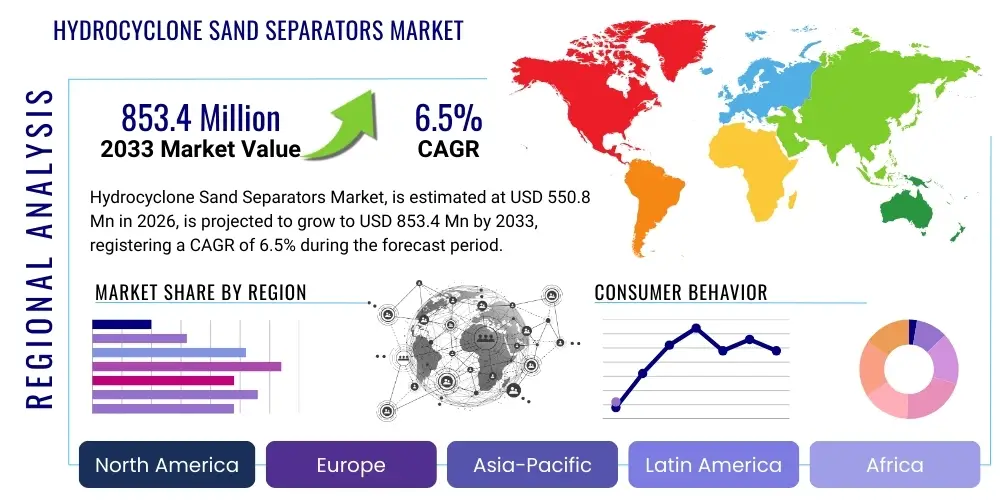

Hydrocyclone Sand Separators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438504 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Hydrocyclone Sand Separators Market Size

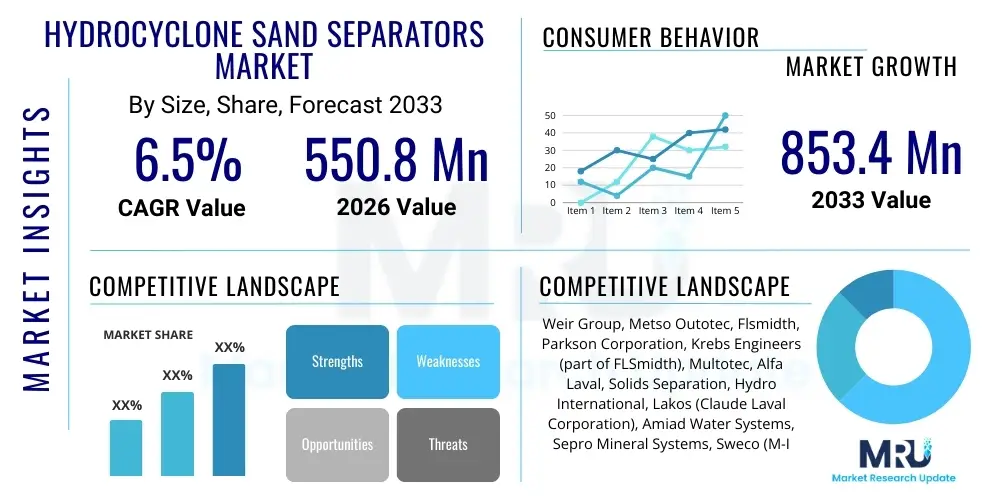

The Hydrocyclone Sand Separators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 550.8 million in 2026 and is projected to reach USD 853.4 million by the end of the forecast period in 2033.

Hydrocyclone Sand Separators Market introduction

The Hydrocyclone Sand Separators Market encompasses the manufacturing, distribution, and utilization of centrifugal devices designed to efficiently remove particulate matter, primarily sand and heavy solids, from liquid streams based on the density difference between the solid and the fluid. These devices operate on the principle of centrifugal force, where fluid enters tangentially, creating a vortex that forces denser solid particles toward the wall and down into an underflow chamber, while cleaner fluid exits through the overflow at the top. The robust design and lack of moving parts make hydrocyclones highly effective and low-maintenance solutions for primary filtration in demanding industrial environments. The primary function is to protect sensitive downstream equipment, such as pumps, nozzles, heat exchangers, and precise filtration systems, from premature wear and blockages caused by abrasive solids.

Major applications for hydrocyclone sand separators span critical industries including oil and gas production, municipal and industrial water treatment, irrigation systems, mineral processing, and power generation. In the oil and gas sector, hydrocyclones are indispensable for produced water treatment, removing fine sands and solids before water disposal or reinjection, thereby protecting high-pressure pumps and minimizing erosion. For irrigation, they are vital in safeguarding drip systems and sprinklers from clogging, ensuring uniform water distribution and optimizing crop yield. The benefits of deploying hydrocyclone technology include enhanced operational efficiency, reduced maintenance downtime, lower energy consumption compared to conventional filters, and the ability to handle high flow rates with minimal pressure drop. Their scalable nature allows for customization across different flow capacities and particle size requirements, contributing significantly to their widespread adoption globally.

The market is currently being driven by several macro-environmental factors, chief among them being the increasing global demand for clean water resources and the stringent environmental regulations concerning industrial effluent and produced water quality, particularly in North America and Europe. Furthermore, the expansion of unconventional oil and gas exploration activities, which often involve managing significant volumes of solid-laden fluids, necessitates advanced and reliable separation technologies. Investment in infrastructure development, especially large-scale irrigation projects in developing economies, also fuels the demand for robust primary filtration systems. The durability, cost-effectiveness, and operational simplicity of hydrocyclone units compared to mechanical filters position them as the preferred choice for bulk solids separation in highly demanding environments, propelling overall market growth across various end-use sectors.

Hydrocyclone Sand Separators Market Executive Summary

The Hydrocyclone Sand Separators Market demonstrates robust growth, primarily driven by escalating global water scarcity issues demanding advanced water recycling and treatment technologies, coupled with intense upstream activities in the oil and gas sector requiring efficient produced water management. Business trends indicate a strong move toward high-efficiency, multi-stage separation systems and the integration of smart monitoring capabilities into hydrocyclone units to optimize performance and predict maintenance needs. Key market participants are focusing on material innovation, such as utilizing advanced corrosion-resistant alloys and composite materials, to extend the lifespan of separators operating in abrasive or chemically harsh environments, particularly in offshore exploration and aggressive mining slurry processing. Strategic partnerships between separator manufacturers and engineering, procurement, and construction (EPC) firms are becoming commonplace, aimed at delivering integrated water and solids management solutions for large industrial and infrastructure projects.

Regionally, the market exhibits dynamic expansion, with the Asia Pacific (APAC) region emerging as the fastest-growing market due to rapid industrialization, massive investments in agricultural irrigation infrastructure, and pressing needs for municipal water infrastructure upgrades in populous nations like China and India. North America remains a dominant market, largely attributed to mature oil and gas exploration sectors, particularly unconventional shale extraction, which demands large-scale, high-capacity hydrocyclone solutions for flowback and produced water handling. Europe maintains a steady market share, driven by stringent environmental regulations mandating high-purity industrial discharge standards and significant investment in sustainable water management practices across manufacturing and processing industries. The Middle East and Africa (MEA) region is also experiencing accelerated adoption, primarily fueled by massive infrastructure projects and the necessity for effective sand management in desert-based oil and gas operations.

Segmentation analysis highlights the dominance of the high-capacity segment in terms of revenue, specifically those units designed to handle flow rates exceeding 1,000 cubic meters per hour, widely used in mining and large-scale water treatment facilities. Based on material, carbon steel remains popular due to cost-effectiveness, but stainless steel and non-metallic composite units are gaining traction due to superior corrosion and abrasion resistance, appealing to the chemical processing and offshore oil sectors. Application-wise, the oil and gas sector contributes the largest revenue share, given the criticality and high volume of fluid handling required, followed closely by the irrigation and agricultural segment, which relies on these separators for preventative maintenance of expensive micro-irrigation systems. Emerging segments include specialized compact hydrocyclones designed for mobile water purification units and modular systems optimized for rapid deployment in remote locations.

AI Impact Analysis on Hydrocyclone Sand Separators Market

Common user questions regarding AI's impact on hydrocyclone technology center around how intelligent systems can optimize separation efficiency, reduce operational costs, and predict equipment failure. Users frequently ask about the integration of machine learning algorithms for real-time monitoring of slurry characteristics, flow rate adjustments, and maintenance scheduling. The consensus expectation is that AI will transform hydrocyclone management from a passive, schedule-based system to an active, predictive one. Key themes include the implementation of smart sensor data fusion to detect subtle changes in separation performance (like cut-point drift or blockage development) and the use of optimization algorithms to dynamically adjust underflow and overflow valves, thereby maximizing fluid recovery and solids removal efficiency under varying operating conditions, ensuring the separator always operates at its optimal design point.

- AI-driven predictive maintenance forecasts wear rates on apex and vortex finder components, minimizing unscheduled downtime.

- Machine learning optimizes process parameters (flow rate, pressure drop, density) in real-time, maintaining precise separation efficiency (cut-point).

- Enhanced automation through AI enables remote diagnostics and self-adjustment of hydrocyclone batteries in dynamic industrial environments.

- Data analytics and digital twinning simulate performance under extreme conditions, aiding in optimal unit design and installation placement.

- AI integration reduces energy consumption by dynamically balancing pump speeds with required separation efficiency, optimizing power usage.

DRO & Impact Forces Of Hydrocyclone Sand Separators Market

The dynamics of the Hydrocyclone Sand Separators Market are profoundly influenced by a complex interplay of drivers, restraints, and opportunities. A primary driver is the global imperative for enhanced fluid cleanliness, particularly within energy sectors where regulations concerning produced water discharge quality are becoming increasingly stringent, necessitating high-efficiency solids removal before treatment or disposal. Furthermore, the persistent demand for reliable and cost-effective solids separation in irrigation infrastructure, especially in water-stressed regions, continues to propel market expansion, as hydrocyclones offer a durable solution for protecting expensive micro-irrigation systems. Technological advancements focused on developing higher-pressure and abrasion-resistant materials also expand the operational envelope of these devices, opening up new applications in deep-sea mining and high-pressure injection systems, contributing significantly to revenue growth.

However, the market faces notable restraints that temper its growth trajectory. The principal challenge lies in the operational limitations of hydrocyclones concerning the separation of extremely fine particles (below 10 microns) and fluids with minimal density contrast, where alternative, often more complex, filtration technologies may be required. Furthermore, the successful operation of a hydrocyclone is highly sensitive to fluctuations in feed pressure and flow rate; substantial variations can drastically reduce separation efficiency, which poses a challenge in highly intermittent industrial processes. High initial capital expenditure for large-scale, customized hydrocyclone battery installations, particularly those utilizing exotic corrosion-resistant alloys, can act as a barrier to entry for smaller enterprises or projects with limited budgetary allocations, particularly impacting adoption rates in certain developing regions.

Significant opportunities exist in the transition towards modular and skid-mounted separation systems, offering flexibility and easier integration into existing infrastructure, thereby reducing installation time and costs. The rising interest in resource recovery, particularly in the mining and chemical industries, presents a substantial opportunity, as hydrocyclones are essential for classification, concentration, and dewatering processes that reclaim valuable minerals or chemicals from waste streams. Impact forces, such as supplier power, remain moderate due to the availability of standardized components, yet the buyer power is high in large project procurements, driving competitive pricing and customization requirements. The threat of substitutes is moderate, mainly from media filters and centrifuges, but hydrocyclones maintain a competitive edge due to their low maintenance, high throughput, and zero moving parts. Overall, the market is poised for sustained expansion, driven by regulatory pressures and technological innovation focused on improving efficiency and material durability.

Segmentation Analysis

The Hydrocyclone Sand Separators Market is comprehensively segmented based on several key operational and structural parameters, including Type (e.g., conventional single cone, multi-cyclone battery), Material (Carbon Steel, Stainless Steel, Composite/Plastics), Capacity (Low, Medium, High Flow Rate), and End-Use Application (Oil and Gas, Water and Wastewater Treatment, Mining and Mineral Processing, Agriculture and Irrigation). This multifaceted segmentation allows market participants to tailor their offerings to precise industry requirements. For instance, the oil and gas sector demands high-pressure, corrosion-resistant stainless steel units, while the agriculture sector prioritizes cost-effective, durable plastic or carbon steel models designed for medium flow rates and ease of maintenance in non-abrasive environments. Analyzing these segments provides strategic insights into investment areas and technological focus for future product development.

The segmentation by capacity is particularly crucial, reflecting the scale of projects. High-capacity hydrocyclones, often configured as multi-cyclone batteries, dominate the revenue landscape, being essential for large municipal water intake facilities and massive mining operations where throughput efficiency is paramount. Conversely, low-capacity units are frequently utilized in smaller commercial applications, tertiary filtration stages, and domestic water systems. The shift towards sustainable materials is evident in the material segmentation; while carbon steel remains cost-dominant, the demand for non-metallic and composite materials is accelerating in the water treatment industry due to their inherent resistance to chemical treatment processes and reduced weight, making installation easier and reducing long-term lifecycle costs associated with corrosion control.

Further granularity in segmentation reveals significant growth potential within the Water and Wastewater Treatment segment, which is undergoing massive modernization efforts globally to comply with increasingly stringent effluent standards and maximize water reuse capabilities. Manufacturers are increasingly focusing on specialized hydrocyclones designed for fine particle separation in produced water treatment and tertiary sewage treatment, moving beyond basic sand removal to micro-solids classification. This strategic focus ensures that products meet the evolving needs of industrial sustainability and regulatory compliance. The interaction between segments, such as high-capacity stainless steel units in the mining industry for slurry dewatering, defines the high-value commercial opportunities within the overall market landscape.

- Type: Single Cyclone, Multi-Cyclone Battery Systems

- Material: Carbon Steel, Stainless Steel (304, 316), Composite Materials and Plastics

- Capacity: Low Flow Rate (0-50 m³/h), Medium Flow Rate (50-500 m³/h), High Flow Rate (500+ m³/h)

- End-Use Application: Oil and Gas (Upstream/Downstream), Water and Wastewater Treatment, Mining and Mineral Processing, Agriculture and Irrigation, Industrial Processing (Chemical, Food & Beverage)

Value Chain Analysis For Hydrocyclone Sand Separators Market

The value chain for the Hydrocyclone Sand Separators Market begins with the upstream procurement of raw materials, primarily specialized metals (carbon steel, stainless steel, nickel alloys), high-grade plastics, and composite materials (fiberglass, specialized resins). Suppliers of these materials exert moderate influence, especially for specialized corrosion-resistant alloys required in harsh operational environments like offshore oil extraction. Key upstream activities involve precision machining, molding, and fabrication of the conical sections, vortex finders, and apex components, which require high tolerance and specialized manufacturing techniques to ensure optimal separation efficiency. Research and development activities, focusing on computational fluid dynamics (CFD) modeling to optimize cyclone geometry and cut-point accuracy, are integral at this initial stage, often involving close collaboration with material science experts to enhance durability and reduce erosion rates.

The midstream phase involves the core manufacturing and assembly of individual hydrocyclone units and the integration of these units into larger, skid-mounted multi-cyclone battery systems. This phase also includes quality control testing, performance validation, and customization based on client specifications regarding pressure ratings, flow capacity, and target particle size separation. Manufacturers often develop proprietary designs for apex dischargers and involute feed inlets to maximize efficiency and minimize turbulence. Downstream distribution involves a complex network combining direct sales and indirect channels. Direct sales are prevalent for large-scale, highly customized projects (e.g., refinery installations or deep-water oil platforms) where technical consultation and ongoing maintenance contracts are mandatory. This allows manufacturers to maintain tight control over installation quality and capture higher service revenue.

Indirect distribution relies heavily on specialized distributors, original equipment manufacturers (OEMs) who integrate the separators into broader fluid handling systems (such as irrigation packages or mobile water treatment units), and third-party engineering firms. These channels provide local presence, technical support, and faster delivery of standardized or medium-sized units. Post-sales service, including spare parts supply (especially apex and vortex finder replacements) and long-term maintenance agreements, forms a crucial part of the downstream value proposition, contributing significantly to customer loyalty and recurring revenue. The effectiveness of the distribution channel is highly dependent on regional application concentration; for example, specialized oilfield service companies dominate distribution in the Middle East, while agricultural equipment dealers are key players in APAC irrigation markets.

Hydrocyclone Sand Separators Market Potential Customers

The primary end-users and buyers of hydrocyclone sand separators are diverse, spanning multiple heavy industries where reliable solids-liquid separation is a non-negotiable prerequisite for operational success and compliance. The Oil and Gas sector, encompassing both upstream exploration and production (E&P) and midstream processing, represents the largest customer base. E&P companies require hydrocyclones for drilling mud cleaning, produced water management (to protect injection wells and disposal systems), and desanding operations. Refineries and processing plants utilize them for cooling water treatment and protecting heat exchangers. These customers prioritize high-pressure ratings, resistance to hydrogen sulfide (H2S) and chlorides, and certified API/ASME compliance, often purchasing large, complex battery systems designed for high flow volumes and continuous operation.

The second major customer segment is the Water and Wastewater Treatment industry, including municipal water authorities and industrial water managers across manufacturing, power generation, and chemical sectors. These customers employ hydrocyclones primarily as pre-treatment devices to remove coarse solids before subsequent steps like membrane filtration or disinfection, thereby reducing turbidity and extending the life of downstream equipment. Their purchasing criteria often focus on material suitability for potable water standards, ease of automation, and low operational expenditure (OPEX). Furthermore, the Agriculture and Irrigation sector, particularly large commercial farms and governmental irrigation schemes, constitute a substantial customer base, where the primary objective is preventing clogging in sophisticated drip irrigation and sprinkler systems caused by silt and sand drawn from rivers or boreholes.

A rapidly expanding segment of potential customers includes Mining and Mineral Processing companies. Hydrocyclones are indispensable in mineral beneficiation processes for classifying particles based on size and density, thickening slurries, and dewatering concentrates, crucial steps in extracting valuable metals like gold, copper, and iron ore. These customers demand extremely robust, abrasion-resistant lining materials (such as high-density polyurethane or ceramics) to withstand highly aggressive, abrasive slurries. Additionally, specialized niche customers such as geothermal power plants, large-scale district cooling systems, and manufacturers of paints and coatings (where hydrocyclones are used for pigment classification) also contribute to the overall demand, seeking solutions that offer precise particle size control and continuous operation without the need for backwashing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.8 Million |

| Market Forecast in 2033 | USD 853.4 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weir Group, Metso Outotec, Flsmidth, Parkson Corporation, Krebs Engineers (part of FLSmidth), Multotec, Alfa Laval, Solids Separation, Hydro International, Lakos (Claude Laval Corporation), Amiad Water Systems, Sepro Mineral Systems, Sweco (M-I Swaco), Baker Hughes, Schlumberger, Enviro-Tech Systems, Petrofac, Desander Solutions, Derrick Corporation, Process Equipment & Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrocyclone Sand Separators Market Key Technology Landscape

The technological landscape of the Hydrocyclone Sand Separators Market is marked by continuous refinement in design geometry, material science, and operational integration. Computational Fluid Dynamics (CFD) modeling remains a cornerstone technology, allowing manufacturers to simulate fluid behavior, optimize internal geometry (cone angle, inlet design, vortex finder dimensions) to minimize turbulence, and precisely predict the cut-point (D50 separation efficiency) for various fluid densities and viscosities. Recent advances focus on developing involute feed geometry, which introduces the feed fluid tangentially with minimal shear stress, leading to more stable vortex formation and significantly improved separation efficiency, particularly for fine particles. Furthermore, manufacturers are increasingly using high-performance ceramic liners, polyurethane coatings, and composite materials (e.g., FRP or specialized polymers) for the internal surfaces of the cone and apex, drastically reducing wear caused by highly abrasive solids in mining and heavy oil applications, thereby extending the operational lifespan far beyond that of traditional steel units.

Another crucial technological trend involves the development of automated and self-regulating hydrocyclone systems. This includes integrating advanced sensor technology, such as ultrasonic sensors and pressure transmitters, to continuously monitor parameters like underflow density, overflow clarity, and pressure drop. This real-time data is essential for implementing intelligent control systems that automatically adjust the apex valve opening or modulate feed pump speed using variable frequency drives (VFDs). This automated optimization ensures the separator maintains peak efficiency even when facing fluctuations in feed characteristics, which is a common challenge in dynamic industrial environments like offshore drilling rigs or intermittent agricultural pumping stations. The integration of IoT connectivity allows for remote monitoring and diagnostics, improving proactive maintenance capabilities and reducing the need for costly field visits.

Innovation is also evident in the design of multi-cyclone systems, moving towards compact, modular skids that offer high flow rates in a reduced footprint, essential for space-constrained environments such as mobile water treatment units or offshore platforms. Specialized designs, such as liquid-liquid hydrocyclones (though focused on oil-water separation, they share design principles), are influencing sand separator design to improve efficiency when handling emulsions or fluids with complex rheological properties. Future technological evolution is expected to focus heavily on optimizing the underflow discharge mechanism (apex), perhaps utilizing advanced materials that change shape or porosity based on solid loading, aiming to minimize liquid loss with the discharged solids (underflow water cut) while preventing roping or plugging, thereby enhancing overall water recovery and process economy, particularly critical in water-scarce regions.

Regional Highlights

- North America: North America holds a dominant position in the Hydrocyclone Sand Separators Market, driven by intensive activity in the oil and gas sector, particularly shale gas and tight oil extraction across the US and Canada. The region demands high-capacity, robust hydrocyclone battery systems for managing vast volumes of flowback and produced water, ensuring environmental compliance before disposal or reuse. Stringent federal and state regulations regarding water discharge quality necessitate the use of highly efficient pre-treatment technologies like hydrocyclones to protect subsequent advanced purification stages. The market is also fueled by modernization and expansion in the mining sector, especially copper and gold mining, which requires advanced mineral processing and classification equipment. Manufacturers in this region often focus on high-pressure ratings, automated controls, and compliance with ASME standards, catering to the sophisticated needs of energy companies and large municipal infrastructure projects. The stability of the regulatory framework and high technological adoption rates sustain the leading market share for North America.

- Europe: The European market for hydrocyclone sand separators is characterized by strong demand driven by environmental stewardship and industrial efficiency requirements. Regulations such as the Water Framework Directive enforce strict limits on industrial discharge and promote water reuse, pushing manufacturing, chemical, and power generation industries to invest heavily in advanced water treatment infrastructure. While the region’s oil and gas market (primarily North Sea operations) remains significant, the core growth engine is industrial processing and municipal water management. Europe shows high adoption rates for stainless steel and specialized composite hydrocyclones due to the prevalence of highly corrosive fluids and a preference for long-lifecycle assets. The regional focus is often on integrating separation units with smart monitoring systems to meet exacting performance standards and support the circular economy model by maximizing water recovery and reducing waste volume.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period, owing to rapid urbanization, massive infrastructure development, and urgent agricultural needs. Countries like China, India, and Australia are undergoing significant investment in large-scale irrigation projects to support growing populations, creating immense demand for low-to-medium capacity separators to protect agricultural pump and drip systems. Furthermore, the burgeoning industrial sector, particularly in Southeast Asia, requires efficient solutions for process water treatment and effluent management in textile, electronics, and power generation plants. The vast and active mining industry in Australia and China also contributes substantially, demanding high-abrasion-resistant hydrocyclones for mineral processing slurries. Price competitiveness and localized manufacturing capabilities are key success factors in the diverse and expansive APAC market, leading to increased adoption of locally sourced carbon steel and plastic units alongside high-end imported technology.

- Latin America (LATAM): The LATAM market growth is closely tied to its dominant sectors: mining (e.g., Chile, Peru, Brazil) and oil and gas (e.g., Brazil, Mexico). The mining sector is a particularly strong consumer, utilizing hydrocyclones for classification and dewatering of ore concentrates. The vast reserves of copper and iron ore necessitate large, heavy-duty separator installations capable of handling high throughput and extreme abrasion. While economic volatility and political instability can occasionally restrain major project investment, the long-term fundamentals driven by global commodity demand remain strong. Infrastructure projects, though slow, are also contributing to demand in municipal water systems. Market penetration often relies on establishing strong partnerships with local distributors and offering tailored technical support to navigate complex operational environments unique to the region.

- Middle East and Africa (MEA): MEA presents a market segment heavily dominated by the oil and gas industry. The necessity for effective sand removal (desanding) from produced fluids is paramount, especially in mature fields and desert environments where sand ingestion is common. Hydrocyclones are essential for protecting downhole equipment, surface facilities, and transportation pipelines. Water scarcity also drives demand for advanced water treatment and seawater desalination pre-treatment, where hydrocyclones protect reverse osmosis membranes. The Gulf Cooperation Council (GCC) countries, investing heavily in economic diversification and large-scale industrial zones, represent key areas of growth. Purchasing decisions in MEA are highly influenced by total cost of ownership (TCO), reliability under harsh climate conditions (high temperature, high salinity), and compliance with strict regional oilfield specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrocyclone Sand Separators Market.- Weir Group

- Metso Outotec

- FLSmidth

- Parkson Corporation

- Krebs Engineers (part of FLSmidth)

- Multotec

- Alfa Laval

- Solids Separation

- Hydro International

- Lakos (Claude Laval Corporation)

- Amiad Water Systems

- Sepro Mineral Systems

- Sweco (M-I Swaco)

- Baker Hughes

- Schlumberger

- Enviro-Tech Systems

- Petrofac

- Desander Solutions

- Derrick Corporation

- Process Equipment & Automation

Frequently Asked Questions

Analyze common user questions about the Hydrocyclone Sand Separators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and key benefit of a hydrocyclone sand separator?

The primary function is the efficient removal and classification of abrasive solids, particularly sand, from fluid streams using centrifugal force without requiring any moving parts. The key benefit is preventing premature wear and failure of critical downstream equipment, such as pumps, nozzles, and delicate filtration membranes, leading to reduced maintenance costs and minimized operational downtime.

Which industrial application contributes the most to the Hydrocyclone Sand Separators Market revenue?

The Oil and Gas industry contributes the largest share of market revenue. This is due to the critical necessity of managing high volumes of produced water and drilling fluids, requiring robust, high-capacity hydrocyclone battery systems for desanding and solids control to protect expensive drilling and processing infrastructure and meet stringent environmental discharge standards.

What limitations do hydrocyclones have compared to other filtration methods?

Hydrocyclones are generally less effective at separating extremely fine particles, typically those below 10 microns, and they struggle with fluids that have minimal density contrast between the solid and liquid phases. Furthermore, their separation efficiency is highly sensitive to variations in feed pressure and flow rate, requiring robust process control for optimal performance.

How is technological advancement influencing hydrocyclone design?

Technological advancement is focused on optimizing internal geometry using Computational Fluid Dynamics (CFD) modeling for enhanced cut-point accuracy, integrating abrasion-resistant materials like ceramics and composites to increase lifespan in harsh environments, and adopting IoT-enabled sensors for real-time monitoring and automated optimization of operational parameters.

Which geographical region is expected to show the highest growth rate and why?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid industrial expansion, massive government investments in agricultural irrigation infrastructure, and pressing needs for water and wastewater treatment upgrades across populous and industrializing nations such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager