Hydrogen Fuel Cell Gas Diffusion Layer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436263 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hydrogen Fuel Cell Gas Diffusion Layer Market Size

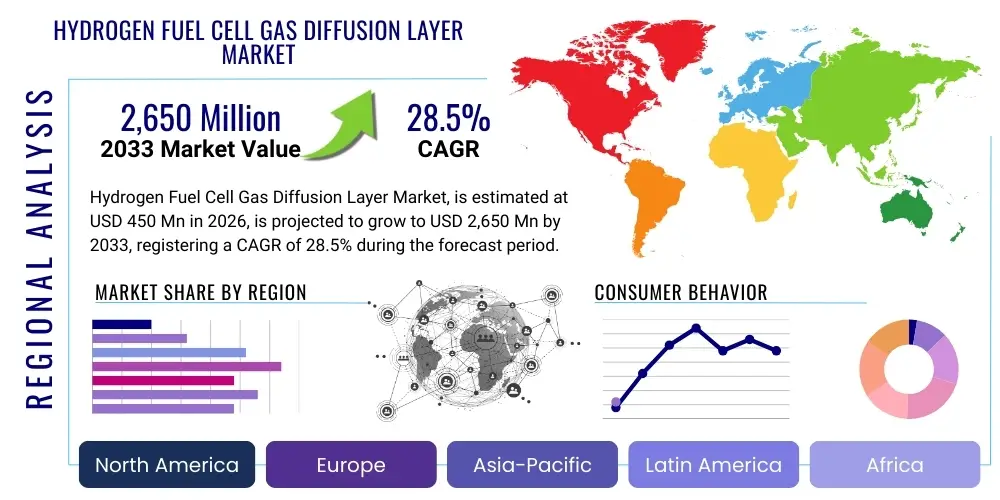

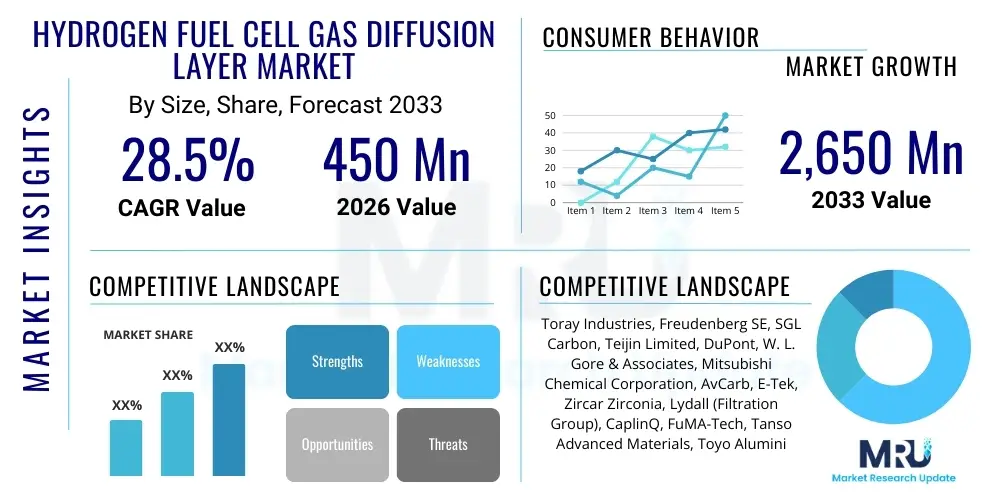

The Hydrogen Fuel Cell Gas Diffusion Layer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 2,650 Million by the end of the forecast period in 2033.

Hydrogen Fuel Cell Gas Diffusion Layer Market introduction

The Gas Diffusion Layer (GDL) is a critical component within Proton Exchange Membrane Fuel Cells (PEMFCs), serving as the interface between the catalyst layer and the flow field plate. Its primary function is multifaceted, encompassing efficient distribution of reactant gases (hydrogen and oxygen), effective removal of product water, and ensuring optimal electrical conductivity to facilitate current collection. Typically composed of carbon paper or carbon cloth, the GDL is treated with polytetrafluoroethylene (PTFE) or other hydrophobic agents to manage water saturation and prevent flooding, which is essential for maintaining high fuel cell performance and durability, particularly in dynamic operating environments like automotive applications.

Major applications of GDLs are predominantly concentrated in the transportation sector, especially in heavy-duty trucks, buses, and passenger vehicles transitioning towards zero-emission technologies. Furthermore, GDLs are integral to stationary power generation units, providing reliable, clean electricity for backup power, distributed generation, and remote locations. The market is defined by continuous technological advancements aimed at improving porosity, thermal management, and mechanical strength to withstand the stresses of operation. The demand for robust, high-performance GDLs is directly proportional to the global uptake of fuel cell electric vehicles (FCEVs).

Key driving factors propelling the market include stringent global emissions regulations, significant government investments and subsidies promoting hydrogen infrastructure development, and the increasing operational efficiency and cost reduction achieved in manufacturing fuel cell stacks. The unique benefits offered by GDLs—such as extended fuel cell lifespan, enhanced power density, and reduced weight—make them indispensable for fuel cell commercialization. The focus on developing thinner, more durable, and cost-effective GDL materials through innovative coating and substrate technologies is central to meeting future market demands.

Hydrogen Fuel Cell Gas Diffusion Layer Market Executive Summary

The global Hydrogen Fuel Cell Gas Diffusion Layer (GDL) market is experiencing transformative growth, driven primarily by ambitious global decarbonization targets and robust expansion in the mobility sector. Business trends indicate a strong move toward vertical integration among material suppliers and fuel cell manufacturers to secure supply chains and optimize material specifications for specific stack designs. Companies are heavily investing in automation and large-scale manufacturing to address the rising demand from automotive OEMs, necessitating standardization in GDL properties while simultaneously developing customized high-performance layers for high power density applications. Technological innovations focusing on advanced microporous layers (MPLs) and novel carbon substrates are key competitive differentiators, aiming to improve water management and reduce overall material costs, thereby lowering the Levelized Cost of Hydrogen Energy (LCOE).

Regional trends are dominated by Asia Pacific (APAC), particularly South Korea, China, and Japan, which lead in both fuel cell production capacity and FCEV adoption, benefiting from strong governmental support for hydrogen economies. North America and Europe are rapidly scaling up, emphasizing the development of hydrogen refueling infrastructure and mandating the use of fuel cells in heavy-duty transport, solidifying these regions as significant consumption hubs. The European Union’s commitment to the 'Green Deal' further accelerates demand, making Europe a focal point for R&D and manufacturing capacity expansion, particularly concerning sustainable sourcing of GDL raw materials.

Segment trends highlight the dominance of the Carbon Fiber Paper segment due to its superior performance characteristics in high-current density PEMFCs, though Carbon Cloth retains importance in certain stationary applications requiring greater mechanical strength. The Automotive application segment maintains the largest market share, characterized by demanding requirements for durability and power density, driving intense research into thinner, highly resilient GDLs. The PEMFC segment remains overwhelmingly dominant, given its suitability for mobile applications and continuous advancements in operational parameters, solidifying its position as the core technology driving GDL innovation and consumption globally through 2033.

AI Impact Analysis on Hydrogen Fuel Cell Gas Diffusion Layer Market

User queries regarding the impact of Artificial Intelligence (AI) on the GDL market frequently center on optimizing material composition, predicting performance degradation, and automating quality control during mass production. Users are keenly interested in how machine learning can accelerate the discovery of novel GDL structures, such as customized porosity distributions and optimized Microporous Layer (MPL) compositions, which traditionally rely on time-consuming experimental iteration. Furthermore, there is significant concern about reducing the substantial manufacturing variability inherent in GDL production; hence, users seek AI-driven solutions for real-time monitoring and anomaly detection to ensure consistency and enhance the overall lifetime of the fuel cell stack. The overarching expectation is that AI will be a core enabler for moving GDL manufacturing from customized batch processes to standardized, high-volume, and cost-effective industrial production essential for global commercialization.

AI is increasingly being utilized to simulate complex multi-physics phenomena within the fuel cell, specifically focusing on water transport dynamics within the GDL, which is challenging to model accurately using traditional computational fluid dynamics (CFD). Machine learning algorithms can analyze vast datasets from experimental trials—including temperature, pressure, humidity, and current density—to predict the onset of flooding or dry-out conditions faster and with greater accuracy than human analysis. This predictive capability allows manufacturers to design GDLs that are robust across a wider range of operational conditions, significantly boosting fuel cell efficiency and minimizing downtime in real-world applications. Integrating AI into design phases dramatically cuts down R&D cycles.

In manufacturing, AI and machine vision systems are revolutionizing quality assurance. High-resolution cameras coupled with deep learning models are employed to inspect the consistency of carbon paper structure, the uniformity of PTFE treatment, and the integrity of the MPL coating in real-time. This level of precision is critical, as microscopic defects or inconsistent hydrophobic treatment can lead to premature fuel cell failure. By applying predictive maintenance algorithms to manufacturing equipment, AI minimizes material waste and ensures that every GDL sheet conforms to stringent performance specifications required by automotive clients, thereby increasing production yield and accelerating market readiness for global hydrogen mobility deployment.

- AI-driven material informatics accelerates the discovery of optimal GDL substrate and coating compositions.

- Machine learning models optimize GDL porosity and hydrophobicity for enhanced water management and reduced flooding potential.

- Predictive modeling using AI simulates complex electrochemistry and water transport dynamics, speeding up R&D cycles.

- Real-time sensor data analysis and anomaly detection reduce manufacturing variability and improve product consistency (Quality 4.0).

- AI enhances manufacturing throughput and yield rates by automating high-precision quality control and inspection processes.

- Optimizing supply chain logistics and inventory management for specialized GDL precursor materials using predictive analytics.

DRO & Impact Forces Of Hydrogen Fuel Cell Gas Diffusion Layer Market

The Hydrogen Fuel Cell Gas Diffusion Layer (GDL) market is powered by significant momentum, counterbalanced by persistent material and manufacturing challenges. The primary drivers include global mandates targeting carbon neutrality, extensive investment in hydrogen infrastructure (such as the EU's Hydrogen Strategy and initiatives in Asia), and the rapid scaling of FCEV production, particularly in heavy-duty trucking and public transport, which require durable, high-power fuel cell stacks. These factors collectively create a massive demand pull for high-performance GDLs. However, the market faces strong restraints centered on the high initial cost of GDL materials, particularly advanced carbon papers and specialized PTFE coatings, and the technical complexity involved in achieving uniform, high-volume manufacturing with minimal defects, which limits immediate cost reduction and scalability.

Opportunities abound in developing next-generation GDLs with improved multi-functional capabilities, such as integrated heating elements for cold start mitigation or bio-inspired structures for superior water channeling. Emerging opportunities also lie in scaling up low-cost production methods and exploring non-fluorinated, environmentally friendlier hydrophobic treatments. Successful innovation in these areas promises to significantly lower the overall stack cost, making hydrogen technology more competitive against traditional internal combustion engines and battery electric vehicles. Strategic partnerships between material science companies and fuel cell integrators are crucial for capitalizing on these advancements and streamlining the transition from lab-scale prototypes to commercialized products.

The market impact forces are driven by substitution risk and competitive pressure from battery technology, though hydrogen's energy density advantage in heavy transport mitigates this. Supplier power is moderate to high, as the raw material supply chain for specialized carbon substrates is concentrated among a few high-tech manufacturers, leading to potential input price volatility. Buyer power is increasing, particularly among large automotive OEMs who demand stricter quality control, lower prices, and guaranteed supply volumes. Technological evolution remains the most critical impact force; breakthroughs in GDL design (e.g., thinner materials, enhanced durability) directly correlate with improvements in fuel cell performance, serving as the main lever for market penetration and accelerating industry-wide adoption.

Segmentation Analysis

The Hydrogen Fuel Cell Gas Diffusion Layer market is extensively segmented based on material type, application, and fuel cell type, reflecting the diverse requirements of different end-use sectors. Material segmentation is fundamental, distinguishing between carbon paper and carbon cloth, where carbon paper dominates due to its superior conductivity and optimized structure for PEMFCs. The application landscape is heavily skewed toward mobility, with the automotive sector commanding the largest market share, although stationary power and portable applications represent growing niches requiring tailored GDL characteristics, particularly regarding resilience and long operational lifespan. Understanding these granular segmentations is crucial for manufacturers to align their R&D and production capabilities with specific demand vectors and technological trends.

Further analysis of the segmentation reveals that the Proton Exchange Membrane Fuel Cell (PEMFC) segment is the foundational growth engine, driving demand for the most advanced GDL products. PEMFCs operate at lower temperatures and are highly suitable for vehicle powertrains, demanding GDLs that can efficiently manage product water under high current density conditions and withstand frequent thermal cycling. Conversely, segments like Phosphoric Acid Fuel Cells (PAFCs), while smaller, utilize GDLs designed for higher operating temperatures and different chemical environments. The continuous pursuit of efficiency improvements within the PEMFC space necessitates ongoing innovation in MPL coatings and the underlying carbon substrate structure.

The strategic differentiation among market players often revolves around specialization within these segments. Companies focusing on the automotive industry prioritize maximizing power density and mechanical durability, leading to investments in advanced hydrophobic treatments and optimized thickness control. Suppliers targeting stationary power, however, might emphasize cost-effectiveness and chemical stability over extreme power density. This segmented requirement profile ensures that the market remains dynamic, requiring suppliers to maintain a diverse product portfolio capable of meeting the rigorous, specific needs across the entire fuel cell value chain.

- By Material Type:

- Carbon Fiber Paper

- Carbon Cloth

- Metal-based GDLs (Emerging)

- By Application:

- Automotive (Passenger Vehicles, Buses, Trucks)

- Stationary Power Generation (Backup Power, Distributed Generation)

- Portable Power (Drones, Consumer Electronics)

- By Fuel Cell Type:

- Proton Exchange Membrane Fuel Cell (PEMFC)

- Phosphoric Acid Fuel Cell (PAFC)

- Others (Alkaline, Microbial)

Value Chain Analysis For Hydrogen Fuel Cell Gas Diffusion Layer Market

The value chain for the Hydrogen Fuel Cell Gas Diffusion Layer market begins with the upstream sourcing and processing of highly specialized raw materials, primarily high-purity carbon precursors such as polyacrylonitrile (PAN) or pitch, used to produce carbon fibers and subsequent carbon paper or cloth substrates. Key upstream activities involve the demanding thermal processing (carbonization and graphitization) to achieve the necessary electrical conductivity and mechanical properties, followed by meticulous quality checks to ensure minimal impurities. The concentration of expertise in producing uniform, high-quality carbon paper means that upstream suppliers often exert considerable pricing power and require long-term contracts with GDL manufacturers.

The midstream segment involves the core manufacturing process: taking the raw carbon substrate and applying multi-stage treatments. This includes macroporous layer (MPL) coating, which involves proprietary slurries of carbon black and binder, and the crucial hydrophobic treatment, typically using PTFE application methods like dipping or spraying, followed by thermal curing. Midstream players, the specialized GDL manufacturers, invest heavily in process control and automation to ensure uniformity in porosity, thickness, and hydrophobicity, which are direct determinants of fuel cell performance and lifetime. Distribution channels are predominantly indirect, leveraging specialized distributors and technical representatives who manage relationships with fuel cell stack assemblers and automotive OEMs, offering tailored material consultation and rapid delivery.

Downstream activities are dominated by large fuel cell stack manufacturers (such as Ballard, Plug Power, and various automotive OEMs) who purchase the finished GDLs and integrate them into Membrane Electrode Assemblies (MEAs) and then into complete fuel cell stacks. These large buyers demand stringent specification adherence and reliability, driving GDL manufacturers toward mass customization and high-volume consistency. While direct sales are common for strategic, large-volume automotive contracts, indirect channels facilitate market reach to smaller R&D labs and specialized system integrators across various regions, ensuring widespread adoption and technical support for diverse fuel cell applications globally.

Hydrogen Fuel Cell Gas Diffusion Layer Market Potential Customers

The primary consumers and end-users of Hydrogen Fuel Cell Gas Diffusion Layers are highly concentrated in the industrial and mobility sectors, revolving around entities responsible for designing, manufacturing, and deploying fuel cell technology. Leading automotive Original Equipment Manufacturers (OEMs) stand as the most significant buyers, including those focusing on passenger cars (e.g., Toyota, Hyundai), as well as manufacturers of heavy-duty vehicles, buses, and commercial fleets (e.g., Nikola, Daimler). These customers require GDLs optimized for high power density, durability under harsh driving cycles, and stringent long-term cost goals, driving demand for innovative, standardized products capable of mass production integration.

Beyond transportation, major purchasers include specialized stationary power system manufacturers and grid operators utilizing fuel cells for backup power, distributed generation, and uninterruptible power supplies (UPS). Companies like Cummins and Plug Power, focused on large-scale industrial applications and material handling equipment (forklifts), represent a substantial customer base seeking GDLs that offer long operational life and robustness against prolonged continuous operation. These customers often prioritize chemical stability and consistent performance over maximum power density, distinguishing their purchasing requirements from those in the automotive sector.

Finally, a niche but critical customer segment includes independent fuel cell stack integrators, national research institutions, and specialized defense contractors globally. These buyers procure GDLs for R&D purposes, technology demonstration projects, and highly customized small-scale applications, such as specialized drones or military power units. Their purchasing criteria often emphasize high customization, exotic material compositions, and superior performance characteristics, regardless of cost, supporting the continuous advancement and technical refinement of GDL technologies before they are scaled up for commercial markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 2,650 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Freudenberg SE, SGL Carbon, Teijin Limited, DuPont, W. L. Gore & Associates, Mitsubishi Chemical Corporation, AvCarb, E-Tek, Zircar Zirconia, Lydall (Filtration Group), CaplinQ, FuMA-Tech, Tanso Advanced Materials, Toyo Aluminium K.K., Hexcel Corporation, Kolon Industries, 3M, Umicore, General Motors (through subsidiary operations) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogen Fuel Cell Gas Diffusion Layer Market Key Technology Landscape

The technological landscape of the Hydrogen Fuel Cell Gas Diffusion Layer market is currently defined by continuous optimization of existing carbon substrate and coating technologies, aiming for superior performance metrics without drastically increasing costs. A primary focus is the refinement of carbon fiber paper manufacturing to ensure high through-plane conductivity and controlled pore structure. Advanced techniques involve sophisticated wet-laying processes and subsequent thermal treatments to achieve a tight distribution of pore sizes (porosity control), which is crucial for efficient fluid dynamics and mechanical stability under compression within the fuel cell stack. Innovations in this area are shifting towards ultra-thin GDLs (below 100 microns) that maintain structural integrity and minimize ohmic resistance, thereby increasing overall fuel cell power density, particularly important for automotive applications where space and weight are major constraints.

The second major area of technological focus involves the development and application of the Microporous Layer (MPL) and hydrophobic treatments. The MPL, often a thin film of carbon black and polymeric binder applied between the GDL and the catalyst layer, is critical for water management by preventing liquid water from blocking the catalyst sites (flooding) and improving electrical contact. Current R&D explores novel MPL compositions using unique nanocarbon materials like carbon nanotubes (CNTs) or graphene derivatives to enhance electro-catalytic activity and improve transport properties. Simultaneously, manufacturers are developing non-fluorinated, environmentally compliant hydrophobic treatments to replace or minimize the use of PTFE, responding to regulatory pressures and consumer demand for 'greener' fuel cell components, while ensuring durability and consistency in water repellency.

A burgeoning technological trend involves the exploration of segmented or functionally graded GDLs. These layers are engineered to have varying porosity, hydrophobicity, or conductivity across their surface or through their thickness to optimize performance under diverse operating conditions (e.g., maintaining high water saturation near the outlet while ensuring drier conditions near the inlet). Furthermore, process engineering innovations, particularly leveraging AI and automation, are transforming the manufacturing scale. High-speed roll-to-roll processing for continuous GDL production is becoming standardized, driving down unit costs and ensuring the high-volume consistency required by the global automotive supply chain, cementing technology as the core competitive advantage in this specialized materials market.

Regional Highlights

Regional dynamics within the GDL market are highly polarized, largely reflecting national hydrogen strategies and the adoption rates of FCEVs.

- Asia Pacific (APAC): APAC is the global leader in both production and consumption. Driven predominantly by China, Japan (Fuel Cell Commercialization Council), and South Korea (Hydrogen Economy Roadmap), the region benefits from aggressive governmental incentives for FCEV adoption and massive public investment in hydrogen infrastructure. This region hosts the highest density of GDL manufacturing facilities and is the primary growth engine for the market.

- North America: This region, particularly the United States, focuses heavily on scaling up heavy-duty trucking applications and industrial mobility (forklifts). Strong political support through federal programs and state initiatives (like California's mandates) drive significant demand for high-durability, cost-competitive GDLs. North America is a major innovation hub, particularly in leveraging advanced materials and computational modeling for GDL design.

- Europe: Europe is rapidly accelerating its hydrogen ambitions under the 'European Green Deal' and associated hydrogen alliance strategies. Demand is concentrated in Western European nations like Germany, France, and the UK, focusing on public transport (buses) and regional heavy-duty logistics. The European market emphasizes sustainable production methods and stringent environmental compliance, necessitating the development of cleaner GDL manufacturing processes and materials.

- Latin America, Middle East, and Africa (LAMEA): While smaller currently, LAMEA represents a high-potential future market, primarily due to large-scale green hydrogen production projects (e.g., in Chile and Saudi Arabia) targeting export and domestic heavy industry decarbonization. Demand for GDLs here is expected to grow as local fuel cell assembly and stationary power applications increase toward the end of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Fuel Cell Gas Diffusion Layer Market.- Toray Industries

- Freudenberg SE

- SGL Carbon

- Teijin Limited

- DuPont

- W. L. Gore & Associates

- Mitsubishi Chemical Corporation

- AvCarb

- E-Tek

- Zircar Zirconia

- Lydall (Filtration Group)

- CaplinQ

- FuMA-Tech

- Tanso Advanced Materials

- Toyo Aluminium K.K.

- Hexcel Corporation

- Kolon Industries

- 3M

- Umicore

- General Motors (through subsidiary operations)

Frequently Asked Questions

Analyze common user questions about the Hydrogen Fuel Cell Gas Diffusion Layer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Gas Diffusion Layer (GDL) in a fuel cell?

The primary function of the GDL is threefold: it efficiently transports reactant gases (H2 and O2) to the catalyst layer, facilitates electrical current collection, and critically manages the removal of product water to prevent flooding and ensure high operational performance and durability of the fuel cell stack.

Which material type dominates the Hydrogen Fuel Cell GDL market segment?

Carbon Fiber Paper currently dominates the GDL market due to its excellent electrical and thermal conductivity, high porosity, and structural consistency, making it the preferred substrate for high-performance Proton Exchange Membrane Fuel Cells (PEMFCs) used in automotive applications.

How is the high cost of GDL materials being addressed by manufacturers?

Manufacturers are addressing high material costs through process optimization, scaling up production via continuous roll-to-roll manufacturing, and investing in R&D for next-generation, lower-cost precursor materials and efficient application of the Microporous Layer (MPL) and hydrophobic treatments.

Which application segment drives the largest demand for GDLs globally?

The Automotive application segment, encompassing passenger vehicles, heavy-duty trucks, and buses, drives the largest global demand for GDLs, fueled by global FCEV mandates and the strategic advantages of hydrogen fuel cells in long-range and high-payload transport.

How does the Microporous Layer (MPL) improve GDL performance?

The MPL, situated between the GDL and the catalyst layer, enhances performance by improving electrical contact, distributing reactants more evenly, and critically, managing product water by creating a physical barrier that prevents bulk liquid water from flooding the reaction sites, thereby maintaining optimal cell efficiency.

The market analysis concludes that the future growth trajectory of the Hydrogen Fuel Cell Gas Diffusion Layer market is inextricably linked to the successful commercialization of hydrogen mobility solutions. Sustained high growth rates are anticipated as production scales up, driven by innovations in material science and manufacturing automation (Industry 4.0 techniques). Strategic alignment between GDL producers and major automotive OEMs will be essential to standardize product specifications and reduce the bill of materials for fuel cell stacks, positioning the GDL as a foundational technology in the global energy transition.

Further investment in sustainable GDL manufacturing and recycling capabilities will be critical for maintaining market momentum, especially in environmentally conscious regions like Europe. The competitive landscape will continue to favor companies capable of supplying ultra-thin, highly durable, and cost-optimized GDL solutions at automotive-grade volumes. The shift towards higher power density fuel cells requires continuous refinement of the GDL's porosity, hydrophobicity, and thermal management characteristics, ensuring that this component remains a central focus of fuel cell R&D efforts throughout the forecast period from 2026 to 2033.

The transition to a hydrogen economy necessitates reliable, high-performing components, making the GDL market crucial. The integration of advanced computational analysis, leveraging AI and machine learning for predictive performance modeling, is expected to democratize GDL design, facilitating rapid iteration and material optimization. This technological push, combined with strong policy support worldwide, secures the GDL market's position as a high-growth sector within the broader clean energy industry, poised for multi-billion dollar valuation growth by the end of the next decade.

In summary, the market is characterized by intense R&D activity, geographical expansion, and a relentless pursuit of cost reduction through manufacturing scale. The established dominance of PEMFCs and the automotive application sector dictates the quality and specifications demanded from GDL manufacturers. Success in this market hinges on innovation in material science, robust quality control, and the ability to navigate complex global supply chain dynamics to meet the accelerating demand from global fuel cell system integrators and transportation manufacturers.

The necessity for GDLs to manage the dual challenges of water transport and electrical conduction simultaneously ensures its irreplaceable role in fuel cell performance. Future GDL architectures might incorporate integrated sensing capabilities or self-regulating properties to dynamically adjust to changing operational loads, representing the next frontier of innovation. The competitive advantages will accrue to firms that can efficiently bridge the gap between material research and scalable, high-volume production required by the rapidly expanding global hydrogen fleet.

Furthermore, the strategic importance of the GDL component is reflected in the M&A activities and partnerships being forged between chemical giants and specialized carbon material providers. This consolidation aims to secure proprietary technologies and ensure a stable supply of high-grade raw materials, critical components needed to meet the steep ramp-up in fuel cell production volumes anticipated globally. The focus on sustainability will also drive innovation towards processes that minimize energy consumption and waste during GDL fabrication, aligning the industry with broader ESG (Environmental, Social, and Governance) investment criteria.

The impact of global geopolitical stability on the supply of carbon precursors, essential for GDL manufacturing, remains a notable risk factor. Manufacturers are increasingly looking to diversify sourcing geographically and investigate alternative non-carbon based substrates, although carbon-based solutions are expected to maintain market dominance throughout the forecast period due to their superior performance characteristics in current-generation PEMFC technology. Ensuring robust supply chain resilience is a key strategic imperative for major market participants aiming for reliable growth and sustained profitability in this specialized materials segment.

Market segmentation based on thickness is also gaining prominence, with ultra-thin GDLs specifically optimized for high-power density automotive stacks and thicker, more mechanically resilient GDLs reserved for high-compression stationary applications. This specialization requires GDL manufacturers to maintain highly adaptable production lines and advanced surface modification capabilities. The long-term trajectory confirms that the GDL market is transitioning from a niche materials sector to a high-volume, performance-critical segment essential for global renewable energy targets.

Technological advancement is not limited to material optimization; breakthroughs in diagnostic tools that allow non-invasive, real-time monitoring of GDL performance within an operating stack are highly sought after. These tools, often employing AI-driven analysis of impedance spectroscopy or neutron imaging data, enable stack designers to fine-tune GDL specifications, further maximizing the efficiency and extending the service life of the fuel cell system. This interplay between material science, advanced manufacturing, and diagnostic technology is setting a new benchmark for component reliability in the hydrogen value chain.

Finally, the interplay between the GDL and the bipolar plate design is a constant area of focus. Optimizing the contact resistance between these two components is paramount for overall stack performance. Innovations in GDL surface treatments or the integration of micro-patterning techniques aim to minimize interfacial resistance while simultaneously facilitating superior water drainage, ensuring that every layer within the fuel cell stack contributes maximally to energy generation and minimizes parasitic losses. This holistic system-level optimization confirms the GDL’s role as far more than a passive component; it is an active determinant of fuel cell viability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager