Hybrid Loaders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431573 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hybrid Loaders Market Size

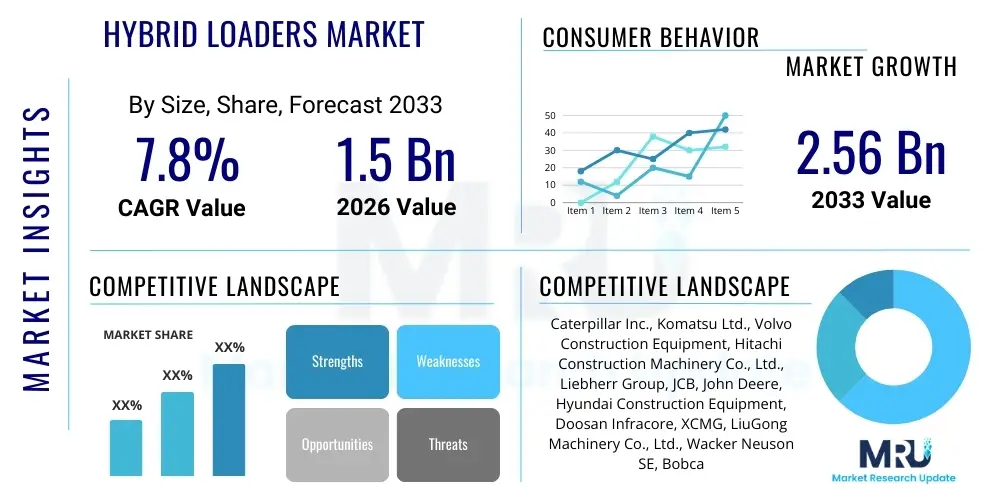

The Hybrid Loaders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Hybrid Loaders Market introduction

The Hybrid Loaders Market encompasses heavy construction and material handling machinery, such as wheel loaders and skid-steer loaders, that integrate traditional internal combustion engines with electric or hydraulic power systems to enhance fuel efficiency, reduce emissions, and optimize operational performance. These machines utilize advanced energy management systems to capture and reuse energy, typically during braking or boom lowering, thereby significantly reducing dependence on fossil fuels compared to conventional diesel counterparts. The primary purpose of hybrid technology in this sector is to provide the necessary power and torque required for heavy-duty cycle operations while meeting increasingly stringent global environmental regulations, particularly those concerning CO2 and NOx emissions in urban and restricted job sites.

Hybrid loaders are increasingly deployed across major sectors including large-scale construction projects, underground and surface mining operations, infrastructure development, municipal waste management, and port logistics/material handling terminals. Their robust design, coupled with intelligent power distribution, allows them to maintain or exceed the performance specifications of pure diesel models while offering substantial long-term cost savings through decreased fuel consumption and reduced maintenance requirements on the primary engine system. Furthermore, the operational silence of the electric component in specific modes makes them ideal for noise-sensitive environments, broadening their application scope in developed economies.

Key driving factors accelerating the adoption of hybrid loaders include aggressive government incentives and mandates promoting fleet decarbonization, volatility in global diesel prices compelling operators to seek efficient alternatives, and the accelerating technological maturation of high-density battery packs and efficient hydraulic recuperation systems. Original Equipment Manufacturers (OEMs) are heavily investing in research and development to standardize these hybrid powertrains across their equipment portfolios, ensuring seamless integration, ease of servicing, and reliable performance across diverse operating conditions, from extreme cold to intense heat, cementing hybrid solutions as a viable and sustainable future for heavy equipment.

Hybrid Loaders Market Executive Summary

The Hybrid Loaders Market is witnessing robust expansion, driven primarily by favorable environmental legislation in North America and Europe mandating lower emissions from heavy machinery, coupled with the inherent economic benefits derived from improved fuel efficiency. Business trends indicate a strong shift among leading OEMs towards modular hybrid solutions that can be easily scaled across different loader classes, from compact utility models to large mining haulers. Strategic collaborations focusing on battery technology sourcing and charging infrastructure development are becoming commonplace, aimed at addressing user concerns regarding uptime and refueling logistics in remote or demanding environments. Furthermore, telematics integration and predictive maintenance are evolving rapidly, leveraging hybrid systems' data generation capabilities to offer superior asset management solutions, enhancing overall total cost of ownership (TCO) for fleet managers.

Regionally, Europe and North America currently dominate the market share due to stringent Stage V and Tier 4 Final emission standards, respectively, creating a mandatory transition path away from conventional diesel power. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market segment. This growth is fueled by massive infrastructure investments, increasing urbanization requiring efficient construction methods, and a growing governmental commitment to addressing severe air quality issues, pushing for the rapid adoption of electric and hybrid construction equipment. Latin America and the Middle East are beginning their adoption curve, focusing initially on large-scale mining and oil & gas projects where operational efficiency and high torque requirements justify the premium cost associated with hybrid machinery.

Segment trends reveal that hydraulic hybrid systems, due to their lower initial cost and proven reliability in capturing kinetic energy, remain popular, especially in smaller and mid-sized wheel loaders used in standard construction cycles. Conversely, electric hybrid loaders, leveraging advanced battery technology for zero-emission capabilities during peak operation or idling, are gaining significant traction in metropolitan areas and large mining applications where downtime and absolute emission control are critical. The 5-10 ton capacity segment is projected to experience the fastest growth, as this size class represents the core workhorse equipment used across diverse applications, making it the most immediate beneficiary of efficiency improvements offered by hybrid powertrains.

AI Impact Analysis on Hybrid Loaders Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change the operational efficiency, safety profile, and maintenance complexity of hybrid loaders. Common questions revolve around the use of machine learning for predictive maintenance schedules, optimizing the power split between the engine and the electric drive system in real-time based on current load and terrain, and the future integration of autonomous operation supported by sophisticated AI sensor fusion. Key user concerns focus on the reliability of AI systems in harsh environments, the cost implications of integrating complex software and sensors, and the necessary cybersecurity measures to protect networked construction assets. The overall expectation is that AI will move hybrid loaders beyond mere energy recovery systems into truly intelligent machines that self-optimize their performance and longevity, significantly lowering operational expenditures and enabling greater utilization rates.

The primary impact of AI centers on optimizing energy management within the hybrid architecture. AI algorithms can analyze historical operational data, real-time sensor inputs (such as bucket fill factor, lift height, and ramp angle), and current battery state of charge to determine the most efficient power combination for any given cycle. This level of optimization surpasses traditional fixed-logic control units, maximizing fuel savings and extending battery life. Furthermore, AI contributes significantly to the safety features by enhancing proximity detection, implementing sophisticated anti-collision logic, and potentially enabling full or partial remote operation capabilities, which are crucial in hazardous environments like underground mining or unstable construction sites.

The implementation of AI also revolutionizes maintenance protocols. By continuously monitoring the health of critical hybrid components, including the high-voltage batteries, electric motors, and hydraulic pumps, AI-driven diagnostics can predict failures weeks in advance, enabling condition-based maintenance rather than relying on fixed hours. This drastically reduces unscheduled downtime, which is a major cost factor in heavy equipment operation. The combination of optimized performance and predictive maintenance solidifies AI as an essential layer of technology that maximizes the return on investment for the inherently complex hybrid loader infrastructure, ultimately driving adoption across major industrial users seeking operational excellence and minimal environmental footprint.

- AI optimizes power train management, maximizing fuel economy by dynamically adjusting engine-electric power split based on real-time operational metrics.

- Machine learning algorithms enable highly accurate predictive maintenance, drastically reducing unscheduled downtime for hybrid components like batteries and motors.

- AI facilitates enhanced operational safety through advanced sensor fusion, object recognition, and implementation of sophisticated collision avoidance systems.

- Integration of AI is fundamental for developing fully autonomous or semi-autonomous hybrid loader operation, particularly in highly repetitive or dangerous tasks.

- Data analytics powered by AI provides fleet managers with granular insights into asset utilization, component lifespan, and overall energy efficiency performance.

DRO & Impact Forces Of Hybrid Loaders Market

The Hybrid Loaders Market is propelled by stringent global emission regulations and the economic imperative to reduce fuel consumption in high-intensity operational cycles, serving as the core drivers (D). However, market expansion faces notable restraints (R), chiefly the high initial capital expenditure associated with hybrid technology compared to standard diesel models, and the dependency on developing robust high-voltage maintenance expertise and charging infrastructure. Significant opportunities (O) arise from the accelerating global trend towards smart cities and sustainable infrastructure development, creating dedicated demand for quiet, low-emission machinery, alongside technological leaps in battery energy density and rapid charging capabilities. These forces collectively shape the market's trajectory, leading to profound impacts on purchasing decisions and fleet renewal strategies across major industries globally.

Impact forces currently influencing the market are strong and varied. On the supply side, increased competition among traditional OEMs and specialized electric machinery manufacturers is fostering rapid innovation, driving down component costs, and accelerating the standardization of hybrid architectures. On the demand side, corporate sustainability mandates (ESG goals) adopted by large-scale construction firms and mining corporations are creating a non-negotiable requirement for greener fleets, pushing hybrid adoption even in regions without strict government mandates. The technological impact force is perhaps the most significant, with continuous improvements in power electronics and energy storage dramatically improving the performance and viability of hybrid systems in heavy-duty applications, resolving earlier concerns about power deficiency or thermal management.

Crucially, the external pressure from fluctuating fossil fuel prices acts as a powerful reinforcing driver. When diesel prices surge, the financial payback period for the higher initial investment in a hybrid loader shortens significantly, making the economic case for adoption highly compelling. Conversely, regulatory uncertainty or slow infrastructure development (e.g., lack of dedicated electric charging ports on job sites) remains a potent restraint, especially in emerging markets. Addressing these restraints through global standardization of charging protocols and incentivizing operator training for complex hybrid systems are paramount to maximizing the positive impact of environmental drivers and technological opportunities within the forecast period, ensuring sustained high growth.

Segmentation Analysis

The Hybrid Loaders Market is comprehensively segmented based on power train type, application, operating capacity, and key components. This granular segmentation provides essential clarity for manufacturers to target specific end-user needs and for investors to understand the fastest-growing niches within the heavy equipment electrification trend. The core segmentations reflect the different approaches to hybridizing power—either through hydraulic energy recuperation or via battery-electric assist—and correlate these technologies with specific operational requirements, such as the need for high-frequency short-cycle loading operations typical of waste management, versus long, continuous operation cycles found in large-scale mining.

Analyzing these segments reveals critical divergences in market maturity and growth potential. For instance, the electric hybrid segment is poised for explosive growth as battery technology improves, offering zero-emission capability vital for indoor material handling and urban construction zones. In contrast, the hydraulic hybrid segment offers a more cost-effective entry point for fleet owners needing incremental efficiency gains without the full infrastructure overhaul required by pure battery systems. Application-wise, Construction and Mining continue to represent the largest segments by volume and value, yet specialized niches like ports and intermodal logistics are demonstrating higher CAGR due to intensive electrification mandates in cargo handling terminals globally.

- By Power Type:

- Electric Hybrid Loaders (Parallel and Series Architectures)

- Hydraulic Hybrid Loaders (Kinetic Energy Recovery Systems)

- By Application:

- Construction and Infrastructure Development

- Mining and Quarrying Operations (Surface and Underground)

- Agriculture and Forestry

- Material Handling and Logistics (Ports, Warehouses)

- Waste Management and Recycling

- By Operating Capacity:

- Below 5 Tons (Compact Loaders)

- 5 Tons to 10 Tons (Mid-Range Wheel Loaders)

- Above 10 Tons (Heavy-Duty Loaders)

- By Component:

- Internal Combustion Engine (Optimized for Hybrid Systems)

- Electric Motor/Generator Sets

- High-Voltage Battery Packs (Li-Ion, Li-Phosphate)

- Power Electronics and Control Units

- Hydraulic and Transmission Systems

Value Chain Analysis For Hybrid Loaders Market

The value chain for the Hybrid Loaders Market is characterized by high integration and critical dependency on specialized component suppliers, extending from upstream raw material sourcing to complex downstream distribution and post-sale support. Upstream activities involve the procurement of specialized materials essential for high-performance components, notably lithium, cobalt, and nickel for battery manufacturing, and advanced alloys for power electronics and hybrid-specific engines. A crucial upstream challenge involves securing a stable and sustainable supply of these battery materials, requiring strategic partnerships between OEMs and cell manufacturers to mitigate supply chain volatility and geopolitical risk. Component specialization means that reliability often hinges on a few core suppliers of advanced electric motors, power inverters, and sophisticated control software.

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs) who integrate these complex components—the engine, transmission, battery, and electronic control units—into the final machine chassis. This requires substantial expertise in high-voltage system integration, thermal management, and sophisticated software calibration to ensure optimal performance and safety. Manufacturing efficiency, quality control, and adherence to rigorous safety standards (especially high-voltage safety) are defining competitive factors at this stage. OEMs must balance the complexity of hybrid system assembly with cost-effectiveness to justify the premium price point to end-users.

Downstream activities center on distribution, sales, and comprehensive after-sales support. Distribution channels are predominantly indirect, utilizing established global dealer networks that provide local sales, financing, and maintenance services. However, due to the technical complexity of hybrid systems, these dealers require significant investment in specialized training, tools, and inventory for high-voltage components. Direct sales channels are increasingly employed for large fleet contracts, particularly in the mining sector, where customized support and long-term service agreements are required. Effective downstream support—including readily available replacement battery packs and specialized technicians—is crucial for maintaining high machine uptime and driving customer satisfaction with the hybrid technology.

Hybrid Loaders Market Potential Customers

The primary consumers and end-users of Hybrid Loaders are large-scale industrial operators and government entities focused on projects demanding high energy efficiency, reduced carbon footprints, and robust performance in demanding operational cycles. These customers prioritize Total Cost of Ownership (TCO) savings derived from lower fuel consumption and extended component life over the initial acquisition cost. Major buyers include international construction companies executing large infrastructure projects (roads, bridges, commercial complexes), global mining corporations focused on sustainable extraction practices, and specialized entities managing waste and material logistics where low noise and emissions are critical regulatory requirements.

Specifically, municipal governments and urban development authorities represent a growing customer base, driven by mandates to reduce localized pollution and noise levels within metropolitan zones. These customers often procure compact and mid-range hybrid loaders for public works, street maintenance, and municipal waste handling. Furthermore, port and intermodal terminal operators are increasingly transitioning their entire fleets, including container handlers and wheel loaders, to hybrid or electric power to meet stricter environmental compliance requirements imposed by maritime regulations and local air quality standards, making them high-value, high-volume purchasers in the material handling segment.

The purchasing decision among these potential customers is heavily influenced by factors such as quantifiable fuel savings data provided by the OEM, the availability of comprehensive local maintenance contracts capable of servicing high-voltage components, and the proven longevity and reliability of the battery and power electronics systems. Fleet replacement cycles, typically ranging from 5 to 8 years in heavy industries, offer recurring market opportunities. Early adopters of hybrid technology are often large, financially stable enterprises capable of absorbing the initial premium, whereas smaller contractors are more cautious, waiting for pricing parity or significant governmental subsidies to de-risk the investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, JCB, John Deere, Hyundai Construction Equipment, Doosan Infracore, XCMG, LiuGong Machinery Co., Ltd., Wacker Neuson SE, Bobcat Company, Yanmar Holdings Co., Ltd., Terex Corporation, SANY Group, Sandvik AB, Epiroc AB, Atlas Copco, Merlo S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid Loaders Market Key Technology Landscape

The technology landscape of the Hybrid Loaders Market is defined by the convergence of advanced energy recovery systems, high-capacity energy storage solutions, and intelligent power management software. The core innovation lies in the electric motor/generator sets which are integrated either in parallel (assisting the engine) or in series (acting as the primary traction source with the engine only charging the battery), enabling kinetic energy recuperation during deceleration or boom lowering. This recovered energy is stored, either mechanically in accumulators (hydraulic hybrid) or electrically in battery packs (electric hybrid), and subsequently redeployed to boost torque or reduce engine load, directly translating to fuel savings of 15% to 40% depending on the duty cycle.

A second critical technology involves the evolution of battery management systems (BMS) and power electronics, which are responsible for safely and efficiently controlling the high-voltage flow between the battery, the motor, and the engine. Modern hybrid loaders leverage high-power density lithium-ion chemistries (such as NMC or LFP) engineered to withstand the extreme vibration, temperature fluctuations, and rapid charge/discharge cycles inherent in heavy equipment operation. The sophistication of the inverter technology is key to ensuring smooth power delivery and maximizing regeneration efficiency, which directly impacts the operational lifespan and reliability of the entire hybrid system in harsh construction or mining environments.

Furthermore, the development of sophisticated telematics and predictive diagnostics software is essential, acting as the nervous system for the hybrid powertrain. These systems continuously monitor component health and optimize the energy management strategy in real-time. The ability to remotely track fuel consumption, battery state of health, and cycle efficiency allows fleet managers to ensure their hybrid assets are performing optimally and helps identify operator behaviors that may undermine the efficiency gains. Ongoing R&D focuses heavily on hydrogen fuel cells as a future hybridization option, particularly for ultra-heavy loaders that require extended runtime without the need for frequent grid charging.

Regional Highlights

The global Hybrid Loaders Market exhibits distinct regional adoption patterns influenced by local regulatory environments, energy costs, and infrastructure readiness. Europe, driven by the stringent EU Stage V emission standards and a strong focus on circular economy principles, remains the dominant region in terms of early adoption and technological maturity. North America follows closely, spurred by Tier 4 Final regulations and robust incentive programs promoting low-emission equipment acquisition, especially among municipal fleets and large material handling ports. Both regions demonstrate high demand for electric hybrid models due to established charging infrastructure and elevated diesel prices.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid acceleration is fueled by massive urbanization and construction booms in developing economies like China, India, and Southeast Asian nations, coupled with increasing government focus on mitigating severe air pollution through mandatory adoption of cleaner construction practices. While cost sensitivity remains higher in APAC, large domestic OEMs are investing heavily in hydraulic hybrid technology as a low-cost, high-impact method to achieve efficiency gains quickly.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, with demand primarily concentrated in the resource extraction sectors—mining in Chile and Peru, and oil & gas infrastructure projects in the Gulf Cooperation Council (GCC) states. Adoption here is driven less by broad environmental mandates and more by the operational benefits: efficiency gains in remote locations where fuel logistics are expensive, and reduced heat signature or noise requirements in specific industrial processes. The heavy-duty segment (above 10 tons) often leads the hybrid transition in these regions due to the high operational hours and fuel consumption typical in mining and port operations.

- North America: High penetration rates driven by Tier 4 Final regulations and significant investment in autonomous and electric hybrid technologies by major OEMs; strong demand from construction and infrastructure renewal projects.

- Europe: Market leader due to strict EU Stage V emission standards, high diesel costs, and government subsidies promoting low-carbon urban fleets; strong focus on hydraulic recuperation systems for short-cycle efficiency.

- Asia Pacific (APAC): Fastest growing region, driven by rapid urbanization, massive infrastructure spending, and increasingly strict domestic pollution controls, particularly in China and India; mix of electric and hydraulic hybrid adoption.

- Latin America (LATAM): Growth centered in the mining and quarrying sectors (Chile, Brazil), prioritizing heavy-duty hybrid loaders for operational cost reduction in remote, fuel-intensive environments.

- Middle East and Africa (MEA): Emerging market concentrated around large-scale government infrastructure projects and oil & gas operations; early adoption focused on enhancing efficiency and robustness in extreme climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid Loaders Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- JCB

- John Deere

- Hyundai Construction Equipment

- Doosan Infracore

- XCMG

- LiuGong Machinery Co., Ltd.

- Wacker Neuson SE

- Bobcat Company

- Yanmar Holdings Co., Ltd.

- Terex Corporation

- SANY Group

- Sandvik AB

- Epiroc AB

- Atlas Copco

- Merlo S.p.A.

Frequently Asked Questions

Analyze common user questions about the Hybrid Loaders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical return on investment (ROI) period for a hybrid loader compared to a conventional diesel loader?

The typical ROI period for a hybrid loader, considering the higher initial cost offset by substantial fuel savings and reduced maintenance, is generally estimated between 3 to 5 years, depending heavily on the intensity of the duty cycle, local fuel prices, and utilization rate of the machine. Higher utilization and volatile fuel markets accelerate the payback period significantly.

How do hybrid loaders address stringent urban emission and noise regulations?

Hybrid loaders address urban regulations by integrating battery-electric power, allowing for operation in low-emission or zero-emission modes during specific periods, such as idling or light duty work. The electric components also drastically reduce noise output, qualifying them for use in noise-sensitive zones and during restricted night-time construction hours.

What are the primary differences between electric hybrid and hydraulic hybrid systems in loaders?

Electric hybrid loaders use electric motors and high-voltage batteries to store and reuse energy, often offering greater fuel efficiency and zero-emission capability. Hydraulic hybrid loaders use high-pressure hydraulic accumulators to capture kinetic energy during braking or boom movement, offering a simpler, lower-cost system focused mainly on peak efficiency gains in short-cycle operations.

Is specialized training required for technicians to maintain hybrid loader fleets?

Yes, specialized training is essential. Hybrid loaders contain complex high-voltage electrical systems and power electronics, requiring technicians to receive certified training in high-voltage safety procedures, diagnostics, and component handling. Maintenance protocols differ significantly from traditional mechanical diesel equipment, particularly concerning battery health and motor maintenance.

What is the expected lifespan of the high-voltage battery pack in a typical hybrid loader?

The high-voltage battery pack in a modern hybrid loader is engineered to last approximately 5,000 to 8,000 hours of operation or about 5 to 7 years under typical heavy-duty conditions before capacity degradation requires replacement or refurbishment. Battery Management Systems (BMS) are used to maximize lifespan by preventing overcharging or deep discharge cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager