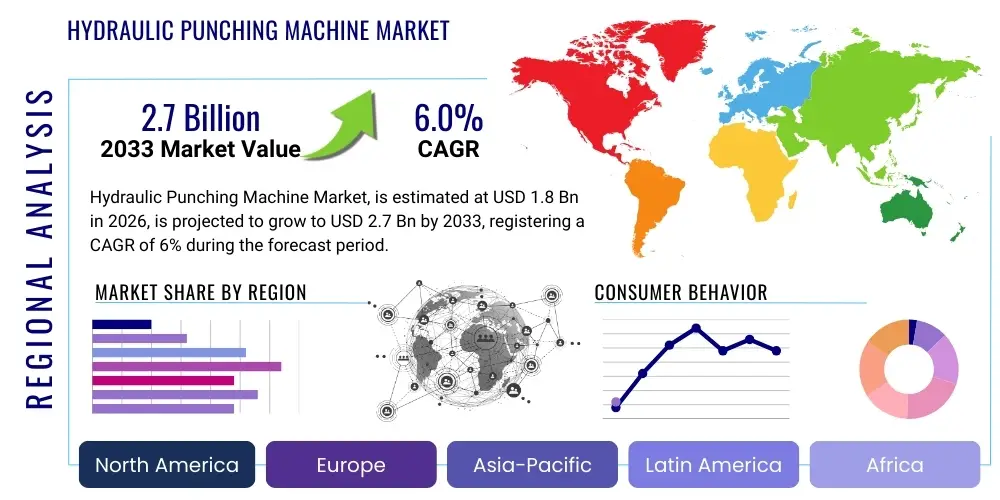

Hydraulic Punching Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436501 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Hydraulic Punching Machine Market Size

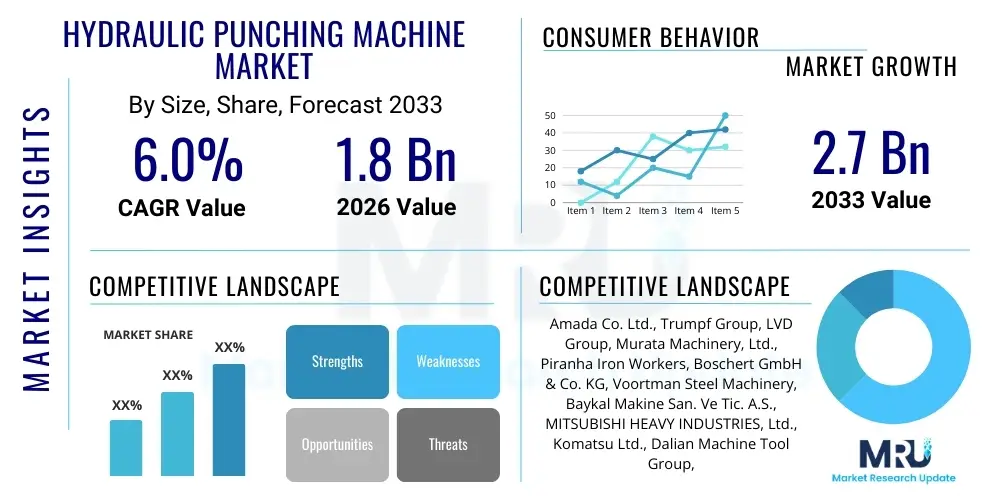

The Hydraulic Punching Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by accelerated infrastructure development and the robust expansion of the global automotive manufacturing sector, which relies heavily on precise and high-tonnage sheet metal fabrication capabilities.

Hydraulic Punching Machine Market introduction

The Hydraulic Punching Machine Market encompasses advanced machinery utilized across various industries for generating precisely shaped holes, slots, or cutouts in materials such as sheet metal, plates, and structural components. These machines operate using hydraulic pressure to exert immense force upon a die and punch set, providing superior power density, controlled stroke movement, and consistent repeatability compared to mechanical alternatives. Modern hydraulic systems are integrated with sophisticated Computer Numerical Control (CNC) technology, ensuring high throughput, minimal material wastage, and the ability to process complex geometries required in high-precision manufacturing environments.

The primary applications of hydraulic punching technology span crucial sectors including construction, automotive manufacturing, aerospace and defense, and general heavy machinery production. In the automotive industry, these machines are essential for chassis components and body panels, while in construction, they are critical for fabricating structural steel elements, beams, and railings used in large-scale projects. The demand for flexible and multi-purpose machinery is pushing manufacturers toward systems that can handle diverse material thicknesses and types, incorporating features like tool change automation and advanced safety interlocks, significantly enhancing operational efficiency and reducing downtime in production lines.

Key benefits driving the adoption of hydraulic punching machines include their inherent high tonnage capacity, making them suitable for thicker materials, excellent durability, and lower maintenance requirements due to fewer moving parts compared to mechanical presses. Furthermore, the precise pressure control offered by hydraulic systems allows for better management of the punching cycle, minimizing shock loading and extending tooling life. This combination of robust performance, operational precision, and favorable cost of ownership establishes hydraulic punching machines as indispensable assets in modern metal fabrication shops globally, particularly as manufacturing processes become increasingly automated and demanding regarding component quality.

Hydraulic Punching Machine Market Executive Summary

The Hydraulic Punching Machine Market is experiencing significant upward business momentum, primarily driven by the global resurgence in manufacturing activities, especially across emerging economies in the Asia Pacific region. Key business trends include the shift towards integrated servo-hydraulic systems that offer the speed of mechanical presses combined with the power of traditional hydraulics, enhancing energy efficiency and control. Manufacturers are also focusing on offering customized solutions tailored to specific industry needs, such as specialized tooling for structural steel fabrication or high-speed systems for consumer electronics casings, leading to higher average selling prices (ASPs) for technologically advanced models. Strategic partnerships between machine builders and software providers are becoming critical to integrate Industrial Internet of Things (IIoT) capabilities for predictive maintenance and remote diagnostics.

Regionally, Asia Pacific (APAC) dominates the market, propelled by massive industrialization in China, India, and Southeast Asian nations. The region’s low manufacturing costs and high volume production requirements, particularly in automotive and consumer goods sectors, necessitate continuous investment in high-capacity punching equipment. North America and Europe, characterized by mature manufacturing ecosystems, exhibit steady demand, driven mainly by the necessity for replacement of aging machinery and the adoption of high-automation, precision-focused models to maintain competitive edge against lower-cost regions. Regulatory pressures toward higher energy efficiency in machinery are also forcing adoption of newer hydraulic technologies in these developed markets, thereby sustaining moderate growth rates.

Segmentation trends indicate that high-tonnage machines (over 100 metric tons) are witnessing accelerated growth due to increased demand in heavy industries like construction and infrastructure, which require processing thick plates and complex structural profiles. CNC-controlled hydraulic punching machines remain the preferred segment over manual or traditional systems, reflecting the industry's pervasive move towards automation and precision engineering. Furthermore, the application segment of Sheet Metal Fabrication holds the largest market share, though the Structural Steel segment is projected to show the fastest CAGR, paralleling global urbanization and large-scale infrastructure projects requiring standardized and repeatable hole punching in beams and columns.

AI Impact Analysis on Hydraulic Punching Machine Market

Common user questions regarding AI's influence on the Hydraulic Punching Machine Market center on how AI can enhance operational efficiency, minimize material waste, and improve predictive maintenance schedules. Users frequently inquire about the feasibility of integrating machine learning algorithms for real-time process optimization, specifically concerning feed rates, pressure settings, and tool wear compensation to extend tooling life and ensure consistent quality across large production batches. There is also significant interest in AI-driven vision systems for automated quality inspection immediately post-punching, addressing concerns about precision defects and required manual inspection labor. Overall, users anticipate that AI will transition hydraulic punching machines from high-power tools to intelligent, self-optimizing manufacturing assets, fundamentally changing the economics of precision metalworking and necessitating new skills for machine operators.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize hydraulic punching operations by introducing unprecedented levels of process control and autonomy. AI models, trained on extensive datasets covering material properties, machine vibration profiles, and finished product quality metrics, can dynamically adjust parameters during operation. This capability minimizes variables such as thermal expansion or material inconsistencies that typically lead to minor dimensional errors, thereby significantly boosting first-pass yield rates. Furthermore, optimizing the complex relationship between punching speed, hydraulic pressure curve, and component thickness using ML ensures maximum efficiency while mitigating the risk of component warping or burring.

Beyond immediate operational improvements, AI’s most transformative impact lies in predictive maintenance and system diagnostics. By continuously analyzing sensory data from hydraulic pumps, valves, temperature sensors, and power consumption monitors, AI systems can accurately predict component failure long before catastrophic breakdown occurs. This transition from reactive or preventative maintenance to truly predictive servicing minimizes unscheduled downtime, which is a major cost driver in high-volume production environments. This shift, coupled with AI-driven inventory management for spares and consumables (like punches and dies), fundamentally improves the utilization rates and total operational lifespan of hydraulic punching assets.

- AI-driven Predictive Maintenance: Analyzing vibration and temperature data to forecast component failure, reducing unscheduled downtime by up to 30%.

- Real-time Process Optimization: Machine learning adjusts hydraulic pressure and stroke speed based on material density and punch wear characteristics.

- Automated Quality Control: AI vision systems inspect punched parts instantly for dimensional accuracy and surface defects, eliminating manual checks.

- Optimized Tooling Life: Algorithms calculate optimal tooling usage cycles, extending punch and die longevity by reducing unnecessary stress.

- Energy Efficiency Management: AI systems learn optimal power consumption profiles for different jobs, reducing energy usage during peak demand periods.

DRO & Impact Forces Of Hydraulic Punching Machine Market

The market dynamics of the Hydraulic Punching Machine Market are dictated by a balanced interplay of robust growth drivers (D), significant external restraints (R), and compelling technological opportunities (O), collectively framed by macroeconomic and competitive impact forces. The primary driving force remains the global demand for high-precision metal components across burgeoning sectors like electric vehicles (EVs) and renewable energy infrastructure, both of which require standardized and durable sheet metal processing. However, this growth is tempered by substantial restraints, notably the high initial capital expenditure associated with sophisticated CNC hydraulic systems and the lack of skilled labor capable of programming and maintaining these complex machines. The key opportunity lies in integrating advanced automation, particularly robotic material handling and automated tool loading, to maximize productivity and justify the investment cost, establishing a competitive advantage for early adopters.

Drivers: Intensified urbanization and governmental investments in infrastructure projects globally necessitate rapid fabrication of structural steel and architectural components, directly translating into high demand for powerful hydraulic punching capacity. Furthermore, the stringent quality requirements and tight tolerances demanded by the aerospace and medical device industries favor the controlled force delivery and repeatability characteristic of hydraulic systems over mechanical alternatives. The increasing adoption of thicker, high-strength low-alloy (HSLA) steel in automotive safety structures further mandates the high tonnage and consistent performance that only hydraulic punching machines reliably provide, ensuring steady market uptake.

Restraints: The most significant restraint is the operational cost structure, particularly the energy consumption and maintenance complexity of large hydraulic systems compared to newer, more efficient servo-electric alternatives. Additionally, the proliferation of advanced laser cutting and plasma cutting technologies presents a viable, non-contact alternative for certain applications, potentially capturing market share, especially where material thickness is moderate or where extremely complex profiles are required. Economic volatility and trade restrictions in certain regions can also impact the procurement of expensive imported machinery, delaying capital investment decisions by mid-sized manufacturers, thereby inhibiting overall market expansion.

Opportunities: Technological advancements, particularly the fusion of hydraulic power with servo control (servo-hydraulic machines), present a massive opportunity for manufacturers to offer hybrid systems that mitigate the efficiency drawbacks of traditional hydraulics while retaining the necessary high-tonnage capacity. The expansion of IIoT capabilities and cloud-based diagnostics allows for remote monitoring and proactive service, reducing lifecycle costs and improving customer satisfaction. Moreover, developing localized manufacturing hubs and robust after-sales service networks in fast-growing regions like Southeast Asia offers significant expansion avenues for international market players, capitalizing on regional demands for reliable support.

- Drivers:

- Surge in global infrastructure and construction spending.

- Rising demand for high-precision components in the EV and aerospace sectors.

- Requirement for processing high-strength, thick materials.

- Technological maturation of reliable CNC hydraulic control systems.

- Restraints:

- High initial capital investment and operational complexity.

- Competition from alternative cutting technologies (laser, plasma).

- Vulnerability to economic downturns impacting capital equipment purchases.

- Shortage of specialized maintenance and programming personnel.

- Opportunities:

- Development and commercialization of energy-efficient servo-hydraulic hybrid systems.

- Integration of advanced automation (robotics and automated tooling).

- Expansion of IIoT and remote diagnostic services for reduced downtime.

- Market penetration in untapped or rapidly industrializing emerging economies.

- Impact Forces:

- Macroeconomic Force: Global interest rate hikes affecting capital equipment financing.

- Technological Force: Acceleration of AI integration in machine monitoring and optimization.

- Competitive Force: Price erosion pressure from low-cost Chinese manufacturers.

- Regulatory Force: Increasing environmental standards necessitating quieter and more energy-efficient hydraulic systems.

Segmentation Analysis

The Hydraulic Punching Machine Market is systematically segmented based on technology, machine tonnage capacity, end-user industry application, and geographical distribution, providing granular insights into demand patterns and competitive landscapes. Analyzing these segments is crucial for strategic planning, as distinct industry requirements necessitate specialized machine configurations. For instance, manufacturers focusing on the construction sector require high-tonnage, robust, and often customized machines for structural steel, whereas those serving the electronics enclosure market prioritize high-speed, lower-tonnage, and highly automated CNC turret punch presses. The evolving industrial landscape increasingly favors customization, prompting vendors to develop modular systems that can be easily configured to address specific throughput and material handling requirements across different end-user segments.

The segmentation by tonnage capacity, categorized into low (under 50 tons), medium (50-100 tons), and high (above 100 tons), is particularly indicative of underlying industrial demands. The high-tonnage segment is experiencing robust growth fueled by heavy engineering and infrastructure development, contrasting with the stable but moderate growth in the low-tonnage segment, which serves smaller job shops and light fabrication industries. Furthermore, the segmentation by technology clearly shows the market shift away from purely manual or simple hydraulic systems toward advanced CNC-integrated hydraulic and hybrid servo-hydraulic models, reflecting the global imperative for enhanced precision, repeatability, and efficient data logging in manufacturing processes.

Geographical segmentation reveals stark differences in market maturity and growth drivers. While regions like North America and Europe focus on adopting premium, highly automated replacement units, the APAC region drives volume growth through high capacity expansion projects. Understanding these segments is vital for supply chain optimization, allowing companies to tailor their sales strategies, service offerings, and pricing models to match regional economic capabilities and prevailing manufacturing trends, ensuring maximum market penetration and sustainable growth across diverse operational environments globally.

- By Technology:

- CNC Hydraulic Punching Machines

- Servo-Hydraulic Punching Machines (Hybrid)

- Traditional/Standard Hydraulic Punching Machines

- By Tonnage Capacity:

- Less than 50 Metric Tons

- 50 to 100 Metric Tons

- Above 100 Metric Tons

- By End-Use Application:

- Sheet Metal Fabrication

- Automotive Industry (Chassis, Body Components)

- Construction & Structural Steel (Beams, Columns)

- Aerospace & Defense

- Power Generation & Utilities (HVAC, Enclosures)

- General Manufacturing & Job Shops

- By Sales Channel:

- Direct Sales (OEMs)

- Indirect Sales (Distributors, Agents)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA) (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Hydraulic Punching Machine Market

The value chain for the Hydraulic Punching Machine Market begins with upstream activities involving the sourcing of critical raw materials and specialized components, followed by manufacturing and assembly, distribution, and finally, extensive downstream after-sales support. Upstream elements are dominated by suppliers of high-grade steel and iron castings for machine frames, precision hydraulic components (pumps, valves, cylinders) typically sourced from specialized international firms, and advanced CNC controllers and software interfaces. The quality and reliability of these upstream inputs directly influence the final machine's performance, durability, and cost structure, making supplier management and quality control paramount for primary machine builders (OEMs).

Manufacturing and assembly form the core transformation stage, where the complexity lies in precision machining the massive frames and integrating the sophisticated electrical and hydraulic systems. Key considerations at this stage include technological innovation in developing proprietary hydraulic circuits for faster cycle times, modular design for easier maintenance, and rigorous testing protocols to ensure high repeatability and safety compliance. The distribution channel, which bridges the manufacturing stage and the end-user, often involves a mix of direct sales forces for large, custom orders and indirect sales through highly knowledgeable regional distributors or agents who provide localized installation, commissioning, and basic training services.

Downstream activities are critical for maintaining market presence and achieving customer loyalty. This includes complex logistics for transporting large machinery, installation and operational training, and long-term after-sales support, encompassing warranty services, parts replacement, and ongoing technical support, increasingly delivered via remote diagnostics (IIoT). Direct distribution channels allow for maximum control over customer relationships and service quality, especially in high-volume or technologically demanding markets. Conversely, indirect channels leverage local expertise, extending market reach into geographically dispersed or niche markets, where agents offer crucial localized technical knowledge and often hold exclusive regional service rights, ensuring continuous machine uptime for the end-users.

Hydraulic Punching Machine Market Potential Customers

Potential customers for hydraulic punching machines are primarily large-scale industrial fabricators and manufacturers requiring high-volume, precision hole punching in medium to thick metal sheets and structural components. The primary end-users fall into distinct industrial segments, each prioritizing specific machine attributes. Automotive manufacturers, for example, require reliable, high-speed machines for stamping chassis components and exhaust systems with minimal tolerance deviation. Infrastructure and construction companies, utilizing structural steel fabricators, prioritize high-tonnage capacity and the ability to process heavy I-beams and channels efficiently and accurately, focusing on throughput and durability in demanding workshop environments.

Beyond these large industrial segments, the defense and aerospace industries represent a niche but highly lucrative customer base, demanding machinery that meets extremely rigorous certification standards and can handle specialized, often difficult-to-machine alloys like titanium and specific aluminum grades. These customers prioritize machine traceability, advanced control systems, and confirmed repeatability, often opting for premium-priced, customized CNC hydraulic systems. Furthermore, general manufacturing job shops, although typically requiring lower-tonnage machines, constitute a vast customer segment driven by the need for versatility to handle diverse, short-run job orders for applications such as electrical enclosures, HVAC components, and industrial shelving units.

The purchasing decisions of these end-users are heavily influenced by the total cost of ownership (TCO), including the initial capital investment, energy efficiency, expected tooling life, and the availability of responsive, localized after-sales service and spare parts. As automation becomes ubiquitous, buyers are increasingly looking for machines that easily integrate with robotic loading and unloading systems and offer sophisticated IIoT connectivity for performance monitoring. Therefore, successful market penetration requires vendors to demonstrate not only the raw power and precision of their hydraulic punching equipment but also its seamless fit into modern, digitally managed manufacturing workflows.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amada Co. Ltd., Trumpf Group, LVD Group, Murata Machinery, Ltd., Piranha Iron Workers, Boschert GmbH & Co. KG, Voortman Steel Machinery, Baykal Makine San. Ve Tic. A.S., MITSUBISHI HEAVY INDUSTRIES, Ltd., Komatsu Ltd., Dalian Machine Tool Group, Danly Punch & Die, Durma CNC, FICEP S.p.A., HACO NV, Iron Worker, SafanDarley B.V., Schiavi Macchine S.r.l., Yangli Group, Euromac S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Punching Machine Market Key Technology Landscape

The technological landscape of the Hydraulic Punching Machine Market is defined by a rigorous push toward integrating digital control with robust mechanical power, moving beyond simple hydraulic actuation. Central to this evolution is the pervasive adoption of Computer Numerical Control (CNC) systems, which provide micro-level precision over the punching stroke, pressure, and feed rates, enabling repeatable and complex part fabrication. Advanced CNC systems now feature integrated CAD/CAM software for direct machine programming, minimizing setup time and maximizing material utilization through sophisticated nesting algorithms. This technological reliance on digitalization ensures that modern hydraulic punching machines meet the stringent dimensional tolerance requirements of high-value industries like aerospace and medical device manufacturing.

The most significant innovation influencing the market is the rise of servo-hydraulic or hybrid punching technology. These machines couple the force-generating capability of hydraulic systems with the energy efficiency and speed control of servo motors. The servo motor controls the flow and pressure of the hydraulic fluid, allowing the machine to use only the necessary power for each punch, dramatically reducing idle time energy consumption and heat generation compared to traditional continuously running hydraulic pumps. This hybrid approach offers superior dynamic response and noise reduction, addressing key operational concerns in modern, environmentally conscious manufacturing facilities, positioning servo-hydraulic models as the premium, growth-driving segment in developed markets.

Furthermore, technology advancements are heavily focused on peripheral automation and connectivity, aligning these machines with Industry 4.0 paradigms. Key implementations include automated tooling turrets and change systems that reduce manual intervention and downtime when switching between jobs, and robotic solutions for automated material handling (loading raw sheets and stacking finished parts). Integration of IIoT sensors facilitates continuous data acquisition related to machine health, production throughput, and tooling performance. This connectivity supports proactive, condition-based monitoring, allowing manufacturers to schedule maintenance precisely when needed, thereby significantly enhancing overall equipment effectiveness (OEE) and ensuring maximum production continuity.

Regional Highlights

The regional analysis underscores disparate growth vectors and market maturity levels across the globe, with the Asia Pacific region serving as the primary engine for volume expansion and the Western markets focusing on technology adoption and machine replacement cycles. The market structure in APAC, encompassing China, India, and ASEAN nations, is characterized by rapid capital investment driven by massive industrial capacity additions in automotive, electronics, and construction sectors. This region benefits from favorable manufacturing policies and lower operating costs, making it the largest consumer and producer of hydraulic punching machinery. The demand here is diversified, spanning from basic high-tonnage machines for structural work to advanced CNC systems for precision sheet metal components.

North America and Europe represent mature, quality-focused markets where growth is more incremental and centered on technological upgrades. European manufacturers, particularly in Germany and Italy, lead in the innovation of advanced servo-hydraulic and automated systems, driven by high labor costs and strict environmental regulations demanding energy-efficient machinery. North American demand is steady, fueled by the revitalization of domestic manufacturing and the need to modernize existing industrial bases. Customers in these regions are willing to invest in premium machines that offer connectivity, superior automation integration, and minimal life-cycle costs, prioritizing precision and energy savings over initial price point, setting a clear trend for high-value segment growth.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant future potential. LATAM's market buoyancy is tied to commodity prices and regional industrial stability, with key growth in Brazil and Mexico driven by automotive and agricultural machinery production. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees demand linked to ambitious construction and diversification projects, requiring heavy-duty hydraulic punching machines for structural fabrication. However, these regions often rely heavily on imported technology and face challenges related to localized service infrastructure and economic volatility, necessitating carefully structured entry strategies by international vendors focused on robust distribution and support networks.

- Asia Pacific (APAC): Dominates the market share due to unprecedented growth in industrialization, particularly in China (highest volume consumer) and India (rapid infrastructure spending). Focus on high volume and capacity expansion across automotive and electronics sectors.

- North America: Stable, high-value market driven by the need for replacement of older equipment, demand for advanced CNC automation, and adoption of IIoT-enabled machinery for enhanced operational efficiency in aerospace and general fabrication.

- Europe: Strong focus on technological innovation, led by countries like Germany and Italy. Demand is concentrated on energy-efficient servo-hydraulic systems to meet stringent environmental standards and maintain global competitiveness in high-precision manufacturing.

- Latin America (LATAM): Growth driven by specific manufacturing hubs (Mexico, Brazil) linked to the global automotive supply chain and heavy equipment sectors. Market volatility and reliance on imports remain key factors.

- Middle East & Africa (MEA): Emerging market primarily linked to large infrastructure and construction projects, especially in the UAE and Saudi Arabia. Demand centers around heavy-duty, high-tonnage machines for structural steel processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Punching Machine Market.- Amada Co. Ltd.

- Trumpf Group

- LVD Group

- Murata Machinery, Ltd.

- Piranha Iron Workers

- Boschert GmbH & Co. KG

- Voortman Steel Machinery

- Baykal Makine San. Ve Tic. A.S.

- MITSUBISHI HEAVY INDUSTRIES, Ltd.

- Komatsu Ltd.

- Dalian Machine Tool Group

- Danly Punch & Die

- Durma CNC

- FICEP S.p.A.

- HACO NV

- Iron Worker

- SafanDarley B.V.

- Schiavi Macchine S.r.l.

- Yangli Group

- Euromac S.p.A.

- GEKA Group

- Scotchman Industries

- Peddinghaus Corporation

- Timesavers LLC

Frequently Asked Questions

Analyze common user questions about the Hydraulic Punching Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a hydraulic punching machine and a servo-electric press?

The primary difference lies in the actuation mechanism; hydraulic machines use pressurized fluid to exert force, offering high tonnage and robust performance, especially for thick materials. Servo-electric presses use a motor and gearbox, offering superior speed, control, and energy efficiency, particularly preferred in high-speed, lower-tonnage applications. Hybrid (servo-hydraulic) systems attempt to combine the advantages of both technologies.

Which factors are driving the adoption of high-tonnage hydraulic punching machines?

Adoption is driven primarily by the escalating demand for structural steel components in global infrastructure projects and the requirement to process thicker, high-strength low-alloy (HSLA) steel sheets used in modern automotive and heavy machinery manufacturing, where only hydraulic power can reliably meet the force requirements.

How is Industry 4.0 influencing the maintenance and operation of these machines?

Industry 4.0 influences maintenance through IIoT integration, enabling predictive maintenance via sensor data analysis (vibration, temperature, pressure), reducing unexpected downtime. Operationally, it allows for remote diagnostics, real-time performance optimization, and seamless integration with robotic material handling systems for fully automated lines.

Which geographical region exhibits the fastest growth rate for the hydraulic punching market?

The Asia Pacific (APAC) region, specifically emerging economies like India and China, exhibits the fastest growth rate. This accelerated growth is attributed to ongoing industrialization, significant capacity expansion in fabrication sectors, and substantial government investment in large-scale infrastructure and manufacturing projects.

What are the key restraints affecting market growth despite strong demand?

Key restraints include the high initial capital investment required for advanced CNC hydraulic systems, the competition posed by alternative metal processing technologies (such as high-definition laser cutting), and the increasing operational complexity demanding a highly skilled, often scarce, labor pool for programming and maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager