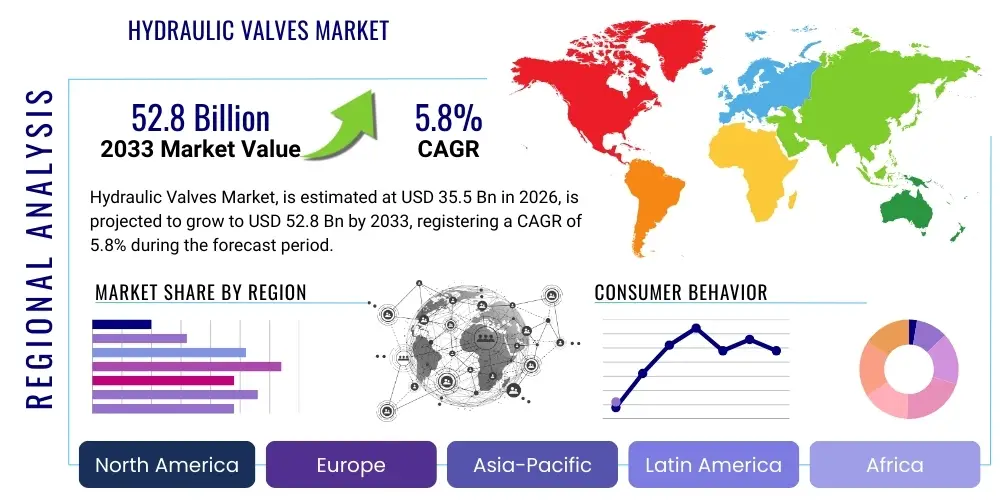

Hydraulic Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436314 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hydraulic Valves Market Size

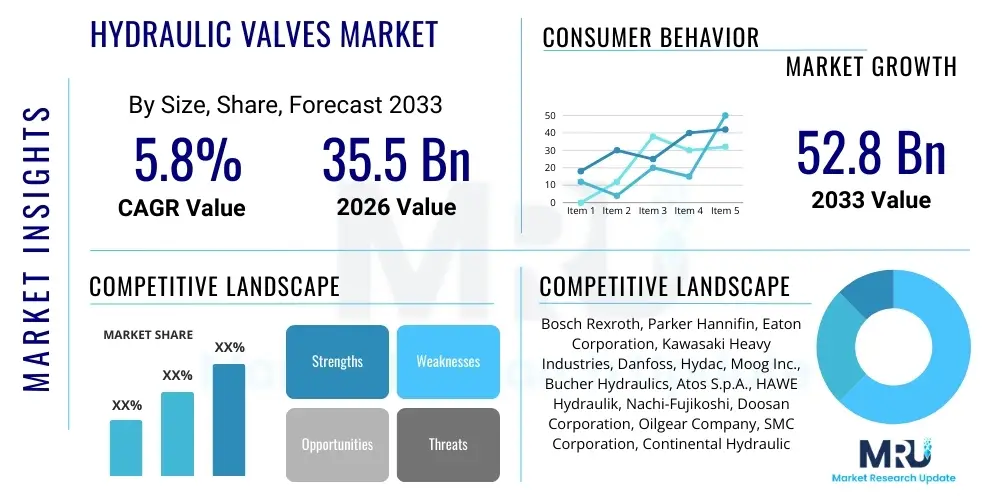

The Hydraulic Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 35.5 billion in 2026 and is projected to reach USD 52.8 billion by the end of the forecast period in 2033.

Hydraulic Valves Market introduction

The Hydraulic Valves Market encompasses the manufacturing and distribution of components essential for controlling the flow, pressure, and direction of hydraulic fluids within power systems. These devices are the crucial interface components in fluid power circuits, ensuring precision, efficiency, and safety in heavy machinery operation. They transform fluid power into controlled mechanical motion, making them indispensable across virtually all industrial and mobile equipment sectors. Hydraulic valves are categorized primarily based on their function—directional control, pressure control, and flow control—and are designed to operate reliably under extreme pressures and demanding environmental conditions, driving the performance envelope of modern automation.

The primary applications of hydraulic valves span key industries including construction equipment (e.g., excavators, loaders), agriculture machinery (e.g., tractors, harvesters), material handling (e.g., forklifts, cranes), and industrial manufacturing (e.g., molding machines, presses). The inherent benefits of utilizing hydraulic systems, such as high power density, reliability, and robust force transmission capabilities, underpin the continuous demand for advanced valve technologies. Modern hydraulic valves are increasingly incorporating electronic controls (electro-hydraulic valves) to enhance response time, improve energy efficiency, and enable seamless integration with sophisticated automation and IoT platforms, thus expanding their utility beyond traditional mechanical control.

Key driving factors accelerating market growth include the robust expansion of infrastructure development globally, particularly in emerging economies, necessitating high-performance construction and mining equipment. Furthermore, the stringent regulatory environment regarding energy consumption and safety mandates the adoption of sophisticated, precision-engineered valves that minimize leakage and optimize power utilization. The ongoing trend towards industrial automation (Industry 4.0) and the increasing complexity of machinery demanding proportional control and digital diagnostics are further cementing the market's trajectory towards technological innovation and expansion in high-precision electro-hydraulic solutions.

Hydraulic Valves Market Executive Summary

The Hydraulic Valves Market is characterized by a strong emphasis on technological convergence, integrating mechanical precision with electronic intelligence to meet the demands of Industry 4.0. Current business trends indicate a significant shift towards smart valves equipped with integrated sensors and communication capabilities, enabling predictive maintenance and enhanced system efficiency. Major manufacturers are focusing their investment on developing highly compact, modular valve systems that allow for easy customization and reduced footprint in sophisticated machinery. Furthermore, sustainability and total cost of ownership (TCO) are central to procurement decisions, favoring valves designed for superior durability and minimal energy losses, driving specialization in leak-proof and low-hysteresis designs.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure investments, rapid urbanization, and accelerated industrial production, especially in China and India. North America and Europe, while mature, remain crucial centers for innovation, leading the adoption of advanced electro-hydraulic proportional valves driven by strict environmental regulations and high automation penetration in manufacturing and mobile applications. Regulatory harmonization and localized manufacturing capabilities are becoming critical factors in accessing and penetrating diverse geographical markets, requiring global players to optimize their supply chains to respond quickly to regional demand fluctuations in construction and agricultural cycles.

Segmentation trends indicate that directional control valves maintain the largest market share due to their fundamental role in initiating and stopping motion across all applications. However, proportional and servo valves, often utilizing advanced electronics, are exhibiting the highest growth rate, reflecting the industry's need for highly accurate, variable speed, and force control necessary for robotics and high-precision manufacturing processes. By end-use sector, the mobile equipment segment (construction, agriculture) is the dominant consumer, driven by continuous fleet replacement cycles and the increasing complexity of modern machinery requiring multi-axis hydraulic control, ensuring sustained demand for high-performance and rugged valve solutions.

AI Impact Analysis on Hydraulic Valves Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) are transforming traditional hydraulic systems. Common questions revolve around the feasibility of AI-driven predictive failure analysis, the integration of AI algorithms into electro-hydraulic controllers for optimized performance, and how digital twins can model valve behavior under stress. Users are keenly interested in moving beyond reactive maintenance to proactive system management facilitated by smart components. The core expectation is that AI will enhance energy efficiency, reduce downtime, and prolong the service life of expensive hydraulic systems by providing real-time diagnostic insights and adaptive control adjustments that traditional controllers cannot achieve.

The impact of AI on the Hydraulic Valves Market is primarily concentrated in the realm of smart hydraulic components (Smart Hydraulics) and sophisticated system optimization. AI algorithms are crucial for processing the vast amounts of data generated by sensors embedded in modern valves (pressure, temperature, flow). This analysis allows systems to autonomously detect subtle operational anomalies, enabling predictive maintenance scheduling before catastrophic failures occur. Furthermore, AI is being leveraged in the design phase, simulating millions of operational cycles to optimize valve spool geometry, minimize internal turbulence, and maximize energy transmission efficiency, thereby accelerating the time-to-market for next-generation, high-performance valves tailored for specific applications.

Ultimately, AI integration shifts the market focus from merely supplying components to delivering integrated, intelligent fluid power solutions. Advanced ML techniques are being applied to closed-loop hydraulic systems to adapt pressure and flow settings dynamically based on changing load requirements or environmental conditions, optimizing actuator speed and power consumption in real-time. This level of adaptive control significantly improves overall machine performance and energy utilization, differentiating leading market players who can successfully package AI-driven software solutions alongside their robust mechanical hardware, providing compelling value propositions centered on operational efficiency and reduced operational expenditures (OPEX).

- Predictive maintenance scheduling enabled by machine learning analysis of sensor data.

- Optimization of valve control parameters for enhanced energy efficiency and throughput.

- Implementation of digital twins for simulating valve performance and diagnostic training.

- Autonomous system calibration and adaptive flow control based on environmental variables.

- AI-driven quality control and defect detection during the manufacturing process.

DRO & Impact Forces Of Hydraulic Valves Market

The Hydraulic Valves Market is driven by global infrastructure expansion and the increasing demand for precision in mobile and industrial machinery. Restraints include the inherent complexity and high cost associated with advanced electro-hydraulic components, alongside volatility in raw material pricing which affects manufacturing margins. Significant opportunities arise from the rapid adoption of smart, connected valves (IoT integration) and the growth of renewable energy sectors, such as wind power, which require robust pitch control systems. These forces collectively shape the market's trajectory, prioritizing innovation in material science and digital integration to overcome cost barriers and capitalize on automation demands.

Drivers: Global population growth and subsequent urbanization necessitate continuous investment in construction and utility infrastructure, directly stimulating demand for heavy mobile equipment utilizing complex hydraulic systems. Furthermore, the push towards automated manufacturing lines, especially in automotive and aerospace sectors, requires hydraulic valves that offer superior speed, accuracy, and repeatability (e.g., proportional and servo valves). The robust nature of hydraulic power—its ability to handle high force and power density—ensures its continued preference over purely electric alternatives in high-duty cycle applications, continuously fueling innovation in valve design.

Restraints: The primary constraint is the relatively high leakage potential and energy loss in certain conventional hydraulic circuits, pressuring manufacturers to invest heavily in specialized sealing technologies and low-loss designs, increasing component cost. Additionally, the fluid contamination sensitivity of high-precision servo valves requires stringent fluid maintenance protocols, increasing operational expenditure for end-users. The significant initial investment required for high-end electro-hydraulic systems, coupled with the specialized technical expertise needed for installation and maintenance, poses a barrier to entry for smaller or less technologically advanced firms, particularly in developing regions.

Opportunities: The transition towards electric and hybrid mobile machinery (e.g., electric construction equipment) presents a key opportunity, as these new platforms require highly efficient, integrated electro-hydraulic manifold blocks for precise power management. The massive potential in retrofitting existing machinery fleets with smart hydraulic valves for predictive maintenance capabilities opens a lucrative aftermarket segment. Moreover, the increasing adoption of 3D printing techniques (Additive Manufacturing) for complex valve manifolds reduces material waste and enables highly customized, optimized geometries that are impossible to achieve through traditional casting methods, presenting a competitive advantage for pioneering firms.

Segmentation Analysis

The Hydraulic Valves Market is comprehensively segmented based on product type, operation type, application, and end-use industry, reflecting the diverse and specialized requirements of fluid power technology. Product segmentation distinguishes between directional, pressure, and flow control valves, each fulfilling a unique functional requirement within a hydraulic circuit, such as starting motion, managing system pressure safety, or regulating actuator speed. Understanding these segments is crucial for manufacturers to tailor their R&D investments toward areas exhibiting the highest growth, particularly in electro-hydraulic integration, which drives precision and automation capabilities across all categories.

Operation type segmentation separates manual/mechanically controlled valves from electronically/solenoid-controlled valves, highlighting the industry's progression toward automated and remote operation. Electronic control offers superior response time and integration with digital control systems (PLCs/microcontrollers), fueling demand for proportional and servo valves, which are critical in applications demanding fine-tuned, continuous adjustments. Furthermore, the market's differentiation by end-use industry, such as mobile equipment versus industrial applications, dictates specific ruggedness, size, and pressure tolerance requirements, demanding customized valve solutions optimized for either harsh outdoor environments or high-speed manufacturing lines.

- Product Type:

- Directional Control Valves (e.g., Spool Valves, Check Valves)

- Pressure Control Valves (e.g., Relief Valves, Reducing Valves, Sequence Valves)

- Flow Control Valves (e.g., Restrictor Valves, Flow Regulators)

- Operation Type:

- Manual/Mechanical Valves

- Solenoid/Electro-Hydraulic Valves

- Proportional and Servo Valves

- End-Use Industry:

- Mobile Equipment (Construction, Agriculture, Mining, Material Handling)

- Industrial Equipment (Machine Tools, Plastics & Rubber Machinery, Metal Forming)

- Aerospace & Defense

- Function/Design:

- Cartridge Valves

- Monoblock Valves

- Modular Valves

Value Chain Analysis For Hydraulic Valves Market

The value chain for the Hydraulic Valves Market begins with rigorous upstream activities focused on raw material sourcing and precision component manufacturing. This involves securing high-grade steel, ductile iron, and aluminum alloys crucial for valve housings and spools, followed by specialized processes like casting, forging, and complex CNC machining to achieve extremely tight tolerances required for leak-proof performance. The cost structure at this stage is heavily influenced by global metal commodity prices and energy consumption for machining, requiring strong supplier relationships and advanced inventory management to maintain competitive pricing downstream. Quality control and material traceability are paramount, as material defects directly compromise the valve's reliability and operational pressure rating.

Midstream activities involve the assembly, integration, testing, and system certification of the final valve units. For complex electro-hydraulic valves, this stage includes integrating sensitive electronic components, solenoids, and sensors, necessitating sterile assembly environments and sophisticated functional testing to ensure electrical and hydraulic performance parameters are met simultaneously. Modular and manifold designs are increasingly being utilized to simplify assembly, reduce potential leak points, and allow manufacturers to rapidly customize products for specific OEM demands, thereby adding significant value through system integration rather than just component supply. Certification bodies play a key role here, ensuring compliance with international standards (e.g., ISO, CE).

The downstream sector is dominated by highly specialized distribution channels. Direct sales are common for large volume OEM contracts in construction and agricultural machinery, fostering deep technical partnerships between valve manufacturers and equipment builders. Indirect channels, which include technical distributors, system integrators, and MRO service providers, manage the aftermarket, providing essential local inventory, repair services, and technical consulting. These distributors are critical for market penetration, acting as the technical interface between the manufacturer and the end-user, often providing value-added services such as hydraulic system design and commissioning, ensuring efficient deployment and longevity of the hydraulic systems.

Hydraulic Valves Market Potential Customers

The primary customers for the Hydraulic Valves Market are large-scale Original Equipment Manufacturers (OEMs) specializing in heavy machinery, followed closely by system integrators and specialized distributors serving the Maintenance, Repair, and Operations (MRO) sector. OEMs in the mobile equipment segment—such as manufacturers of excavators, loaders, dozers, and combine harvesters—represent the largest and most consistent demand base, requiring custom-engineered, rugged, and high-pressure valves. These customers prioritize reliability, durability, and integration compatibility with proprietary machine control systems, leading to long-term supply contracts and intensive technical collaboration in the design phase.

Another crucial customer segment is the industrial machinery manufacturers, including those producing plastic injection molding machines, metal forming presses, and specialized machine tools. These industrial customers demand high-precision electro-hydraulic components, particularly servo and proportional valves, that enable rapid cycle times, high repeatability, and energy efficiency crucial for mass production environments. Their purchasing criteria heavily emphasize technical specifications such as low hysteresis, high frequency response, and compatibility with advanced industrial communication protocols (e.g., EtherCAT, PROFINET), often requiring customized manifolds and integrated control packages.

Furthermore, government and private entities involved in infrastructure projects, mining, and offshore oil and gas exploration are significant end-users, typically procuring valves through MRO channels or specialized fluid power distributors. This segment emphasizes robustness, certified safety features, and long-term serviceability, often requiring valves rated for hazardous or corrosive environments. Their buying behavior is often driven by regulatory compliance and the need to minimize operational downtime, making specialized, heavy-duty valve solutions a preferred choice for reliable, mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 billion |

| Market Forecast in 2033 | USD 52.8 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton Corporation, Kawasaki Heavy Industries, Danfoss, Hydac, Moog Inc., Bucher Hydraulics, Atos S.p.A., HAWE Hydraulik, Nachi-Fujikoshi, Doosan Corporation, Oilgear Company, SMC Corporation, Continental Hydraulics, Poclain Hydraulics, Voith Turbo, Argo-Hytos, Nord Hydraulic, Walvoil S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Valves Market Key Technology Landscape

The current technology landscape in the Hydraulic Valves Market is defined by the rapid evolution of electro-hydraulics, sensor integration, and advanced manufacturing techniques aimed at improving precision and efficiency. Proportional and servo valve technology sits at the forefront, offering continuous, variable control over fluid flow and pressure, moving away from simple on/off switching. These valves utilize high-speed solenoids and sophisticated electronic controllers (often with integrated microprocessors) to achieve precise positioning and force control, essential for robotics, aerospace, and high-performance machine tools. The technological challenge lies in achieving zero-leakage performance and maximizing the frequency response speed while minimizing power consumption during operation, leading to innovation in digital control algorithms.

Another significant technological advancement is the widespread adoption of cartridge valve technology and integrated manifold systems. Cartridge valves are modular, standardized components inserted into custom-machined metal blocks (manifolds). This design minimizes external plumbing, reduces the system footprint, decreases pressure drops, and simplifies maintenance, making the overall hydraulic system cleaner and more energy-efficient. Manufacturers are increasingly utilizing computational fluid dynamics (CFD) simulations to optimize the internal flow paths within these manifolds, resulting in significantly higher power-to-weight ratios for mobile applications and cleaner fluid handling for sensitive industrial machinery.

Furthermore, the incorporation of smart technology—integrating IoT capabilities directly into the valve component—is fundamentally reshaping the landscape. Modern hydraulic valves are equipped with built-in sensors for monitoring key performance indicators (KPIs) such as temperature, pressure spikes, and spool position feedback. These smart components communicate wirelessly or via fieldbus systems, allowing for real-time diagnostics and condition monitoring. This technology facilitates the shift to predictive maintenance models, allowing end-users to anticipate component failure, schedule repairs proactively, and maximize machine uptime, which is a major driver of customer value in capital-intensive industries.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven primarily by government initiatives focused on infrastructure development in China, India, and Southeast Asian nations. The region has a massive concentration of construction, automotive, and general manufacturing industries that rely heavily on hydraulic equipment.

- North America: This region is characterized by high adoption rates of advanced electro-hydraulic and proportional valve technology, largely due to stringent environmental regulations and the need for precision automation in sectors like aerospace, oil and gas, and advanced agricultural machinery.

- Europe: Europe represents a mature but technologically advanced market, dominating in the adoption of energy-efficient and modular hydraulic solutions. Germany, Italy, and Scandinavia are key manufacturing hubs, focusing heavily on R&D for compact, high-pressure, and integrated fluid power systems aligned with EU sustainability mandates.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity markets, particularly mining and agriculture in countries like Brazil and Mexico. The demand is strong for reliable, heavy-duty valves suitable for harsh operating conditions, though adoption of advanced smart valves lags behind North America and Europe.

- Middle East and Africa (MEA): Market growth in MEA is driven by large-scale oil and gas exploration projects, infrastructure megaprojects, and increased investment in mining operations. The primary requirement is for extremely durable, robust valves capable of handling high temperatures and challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Valves Market.- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation plc

- Danfoss A/S

- Kawasaki Heavy Industries, Ltd.

- Moog Inc.

- Hydac International GmbH

- Bucher Hydraulics GmbH

- Atos S.p.A.

- HAWE Hydraulik SE

- Nachi-Fujikoshi Corp.

- Oilgear Company

- SMC Corporation

- Continental Hydraulics

- Poclain Hydraulics

- Voith Turbo GmbH & Co. KG

- Argo-Hytos GmbH

- Walvoil S.p.A.

- Trelleborg AB (Sealing Solutions)

- Wandfluh AG

Frequently Asked Questions

Analyze common user questions about the Hydraulic Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for electro-hydraulic proportional valves?

The primary driver is the need for enhanced precision and automation (Industry 4.0) in heavy machinery and manufacturing processes. Proportional valves allow for continuous, variable control of speed and force, essential for modern, complex tasks like robotics and high-speed pressing.

How does the shift towards electric mobile equipment impact the hydraulic valves market?

The shift necessitates the development of highly efficient, compact, and specialized electro-hydraulic valves and integrated manifolds optimized for battery-powered systems. These components must minimize energy leakage to maximize battery life while maintaining high power density.

Which geographic region demonstrates the highest growth potential for hydraulic valves?

The Asia Pacific (APAC) region, particularly driven by large-scale infrastructure and industrial expansion in China and India, exhibits the highest growth potential due to sustained investment in construction, mining, and general manufacturing capacity.

What is the role of Additive Manufacturing (3D Printing) in valve production?

Additive Manufacturing is increasingly used to create complex, optimized hydraulic manifold blocks and valve components. This technology reduces material waste, enables customized geometries impossible through casting, and improves flow characteristics for better energy efficiency.

What is the difference between a directional control valve and a pressure control valve?

A directional control valve dictates the path of the hydraulic fluid, controlling the movement (start, stop, reverse) of an actuator. A pressure control valve, conversely, regulates the maximum pressure within a circuit to prevent system damage and ensure safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager