Hydrophobic Agent Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439664 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Hydrophobic Agent Market Size

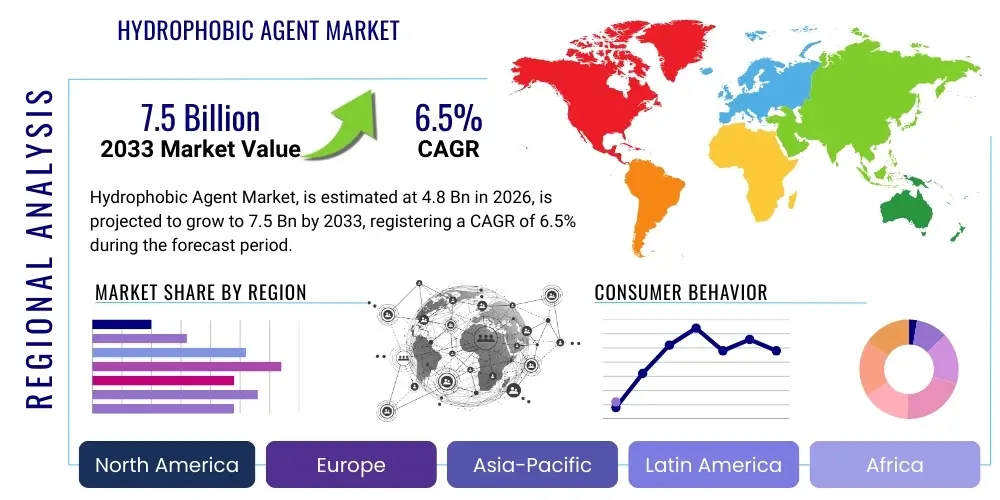

The Hydrophobic Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing demand across diverse industries, particularly in construction, textiles, and automotive sectors, driven by the need for enhanced material performance, durability, and resistance to environmental factors. The market expansion is further fueled by ongoing innovations in material science and the development of more effective and environmentally friendly hydrophobic solutions, addressing a broader spectrum of applications from water-repellent coatings to advanced electronics protection.

Hydrophobic Agent Market introduction

Hydrophobic agents are specialized chemical compounds designed to impart water-repellent properties to surfaces or materials, effectively minimizing water absorption and enhancing durability. These agents achieve their effect by altering the surface tension, causing water to bead up and roll off rather than spreading and penetrating. The primary types of hydrophobic agents include silicone-based, fluorocarbon-based, wax-based, and stearic acid-based compounds, each offering distinct performance characteristics suited for specific applications and environmental conditions. Their versatility makes them indispensable across a wide array of industries, providing critical protection against moisture-induced damage, degradation, and operational inefficiencies.

Major applications for hydrophobic agents span construction materials such as concrete, wood, and masonry, where they extend the lifespan of structures and prevent mildew growth. In the textile industry, they are crucial for producing water-resistant apparel and outdoor gear, enhancing comfort and functionality. The automotive sector utilizes these agents in coatings for vehicle bodies and interior components to improve durability and ease of cleaning, while the electronics industry employs them to protect sensitive components from moisture and corrosion. Furthermore, they find utility in packaging, personal care products, and medical devices, demonstrating their broad applicability in safeguarding materials and improving product performance against environmental adversaries. The benefits derived from incorporating hydrophobic agents are substantial, including improved material longevity, enhanced aesthetic appeal, reduced maintenance costs, and increased product safety and reliability.

Key driving factors for the hydrophobic agent market include rapid urbanization and infrastructure development globally, particularly in emerging economies, which escalate the demand for durable construction materials. The growing consumer preference for high-performance and long-lasting products, coupled with an increasing awareness regarding the importance of protective coatings in various end-use industries, further propels market expansion. Moreover, stringent regulatory standards concerning material longevity and performance, especially in automotive and construction sectors, mandate the integration of advanced protective solutions like hydrophobic agents. Continuous research and development initiatives focused on developing novel, eco-friendly, and cost-effective hydrophobic formulations are also significant catalysts for market growth.

Hydrophobic Agent Market Executive Summary

The Hydrophobic Agent Market is currently experiencing dynamic shifts driven by a confluence of evolving business trends, significant regional developments, and distinct segmental growth patterns. The global business landscape is increasingly focused on sustainability and efficiency, leading to a surge in demand for bio-based and environmentally benign hydrophobic solutions that align with green building initiatives and circular economy principles. Furthermore, technological advancements in nanotechnology and surface engineering are enabling the creation of superhydrophobic materials with enhanced performance characteristics, pushing the boundaries of traditional applications. Companies are also investing heavily in R&D to develop multi-functional agents that offer not only water repellency but also anti-corrosion, anti-fouling, or self-cleaning properties, catering to more complex industrial needs and expanding market potential. Strategic collaborations and partnerships between manufacturers and end-users are becoming more prevalent, fostering innovation and facilitating market penetration for specialized hydrophobic products.

Regional trends indicate that the Asia Pacific (APAC) region is poised for significant growth, primarily due to rapid industrialization, urbanization, and burgeoning construction activities in countries like China, India, and Southeast Asian nations. This robust economic expansion drives substantial demand for protective coatings and materials. North America and Europe, while mature markets, continue to innovate, particularly in advanced materials for automotive and aerospace, and are witnessing a shift towards stricter environmental regulations, accelerating the adoption of sustainable hydrophobic agents. Latin America and the Middle East & Africa (MEA) are also emerging as promising markets, buoyed by ongoing infrastructure projects, increasing industrial output, and rising disposable incomes contributing to heightened demand for consumer goods incorporating hydrophobic properties. These regional dynamics reflect a diverse demand landscape, influenced by economic development, regulatory frameworks, and technological readiness across different geographies.

Segment-wise, the market is demonstrating strong growth in specific areas. The construction sector remains a dominant segment, with continuous innovation in concrete admixtures, wood sealants, and façade coatings requiring advanced hydrophobic protection. The textile industry is also a significant contributor, driven by the increasing consumer demand for water-resistant and breathable fabrics in activewear, outdoor clothing, and technical textiles. In terms of product type, silicone-based hydrophobic agents continue to hold a substantial share due to their proven efficacy, durability, and cost-effectiveness, though fluorocarbon-based agents are gaining traction in high-performance applications despite environmental scrutiny. There is a discernible trend towards customized hydrophobic solutions tailored to specific material substrates and application methods, signifying a move towards niche market opportunities and specialized product development to meet unique industry requirements. These segmental trends underscore the diversified and specialized nature of the hydrophobic agent market, driven by specific industrial needs and technological advancements.

AI Impact Analysis on Hydrophobic Agent Market

Users frequently inquire about how artificial intelligence (AI) can revolutionize the development and application of hydrophobic agents, ranging from accelerated material discovery to optimized manufacturing processes and enhanced product performance. Common questions often revolve around AI's capability to predict molecular structures with desired hydrophobic properties, design novel formulations with improved efficiency and reduced environmental impact, and streamline complex synthesis routes. There is also significant interest in AI's role in real-time quality control, predictive maintenance of application equipment, and personalized material solutions. Users express expectations that AI will not only shorten development cycles and reduce costs but also lead to the creation of 'smart' hydrophobic surfaces that can adapt to changing environmental conditions or self-heal, thus opening entirely new avenues for product innovation and market growth.

- AI accelerates the discovery and design of novel hydrophobic molecules and formulations by simulating molecular interactions and predicting material properties, significantly reducing R&D timelines.

- Optimized synthesis pathways and manufacturing processes for hydrophobic agents through AI-driven predictive analytics, leading to higher yields, reduced waste, and lower production costs.

- Enhanced quality control and consistency in hydrophobic agent production by leveraging machine learning algorithms to monitor process parameters and detect anomalies in real-time.

- Development of 'smart' hydrophobic coatings and materials with adaptive functionalities, such as variable repellency or self-healing capabilities, through AI-driven material science.

- Personalized formulation and application recommendations for specific substrates and environmental conditions, improving efficacy and reducing material consumption through AI-powered predictive models.

- Improved supply chain management and logistics for hydrophobic agent raw materials and finished products, leading to greater efficiency and responsiveness to market demands.

- Facilitation of sustainable hydrophobic agent development by AI identifying eco-friendly raw materials and processes, aligning with stringent environmental regulations and consumer preferences.

DRO & Impact Forces Of Hydrophobic Agent Market

The Hydrophobic Agent Market is shaped by a complex interplay of internal and external forces, categorized as Drivers, Restraints, Opportunities, and Impact Forces (DRO & Impact Forces), which collectively dictate its growth trajectory and competitive landscape. A primary driver is the escalating demand for enhanced material protection and longevity across diverse end-use industries, particularly in construction, textiles, and automotive, where moisture damage can lead to significant economic losses and safety hazards. The increasing consumer awareness and preference for durable, low-maintenance, and aesthetically pleasing products further propel the adoption of hydrophobic solutions. Moreover, stringent regulatory frameworks enforcing higher performance standards and material sustainability in various sectors necessitate the integration of advanced protective agents, stimulating innovation and market expansion. The continuous evolution in material science, leading to the development of more effective and versatile hydrophobic formulations, also serves as a critical driver for market growth.

Conversely, the market faces several significant restraints that could impede its progress. The relatively high cost associated with advanced and specialized hydrophobic agents, especially fluorocarbon-based chemistries, can deter adoption in price-sensitive markets or applications where budget constraints are paramount. Additionally, growing environmental concerns and increasingly stringent regulations regarding the use of certain chemical compounds, particularly per- and polyfluoroalkyl substances (PFAS) found in some fluorocarbon agents, pose a significant challenge for manufacturers, necessitating investment in alternative, eco-friendly formulations. The availability of alternative surface modification techniques and competing waterproofing solutions, while not always offering the same level of performance, can also present competitive pressures and limit market penetration for hydrophobic agents. Furthermore, the technical complexities involved in ensuring uniform application and long-term efficacy of hydrophobic coatings can be a barrier for some end-users, requiring specialized expertise and equipment.

Despite these restraints, the market is rich with opportunities that promise substantial growth. The development and commercialization of bio-based and sustainable hydrophobic agents, driven by environmental consciousness and regulatory pushes, present a significant avenue for innovation and market differentiation. Expansion into emerging economies, characterized by rapid urbanization, industrialization, and infrastructure development, offers vast untapped potential for hydrophobic agent applications in construction, automotive, and consumer goods sectors. Moreover, the integration of hydrophobic properties into smart materials and advanced functional textiles, such as self-cleaning surfaces or smart fabrics that adapt to environmental conditions, represents a frontier for high-value applications. The continuous evolution of nanotechnology to create superhydrophobic surfaces with superior performance characteristics and durability also opens new market niches. These opportunities suggest a vibrant future for the market, contingent on strategic innovation and adaptation to evolving market demands.

Segmentation Analysis

The Hydrophobic Agent Market is comprehensively segmented to provide granular insights into its diverse components, allowing for a detailed understanding of market dynamics, consumer preferences, and growth opportunities across various product types, applications, and end-use industries. This segmentation facilitates strategic planning and targeted marketing efforts by identifying key areas of demand and competition. The market's intricate structure reflects the broad utility and specialized requirements of hydrophobic agents across a multitude of industrial and consumer sectors, each demanding tailored solutions to achieve optimal performance and durability against moisture-related challenges. The continuous innovation within each segment is pivotal for overall market expansion and the development of next-generation protective materials.

- By Type:

- Silicone-based Hydrophobic Agents: Widely used due to excellent water repellency, thermal stability, and durability. Applications range from construction to textiles and personal care.

- Fluorocarbon-based Hydrophobic Agents: Known for superior water and oil repellency, often used in high-performance textiles and industrial coatings, though facing regulatory scrutiny due to environmental concerns.

- Wax-based Hydrophobic Agents: Cost-effective and commonly employed in construction materials, wood treatments, and paper coatings for basic water resistance.

- Stearic Acid-based Hydrophobic Agents: Utilized primarily in concrete and masonry applications, providing water repellency by forming insoluble soaps with calcium ions.

- Others (e.g., Polyurethane-based, Acrylate-based): Encompasses emerging and specialized chemistries offering specific benefits like enhanced flexibility, adhesion, or environmental profiles for niche applications.

- By Application:

- Construction: Including admixtures for concrete, sealants for wood and masonry, façade coatings, and tile grouts to prevent water ingress and improve structural integrity.

- Textiles & Leather: For manufacturing water-resistant clothing, outdoor gear, upholstery, and footwear, enhancing comfort and longevity.

- Automotive: Utilized in protective coatings for vehicle bodies, interior components, and glass treatments to improve durability, aesthetics, and ease of cleaning.

- Electronics: Crucial for protecting sensitive electronic components, circuit boards, and devices from moisture, humidity, and corrosion, ensuring reliability.

- Medical & Healthcare: Applications in medical devices, wound dressings, and laboratory equipment where water repellency and hygiene are critical.

- Packaging: In food packaging, industrial packaging, and protective films to prevent moisture damage to contents and extend shelf life.

- Personal Care & Cosmetics: Used in sunscreens, makeup, and hair care products to provide water resistance and improve product performance.

- Others: Includes applications in agriculture (e.g., anti-caking agents), oil & gas (e.g., pipeline coatings), and various industrial processes.

- By End-Use Industry:

- Building & Construction: The largest end-use segment, driven by global infrastructure development and the need for durable, low-maintenance structures.

- Textile & Leather: Growing demand for high-performance and functional fabrics in sports, outdoor, and protective wear.

- Automotive & Transportation: Focus on lightweight, durable, and protective materials for vehicle manufacturing and maintenance.

- Personal Care: Driven by consumer demand for water-resistant and long-lasting cosmetic and hygiene products.

- Electrical & Electronics: Essential for protecting increasingly miniaturized and sensitive electronic components from environmental factors.

- Healthcare: Applications in sterile environments and medical devices requiring advanced moisture protection and biocompatibility.

- Food & Beverage Packaging: Crucial for preserving food quality and extending shelf life by protecting against moisture.

- Industrial: Diverse applications across various manufacturing and processing industries requiring specialized protective coatings and treatments.

Value Chain Analysis For Hydrophobic Agent Market

The value chain for the Hydrophobic Agent Market is a sophisticated network encompassing raw material sourcing, manufacturing, distribution, and end-user application, with each stage adding significant value and contributing to the final product's efficacy and market reach. Upstream analysis reveals a reliance on key chemical precursors and specialized raw materials such as silicones, fluoropolymers, waxes, and fatty acids, which are primarily sourced from petrochemical companies and specialty chemical suppliers. The quality, availability, and cost fluctuations of these raw materials directly impact the manufacturing efficiency and pricing strategies of hydrophobic agent producers. Research and development activities, including material synthesis and formulation optimization, form a critical part of the upstream segment, driving innovation and differentiation in product offerings. Manufacturers of hydrophobic agents transform these raw materials into various forms, including liquids, powders, emulsions, and dispersions, tailored for specific applications. This stage involves complex chemical processes, stringent quality control, and significant capital investment in production facilities. The technical expertise in formulating these agents to achieve desired performance characteristics, such as contact angle, durability, and adhesion to different substrates, is a core value-adding component at this stage.

The downstream analysis focuses on the integration of these agents into final products across diverse industries. This includes the direct incorporation of hydrophobic agents into building materials during manufacturing, their application as coatings or treatments on textiles and leather, or their use as additives in personal care and electronic formulations. This stage often involves collaboration between hydrophobic agent manufacturers and end-product producers to ensure compatibility and optimal performance. The effectiveness of the hydrophobic agent is ultimately validated at the downstream level through real-world application and user feedback, which then informs further R&D and product refinement. The distribution channel for hydrophobic agents is multi-faceted, involving both direct and indirect sales approaches. Direct sales are common for large-volume industrial clients, particularly in the construction and automotive sectors, where technical support and customized solutions are paramount. This often involves direct engagement between the manufacturer's sales team and the end-user, facilitating deeper technical discussions and tailored product offerings. Direct channels allow for greater control over customer relationships and responsiveness to specific needs, ensuring that complex formulations are correctly understood and applied.

Indirect distribution channels typically involve a network of distributors, wholesalers, and specialized chemical retailers who serve smaller businesses or provide regional market access. These intermediaries play a crucial role in market penetration, inventory management, and providing localized technical support. They help bridge the gap between manufacturers and a diverse customer base, particularly in fragmented markets. The choice between direct and indirect channels is often dictated by factors such as market size, geographical reach, product complexity, and customer relationship requirements. The efficiency of these distribution networks is critical for ensuring timely delivery and widespread availability of hydrophobic agents. Both direct and indirect channels contribute to maximizing market coverage, with effective logistical support and a strong sales force being essential for competitive advantage in the Hydrophobic Agent Market.

Hydrophobic Agent Market Potential Customers

The potential customers for hydrophobic agents are incredibly diverse, spanning numerous industries that prioritize material protection, durability, and performance against moisture. At the forefront are end-users within the building and construction sector, including concrete manufacturers, construction chemical formulators, architectural coatings producers, and wood treatment companies. These customers utilize hydrophobic agents to enhance the longevity of structures, prevent water penetration in facades, improve insulation properties, and protect timber from rot and decay. The demand from this segment is consistently high due to ongoing global urbanization, infrastructure development projects, and the need for resilient building materials that can withstand various climatic conditions. Furthermore, property owners and maintenance companies represent a significant customer base for aftermarket applications, seeking solutions to prolong the life of existing structures and reduce maintenance costs associated with moisture damage.

Another substantial customer segment comprises manufacturers in the textile and leather industries. Apparel brands, sportswear companies, outdoor gear producers, and automotive interior suppliers are keen buyers of hydrophobic agents to impart water-repellent and stain-resistant properties to their fabrics and leather products. This enables the creation of high-performance clothing, technical textiles, and durable upholstery that cater to consumer demands for comfort, functionality, and longevity. The automotive industry itself, including vehicle manufacturers and aftermarket suppliers of coatings and sealants, represents a key customer group. They utilize hydrophobic agents in exterior paints, interior surfaces, and glass treatments to improve aesthetics, enhance vehicle durability, facilitate cleaning, and ensure safety by improving visibility in adverse weather conditions. The electronics sector, with its need for protecting sensitive components from humidity and water damage, also includes a growing number of potential customers, such as manufacturers of printed circuit boards, smartphones, and various electronic devices.

Beyond these major sectors, the market extends to personal care and cosmetics companies, who incorporate hydrophobic agents into products like sunscreens, makeup, and hair sprays for water resistance. Healthcare and medical device manufacturers use these agents for creating sterile, moisture-resistant surfaces and components. The packaging industry is another vital customer base, applying hydrophobic treatments to paper, cardboard, and plastic films to protect goods from moisture during storage and transit. Lastly, agricultural chemical producers and specialized industrial manufacturers also procure hydrophobic agents for applications ranging from anti-caking agents in fertilizers to protective coatings for industrial equipment. This wide spectrum of potential customers underscores the indispensable role of hydrophobic agents in enhancing product quality, extending service life, and improving performance across a myriad of everyday and specialized applications, reflecting a broad and robust demand landscape for these specialized chemicals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Wacker Chemie AG, BASF SE, Dow Inc., Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Elkem ASA, Nouryon, Croda International Plc, Ashland Global Holdings Inc., Arkema S.A., Clariant AG, Huntsman Corporation, Cabot Corporation, Imerys S.A., Sartomer (Arkema Group), Gelest Inc. (Mitsubishi Chemical Group), BYK-Chemie GmbH (Altana AG), Lubrizol Corporation (Berkshire Hathaway), Sika AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrophobic Agent Market Key Technology Landscape

The Hydrophobic Agent Market is characterized by a dynamic and evolving technological landscape, driven by continuous innovation aimed at enhancing performance, durability, and environmental sustainability. A pivotal technological area involves advanced material science, particularly in the development of nanotechnology-based hydrophobic agents. Nanoparticles, such as silica or titanium dioxide, are engineered to create intricate surface topologies that mimic the lotus effect, resulting in superhydrophobic properties with contact angles exceeding 150 degrees. This approach allows for the creation of surfaces that not only repel water but also exhibit self-cleaning characteristics, significantly reducing maintenance requirements in applications ranging from automotive coatings to architectural facades. The precise control over nanoscale structures enables a new generation of high-performance, ultra-durable hydrophobic solutions that were previously unattainable with conventional chemistries. Furthermore, advancements in polymer science are leading to the development of novel polymeric materials that inherently possess hydrophobic properties or can be easily modified to achieve them, offering greater flexibility in formulation and application.

Another crucial technological trend revolves around the shift towards eco-friendly and bio-based hydrophobic solutions. With increasing environmental regulations and consumer demand for sustainable products, significant R&D efforts are focused on replacing traditional fluorocarbon-based agents with alternative chemistries that are biodegradable, non-toxic, and derived from renewable resources. This includes the exploration of natural waxes, modified polysaccharides, and other bio-polymers that can impart effective water repellency without adverse environmental impacts. The development of fluorine-free hydrophobic agents (C0, C4, C6 technologies) is a prime example of this technological shift, driven by legislative pressures like those targeting PFAS compounds. These new generations of agents aim to provide comparable performance to their conventional counterparts while adhering to stringent environmental standards, which is a major technological challenge requiring innovative synthetic routes and formulation expertise. The emphasis on sustainability is not merely about raw materials but also extends to energy-efficient manufacturing processes and the entire lifecycle assessment of hydrophobic products.

Furthermore, application technologies are also seeing significant advancements, facilitating the more efficient and effective deployment of hydrophobic agents. This includes the development of advanced spraying systems, coating techniques (e.g., plasma deposition, chemical vapor deposition, sol-gel processes), and impregnation methods that ensure uniform coverage and optimal adhesion on diverse substrates. For instance, the advent of self-healing hydrophobic coatings, where the material can autonomously repair minor damages to maintain its water-repellent properties, represents a significant technological leap. Smart application methods, potentially integrating AI and robotics, are being explored to ensure precision and consistency, especially in large-scale industrial settings. The focus is also on developing multi-functional coatings that offer not just hydrophobicity but also anti-corrosion, anti-microbial, or UV-protective properties, leveraging synergistic effects from various chemical components. This holistic approach to surface modification, combining material innovation with advanced application techniques, defines the current cutting edge of the hydrophobic agent market's technology landscape.

Regional Highlights

- North America: This region is characterized by high adoption rates of advanced hydrophobic agents, especially in the construction, automotive, and personal care industries. Driven by stringent quality standards, technological innovation, and a strong emphasis on product durability and performance, North America continues to be a significant market. The demand for sustainable and fluorine-free hydrophobic solutions is also gaining traction, propelled by environmental awareness and regulatory pressures.

- Europe: Europe represents a mature market with a strong focus on environmental sustainability, driving the demand for bio-based and eco-friendly hydrophobic agents. The automotive and textile industries, particularly in countries like Germany and Italy, are major consumers. Strict regulations regarding chemical usage and a high level of consumer environmental consciousness significantly influence product development and market trends.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for hydrophobic agents, fueled by rapid urbanization, industrialization, and significant infrastructure development in emerging economies such as China, India, and Southeast Asian countries. The booming construction, automotive, and electronics manufacturing sectors are key drivers, alongside an increasing disposable income leading to higher demand for performance-enhanced consumer goods.

- Latin America: This region is experiencing steady growth in the hydrophobic agent market, primarily due to expanding construction activities and a developing manufacturing sector. Countries like Brazil and Mexico are leading the demand, with increasing investments in infrastructure and a growing awareness of protective material benefits. The market here is also influenced by economic stability and trade policies affecting raw material imports.

- Middle East and Africa (MEA): The MEA region shows promising growth potential, particularly with large-scale infrastructure projects, diversification efforts away from oil economies, and rising industrial output. The construction sector, driven by mega-projects in the UAE and Saudi Arabia, along with a growing automotive market in South Africa, are key contributors to the demand for hydrophobic agents in enhancing material durability and resilience in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrophobic Agent Market.- Evonik Industries AG

- Wacker Chemie AG

- BASF SE

- Dow Inc.

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA

- Nouryon

- Croda International Plc

- Ashland Global Holdings Inc.

- Arkema S.A.

- Clariant AG

- Huntsman Corporation

- Cabot Corporation

- Imerys S.A.

- Sartomer (Arkema Group)

- Gelest Inc. (Mitsubishi Chemical Group)

- BYK-Chemie GmbH (Altana AG)

- Lubrizol Corporation (Berkshire Hathaway)

- Sika AG

Frequently Asked Questions

Analyze common user questions about the Hydrophobic Agent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a hydrophobic agent and how does it work?

A hydrophobic agent is a substance designed to repel water from surfaces by reducing surface energy and increasing the contact angle of water droplets. It works by creating a non-polar, low-surface-tension barrier at the material's surface, causing water to bead up and roll off rather than penetrate, thereby preventing moisture absorption and enhancing durability.

What are the main applications of hydrophobic agents?

Hydrophobic agents are widely used across various industries, including construction (for concrete, wood, masonry), textiles (waterproof fabrics), automotive (vehicle coatings, glass treatments), electronics (component protection), personal care (water-resistant cosmetics), and packaging (moisture barrier films). Their primary function is to impart water repellency and enhance material longevity.

What are the different types of hydrophobic agents available in the market?

Key types include silicone-based agents (known for durability and versatility), fluorocarbon-based agents (offering high performance, but facing environmental scrutiny), wax-based agents (cost-effective for basic water resistance), and stearic acid-based agents (common in masonry). Other emerging types include polyurethane-based and acrylate-based chemistries for specialized applications.

What factors are driving the growth of the hydrophobic agent market?

Market growth is primarily driven by increasing demand for enhanced material protection and durability in construction, textiles, and automotive sectors. Other significant drivers include rapid urbanization, stringent regulatory standards for material performance, and continuous advancements in material science leading to more effective and sustainable hydrophobic solutions.

What are the environmental considerations for hydrophobic agents?

Environmental concerns primarily revolve around fluorocarbon-based agents, specifically PFAS compounds, due to their persistence in the environment. This has led to a significant industry shift towards developing and adopting eco-friendly, bio-based, and fluorine-free (PFOA/PFOS-free) hydrophobic alternatives to meet regulatory demands and consumer preferences for sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager