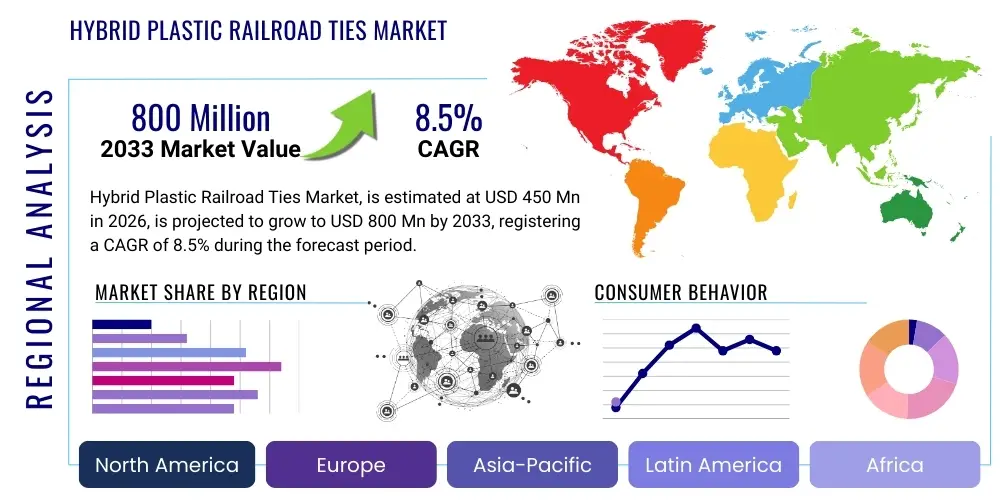

Hybrid Plastic Railroad Ties Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438880 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hybrid Plastic Railroad Ties Market Size

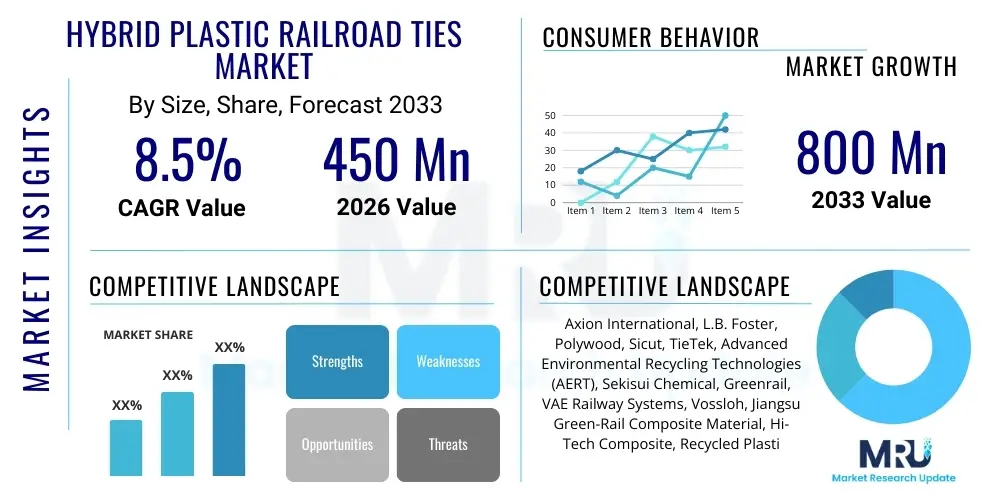

The Hybrid Plastic Railroad Ties Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Hybrid Plastic Railroad Ties Market introduction

Hybrid Plastic Railroad Ties, often referred to as composite sleepers, represent an advanced engineering solution replacing traditional timber and concrete railway sleepers. These ties are predominantly manufactured from a complex blend of recycled plastics (such as HDPE or PET) and reinforcing materials, including fiberglass, steel, or specialized elastomers, designed to optimize both durability and elasticity. This unique composite formulation grants the ties superior resistance to environmental degradation, moisture absorption, insect infestation, and severe temperature fluctuations, which are common failure points for traditional wooden ties. Their structural integrity ensures they maintain gauge geometry and support track loads effectively across diverse geographical and climatic conditions, making them a pivotal component in modern, sustainable railway infrastructure projects globally.

The primary applications of hybrid plastic ties span across heavy-haul freight lines, high-speed passenger railways, and urban transit systems, including light rail and metro lines. Their implementation is particularly advantageous in challenging environments such as tunnels, bridges, and areas prone to excessive moisture or chemical exposure where traditional materials necessitate frequent replacement. Beyond their functional resilience, these ties significantly contribute to the circular economy by utilizing vast quantities of post-consumer and post-industrial plastic waste, thereby reducing landfill burden. This dual benefit—enhanced performance combined with environmental stewardship—is rapidly driving their adoption as railway operators seek long-term, low-maintenance track solutions that align with global sustainability mandates and lifecycle cost optimization strategies.

Driving factors for the substantial market growth include aggressive investment in railway modernization programs across developed and emerging economies, a stringent focus on reducing maintenance expenditure over the asset lifespan, and increasing governmental mandates promoting sustainable construction materials in public infrastructure. The inherent benefits, such as extended service life, resistance to rotting and splitting, and simplified handling due to their lighter weight compared to concrete, further solidify their appeal. Furthermore, the rising global concern regarding deforestation and the dwindling supply of suitable hardwood timber for traditional ties compels railway authorities to pivot toward high-performance, resource-efficient alternatives like hybrid plastic composites, ensuring stable supply chains and predictable long-term material characteristics.

Hybrid Plastic Railroad Ties Market Executive Summary

The Hybrid Plastic Railroad Ties Market is characterized by robust growth, propelled primarily by global infrastructure modernization efforts and stringent environmental regulations favoring sustainable materials. Current business trends indicate a strong move toward advanced material science, focusing on enhancing fiber reinforcement techniques and optimizing the polymer matrix to achieve superior stiffness, creep resistance, and fire safety ratings, enabling deployment even on high-tonnage freight routes. Major manufacturers are forming strategic alliances with waste management firms and major rail operators to secure consistent raw material supply and conduct real-world performance validation, thereby overcoming historical adoption inertia related to long-term creep performance. The shift from short-term cost evaluation to a holistic lifecycle cost assessment model strongly favors hybrid plastic ties due to their minimal maintenance needs and significantly extended service life, often exceeding 50 years.

Geographically, market expansion is currently dominated by North America and Europe, regions leading in track replacement and modernization projects aimed at increasing network resilience and speed capacity. These regions benefit from established regulatory frameworks and public sector commitment to using recycled content in infrastructure. However, the Asia Pacific (APAC) region is poised for the highest acceleration, driven by massive new railway construction initiatives in countries like China and India, coupled with increasing governmental scrutiny over timber harvesting practices. Regional trends also show a higher demand for standard gauge freight ties in North America, while Europe and APAC focus heavily on high-speed and urban transit segments, demanding specific material properties to handle complex signaling systems and high vibration damping requirements prevalent in dense metropolitan areas.

Segmentation analysis reveals that the composite plastic segment, utilizing high-performance fiber reinforcement, maintains the largest market share due to its proven efficacy in demanding applications. Simultaneously, the replacement and maintenance segment significantly outweighs new construction, as aging global infrastructure mandates continuous refurbishment. Key segment trends include the emergence of intelligent ties, which integrate IoT sensors for real-time monitoring of track geometry, temperature, and ballast conditions, adding sophisticated diagnostic capabilities to the inherent material advantages. This technological integration transforms the tie from a passive structural component into an active data-gathering asset, drastically improving preventative maintenance scheduling and enhancing overall network safety and operational efficiency.

AI Impact Analysis on Hybrid Plastic Railroad Ties Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hybrid Plastic Railroad Ties Market center on two primary themes: optimized production processes and enhanced asset management. Users frequently inquire about how AI can refine material blending ratios to improve product consistency, given the variability of recycled plastic feedstock, and how AI-driven predictive maintenance (PdM) can leverage data from smart ties to forecast failure and optimize replacement cycles. There is significant interest in using machine learning (ML) models to analyze manufacturing parameters, such as extrusion pressure and curing temperature, to minimize material defects and ensure maximum structural performance. Furthermore, stakeholders anticipate that AI will integrate disparate data sources—including weather patterns, operational load histories, and tie sensor data—to create dynamic digital twins of the railway network, profoundly changing the lifecycle management paradigm for hybrid plastic ties by maximizing their uptime and minimizing unscheduled disruptions.

- AI-driven optimization of composite material recipes to ensure consistency despite variable recycled plastic feedstock quality.

- Implementation of Machine Learning (ML) for non-destructive testing (NDT) during manufacturing, enhancing quality control and reducing defect rates.

- Utilization of AI algorithms in Predictive Maintenance (PdM) systems, analyzing real-time data from embedded IoT sensors in smart hybrid ties.

- Improved logistics and supply chain efficiency through AI-based demand forecasting for tie replacement components based on route usage and degradation modeling.

- Creation of comprehensive Digital Twins of railway lines, simulating the long-term performance and failure modes of hybrid ties under extreme stress and environmental conditions.

- AI facilitating automated visual inspection of installed ties, identifying early signs of surface damage, cracking, or creep before catastrophic failure occurs.

DRO & Impact Forces Of Hybrid Plastic Railroad Ties Market

The Hybrid Plastic Railroad Ties Market is driven by environmental sustainability mandates and the necessity for long-term reduction in lifecycle costs, positioning these ties as a crucial infrastructure upgrade. However, the market faces significant restraints primarily related to the high initial capital investment compared to traditional softwood timber ties, and historical skepticism among traditional rail engineers regarding the long-term creep performance and fire resistance of certain polymer blends. Despite these hurdles, a massive opportunity lies in expanding penetration into the heavy-haul segment, where the durability and reduced maintenance frequency offer substantial operational savings over decades. Impact forces, such as fluctuating petrochemical costs affecting virgin polymer components and the volatility of recycled feedstock availability, necessitate robust supply chain management, while stringent governmental regulations concerning material safety and infrastructure resilience further shape market adoption trajectories.

Key drivers include the imperative for railways to achieve carbon neutrality, as hybrid ties possess a significantly lower carbon footprint than concrete and eliminate the ecological impacts associated with timber harvesting. The opportunity landscape is broad, encompassing emerging markets seeking rapid, resilient infrastructure deployment and developed nations undertaking large-scale track renewal. Technological advancements in co-extrusion and composite engineering are mitigating historical concerns, enabling the production of ties with certified Class A fire ratings and mechanical properties comparable to hardwood. The compelling business case, emphasizing the reduction in operational disruptions and the elimination of chemical treatments required for timber, ensures that the long-term commercial impact of these forces strongly favors accelerated market expansion, especially as regulatory bodies worldwide increasingly standardize testing protocols for composite materials.

The interplay between internal market dynamics and external macro-environmental forces dictates the pace of adoption. While high raw material acquisition costs (especially for high-grade reinforcing materials) act as a restraint, the overriding impact force stemming from global railway modernization investments provides immense forward momentum. Governmental incentives and subsidies aimed at promoting green infrastructure investments further tilt the balance in favor of hybrid plastic ties. Ultimately, the market trajectory is driven by the industry’s shift from lowest initial cost procurement to total cost of ownership (TCO) evaluation, solidifying the market's fundamental long-term growth potential and mitigating the immediate impact of capital expenditure barriers.

Segmentation Analysis

The Hybrid Plastic Railroad Ties Market is comprehensively segmented based on material type, application, and end-use, reflecting the diverse requirements of the global railway industry. Material segmentation is crucial, differentiating between ties made primarily from 100% recycled plastic and those classified as high-performance composites incorporating specialized fibers or aggregates for enhanced mechanical strength and stability, crucial for meeting stringent engineering standards in high-speed and heavy-load environments. Application segmentation highlights the ties’ suitability across varying track conditions, from standard freight lines that prioritize low cost and durability to urban transit lines that require superior noise and vibration dampening capabilities. This structure allows manufacturers to tailor products precisely to regulatory demands and operational environments.

The end-use segmentation is particularly important for market forecasting, distinguishing between demand arising from new track construction projects—often seen in rapidly developing Asian countries—and the extensive replacement and maintenance (R&M) activities undertaken in aging networks across North America and Europe. The R&M segment currently dominates, driven by the lifecycle failure of old wooden ties and the necessity to upgrade existing infrastructure to handle increasing axle loads and higher speeds. Analyzing these segments provides strategic clarity for market players, allowing them to focus R&D efforts on materials that can either offer the highest load-bearing capacity for mainline railways or the most cost-effective and environmentally friendly solution for non-critical, secondary lines, thereby capturing maximum market value across the spectrum of railway needs.

- By Material Type:

- Composite Plastic Ties (Reinforced with glass fiber, steel, or specialty polymers)

- Recycled Plastic Ties (Primarily non-reinforced or lightly reinforced)

- By Application:

- Freight Rail/Heavy Haul Lines

- High-Speed Rail

- Urban Transit (Metro, Light Rail, Tramways)

- Industrial & Port Sidings

- By End-Use:

- Replacement and Maintenance (R&M)

- New Construction

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Hybrid Plastic Railroad Ties Market

The value chain for Hybrid Plastic Railroad Ties begins with the upstream segment focusing on raw material sourcing, primarily involving waste management companies and petrochemical industries supplying recycled polymers (e.g., HDPE, LDPE, PP, PET) and reinforcing materials suchers as glass fibers and specialized additives. Consistent quality and volume of recycled feedstock are critical challenges at this stage, leading many manufacturers to vertically integrate or establish long-term sourcing contracts to mitigate supply volatility. The middle segment involves complex manufacturing processes, including material preparation, compounding, extrusion, and often post-molding treatment, where technological expertise in composite engineering is paramount to ensuring the final product meets stringent railway safety standards for resilience, stiffness, and dimensional stability under load. Process optimization at this stage is crucial for cost control and quality assurance.

The downstream segment encompasses distribution, installation, and end-user engagement. Distribution channels are typically specialized, involving direct sales to major railway operators (National Railways, Class I Freight Carriers) or sales through established railway infrastructure contractors and engineering procurement construction (EPC) firms. Direct channels are prevalent for large-volume, customized orders, allowing manufacturers to provide technical support and ensure proper specification adherence. Indirect channels, through regional distributors, handle smaller projects and maintenance inventory. Successful market penetration relies heavily on rigorous testing and certification from national railway bodies, necessitating significant pre-sales validation and technical partnership with the end-users to secure long-term approval and adoption into standard specifications.

Post-installation, the value chain extends to lifecycle management, which represents a significant advantage for hybrid plastic ties. Unlike wooden ties, which must be disposed of or chemically treated, plastic ties can be recovered and recycled back into the manufacturing process, closing the loop and significantly reducing disposal costs for the railway operators. This circularity strengthens the overall value proposition, particularly for environmentally conscious buyers. The distribution channels must manage complex logistics, given the large size and specific handling requirements of ties, often involving specialized railside delivery capabilities. Effective management across the entire chain, from volatile waste sourcing to final rail network integration, is key to achieving profitability and scalability in this niche infrastructure market.

Hybrid Plastic Railroad Ties Market Potential Customers

The primary consumers and buyers of Hybrid Plastic Railroad Ties are large-scale organizations responsible for the construction, maintenance, and operation of railway networks globally. This group is segmented into national governmental railway authorities, which manage mainline passenger and freight infrastructure; private Class I and regional freight carriers, particularly dominant in North America; and metropolitan public transit agencies overseeing urban rail systems. National railways and government bodies are often driven by regulatory requirements for sustainability, safety, and long-term asset performance, making them ideal candidates for large-volume procurement of high-quality composite ties for track renewal programs mandated by long-term infrastructure investment cycles.

Private freight companies, which operate heavy-haul routes subject to extreme axle loads and high-tonnage traffic, constitute another critical customer base. These operators prioritize durability, minimal maintenance intervention, and reduced operational downtime. The extended lifespan and resistance to splitting and decay offered by hybrid ties directly address their core concern of maintaining high reliability and optimizing total cost of ownership (TCO) over standard timber ties, especially in geographically challenging routes. Furthermore, municipal and urban transit authorities represent a growing customer segment, valuing the hybrid ties' superior noise and vibration attenuation properties, which are critical for lines passing through densely populated urban areas, enhancing commuter comfort and adhering to local noise pollution regulations.

Secondary customer segments include large industrial corporations, mining operations, and port authorities that maintain extensive private railway sidings and specialized tracks. In these environments, exposure to aggressive chemicals, moisture, and consistent heavy-duty use necessitates materials that exceed the performance of traditional wood, often making plastic composite ties the preferred specification due to their inert nature and resilience. Finally, Engineering Procurement and Construction (EPC) companies and independent railway track laying contractors, who execute major infrastructure projects, act as influential buyers, recommending and procuring these advanced materials on behalf of the ultimate network owners, focusing on ease of installation and guaranteed structural longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axion International, L.B. Foster, Polywood, Sicut, TieTek, Advanced Environmental Recycling Technologies (AERT), Sekisui Chemical, Greenrail, VAE Railway Systems, Vossloh, Jiangsu Green-Rail Composite Material, Hi-Tech Composite, Recycled Plastic Products Inc., Dura Composites, IntegriCo Composites, Trelleborg AB, Fiberforge Corporation, Railtech International, Polieco Group, Koppers Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid Plastic Railroad Ties Market Key Technology Landscape

The technological evolution within the Hybrid Plastic Railroad Ties market is centered on advanced materials science and manufacturing precision to ensure performance parity with, or superiority over, traditional materials. Core technologies involve the specialized compounding and homogenization of disparate material streams, notably blending varied grades of recycled polymers (polyethylene, polypropylene) with high-strength reinforcing fillers like glass or carbon fibers, and mineral aggregates. Advanced extrusion and compression molding techniques are used to produce ties with precise geometric tolerances and optimal density distribution, minimizing internal voids and ensuring uniform load transfer. A critical technological focus is the development of surface treatments and polymer additives that enhance UV stability, improve fire retardancy to meet rigorous European standards (e.g., EN 45545), and, critically, mitigate material creep under sustained heavy loads and high temperatures, which remains a key engineering challenge for plastic composites.

A significant trend shaping the current landscape is the integration of smart technologies, transforming basic structural ties into data-gathering assets. This involves embedding Fiber Optic Sensors (FOS) or micro-electromechanical systems (MEMS) within the composite matrix during the molding process. These integrated sensors monitor vital parameters such as rail seat deflection, thermal expansion, track geometry stability, and vibrations in real-time. This data is wirelessly transmitted, often via low-power wide-area network (LPWAN) protocols, to central maintenance systems for AI-driven predictive analytics. The successful fusion of composite material technology with Internet of Things (IoT) capabilities enables railroad operators to move from reactive or time-based maintenance scheduling to highly efficient condition-based maintenance, thereby maximizing asset uptime and reducing long-term operational expenditures related to inspection and unforeseen failures.

Furthermore, technology is playing a pivotal role in raw material preparation, specifically in dealing with the complex challenge of utilizing commingled, low-grade recycled plastics. Innovations in pyrolysis and advanced separation techniques are improving the purity and consistency of polymer feedstock, making the manufacturing process more reliable and cost-effective while boosting the environmental credentials of the final product. Research into bio-based or bio-degradable polymer matrices is also emerging, although commercialization remains early-stage. Manufacturers are continuously refining proprietary resin formulations and reinforcement layering strategies to specifically target weaknesses, such as impact resistance at rail seats and resistance to rail abrasion. These ongoing material science improvements are essential for hybrid plastic ties to fully displace conventional concrete and wood across all classes of mainline high-stress track applications.

Regional Highlights

The adoption and growth of the Hybrid Plastic Railroad Ties Market are highly stratified across major global regions, driven by differing regulatory frameworks, infrastructure maturity, and commitment to environmental targets. North America, encompassing the United States and Canada, represents a significant and mature market segment, largely driven by the extensive network of Class I freight railways focused on replacing aging timber ties. These railways prioritize materials that can withstand extreme temperature variations, high axle loads, and maintain gauge integrity with minimal maintenance, leading to substantial investment in high-performance composite ties, particularly those approved by major standards bodies like the American Railway Engineering and Maintenance-of-Way Association (AREMA). The region's emphasis on lifecycle cost reduction and safety drives consistent demand for durable, proven replacements.

Europe stands as a pioneering market, characterized by strict environmental legislation and a dense network of high-speed passenger rail and urban transit systems. European nations frequently mandate the use of recycled content in public procurement and enforce rigorous standards for fire safety and noise reduction, stimulating demand for highly engineered hybrid ties with superior acoustic properties. Countries such as Germany, France, and the UK are leaders in adopting these ties in specific applications like bridges, switches, and transition zones where traditional materials struggle. Regional growth is further supported by the political push for railway modernization under the European Green Deal, necessitating materials that contribute positively to carbon reduction goals and operational resilience in cross-border rail traffic.

The Asia Pacific (APAC) region is projected to experience the fastest growth rate, fueled by unprecedented investment in new railway network expansion, particularly in high-density countries like China, India, and Southeast Asian nations. While initial cost remains a crucial factor, the environmental necessity of avoiding timber reliance and the need for resilient materials in tropical and monsoon-affected regions are propelling adoption. Governments in APAC are increasingly integrating sustainability into large-scale infrastructure planning, creating massive new market opportunities for both composite and recycled plastic ties across urban metro projects and new mainline corridors. Infrastructure development bank financing often stipulates green materials, further accelerating market penetration across this geographically diverse and rapidly expanding railway landscape.

- North America: Focus on heavy-haul freight lines, replacement of chemically treated timber, and stringent AREMA compliance. High adoption driven by TCO analysis among Class I railroads.

- Europe: Driven by environmental mandates, high-speed rail requirements, superior noise reduction properties, and compliance with strict fire safety (EN 45545) regulations, particularly in urban and tunnel applications.

- Asia Pacific (APAC): Highest expected growth rate, driven by massive new railway construction, urbanization projects (metro systems), and necessity for resilient materials in variable climates, often balancing cost with performance.

- Latin America (LATAM): Emerging market primarily focusing on maintenance and expansion of mining and agricultural freight lines; initial price sensitivity gradually shifting toward durability for remote or challenging access areas.

- Middle East & Africa (MEA): Growing market segment driven by major infrastructure initiatives (e.g., GCC rail network) requiring materials resistant to extreme desert temperatures and sand abrasion, promoting interest in high-stability composite solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid Plastic Railroad Ties Market.- Axion International

- L.B. Foster

- Polywood

- Sicut

- TieTek

- Advanced Environmental Recycling Technologies (AERT)

- Sekisui Chemical

- Greenrail

- VAE Railway Systems

- Vossloh

- Jiangsu Green-Rail Composite Material

- Hi-Tech Composite

- Recycled Plastic Products Inc.

- Dura Composites

- IntegriCo Composites

- Trelleborg AB

- Fiberforge Corporation

- Railtech International

- Polieco Group

- Koppers Inc.

Frequently Asked Questions

Analyze common user questions about the Hybrid Plastic Railroad Ties market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of hybrid plastic ties over traditional wooden ties?

Hybrid plastic ties offer significantly extended service life (often 50+ years), superior resistance to moisture, insects, and chemical attack, and do not require hazardous chemical treatment. They enhance track geometry stability and lower long-term maintenance costs due to reduced splitting or rotting compared to timber alternatives.

How do hybrid plastic railroad ties contribute to environmental sustainability?

These ties support the circular economy by extensively utilizing post-consumer and post-industrial recycled plastics, reducing landfill waste. They also eliminate the need for chemical wood preservation (creosote) and reduce deforestation, lowering the overall carbon footprint of railway construction and maintenance.

Are hybrid plastic ties suitable for high-speed rail and heavy-haul applications?

Yes, advanced composite hybrid ties are increasingly engineered with fiber reinforcement to meet the stringent mechanical demands of high-speed passenger and heavy-haul freight lines. Manufacturers ensure these ties meet standards for creep resistance, stiffness, and impact absorption under extreme load and temperature cycles.

What is the typical difference in initial cost between hybrid plastic ties and traditional wood or concrete ties?

Hybrid plastic ties often have a higher initial capital expenditure (CapEx) compared to conventional timber ties. However, when assessed using a Total Cost of Ownership (TCO) model over a 30-to-50-year lifespan, their minimal maintenance requirements and superior longevity result in substantial cost savings compared to both wood and concrete.

What role does smart technology play in the future of the hybrid plastic tie market?

Smart hybrid ties integrate IoT sensors for real-time monitoring of track conditions, including deflection and temperature. This technological integration allows railway operators to employ AI-driven predictive maintenance (PdM) strategies, dramatically improving operational efficiency, network safety, and reducing unscheduled downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager