Hybrid Boiler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433644 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hybrid Boiler Market Size

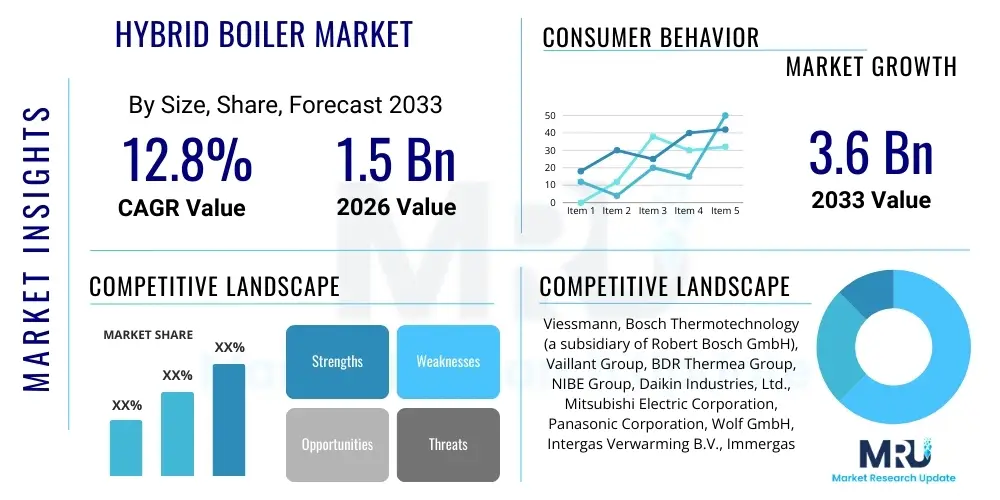

The Hybrid Boiler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by stringent environmental regulations mandating reductions in carbon emissions, particularly across key European and North American geographies, coupled with increasing consumer awareness regarding long-term operational energy savings. The shift towards electrification in heating infrastructure, supported by governmental incentives and subsidies for renewable and highly efficient heating systems, positions hybrid boilers as a critical transitional technology.

The valuation of the market reflects the growing adoption rate in the residential sector, which remains the dominant application segment. Hybrid boilers offer a compelling solution by integrating a highly efficient gas boiler with an electric heat pump, optimizing performance based on fluctuating external temperatures and energy tariffs. This dual-source capability allows consumers to leverage the highest efficiency operation at all times, thereby mitigating the risk associated with relying solely on nascent renewable technologies in regions with extreme climate variations. Furthermore, the compatibility of hybrid systems with existing radiator infrastructure reduces installation complexity and costs, accelerating market penetration.

Hybrid Boiler Market introduction

The Hybrid Boiler Market encompasses heating systems that combine two different heat sources, typically a traditional fossil fuel boiler (gas or oil) with a renewable energy source, most commonly an electric air source heat pump. This integrated approach ensures optimal energy efficiency, lower carbon footprints, and reliable heating and hot water supply, particularly in retrofitting applications where full heat pump conversion is impractical. Major applications span the residential housing sector, where space constraints and existing infrastructure dictate the need for versatile heating solutions, and the light commercial sector, including small offices and retail spaces seeking compliance with energy efficiency mandates. The inherent benefit of hybridization lies in the intelligent control system that automatically selects the most economical and environmentally friendly heating source at any given time, providing both resilience and reduced running costs.

Driving factors for this market are multifaceted, anchored by the global decarbonization agenda, notably policies like the EU's Energy Performance of Buildings Directive (EPBD) and national incentive schemes aimed at replacing older, less efficient boilers. Consumers are increasingly motivated by the promise of significant operational cost reductions as electricity prices fluctuate less dramatically than volatile global gas markets. Moreover, the ease of installation and integration into existing domestic plumbing and heating systems makes hybrid boilers a highly attractive alternative to full heat pump installations, which often require extensive modifications to insulation and radiator systems, further propelling market demand.

Product descriptions emphasize the intelligent control unit, known as the 'hybrid manager,' which continuously monitors outdoor temperatures, current energy prices (gas vs. electricity), and system demand to seamlessly switch between the boiler and the heat pump, or run them simultaneously. This smart optimization minimizes energy consumption while ensuring comfort. The market introduction phase focused heavily on Western Europe, specifically Germany, the UK, and France, due to strong governmental support for heat pumps and high awareness of energy efficiency, establishing these regions as early adopters and technological innovators in the hybrid heating space.

Hybrid Boiler Market Executive Summary

The Hybrid Boiler Market is experiencing robust expansion driven by critical regulatory shifts and technological maturity. Business trends highlight a strong focus on partnerships between traditional boiler manufacturers and heat pump specialists, aiming to streamline integrated system offerings and simplify installer training. There is a palpable trend towards developing highly modular and compact hybrid units suitable for dense urban environments where space efficiency is paramount. Furthermore, connectivity and smart home integration are becoming standard features, enabling remote diagnostics, predictive maintenance, and real-time energy monitoring, which enhances the value proposition for both installers and end-users. Investment in supply chain resilience, particularly for electric components and refrigerants used in the heat pump segment, remains a critical focus area for sustained growth across the major market players.

Regional trends indicate Europe leading the market, primarily due to ambitious net-zero targets and comprehensive governmental grant programs designed to accelerate the adoption of hybrid heating systems as a mid-term strategy before full electrification. North America, particularly the US, is showing rapid acceleration, bolstered by the Inflation Reduction Act (IRA) and similar state-level incentives favoring energy-efficient appliances and heat pump installations. Asia Pacific, while nascent, is emerging as a potential high-growth region, especially in developed economies like Japan and South Korea, where high energy import costs make efficiency a priority. However, adoption rates in APAC are highly sensitive to local construction standards and the prevalence of centralized heating systems versus individual units.

Segment trends underscore the dominance of the residential application, driven by the massive existing installed base of conventional boilers needing replacement or upgrade. Within the technology segment, gas-electric hybrid systems hold the largest share, benefiting from the ubiquitous natural gas infrastructure in developed markets. However, the oil-electric segment is gaining traction in rural areas not served by gas pipelines, particularly as bio-oil and future sustainable liquid fuels are integrated. The overall market momentum is tilting towards smaller, wall-mounted units, aligning with the preference for discreet, space-saving installations in modern homes and apartments, emphasizing the market's trajectory towards smaller capacity, high-efficiency equipment.

AI Impact Analysis on Hybrid Boiler Market

Common user inquiries regarding AI in the Hybrid Boiler Market center on how artificial intelligence can optimize the complex decision-making process inherent in hybrid systems, specifically asking: "How does AI determine when to switch from gas to electric heating?", "Can AI predict future energy tariffs to minimize running costs?", and "Will AI integration make installation and maintenance more complex?". Users are primarily concerned with maximizing the economic benefit of their investment and ensuring the long-term reliability of these sophisticated systems. The analysis indicates a strong expectation that AI will move hybrid boilers beyond basic temperature and tariff monitoring into predictive optimization, seamlessly integrating data from weather forecasts, grid load management signals, and historical usage patterns to make proactive, second-by-second fuel source choices.

The key themes emerging from user expectations revolve around predictive energy management and enhanced system diagnostics. Consumers anticipate that AI algorithms will learn individual home heating profiles, identifying optimal start times and minimizing standby losses, thereby achieving efficiencies far exceeding static programmed settings. Furthermore, there is significant interest in AI's capability to perform advanced anomaly detection. By continuously monitoring operational parameters such as compressor run-time, refrigerant pressure, and flue gas temperatures, AI can flag potential component failures well before they manifest as a system breakdown. This proactive maintenance capability, often delivered via connected apps, is viewed as crucial for reducing lifecycle costs and enhancing customer satisfaction with high-tech heating solutions.

The long-term influence of AI is expected to transform hybrid boilers from independent heating units into integral components of the smart grid. AI-driven controls will enable hybrid systems to participate in demand-side response programs, modulating their electricity consumption in response to grid stability needs, potentially leading to financial incentives for homeowners. This evolution ensures that hybrid boilers contribute positively to overall energy system management, leveraging their inherent flexibility to store energy or shift load away from peak demand periods. This capability is vital for integrating higher levels of intermittent renewable energy sources, thereby solidifying the hybrid boiler's role as a cornerstone technology for sustainable and resilient domestic heating infrastructure.

- AI-powered predictive control optimizes fuel switching decisions based on real-time energy tariffs, weather forecasts, and historical usage patterns.

- Advanced AI diagnostics enable predictive maintenance, identifying component wear and potential failures before system downtime occurs, reducing servicing costs.

- Integration with smart grid platforms allows hybrid boilers to participate in demand response programs, adjusting electricity consumption to support grid stability.

- Machine learning algorithms personalize heating schedules, adapting system operation to specific household occupancy and comfort preferences for maximum energy savings.

- AI facilitates seamless commissioning and configuration by automatically recognizing installed components and calibrating system parameters during setup.

DRO & Impact Forces Of Hybrid Boiler Market

The Hybrid Boiler Market is powerfully shaped by Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces governing its trajectory. Primary drivers include stringent governmental decarbonization mandates, particularly the phase-out of conventional fossil fuel-only boilers, and significant financial incentives, such as rebates and tax credits, which reduce the initial purchase barrier. Restraints primarily involve the high upfront cost relative to conventional boilers, the required availability of qualified installers proficient in both plumbing and refrigeration/electrical work, and the dependency on a reliable electricity grid to power the heat pump component. Opportunities emerge from the immense potential in the residential retrofit market, the development of heat pumps utilizing low Global Warming Potential (GWP) refrigerants, and the increasing integration with smart home energy management ecosystems, enhancing the overall user experience and system efficiency.

Impact forces are predominantly high, driven by regulatory pressure and rising consumer energy awareness. Regulatory impact is the most significant force; for instance, the European Union's focus on phasing out fluorinated greenhouse gases (F-gases) necessitates rapid technological adaptation within the heat pump segment of the hybrid system. Market attractiveness is also strongly influenced by the comparative life cycle costs. As energy tariffs become more volatile and carbon taxes increase, the economic case for highly efficient hybrid solutions becomes overwhelming, pushing rapid market acceptance. The technological force is continuously positive, with manufacturers investing heavily in smaller, quieter, and more efficient heat pump units and smarter control algorithms, which directly address previous restraints related to installation complexity and noise output.

The primary restraint concerning skilled labor is actively being mitigated through specialized training programs and modular product designs that simplify installation, thereby easing the bottleneck in deployment. Furthermore, the market opportunity presented by the integration of renewable electricity generation, such as rooftop solar panels, directly enhances the efficiency of the hybrid electric heat pump component, providing a self-reinforcing loop of sustainability and cost reduction. The interplay between these factors ensures that while initial costs remain a hurdle, the long-term environmental necessity and compelling operational savings serve as powerful, enduring drivers for market growth, creating a dynamic environment where rapid technological advancement is key to competitive advantage.

Segmentation Analysis

The Hybrid Boiler Market is segmented primarily across product type, fuel type (of the conventional unit), capacity, and application. This segmentation provides a granular understanding of consumer preferences and regional technology uptake. The primary distinction arises from the fuel used in the backup or primary boiler, largely dividing the market between gas-electric and oil-electric hybrid systems. Product type segmentation distinguishes between highly compact, integrated wall-mounted units favored in small urban dwellings, and larger, floor-standing units often deployed in spacious homes or light commercial settings requiring higher heating loads. Capacity segmentation, typically defined in kilowatts (kW), allows manufacturers to target specific market needs, ranging from low-capacity systems for apartments to high-capacity solutions for commercial premises.

The application segment clearly identifies the residential sector as the most substantial consumer base, driven by the sheer volume of existing homes undergoing boiler replacements under stricter energy efficiency standards. The commercial segment, while smaller, represents a higher value opportunity due to the larger capacity systems required, encompassing schools, hospitals, and office buildings that mandate robust, reliable, and energy-efficient heating systems. Understanding the interplay between these segments is crucial for manufacturers to tailor their marketing and distribution strategies. For example, the European market shows a heavy preference for compact, high-efficiency gas-electric wall-mounted units in the residential sector, whereas North America exhibits a more varied demand, including oil-electric solutions in non-gas-piped rural areas, emphasizing the need for regional product customization.

- By Fuel Type:

- Gas-Electric Hybrid Boilers (Dominant Segment)

- Oil-Electric Hybrid Boilers

- By Product Type:

- Wall-Mounted Hybrid Systems (Space-Saving)

- Floor-Standing Hybrid Systems (High Capacity)

- By Capacity:

- Up to 20 kW (Small Residential)

- 20 kW to 35 kW (Large Residential/Small Commercial)

- Above 35 kW (Commercial)

- By Application:

- Residential

- Commercial (Office Buildings, Retail, Healthcare)

Value Chain Analysis For Hybrid Boiler Market

The Hybrid Boiler Market value chain begins with upstream activities involving the sourcing of highly specialized components, which include sophisticated electronics for the hybrid management control system, refrigeration components (compressors, heat exchangers) for the heat pump side, and high-efficiency burner technology for the boiler side. Critical upstream challenges include securing reliable supplies of semi-conductors and managing fluctuating prices and supply chain security for refrigerants, particularly as the industry transitions toward lower GWP alternatives like R290 (propane). Manufacturers often integrate key component production or form strategic alliances with specialized suppliers to maintain control over quality and intellectual property related to heat exchange and energy conversion technologies. The integration of two complex technologies requires stringent quality control at the manufacturing stage to ensure system compatibility and reliability.

Midstream processes involve the assembly and production of the integrated hybrid unit, followed by robust testing and certification (e.g., ErP Directive compliance in Europe). Distribution channels are highly dependent on established networks, primarily consisting of specialized plumbing and heating distributors, large wholesale building supply centers, and direct sales channels targeting large commercial contractors. Indirect distribution through wholesalers remains the dominant method, as installers prefer obtaining comprehensive product support and warranty services through established local partners. Direct channels are generally reserved for highly customized or large-scale commercial projects requiring bespoke engineering solutions and direct manufacturer consultation. The efficiency of the logistical network is paramount, given the size and weight of hybrid boiler systems, necessitating well-managed inventory and just-in-time delivery capabilities to meet installer schedules.

Downstream activities focus heavily on installation, maintenance, and end-user support. The complexity of hybrid systems demands a highly skilled installer base, which represents a critical bottleneck. Consequently, manufacturers invest heavily in training programs and certification schemes for plumbing and heating engineers to ensure correct sizing and installation, which is vital for achieving the advertised energy efficiency. Aftermarket services, including routine maintenance, repair, and remote diagnostics facilitated by IoT connectivity, are rapidly becoming major differentiators. Customer retention is driven by seamless technical support and long-term service contracts, making the relationship with certified service providers a crucial element of the downstream value proposition and ensuring the sustained operational efficiency of the installed base.

Hybrid Boiler Market Potential Customers

The primary end-users and buyers of hybrid boiler systems fall predominantly into the residential replacement market. These customers are homeowners, particularly those residing in detached or semi-detached properties built before modern insulation standards were enforced, who possess an existing fossil fuel boiler that is nearing the end of its operational life. These individuals are increasingly driven by two core motivations: the need to reduce escalating heating bills and the desire to improve their home's environmental performance in anticipation of future regulatory constraints or property value benefits associated with higher energy ratings. These customers are seeking a reliable, high-efficiency upgrade that minimizes disruption, offering a crucial transitional step towards full electrification without the substantial upfront investment or intrusive infrastructure changes often associated with standalone heat pump installations.

A significant secondary customer base is the residential new build sector and light commercial property owners. In the new build market, developers are increasingly mandated to meet high energy performance standards that often require partial reliance on renewable heating sources. Hybrid boilers provide compliance assurance while maintaining the reliable output provided by a gas backup, satisfying both regulatory requirements and buyer expectations for robust performance. Commercial buyers, such as small business owners, facility managers of small office complexes, and local authority housing providers, prioritize system resilience, low running costs over a 15-20 year lifespan, and remote monitoring capabilities to manage energy usage across multiple sites efficiently. These buyers typically require higher capacity systems and prioritize robust service contracts and proven reliability records from manufacturers.

Furthermore, energy service companies (ESCOs) and housing associations represent a growing segment of bulk buyers. These organizations manage large portfolios of properties and are focused on mass retrofitting strategies to meet ambitious carbon reduction targets across their housing stock. For ESCOs, the ability of hybrid systems to perform reliably in diverse property types, including those with poor insulation, and to provide measurable, data-backed energy savings, makes them a compelling choice. This buyer segment values scalable installation procedures, long-term operational guarantees, and partnerships with manufacturers that offer comprehensive technical support and standardized training for their internal maintenance teams, ensuring a smooth transition across hundreds or thousands of properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viessmann, Bosch Thermotechnology (a subsidiary of Robert Bosch GmbH), Vaillant Group, BDR Thermea Group, NIBE Group, Daikin Industries, Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Wolf GmbH, Intergas Verwarming B.V., Immergas S.p.A., ATAG Heating, Groupe Atlantic, Samsung HVAC, Lennox International Inc., Carrier Global Corporation, Rheem Manufacturing Company, Bradford White Corporation, AO Smith Corporation, and Rinnai Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid Boiler Market Key Technology Landscape

The Hybrid Boiler Market's technological landscape is defined by the synergistic integration of two distinct, highly advanced heating modalities: high-efficiency condensing boiler technology and modern air source heat pump (ASHP) systems. On the boiler side, manufacturers utilize advanced stainless steel or aluminum heat exchangers and sophisticated modulation capabilities to achieve condensing efficiencies exceeding 90%. This ensures that even when the heat pump is not operational, the gas or oil backup provides highly efficient heating. The boiler technology focuses on minimal emissions (low NOx burners) and compact design. On the heat pump side, technological breakthroughs focus on increasing the Coefficient of Performance (COP), especially at low ambient temperatures, utilizing technologies like enhanced vapor injection (EVI) compressors and optimizing defrost cycles to maintain high efficiency even during severe winters, thus maximizing the time the system operates in electric-only mode.

The central technological differentiator is the Hybrid Manager or intelligent control system. This software-driven unit employs complex algorithms to monitor external factors—such as local electricity and gas prices (often requiring real-time tariff integration via APIs), weather forecasts, and historical home energy performance data—to execute the 'bivalence point' strategy. The bivalence point is the precise outdoor temperature threshold at which the system switches from the heat pump as the sole source to engaging the boiler, either in parallel or as the primary heat source. Modern hybrid controls utilize predictive analytics, moving beyond static temperature thresholds to dynamically adjust the bivalence point hourly or daily, ensuring the system always operates at the lowest carbon footprint and minimum running cost. Connectivity, powered by IoT standards, is fundamental to delivering this level of intelligence.

A burgeoning technological trend is the adoption of natural refrigerants, such as R290 (propane), in the heat pump component. This move is driven by stringent global F-gas regulations aiming to curb the use of high GWP refrigerants. R290 offers superior thermodynamic properties, often resulting in higher hot water temperatures and better low-temperature performance compared to older HFC refrigerants. Furthermore, there is ongoing innovation in acoustic engineering to minimize the noise output of the external heat pump unit, a critical factor for residential adoption, particularly in high-density housing areas. The overall technological direction points toward fully integrated, plug-and-play systems that simplify installation and maximize efficiency through increasingly sophisticated, self-learning digital controls, effectively blurring the line between traditional heating and renewable energy technologies.

Regional Highlights

The global Hybrid Boiler Market exhibits distinct characteristics across major geographical regions, heavily influenced by local regulatory environments, existing infrastructure, and energy pricing structures. Europe remains the undisputed leader, accounting for the largest share of the market, driven by ambitious climate targets, significant government subsidies (e.g., Boiler Upgrade Scheme in the UK, MaPrimeRénov in France), and the widespread availability of natural gas infrastructure. Countries like Germany, France, and the UK are experiencing rapid adoption as hybrid systems provide a practical, non-disruptive path towards compliance with tightening efficiency standards, particularly in the vast residential retrofit sector.

North America is emerging as the fastest-growing region, specifically in the United States, where federal incentives through the Inflation Reduction Act (IRA) have significantly lowered the cost barrier for highly efficient heating solutions, including heat pumps and hybrid systems. While natural gas remains prevalent, regional variations—such as high electricity costs in certain states contrasting with favorable climate zones—mean that system optimization and intelligent controls are highly valued. Canada also contributes substantial demand, driven by the need for reliable heating in extreme cold conditions, where the gas backup component provides essential security against performance drop-offs associated with air source heat pumps at very low temperatures.

Asia Pacific (APAC) represents a significant future growth opportunity, though adoption is currently concentrated in developed economies like Japan, South Korea, and increasingly, parts of coastal China. These markets are characterized by a high reliance on imported energy and dense urban housing, leading to a strong demand for compact, efficient, and quiet systems. While the market structure differs, with less reliance on traditional large-scale central heating, the principles of energy efficiency and space saving inherent in hybrid technologies are highly appealing. However, widespread adoption in developing nations within APAC is constrained by higher initial costs and limited consumer awareness compared to mature Western markets.

- Europe (Dominant Market): Fueled by the EU's net-zero directives (Fit for 55 package), high natural gas prices, and extensive government incentives making hybridization economically viable for millions of existing homes.

- North America (Fastest Growth): Driven by the US Inflation Reduction Act (IRA) and state-level rebates that subsidize high-efficiency installations; hybrid systems offer crucial reliability in regions with severe winters.

- Asia Pacific (Emerging Market): Growth concentrated in Japan and South Korea, focusing on compact unit design and exceptional energy efficiency due to high population density and energy costs.

- Latin America & MEA (Nascent): Limited penetration currently, but potential exists in urban centers focusing on high-efficiency solutions in response to rising energy costs and sporadic infrastructural constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid Boiler Market.- Viessmann

- Bosch Thermotechnology (a subsidiary of Robert Bosch GmbH)

- Vaillant Group

- BDR Thermea Group

- NIBE Group

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Wolf GmbH

- Intergas Verwarming B.V.

- Immergas S.p.A.

- ATAG Heating

- Groupe Atlantic

- Samsung HVAC

- Lennox International Inc.

- Carrier Global Corporation

- Rheem Manufacturing Company

- Bradford White Corporation

- AO Smith Corporation

- Rinnai Corporation

Frequently Asked Questions

Analyze common user questions about the Hybrid Boiler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical return on investment (ROI) period for a hybrid boiler system?

The ROI period for a hybrid boiler generally ranges between five and eight years, heavily dependent on regional energy prices (gas vs. electricity tariffs), governmental subsidies received at the time of installation, and the efficiency of the old boiler being replaced. Systems installed in regions with high carbon taxes or aggressive electrification mandates often see a quicker payback due to immediate operational savings and incentive valorization.

How do hybrid boilers compare to full heat pump systems in older, poorly insulated homes?

Hybrid boilers are superior for retrofitting poorly insulated or older homes because they maintain the reliability of high-temperature heating using the gas boiler backup when the heat pump efficiency drops in extreme cold. Full heat pumps often require costly and disruptive upgrades to insulation and radiator systems to achieve optimal performance, whereas a hybrid system can integrate seamlessly with the existing infrastructure, making it a lower-risk transitional solution.

What role do smart controls play in maximizing the efficiency of hybrid systems?

Smart controls are crucial for hybrid efficiency, acting as the 'brain' that decides the operational mode. They continuously analyze real-time variables—including outdoor temperature, current energy prices, system demand, and grid stability signals—to dynamically determine the most cost-effective and low-carbon heat source (heat pump, boiler, or both), optimizing the system far beyond basic programmed settings.

Are hybrid boilers environmentally friendly given they still use natural gas?

Hybrid boilers are considered a key transitional technology for decarbonization. They significantly reduce dependence on fossil fuels (often cutting gas consumption by 50-70% compared to conventional boilers) by utilizing the electric heat pump for the majority of the heating load. This reduction lowers carbon emissions immediately while ensuring heating resilience, facilitating the gradual shift toward fully renewable heating systems over time.

What are the primary maintenance requirements and expected lifespan of a hybrid boiler?

The lifespan of a hybrid boiler system is typically 15 to 20 years, similar to high-quality conventional boilers. Maintenance involves annual servicing of both the boiler component (flue gas analysis and cleaning) and the heat pump component (checking refrigerant levels, cleaning the condenser/evaporator coil), ensuring long-term operational performance and validating extended warranty provisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager