Hydraulic Tiltrotator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436880 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Hydraulic Tiltrotator Market Size

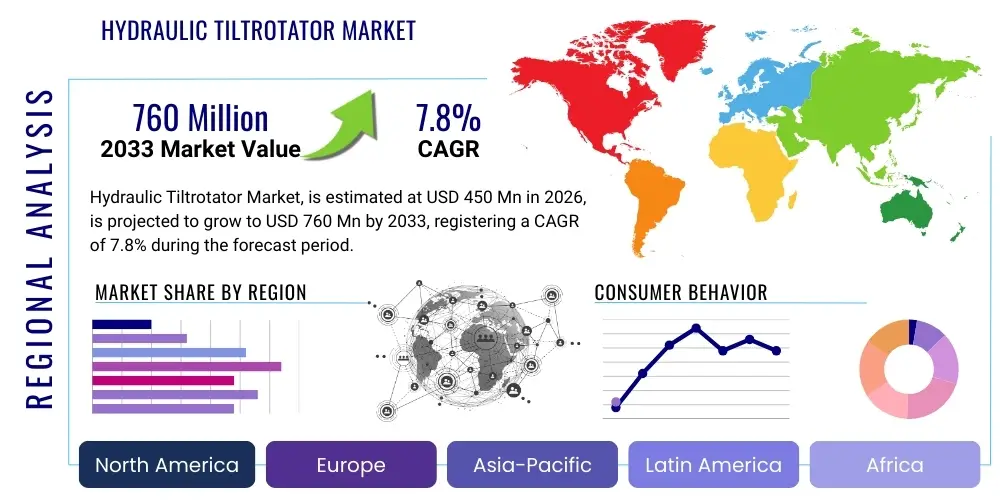

The Hydraulic Tiltrotator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 760 Million by the end of the forecast period in 2033.

Hydraulic Tiltrotator Market introduction

The Hydraulic Tiltrotator Market encompasses specialized attachments for excavators and backhoes, revolutionizing efficiency in the construction, utility, and infrastructure sectors. A tiltrotator is a sophisticated hydraulic system mounted between the machine's arm and the bucket or attachment, providing the operator with the ability to rotate the attachment 360 degrees and tilt it up to 45 degrees, significantly enhancing maneuverability and precision. This inherent versatility allows a single machine to perform tasks previously requiring multiple pieces of equipment or constant manual repositioning, leading to substantial time and cost savings on project sites, fundamentally transforming the operational paradigm of earthmoving machinery. The core mechanism involves advanced hydraulic circuits and proportional control systems that seamlessly integrate with the base machine, often featuring highly advanced quick couplers for rapid, secure attachment changes without the operator leaving the cab, thus boosting site safety and productivity metrics simultaneously.

Key applications of hydraulic tiltrotators span demanding fields such as road construction, landscaping, pipeline laying, detailed trenching, precision grading, complex demolition, and general bulk excavation work where intricate movements are required. Their unparalleled ability to work efficiently in confined urban environments, steep slopes, or areas with complex infrastructure geometries makes them indispensable tools for modern infrastructure development, especially in densely populated regions prioritizing operational efficiency, minimizing environmental footprint, and adhering to strict project timelines. The integration of highly accurate sensors and state-of-the-art proportional control systems ensures extraordinarily smooth, repeatable, and precise movements, which contributes directly to higher quality project output, reduces material rework, and significantly decreases operator fatigue over long shifts. This reduction in physical and cognitive strain allows operators to maintain high levels of performance throughout the working day, contributing to overall site efficiency and risk mitigation.

The market growth is fundamentally driven by the escalating global trend towards increased automation and digitalization in construction, stringent environmental regulations necessitating minimized ground disturbance and higher operational precision, and the overwhelming demand for high-performance construction equipment that maximizes the return on operational expenditure (OPEX). Benefits derived from tiltrotator adoption include a measurable reduction in fuel consumption due to fewer machine travel movements, dramatically enhanced site safety by minimizing the need for ground crew intervention near active machinery, and substantially quicker project completion times, enabling contractors to bid competitively on complex jobs. These powerful commercial drivers, coupled with continuous technological advancements in advanced hydraulic system design, remote diagnostics via telematics, and the development of lightweight yet highly durable structural materials, solidify the tiltrotator's critical and expanding role in the ongoing evolution of highly productive modern earthmoving and construction equipment worldwide. Furthermore, the expanding array of compatible attachments, ranging from dedicated sorting grabs to vibratory plate compactors and specialized road planing tools, continuously broadens the application scope and deepens the market penetration of this specialized machinery.

Hydraulic Tiltrotator Market Executive Summary

The global Hydraulic Tiltrotator Market is undergoing a period of accelerated growth, characterized by significant technological innovation and expanding geographic adoption. Key business trends underscore the move towards fully integrated solutions, where manufacturers are increasingly focusing on developing holistic systems that combine the tiltrotator, advanced quick couplers, and 3D machine control software into a single, seamless package. This integration not only simplifies installation for OEMs but also significantly improves the user experience and data accuracy for end-users. Consolidation within the market, marked by strategic acquisitions and OEM partnerships, is optimizing distribution channels and leveraging the established global service networks of major heavy equipment manufacturers, thereby making the technology more accessible across diverse international markets and standardizing maintenance procedures.

Regionally, the market dynamic is defined by a mature European core providing consistent demand for replacement and technology upgrades, while North America acts as the primary engine for recent growth, exhibiting the highest percentage increases in adoption, particularly among utility contractors and large civil infrastructure projects spurred by government funding initiatives. Asia Pacific, despite its current lower penetration rate, represents the critical long-term growth opportunity; accelerating urbanization and multi-billion-dollar infrastructure commitments in countries like India and Indonesia are creating favorable conditions for large-scale adoption, provided manufacturers can overcome cost sensitivity barriers with robust, entry-level, yet high-quality product offerings. The Middle East is showing localized spikes in demand tied to large construction projects, valuing the durability and high performance required in extreme climatic conditions.

Segment trends confirm the 13-30 metric ton excavator class as the dominant market segment, reflecting the versatility of mid-sized machines in both urban and rural civil works. There is an observable shift in the component segmentation towards smart hydraulics, which involves sophisticated valve blocks capable of independently controlling multiple functions and communicating diagnostics. The aftermarket segment is robust and essential, driven by the need for specialized maintenance, replacement parts, and accessories like dedicated attachments (e.g., asphalt cutters, rail grabs), emphasizing the necessity for manufacturers to establish comprehensive and responsive service networks globally. Environmental regulations favoring reduced emissions and operational noise further drive the demand for finely tuned, high-efficiency hydraulic systems inherent in advanced tiltrotator designs.

AI Impact Analysis on Hydraulic Tiltrotator Market

User queries regarding AI's influence on the Hydraulic Tiltrotator Market frequently center on themes of predictive maintenance, autonomous operation potential, and optimizing digging cycles. Users are keen to understand how AI algorithms can leverage vast amounts of telematics data—such as high-frequency pressure readings, hydraulic fluid temperature and flow rates, rotational tolerances, and total operational hours under load—to accurately forecast component degradation or potential failure points, thereby transitioning maintenance from reactive to truly predictive, minimizing unexpected and costly downtime. Another significant area of interest is the application of machine learning in streamlining highly complex operational movements, such as enabling semi-autonomous precision grading or intricate trenching tasks where the tiltrotator automatically adjusts its tilt and rotation angles and speeds based on instantaneous, real-time ground condition feedback and pre-loaded 3D design models. Expectations are high that AI will fundamentally move tiltrotator operations beyond conventional remote control toward intelligent, self-correcting, and hyper-efficient systems that dramatically improve precision, consistency, and overall operational sustainability, especially concerning fine-tuning fuel usage optimization and providing highly personalized, adaptive operator training assistance directly through the machine interface, ultimately lowering the skill threshold required for high-precision work.

- Enhanced Predictive Maintenance: AI analyzes hydraulic system telemetry data (pressure, temperature, vibration profiles, cycle counts) to precisely predict potential component failures in the tiltrotator, proactively triggering service notifications and maximizing asset uptime.

- Optimized Operational Efficiency: Machine learning algorithms dynamically refine complex digging, grading, and positioning patterns, automatically adjusting both tilt and rotation angles for difficult or complex tasks based on immediate ground reaction and reference to embedded 3D site models, ensuring sub-centimeter accuracy.

- Semi-Autonomous Functions: AI facilitates automated execution of highly repetitive tasks, such such as precise utility trenching along a predefined path or specific slope grading to a digital contour map, drastically reducing reliance on constant, tiring manual input and improving execution consistency.

- Improved Fuel Economy and Sustainability: AI systems analyze real-time operator input, ground resistance, and task requirements to optimize hydraulic pump flow and pressure settings within the tiltrotator’s integrated circuit, minimizing wasted energy and leading to measurable reductions in carbon emissions and operational costs.

- Advanced Operator Assistance: Real-time feedback, operational boundary warnings, and guided instructions driven by AI help novice and intermediate operators quickly master the complex, coordinated movements required for high-precision tiltrotator usage, substantially lowering the effective learning curve and minimizing errors on critical jobs.

- Data-Driven Design Iterations: Extensive operational data gathered and systematically analyzed by AI informs manufacturers about precise wear patterns, hydraulic component stress points, and failure modes across various environments, directly guiding the subsequent design of more robust, lighter, and durable tiltrotator models and their attachment interfaces.

- Seamless Integration with Machine Control: AI enables tighter, smarter functional integration between the tiltrotator's kinetic movements and the excavator's main 3D machine control system, ensuring holistic project execution accuracy across both horizontal and vertical axes, eliminating discrepancies between machine positioning and attachment orientation.

DRO & Impact Forces Of Hydraulic Tiltrotator Market

The trajectory of the Hydraulic Tiltrotator Market is fundamentally shaped by a powerful confluence of drivers, restraints, and latent opportunities, all profoundly influenced by critical macro and micro impact forces derived from technology, economics, regulation, and evolving demographic trends in the construction sector. The primary driver is the scientifically demonstrable and economically compelling increase in productivity and operational efficiency that tiltrotators offer over conventional attachments. This technological leap compels construction companies globally to accelerate adoption in order to effectively offset rapidly escalating labor costs, address persistent skilled labor shortages, and rigorously meet increasingly stringent project deadlines. This significant productivity gain, frequently cited in industry analyses as enabling the completion of complex tasks up to 40-50% faster, acts as an incredibly strong economic incentive across virtually all end-use sectors, including utilities maintenance, highly complex civil engineering, and particularly infrastructure development like road and rail projects which inherently demand high-volume earthmoving combined with high-precision finishing work, making the total cost of ownership highly favorable over the long term.

Despite these compelling drivers, the market faces several significant structural restraints that impede universal and rapid penetration. Most notably, the high initial capital investment cost associated not only with the advanced tiltrotator unit itself but also with the necessary installation of sophisticated proportional hydraulic control systems and potentially specialized machine control integration software required on the base excavator machine. This substantial upfront expenditure can prove prohibitively costly for smaller, independent construction enterprises or regional contractors who often operate on very narrow financial margins, particularly inhibiting adoption velocity in many developing and price-sensitive emerging economies. Furthermore, the inherent complexity of mastering the operation of advanced, multi-functional tiltrotator systems requires substantial specialized training for machine operators, presenting a tangible operational barrier and resource commitment challenge for firms seeking immediate fleet integration. Market resistance is also observable from entrenched traditional construction methodologies, where some large, established companies may exhibit a strong reluctance to replace proven, decades-old, albeit less efficient, operational practices, necessitating sustained, well-funded market education and demonstration efforts by manufacturers to thoroughly showcase the superior total lifecycle cost benefits and long-term economic advantages.

Significant opportunities abound for future market expansion, primarily through aggressive geographical penetration into the rapidly developing Asia Pacific and Latin American markets, catalyzed by monumental planned government infrastructure spending and steadily increasing awareness of advanced construction techniques among regional contractors. Technologically, the shift towards fully automated, sensor-integrated, and IoT-connected systems presents immediate avenues for premium product development, market differentiation, and the creation of high-value service contracts based on predictive diagnostics. The growing global shift towards electric and hybrid construction equipment also provides a unique opportunity for tiltrotator manufacturers to engineer purpose-built hydraulic systems specifically optimized for battery-powered excavators, potentially enabling more streamlined power management, increased efficiency, and drastically reduced maintenance complexity. The key impact forces are predominantly positive: technological advancement is high, accelerating product maturity and feature richness; competitive rivalry is intense but manageable among the leading specialists; and while customer purchasing power is relatively high due to the specialized nature of the equipment, sustained brand loyalty can be achieved through superior product reliability, robust warranty coverage, and exceptionally responsive, comprehensive after-sales service and support networks, which are crucial factors in maintaining high machine utilization.

Segmentation Analysis

The Hydraulic Tiltrotator Market is systematically segmented based on key functional attributes, machine compatibility, and application areas, providing a clear analytical framework essential for understanding granular market dynamics, competitive positioning, and designing tailored marketing strategies. Analyzing the market based on product type—specifically distinguishing between Direct Mount Tiltrotators, which are permanently affixed or semi-permanently installed, and Quick Coupler Mount Tiltrotators, which allow for rapid removal and attachment interchangeability—is vital as it reflects differences in customer preference for flexibility versus maximum stability. The segmentation across excavator weight classes (e.g., below 6 tons, 6-13 tons, 13-30 tons, and above 30 tons) is perhaps the most crucial classification, as the specific structural design specifications, hydraulic performance requirements, load capacity, and necessary control system complexity vary dramatically across these ranges, directly correlating with the specific scale and nature of project work, from utility digging to heavy civil earthmoving.

Furthermore, segmentation by end-user application is essential for identifying high-growth sectors and tailoring product features. The market penetrates deeply into diverse fields including general commercial and residential construction, specialized utility and pipeline infrastructure works requiring fine maneuverability, large-scale road and highway construction demanding high-volume grading accuracy, detailed landscaping and municipal upkeep, and even specific niches like forestry and demolition operations. This granular application segmentation highlights the wide-ranging applicability of tiltrotator technology and guides manufacturers in developing both generalized high-performance models and highly specific application attachments and control algorithms, ensuring that the product meets the stringent demands of each distinct vertical market segment effectively.

The segmentation by sales channel—Original Equipment Manufacturers (OEMs) versus the Aftermarket—reflects the differing routes to market and associated margins. Sales through OEMs typically involve large, volume contracts for factory installation, demanding strict quality control and seamless system integration, but often commanding lower individual unit prices. Conversely, the aftermarket channel, supported by independent specialized dealers and distributors, focuses on retrofitting existing fleets and providing comprehensive service and accessory packages, typically offering higher margins but requiring intensive local support and maintenance capabilities. Understanding this dual sales structure is fundamental for projecting revenue streams and managing inventory across diverse product lines and geographical areas.

- By Type:

- Direct Mount Tiltrotators (Affixed for maximum strength and hydraulic throughput)

- Quick Coupler Mount Tiltrotators (Prioritizing interchangeability and flexibility across various host machines)

- By Excavator Weight Class:

- Below 6 Metric Tons (Micro and Mini Excavators, often used in landscaping and residential work)

- 6-13 Metric Tons (Compact and Mid-Range Excavators, popular for utility and urban construction)

- 13-30 Metric Tons (Standard General Purpose Excavators, the largest volume segment)

- Above 30 Metric Tons (Heavy-Duty Excavators, used in quarrying, large civil engineering, and demolition)

- By Application/End-User:

- General Construction (Residential, Commercial, and Industrial building sites)

- Utility and Pipeline Works (Cable laying, sewer, water, and gas line installation/repair)

- Road and Highway Construction (Precision grading, shoulder work, and drainage preparation)

- Landscaping and Municipal Works (Parks, gardens, urban maintenance, and public infrastructure)

- Forestry and Agricultural Operations (Specialized tree handling and land clearing)

- Demolition and Recycling (Sorting, breaking, and controlled dismantling operations)

- By Sales Channel:

- Original Equipment Manufacturers (OEMs) (Direct sales for factory installation)

- Aftermarket (Independent Dealers & Specialized Distributors for retrofit and service)

- By Geography:

- North America (U.S., Canada, Mexico) - Focus on infrastructure renewal and housing.

- Europe (Germany, UK, France, Scandinavia, Rest of Europe) - Mature market, focus on efficiency and technology.

- Asia Pacific (China, Japan, India, Southeast Asia) - High growth potential fueled by urbanization.

- Latin America (Brazil, Argentina, Rest of Latin America) - Emerging market tied to commodity and infrastructure projects.

- Middle East & Africa (MEA) (GCC Countries, South Africa) - Project-driven demand for high durability.

Value Chain Analysis For Hydraulic Tiltrotator Market

The value chain for the Hydraulic Tiltrotator Market is characterized by high engineering intensity and demands for specialized component sourcing, commencing with sophisticated upstream activities. The input stage requires the meticulous procurement of high-grade specialized hydraulic components, including precision servo valves, high-pressure swivel joints, robust seals capable of handling fluctuating pressures, custom-engineered bearings designed for extreme radial and axial loads, and specialized high-tensile, low-weight steel alloys or castings necessary to construct the main rotating body of the unit. This complex sourcing demands rigorous quality assurance protocols and long-term strategic partnerships with leading global hydraulic component suppliers to ensure consistency in performance and reliability. Manufacturers must also secure a stable supply of sophisticated electronics, including highly sensitive angle sensors, CAN-bus communicators, and custom-programmed proportional logic controllers (PLCs) that form the electronic brain of the advanced control systems, as the technological performance of the internal components directly dictates the market standing and reliability metrics of the final product.

The midstream segment involves the core manufacturing, precision machining, robotic welding, and final assembly processes. This stage is capital-intensive, requiring advanced machining centers to achieve the tight tolerances necessary for smooth rotation and tilting movements under maximum load. Crucially, every assembled unit undergoes exhaustive multi-stage quality control testing, including rigorous hydraulic pressure tests, load-bearing simulations, and functional checks to verify seamless integration with quick coupler systems and remote control interfaces. The final product is then prepared for distribution. Downstream market penetration relies heavily on selecting the optimal distribution channel; direct distribution focuses on servicing major Original Equipment Manufacturers (OEMs) who integrate the tiltrotator as a premium, factory-installed option, leveraging their scale and reducing integration complexities for the end-user. Conversely, indirect distribution utilizes a highly professional network of independent dealer partners and specialized heavy equipment distributors. These indirect partners are critical for providing localized installation, extensive operator training, immediate technical support, and essential after-sales service and maintenance, acting as the primary point of contact for the vast retrofit and aftermarket segment.

The sustainability and efficiency of the value chain are intrinsically linked to robust post-sales support infrastructure. Since tiltrotators are specialized, high-productivity tools, any period of machine downtime carries a very high economic penalty for the end-customer. Therefore, manufacturers and their distribution partners must maintain comprehensive global inventories of replacement parts, including high-wear items like seals, bearings, and hydraulic motors, and invest continuously in certified, highly trained service technicians capable of performing complex field repairs. The integration of advanced digital technologies, particularly IoT sensors enabling remote diagnostics and real-time performance telematics, significantly enhances the downstream service value proposition. This connectivity allows for proactive identification of potential issues before they lead to failure, facilitating just-in-time maintenance scheduling and minimizing non-productive idle time, thereby substantially maximizing the operational lifetime and overall profitability derived from the hydraulic tiltrotator investment by the customer base, reinforcing brand loyalty and justifying the premium pricing strategy adopted by market leaders.

Hydraulic Tiltrotator Market Potential Customers

The primary customer base for hydraulic tiltrotators consists predominantly of large, sophisticated organizations and highly specialized contractors who extensively utilize medium to large excavators (ranging from 6 to 30 tons) in operating environments where precision, unparalleled maneuverability, and minimizing non-productive machine repositioning are indispensable for achieving project targets. Leading customers include tier-one civil engineering firms specializing in vast, complex infrastructure undertakings such as new highway interchanges, intricate underground utility installations, rail track laying, and crucial urban redevelopment projects. In these high-stakes environments, the tiltrotator's advanced multi-axis functionality allows for pinpoint accurate pipe bedding, complex slope creation, and precise material handling without continuously disrupting the surrounding site, driving down operational costs and vastly improving execution quality. These institutional firms prioritize the superior return on investment (ROI) derived from the calculated increase in site productivity and the capability to drastically reduce reliance on high-cost, specialized manual labor, positioning the tiltrotator as essential, high-return capital equipment.

A second, critically important, and rapidly expanding customer segment encompasses municipal service providers, large utility companies (including power, gas, and telecommunications), and governmental public works departments that manage and maintain extensive existing underground and surface networks. In these highly constrained and regulated urban environments, the ability of a tiltrotator to perform delicate, surgical digging, precise material sorting, and controlled backfilling adjacent to existing, sensitive infrastructure (cables, pipes) minimizes the risk of catastrophic damage. This capability makes the tiltrotator an invaluable tool for urban maintenance, emergency repair work, and routine upgrades where spatial limitations are severe. Furthermore, large-scale commercial landscape contractors, vineyard management companies, and specialized forestry management firms constitute significant end-users, leveraging the tiltrotator’s extreme versatility for complex land shaping, precise heavy planting, controlled tree removal, and sensitive terrain preparation tasks that require superior articulation and highly delicate handling of valuable materials and environmental assets.

Finally, global and national heavy equipment rental companies represent a profoundly critical and high-volume customer segment. These companies acquire large fleets of tiltrotators to offer advanced, cutting-edge machinery solutions to a much broader range of smaller-to-medium independent contractors who may lack the necessary capital for outright specialized equipment purchase. High demand within the rental fleet segment serves as a strong, reliable indicator of accelerating mainstream market acceptance and contractor confidence in the technology’s productivity claims. Rental customers demand exceptionally robust, highly durable, and easily operable units that are equipped with universal quick-hitch compatibility to withstand varied, multi-operator operating environments. Therefore, reliability, ruggedness, ease of interchangeability, and standardized control systems are crucial purchasing criteria for major rental organizations, dictating significant market volume and technological deployment pace across the broader construction industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 760 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Engcon, Rototilt, Steelwrist, Kinshofer, SMP Parts, OilQuick, Geith International, VTN Europe, Miller UK, Remu Oy, HKS Dreh-Antriebe GmbH, Indexator Rotator Systems AB, Arden Equipment, Digga, NOX Tiltrotator (Kuhn GmbH), MB Crusher, Lehnhoff, Doosan Attachments, Wacker Neuson, CAT Work Tools, Volvo Construction Equipment Attachments, Kobelco Attachments, JCB Attachments, Takeuchi Attachments, Liebherr Attachments, Cangini Benne Srl, RH Tiltrotator, Mecanil Oy Ab, Hammer Srl, EIK Engineering Sdn Bhd, Amulet Attachments, Kocurek Excavators Ltd, Petersen Industries, Paladin Attachments, Helac Corporation, Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Hyundai Construction Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Tiltrotator Market Key Technology Landscape

The technological evolution within the Hydraulic Tiltrotator Market is intensely focused on achieving unprecedented levels of precision, deep digital control integration, and maximizing mechanical durability under continuous load. The most profound technological advancement is the widespread deployment of highly sophisticated proportional hydraulics, moving far beyond rudimentary on/off valve systems. Proportional control systems meticulously regulate the speed, force, and simultaneous movement of both the tilt and rotation functions, allowing the operator to execute highly complex, composite movements with exceptional fluidity and control. This results directly in significantly smoother machine operation, dramatically increased accuracy, and a notable reduction in material wastage, which is particularly vital for precision tasks such as final grading, setting utility structures, or working within highly confined zones. This superior precision capability is a defining technological differentiator among market leaders. Furthermore, core hydraulic advancements now incorporate specialized, fully sealed, and often grease-free hydraulic coupling and swivel systems, alongside structural designs utilizing high-wear resistance internal components, all engineered to drastically minimize wear and tear, thereby substantially extending the service interval and significantly reducing the overall lifetime maintenance expenditure for the owner.

A second critically transformative technology landscape development is the pervasive integration of advanced angular sensors, highly accurate position encoders, and robust telematics communication systems. Modern, high-end tiltrotators are factory-fitted with digital sensors that relay real-time data on the attachment’s exact spatial orientation (pitch, yaw, roll) directly into the excavator’s centralized 2D or 3D machine control system. This essential integration enables operators to work precisely to complex digital terrain models and engineered design files with high fidelity, which accelerates the achievement of final grade on the first pass. Telematics capabilities are paramount, providing fleet managers with remote monitoring functionalities for operational performance parameters, predictive diagnostics based on operational anomalies, and precise utilization rate tracking across large fleets, which is critical for proactive maintenance scheduling and optimizing asset deployment. The development of ergonomic, highly customizable joysticks that integrate all tiltrotator functions seamlessly into the base machine’s control environment further enhances user acceptance, operator efficiency, and minimizes the learning curve associated with complex, coordinated machine maneuvers.

Finally, the ongoing efforts focused on standardization, refinement, and optimization of quick coupler technology represent a major focus area for manufacturers. Investment is centered on developing proprietary yet compatible coupler interfaces (such as recognized standards like the S-Type, or specialized locking systems like OilQuick) to ensure the highly rapid, secure, and reliable interchangeability of the tiltrotator itself with a vast array of compatible attachments (e.g., various buckets, dedicated material grabs, compactors, pallet forks), and also ensuring the ability to rapidly transfer the tiltrotator unit between different excavator models within a fleet. This obsessive focus on modularity and quick change systems significantly maximizes the host machine’s operational flexibility and minimizes non-productive downtime, directly improving site throughput. Structural material science also contributes substantially, with ongoing R&D into proprietary lightweight, high-tensile materials, often incorporating specialized aluminum alloys or advanced high-strength steels, which successfully reduce the overall mass of the attached unit. This critical weight reduction maximizes the nominal lifting capacity and improves the overall stability of the host excavator, all while ensuring uncompromising structural integrity and guaranteeing long-term resilience against dynamic operational stress.

Regional Highlights

The geographical analysis of the Hydraulic Tiltrotator Market reveals highly varied adoption rates and growth drivers, reflecting disparate levels of construction maturity, national infrastructure investment strategies, and prevailing labor market conditions across the globe. Understanding these regional nuances is essential for market entry strategies and resource allocation.

- Europe: Europe maintains its position as the undisputed technological and commercial leader in the Hydraulic Tiltrotator Market. The Nordic countries, particularly Sweden, Norway, and Finland, exhibit the highest global penetration rates, treating the tiltrotator as a standard, mandatory piece of equipment for virtually all medium excavators due to extremely high labor costs and early recognition of its productivity benefits. The wider European market (including Germany, UK, France, and Benelux) is experiencing rapid adoption, heavily driven by stringent EU regulations promoting workplace safety, efficiency, and environmental minimization of site disturbance, particularly within intensive utility and urban road infrastructure renewal programs. The regional demand is strongly focused on advanced systems integrating proportional control and factory-fitted 3D machine guidance technology.

- North America (U.S. and Canada): Characterized by explosive recent growth, North America has successfully overcome initial skepticism regarding the technology's utility. The market is now rapidly accelerating its adoption curve, fueled by aggressive competition among large contractors seeking productivity gains, combined with substantial federal and state investment in national infrastructure modernization programs (roads, bridges, utilities). Growth is particularly robust in the mid-range excavator segment (10-20T) and is supported by major manufacturers heavily investing in comprehensive local dealer networks, offering attractive financing options, and prioritizing specialized, highly intensive operator training programs to facilitate seamless transition from traditional methods.

- Asia Pacific (APAC): APAC is emphatically projected to be the engine of future growth, anticipated to exhibit the highest Compound Annual Growth Rate over the forecast period. This acceleration is underpinned by unprecedented government spending on massive urbanization projects, the development of high-speed rail networks, and rapid industrial zone expansion across economic powerhouses like China, India, and Indonesia. While price sensitivity remains a constraint, the sheer scale of mega-projects necessitates the efficiency offered by tiltrotator technology. Manufacturers are strategically focusing on introducing robust, slightly simplified, and cost-effective models tailored to meet local demands, alongside establishing localized manufacturing and assembly partnerships to mitigate import duties and optimize supply chains.

- Latin America: This market segment remains strategically emerging, with adoption rates highly correlated to the stability of national economies and investment cycles in key sectors like mining infrastructure and large, localized public works projects, predominantly in Brazil, Mexico, and Chile. The demand profile typically favors basic, highly durable, and mechanically robust tiltrotator models that can withstand challenging and often remote operating conditions. Market penetration relies heavily on establishing strong, reliable local service centers and providing flexible financing solutions to counter the capital constraints faced by many local contractors.

- Middle East and Africa (MEA): Growth in the MEA region is episodic and primarily linked to large-scale, high-value oil & gas, tourism, and national diversification infrastructure projects, particularly within the Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia, Qatar). Regional demand places an exceptionally high premium on product durability, reliable cooling mechanisms, and the ability of hydraulic systems to function flawlessly in environments characterized by extreme ambient heat and abrasive dust conditions. South Africa serves as a critical entry point and regional hub, driving concentrated demand across mining and heavy industrial construction sectors in Sub-Saharan Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Tiltrotator Market.- Engcon

- Rototilt

- Steelwrist

- Kinshofer

- SMP Parts

- OilQuick

- Geith International

- VTN Europe

- Miller UK

- Remu Oy

- HKS Dreh-Antriebe GmbH

- Indexator Rotator Systems AB

- Arden Equipment

- Digga

- NOX Tiltrotator (Kuhn GmbH)

- MB Crusher

- Lehnhoff

- Doosan Attachments

- Wacker Neuson

- CAT Work Tools

- Volvo Construction Equipment Attachments

- Kobelco Attachments

- JCB Attachments

- Takeuchi Attachments

- Liebherr Attachments

- Cangini Benne Srl

- RH Tiltrotator

- Mecanil Oy Ab

- Hammer Srl

- EIK Engineering Sdn Bhd

- Amulet Attachments

- Kocurek Excavators Ltd

- Petersen Industries

- Paladin Attachments

- Helac Corporation

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery

- Hyundai Construction Equipment

Frequently Asked Questions

Analyze common user questions about the Hydraulic Tiltrotator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a hydraulic tiltrotator compared to a standard excavator bucket?

The primary benefit is a drastic, measurable increase in machine versatility and operational efficiency. A tiltrotator provides full 360-degree continuous rotation and substantial tilt capability (up to 45 degrees), allowing the operator to execute complex, multi-axis tasks like precision grading, detailed trenching, and utility placement without repeatedly repositioning the heavy base excavator, frequently resulting in up to 40-50% faster task completion times and significant fuel savings.

How do manufacturers ensure compatibility between different brands of excavators and their tiltrotator models?

Compatibility is ensured through adherence to standardized hydraulic quick coupling systems (such as the widely recognized S-Type or proprietary automated systems like OilQuick) and by utilizing advanced, configurable electronic control systems. Modern tiltrotators use standardized CAN-bus communication protocols to integrate seamlessly with the host excavator's electrical and hydraulic management systems, often requiring manufacturer-specific installation kits and highly ergonomic custom joystick controllers.

Is the high initial capital cost of a tiltrotator justified by the expected return on investment (ROI) for contractors?

Yes, for contractors with high machine utilization and complex project portfolios, the high initial capital expenditure is strongly justified by the superior long-term ROI. The investment is typically recouped through substantial reductions in required labor hours, drastically decreased fuel consumption (due to optimized machine movements), minimized wear on the excavator’s undercarriage, and the critical ability to bid successfully on a wider variety of specialized, high-margin projects using fewer machines.

What are the typical maintenance requirements and structural lifespan of a hydraulic tiltrotator unit in heavy use?

Tiltrotators require disciplined routine maintenance, primarily involving daily greasing of critical articulation points, periodic inspection and replacement of high-pressure hydraulic hoses and seals, and regular checks of the gear unit oil levels. Modern units are structurally engineered for harsh operational environments and, with strict adherence to manufacturer maintenance schedules, offer a reliable structural lifespan often exceeding 10,000 operational hours, comparable to the service life of the base excavator.

Which geographical region globally currently leads the market both in sales volume and technological advancement for tiltrotators?

Europe is the global leader, specifically the highly mature and sophisticated Scandinavian market (Sweden, Norway), which drives both the highest sales volumes relative to the excavator fleet size and spearheads technological adoption, particularly concerning integrated proportional control systems, advanced 3D machine guidance integration, and pioneering sustainable hydraulic practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager