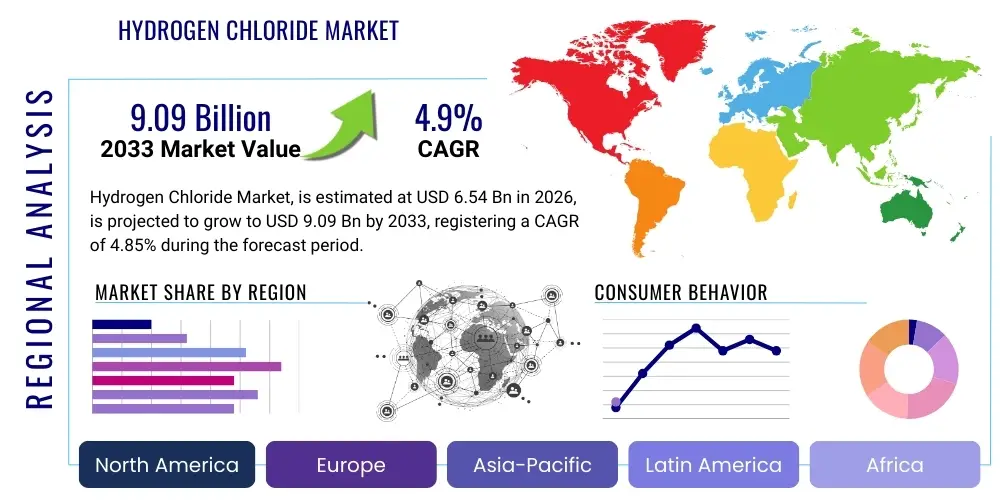

Hydrogen Chloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437845 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Hydrogen Chloride Market Size

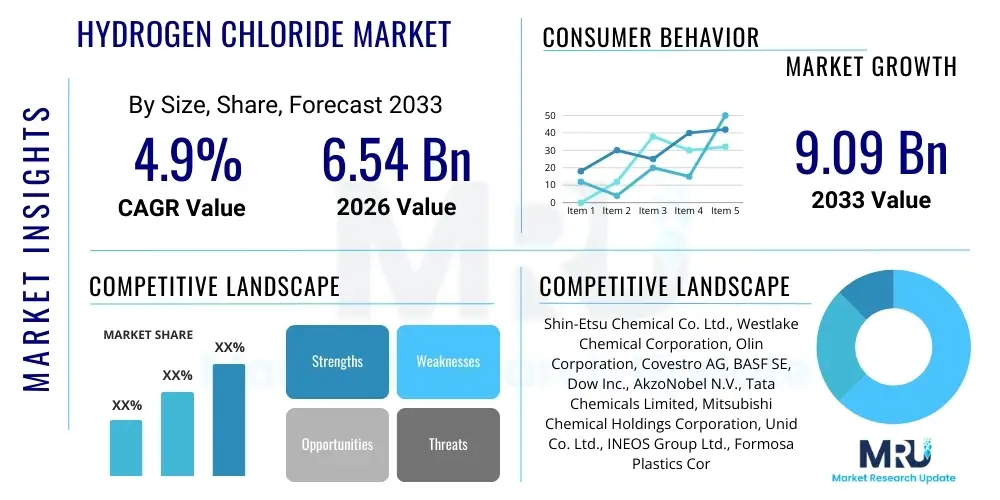

The Hydrogen Chloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.85% between 2026 and 2033. The market is estimated at USD 6.54 Billion in 2026 and is projected to reach USD 9.09 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating demands from the vinyl chloride monomer (VCM) and polyurethane industries, particularly in rapidly industrializing regions across Asia Pacific. The essential role of Hydrogen Chloride (HCl) as a primary reagent in large-scale chemical processes ensures its sustained market relevance, despite increasing environmental scrutiny regarding production methods and handling protocols.

The valuation reflects the critical requirement for both aqueous (hydrochloric acid) and anhydrous forms of Hydrogen Chloride across various technical and high-purity applications. Technical grade HCl dominates volume sales, driven mainly by large-scale metal pickling in the automotive and construction sectors, and its extensive use in organic synthesis. However, the high-purity electronic and food grades command significantly higher prices, contributing disproportionately to the overall revenue growth. The market trajectory is closely tied to global capital expenditure in chemical manufacturing and the steel industry, which are inherently cyclic but demonstrate strong long-term expansion potential, particularly as infrastructure projects proliferate globally.

Regional variations in growth rates are pronounced, with Asia Pacific expected to register the highest CAGR due to burgeoning domestic chemical production capacity, especially in China and India. Conversely, mature markets like North America and Europe, while maintaining robust consumption, are seeing growth predominantly driven by the transition towards specialized, high-margin products such as electronic-grade HCl used in semiconductor manufacturing. Investment in captive production facilities by large chemical conglomerates seeking operational efficiency and supply security is also a defining characteristic influencing market size projections over the forecast period.

Hydrogen Chloride Market introduction

Hydrogen Chloride (HCl) is a colorless, highly corrosive gas that, when dissolved in water, forms hydrochloric acid. It serves as one of the most vital industrial chemicals globally, characterized by its strong acidic properties and versatility as a chemical reagent. Primarily, HCl is produced either directly via the burning of hydrogen and chlorine gas, or more commonly, as a byproduct during the chlorination of organic chemicals, notably in the manufacturing of precursors for plastics and polymers. Its applications span a vast range of industrial processes, distinguishing it as a foundational component in the global chemical value chain.

The major applications of Hydrogen Chloride are predominantly centered around chemical synthesis, where it acts as a catalyst, reactant, or pH regulator. Key downstream industries include the production of vinyl chloride monomer (VCM), which is the primary precursor for Polyvinyl Chloride (PVC), a ubiquitous plastic used extensively in construction and packaging. Furthermore, HCl is indispensable in metal treatment processes, specifically steel pickling, where it removes rust and scale prior to galvanizing or coating. In highly specialized sectors, high-purity anhydrous Hydrogen Chloride is critical for the etching and cleaning processes within the semiconductor and electronics manufacturing industries, driven by the escalating demand for advanced microelectronics.

Driving factors for sustained market growth include the relentless expansion of the global construction industry, which directly correlates with PVC demand, and continuous innovation in material science requiring specialized acid treatments. The benefits offered by Hydrogen Chloride, such as cost-effectiveness, high reactivity, and availability in various concentrations and purities, make it difficult to substitute in core industrial applications. However, handling complexity and strict regulatory standards governing its transport and storage necessitate sophisticated operational protocols, influencing capital investment and supply chain structure within the market.

Hydrogen Chloride Market Executive Summary

The global Hydrogen Chloride market exhibits strong resilience, underpinned by robust business trends characterized by strategic vertical integration among key players aiming to secure raw material supply (chlorine and hydrogen) and optimize byproduct management. A notable trend is the increasing investment in purification technologies to meet the stringent specifications required by the electronics and food processing sectors, shifting the focus from purely volume-driven sales to high-value, specialty grades. Furthermore, sustainability pressures are subtly influencing production methods, with a gradual push towards utilizing HCl derived from greener or more efficient captive processes, minimizing waste generation and external logistics costs, thereby improving overall cost efficiencies across the supply chain.

Regionally, the Asia Pacific market stands as the undisputed engine of growth, propelled by massive industrialization, rapid urbanization, and significant governmental investment in infrastructure, all of which fuel demand for PVC and steel products. While North America and Europe demonstrate slower volume growth, these regions maintain dominance in specialized and high-purity segments. European trends are heavily influenced by the REACH regulatory framework, driving manufacturers to seek safer, more efficient closed-loop systems for HCl usage. Latin America and the Middle East & Africa are emerging as growing markets, reflecting investments in regional petrochemical complexes and downstream chemical manufacturing capabilities.

Segmentation trends highlight the increasing disparity between technical-grade and electronic-grade HCl. While technical grade remains the largest by volume, the electronic-grade segment is the fastest-growing in terms of revenue, driven by the global digitalization push and the booming semiconductor industry. Application-wise, chemical synthesis continues to be the dominant user, but metal treatment shows steady growth linked to automotive lightweighting and increasing infrastructure maintenance. Manufacturers are therefore optimizing production portfolios to balance high-volume, low-margin technical sales with lower-volume, high-margin electronic sales, reflecting a strategic response to evolving end-user demands and technological sophistication.

AI Impact Analysis on Hydrogen Chloride Market

User queries regarding AI's influence on the Hydrogen Chloride market predominantly revolve around optimizing complex manufacturing processes, ensuring safety and compliance, and enhancing supply chain visibility for hazardous materials. Common themes include how AI-driven predictive maintenance can prevent corrosive failures in production plants, the role of machine learning in optimizing reaction kinetics for HCl synthesis, and utilizing advanced analytics to forecast demand fluctuations in highly interconnected derivative markets like PVC and VCM. Users are also keenly interested in AI’s potential to manage regulatory complexity and improve traceability of high-purity grades to mitigate contamination risks in sensitive applications like semiconductor fabrication.

AI technologies, including machine learning algorithms and advanced control systems, are being integrated into large-scale chlor-alkali and byproduct management facilities. This integration is crucial for maximizing yield and purity while minimizing energy consumption during the synthesis and purification of Hydrogen Chloride. By analyzing real-time sensor data—such as temperature, pressure, flow rates, and impurity levels—AI systems can make instantaneous adjustments to process parameters, which is particularly vital for maintaining the stability and safety of highly corrosive operations. Furthermore, AI contributes significantly to predictive maintenance schedules, allowing operators to anticipate equipment failure due to corrosion before it leads to costly downtime or safety incidents, thereby enhancing operational safety and extending asset life.

In the commercial sphere, AI applications are transforming logistics and distribution, especially concerning the transportation of concentrated hydrochloric acid, which is classified as dangerous goods. Machine learning models analyze complex variables—including weather patterns, traffic congestion, regulatory restrictions, and inventory levels—to optimize routing and scheduling, ensuring timely and safe delivery while reducing carbon footprints. For high-purity electronic grade HCl, AI-enhanced quality control systems utilize image recognition and data analytics to scrutinize purity certificates and track batches, significantly improving transparency and reliability, which are paramount concerns for buyers in the sensitive electronics value chain.

- Enhanced Process Optimization: AI algorithms fine-tune synthesis reactors, maximizing HCl yield and reducing energy input based on real-time kinetics.

- Predictive Maintenance: Machine learning forecasts corrosion rates and equipment failure in highly corrosive environments, preventing unscheduled shutdowns and ensuring operational safety.

- Supply Chain Resilience: AI-driven logistics planning optimizes routes for hazardous material transport, improving delivery reliability and minimizing risk exposure.

- Quality Control Assurance: Advanced analytics monitor purification stages, ensuring stringent purity requirements for electronic and food grades are consistently met.

- Regulatory Compliance Management: AI systems track evolving global safety and environmental regulations, alerting operators to necessary process adjustments and simplifying documentation.

DRO & Impact Forces Of Hydrogen Chloride Market

The market dynamics for Hydrogen Chloride are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces felt across the value chain. Key drivers include the exponential growth in demand for Polyvinyl Chloride (PVC) driven by global infrastructure development and the robust expansion of the automotive sector, which requires vast amounts of steel pickling using hydrochloric acid. These drivers provide the foundational demand volume, ensuring the continuous requirement for large-scale HCl production capabilities globally. Simultaneously, the specialized demand from the high-tech electronics industry for ultra-high purity HCl is creating a lucrative niche, driving technological investments in advanced purification processes and commanding premium pricing.

However, the market faces significant restraints, primarily related to the hazardous nature of Hydrogen Chloride and hydrochloric acid. Strict regulations governing storage, transport, and disposal—such as those enforced by OSHA, EPA, and regional bodies like REACH—impose substantial compliance costs and operational complexities on manufacturers and distributors. Furthermore, the volatility of raw material prices, particularly chlorine and energy, directly impacts the profitability margins, as HCl production is often co-located with chlor-alkali plants. Public perception and environmental scrutiny surrounding large chemical operations also pose ongoing challenges, pushing for stricter emission controls and waste management protocols.

Opportunities for growth are concentrated in the development of sustainable or "green" HCl production methods, moving away from relying solely on byproduct generation towards cleaner, dedicated synthesis routes. Another significant opportunity lies in the expanding semiconductor market, where the transition to smaller node sizes requires even purer grades of etching gases, positioning electronic-grade HCl as a key future growth segment. The collective impact forces show a market that is fundamentally strong due to indispensable applications, but one that is increasingly steered by regulatory pressure and the strategic imperative to specialize in high-ppurity, high-value offerings to mitigate commodity price volatility and complexity in handling hazardous substances.

Segmentation Analysis

The Hydrogen Chloride market is meticulously segmented based on key parameters including Grade, Application, and Manufacturing Process, reflecting the diverse requirements of end-user industries ranging from bulk commodity chemical production to highly specialized microelectronics manufacturing. This segmentation is crucial for market participants to tailor their production, distribution, and pricing strategies effectively. The grade classification, separating Technical, Food, and Electronic (High-Purity) grades, fundamentally dictates the purification complexity, operational costs, and corresponding market price of the product, with electronic grade commanding the highest premium due to stringent impurity limitations measured in parts per trillion (ppt).

The application segmentation illustrates where the primary demand volume originates and where future revenue growth is anticipated. Chemical synthesis, dominated by VCM and MDI/TDI production, remains the backbone of the market, consuming the largest share of technical grade HCl. In contrast, the application of HCl in metal cleaning and regeneration of ion exchange resins represents secondary, yet stable, demand centers tied closely to industrial output and water treatment cycles. Understanding this application matrix allows suppliers to optimize their supply chain logistics, ensuring the appropriate concentration and purity are delivered to the highly varied needs of different industrial sectors.

Further analysis of segmentation by manufacturing process—including direct synthesis, salt-sulfuric acid, and, most predominantly, byproduct recovery from organic chlorination—provides insights into the cost structure and supply stability of the product. Manufacturers primarily relying on byproduct recovery are intrinsically linked to the demand and production levels of their primary chemical processes, creating a unique dependency structure within the HCl supply chain. This interdependency means the market price of HCl can often be decoupled from its own direct cost of production, being instead a function of the chlorine market and the output of chlorinated organic solvents.

- By Grade:

- Technical Grade

- Food Grade

- Electronic/High-Purity Grade

- By Application:

- Chemical Synthesis (VCM, Isocyanates, Chlorinated Solvents)

- Steel Pickling and Metal Treatment

- Oil and Gas Well Acidizing

- Food Processing and Preservation

- Water Treatment (pH control, Resin Regeneration)

- Semiconductor and Electronics Manufacturing (Etching and Cleaning)

- By Form:

- Aqueous (Hydrochloric Acid)

- Anhydrous (Gas)

Value Chain Analysis For Hydrogen Chloride Market

The value chain for the Hydrogen Chloride market begins with the upstream procurement of raw materials, primarily chlorine (Cl₂) and hydrogen (H₂). Chlorine is typically sourced from the massive chlor-alkali industry, produced via electrolysis of brine, making the pricing and supply of HCl highly dependent on the stability and output of caustic soda and chlorine markets. Hydrogen is often a byproduct of this same electrolysis process or secured from natural gas reformation. The midstream activities involve the synthesis itself, which is largely driven by organic chlorination processes where HCl is generated as a byproduct. This byproduct reliance is a distinguishing feature, influencing cost efficiencies and production locations.

Midstream processing also includes crucial purification steps, particularly vital for producing high-purity grades required by the food and electronics sectors. Purification technologies, such as adsorption, distillation, and specialized scrubbing, are capital-intensive and define the value addition at this stage. After synthesis and purification, the distribution channel becomes critical due to the highly corrosive and hazardous nature of the product. Direct distribution for large-volume technical grade acid often occurs via dedicated pipelines or rail tankers, minimizing handling risks. For specialty grades and smaller volumes, distribution relies on specialized fleets of road tankers and cylinders for anhydrous gas, adhering to strict international dangerous goods regulations (DG).

The downstream segment involves the ultimate consumption by end-users. Chemical manufacturers, particularly those involved in PVC production, form the largest direct consumption base. Steel manufacturers utilize HCl for pickling, often purchasing directly or through specialized regional distributors offering integrated acid management services, including spent acid regeneration. Indirect distribution often involves chemical wholesalers or regional agents who manage logistics for smaller or more geographically dispersed customers across various industries, including textiles, food, and municipal water treatment facilities. The movement towards greater control over the supply chain, through vertical integration or long-term contracts, minimizes exposure to supply disruptions and ensures consistency of quality, particularly in sensitive high-purity applications.

Hydrogen Chloride Market Potential Customers

Potential customers for Hydrogen Chloride are diverse, spanning multiple heavy and high-tech industries where its acidic and reactive properties are indispensable. The largest volume consumers are petrochemical and chemical manufacturing companies that require HCl as a primary reactant or catalyst in the production of bulk chemicals. Specifically, manufacturers of vinyl chloride monomer (VCM), which feeds the PVC industry, and producers of isocyanates, crucial for polyurethane foams and coatings (MDI and TDI), represent the core commercial end-user segment for technical-grade product. These customers require large, stable, and cost-effective supplies, often relying on geographically co-located or pipeline-fed arrangements to ensure continuous operation.

The metal industry, particularly integrated steel mills and specialized finishing plants, represents another major consumer base, utilizing hydrochloric acid extensively in the pickling process. These customers require high volumes of concentrated acid to efficiently remove oxide scale from hot-rolled steel sheets before galvanizing or cold rolling. The operational efficiency and environmental footprint of these customers are significantly influenced by their ability to manage and regenerate spent pickling liquor, creating a market for specialized acid recovery services and technologies often bundled with the initial HCl supply.

In the high-value segment, potential customers include semiconductor fabrication plants (fabs) and specialized electronics manufacturers. These buyers demand ultra-high purity, electronic-grade anhydrous HCl for critical etching and cleaning steps in microchip manufacturing. Given the stringent quality requirements and zero-tolerance for impurities, the purchasing decision for these customers is driven almost entirely by product purity and supplier reliability, rather than price. Finally, the food processing industry, using food-grade HCl for pH adjustment, gelatin production, and syrup refinement, and municipalities using it for water treatment, round out the specialized customer base, emphasizing the chemical’s versatility across essential economic sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.54 Billion |

| Market Forecast in 2033 | USD 9.09 Billion |

| Growth Rate | CAGR 4.85% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co. Ltd., Westlake Chemical Corporation, Olin Corporation, Covestro AG, BASF SE, Dow Inc., AkzoNobel N.V., Tata Chemicals Limited, Mitsubishi Chemical Holdings Corporation, Unid Co. Ltd., INEOS Group Ltd., Formosa Plastics Corporation, AGC Inc., Linde plc, Air Products and Chemicals Inc., Axiall Corporation, Tosoh Corporation, Nouryon, Chemours Company, Sumitomo Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogen Chloride Market Key Technology Landscape

The technology landscape in the Hydrogen Chloride market is dominated by advancements in synthesis efficiency, byproduct utilization, and, most crucially, ultra-purification methods necessary for specialized grades. Historically, the salt-sulfuric acid method was common, but modern production is overwhelmingly tied to the chlor-alkali industry and subsequent byproduct recovery from processes like the thermal cracking of dichloroethane (EDC) to produce VCM. The integration of advanced membrane cell technology in chlor-alkali production has increased the efficiency and scale of primary raw material sourcing, indirectly stabilizing the supply of HCl derived from these integrated chemical complexes. Efficiency in managing the exothermic nature of direct synthesis (H₂ + Cl₂) remains a focus area for dedicated producers.

For high-purity applications, the technological frontier centers on achieving extreme cleanliness and drying of the product. Purification technologies utilize multi-stage distillation, deep-bed adsorption using specialized desiccants, and fractional crystallization to remove trace impurities such as heavy metals, non-volatile residues, and moisture to levels acceptable for semiconductor manufacturing (typically requiring 99.999% purity or higher). Continuous monitoring technologies, often supported by AI, are essential components of these high-purity lines, ensuring real-time quality control and immediate process adjustment to prevent contamination. Investment in these specialized purification trains is a high-cost barrier to entry but is fundamental for participating in the high-growth electronics sector.

Furthermore, technology related to environmental compliance, specifically spent acid regeneration (SAR), is becoming increasingly relevant. Steel pickling operations generate vast quantities of spent hydrochloric acid rich in ferrous chloride. SAR technologies, such as fluid bed or spray roasting, efficiently recover and recycle the HCl while converting the ferrous chloride into useful iron oxide, significantly reducing waste disposal costs and environmental impact. The adoption of efficient SAR systems represents a crucial competitive advantage and technological innovation, allowing large consumers to operate a closed-loop system, thereby securing their internal supply and reducing reliance on external purchasing and disposal logistics. This closed-loop approach is central to modern sustainable industrial practices in metal treatment.

Regional Highlights

Regional dynamics play a significant role in shaping the global Hydrogen Chloride market, reflecting varying degrees of industrial maturity, regulatory stringency, and consumption patterns. Asia Pacific (APAC) stands out as the largest and fastest-growing region, primarily driven by China and India. This explosive growth is attributable to massive domestic infrastructure projects, rapid expansion of chemical and petrochemical complexes, and the concentration of global semiconductor manufacturing capabilities. The region's robust demand for PVC, coupled with lower operational costs compared to Western counterparts, ensures its continued dominance in both volume and growth rate, positioning it as the key focus area for capacity expansion.

North America and Europe represent mature markets characterized by stable but slower growth, heavily concentrated in specialty and high-purity applications. North America benefits from a strong base in petrochemicals, providing a steady supply of byproduct HCl, and a significant presence of the electronics sector, driving demand for electronic-grade gas. European markets, particularly Germany and Belgium, exhibit high levels of regulatory oversight (REACH), which fosters innovation in cleaner production and efficient acid recycling technologies. Demand in these regions is less tied to bulk infrastructure growth and more focused on technological upgrade cycles and maintenance activities within established industrial bases.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions that show promising growth trajectories. LATAM's market is linked to mining activities and increasing urbanization, requiring acid for pH regulation and water treatment. MEA, particularly the GCC nations, is investing heavily in diversifying its economy away from crude oil, building vast new petrochemical complexes. These complexes generate byproduct HCl, which is then utilized domestically or exported. The regional growth in MEA is highly dependent on the timely execution of large-scale chemical manufacturing projects and the subsequent development of downstream consumption centers, marking it as a critical area for future greenfield investment in HCl production capacity.

- Asia Pacific (APAC): Dominates the global market volume and growth rate, fueled by VCM/PVC production, rapid infrastructure development in China and India, and major semiconductor manufacturing hubs.

- North America: Stable consumer base, strong demand for electronic-grade HCl due to the advanced technology sector, and sophisticated infrastructure for handling hazardous materials.

- Europe: Characterized by stringent regulatory compliance (REACH), focus on acid regeneration technologies in the steel industry, and stable demand from the pharmaceutical sector.

- Middle East & Africa (MEA): Emerging market driven by new petrochemical and chlor-alkali capacity additions, aiming for regional self-sufficiency in chemical intermediates.

- Latin America: Growth driven by mining applications (acid leaching), water treatment needs, and foundational chemical manufacturing expansions, particularly in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Chloride Market.- Shin-Etsu Chemical Co. Ltd.

- Westlake Chemical Corporation

- Olin Corporation

- Covestro AG

- BASF SE

- Dow Inc.

- AkzoNobel N.V.

- Tata Chemicals Limited

- Mitsubishi Chemical Holdings Corporation

- Unid Co. Ltd.

- INEOS Group Ltd.

- Formosa Plastics Corporation

- AGC Inc.

- Linde plc

- Air Products and Chemicals Inc.

- Axiall Corporation

- Tosoh Corporation

- Nouryon

- Chemours Company

- Sumitomo Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Hydrogen Chloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Hydrogen Chloride globally?

The primary factor driving global demand for Hydrogen Chloride (HCl) is the production of vinyl chloride monomer (VCM), which is the essential precursor for manufacturing Polyvinyl Chloride (PVC). PVC’s extensive use in construction, piping, and automotive components directly correlates with global infrastructure development and urbanization trends, ensuring continuous high volume demand for technical grade HCl.

How is the purity of Hydrogen Chloride measured for electronic applications?

For electronic-grade HCl used in semiconductor manufacturing, purity is measured at extremely low levels, often in parts per billion (ppb) or parts per trillion (ppt). This ultra-high purity is critical to prevent contamination of silicon wafers during etching and cleaning processes. Specialized analytical techniques, such as gas chromatography and mass spectrometry, are employed to verify the absence of metal ions and moisture content.

What are the key differences between byproduct HCl and dedicated synthesis HCl?

Byproduct HCl, primarily generated during the chlorination of organic chemicals (like VCM production), often represents the most cost-effective supply source, but its volume is dependent on the primary process demand. Dedicated synthesis HCl, produced by burning chlorine and hydrogen, offers purer streams and greater control over production volume, making it often preferred for high-purity or specialized applications where supply consistency is paramount.

What impact do environmental regulations like REACH have on the Hydrogen Chloride market in Europe?

Environmental regulations such as REACH significantly impact the European HCl market by imposing strict standards on handling, storage, and emissions. This drives market players to invest in safer operational technologies, promote closed-loop systems like spent acid regeneration (SAR) to minimize waste, and ensures greater traceability and risk management throughout the product lifecycle.

Which application segment provides the highest revenue growth potential for the Hydrogen Chloride market?

The Semiconductor and Electronics Manufacturing segment offers the highest revenue growth potential. Although lower in volume compared to chemical synthesis, the demand for ultra-high purity, electronic-grade anhydrous HCl is accelerating due to the global boom in microchip production and the shift towards advanced, smaller node technology, allowing suppliers to command premium pricing and higher margins in this specialized niche.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ultra-high-purity Anhydrous Hydrogen Chloride (HCl) Gas Market Statistics 2025 Analysis By Application (Chemical, Electronics, Food & Beverages, Steel & Metals, Pharmaceutical, Other), By Type (Pharmaceutical Grade, Electronic Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ultra-high-purity Anhydrous Hydrogen Chloride (HCl) Market Statistics 2025 Analysis By Application (Chemical, Electronics, Food & Beverages, Pharmaceutical, Other), By Type (Electronic Grade, Chemical Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hydrogen Chloride Market Statistics 2025 Analysis By Application (Chemical Industry, Semiconductor Industry, Pharmaceutical Industry, Others), By Type (Technical Grade, Electronic Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hydrogen Chloride Market Statistics 2025 Analysis By Application (Chemical Industry, Semiconductor Industry, Pharmaceutical Industry), By Type (Technical Grade, Electronic Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Silane (SiH4) Gas Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Arises from the Reaction of Hydrogen Chloride with Magnesium Silicide, Other), By Application (Semiconductor Industry, Rubber & Plastics, Fiber Treatment, Adhesives & Sealants), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager