Hydraulic Fracturing & Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432156 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Hydraulic Fracturing & Services Market Size

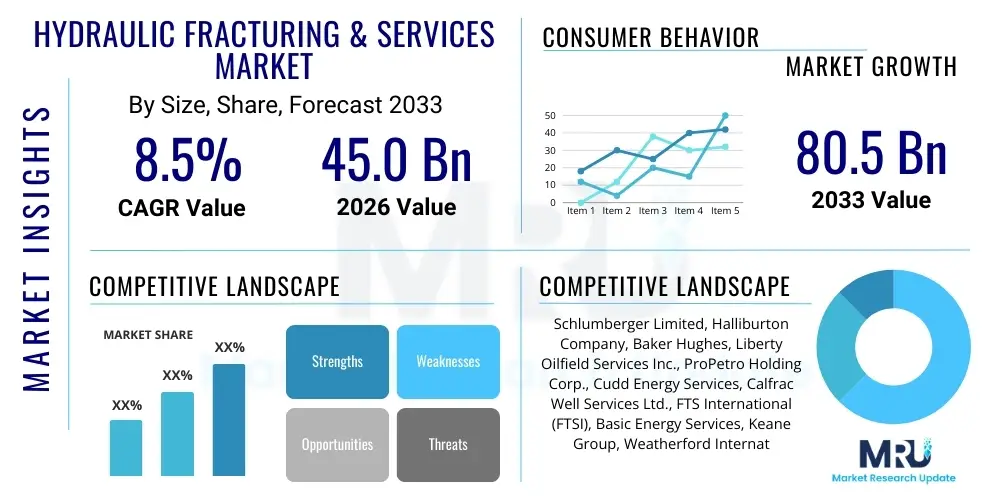

The Hydraulic Fracturing & Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.0 billion in 2026 and is projected to reach USD 80.5 billion by the end of the forecast period in 2033.

Hydraulic Fracturing & Services Market introduction

The Hydraulic Fracturing & Services Market encompasses the provision of specialized technologies, equipment, and expertise required to execute the process of hydraulic fracturing (fracking). This technique involves injecting high-pressure fluid—typically water mixed with sand (proppant) and chemical additives—into subterranean rock formations, such as shale or tight sandstone, to create fractures. These fractures enable the extraction of trapped hydrocarbons (natural gas and crude oil) that would otherwise be economically inaccessible. The primary market drivers include the global energy transition demanding stable baseload supply, the continuous discovery of vast unconventional resource plays, and technological advancements aimed at optimizing well productivity and minimizing environmental footprints.

Hydraulic fracturing services are critical for maximizing the economic output of unconventional oil and gas fields, particularly across North America and increasingly in emerging resource basins globally. Major applications span the entire lifecycle of an unconventional well, from initial planning and reservoir modeling to the actual execution of the fracturing job, including fluid management, proppant delivery, and flowback handling. The key benefit derived from these services is enhanced ultimate recovery (EUR) from resource reservoirs, significantly boosting global oil and gas supply security and often lowering production costs per barrel compared to mature conventional fields.

Driving factors propelling market expansion include sustained global demand for hydrocarbon fuels, particularly in the industrial and petrochemical sectors, alongside crucial improvements in horizontal drilling techniques. The convergence of multi-stage fracturing operations and longer lateral wellbores has revolutionized resource exploitation. Furthermore, ongoing innovation focusing on water recycling technologies, the use of environmentally friendly chemical additives, and the application of digitalization (data analytics, real-time monitoring) are mitigating previous operational and regulatory concerns, thereby sustaining market momentum and investment.

Hydraulic Fracturing & Services Market Executive Summary

The Hydraulic Fracturing & Services Market is characterized by robust growth driven by significant investments in unconventional resource development, primarily in the Permian Basin and other key shale plays. Business trends indicate a shift towards efficiency gains, characterized by high-pressure pumping capabilities, standardized well designs, and integrated service models offered by major oilfield service providers. Companies are focusing intensely on proprietary proppant technology and optimized fracturing fluid compositions to improve conductivity and extend well life. Operational consolidation and strategic partnerships are also becoming prevalent as operators seek to secure reliable, scaled service provision capable of handling complex, multi-well pad drilling programs efficiently.

Regionally, North America remains the undisputed epicenter of market activity, accounting for the largest share due to mature regulatory frameworks, extensive infrastructure, and abundant shale reserves. However, emerging regional trends show rising interest and pilot projects in regions like Argentina (Vaca Muerta), China, and potentially parts of Europe, contingent on local regulatory acceptance and geological viability. Asia Pacific, driven by China's domestic energy security goals, represents a nascent yet potentially substantial growth area for specialized fracturing services. Latin America is gaining traction due to foreign investment and regulatory reforms aimed at unlocking unconventional reserves.

Segmentation trends highlight the increasing dominance of slickwater fracturing techniques due to their cost-effectiveness and applicability in large shale plays. Furthermore, the demand for specialized chemicals, particularly friction reducers and scale inhibitors, is escalating in complex, high-temperature wells. The services segment (pressure pumping and cementing) retains the largest market share, but equipment sales related to mobile fracturing fleets and digitalization tools are experiencing the fastest growth, reflecting the industry's commitment to modernization, reduced downtime, and improved logistical efficiency across extensive acreage.

AI Impact Analysis on Hydraulic Fracturing & Services Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Hydraulic Fracturing & Services Market frequently center on predictive maintenance capabilities, optimization of frac design parameters, and the potential for autonomous operations. Users are keen to understand how AI can minimize non-productive time (NPT) and improve the effectiveness of high-cost fracturing operations. Key concerns revolve around the complexity of integrating diverse datasets (seismic, drilling logs, microseismic monitoring, and real-time pumping data) and ensuring the fidelity of AI models in variable geological settings. There is high expectation that AI will lead to more precise placement of fracturing stages, significantly reducing water and chemical usage while maximizing hydrocarbon recovery, thereby addressing both economic and environmental stewardship goals.

AI's role extends beyond simple data aggregation; it is fundamental to advancing reservoir understanding and operational excellence. Machine learning algorithms are now routinely employed to analyze historical frac data to predict optimal proppant concentrations and fluid injection rates tailored to specific well characteristics, moving away from generalized frac recipes. This shift towards data-driven completion strategies allows operators to execute 'smarter' completions, where real-time diagnostics—such as pressure telemetry—feed directly into AI models that instantaneously adjust pumping parameters, ensuring fractures propagate optimally and efficiently. This level of dynamic optimization dramatically enhances the return on investment for complex well designs.

Furthermore, the integration of AI platforms facilitates the automation of complex logistical tasks, such as managing the intricate supply chain for proppants and chemicals, and optimizing the sequencing of equipment deployment (e.g., fracturing fleets, blenders). This reduction in human interface for routine tasks not only boosts efficiency but also enhances site safety. The future outlook suggests AI will be instrumental in enabling fully automated or 'lights-out' fracturing operations, minimizing personnel exposure and maximizing the utilization rate of expensive capital equipment through highly accurate, predictive maintenance scheduling.

- AI-driven optimization of fracture geometry and stage placement to maximize conductivity and resource recovery.

- Predictive maintenance analytics for high-pressure pumping equipment, reducing downtime and operational costs.

- Real-time autonomous adjustment of frac fluid composition and injection rates based on downhole telemetry and microseismic feedback.

- Enhanced logistical efficiency through machine learning models optimizing proppant and chemical supply chains.

- Advanced reservoir modeling and simulation using deep learning to predict well performance before fracturing commences.

- Improved health, safety, and environmental (HSE) outcomes via AI monitoring of critical operational parameters and early detection of anomalies.

DRO & Impact Forces Of Hydraulic Fracturing & Services Market

The Hydraulic Fracturing & Services Market is governed by a powerful interplay of Driving forces (D), Restraints (R), and Opportunities (O), collectively shaping its trajectory and competitive landscape. The primary drivers include the necessity for global energy security, the economic viability of unconventional resources, and continuous technological refinements that lower operational risks and costs. Major restraints are rooted in stringent environmental regulations, particularly concerning water usage and seismic activity, coupled with persistent public perception challenges related to environmental impact. Significant opportunities lie in the integration of digital oilfield technologies, expansion into underdeveloped international unconventional basins, and the development of sustainable, non-water-based fracturing fluids, such as liquefied petroleum gas (LPG) or compressed natural gas (CNG).

Impact forces on the market are profound and multi-faceted. Economic forces, driven by global oil and gas commodity prices, dictate capital expenditure decisions by exploration and production (E&P) companies, directly influencing the demand for fracturing services. When prices are high, activity accelerates, leading to capacity constraints; when prices drop, operational efficiency and cost reduction become paramount. Technological forces, specifically advancements in drilling automation and high-efficiency pumping equipment, act as powerful accelerators, continually improving the feasibility and sustainability of unconventional extraction, making previously marginal plays viable.

Furthermore, socio-political and environmental forces exert significant pressure. Regulatory bodies are increasingly scrutinizing water disposal methods and methane emissions, necessitating substantial investment in closed-loop systems and emission control technologies. Geopolitical instability also plays a role, as disruptions in conventional supply routes enhance the strategic importance of domestically produced unconventional resources, driving increased market investment in established and emerging shale plays. Service providers must navigate this complex landscape by demonstrating operational excellence, regulatory compliance, and commitment to reduced environmental impact.

Segmentation Analysis

The Hydraulic Fracturing & Services Market is meticulously segmented across several critical dimensions, providing granular insights into operational preferences, technological adoption, and expenditure patterns. Primary segmentation criteria include the type of service, the application area (oil vs. gas), the fracturing technique utilized, and the type of proppant deployed. The Service Type segment, encompassing pressure pumping, chemical services, water management, and proppant handling, dominates the revenue contribution as these are essential components of every fracturing operation. The Application segment reflects the relative dominance of oil-focused wells, particularly in North America, which typically require more intensive and complex fracturing jobs compared to drier gas plays.

Analysis of fracturing techniques reveals a sustained shift towards high-volume, multi-stage, slickwater fracturing, preferred for its efficiency in extracting resources from tight shale rock. However, niche techniques utilizing energized fluids (e.g., CO2 or N2) are gaining attention in specific environments where water availability is constrained or minimizing formation damage is critical. Proppant selection remains a vital differentiating factor, with increasingly robust and specialized ceramic proppants being deployed in deep, high-stress environments to ensure fracture conductivity is maintained over the long term, contrasting with the high-volume use of low-cost raw sand (White Sand) in shallower plays.

- By Service Type:

- Pressure Pumping Services

- Proppant Services

- Fluid & Chemical Additives Services

- Water Management Services

- Support Services (Data Acquisition, Logging, Consulting)

- By Application:

- Crude Oil Production

- Natural Gas Production

- By Technology/Technique:

- Slickwater Fracturing

- Linear Gel Fracturing

- Cross-linked Gel Fracturing

- Energized Gas Fracturing (N2/CO2)

- Foam Fracturing

- By Proppant Type:

- Ceramic Proppants (Bauxite, Lightweight Ceramics)

- Resin-Coated Sand

- Raw Sand (White Sand, Brown Sand)

Value Chain Analysis For Hydraulic Fracturing & Services Market

The Hydraulic Fracturing & Services market value chain is extensive and begins with upstream activities focused on securing the necessary raw materials and specialized equipment. Upstream elements primarily include the mining, processing, and transportation of proppants (sand/ceramics) and the manufacturing of specialized chemical additives, such as friction reducers, biocides, and scale inhibitors. This phase is characterized by high capital expenditure for equipment (e.g., frac pumps, blenders, hydration units) and complex logistics management to ensure just-in-time delivery of millions of pounds of proppant and thousands of gallons of fluid to remote well sites. Securing stable, high-quality proppant supply chains and reliable high-horsepower pressure pumping equipment is critical for market profitability.

The core of the value chain is the service delivery phase (midstream activities), where oilfield service companies execute the fracturing job directly at the wellhead. This involves specialized personnel, advanced software for real-time monitoring, and coordinated deployment of vast hydraulic horsepower. Distribution channels for these core services are predominantly direct; service companies contract directly with E&P operators, forming strategic, often long-term, partnerships. Indirect distribution may involve smaller, specialized consulting firms providing niche services like microseismic monitoring or data interpretation, complementing the primary fracturing provider. Success in this phase relies heavily on operational safety, efficiency (NPT reduction), and maximizing the achieved fracture network complexity.

The downstream component of the value chain involves the management of the extracted products and the associated environmental byproducts. This includes flowback water management (storage, treatment, and disposal/recycling), which has become increasingly regulated and technologically intensive. Ultimately, the successful fracturing operation feeds directly into the larger oil and gas midstream infrastructure (pipelines and processing facilities), connecting the unconventional resource to the refinery or utility end-user. Service integration, where major providers offer bundled drilling, cementing, and fracturing packages, aims to streamline the entire upstream process, reducing interface risk and enhancing project delivery speed.

Hydraulic Fracturing & Services Market Potential Customers

The potential customers and end-users of hydraulic fracturing services are predominantly Exploration and Production (E&P) companies, ranging from large, multinational integrated oil majors to mid-sized independent operators focused exclusively on specific unconventional resource plays. These entities are the direct buyers, seeking specialized services to complete their drilled wells and bring them into economic production. Their purchasing decisions are heavily influenced by prevailing commodity prices, corporate capital expenditure budgets, and the technical complexity of the targeted reservoirs.

Specifically, national oil companies (NOCs) are increasingly becoming significant purchasers of these services, particularly as countries like China, Saudi Arabia, and Argentina look to develop their domestic unconventional reserves to enhance energy independence and security. Independent operators, particularly those focused on tight oil basins like the Permian or Eagle Ford, represent a highly active customer base characterized by aggressive drilling schedules and a continuous demand for cost-efficient, high-performance fracturing techniques. These customers require customized solutions that can maximize well performance while adhering to strict environmental standards and regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 billion |

| Market Forecast in 2033 | USD 80.5 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Halliburton Company, Baker Hughes, Liberty Oilfield Services Inc., ProPetro Holding Corp., Cudd Energy Services, Calfrac Well Services Ltd., FTS International (FTSI), Basic Energy Services, Keane Group, Weatherford International, NexTier Oilfield Solutions, RPC Inc., Select Energy Services, Nuverra Environmental Solutions, U.S. Silica Holdings Inc., Covia Holdings Corporation, Weir Group PLC, NOV Inc., Cactus, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Fracturing & Services Market Key Technology Landscape

The technological landscape of the Hydraulic Fracturing & Services Market is rapidly evolving, driven by the imperative to increase operational efficiency, reduce environmental impact, and enhance downhole monitoring capabilities. A major technological advancement is the shift towards electric-powered fracturing fleets ('e-frac'), which utilize grid power or natural gas generators instead of traditional diesel engines. This transition significantly lowers fuel consumption, reduces greenhouse gas emissions, and decreases noise pollution at the well site. Furthermore, operators are adopting automated control systems and high-pressure, continuous pumping technologies that minimize non-productive time (NPT) by ensuring consistent flow rates and pressure stability throughout complex multi-stage jobs.

Another critical area of innovation focuses on the fracturing fluid system itself. Research and development efforts are concentrated on creating advanced chemical additives that are less toxic and more biodegradable, addressing environmental concerns related to groundwater contamination. Simultaneously, the industry is exploring alternatives to water-based fluids, such as non-aqueous fluids (NAFs) like LPG, which offer superior reservoir contact and eliminate the complex issue of flowback water disposal, though they introduce enhanced safety requirements due to flammability. The management of proppant delivery has also seen technological improvements, utilizing automated sand handling systems and mobile logistical platforms to ensure rapid and accurate deployment of materials.

Digitalization technologies, including advanced fiber optic sensing and downhole pressure gauges, are transforming data collection. These tools allow service providers to acquire high-resolution, real-time data on fracture propagation and well performance. This data feeds into advanced analytical platforms and machine learning models, enabling immediate adjustments to the fracturing schedule and providing deeper insights into reservoir behavior. This emphasis on data-driven decision-making represents a fundamental technological pivot, moving the industry towards more precise, predictable, and repeatable completion results, thereby maximizing the ultimate recovery factor (EUR) from unconventional reservoirs.

Regional Highlights

Regional dynamics are central to the Hydraulic Fracturing & Services Market analysis, reflecting varied geological conditions, regulatory environments, and investment climates globally. North America, encompassing the United States and Canada, stands as the dominant market leader, largely due to the maturity and sheer scale of its unconventional resource development, particularly in prolific basins such as the Permian, Marcellus, and Montney. This region benefits from established infrastructure, experienced service providers, and a favorable regulatory framework supportive of continuous exploration, making it the global benchmark for fracturing technology and operational efficiency.

The Asia Pacific (APAC) region represents a burgeoning market opportunity, primarily driven by China's assertive policy of developing its massive shale gas reserves in regions like the Sichuan Basin to achieve greater energy self-sufficiency. Although faced with geological complexity, water scarcity challenges, and infrastructure limitations, governmental backing for energy security is fostering significant investment in advanced hydraulic fracturing technologies, necessitating imported expertise and equipment from North American firms. Other APAC countries, including Australia and India, are conducting feasibility studies, potentially opening new fronts for service providers.

Latin America, spearheaded by Argentina's Vaca Muerta shale play, is rapidly emerging as a high-growth region. Favorable government policies and substantial international investment have accelerated activity, particularly in oil-focused unconventional plays. Meanwhile, the Middle East and Africa (MEA) present niche opportunities where conventional fields are maturing, and national oil companies are exploring tight gas and shale formations (e.g., Saudi Arabia, Oman, Algeria) to diversify their energy mix. Market penetration in MEA is often slower, constrained by high upfront costs and the need to adapt technology to unique high-temperature and deep formation characteristics.

- North America (U.S., Canada): Market leader; characterized by high operational intensity, adoption of e-frac technology, and sophisticated multi-well pad drilling programs in the Permian and Appalachian basins.

- Asia Pacific (China, Australia): Emerging growth market focused on energy security; high demand for imported advanced technology to tackle complex geology and water management issues, particularly in Chinese shale gas fields.

- Latin America (Argentina, Mexico): Rapidly developing region, notably driven by the world-class Vaca Muerta shale deposit in Argentina; substantial foreign investment fueling market expansion.

- Europe (UK, Poland, Ukraine): Regulatory hurdles and high public opposition limit large-scale operations; activity is constrained primarily to niche research and pilot projects, though gas import crises could shift policy.

- Middle East & Africa (Saudi Arabia, Oman): Strategic interest in developing tight gas and unconventional oil to meet domestic energy demand and maintain export capacity; requires specialized high-pressure/high-temperature fracturing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Fracturing & Services Market.- Schlumberger Limited

- Halliburton Company

- Baker Hughes

- Liberty Oilfield Services Inc.

- ProPetro Holding Corp.

- Cudd Energy Services

- Calfrac Well Services Ltd.

- FTS International (FTSI)

- Basic Energy Services

- Keane Group

- Weatherford International

- NexTier Oilfield Solutions

- RPC Inc.

- Select Energy Services

- Nuverra Environmental Solutions

- U.S. Silica Holdings Inc.

- Covia Holdings Corporation

- Weir Group PLC

- NOV Inc.

- Cactus, Inc.

Frequently Asked Questions

Analyze common user questions about the Hydraulic Fracturing & Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Hydraulic Fracturing & Services Market?

The primary driver is the ongoing global demand for stable energy supplies coupled with the high economic viability and technological advancement in extracting oil and gas from unconventional shale and tight resource formations, particularly in North America.

How is environmental regulation impacting the growth trajectory of hydraulic fracturing services?

Stringent environmental regulations, especially those governing fresh water usage, wastewater disposal (flowback), and induced seismicity, act as significant restraints, necessitating substantial capital investment in water recycling infrastructure and non-aqueous fracturing fluid technologies.

Which geographical region holds the largest market share for hydraulic fracturing services?

North America, specifically the United States, maintains the largest market share due to its vast, mature shale plays (e.g., Permian Basin) and continuous innovation in multi-stage horizontal drilling and high-efficiency electric fracturing fleets (e-frac).

What are the key technological trends revolutionizing hydraulic fracturing operations?

Key technological trends include the deployment of electric fracturing fleets (e-frac) for reduced emissions, the use of advanced fiber optics and AI for real-time frac monitoring and optimization, and the development of less water-intensive fluid systems.

What role do specialized proppants play in the market?

Specialized proppants, particularly resin-coated sand and high-strength ceramics, are crucial for maintaining fracture conductivity in deep, high-pressure, high-temperature reservoirs, thereby maximizing the sustained flow rate and ultimate hydrocarbon recovery (EUR) from the well.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager