Hydraulic Tyre Vulcanizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435298 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Hydraulic Tyre Vulcanizer Market Size

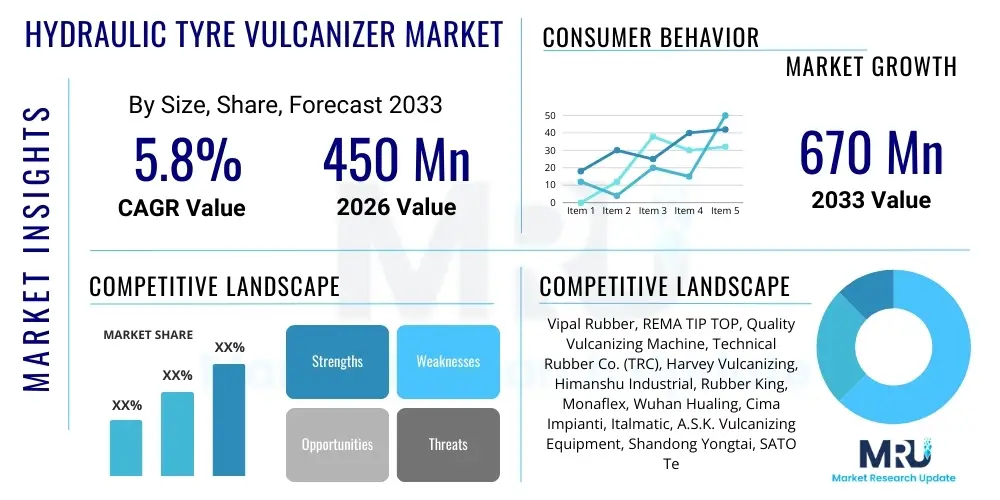

The Hydraulic Tyre Vulcanizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing global vehicle fleet size, particularly commercial vehicles, which require robust and efficient tyre repair and retreading solutions to optimize operational costs. The transition towards high-capacity, automated vulcanizing equipment enhances efficiency and reduces labor costs, further contributing to market valuation.

The estimation methodology incorporates complex macroeconomic variables, including raw material price volatility (rubber and steel), advancements in tyre technology necessitating more precise curing processes, and environmental regulations promoting tyre longevity through retreading. While the initial investment in hydraulic systems is higher compared to traditional screw-press vulcanizers, the superior pressure consistency, faster cycle times, and enhanced safety features justify the rapid adoption across large-scale retreading plants and fleet maintenance centers worldwide. This technological superiority is a core element supporting the aggressive growth trajectory predicted through 2033.

Geographically, growth is concentrated in emerging economies in the Asia Pacific region, fueled by massive infrastructural investments and burgeoning logistics sectors. However, mature markets in North America and Europe maintain stable demand, focusing on replacing older machinery with technologically advanced, energy-efficient hydraulic units that comply with stringent industrial safety standards. The sustained growth indicates a mature yet dynamic market segment, integral to the circular economy within the automotive and transportation sectors, emphasizing sustainability and resource optimization through tyre lifecycle extension.

Hydraulic Tyre Vulcanizer Market introduction

The Hydraulic Tyre Vulcanizer Market encompasses the manufacturing, distribution, and utilization of sophisticated machinery designed for the repair and retreading of vehicle tyres. A hydraulic tyre vulcanizer utilizes pressurized hydraulic fluid systems to apply immense, uniformly distributed pressure and controlled heat necessary for the curing process, permanently bonding repair patches or new tread rubber onto the tyre casing. This process, known as vulcanization, is critical for restoring structural integrity and extending the operational life of damaged or worn-out tyres. The primary advantage of hydraulic systems over mechanical or pneumatic counterparts lies in their ability to deliver high, consistent pressure across large surface areas, crucial for radial tyre structures and high-load commercial vehicle tyres, ensuring superior quality and reliability in the finished product.

Major applications of hydraulic tyre vulcanizers are predominantly found in commercial tyre retreading facilities, fleet maintenance workshops, and specialized tyre repair centers globally. These machines are essential for processing truck and bus radial (TBR) tyres, off-the-road (OTR) tyres used in mining and construction, and, to a lesser extent, passenger car tyres. The market is intrinsically linked to the freight and logistics industry, as fleet operators seek reliable methods to reduce expenditure on new tyre purchases. Key benefits driving market adoption include significant cost savings realized through tyre lifecycle management, enhanced safety through robust repair quality assurance, reduced environmental footprint due to less waste generation, and increased operational throughput facilitated by automation features built into modern hydraulic vulcanizers.

Driving factors for the market expansion include the exponential increase in commercial vehicle registrations globally, particularly in developing nations undergoing rapid industrialization and urbanization. Furthermore, strict regulatory environments, especially in developed economies, mandate specific safety and performance criteria for repaired and retreaded tyres, pushing repair shops to upgrade to precision hydraulic technology capable of meeting these standards. Technological advancements, such as PLC-based controls, remote monitoring capabilities, and energy-efficient heating elements, are further accelerating the replacement cycle of older equipment, ensuring the continuous demand flow for advanced hydraulic vulcanizers that offer high degrees of process control and documentation for traceability.

Hydraulic Tyre Vulcanizer Market Executive Summary

The Hydraulic Tyre Vulcanizer Market exhibits robust expansion, characterized by a fundamental shift toward automation, precision, and energy efficiency across all major geographical segments. Current business trends are defined by manufacturers investing heavily in R&D to integrate advanced sensor technology and sophisticated pressure control algorithms, moving away from simple manual controls. The consolidation of smaller regional repair shops into larger, centrally managed retreading chains is bolstering demand for high-capacity, multi-station hydraulic systems. Furthermore, supply chain optimization is crucial, with companies prioritizing localization of manufacturing and service centers to mitigate geopolitical risks and reduce lead times for complex machinery installation and maintenance, a critical consideration for capital-intensive equipment.

Regionally, Asia Pacific (APAC) stands as the primary engine of market growth, driven by massive trucking volumes associated with manufacturing and infrastructure development in China, India, and Southeast Asian nations. This region demands cost-effective, durable equipment, making hydraulic vulcanizers an attractive long-term investment. North America and Europe, while slower in growth volume, command higher average selling prices due to stringent demands for automation, safety certifications, and integration capabilities with centralized factory management systems. The Middle East and Africa (MEA) are emerging areas, supported by expanding logistics hubs and mining activities requiring specialized OTR tyre vulcanizing units. These regional disparities necessitate tailored product offerings and distribution strategies, emphasizing robust after-sales support in high-growth areas.

Segmentation trends indicate a strong preference for fully automatic, PLC-controlled hydraulic vulcanizers, particularly in the larger capacity segment serving commercial truck and bus tyres. By product type, the demand for sectional repair vulcanizers, capable of addressing significant sidewall and shoulder damage, is increasing due to the higher intrinsic value of modern commercial tyre casings, making extensive repair economically viable. The market is also witnessing differentiation based on heating methods, with electric and thermal fluid heating systems gaining traction over steam-based systems due to lower operational complexities and enhanced energy efficiency, aligning with global efforts towards sustainable manufacturing practices and operational optimization in the heavy-duty transportation sector.

AI Impact Analysis on Hydraulic Tyre Vulcanizer Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the precision, quality control, and overall throughput of the vulcanization process, traditionally a highly empirical manufacturing stage. Common concerns revolve around implementing predictive maintenance to minimize costly equipment downtime, utilizing machine learning (ML) for optimizing curing cycles based on real-time tyre casing data, and automating quality inspection to detect internal defects introduced during repair. Users seek clarification on the feasibility and ROI of integrating advanced vision systems powered by AI to assess damage severity prior to repair, thereby reducing manual error and ensuring that only structurally sound casings enter the vulcanization stage. The overarching expectation is that AI integration will transform hydraulic vulcanizing from a process reliant on operator experience to a standardized, highly reliable, and traceable manufacturing step, critical for maintaining fleet safety standards.

The core themes emerging from user analysis focus on process standardization and yield maximization. AI algorithms are expected to monitor parameters such as internal mould temperature gradients, pressure curve profiles, and dwell times in real-time, adjusting hydraulic flow and heating element output dynamically to achieve the optimal cure state specific to the tyre size, material composition, and ambient conditions. This level of adaptive control is unattainable through conventional PLC programming alone. Furthermore, the integration of AI with ERP systems allows for advanced traceability, linking specific repair batches and curing data to the tyre's operational history, significantly enhancing manufacturer liability management and facilitating adherence to rigorous regulatory standards concerning tyre safety and performance, which is a major concern for large fleet operators and retreading plant managers.

- Predictive Maintenance: AI analyzes sensor data (pressure fluctuations, temperature variances, vibration) to forecast hydraulic component failure, minimizing unscheduled downtime.

- Adaptive Curing Cycle Optimization: Machine Learning models dynamically adjust heat and pressure profiles based on real-time casing characteristics (e.g., thickness, rubber compound), ensuring optimal vulcanization quality.

- Automated Quality Inspection: AI-powered vision systems detect subtle defects post-cure, such as uneven bonding or trapped air, which are invisible to the human eye.

- Material Flow Management: Optimization of repair patch placement and adhesive application using guided robotics informed by AI analysis of damage geometry.

- Energy Consumption Optimization: Algorithms manage heating elements to minimize energy usage while maintaining required temperature stability throughout the curing phase.

- Operator Assistance and Training: AI provides real-time guidance and anomaly detection to operators, improving consistency and reducing the skill gap required for complex operations.

DRO & Impact Forces Of Hydraulic Tyre Vulcanizer Market

The dynamics of the Hydraulic Tyre Vulcanizer Market are characterized by a strong interplay between economic necessity, technological capability, and environmental mandates. The primary driver is the increasing volume of commercial road freight globally, which directly translates into higher demand for efficient tyre maintenance and retreading to control massive operational budgets. Conversely, high initial capital investment costs for advanced hydraulic systems and the specialized skill set required for operation and maintenance act as significant restraints, especially for small and medium-sized independent repair shops. Opportunities are substantial in leveraging automation and digital integration, particularly in offering subscription-based maintenance services and integrated machinery packages that reduce the total cost of ownership (TCO) for large corporate fleets. These forces collectively dictate the market structure, pushing innovation toward affordability, durability, and seamless digital integration.

Key drivers include the demonstrable cost savings realized by fleet operators when utilizing high-quality retreaded tyres, which can cost significantly less than new premium tyres while offering comparable performance for certain applications. Regulatory impetus from governmental bodies promoting the circular economy and mandating improved environmental performance also drives the demand for retreading equipment that extends the life of valuable tyre casings. Restraints largely center on the perception and quality concerns associated with retreaded tyres in specific consumer segments and the technical complexity involved in repairing modern, high-performance tyre structures, which demands highly precise hydraulic vulcanization control to prevent structural degradation. Furthermore, volatility in the supply chain for high-pressure hydraulic components and sophisticated control electronics poses periodic operational challenges for manufacturers.

Opportunities for market players are concentrated in offering specialized solutions for high-growth tyre segments, such as large OTR tyres used in mining and construction, where replacement costs are exceptionally high, making vulcanization mandatory. Developing hybrid systems combining electric heating with hydraulic pressure could address the high energy consumption restraint. The competitive impact forces are driven by pricing pressures from APAC-based manufacturers offering cost-effective standard hydraulic units, forcing established Western players to differentiate through advanced automation, superior durability, and comprehensive service agreements. The threat of substitutes, while limited (as vulcanization remains the definitive method for permanent rubber repair), arises minimally from innovative puncture-sealing technologies, though these do not address major structural damage requiring hydraulic curing. Ultimately, market success hinges on balancing performance quality with capital accessibility for end-users.

Segmentation Analysis

The Hydraulic Tyre Vulcanizer Market is structurally segmented based on crucial operational and application variables, providing a granular view of user needs and technological requirements. The categorization by product type differentiates between spot repair vulcanizers (for minor, localized damage), sectional repair vulcanizers (for major shoulder and sidewall damage), and full mould vulcanizers (primarily used in retreading for applying full new treads). Segmentation by operation type—manual, semi-automatic, and fully automatic—reflects the varying levels of capital investment and throughput required by end-users, with the trend heavily favoring automated systems for high-volume retreading plants due to superior process consistency and reduced labor dependency. These defined segments are crucial for manufacturers to tailor machinery specifications and marketing strategies effectively.

The application segmentation is pivotal, primarily distinguishing between facilities handling Truck and Bus Radial (TBR) tyres and those specializing in Off-the-Road (OTR) tyres. TBR tyre vulcanizers represent the largest volume segment, serving the massive global logistics industry, requiring high-speed processing and robust quality control features. OTR tyre vulcanizers, while lower in volume, command significantly higher prices due to the sheer scale, pressure requirements, and customized mould designs necessary for enormous construction and mining vehicle tyres. Understanding these application segments is vital for analyzing market pricing power and technological focus, as OTR vulcanizers demand significantly greater hydraulic tonnage capabilities and highly durable components to withstand continuous heavy-duty cycles.

Further segment refinement includes categorizing based on heating source (electric, steam, thermal fluid) and maximum tyre capacity (ranging from light commercial to super-heavy OTR). The transition from steam-based heating to thermal fluid or electric systems reflects a market move towards safer, more controllable, and energy-efficient solutions. This comprehensive segmentation allows market participants, from raw material suppliers to machinery manufacturers, to accurately assess demand pockets, identify unmet needs within niche applications (e.g., aircraft tyres), and strategically allocate resources toward developing next-generation vulcanization technologies that meet evolving industry safety and productivity metrics.

- By Product Type:

- Spot Repair Vulcanizers

- Sectional Repair Vulcanizers (Sidewall, Shoulder, Crown)

- Full Retreading Mould Vulcanizers (Curing Chambers)

- By Operation Type:

- Manual Hydraulic Vulcanizers

- Semi-Automatic Hydraulic Vulcanizers

- Fully Automatic Hydraulic Vulcanizers (PLC Controlled)

- By Application:

- Truck and Bus Radial (TBR) Tyres

- Off-the-Road (OTR) and Industrial Tyres

- Passenger Car Tyres (Pneumatic)

- By Heating Method:

- Electric Heating

- Steam Heating

- Thermal Fluid Heating

- By Capacity (Tonnage):

- Low Capacity (Under 50 Ton)

- Medium Capacity (50-150 Ton)

- High Capacity (Above 150 Ton)

Value Chain Analysis For Hydraulic Tyre Vulcanizer Market

The value chain for the Hydraulic Tyre Vulcanizer Market begins with the upstream suppliers providing high-precision components critical for hydraulic function and heating integrity. This includes specialized manufacturers of high-pressure hydraulic pumps, cylinders, valves, advanced PLC controllers, high-tolerance steel alloys for mould construction, and high-quality electrical heating elements or thermal fluid systems. The quality and reliability of these upstream inputs directly determine the final performance and lifespan of the vulcanizing machine. Manufacturers typically engage in rigorous vendor qualification processes to ensure compliance with stringent durability and safety standards, given the high pressures and temperatures involved in the vulcanization process. Price stability and supply chain resilience for microprocessors and hydraulic components have become particularly critical risk factors in recent years, prompting manufacturers to dual-source key components to maintain production schedules.

Mid-stream activities involve the core machinery manufacturing, assembly, system integration, and rigorous testing of the hydraulic vulcanizers. This phase requires specialized engineering expertise to design press frames that withstand immense cyclical loads, integrate complex electronic controls for precise temperature and pressure management, and ensure ergonomic and safe operation. Following manufacturing, the distribution channel plays a crucial role. Direct distribution is often favored for large-scale, customized hydraulic installations, involving direct sales teams, specialized engineers for site assessment, and bespoke commissioning services. Indirect distribution, through regional dealers or specialized industrial equipment distributors, is more common for standard, smaller-capacity repair units, providing local inventory, immediate technical support, and localized maintenance contracts.

The downstream segment encompasses the end-users—large tyre retreading factories, independent repair workshops, and major transportation fleet maintenance depots—where the vulcanizers are actively utilized. After-sales support and maintenance are critical components of the value chain, representing a significant revenue stream for manufacturers and distributors. The complexity and cost of hydraulic systems necessitate specialized technical service, calibration, and spare parts supply, ensuring operational uptime. Effective management of the distribution channel, balancing the efficiency of indirect sales with the technical depth required for direct, high-value installations, is a key determinant of competitive advantage in this capital equipment market. The entire chain emphasizes durability, precision, and minimizing total ownership cost (TCO) for the final consumer.

Hydraulic Tyre Vulcanizer Market Potential Customers

The potential customer base for the Hydraulic Tyre Vulcanizer Market is inherently segmented based on the volume and type of tyres processed, primarily comprising entities heavily invested in commercial transportation and industrial operations where tyre expenditure is a substantial operational cost. Large-scale tyre retreading plants constitute the most significant segment, as they require continuous, high-throughput, fully automated hydraulic systems capable of curing thousands of TBR and OTR tyres annually. These customers prioritize machine reliability, energy efficiency, and integration capabilities with their overall factory management software, often purchasing multiple high-capacity units simultaneously to maximize economies of scale and meet stringent regulatory requirements for quality assurance in commercial tyre maintenance.

Another major customer group consists of commercial fleet operators, including large trucking, bus, and logistics companies that establish in-house maintenance and repair workshops. While their vulcanizer needs may be lower in throughput compared to dedicated retreaders, these customers demand robust, user-friendly sectional repair vulcanizers to minimize vehicle downtime and ensure immediate repairs on their proprietary fleet casings. The third significant group includes independent, specialized tyre repair shops that serve a local or regional clientele. These smaller businesses typically opt for semi-automatic or spot repair hydraulic vulcanizers, prioritizing versatility across different tyre sizes and lower initial investment costs. Furthermore, governmental and municipal entities operating large fleets (public transport, sanitation services) are also key buyers, driven by public sector mandates for longevity and maintenance cost control. The underlying purchasing decision for all these groups is predicated on achieving the lowest cost-per-mile operationally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vipal Rubber, REMA TIP TOP, Quality Vulcanizing Machine, Technical Rubber Co. (TRC), Harvey Vulcanizing, Himanshu Industrial, Rubber King, Monaflex, Wuhan Hualing, Cima Impianti, Italmatic, A.S.K. Vulcanizing Equipment, Shandong Yongtai, SATO Tech, Tech Retread, VMI Group, Tyre-Aid, Wiedenmann, Zhongkai Rubber Machinery, Matangi Rubber Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Tyre Vulcanizer Market Key Technology Landscape

The technological landscape of the Hydraulic Tyre Vulcanizer Market is centered on precision engineering, advanced control systems, and material science innovation to maximize the longevity and safety of repaired tyres. Modern hydraulic vulcanizers utilize sophisticated proportional hydraulic valve technology to ensure highly accurate pressure curves during the curing cycle, which is essential for uniform stress distribution in radial ply tyres. The shift from basic mechanical pressure gauges to high-resolution digital pressure transducers allows for real-time monitoring and computerized logging of every curing cycle, providing auditable data trails for quality assurance purposes. Furthermore, the integration of multi-zone heating systems, often utilizing thermal oil circulation or highly efficient electric heating pads, ensures that temperature is controlled within narrow tolerances across the entire repair area, preventing localized over-curing or under-curing which compromises tyre integrity. This reliance on computerized process control distinguishes current hydraulic vulcanizers from their predecessors and is critical for processing complex modern rubber compounds.

A significant advancement involves the use of Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) for complete automation of the vulcanization process. Operators can input specific tyre specifications (size, type, damage location) into the HMI, and the PLC automatically executes the predefined curing recipe, controlling ramp rates for heat and pressure, dwell times, and cool-down cycles. This automation minimizes operator variability, ensuring consistent high-quality repairs across different shifts and technicians. Furthermore, the development of lightweight yet extremely durable aluminium or composite moulds is another key trend. These advanced moulds improve heat transfer efficiency and reduce the overall weight and mass that needs to be heated, significantly lowering cycle times and energy consumption compared to traditional cast iron moulds, thereby increasing the economic viability of high-volume retreading operations. The focus is increasingly on modular design, allowing vulcanizers to be rapidly adapted for various tyre sizes and damage types through interchangeable components.

Connectivity and remote diagnostics represent the cutting edge of the technology landscape. Many high-end hydraulic vulcanizers are now equipped with IoT capabilities, allowing for remote monitoring of machine performance, cycle completion alerts, and predictive maintenance alerts based on operational data analysis. This cloud connectivity is vital for large multi-site retreading chains to centrally manage their equipment, standardize curing recipes globally, and perform remote troubleshooting, drastically reducing maintenance downtime. Furthermore, integration with specialized Nondestructive Testing (NDT) equipment, such as shearography systems used for pre-inspection, ensures that only defect-free casings proceed to the high-cost vulcanization stage. The trajectory of technological development strongly suggests a future where vulcanizers are not standalone machines but integral, digitally connected, and self-optimizing components within a larger, smart factory ecosystem dedicated to tyre lifecycle management.

Regional Highlights

- Asia Pacific (APAC): This region dominates the Hydraulic Tyre Vulcanizer Market, primarily due to the vast and rapidly expanding commercial transportation sector in countries like China, India, Indonesia, and Thailand. High growth is sustained by infrastructural projects, booming logistics industries, and a greater emphasis on cost-effective tyre management strategies. APAC manufacturers often focus on producing robust, high-throughput hydraulic units offering competitive pricing, catering both to large domestic retreaders and global export markets.

- North America: Characterized by high labor costs and stringent safety regulations, the North American market demands high levels of automation and sophistication. Key factors include the dominance of large fleet operators prioritizing minimizing downtime and requiring detailed digital traceability of all repairs. Demand here focuses on advanced, fully automatic hydraulic vulcanizers that incorporate AI/ML for precise quality control and compliance reporting.

- Europe: The European market is highly mature and driven by regulatory compliance related to tyre waste and circular economy initiatives. European demand is focused on acquiring energy-efficient, low-emission hydraulic systems, often preferring thermal fluid heating over steam. Germany, France, and the UK are major consumers, emphasizing quality, durability, and robust local service networks provided by manufacturers.

- Latin America (LATAM): Growth in LATAM is tied closely to commodity export and mining activities, driving specific demand for large-scale OTR and TBR vulcanizers in countries like Brazil and Mexico. The market often balances price sensitivity with the need for durable machinery capable of operating reliably in challenging conditions, making the longevity of hydraulic components a crucial purchasing criterion.

- Middle East and Africa (MEA): This region is an emerging market, fueled by increasing investment in logistics hubs (e.g., UAE, Saudi Arabia) and expansive mining operations in Africa. The demand trajectory is steep, focusing on reliable, easy-to-maintain hydraulic vulcanizers that can handle large fleets operating over long distances in harsh desert or remote environments, necessitating strong reliance on imported technology and technical support services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Tyre Vulcanizer Market.- Vipal Rubber

- REMA TIP TOP AG

- Technical Rubber Co. (TRC)

- Harvey Vulcanizing

- Monaflex

- Italmatic S.r.l.

- Wuhan Hualing Machinery Co., Ltd.

- Quality Vulcanizing Machine Co.

- Cima Impianti S.r.l.

- Himanshu Industrial

- Rubber King Tyre Retreading Equipment

- A.S.K. Vulcanizing Equipment

- Shandong Yongtai Machinery Co., Ltd.

- SATO Tech

- Tech Retread

- VMI Group

- Tyre-Aid Equipment

- Wiedenmann Gummiwerk GmbH

- Zhongkai Rubber Machinery Co., Ltd.

- Matangi Rubber Industries Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Hydraulic Tyre Vulcanizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hydraulic and mechanical tyre vulcanizers, and why are hydraulic systems preferred?

Hydraulic vulcanizers use pressurized fluid to generate precise, high, and uniformly distributed pressure across the tyre casing, ensuring consistent curing and superior bond strength, crucial for complex radial tyres. Mechanical vulcanizers, relying on screw presses, often provide less consistent pressure distribution, which can lead to quality variations in the repair, making hydraulics the preferred choice for high-quality, large-scale retreading operations.

How does the integration of PLC controls impact the efficiency of a hydraulic vulcanizer?

PLC (Programmable Logic Controller) integration allows for complete automation of the curing cycle, including precise management of temperature ramp-up, pressure application timing, and dwell periods. This standardization minimizes human error, ensures batch-to-batch consistency, drastically reduces cycle times, and provides necessary digital records for quality assurance and regulatory compliance.

Which application segment drives the highest demand in the Hydraulic Tyre Vulcanizer Market globally?

The Truck and Bus Radial (TBR) tyre segment generates the highest volume demand globally. TBR tyres are expensive and critical for the logistics industry, making high-quality retreading economically essential. The need for precise, high-pressure curing to maintain the structural integrity of these heavy-duty casings drives significant investment in advanced hydraulic vulcanizers across all major regions, particularly APAC.

What role does predictive maintenance play in the future of hydraulic vulcanizing equipment?

Predictive maintenance, enabled by IoT sensors and AI analytics, monitors the operational health of critical hydraulic components (pumps, seals, valves) in real-time. By forecasting potential failures before they occur, it allows for scheduled maintenance, significantly reducing unplanned downtime, improving overall equipment effectiveness (OEE), and lowering the long-term maintenance costs associated with complex hydraulic machinery.

Are electric heating systems replacing steam or thermal fluid heating in modern hydraulic vulcanizers?

Electric heating systems are increasingly preferred in modern vulcanizers due to their enhanced control, safety, and energy efficiency, particularly in smaller to medium-sized units, especially in regions with high energy costs. While thermal fluid remains common for very large industrial presses due to its heat transfer properties, electric heating is gaining ground as manufacturers focus on environmentally compliant, modular, and highly precise temperature management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager