Hydraulic Pressure Reducing Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434525 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Hydraulic Pressure Reducing Valve Market Size

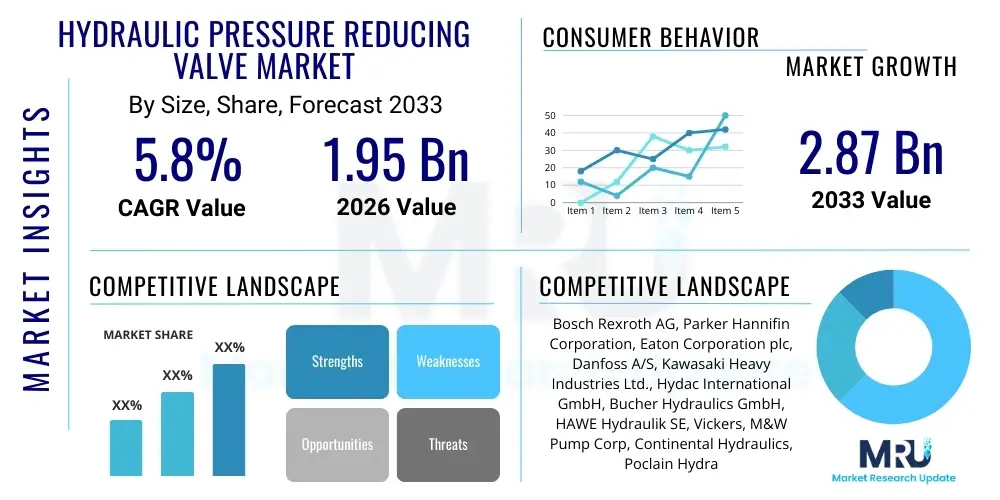

The Hydraulic Pressure Reducing Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.87 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by accelerated infrastructure development across emerging economies, coupled with the increasing demand for precision hydraulic systems in heavy machinery and industrial automation processes. The robustness and reliability offered by modern pressure reducing valves are crucial for enhancing operational safety and efficiency in high-pressure applications, securing their essential role in the industrial landscape.

Hydraulic Pressure Reducing Valve Market introduction

The Hydraulic Pressure Reducing Valve Market encompasses components designed to regulate the pressure in specific parts of a hydraulic circuit to a lower, predetermined level, irrespective of variations in the main system pressure or flow rate. These valves are critical for protecting sensitive components downstream from excessively high pressure, ensuring longevity, consistency, and safe operation of complex hydraulic systems. They operate by balancing the downstream pressure against an internal spring force, thereby maintaining stable outlet pressure even when inlet conditions fluctuate significantly. This capability is paramount in systems requiring multi-pressure zones, where different actuators or mechanisms operate optimally at varied pressure settings.

Major applications of hydraulic pressure reducing valves span numerous sectors, including mobile hydraulics, industrial machinery, aerospace, marine, and energy production (such as oil and gas exploration equipment). In mobile applications, such as construction equipment and agricultural machinery, these valves enable precise control over attachments and complex movements. In the industrial realm, they are essential for machine tools, injection molding equipment, and metal forming presses, where accurate force control is mandatory for quality production. The core benefit derived from their use is enhanced system control, reduced energy consumption due to optimized pressure settings, and significantly increased equipment lifespan by mitigating stress on seals and internal components.

Key driving factors accelerating the market growth include the global trend toward automation and digitalization in manufacturing, which necessitates more sophisticated and reliable fluid power components. Furthermore, stringent regulatory requirements concerning industrial safety and energy efficiency compel end-users to upgrade existing hydraulic infrastructure with advanced pressure control solutions. The continuous innovation in valve materials and design, particularly the development of high-pressure and high-flow capacity valves, further contributes to market expansion by meeting the rigorous demands of modern heavy-duty applications. The integration of proportional control capabilities also allows for dynamic pressure management, crucial for high-performance systems.

Hydraulic Pressure Reducing Valve Market Executive Summary

The Hydraulic Pressure Reducing Valve Market is characterized by robust business trends driven by technological convergence, particularly the integration of smart sensors and digital controls into conventional hydraulic components. Manufacturers are increasingly focusing on developing pilot-operated valves with enhanced accuracy and reduced response times, catering to the burgeoning demand for high-performance automation. Strategic partnerships between valve manufacturers and system integrators are becoming common to provide tailored, complete hydraulic solutions that optimize efficiency and predictive maintenance capabilities. The shift towards electrification in mobile equipment also influences valve design, necessitating lighter, more compact, and energy-efficient components compatible with battery-powered machinery.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market, largely due to massive investments in infrastructure development, rapid industrialization, and the booming automotive and manufacturing sectors in countries like China, India, and South Korea. North America and Europe, while mature, demonstrate strong demand for replacement and upgrade components, driven by strict safety standards and the widespread adoption of Industry 4.0 principles, focusing on precision engineering and IoT integration. Demand in the Middle East and Africa (MEA) is closely tied to fluctuations in the oil and gas sector, where specialized, high-pressure valves are essential for extraction and refining processes, maintaining a steady, albeit sensitive, growth trajectory.

Segment trends highlight the dominance of pilot-operated valves due to their superior flow handling capabilities and precision control in demanding industrial applications. Application-wise, the mobile equipment segment, encompassing construction and agricultural machinery, exhibits the highest growth rate, propelled by mechanization efforts globally. Furthermore, the market is seeing a noticeable trend toward modular and cartridge valve designs, which offer easier installation, maintenance, and system flexibility compared to traditional subplate-mounted configurations. The end-user segment is increasingly differentiating between Original Equipment Manufacturers (OEMs) seeking cost-effective, high-volume solutions and the Aftermarket segment prioritizing rapid replacement and backward compatibility.

AI Impact Analysis on Hydraulic Pressure Reducing Valve Market

User inquiries regarding AI's impact on the hydraulic market often center on predictive maintenance, system optimization, and the potential development of 'self-adjusting' hydraulic circuits. Key user themes involve how AI algorithms can analyze performance data (such as pressure, temperature, and flow rate captured via integrated sensors) to predict valve failure before it occurs, minimizing costly downtime. Concerns are frequently raised about the data infrastructure required to support these smart valves and the cybersecurity implications of integrating fluid power systems into broader industrial IoT networks. Expectations are high for AI to enable dynamic pressure regulation based on real-time operational load, moving beyond static pressure settings to truly optimize energy consumption and prolong valve life under varying field conditions, thus creating a demand for smarter, digitally integrated valve solutions.

- AI facilitates predictive maintenance scheduling by analyzing sensor data streams from valves, reducing unexpected failures.

- Machine learning algorithms optimize valve performance parameters dynamically based on load variations and ambient conditions.

- AI supports the development of diagnostic tools for real-time fault detection and classification within complex hydraulic networks.

- Enhanced system efficiency through AI-driven load sensing and optimized pressure setting adjustments, leading to energy savings.

- Development of self-calibrating and adaptive pressure control valves that autonomously adjust to system degradation or change requirements.

- Improved quality control during manufacturing by using AI for vision inspection and anomaly detection in valve components.

- AI models contribute to faster design iteration cycles for next-generation proportional pressure reducing valves.

DRO & Impact Forces Of Hydraulic Pressure Reducing Valve Market

The Hydraulic Pressure Reducing Valve Market is primarily driven by global industrialization and infrastructure spending, particularly in rapidly developing nations, which necessitate robust and reliable heavy machinery. However, the market faces significant restraints, including the high initial cost of precision-engineered components and the complex installation and maintenance requirements associated with sophisticated hydraulic circuits. Opportunities arise from the increasing adoption of high-efficiency fluid power systems, the demand for compact and lightweight valve solutions in mobile machinery, and the ongoing integration of smart technology (IoT and sensors) to enable condition monitoring and predictive capabilities. These elements combine to define the competitive landscape and technological investment focus.

Impact forces governing the market dynamics include the intense competitive rivalry among established global players and niche manufacturers, leading to continuous innovation in material science and electronic control systems. Buyer power is moderately high, particularly for large OEMs who demand custom, high-volume components at competitive prices, forcing suppliers to optimize supply chain efficiency. Supplier power is generally moderate, although specialized component suppliers (e.g., for seals and high-tolerance castings) can exert influence. The threat of substitutes is low, as hydraulic power remains indispensable for high-force, high-density power transmission compared to electric or pneumatic alternatives in heavy-duty applications. The primary external pressure comes from stringent governmental regulations regarding environmental impact and safety standards, forcing continuous component refinement.

The market’s overall momentum is sustained by macroeconomic shifts, notably the rebound in global manufacturing post-pandemic and the renewed focus on sustainable industrial practices. The necessity for precise force and speed control in advanced manufacturing processes, such as robotics and high-speed CNC machines, locks in the demand for sophisticated pressure reducing valves. Conversely, volatility in raw material prices (steel, aluminum, specialized alloys) and geopolitical instability affecting international trade routes pose persistent challenges that manufacturers must navigate through strategic sourcing and hedging. The balance between technological advancement (creating new demand) and economic headwinds (constraining capital expenditure) dictates the short-to-medium term growth trajectory.

Segmentation Analysis

The Hydraulic Pressure Reducing Valve Market is segmented extensively based on product type, operation mechanism, application, end-user, and operating pressure range, allowing for a detailed understanding of diverse market needs. The product type segmentation typically differentiates between direct-acting valves, which are simpler and used for lower flows and pressures, and pilot-operated valves, which leverage system pressure to assist in actuation, providing superior flow handling and stability in high-demand environments. This delineation is critical for manufacturers tailoring products to specific performance envelopes and cost constraints.

Further segmentation by application highlights the disparate requirements across various industries. Mobile hydraulics require robustness, compactness, and resistance to harsh environmental conditions, whereas industrial applications prioritize precision, repeatability, and integration into automated control systems. The rapid growth witnessed in the construction and agricultural machinery sectors directly impacts the demand for pressure reducing valves designed to withstand high shock loads and continuous duty cycles. Analyzing these segmentations is vital for companies to focus their research and development efforts on profitable and rapidly evolving market niches.

- By Type: Direct Acting Pressure Reducing Valves, Pilot Operated Pressure Reducing Valves

- By Operating Pressure: Low Pressure (<100 bar), Medium Pressure (100-300 bar), High Pressure (>300 bar)

- By Application: Mobile Equipment (Construction, Material Handling, Agricultural Machinery, Mining), Industrial Machinery (Machine Tools, Presses, Injection Molding, Test Equipment), Automotive Manufacturing, Aerospace & Defense, Energy & Power Generation (Oil & Gas, Wind Turbine Pitch Control)

- By End-User: Original Equipment Manufacturers (OEMs), Aftermarket (MRO & Replacement)

- By Mounting Style: Subplate Mounted, Threaded Cartridge, Inline Mounted (Manifold Blocks)

Value Chain Analysis For Hydraulic Pressure Reducing Valve Market

The value chain for the Hydraulic Pressure Reducing Valve Market begins with the Upstream Analysis, which involves the sourcing of critical raw materials such as specialized high-strength steel, aluminum alloys, precision castings, and high-performance sealing materials (e.g., fluorocarbon elastomers). Key upstream activities also include precision machining, honing, and surface treatment processes required to meet the extremely tight tolerances necessary for reliable valve operation. Relationships with specialized suppliers who can guarantee material quality and consistency are crucial, as component failure due to poor material integrity can lead to catastrophic system breakdown in high-pressure applications. Efficient management of raw material costs and stable sourcing are major determinants of profitability at this stage.

Moving through the value chain, the manufacturing stage involves complex assembly, testing, and quality assurance processes. Advanced manufacturers utilize highly automated CNC machining centers and stringent validation testing (pressure testing, response time analysis) to ensure compliance with international fluid power standards. Distribution channels are bifurcated into Direct and Indirect sales. Direct sales are often utilized for large Original Equipment Manufacturers (OEMs) or specialized industrial clients requiring custom-engineered solutions and direct technical support. This allows manufacturers to maintain closer control over specifications and delivery schedules, fostering long-term relationships and brand loyalty within strategic sectors like aerospace and heavy engineering.

The Downstream Analysis focuses on the market penetration and after-sales support structure. Indirect distribution leverages a network of specialized fluid power distributors, local agents, and maintenance, repair, and overhaul (MRO) service providers who stock standardized valves and provide local technical assistance to smaller end-users and the aftermarket segment. This network is essential for rapid delivery of replacement parts and localized troubleshooting, particularly vital in sectors like construction and agriculture where uptime is critical. Effective aftermarket support, including training and readily available spare parts, significantly enhances customer satisfaction and contributes substantially to the overall revenue stream throughout the product lifecycle.

Hydraulic Pressure Reducing Valve Market Potential Customers

Potential customers for the Hydraulic Pressure Reducing Valve Market are highly diverse but primarily categorized into two major segments: Original Equipment Manufacturers (OEMs) and End-Users utilizing Maintenance, Repair, and Overhaul (MRO) services. OEMs represent the highest volume buyers, incorporating these valves directly into new hydraulic systems and machinery across sectors such as construction (e.g., excavators, loaders), agriculture (e.g., tractors, harvesters), industrial automation (e.g., robotic arms, manufacturing cells), and specialized vehicles. These customers prioritize high reliability, compact design, seamless integration, and competitive bulk pricing, often seeking valves that comply with specific regional safety and performance certifications.

The second major group comprises MRO and aftermarket buyers, typically existing industrial plants, fleet operators, and service centers that require replacement or upgraded valves for maintenance purposes. These customers prioritize quick availability, ease of installation, and backward compatibility with legacy systems. Specific industry end-users include large metal processing facilities that operate high-tonnage presses requiring stringent pressure control, marine and offshore operators demanding corrosion-resistant and high-pressure rated valves, and energy companies utilizing complex hydraulic circuits for subsea equipment and power generation turbine controls. The purchasing criteria for these specialized end-users often emphasize extreme durability and conformity to highly specific industry standards like API or ISO requirements.

Furthermore, specialized segments such as defense and aerospace procurement agencies constitute a high-value customer base, albeit lower volume. These organizations require custom-designed valves engineered to operate under extreme temperature and vibration conditions, where failure is not an option. The purchasing cycle in this segment is characterized by rigorous qualification processes, extended lead times, and a demand for comprehensive technical documentation and traceable supply chains. The collective purchasing power of these segments drives innovation towards smarter, more robust, and highly customizable pressure control solutions tailored to specific operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.87 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation plc, Danfoss A/S, Kawasaki Heavy Industries Ltd., Hydac International GmbH, Bucher Hydraulics GmbH, HAWE Hydraulik SE, Vickers, M&W Pump Corp, Continental Hydraulics, Poclain Hydraulics, Atos S.p.A., Oilgear Company, Yuken Kogyo Co. Ltd., Moog Inc., NACHI-FUJIKOSHI Corp., Tokyo Keiki Co. Ltd., Sun Hydraulics (Helios Technologies), HUSCO International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Pressure Reducing Valve Market Key Technology Landscape

The technological landscape of the Hydraulic Pressure Reducing Valve Market is rapidly evolving beyond basic mechanical functionality, embracing electro-hydraulic controls and digitalization to enhance precision and system intelligence. The shift is primarily centered around Proportional Pressure Reducing Valves, which use solenoids and electronic feedback loops to infinitely vary the reduced pressure output based on an electrical command signal. This proportionality allows for highly dynamic control in sophisticated automation tasks, offering superior performance compared to older, fixed-setting relief valves. The integration of LVDT (Linear Variable Differential Transformer) or similar displacement sensors provides highly accurate feedback on spool position, ensuring rapid response times and minimal hysteresis, crucial for high-speed machine tool operations.

Another significant area of technological advancement involves the miniaturization and modularization of valve designs, particularly the proliferation of Cartridge Valves. These valves are designed to be screwed directly into custom manifold blocks, significantly reducing system footprint, eliminating external plumbing, and simplifying maintenance procedures. This design approach not only saves installation space, critical in mobile equipment, but also reduces the potential for leakage points, thereby enhancing system reliability and overall energy efficiency. Specialized surface treatments and advanced sealing technologies are also continuously refined to withstand extreme operating pressures (up to 700 bar in some specialized aerospace applications) and aggressive hydraulic fluids, extending the serviceable life of the components dramatically.

The emerging technological frontier is the integration of Industrial Internet of Things (IIoT) capabilities directly into the valve body. This includes embedding smart sensors for real-time monitoring of internal pressure, temperature, and vibration characteristics. These Smart Valves can communicate their operational status wirelessly or via industrial protocols (like EtherCAT or PROFINET) to centralized control systems or cloud-based platforms. This digital capability facilitates condition-based monitoring, predictive maintenance algorithms powered by AI, and remote diagnostics, transforming the valve from a passive component into an active, data-generating asset within the wider hydraulic system. This move towards digitalization is driving major R&D investments across leading market players seeking competitive advantage through integrated intelligence and data services.

Regional Highlights

Regional dynamics are critical in defining the specific market requirements for Hydraulic Pressure Reducing Valves, largely influenced by the maturity of industrial sectors, regulatory environments, and investment cycles in infrastructure. North America remains a substantial market, characterized by demand for high-performance, digitally-enabled valves used extensively in advanced manufacturing, shale gas extraction, and high-tech defense applications. The emphasis here is often on robust construction, compliance with stringent safety standards (OSHA), and compatibility with advanced control protocols, driving demand for premium-priced, technologically advanced components suitable for continuous, heavy-duty operation in demanding industrial environments.

Europe represents a stable and innovative market, driven heavily by environmental regulations and the strong commitment to Industry 4.0 principles, particularly in Germany and Italy, the continent's hydraulic manufacturing hubs. European demand prioritizes energy-efficient solutions and valves optimized for low noise emissions and precise control, crucial for maintaining the operational excellence required in automated factory floors and precision agricultural machinery. Innovation in modular and integrated valve systems, often featuring sophisticated proportional electronic control, is particularly strong in this region, catering to the continent’s leading positions in automotive and high-end machinery manufacturing sectors.

Asia Pacific (APAC) stands out as the engine of market growth, buoyed by unprecedented expansion in construction, manufacturing, and automotive production across economies like China, India, and Southeast Asian nations. The region exhibits high volume demand, driven by large-scale infrastructure projects and rapid mechanization in agriculture, often requiring a balance between cost-effectiveness and reliable performance. While basic valve types see high consumption, there is an accelerating shift towards complex, high-pressure valves necessary for advanced shipbuilding, heavy material handling, and modern automated factories established by multinational corporations, creating a dual-tier market structure.

- Asia Pacific (APAC): Dominates growth due to extensive infrastructure spending, rapid industrialization, and high volume production in China and India.

- North America: Focuses on advanced, digitally integrated valves for oil & gas, aerospace, and sophisticated manufacturing automation.

- Europe: Strong demand driven by Industry 4.0, stringent environmental norms, and advanced proportional control systems in German and Italian machinery manufacturers.

- Latin America: Growth tied to mining operations, agricultural mechanization, and recovery in the local construction sector, demanding reliable, cost-effective solutions.

- Middle East & Africa (MEA): Demand primarily concentrated in the highly specialized oil and gas sector and heavy construction projects, requiring high-pressure, corrosion-resistant components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Pressure Reducing Valve Market.- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation plc

- Danfoss A/S

- Kawasaki Heavy Industries Ltd.

- Hydac International GmbH

- Bucher Hydraulics GmbH

- HAWE Hydraulik SE

- Vickers (A brand within Eaton Corporation)

- Continental Hydraulics

- Poclain Hydraulics

- Atos S.p.A.

- Oilgear Company

- Yuken Kogyo Co. Ltd.

- Moog Inc.

- NACHI-FUJIKOSHI Corp.

- Tokyo Keiki Co. Ltd.

- Sun Hydraulics (Helios Technologies)

- HUSCO International

- Doosan Corporation (Mottrol)

Frequently Asked Questions

Analyze common user questions about the Hydraulic Pressure Reducing Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a hydraulic pressure reducing valve in a circuit?

The primary function is to maintain a stable, lower-than-system pressure in a specific branch of the hydraulic circuit, safeguarding downstream components from overpressure regardless of fluctuations in the main line supply or flow rate. This ensures the correct force application and protects sensitive equipment like gauges or lower-rated actuators.

What are the key differences between direct-acting and pilot-operated pressure reducing valves?

Direct-acting valves are simpler, respond quickly, and are suitable for lower flow rates and pressures, using a single spring mechanism. Pilot-operated valves use a small internal pilot circuit to assist in shifting a larger main spool, providing superior stability, flow capacity, and accuracy under high-pressure, high-flow conditions typical of industrial machinery.

How does the integration of IoT technology impact the future performance of hydraulic reducing valves?

IoT integration enables the transition to 'smart' valves equipped with sensors for real-time monitoring of pressure, temperature, and vibration. This data allows for predictive maintenance, remote diagnostics, and dynamic pressure optimization using AI, significantly reducing system downtime and improving overall energy efficiency across the fluid power network.

Which industry segment currently drives the highest demand for hydraulic pressure reducing valves?

The Mobile Equipment segment, particularly construction machinery (excavators, cranes) and agricultural machinery, currently drives the highest demand. This growth is fueled by increasing global infrastructure investment, mechanization in developing economies, and the need for precise hydraulic control in heavy-duty mobile applications.

What factors should engineers consider when selecting the appropriate pressure reducing valve for a new hydraulic system?

Engineers must consider the required maximum flow rate, the stability and accuracy of the pressure setting needed (hysteresis and repeatability), the maximum inlet pressure, response time requirements, mounting style (cartridge vs. subplate), and the overall system cleanliness and fluid compatibility to ensure optimal performance and longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager