Hybrid Street Light Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436008 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hybrid Street Light Market Size

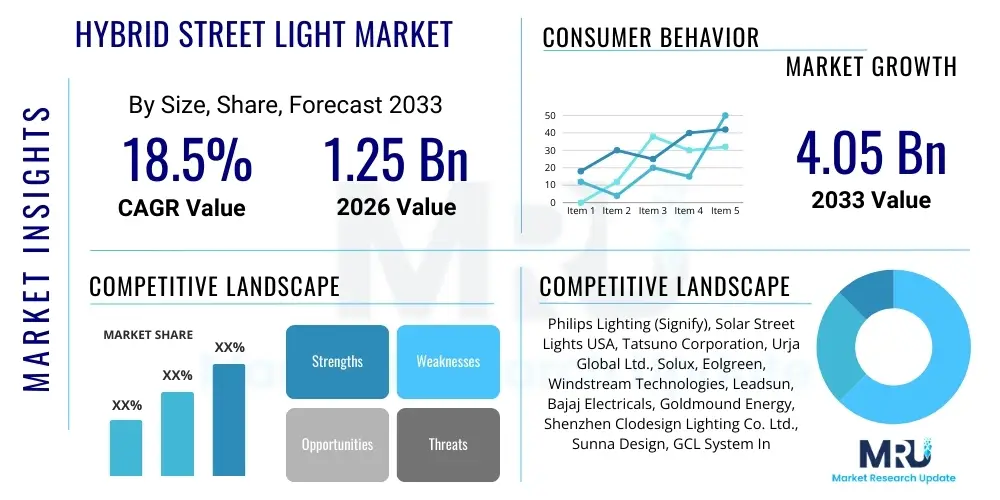

The Hybrid Street Light Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033.

Hybrid Street Light Market introduction

The Hybrid Street Light Market encompasses advanced outdoor lighting systems that utilize a combination of renewable energy sources, predominantly solar photovoltaic (PV) panels and small-scale wind turbines, integrated with high-efficiency LED lighting fixtures and robust battery storage solutions. These systems are specifically designed to provide reliable illumination in areas where grid connectivity is unreliable, costly to install, or entirely absent, offering a sustainable alternative to traditional grid-powered or fuel-based lighting infrastructure. The primary functional benefits include complete energy independence, zero operational carbon emissions, and significantly reduced long-term maintenance costs compared to conventional lighting methods. The core product offering involves intelligent control systems that manage energy harvesting, storage optimization, and illumination scheduling, often incorporating motion sensors and remote monitoring capabilities.

Major applications of hybrid street lighting are critically spread across governmental infrastructure projects, primarily focused on illuminating highways, rural roads, public parks, urban residential developments, and remote industrial facilities. The robust design and autonomous operation make them ideal for infrastructure development in emerging economies prioritizing sustainable growth and rapid electrification. Furthermore, the rising global focus on developing "smart cities" provides a significant impetus, as hybrid street lights naturally integrate with Internet of Things (IoT) frameworks, serving as crucial nodes for environmental monitoring, traffic management, and security surveillance networks. The capability of these systems to operate off-grid fundamentally addresses issues related to grid vulnerability and energy security, which are becoming paramount concerns for municipal planning authorities globally.

Driving factors for sustained market expansion include strict governmental mandates promoting energy conservation and reducing carbon footprints, especially within the OECD nations and rapidly urbanizing regions in Asia Pacific and Africa. Technological advancements in battery storage capacity (particularly lithium-ion and flow batteries) and efficiency improvements in small wind turbines and monocrystalline solar panels have drastically improved the performance and lowered the overall total cost of ownership (TCO) of these hybrid solutions. Additionally, favorable government subsidies, feed-in tariffs, and public-private partnership models encouraging the deployment of sustainable infrastructure are accelerating the adoption cycle, positioning hybrid street lights as a critical component in achieving global sustainable development goals (SDGs) related to clean energy access and sustainable communities.

Hybrid Street Light Market Executive Summary

The Hybrid Street Light Market is characterized by robust technological integration and significant governmental backing, propelling it into a phase of accelerated growth. Business trends highlight a strong shift toward system-as-a-service models and long-term maintenance contracts, moving away from simple product sales. Key players are increasingly forming strategic alliances with smart city technology providers to integrate lighting infrastructure with broader municipal data networks, enhancing value proposition beyond simple illumination. Furthermore, the consolidation among component suppliers, especially in the battery and advanced controller segments, is driving standardization and scalability, improving the ease of deployment for large-scale municipal projects. Investment activity remains high, particularly focused on R&D to enhance system efficiency, weather resilience, and remote diagnostics capabilities, ensuring minimal downtime and maximizing energy capture in varied climatic conditions.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure deficits in countries like India, China, and Indonesia, coupled with aggressive targets for renewable energy integration in urban and rural settings. North America and Europe, while having mature power grids, are showing strong demand driven by smart city initiatives, the replacement of aging infrastructure, and stringent environmental regulations favoring renewable sources. The Middle East and Africa (MEA) region presents immense potential, leveraging hybrid solutions to electrify remote communities and manage energy demand volatility inherent in oil-dependent economies. These regional trends underscore a global commitment to decentralized, resilient energy systems, where hybrid street lighting plays a foundational role.

Segment trends reveal that the solar-wind hybrid segment, offering enhanced reliability in diverse weather conditions, is gaining traction over pure solar or pure wind solutions, particularly in high-latitude or inconsistent wind speed zones. The lithium-ion battery segment is dominating the storage component due to its high energy density and extended cycle life, despite initial cost barriers. Application-wise, highways and public infrastructure remain the largest consumers, but the market is seeing burgeoning demand from the industrial and commercial sectors looking for independent lighting solutions for perimeter security and parking lots. The integration of advanced features, such as integrated CCTV and Wi-Fi hotspots into the street light units, represents a significant segment shift toward multifunctional smart poles, increasing the average revenue per unit deployed.

AI Impact Analysis on Hybrid Street Light Market

Common user questions regarding AI's impact on Hybrid Street Light Market frequently revolve around optimizing energy consumption, predictive maintenance, and enhancing operational efficiency within expansive networks. Users are primarily concerned with how AI can dynamically adjust energy harvesting parameters based on localized weather forecasts (e.g., anticipating solar irradiance or wind speed patterns), thereby maximizing battery lifespan and minimizing reliance on backups. A key expectation is the ability of AI algorithms to detect subtle anomalies in component performance—such as minor degradation in PV panel output or battery health drift—before they lead to systemic failure, shifting maintenance from reactive to predictive models. Furthermore, inquiries focus on AI’s role in optimizing illumination profiles, ensuring lighting levels meet safety requirements while dynamically responding to real-time presence detection (vehicular or pedestrian traffic), leading to significant energy savings across the network. The consensus suggests AI integration is critical for transitioning hybrid street lighting from simple automated systems to complex, self-optimizing energy nodes.

The integration of Artificial Intelligence transforms hybrid street light networks into intelligent energy management ecosystems. AI algorithms process vast amounts of data originating from meteorological services, internal sensors measuring battery charge/discharge rates, energy generation levels, and external inputs like motion detection or traffic flow data. This capability allows the system to establish highly accurate predictive models for energy demand and supply. For instance, in areas prone to sudden changes in weather, AI can prioritize immediate charging or implement more stringent load shedding schedules to ensure critical operational hours are covered, drastically improving system reliability and resilience.

The impact of AI extends significantly into the commercial viability and scalability of hybrid lighting projects. By precisely predicting component failures, municipalities can reduce the cost and complexity associated with field service, managing inventory of replacement parts more effectively. Moreover, AI enables advanced network-level optimization, allowing adjacent street lights within a dense deployment to share operational data and balance loads, improving overall network efficiency. This level of granular control and predictive intelligence ensures that hybrid street lighting systems are not only sustainable but also economically superior in the long run compared to non-intelligent, static renewable lighting solutions, cementing their role in the next generation of smart urban infrastructure development.

- Enhanced Energy Harvesting Prediction: AI utilizes machine learning to forecast solar and wind energy output based on complex weather modeling, optimizing charge controller settings.

- Predictive Maintenance: Algorithms analyze real-time sensor data (voltage, temperature, current) to predict component failure (e.g., LED driver malfunction, battery degradation), ensuring proactive service intervention.

- Dynamic Illumination Control: AI processes traffic and pedestrian density data to adjust brightness levels dynamically, maximizing energy conservation while maintaining public safety standards.

- Network Optimization and Load Balancing: Intelligent systems coordinate power usage and sharing across a network of street lights to prevent localized outages and maximize resource utilization.

- Cybersecurity and Anomaly Detection: AI monitors network communication patterns for unusual activity, enhancing security against malicious attacks or systemic irregularities in smart pole networks.

DRO & Impact Forces Of Hybrid Street Light Market

The dynamics of the Hybrid Street Light Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary drivers revolve around global decarbonization targets and the imperative for energy access in off-grid locations, compelling governments and municipalities to invest in independent renewable energy solutions. However, these systems face significant restraints, most notably the high initial capital expenditure compared to conventional grid-tied LED lighting and the perceived performance risk associated with extreme weather variability (e.g., prolonged cloudy periods or low wind speeds). Opportunities abound in the burgeoning integration with IoT and 5G infrastructure, transforming street lights into multifunctional smart poles, and leveraging advancements in solid-state battery technology to mitigate storage issues. These forces collectively lead to intense competitive pressure on system integrators to achieve cost parity while guaranteeing extreme reliability and longevity, particularly in challenging environments.

The most compelling impact force driving market trajectory is the increasing demand for resilient infrastructure. Traditional electrical grids are susceptible to widespread failures due to natural disasters, physical attacks, or aging infrastructure. Hybrid street lights, being decentralized and self-sufficient energy islands, offer unparalleled resilience. This factor is increasingly influencing purchasing decisions in disaster-prone regions and areas requiring high security, elevating the value proposition beyond mere cost savings. This resilience factor acts as a counterbalance to the high initial investment restraint, especially when factoring in the avoided costs of grid maintenance and service downtime during emergencies.

The second major impact force is the rapidly evolving regulatory landscape, which mandates sustainability standards for public tenders globally. In many jurisdictions, new public infrastructure projects must incorporate a minimum percentage of renewable energy sources or meet specific energy efficiency targets, often making hybrid solutions the most compliant choice. This regulatory push creates a favorable environment for market penetration, reducing the reliance solely on economic variables. Manufacturers are responding by focusing heavily on certifications (e.g., ISO, CE, RoHS) and establishing robust supply chains to meet the accelerating global demand stimulated by these structural market forces.

- Drivers: Global push for renewable energy adoption; necessity for lighting solutions in off-grid or rural areas; increasing governmental emphasis on smart city development; declining costs of LED fixtures and solar PV components.

- Restraints: High upfront capital investment; maintenance complexity (servicing solar panels and wind turbines); challenges related to battery lifecycle management and disposal; unpredictable weather limiting energy generation consistency.

- Opportunities: Integration of IoT sensors, CCTV, and communication technologies into smart poles; development of next-generation high-density, long-life battery storage (e.g., sodium-ion, solid-state); expansion into commercial, industrial, and specialized infrastructure (ports, railways) lighting segments.

- Impact Forces: Pressure for resilient and decentralized energy systems; standardization requirements driven by municipal contracts; intense competition driving down module costs; shift towards subscription-based maintenance models.

Segmentation Analysis

The Hybrid Street Light Market is comprehensively segmented based on its energy source combination, component type, application area, and regional distribution. Analyzing these segments provides critical insights into market drivers and investment hot spots. The source combination segmentation, primarily between Solar-Wind Hybrid and Pure Solar Hybrid (with grid backup), indicates a preference for diversified energy harvesting systems where climatic conditions vary widely, optimizing performance reliability throughout the year. The component segmentation highlights the technological battlefield, centered around improving the efficiency of LED lighting modules, increasing the power density of storage batteries, and enhancing the intelligence of charge controllers and energy management units (EMUs). These component segments are crucial for driving system longevity and performance metrics.

- By Energy Source Combination:

- Solar-Wind Hybrid

- Solar-Grid Hybrid (with Battery Backup)

- Pure Wind-Grid Hybrid

- By Component:

- LED Luminaires

- Solar Panels (PV Modules)

- Wind Turbines (Vertical Axis, Horizontal Axis)

- Battery Storage (Lithium-ion, Lead-acid, Others)

- Charge Controllers and EMUs

- By Application:

- Highways and Roadways

- Rural and Remote Areas

- Public Parks and Gardens

- Residential and Commercial Areas

- Industrial and Institutional Campuses

Value Chain Analysis For Hybrid Street Light Market

The value chain for the Hybrid Street Light Market is complex, stretching from upstream raw material sourcing and component manufacturing to downstream installation, operation, and maintenance. Upstream activities are dominated by specialized component manufacturers focusing on high-efficiency solar cells, rare-earth magnets for wind turbines, sophisticated battery chemistry development, and advanced semiconductor production for LED drivers and intelligent controllers. Key challenges in this stage include securing stable supply chains for materials like lithium and copper, and maintaining quality control across globally distributed manufacturing hubs. This phase dictates the performance parameters and initial cost of the final product.

The midstream section involves system integration and distribution. System integrators (SIs) are pivotal; they combine components from various specialized suppliers, design the optimal hybrid system configuration (sizing solar, wind, and battery capacity based on geographical load requirements), and manage the complex logistics of delivering bulky, specialized poles and fixtures. Distribution channels are typically a mix of direct sales to large municipal government agencies and indirect distribution through specialized electrical contractors and lighting distributors who handle smaller commercial projects. Direct channels ensure technical integrity for large-scale projects, while indirect channels provide broader market reach and localized support.

Downstream activities center on installation, commissioning, maintenance, and end-of-life management. Given the technical complexity (combining electrical, mechanical, and IT infrastructure), specialized installation teams are necessary. The long-term profitability model increasingly relies on post-sales maintenance and service contracts, often leveraging remote diagnostics. The rapid evolution of the market is pushing manufacturers toward "as-a-service" models, where the vendor retains ownership of the assets and guarantees performance, transferring operational risk away from the end-user. This emphasis on long-term relationship management is driving efficiency improvements and extending the profitable lifespan of installed units.

Hybrid Street Light Market Potential Customers

The primary end-users and buyers of hybrid street lighting solutions are governmental and quasi-governmental bodies responsible for public infrastructure development and maintenance. Municipalities worldwide represent the largest customer base, focusing on replacing conventional high-pressure sodium (HPS) lamps with sustainable, intelligent hybrid systems to meet mandated energy efficiency targets. Beyond urban centers, national departments of transportation and highway authorities are major consumers, utilizing these systems for lighting remote stretches of roads, tunnels, and rest stops where extending grid infrastructure is prohibitively expensive or unreliable. These public sector entities value system longevity, compliance with safety standards, and guaranteed long-term reliability.

A rapidly expanding customer segment includes the industrial and commercial sectors. Large logistical hubs, manufacturing plants, mining operations, and expansive commercial parking lots require reliable, high-lumen illumination for security and operational continuity. For these entities, the ability to operate independently from the potentially volatile utility grid serves as a crucial operational advantage, protecting against power outages and reducing peak demand charges. Additionally, developers of eco-friendly housing projects and sustainable resorts are increasingly adopting hybrid street lights to market their commitment to green technology, further expanding the non-governmental demand base.

Furthermore, international development organizations and Non-Governmental Organizations (NGOs) focused on rural electrification and poverty alleviation in developing nations constitute a significant and growing market segment. Hybrid street lights offer a scalable, rapidly deployable solution to introduce public lighting and safety infrastructure in remote villages and refugee camps, bypassing the need for extensive centralized grid investment. These buyers prioritize robust, tamper-proof designs and systems that require minimal technical expertise for basic maintenance, ensuring sustainable functionality in challenging environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philips Lighting (Signify), Solar Street Lights USA, Tatsuno Corporation, Urja Global Ltd., Solux, Eolgreen, Windstream Technologies, Leadsun, Bajaj Electricals, Goldmound Energy, Shenzhen Clodesign Lighting Co. Ltd., Sunna Design, GCL System Integration Technology Co. Ltd., Yingli Solar, Linuo Power Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid Street Light Market Key Technology Landscape

The technological landscape of the Hybrid Street Light Market is characterized by rapid innovation focused primarily on energy conversion efficiency, storage longevity, and system intelligence. A critical technology driving current market advancements is the integration of high-efficiency components: monocrystalline solar panels offering higher power output per unit area, and advanced LED luminaires that deliver superior illumination while drawing minimal power (high lumens per watt). Furthermore, Vertical Axis Wind Turbines (VAWTs) are becoming increasingly popular for street light applications due to their quiet operation, ability to capture wind from any direction, and reduced vibrational stress on the pole structure, making them aesthetically and structurally superior to traditional Horizontal Axis Wind Turbines (HAWTs) in urban environments.

The most crucial area of technological advancement is battery storage. Lithium-ion batteries, particularly LiFePO4 (Lithium Iron Phosphate), dominate due to their enhanced safety profile, long cycle life (crucial for daily charge/discharge cycles), and depth of discharge capabilities. However, research into next-generation alternatives, such as sodium-ion batteries and advanced flow batteries, is significant, aiming to reduce reliance on critical minerals and improve performance stability across wider temperature ranges. These storage innovations are directly addressing the historical restraint of high replacement costs and limited performance duration in extreme climates, thereby unlocking new market opportunities in previously inaccessible regions.

Finally, the evolution of Smart Management Systems (SMS) and Charge Controllers defines the intelligence of the system. Modern charge controllers integrate Maximum Power Point Tracking (MPPT) algorithms to maximize energy harvesting from both solar and wind components simultaneously. These systems are now universally equipped with bi-directional communication capabilities (using LoRaWAN, Zigbee, or cellular networks) to facilitate remote monitoring, fault diagnosis, and over-the-air firmware updates. This technological maturation ensures that hybrid street lights are not standalone fixtures but integrated, communicating elements of a unified smart grid infrastructure, capable of real-time performance optimization and dynamic adaptation to grid conditions or environmental changes.

Regional Highlights

- North America: This region is a leading adopter driven by substantial smart city investments and the necessity for grid resilience following extreme weather events. Key states and provinces are implementing large-scale pilot programs focusing on the integration of hybrid poles with 5G connectivity and edge computing capabilities. The market here emphasizes technological sophistication and advanced monitoring systems, with a strong preference for high-quality, long-life lithium battery solutions, primarily catering to replacing aging infrastructure in major metropolitan and suburban corridors.

- Europe: Driven by the European Green Deal and stringent decarbonization targets, Europe focuses on high-aesthetic, certified hybrid solutions. Germany, France, and the UK are key markets, prioritizing self-sufficient lighting for rural roads and public areas designated as heritage sites where conventional trenching for grid extension is disruptive or restricted. The market values energy efficiency above all, leading to high adoption rates of advanced MPPT controllers and optimized LED optics. Regulatory standards for recycling and environmental impact are also exceptionally high, influencing component selection.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by aggressive government infrastructure projects in China, India, and Southeast Asian nations aimed at rapid urbanization and closing the energy access gap in remote areas. The sheer volume of new road construction and the need for affordable, scalable solutions drive demand. Price competitiveness and robust, simplified designs that require minimal maintenance intervention are crucial factors for success, making this region a dominant force in volume manufacturing and deployment.

- Latin America (LATAM): Growth is characterized by governmental efforts to improve public safety and security in urban centers and providing basic lighting infrastructure in developing areas. Brazil and Mexico are leading the charge, utilizing hybrid systems to combat electricity theft and improve lighting quality without incurring high utility costs. The market is sensitive to economic fluctuations, favoring cost-effective, durable systems that can withstand varying tropical and high-altitude climates.

- Middle East and Africa (MEA): This region offers immense potential due to vast off-grid rural populations and favorable solar irradiation levels in the Middle East. African nations, particularly South Africa, Nigeria, and Kenya, are deploying hybrid street lights as part of national electrification strategies. The MEA market prioritizes system robustness against extreme heat, sandstorms, and dust, necessitating sealed, rugged enclosures and high-temperature performance batteries, often subsidized through international development aid programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid Street Light Market.- Philips Lighting (Signify)

- Solar Street Lights USA

- Tatsuno Corporation

- Urja Global Ltd.

- Solux

- Eolgreen

- Windstream Technologies

- Leadsun

- Bajaj Electricals

- Goldmound Energy

- Shenzhen Clodesign Lighting Co. Ltd.

- Sunna Design

- GCL System Integration Technology Co. Ltd.

- Yingli Solar

- Linuo Power Group

- Renewable Energy Systems (RES)

- SEPCO Solar Electric Power Company

- Carmanah Technologies Corp.

- Helios Energy Systems

- Omega Solar

Frequently Asked Questions

Analyze common user questions about the Hybrid Street Light market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and required maintenance of a hybrid street light system?

Hybrid street lights typically offer a long operational lifespan, often exceeding 15 to 25 years for the pole and structural components. LED luminaires generally last 50,000 to 100,000 hours. The primary maintenance focus is on battery replacement, usually required every 5 to 7 years for standard lead-acid batteries, or 8 to 12 years for high-quality lithium-ion batteries. Maintenance also involves periodic cleaning of solar panels and wind turbine blades to ensure optimal energy capture, which is increasingly monitored remotely via smart systems.

How do hybrid street lights perform in regions with inconsistent weather patterns or low sunlight?

Hybrid systems are specifically designed to address energy inconsistency by combining solar and wind generation, ensuring continued operation even when one resource is limited. Advanced charge controllers and appropriately sized battery banks store sufficient energy reserves (typically for 3 to 5 days autonomy) to cover prolonged periods of low generation. System sizing is crucial and must be precisely calculated based on site-specific irradiance and wind data to guarantee reliable year-round performance in diverse climatic conditions.

What are the primary cost components that contribute to the high initial investment of hybrid street lighting?

The high initial cost is largely driven by three primary components: the battery storage system (which accounts for a significant portion, especially for large capacity lithium-ion solutions), the solar PV panels and/or wind turbine, and the highly efficient, intelligent Charge Controller/Energy Management Unit (EMU). While the lifetime operating cost is significantly lower than grid-tied lighting, the capital expenditure requires robust financing models or subsidies to facilitate mass adoption, particularly for municipal projects.

Are hybrid street lights capable of integrating into smart city IoT networks, and what functionalities do they offer?

Yes, modern hybrid street lights are essential nodes in smart city infrastructure. Beyond basic illumination, they often integrate sensors for air quality monitoring, noise pollution measurement, and high-definition CCTV surveillance. Their autonomous power source makes them ideal platforms for housing small-cell 5G network repeaters or Wi-Fi hotspots, all managed remotely through centralized software platforms utilizing standardized communication protocols for data aggregation and real-time control.

Which regulatory factors are most significantly influencing the growth of the Hybrid Street Light Market?

Market growth is highly influenced by regulatory mandates promoting renewable energy deployment and energy efficiency standards (such as the EU's directives and various national Renewable Portfolio Standards). Furthermore, favorable government incentives, including capital subsidies, tax credits for green infrastructure development, and simplified permitting processes for off-grid installations, are critical regulatory catalysts accelerating market penetration globally, ensuring sustainability targets are met by public infrastructure projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager