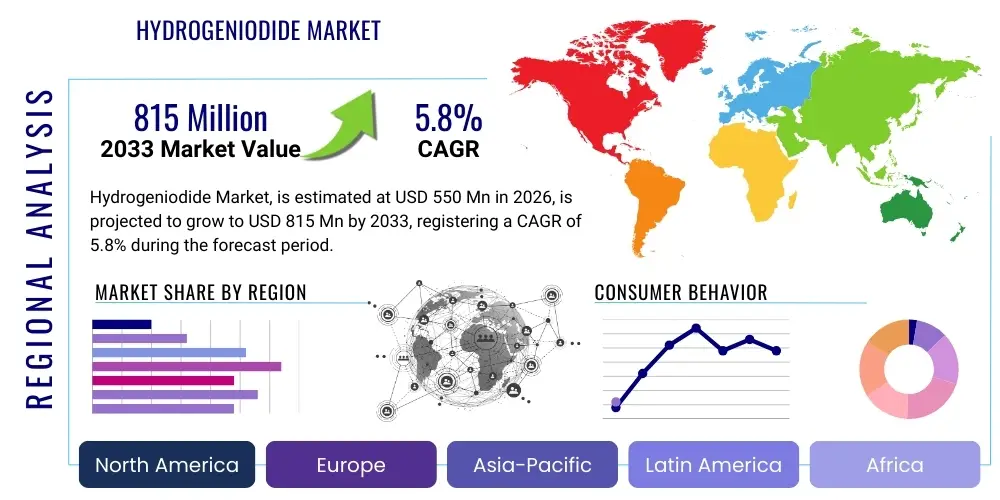

Hydrogeniodide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437957 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hydrogeniodide Market Size

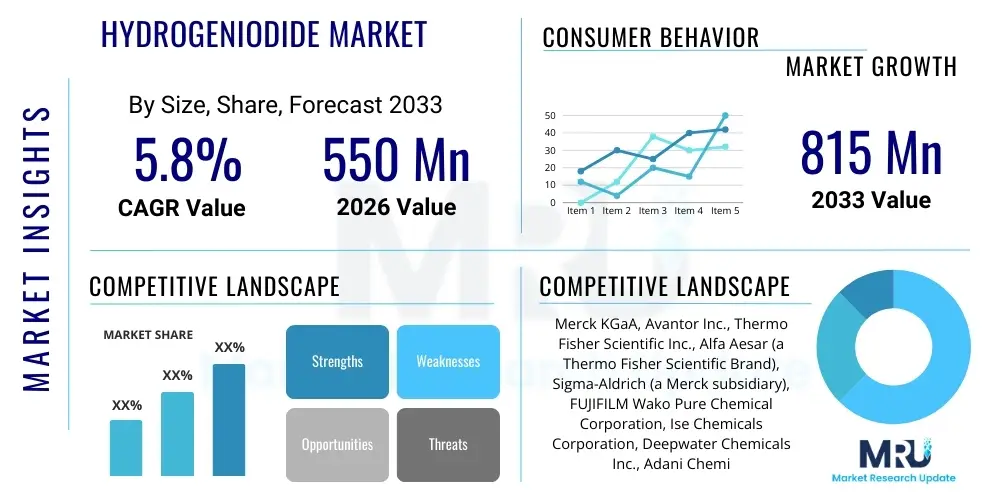

The Hydrogeniodide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033.

Hydrogeniodide Market introduction

Hydrogen iodide (HI) is a colorless gas that, when dissolved in water, forms hydroiodic acid, a strong acid and a crucial reagent in various industrial chemical processes. Historically, the market for Hydrogeniodide has been intrinsically linked to the chemical manufacturing sector, particularly in the synthesis of organic and inorganic iodine compounds. Its primary industrial applications leverage its potent reducing capabilities and its role as a key intermediate in complex chemical synthesis routes. As global regulatory standards evolve, demanding cleaner and more efficient synthesis methods, the demand for high-purity HI in specialized applications, such as pharmaceutical intermediates and advanced materials, has intensified.

The product is commercially available in various grades, including highly concentrated aqueous solutions and anhydrous gas. Major applications span several sectors, notably catalysis, where HI serves as a strong reducing agent or an acid catalyst, and in the production of high-purity iodides essential for electronics and specialized batteries. One of the most significant emerging applications is within the energy sector, specifically the Sulfur-Iodine (S-I) cycle for thermochemical production of hydrogen, positioning HI as a critical component in future green energy infrastructure. The inherent benefits of using HI, such as high reactivity and selectivity in certain chemical reactions, alongside increasing global chemical production, are driving continuous market expansion.

Driving factors for the growth of the Hydrogeniodide market include the accelerating demand for high-performance organic chemicals used in pharmaceutical synthesis, the proliferation of specialized catalyst systems requiring iodide compounds, and the substantial investment in green hydrogen technologies worldwide. Furthermore, the electronics industry's reliance on high-purity inorganic iodides for semiconductor and display manufacturing provides a steady baseline demand. These multifaceted demands across high-value industries ensure sustained growth, despite challenges related to HI’s corrosive nature and stringent handling requirements.

Hydrogeniodide Market Executive Summary

The global Hydrogeniodide market is experiencing moderate but steady growth, fundamentally driven by expanding pharmaceutical synthesis activities, particularly in Asia Pacific, and significant governmental investment into advanced hydrogen production methodologies in North America and Europe. Business trends indicate a strong industry focus on enhancing purity levels and developing safer, more efficient storage and delivery systems to manage HI’s corrosive properties, translating into premium pricing for anhydrous, high-ppurity gas grades favored by the electronics and high-tech sectors. Regionally, Asia Pacific maintains market dominance due to its robust chemical manufacturing base and rapid expansion in pharmaceutical R&D, while North America and Europe are pivotal markets emphasizing sustainable energy solutions, notably the Sulfur-Iodine thermochemical process for hydrogen generation, which promises to become a significant long-term demand driver.

Segment trends reveal that the high-purity grade (greater than 99.9%) segment is projected to exhibit the fastest growth CAGR, spurred by strict quality requirements in semiconductor etching and specialty material synthesis, commanding a price premium significantly higher than standard chemical grades. Application-wise, the reducing agent and catalyst segment currently holds the largest share, indispensable in basic and specialty chemical production, though the emerging application in the energy sector for hydrogen production is expected to rapidly increase its proportional market size over the forecast period. End-user analysis highlights the chemical manufacturing segment as the primary consumer, although the nascent, high-growth electronics and energy sectors are expected to progressively erode this dominance by demanding extremely specialized and stable formulations of Hydrogeniodide.

Overall, the market remains moderately consolidated, with a few large global chemical manufacturers controlling the primary supply chains of crude iodine necessary for HI synthesis. Strategic insights suggest that companies investing in forward integration, particularly securing reliable iodine sources and developing proprietary, safer transportation mechanisms for highly concentrated HI, will gain a competitive edge. The market is also heavily influenced by regulatory oversight regarding the transportation of hazardous materials and environmental safety standards, compelling manufacturers to adopt rigorous internal quality control and safety protocols, thereby raising entry barriers for smaller players.

AI Impact Analysis on Hydrogeniodide Market

Common user questions regarding AI's influence on the Hydrogeniodide market frequently center on its role in optimizing complex, energy-intensive chemical synthesis processes and improving safety protocols surrounding highly corrosive and hazardous materials. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in HI production facilities, whether machine learning algorithms can accelerate the discovery of new, more stable iodide derivatives, and how smart supply chain logistics can ensure the secure and timely delivery of sensitive chemical feedstock. Key themes emerging from these inquiries include process optimization for cost reduction, enhanced safety mechanisms through predictive analytics, and AI's potential in accelerating research and development for HI's application in emerging fields like green hydrogen production via the S-I cycle, specifically monitoring reaction kinetics and optimizing heat exchange efficiency.

The integration of Artificial Intelligence and Machine Learning (ML) models is poised to revolutionize the operational efficiencies within the Hydrogeniodide production ecosystem. AI can process vast datasets related to reaction parameters, temperature stability, pressure variations, and catalyst performance in real-time, allowing manufacturers to move from reactive maintenance schedules to highly precise predictive modeling. This shift ensures continuous optimal output, minimizes waste generation, and significantly reduces the operational expenditure associated with managing complex chemical processes involving highly corrosive agents like HI. Furthermore, AI tools are essential for simulating and predicting the stability and reaction pathways of new iodine compounds, thereby accelerating the time-to-market for specialized iodide derivatives used in high-purity applications.

In the crucial domain of quality control and safety, AI systems offer sophisticated surveillance and anomaly detection capabilities that are difficult to achieve through traditional monitoring. Given the hazardous nature of anhydrous HI gas and concentrated hydroiodic acid, AI-powered systems can analyze sensor data for minute leakages, predict equipment failure weeks in advance, and optimize ventilation and neutralization protocols instantly during emergency scenarios. This enhancement in safety not only protects personnel and infrastructure but also ensures compliance with increasingly strict global regulatory standards regarding hazardous chemical handling, contributing significantly to the overall integrity and reliability of the HI supply chain.

- AI-driven optimization of the Sulfur-Iodine cycle parameters for maximized hydrogen yield.

- Predictive maintenance analytics to prevent corrosion-induced failures in high-pressure reactors and pipelines.

- Machine learning algorithms utilized for optimizing reaction kinetics in HI synthesis, reducing energy consumption.

- Automated quality control systems using computer vision and sensor data for purity verification of commercial HI grades.

- Smart supply chain logistics forecasting demand fluctuations and optimizing secure transportation routes for hazardous materials.

- AI modeling of novel iodide precursors for battery electrolytes and pharmaceutical intermediates.

DRO & Impact Forces Of Hydrogeniodide Market

The Hydrogeniodide market is shaped by a robust interplay of driving forces centered on technological advancements in high-value industries, tempered by significant inherent constraints related to the product's chemical properties and regulatory scrutiny. Key drivers include the accelerated global transition toward green hydrogen via thermochemical cycles, the increasing complexity of pharmaceutical synthesis requiring highly selective reducing agents, and the persistent expansion of the electronics sector demanding high-purity inorganic iodides for etching and deposition processes. These drivers collectively create a sustained, high-value demand trajectory. Conversely, significant restraints include the extreme corrosiveness of HI, requiring specialized and expensive handling and storage infrastructure, its relatively high production cost linked to iodine sourcing, and stringent governmental regulations on the transport and storage of hazardous chemicals, which restrict global trade flexibility.

Opportunities for market players are primarily concentrated in the innovation of safer handling technologies, development of next-generation, stable HI carriers, and penetrating the emerging energy sector as major hydrogen projects transition from pilot to commercial scale. The shift towards sustainable chemistry also offers opportunities for HI suppliers to collaborate on developing eco-friendlier synthesis routes for complex molecules. The primary impact forces affecting the market equilibrium are the volatility in global iodine prices, which directly influences production costs; technological breakthroughs in alternative, less corrosive reducing agents; and the speed of commercialization of the S-I cycle for hydrogen, which dictates a massive new demand pool for HI. Fluctuations in these forces directly influence market pricing and strategic investment decisions across the value chain, necessitating robust risk management strategies for market participants.

Specifically, the intense investment in alternative, non-corrosive hydrogen production technologies, such as advanced electrolysis, poses a long-term threat to the projected demand increase from the S-I cycle, constituting a major counter-impact force. However, the unique, catalytic role of HI in specific organic synthesis reactions ensures that its demand in specialty chemical and pharmaceutical sectors remains relatively inelastic to external energy market shifts. Successful mitigation of restraints, particularly through advanced material science leading to cheaper, corrosion-resistant production equipment, would substantially amplify the driving forces, unlocking significant growth potential in the global HI market.

Segmentation Analysis

The Hydrogeniodide market segmentation provides a granular view of demand distribution based on purity requirements, intended application, and the ultimate end-use industry. Segmentation by purity grade is critical, reflecting the vast differences in pricing and market requirements, with high-purity grades fetching significant premiums for use in sensitive electronic manufacturing, contrasted with lower purity aqueous solutions utilized in bulk chemical synthesis. The application segmentation delineates the market’s primary functions, showcasing the foundational role of HI as a strong reducing agent and acid catalyst, increasingly balanced by its emerging function as a key intermediate in sustainable energy systems like the Sulfur-Iodine cycle. Analyzing these segments is essential for manufacturers to align production capabilities with evolving high-growth sectors, ensuring that product specifications meet the stringent demands of specialized users.

The end-user segmentation clearly identifies the primary consumption centers, with chemical manufacturing remaining the largest volume consumer for traditional synthesis applications, including the formation of various iodides and pharmaceutical intermediates. However, the forecast period is marked by the accelerated proportional growth of the energy sector segment, driven by global hydrogen initiatives, and the sustained, high-value demand from the electronics sector for semiconductor processing. Understanding these segments allows suppliers to tailor their sales strategies, focusing marketing efforts and R&D investments toward the most lucrative and rapidly evolving industry sectors. Furthermore, purity requirements often dictate the selection of appropriate packaging and transportation methods, adding another layer of complexity to segment-specific logistics planning.

- By Purity Grade:

- 99.5% Purity Grade (Standard Industrial Grade)

- 99.9% Purity Grade (High Purity)

- >99.9% Purity Grade (Ultra-High Purity, Anhydrous)

- By Application:

- Reducing Agent

- Catalysis and Chemical Synthesis

- Pharmaceutical Intermediates (e.g., in stereoselective synthesis)

- Iodide Salt Production (e.g., Potassium Iodide)

- Energy Sector (Sulfur-Iodine Cycle for Hydrogen Production)

- Specialty Materials and Electronics

- By End-User:

- Chemical Manufacturing

- Pharmaceutical Industry

- Energy Sector

- Electronics Industry (Semiconductor and Display Manufacturing)

- Agriculture (Feed Additives and Pesticides)

Value Chain Analysis For Hydrogeniodide Market

The Hydrogeniodide market value chain begins with the critical upstream segment, which involves the mining or sourcing of raw iodine, primarily from underground brines or caliche ore deposits. This stage is dominated by a few large global producers, creating a significant dependency on the stability of the crude iodine supply chain and its associated price volatility. The synthesis of HI typically involves the reaction of iodine with hydrogen or phosphorus-based reduction methods. Given that HI production requires specialized, corrosion-resistant equipment (often glass-lined or high-nickel alloy reactors) and high energy input, the upstream phase dictates both the quality and baseline cost of the final product, emphasizing the importance of securing long-term, favorable contracts for raw material supply.

The midstream phase focuses on the purification, concentration, and formulation of HI into commercial products, ranging from concentrated hydroiodic acid solutions (typically 57%) to ultra-high purity anhydrous gas for sensitive electronic applications. This segment involves complex, specialized processing techniques to achieve the purity levels demanded by the electronics and pharmaceutical sectors. Distribution channels are highly specialized, utilizing dedicated transportation containers and carriers designed for hazardous materials (DOT Class 8 and 2.3), reflecting the dual challenge of acidity and toxicity. Direct distribution is common for ultra-high purity grades sold to major electronics or pharmaceutical manufacturers, ensuring minimal contamination risk and traceability.

Conversely, indirect distribution often utilizes specialized chemical distributors who manage warehousing and logistics for standard-grade HI to reach smaller or geographically dispersed chemical manufacturers and academic institutions. The downstream market consists of the end-users, where the product is consumed in highly regulated environments such as hydrogen generation facilities, specialty chemical plants, and pharmaceutical laboratories. The integration between upstream iodine sourcing and midstream processing efficiency is paramount, as logistical complexities and safety compliance requirements heavily influence the final cost structure and market accessibility of Hydrogeniodide.

Hydrogeniodide Market Potential Customers

Potential customers for Hydrogeniodide are predominantly high-volume industrial entities that require a powerful reducing agent, a strong acid catalyst, or a critical iodine source for complex synthesis reactions. The largest segment of buyers consists of major chemical manufacturing corporations that use HI as a primary feedstock in the large-scale production of various inorganic and organic iodides, including potassium iodide, ethyl iodide, and precursors for pesticides and other industrial chemicals. These customers prioritize bulk availability, competitive pricing, and certified purity grades, generally consuming the standard 57% aqueous solution grade.

Another significant customer base resides within the pharmaceutical and life sciences industries, where HI is utilized as a selective reagent in the synthesis of complex drug intermediates, particularly in hydroiodination reactions or for the preparation of certain contrast agents. These buyers demand extremely high-purity and well-documented grades (often 99.9%+) and are highly sensitive to batch consistency and regulatory compliance, making traceability and supplier reliability critical purchasing factors. The third, rapidly expanding segment comprises companies involved in emerging sustainable technologies, specifically those developing and commercializing the Sulfur-Iodine thermochemical cycle for large-scale, carbon-free hydrogen production, representing potential high-volume buyers of industrial-grade HI gas or concentrated acid.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor Inc., Thermo Fisher Scientific Inc., Alfa Aesar (a Thermo Fisher Scientific Brand), Sigma-Aldrich (a Merck subsidiary), FUJIFILM Wako Pure Chemical Corporation, Ise Chemicals Corporation, Deepwater Chemicals Inc., Adani Chemical Industries, Samrat Pharmachem Limited, Tokyo Chemical Industry Co., Ltd. (TCI), Kanto Chemical Co., Inc., American Elements, Central Glass Co., Ltd., BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogeniodide Market Key Technology Landscape

The technology landscape in the Hydrogeniodide market primarily revolves around advanced synthesis methodologies aimed at achieving ultra-high purity and novel handling solutions to mitigate corrosion and improve safety. Traditional HI production involves the direct reaction of hydrogen and iodine, often catalyzed, or alternative methods utilizing water and iodine with red phosphorus, necessitating precise temperature and pressure control. Recent technological focus has shifted significantly towards optimizing these synthesis routes, particularly developing continuous flow systems that enhance yield, reduce processing time, and minimize contamination risk, which is crucial for delivering grades suitable for semiconductor manufacturing where trace impurities can compromise device performance. Furthermore, proprietary scrubbing and purification technologies, such as advanced fractional distillation and selective adsorption techniques, are increasingly being employed to remove residual moisture, oxygen, and phosphorus compounds to meet the demanding specifications of the electronics sector (the >99.99% purity market).

A critical area of innovation involves the specialized handling and storage equipment, driven by the need to manage the corrosive properties of HI. This includes the development and adoption of new materials for reactor linings and storage tanks, such as fluoropolymers (e.g., PFA, PTFE) and high-nickel alloys (e.g., Hastelloy), which significantly extend the operational lifespan of equipment and reduce maintenance costs associated with corrosion damage. These material science advancements are vital for ensuring the integrity of the supply chain, especially when dealing with anhydrous HI gas, which is used in specialized chemical vapor deposition (CVD) and etching processes. The adoption of smart sensing technologies, including corrosion monitoring sensors integrated with IIoT platforms, provides real-time data on equipment health, contributing to operational safety and efficiency.

Looking ahead, the energy application segment is driving technological advancements related to the thermochemical processing of HI. Specifically, the high-temperature decomposition of HI gas (part of the S-I cycle) requires specialized reactor design capable of efficiently handling highly corrosive, high-temperature gas mixtures. Research focuses on optimizing heat exchanger materials and developing stable, high-efficiency catalysts to lower the necessary decomposition temperature, thereby reducing the overall energy intensity of the hydrogen production process. These technological improvements are essential not only for market growth but also for establishing HI as a viable cornerstone chemical in the future global hydrogen economy, demanding continuous collaboration between chemical engineers, materials scientists, and energy technology developers to overcome the substantial engineering challenges inherent in HI utilization.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Hydrogeniodide market, primarily due to its massive and rapidly expanding chemical manufacturing base, led by China and India. The region is a global hub for pharmaceutical synthesis and generic drug production, creating persistent high-volume demand for HI as a key intermediate and reducing agent. Furthermore, APAC is home to the world’s largest electronics manufacturing ecosystem, driving substantial demand for ultra-high-purity HI gas for etching processes in semiconductor and display manufacturing. Investments in domestic R&D and supportive government policies favoring specialty chemical production solidify APAC’s position as both the largest consumer and a crucial manufacturing center for HI and its derivatives.

- North America: North America represents a significant, high-value segment characterized by stringent quality standards and a strong focus on advanced materials and green energy solutions. Demand is driven by the mature pharmaceutical sector and advanced research into hydrogen economy technologies. The region, particularly the US, is investing heavily in pilot and commercial scale projects utilizing the Sulfur-Iodine cycle for hydrogen generation, positioning the energy sector as a major future consumption driver. The demand here focuses heavily on high-purity, low-impurity grades suitable for sensitive applications and adherence to strict environmental and safety regulations.

- Europe: Europe is characterized by slow but stable growth, anchored by robust specialty chemical manufacturers and stringent environmental regulations (e.g., REACH). The demand is concentrated in high-end pharmaceutical manufacturing and catalysis applications. European research institutions are heavily involved in optimizing HI use in sustainable chemistry and high-performance material synthesis. The regional market growth is supported by initiatives aimed at decarbonization, which encourages the exploration and eventual adoption of HI-dependent green hydrogen methods, offsetting the historically conservative growth profile of the region's established chemical industries.

- Latin America: This region holds a moderate share, driven primarily by localized chemical and agricultural industries. HI is utilized in the production of agricultural chemicals, including certain pesticides and feed additives. Market penetration is often dependent on foreign investment and technology transfer, and infrastructure limitations can pose challenges for the secure transportation and storage of hazardous HI, leading to a preference for locally produced or low-volume specialized imports.

- Middle East and Africa (MEA): The MEA market is the smallest but exhibits potential for growth, particularly linked to major energy diversification efforts in the Gulf Cooperation Council (GCC) countries. As these nations invest in advanced petrochemical manufacturing and sustainable energy projects (including future hydrogen hubs), the demand for core industrial chemicals like HI is expected to rise. Currently, demand is sporadic, relying heavily on imports for niche applications in local chemical processing and mining operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogeniodide Market.- Merck KGaA

- Avantor Inc.

- Thermo Fisher Scientific Inc.

- Alfa Aesar (a Thermo Fisher Scientific Brand)

- Sigma-Aldrich (a Merck subsidiary)

- FUJIFILM Wako Pure Chemical Corporation

- Ise Chemicals Corporation

- Deepwater Chemicals Inc.

- Adani Chemical Industries

- Samrat Pharmachem Limited

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Kanto Chemical Co., Inc.

- American Elements

- Central Glass Co., Ltd.

- BASF SE

- Hubei Zhenhua Chemical Co., Ltd.

- Finetech Industry Limited

- Jost Chemical Co.

- Solvay S.A.

- Nippon Chemical Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hydrogeniodide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary commercial applications of Hydrogeniodide (HI)?

The primary commercial applications of Hydrogeniodide include its use as a potent reducing agent and acid catalyst in chemical and pharmaceutical synthesis, its role in manufacturing various inorganic and organic iodide salts, and its critical function as an intermediate in the Sulfur-Iodine thermochemical cycle for large-scale hydrogen production.

How is the demand for ultra-high purity Hydrogeniodide being driven by the electronics sector?

The electronics sector, particularly semiconductor and display manufacturing, drives demand for ultra-high purity (>99.99%) anhydrous HI gas. It is essential for highly precise chemical vapor deposition (CVD) and etching processes where trace impurities must be strictly avoided to ensure the integrity and performance of electronic components.

What major challenges exist in the Hydrogeniodide supply chain?

Major challenges in the HI supply chain include the extreme corrosiveness and hazardous nature of the substance, necessitating high-cost, specialized infrastructure for production and transport. Additionally, the supply chain is sensitive to price volatility and stability in the upstream sourcing of raw iodine.

Which geographical region holds the largest market share for Hydrogeniodide and why?

The Asia Pacific (APAC) region currently holds the largest market share, driven by its extensive and rapidly growing chemical, pharmaceutical manufacturing, and electronics production industries, especially in major economies like China and India which require large volumes of chemical intermediates.

Is Hydrogeniodide essential for green hydrogen production, and what is its role?

Yes, Hydrogeniodide is essential for certain green hydrogen production methods. It is the core chemical intermediate that undergoes high-temperature decomposition in the Sulfur-Iodine (S-I) cycle, a thermochemical process designed to produce hydrogen without relying on fossil fuels or traditional electrolysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager