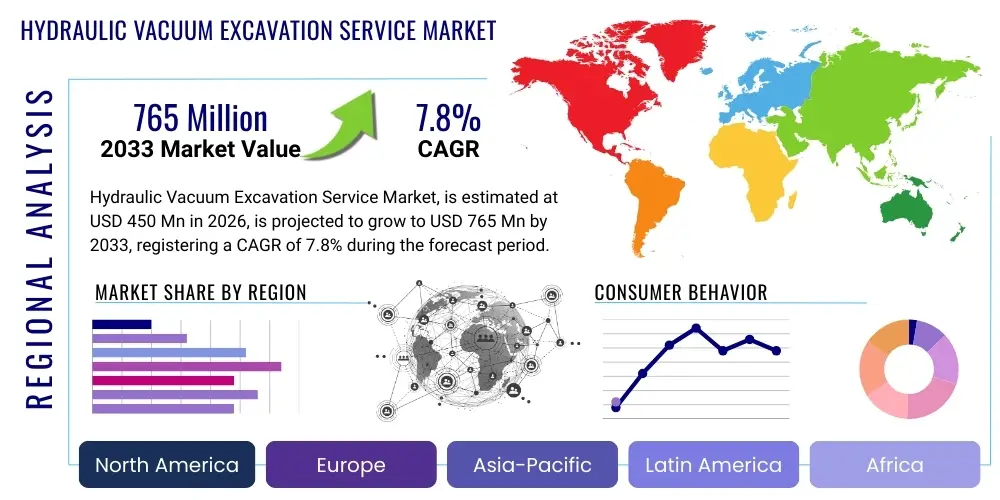

Hydraulic Vacuum Excavation Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438341 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hydraulic Vacuum Excavation Service Market Size

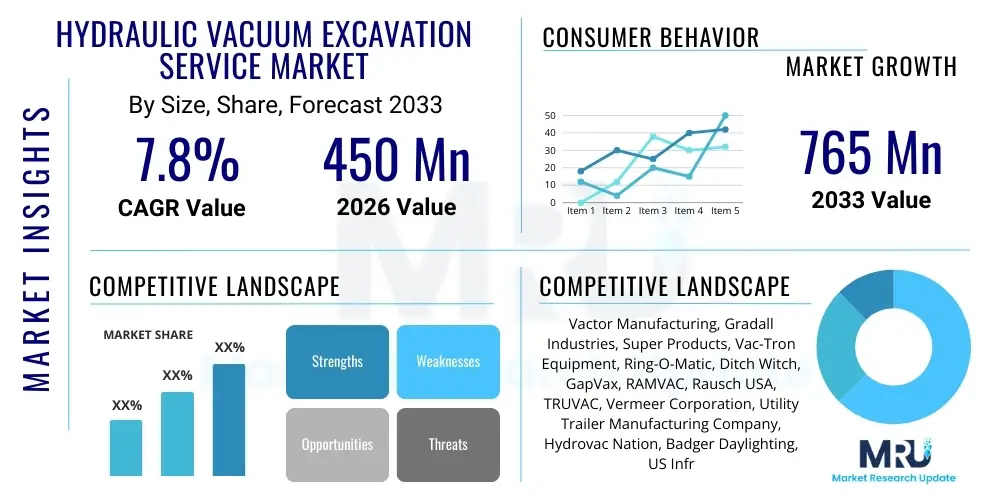

The Hydraulic Vacuum Excavation Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033.

Hydraulic Vacuum Excavation Service Market introduction

The Hydraulic Vacuum Excavation Service Market encompasses specialized non-destructive digging techniques utilized primarily for safe exposure of underground utilities and infrastructure. This methodology employs highly pressurized water jets to loosen soil and an industrial-strength vacuum system to simultaneously extract the slurry (mixture of water and soil). This process offers a superior alternative to traditional mechanical digging, significantly reducing the risk of damaging vital buried assets such as fiber optic cables, gas pipelines, and electrical conduits. The fundamental principle driving adoption is the heightened requirement for safety and precision in densely populated or highly congested utility corridors.

Major applications for hydraulic vacuum excavation services span across utility maintenance, telecommunication installation, municipal infrastructure repair, and oil and gas pipeline exposure. The primary product deployed in this service sector includes powerful truck- or trailer-mounted hydro-excavation units, equipped with large debris tanks, sophisticated filtration systems, and precise water pressure controls. The key benefit derived from employing these services is the reduction in liabilities associated with utility strikes, minimization of environmental disturbance, and overall improvement in project timelines, particularly for sensitive infrastructure projects.

Driving factors sustaining market expansion include increasingly stringent governmental regulations mandating non-destructive excavation methods near critical infrastructure, the continuous aging and required maintenance of utility grids globally, and significant investment in smart city projects that necessitate accurate subterranean mapping and minimal disruption during utility access and repair. Furthermore, the growing awareness among utility operators regarding the high cost of accidental utility damage is fueling the transition from traditional mechanical excavation to safer hydrovac techniques.

Hydraulic Vacuum Excavation Service Market Executive Summary

The Hydraulic Vacuum Excavation Service Market is characterized by robust growth, primarily propelled by global regulatory frameworks focused on worker safety and utility protection, alongside massive investments in infrastructure renewal. Business trends indicate a movement towards larger, integrated service providers offering comprehensive subsurface utility engineering (SUE) solutions, positioning hydrovac services not just as a digging method but as a critical component of infrastructure mapping and protection programs. Technological advancements, particularly in remote monitoring and enhanced debris handling capabilities, are improving operational efficiency and broadening the scope of suitable excavation projects, driving sustained market penetration across various industrial segments.

Regionally, North America maintains a dominant position due to established infrastructure, high labor costs, and stringent utility damage prevention legislation (e.g., Common Ground Alliance initiatives). The Asia Pacific region, however, is emerging as the fastest-growing market, driven by rapid urbanization, extensive new utility installations, and increasing foreign direct investment in public infrastructure, requiring safe and rapid excavation techniques. European markets display stable growth, emphasizing environmentally sustainable excavation practices and efficiency improvements in historic urban areas.

Segment trends highlight the Utility sector (covering water, gas, and electric lines) as the largest consumer of hydraulic vacuum excavation services, demanding emergency and scheduled maintenance capabilities. Segmentation by service type indicates that routine maintenance and potholing services, crucial for asset verification, constitute a significant portion of revenue, offering stable, recurring contract opportunities for service providers. The shift towards higher pressure and flow rate equipment, categorized under Truck-Mounted Units, reflects the industry's need for deeper and faster excavation capabilities in diverse soil conditions, ensuring operational resilience and productivity.

AI Impact Analysis on Hydraulic Vacuum Excavation Service Market

User inquiries concerning AI's integration into the Hydraulic Vacuum Excavation Service Market frequently center on predictive maintenance of expensive hydrovac equipment, optimization of excavation paths, and enhancing safety protocols through real-time data interpretation. Key themes include the expectation that AI will transition the industry from reactive maintenance to proactive operational management, reducing downtime and operational costs. Users are concerned with how AI can analyze complex subterranean mapping data (often gathered by Ground Penetrating Radar or SUE techniques) to automatically determine optimal digging locations and depths, minimizing operator error and maximizing the non-destructive nature of the process. Furthermore, there is significant interest in using machine learning models to analyze slurry composition and soil types in real-time, allowing automated adjustment of water pressure and vacuum strength for maximum efficiency and reduced environmental impact.

- AI-driven predictive maintenance scheduling for hydrovac fleets, reducing equipment failure and unscheduled downtime.

- Optimization of service routes and resource allocation using machine learning algorithms based on geographic and project complexity data.

- Real-time subterranean data analysis (e.g., GPR feedback) integrated with AI for automated identification and avoidance of unknown or undocumented utilities.

- Enhanced worker safety monitoring through AI analysis of operational metrics, identifying high-risk excavation behaviors and conditions.

- Automated volumetric soil analysis and debris tank management, optimizing disposal logistics and minimizing water usage.

- Implementation of Computer Vision for quality control and documentation of exposed utilities post-excavation.

DRO & Impact Forces Of Hydraulic Vacuum Excavation Service Market

The market dynamics of Hydraulic Vacuum Excavation Services are driven by a compelling combination of mandatory safety standards and vital infrastructure needs, moderated by substantial operational constraints and emerging technological opportunities. The primary impact force is stringent regulatory enforcement related to utility damage prevention, particularly in developed economies, making traditional mechanical digging increasingly risky and costly. Drivers related to aging infrastructure across North America and Europe necessitate frequent, precise, and non-disruptive access for repairs and upgrades, thereby cementing the role of hydrovac technology as the preferred methodology for sensitive maintenance operations.

However, the market faces significant restraints, including the high initial capital expenditure required for purchasing and maintaining specialized hydrovac trucks, which limits the entry of smaller service providers. Furthermore, the logistical challenge and cost associated with managing and disposing of the large volumes of soil and water slurry generated during excavation pose a considerable operational hurdle. Regulations surrounding environmental compliance and hazardous waste disposal add complexity and cost to service delivery, acting as a decelerating factor, particularly in densely populated urban centers with strict environmental controls.

Opportunities for growth are prominently situated within the expansion of renewable energy infrastructure (e.g., solar and wind farms) and the development of smart cities, both requiring extensive, precise trenching and utility installation. The integration of advanced mapping technologies (like 3D modeling and augmented reality) with hydrovac equipment presents an opportunity for service differentiation and higher value project execution. The increasing trend of outsourcing specialized excavation tasks by utility owners offers further expansion potential for dedicated service companies, shifting the operational burden and capital requirements from end-users to specialized third-party providers. The cumulative impact forces, while restrained by high operational costs, fundamentally favor market expansion due to unavoidable regulatory mandates and critical infrastructure requirements.

Segmentation Analysis

The Hydraulic Vacuum Excavation Service Market is fundamentally segmented based on the type of service delivered, the specific application context, the nature of the end-use sector, and the type of equipment employed. This segmentation allows for targeted market strategies, recognizing the diverse needs ranging from rapid emergency response for critical utility strikes to planned, large-scale infrastructure development projects. The complexity of regulatory requirements and soil conditions dictates which equipment segment (Truck-Mounted vs. Trailer-Mounted) is most suitable for a given project, influencing regional service offerings and pricing models.

Analysis by Application shows a strong dichotomy between planned infrastructure projects (which demand high volume, sustained excavation capability) and urgent maintenance requirements (which prioritize rapid mobilization and precision). The utility sector consistently dominates consumption due to the inherent dangers and high financial penalties associated with damaging subterranean lines, making hydrovac services indispensable for routine maintenance, asset verification (potholing), and crucial repairs. The emerging Telecommunications segment, driven by 5G network expansion and fiber optic deployment, is rapidly increasing its demand for non-destructive service providers to protect high-value, sensitive cables.

- By Service Type:

- Emergency Excavation

- Scheduled Maintenance (Potholing/Daylighting)

- Infrastructure Development (Trenching and Slot Trenching)

- Debris Removal and Cleaning

- By Application:

- Utilities (Water, Gas Distribution, Electric Power Transmission)

- Telecommunications (Fiber Optic, Cable Lines)

- Construction (General Excavation Support, Foundation Preparation)

- Oil & Gas (Pipeline Maintenance, Valve Exposure)

- By End-Use Sector:

- Municipalities and Government Agencies

- Industrial and Manufacturing Facilities

- Commercial Infrastructure Developers

- By Equipment Type:

- Truck-Mounted Units

- Trailer-Mounted Units

Value Chain Analysis For Hydraulic Vacuum Excavation Service Market

The value chain for the Hydraulic Vacuum Excavation Service Market begins with upstream suppliers involved in the manufacturing of specialized equipment and core components. This includes chassis manufacturers (for truck-mounted units), pump and vacuum system producers, and specialized tank fabricators (steel or aluminum). Innovation in this segment focuses on optimizing pump efficiency, developing lighter yet durable materials for debris tanks, and integrating sophisticated control systems. Effective sourcing and quality control of these high-cost components are critical for manufacturers to maintain competitiveness and ensure the long-term reliability of the hydrovac units.

The midstream sector is dominated by the service providers—the core segment of the market—who own, operate, and maintain the hydrovac fleets. These providers invest heavily in labor training, safety certifications, and fleet management technology (including GPS tracking and remote diagnostics) to ensure operational readiness and compliance. Differentiation in this stage is achieved through specialized service offerings, regional coverage density, and the ability to handle complex, high-risk projects. Distribution channels primarily involve direct sales or long-term lease agreements between equipment manufacturers and service providers, often bypassing traditional dealerships for high-value specialized equipment.

Downstream elements involve the end-users, principally utility companies, municipalities, and construction firms, who contract the services. Service delivery is often direct, involving on-site deployment. Indirect relationships might involve engineering firms or general contractors who subcontract the excavation work. The final stage involves regulatory compliance, including the proper treatment and disposal of excavated slurry, which requires adherence to environmental and waste management laws. Efficient downstream operations rely heavily on seamless communication and coordination between the service provider and the end-user to manage project timelines and minimize environmental liability.

Hydraulic Vacuum Excavation Service Market Potential Customers

Potential customers for Hydraulic Vacuum Excavation Services are entities that manage or develop infrastructure requiring non-destructive access to subterranean assets. The primary end-users are large utility companies responsible for gas transmission and distribution networks, electrical power grids, and crucial water and sewer infrastructure. These customers utilize hydrovac services extensively for preventative maintenance, mandated asset identification (potholing), and immediate repair of leaks or faults, valuing precision and safety above all else to avoid catastrophic utility strikes.

A significant customer base exists within government and municipal entities, including Public Works departments and State Departments of Transportation (DOTs). Municipalities frequently employ these services for urban infrastructure projects, storm drain cleaning, street light foundation work, and managing underground storage tanks. Their buying decisions are often driven by regulatory compliance, public safety concerns, and the need to minimize traffic disruption during excavation activities.

Furthermore, large-scale civil engineering firms, commercial real estate developers, and specialized contractors working on pipeline installation or telecommunication expansion represent critical buyers. For these groups, hydrovac services reduce project risk and insurance costs while providing necessary pre-construction geotechnical data. Their procurement decisions are influenced by service provider capacity, scalability, and integration with modern Subsurface Utility Engineering (SUE) techniques.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vactor Manufacturing, Gradall Industries, Super Products, Vac-Tron Equipment, Ring-O-Matic, Ditch Witch, GapVax, RAMVAC, Rausch USA, TRUVAC, Vermeer Corporation, Utility Trailer Manufacturing Company, Hydrovac Nation, Badger Daylighting, US Infrastructure Company, Clean Harbors, EnviroVac, TerraFirma, CUES, Inc., Hi-Vac Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Vacuum Excavation Service Market Key Technology Landscape

The Hydraulic Vacuum Excavation Service Market is increasingly reliant on technological integration to enhance precision, efficiency, and safety. A central technological advancement is the incorporation of advanced GPS and Geographic Information Systems (GIS) directly into the excavation units. This allows operators to overlay real-time excavation data onto precise utility maps and subterranean surveys, ensuring digging is confined strictly to designated safe zones. This integration is crucial for minimizing human error and providing verifiable documentation of the excavation process, aligning service delivery with high compliance standards.

Furthermore, equipment innovation focuses heavily on maximizing operational effectiveness through better control systems and debris management. Modern hydrovac trucks feature variable water pressure and vacuum flow controls, allowing fine-tuning based on soil composition, thereby reducing water consumption and improving digging speed without compromising safety. Key developments also include improved filtration and separation systems built into the vacuum tanks, which facilitate the easier and more environmentally compliant disposal or recycling of the excavated slurry, addressing a significant logistical challenge in the industry.

The adoption of telematics and Internet of Things (IoT) sensors is rapidly becoming standard. These technologies enable remote monitoring of engine performance, water usage, tank fill levels, and hydraulic system health. This connectivity supports the shift towards predictive maintenance models, ensuring high fleet uptime, which is essential for service providers managing emergency utility response contracts. Additionally, the integration of auxiliary non-destructive testing (NDT) tools, such as Ground Penetrating Radar (GPR) and pipe inspection cameras, alongside the hydrovac unit further elevates the value proposition of the specialized service.

Regional Highlights

- North America: Dominates the global market, driven by highly developed infrastructure networks, robust governmental safety mandates (like "Call Before You Dig" programs), and a mature service provider network. The presence of major oil and gas pipelines, coupled with continuous investment in maintaining aging electrical and water systems, ensures sustained high demand. Adoption rates for high-end, truck-mounted units featuring advanced technological integration are highest here, reflecting the industry's focus on productivity and liability mitigation.

- Europe: Exhibits steady growth, focusing heavily on infrastructure replacement and upgrades in historic urban centers where subterranean utility density is exceptionally high. Regulations prioritize minimizing environmental impact and noise pollution, favoring service providers who utilize advanced noise-dampening technology and efficient slurry processing systems. Countries like Germany and the UK are leading in adopting hydrovac techniques for utility maintenance and fiber optic deployment.

- Asia Pacific (APAC): Positioned as the fastest-growing region, fueled by unprecedented urbanization rates, massive state-led infrastructure projects (e.g., high-speed rail, new city development), and exponential growth in telecommunications networks. While regulatory enforcement is sometimes less centralized than in Western markets, the sheer volume of new construction requiring safe utility location is driving market expansion. Investment in local manufacturing and service provision is accelerating rapidly, primarily concentrated in high-growth economies such as China and India.

- Latin America (LATAM): Represents an emerging market with gradual adoption, concentrated around key economic hubs and resource extraction projects (mining and oil & gas). Growth is constrained by inconsistent infrastructure spending and regulatory environments, but increasing foreign investment and the necessity for safer excavation practices in high-density areas are slowly boosting demand.

- Middle East and Africa (MEA): Growth is primarily derived from large-scale development projects (e.g., smart city construction in the UAE and Saudi Arabia) and the continuous expansion and maintenance of regional oil and gas infrastructure. The challenging desert environment necessitates specialized hydrovac solutions capable of handling sand and unique soil compositions efficiently, driving demand for robust, high-performance equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Vacuum Excavation Service Market.- Vactor Manufacturing

- Gradall Industries

- Super Products

- Vac-Tron Equipment

- Ring-O-Matic

- Ditch Witch

- GapVax

- RAMVAC

- Rausch USA

- TRUVAC

- Vermeer Corporation

- Utility Trailer Manufacturing Company

- Hydrovac Nation

- Badger Daylighting

- US Infrastructure Company

- Clean Harbors

- EnviroVac

- TerraFirma

- CUES, Inc.

- Hi-Vac Corporation

Frequently Asked Questions

Analyze common user questions about the Hydraulic Vacuum Excavation Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hydraulic Vacuum Excavation Service Market?

The primary factor driving growth is the increasing severity and enforcement of utility damage prevention regulations globally, compelling infrastructure owners and contractors to adopt non-destructive excavation methods like hydrovac to minimize risks to buried high-value assets such as gas lines and fiber optic cables.

How does hydraulic vacuum excavation differ from traditional mechanical digging?

Hydraulic vacuum excavation uses pressurized water and a powerful vacuum to safely loosen and remove soil without physically striking buried lines, offering a precise, non-destructive alternative to mechanical digging which relies on sharp tools and carries a high risk of damaging sensitive utilities, leading to significant financial and safety liabilities.

Which geographical region dominates the hydraulic vacuum excavation market?

North America currently dominates the market due to its extensive, aging utility infrastructure, strict safety standards (e.g., 'One Call' legislation), and the high prevalence of service providers specialized in offering integrated Subsurface Utility Engineering (SUE) services utilizing hydrovac technology.

What are the main operational challenges faced by hydrovac service providers?

The main operational challenges include the high initial capital investment for specialized hydrovac units, the substantial logistics and environmental costs associated with the proper disposal of the water and soil slurry, and the need to maintain highly skilled and certified operators for complex urban projects.

What role does technology play in modern hydraulic vacuum excavation services?

Modern hydrovac services integrate advanced technology, including GPS/GIS mapping, telematics for fleet monitoring, remote diagnostic sensors, and sophisticated variable pressure controls. This technology enhances precision, optimizes operational efficiency, improves safety documentation, and facilitates compliance with project specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager