diversification away from fossil fuels, leveraging significant capital for smart city and charging infrastructure deployment. Africa remains highly reliant on imported used vehicles, but public transport and specialized mining fleet electrification present nascent opportunities for high-impact growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid And Electric Vehicles Market.- Tesla Inc.

- BYD Co. Ltd.

- Volkswagen Group

- BMW Group

- General Motors Company

- Ford Motor Company

- Hyundai Motor Company

- Toyota Motor Corporation

- Nissan Motor Co., Ltd.

- Honda Motor Co., Ltd.

- Mercedes-Benz Group AG

- Stellantis N.V.

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- NIO Inc.

- XPeng Inc.

- Li Auto Inc.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Panasonic Corporation

- LG Energy Solution Ltd.

- SK Innovation Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hybrid And Electric Vehicles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the rapid growth of the Hybrid and Electric Vehicles market?

The primary driving factor is the imposition of stringent government emission regulations globally, particularly phase-out targets for internal combustion engine (ICE) sales, coupled with significant governmental incentives (tax credits and subsidies) designed to reduce the high initial purchase cost for consumers and accelerate the transition to electric mobility solutions.

How do solid-state batteries (SSBs) impact the future performance of electric vehicles (EVs)?

Solid-state batteries are anticipated to be a game-changer by offering significantly higher energy density than current lithium-ion batteries, translating directly into longer driving ranges. They also promise faster charging times and enhanced thermal safety by replacing the flammable liquid electrolyte, addressing the main constraints of current EV technology.

Which geographical region dominates the Hybrid and Electric Vehicles market in terms of production and adoption?

Asia Pacific (APAC), particularly China, dominates the global H&EV market. China has established the largest production capacity, especially for battery manufacturing, and leads in consumer adoption due to extensive state support, favorable regulatory quotas for New Energy Vehicles (NEVs), and strong localized supply chains.

What are the main financial benefits of owning an Electric Vehicle (EV) compared to a traditional gasoline vehicle?

The main financial benefits include a lower Total Cost of Ownership (TCO) over the vehicle's lifespan, driven by substantially reduced fuel/energy costs, lower maintenance expenses due to fewer moving parts, and access to various governmental financial incentives and tax breaks at the point of purchase.

What are the key components facing supply chain risks in the EV industry?

The key components facing critical supply chain risks are the raw materials essential for high-voltage batteries, notably lithium, cobalt, and nickel. Geopolitical concentration of mining and refining operations, coupled with soaring global demand, creates volatility and potential bottlenecks, prompting industry players to seek vertical integration and long-term supply security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager