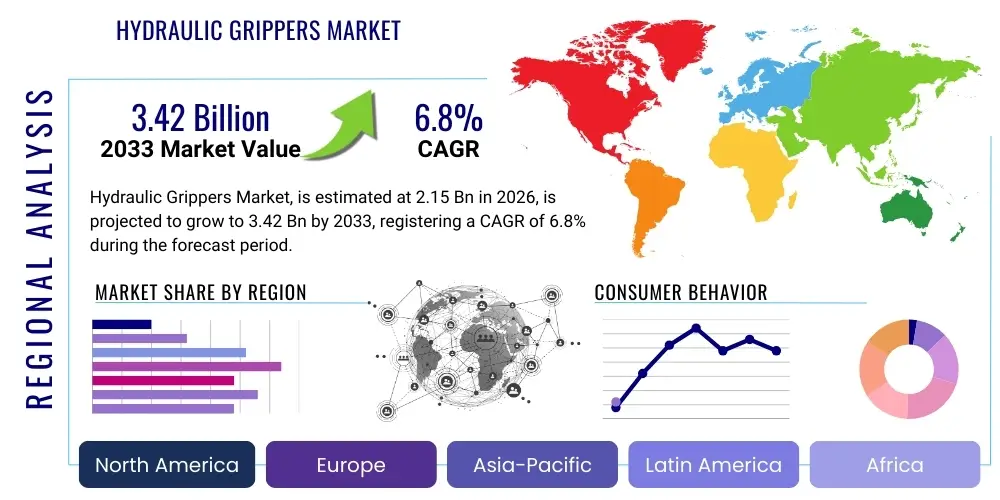

Hydraulic Grippers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440631 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hydraulic Grippers Market Size

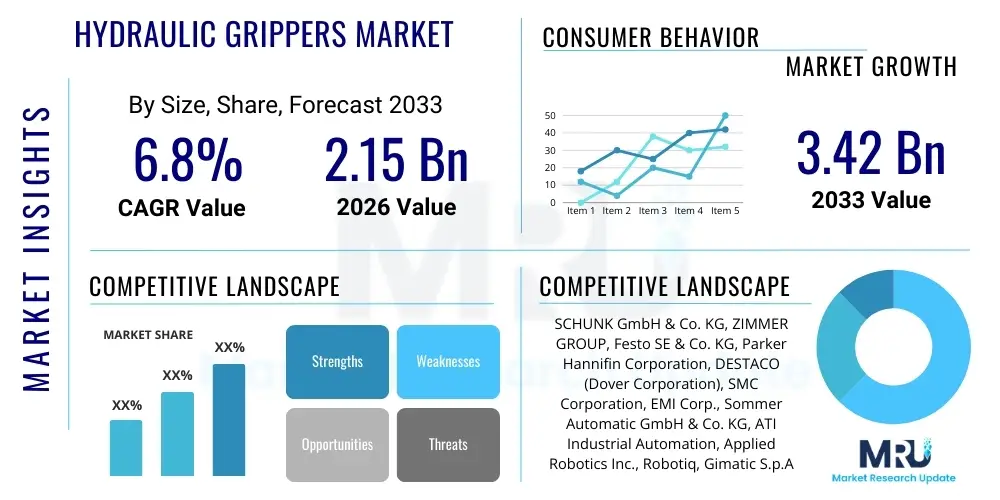

The Hydraulic Grippers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.42 Billion by the end of the forecast period in 2033.

Hydraulic Grippers Market introduction

The Hydraulic Grippers Market plays a pivotal role in the global industrial automation landscape, serving as a critical component in manufacturing processes requiring high gripping force, precision, and durability. These robust mechanical devices utilize hydraulic pressure to actuate their jaws, enabling them to securely grasp, hold, and manipulate objects across a wide range of weights and dimensions. Their inherent ability to generate substantial clamping forces, often exceeding that of pneumatic or electric alternatives, makes them indispensable in heavy-duty applications and environments where consistent, powerful gripping is paramount. The market encompasses a diverse array of gripper types, each designed for specific operational requirements, from parallel and angular grippers to more complex multi-finger configurations, catering to varied industrial demands for material handling, assembly, and machine tending.

The product, a hydraulic gripper, is fundamentally a mechanism comprising a hydraulic cylinder, piston, and precision-engineered jaws, often configurable or interchangeable to suit different part geometries. The hydraulic system provides a constant and powerful clamping force, ensuring secure handling of workpieces, even under dynamic conditions or when dealing with irregular shapes. Major applications span across critical industrial sectors including the automotive industry for engine block manipulation and body panel assembly, heavy machinery manufacturing for handling large components, general manufacturing for automated assembly lines, and material handling systems in logistics and warehousing. Their reliability and capacity to operate in harsh industrial environments, such as those with high temperatures, dust, or moisture, further solidify their position as a preferred choice for robust automation solutions. The precision offered by advanced hydraulic control systems also ensures delicate part handling when required, despite their high-force capabilities.

The benefits derived from deploying hydraulic grippers are manifold, contributing significantly to enhanced operational efficiency, improved safety, and reduced labor costs. Their high gripping force ensures secure part transfer, minimizing the risk of slippage and damage, thereby improving product quality and reducing scrap rates. The robust construction of hydraulic grippers translates to exceptional durability and a long operational lifespan, even in demanding continuous-operation settings, leading to lower total cost of ownership over time. Moreover, their consistent performance contributes to higher throughput and faster cycle times in automated processes, directly boosting productivity. Key driving factors propelling the growth of this market include the escalating global demand for industrial automation driven by Industry 4.0 initiatives, the increasing adoption of robotics across diverse sectors, and the continuous push by manufacturers to achieve higher levels of precision, efficiency, and safety in their production lines. As industries worldwide strive for greater competitiveness and operational excellence, the role of advanced hydraulic gripping solutions becomes increasingly vital.

Hydraulic Grippers Market Executive Summary

The Hydraulic Grippers Market is currently undergoing significant transformation, characterized by several prominent business trends. A notable shift is towards enhanced customization and modularity, allowing manufacturers to offer grippers precisely tailored to specific application requirements, integrating seamlessly with diverse robotic platforms and industrial setups. There is also a growing emphasis on developing smart grippers equipped with integrated sensors for real-time feedback on grip force, object detection, and position, facilitating more intelligent and adaptive manufacturing processes. Furthermore, manufacturers are exploring lightweight yet durable materials to improve robot payload capacity and energy efficiency. The market is also witnessing increased consolidation, with leading players acquiring smaller, specialized firms to expand their product portfolios and technological capabilities, aiming to offer comprehensive automation solutions rather than standalone components. This strategic focus on integrated solutions aligns with the broader industry trend of holistic automation ecosystems.

From a regional perspective, the market dynamics for hydraulic grippers exhibit distinct characteristics. The Asia-Pacific region continues to dominate, primarily driven by rapid industrialization, extensive manufacturing activities, and significant investments in automation, particularly in countries like China, Japan, South Korea, and India. This region benefits from a large installed base of industrial robots and a growing automotive and electronics manufacturing sector, which are major consumers of hydraulic grippers. North America and Europe represent mature markets, characterized by a strong emphasis on advanced manufacturing, high-precision automation, and the adoption of Industry 4.0 technologies. In these regions, the growth is fueled by modernization of existing facilities, demand for sophisticated collaborative robotic applications, and the need to maintain competitiveness against lower-cost manufacturing hubs. Latin America and the Middle East & Africa (MEA) are emerging markets, showing gradual growth driven by expanding industrial infrastructure, diversification of economies, and increasing foreign direct investment in manufacturing capabilities.

Segmentation trends within the Hydraulic Grippers Market highlight evolving preferences and technological advancements. Parallel grippers, known for their versatility and precision, remain a dominant segment due to their widespread use in assembly and material handling across various industries. However, there is an increasing demand for angular grippers for specific applications requiring a wider opening or rotational capabilities, and specialized multi-finger grippers for handling complex or irregularly shaped objects. By application, the automotive sector continues to be a primary consumer, followed closely by general manufacturing, machine tooling, and material handling & logistics. The electronics and medical device industries are also showing significant uptake, driven by the need for high-precision, contaminant-free handling of delicate components. Technological advancements are leading to grippers with improved force-to-weight ratios, faster response times, and enhanced durability, further segmenting the market based on performance characteristics and specialized features like wash-down capabilities for food and pharmaceutical applications.

AI Impact Analysis on Hydraulic Grippers Market

Users frequently inquire about how artificial intelligence can enhance the performance and utility of hydraulic grippers, focusing on aspects like improved precision, predictive maintenance, adaptability to varied workpieces, and the potential for more seamless human-robot collaboration. Common concerns revolve around the complexity of integrating AI, the associated costs, and the practical benefits in real-world industrial settings. There's a strong expectation that AI will unlock new levels of efficiency and autonomy in gripping operations, moving beyond simple programmed movements to more intelligent and responsive actions. This anticipation underscores a user desire for grippers that can 'think' and adapt, thereby reducing errors, optimizing processes, and ultimately contributing to more flexible and robust manufacturing systems. The integration of AI is seen not just as an upgrade but as a transformative element for the future of industrial gripping technology.

- Predictive Maintenance: AI algorithms analyze sensor data (e.g., pressure, temperature, cycle count) from hydraulic grippers to predict potential failures, enabling proactive maintenance and minimizing downtime.

- Adaptive Gripping: AI allows grippers to dynamically adjust gripping force and jaw position based on real-time feedback from vision systems or force sensors, accommodating variations in workpiece size, shape, and material properties.

- Real-time Quality Control: Integrated AI can detect anomalies during gripping, such as incorrect part placement or deformed workpieces, triggering immediate corrective actions or flagging for human inspection.

- Optimized Path Planning: AI-powered robotic systems can optimize the gripper's trajectory and orientation for faster and more efficient pick-and-place operations, reducing cycle times.

- Enhanced Human-Robot Collaboration: AI enables grippers in collaborative robot (cobot) applications to anticipate human movements and intentions, ensuring safety and fluidity in shared workspaces.

- Energy Efficiency: AI can optimize hydraulic power consumption by precisely controlling pressure and flow based on the task at hand, reducing energy waste during gripping cycles.

- Process Optimization: By analyzing vast amounts of operational data, AI can identify patterns and suggest improvements for gripper usage, contributing to overall production line efficiency.

DRO & Impact Forces Of Hydraulic Grippers Market

The Hydraulic Grippers Market is primarily driven by the relentless global push for enhanced industrial automation and robotics integration across manufacturing sectors. The increasing imperative to reduce labor costs, improve workplace safety, and achieve higher levels of precision and consistency in production processes serves as a fundamental catalyst for market expansion. Industries such as automotive, aerospace, and heavy machinery, which frequently handle large, heavy, or complex components, rely heavily on the high gripping force and robust performance of hydraulic grippers. The continuous growth in material handling and logistics, coupled with the rising adoption of automated assembly lines, further fuels the demand for these dependable gripping solutions. Moreover, the evolution of Industry 4.0, emphasizing smart factories and interconnected systems, necessitates advanced grippers capable of seamless integration and intelligent operation, thereby propelling technological advancements and market adoption.

Despite the robust drivers, the market faces several restraining factors that could impede its growth. The relatively high initial capital expenditure associated with hydraulic gripper systems, including the gripper itself, the hydraulic power unit, and necessary piping, can be a deterrent for small and medium-sized enterprises (SMEs) with limited budgets. The complexity of integrating hydraulic systems into existing automation infrastructure, requiring specialized expertise for installation and maintenance, poses another challenge. Furthermore, hydraulic systems require regular maintenance, including fluid checks and seal replacements, which can lead to operational downtime and increased recurring costs compared to electric or pneumatic alternatives. Environmental concerns regarding potential hydraulic fluid leaks and their disposal also present a regulatory and operational challenge, especially in sensitive manufacturing environments like food processing or medical device production where contamination risks are paramount.

Significant opportunities for market expansion lie in the burgeoning demand from emerging economies, particularly in Asia-Pacific and Latin America, where rapid industrialization and manufacturing growth are creating new avenues for automation adoption. The continuous development of more energy-efficient and compact hydraulic systems, coupled with advancements in sensor integration and smart control, presents avenues for product innovation that can address some of the existing restraints. Furthermore, the increasing need for specialized grippers for new applications, such as in the medical device manufacturing for handling delicate components or in e-commerce fulfillment centers for varied package handling, offers niche market growth. The ongoing trend towards collaborative robotics also opens opportunities for developing hydraulic grippers with enhanced safety features and more intuitive control interfaces, fostering greater human-robot interaction within production environments. Leveraging these opportunities through strategic investment in R&D and market penetration will be crucial for sustainable growth.

The Hydraulic Grippers Market is subject to various impact forces that shape its trajectory. Technological advancements represent a primary force, continually pushing the boundaries of gripper capabilities, leading to more precise, faster, and more adaptable products. Innovations in materials science contribute to lighter yet stronger grippers, while advancements in hydraulic control systems enhance force accuracy and energy efficiency. The competitive landscape, characterized by both established global players and niche specialists, drives innovation and price competition, benefiting end-users with a broader range of options and improved performance. Regulatory standards, especially those related to industrial safety and environmental protection, significantly influence product design and operational practices, pushing manufacturers towards safer, more eco-friendly solutions. Economic cycles and global manufacturing output directly impact demand, with expansions driving investment in automation and downturns potentially leading to postponed capital expenditures. Finally, supply chain resilience, particularly concerning hydraulic components and raw materials, can profoundly affect production costs and lead times, acting as a critical external force.

Segmentation Analysis

The Hydraulic Grippers Market is segmented across various dimensions to provide a comprehensive understanding of its intricate structure and diverse application areas. These segmentations allow for a detailed analysis of market dynamics, identifying key growth drivers, emerging opportunities, and competitive landscapes within specific product categories, application sectors, gripping force capacities, end-user industries, and sales channels. Such a granular view is essential for manufacturers to tailor their product offerings, for market entrants to identify underserved niches, and for investors to gauge the potential returns across different market segments. Understanding these distinctions helps in formulating targeted strategies and forecasting future trends more accurately within the complex industrial automation ecosystem.

- By Type

- Parallel Grippers

- Angular Grippers

- 3-Finger Grippers

- 4-Finger Grippers

- Radial Grippers

- Custom/Specialty Grippers

- By Application

- Automotive

- Material Handling

- Machine Tooling

- Electronics & Electrical

- Packaging

- Assembly

- Medical & Pharmaceutical

- Food & Beverage

- Aerospace & Defense

- Heavy Machinery

- Others (e.g., Construction, Energy)

- By Gripping Force

- Low Force (Up to 500 N)

- Medium Force (500 N to 2000 N)

- High Force (Above 2000 N)

- By End-User Industry

- Manufacturing (General)

- Logistics & Warehousing

- Automotive OEM & Tier Suppliers

- Aerospace

- Electronics

- Food & Beverage Processing

- Medical Device Manufacturing

- Pharmaceuticals

- Heavy Industry

- Others (e.g., Research & Development)

- By Sales Channel

- Direct Sales

- Distributors/Integrators

- Online Channels

Value Chain Analysis For Hydraulic Grippers Market

The value chain for the Hydraulic Grippers Market commences with an extensive upstream analysis, focusing on the sourcing and processing of raw materials and the manufacturing of essential components. This segment includes suppliers of high-grade metals such as steel alloys and aluminum for gripper bodies and jaws, critical for ensuring structural integrity and durability. Additionally, suppliers of specialized seals, O-rings, and other elastomeric components are vital for maintaining the hydraulic system's integrity and preventing fluid leaks. The upstream also encompasses manufacturers of hydraulic cylinders, pistons, valves, and fluid power units, which are core technological elements determining the gripper's force, speed, and precision. The quality and availability of these foundational materials and components directly impact the performance, cost-efficiency, and overall reliability of the final hydraulic gripper product. Strong relationships with reliable upstream suppliers are critical for managing supply chain risks and ensuring consistent product quality, especially given the precision engineering required for these components.

Moving downstream, the value chain encompasses the manufacturing, assembly, and integration of hydraulic grippers into larger automation systems. This phase involves the design and engineering of various gripper types, the precise machining of components, and the meticulous assembly and testing of the final products. Once manufactured, these grippers are then integrated by automation system integrators and original equipment manufacturers (OEMs) into robotic cells, automated assembly lines, and specialized machinery. These integrators often provide custom solutions, combining grippers with robots, sensors, and control systems to meet specific end-user application requirements. The value added at this stage is significant, transforming individual components into fully functional, high-performance automation tools. Aftermarket services, including installation support, maintenance, and repair, also form a crucial part of the downstream value chain, ensuring the long-term operational efficiency and reliability of the hydraulic grippers deployed in industrial settings.

The distribution channel plays a critical role in connecting hydraulic gripper manufacturers with their diverse customer base, encompassing both direct and indirect approaches. Direct sales involve manufacturers selling directly to large end-users, OEMs, or major integrators, often through their dedicated sales teams or corporate offices. This channel allows for direct communication, custom solutions, and strong customer relationships, particularly for large-volume orders or highly specialized applications. Conversely, indirect distribution channels are prevalent, relying on a network of authorized distributors, resellers, and value-added integrators. These partners provide localized sales, technical support, and often integrate grippers into broader automation packages, serving a wider range of customers, including small and medium-sized enterprises (SMEs). E-commerce platforms are also gaining traction, offering a convenient way for customers to research, compare, and purchase standard hydraulic gripper models. Effective management of both direct and indirect channels is essential for maximizing market reach, providing comprehensive customer support, and adapting to varying regional market demands, ensuring efficient delivery and service throughout the product lifecycle.

Hydraulic Grippers Market Potential Customers

The Hydraulic Grippers Market serves a diverse array of potential customers, primarily comprising industries and enterprises engaged in manufacturing, logistics, and heavy industrial operations that necessitate robust and precise material handling. Automotive manufacturers, including both Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers, represent a significant customer segment. These entities utilize hydraulic grippers extensively for tasks such as handling heavy engine blocks, chassis components, body panels, and other large parts on assembly lines, where high force, reliability, and consistent positioning are paramount. The repetitive, high-volume nature of automotive production makes automation with hydraulic grippers an economic and operational necessity, contributing to improved throughput and reduced human error in critical processes.

Beyond the automotive sector, the general manufacturing industry forms a broad base of potential customers. This includes companies involved in producing everything from consumer electronics and appliances to industrial machinery and equipment. In these environments, hydraulic grippers are employed for machine tending, loading and unloading parts from CNC machines, manipulating workpieces during various stages of assembly, and automated inspection processes. The ability of hydraulic grippers to maintain a firm grip on a variety of materials, often with irregular shapes or high temperatures, makes them invaluable. Furthermore, the burgeoning aerospace and defense sector represents a niche yet high-value customer group, requiring ultra-precise and reliable grippers for handling complex and often delicate components during manufacturing and assembly of aircraft and defense systems, where exacting standards and zero-defect tolerance are non-negotiable.

Logistics and warehousing operations also stand out as growing segments of potential customers. As e-commerce expands and supply chains become more complex, there is an increasing demand for automated solutions to handle packages, pallets, and various goods. While lighter items might use pneumatic or electric grippers, hydraulic grippers are crucial for manipulating heavier loads, often in automated storage and retrieval systems (AS/RS) or for robotic palletizing and depalletizing tasks. Additionally, industries such as metal fabrication, foundries, and heavy construction equipment manufacturing frequently require the high gripping force of hydraulic grippers to manipulate raw materials, castings, and large sub-assemblies. The food and beverage and pharmaceutical industries are also emerging as key customers, particularly for specialized hydraulic grippers designed with hygienic materials and wash-down capabilities, ensuring sterile and safe handling of products in regulated environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.42 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHUNK GmbH & Co. KG, ZIMMER GROUP, Festo SE & Co. KG, Parker Hannifin Corporation, DESTACO (Dover Corporation), SMC Corporation, EMI Corp., Sommer Automatic GmbH & Co. KG, ATI Industrial Automation, Applied Robotics Inc., Robotiq, Gimatic S.p.A., H.I.D. Hydraulic-pneumatic Engineering Co. Ltd., ASS Maschinenbau GmbH, SAS Automation LLC, TECO-Westinghouse Motor Company, Yamaha Motor Co., Ltd. (Robotics Division), Yaskawa Electric Corporation, ABB Ltd., KUKA AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Grippers Market Key Technology Landscape

The Hydraulic Grippers Market is continuously evolving through significant advancements in its core technology landscape, aiming to enhance performance, versatility, and integration capabilities. A critical area of development involves the use of advanced materials, such as high-strength aluminum alloys and specialized steels, which contribute to lighter yet more robust gripper designs. These materials not only improve the gripper's force-to-weight ratio, allowing robots to handle heavier payloads, but also enhance durability and resistance to harsh industrial environments, including those with abrasive dust, high temperatures, or corrosive agents. Additionally, the development of specialized coatings and surface treatments for gripper jaws is crucial for optimizing grip friction, minimizing workpiece damage, and enabling the secure handling of delicate or irregularly shaped objects without slippage, thereby extending the range of applications for hydraulic grippers.

Another pivotal technological trend is the integration of sophisticated sensor technology and intelligent control systems. Modern hydraulic grippers are increasingly equipped with embedded force sensors, position sensors, and pressure transducers that provide real-time feedback on gripping parameters. This sensor data is crucial for precise control over gripping force, allowing for adaptive handling of various materials and preventing overtightening or under-gripping. Coupled with advanced proportional valves and closed-loop control algorithms, these systems enable dynamic adjustment of hydraulic pressure and flow, resulting in faster response times, higher accuracy, and improved repeatability. Furthermore, the incorporation of diagnostic sensors for monitoring hydraulic fluid quality, temperature, and leakage detection supports predictive maintenance strategies, reducing unscheduled downtime and extending the operational life of the grippers.

The development of modular designs and standardized interfaces is also profoundly shaping the hydraulic grippers market. Modular gripper systems allow for quick and easy interchangeability of jaws and finger configurations, enabling manufacturers to adapt a single gripper base to multiple applications and workpiece geometries without significant retooling. This flexibility is critical for high-mix, low-volume production environments and for rapid prototyping. Moreover, the focus on developing digital twin technology for hydraulic grippers is gaining traction, where virtual models accurately simulate the gripper's behavior, allowing for optimized design, predictive maintenance, and real-time monitoring in a digital environment. Finally, seamless integration with robotic control systems and broader Industry 4.0 platforms, through standardized communication protocols like OPC UA and Ethernet/IP, is enabling hydraulic grippers to become smart, interconnected components within fully automated and data-driven manufacturing ecosystems, facilitating remote monitoring, data analytics, and enhanced operational intelligence.

Regional Highlights

- North America: This region, particularly the United States and Canada, is a mature market driven by high adoption rates of industrial automation and advanced manufacturing practices. Key sectors include automotive, aerospace, heavy machinery, and general manufacturing, which consistently demand high-performance hydraulic grippers for complex assembly and material handling tasks. Investment in smart factories and collaborative robotics further fuels growth.

- Europe: Countries like Germany, Italy, and France are at the forefront of automation, with strong automotive, machine tool, and robotics industries. Europe emphasizes precision engineering, quality, and compliance with stringent safety standards, driving demand for sophisticated and reliable hydraulic gripping solutions. The focus on Industry 4.0 initiatives also encourages the integration of advanced grippers.

- Asia Pacific (APAC): The largest and fastest-growing market due to rapid industrialization and extensive manufacturing bases in China, Japan, South Korea, and India. This region benefits from significant investments in new production facilities and automation technologies, driven by lower labor costs and increasing production volumes across automotive, electronics, and general manufacturing sectors.

- Latin America: An emerging market experiencing steady growth, primarily led by industrial expansion in Brazil, Mexico, and Argentina. The automotive industry is a significant consumer of hydraulic grippers in this region, alongside growing investments in general manufacturing and infrastructure development.

- Middle East and Africa (MEA): This region is in an early stage of automation adoption but shows promise with diversification efforts in economies away from oil and gas. Investments in manufacturing infrastructure, logistics, and construction are gradually creating demand for hydraulic grippers, particularly in countries like UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Grippers Market.- SCHUNK GmbH & Co. KG

- ZIMMER GROUP

- Festo SE & Co. KG

- Parker Hannifin Corporation

- DESTACO (Dover Corporation)

- SMC Corporation

- EMI Corp.

- Sommer Automatic GmbH & Co. KG

- ATI Industrial Automation

- Applied Robotics Inc.

- Robotiq

- Gimatic S.p.A.

- H.I.D. Hydraulic-pneumatic Engineering Co. Ltd.

- ASS Maschinenbau GmbH

- SAS Automation LLC

- TECO-Westinghouse Motor Company

- Yamaha Motor Co., Ltd. (Robotics Division)

- Yaskawa Electric Corporation

- ABB Ltd.

- KUKA AG

Frequently Asked Questions

Analyze common user questions about the Hydraulic Grippers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are hydraulic grippers primarily used for in industrial settings?

Hydraulic grippers are predominantly used in industrial settings for tasks requiring high gripping force, precision, and durability. Their primary applications include handling heavy components in automotive and aerospace manufacturing, machine tending for loading and unloading parts, automated assembly processes, and robust material handling in logistics and heavy machinery production. They are favored for their ability to securely manipulate objects, especially large or irregularly shaped workpieces, under demanding conditions.

How do hydraulic grippers compare to pneumatic and electric grippers?

Hydraulic grippers typically offer the highest gripping force and robustness, making them suitable for heavy-duty applications and harsh environments. Pneumatic grippers are faster and more cost-effective for lighter loads and simpler operations, but with less force and precision. Electric grippers provide excellent precision, control, and energy efficiency, often with adjustable force and position, making them versatile for various tasks but generally at a higher cost and lower force than hydraulic alternatives.

What are the key benefits of implementing hydraulic grippers in automation?

Key benefits include superior gripping force, enabling secure handling of heavy or awkward objects; exceptional durability and reliability for long operational life in harsh conditions; high precision and repeatability for consistent part placement; improved safety by reducing manual handling of heavy items; and increased productivity through faster cycle times and reduced downtime. These advantages contribute to lower operational costs and enhanced manufacturing efficiency.

What industries are major adopters of hydraulic gripper technology?

The automotive industry is a leading adopter due to its need for handling heavy components and high production volumes. Other major adopting industries include heavy machinery manufacturing, aerospace and defense for precision assembly, general manufacturing for diverse automation needs, logistics and warehousing for automated material handling, and metal fabrication. Emerging sectors like medical device manufacturing and food & beverage are also increasingly using specialized hydraulic grippers.

How is AI impacting the development and functionality of hydraulic grippers?

AI is transforming hydraulic grippers by enabling features like predictive maintenance, where algorithms anticipate potential failures; adaptive gripping, allowing for dynamic adjustment of force based on workpiece characteristics; and real-time quality control through sensor data analysis. AI integration also enhances process optimization, energy efficiency, and facilitates more intuitive human-robot collaboration, making grippers smarter, more autonomous, and integral to Industry 4.0 environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager