Hydrostatic Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438770 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Hydrostatic Testing Market Size

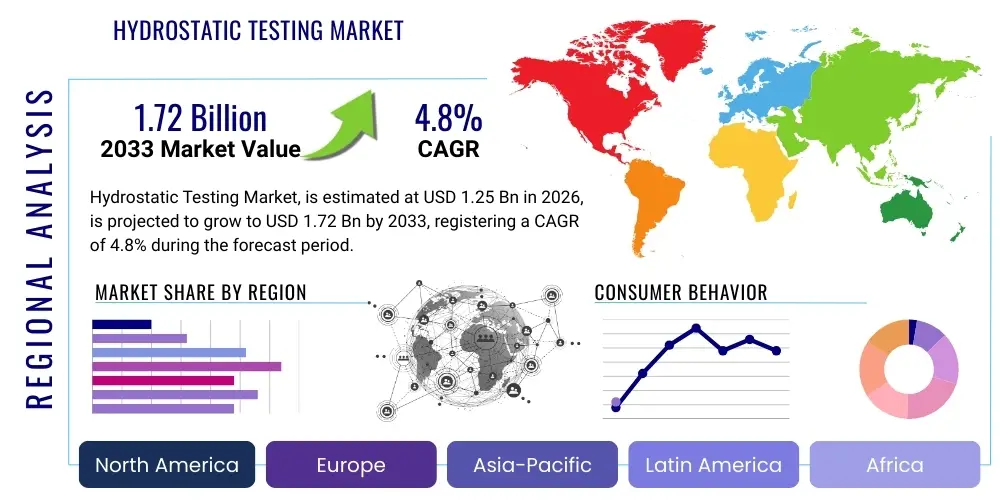

The Hydrostatic Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.72 Billion by the end of the forecast period in 2033.

Hydrostatic Testing Market introduction

Hydrostatic testing is a crucial Non-Destructive Testing (NDT) method used globally to ensure the structural integrity, leak tightness, and safety of pressure vessels, pipelines, boilers, and storage tanks. This process involves filling the component with an incompressible liquid, typically water, and pressurizing the system to a specified test pressure, which is usually 1.5 times the design pressure. The primary objective is to verify that the vessel or piping system can safely hold the required pressure without material failure or unacceptable leakage, thus complying with rigorous industry standards and regulatory requirements set by bodies such as ASME, API, and ISO.

The major applications of hydrostatic testing span high-stakes sectors, including oil and gas, chemical processing, power generation, and specialized manufacturing. In the energy sector, it is indispensable for commissioning new pipelines, requalifying existing infrastructure, and ensuring the safety of offshore drilling equipment. The inherent benefits of hydrostatic testing include providing a definitive pressure strength measurement, identifying latent manufacturing defects, and offering an economical, scalable method for large-scale infrastructure integrity assessment compared to alternative methods like pneumatic testing, which carries higher inherent risks.

Key driving factors accelerating the market growth include stringent global safety regulations mandating periodic requalification of aging industrial assets, particularly in the midstream oil and gas sector. Furthermore, the rapid expansion of complex pipeline networks and the increasing investment in high-pressure liquefied natural gas (LNG) terminals necessitate robust integrity verification processes. The adoption of advanced data acquisition systems and automated pressure logging equipment further enhances the efficiency and reliability of hydrostatic testing services, driving sustained demand across industrialized and developing economies seeking to minimize operational risks.

Hydrostatic Testing Market Executive Summary

The global Hydrostatic Testing Market is characterized by robust growth, primarily driven by mandatory safety regulations and the need for rigorous integrity management across critical infrastructure. Business trends indicate a strong move towards automated testing equipment featuring real-time data monitoring and digital reporting capabilities, enhancing accuracy and reducing test cycle times. Strategic partnerships between NDT service providers and large asset owners (like pipeline operators and chemical manufacturers) are becoming prevalent, focusing on long-term maintenance contracts that ensure predictive requalification schedules, thus stabilizing market demand and fostering competitive differentiation based on technological expertise.

Regionally, North America and Europe currently dominate the market due to extensive aging infrastructure, mature regulatory frameworks, and high operational safety standards in the oil, gas, and petrochemical industries. However, the Asia Pacific region is projected to exhibit the fastest growth, fueled by massive industrialization, burgeoning energy demand, and significant investments in new refinery expansions and cross-country pipeline projects, particularly in China and India. Middle East and Africa (MEA) also show substantial growth potential, driven by capacity expansion in crude oil production and the subsequent construction of storage and transportation facilities requiring comprehensive pressure verification.

Segment trends reveal that the pipeline testing segment holds the largest market share, directly linked to new infrastructure buildouts and the maintenance of existing vast networks. In terms of components, pressure vessels and reactors in the chemical and power sectors are high-value targets for hydrostatic testing, requiring specialized equipment calibrated for high-pressure applications. Furthermore, there is a noticeable shift in end-user preference toward utilizing advanced testing techniques that incorporate Volumetric Expansion Measurement (VEM) alongside traditional methods, enabling more precise defect detection and localization, thereby minimizing asset downtime and optimizing maintenance schedules.

AI Impact Analysis on Hydrostatic Testing Market

Common user questions regarding AI's influence on the Hydrostatic Testing Market often revolve around how AI can enhance test reliability, reduce human error, and integrate the massive datasets generated during pressurized assessments. Users are keen to understand if AI can predict potential failure points before testing commences, optimize pressure cycles, and automate the interpretation of complex sensor data, thereby moving testing from a purely reactive measure to a predictive integrity management tool. A key concern is the reliability of AI algorithms in compliance-critical environments and the regulatory acceptance of AI-driven recommendations in highly scrutinized industries like nuclear power and petrochemicals. The overarching expectation is that AI will streamline the post-test analysis and reporting phase, making the entire process faster, safer, and more data-driven.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the hydrostatic testing domain is primarily focused on data analytics and predictive maintenance. AI algorithms are being trained on historical test data, correlating pressure decay curves, temperature fluctuations, and material specifications with known failure modes. This allows service providers to identify anomalies or subtle deviations during the test procedure that human operators might overlook, significantly boosting the accuracy of integrity assessments. Moreover, AI can optimize testing parameters—such as the required hold time and target pressure ramp-up rate—based on real-time material condition assessment, ensuring compliance while minimizing undue stress on aging assets.

Furthermore, AI plays a pivotal role in the automation of reporting and compliance documentation. Post-test, specialized ML models can automatically analyze the volumetric expansion data, pressure logs, and environmental factors, generating detailed, auditable reports that meet stringent industry regulations. This automation drastically reduces the manual effort and time spent on documentation, allowing engineers to focus on interpreting critical insights rather than compiling raw data. The future impact lies in combining AI-driven integrity models with other NDT methods (like ultrasonic testing) to create comprehensive digital twins of assets, enabling highly personalized and condition-based requalification strategies that move beyond standardized, time-based hydrostatic test intervals.

- AI-powered predictive modeling identifies optimal test pressure and hold times, minimizing material stress.

- Machine learning enhances the accuracy of leak detection by analyzing subtle pressure drops and sensor noise patterns.

- Automation of post-test data analysis and report generation ensures rapid compliance and minimizes human error in documentation.

- Integration of AI with real-time monitoring systems provides instantaneous alerts for anomalous volumetric expansion during testing.

- AI facilitates the creation of digital asset twins by combining hydrostatic test results with material fatigue models.

DRO & Impact Forces Of Hydrostatic Testing Market

The Hydrostatic Testing Market is propelled by mandatory regulatory frameworks and heightened focus on industrial safety (Drivers), while facing challenges related to environmental concerns regarding water usage and the logistical complexities of testing large infrastructure (Restraints). Opportunities lie in technological advancements, particularly automation and the integration of specialized testing chemicals, and the increasing demand for high-pressure testing in emerging energy sectors like hydrogen transport. These dynamics are significantly influenced by the impact forces stemming from regulatory stringency and global infrastructure investment cycles, which dictate the frequency and scale of testing required across industries.

Drivers: Key market drivers include the global push for stricter safety and environmental standards, particularly following high-profile industrial incidents, which mandate periodic requalification of pressure equipment. The rapid global expansion of pipeline infrastructure, both for oil/gas and water distribution, requires initial commissioning tests. Furthermore, the aging infrastructure in mature economies like the US and Europe necessitates substantial investment in integrity maintenance and requalification to extend the operational life of existing assets safely.

Restraints: Major restraints involve the significant operational downtime required for hydrostatic testing, which can be expensive for asset owners. Logistical challenges associated with accessing remote pipeline sections, managing large volumes of test water, and the subsequent disposal of that water (which may contain residues or testing chemicals) also hinder market acceleration. Additionally, the increasing adoption of alternative, less disruptive NDT methods, such as advanced ultrasonic testing (AUT) or acoustic emission testing (AET), poses competitive pressure, especially for internal inspection needs.

Opportunities: Significant market opportunities exist in the development of automated, smaller-footprint testing equipment that reduces water consumption and improves portability. The nascent but growing hydrogen economy and Carbon Capture and Storage (CCS) projects offer new applications requiring ultra-high pressure testing protocols. Furthermore, integrating smart sensor technology and Internet of Things (IoT) connectivity into testing equipment allows for remote monitoring and enhanced data fidelity, appealing to large, geographically dispersed asset operators. The development of specialized corrosion-inhibited testing liquids also presents an opportunity to address environmental concerns and extend equipment service life.

Impact Forces: The market’s trajectory is heavily influenced by the oscillating global prices of oil and gas; high energy prices spur infrastructure investment and capacity expansion, increasing testing demand, while prolonged low prices can lead to deferred maintenance schedules. Regulatory enforcement remains the most critical impact force, as compliance mandates dictate the volume and necessity of testing irrespective of economic conditions. Finally, technological substitution risk from non-invasive NDT techniques constantly pressures service providers to enhance the efficiency and supplementary data output of traditional hydrostatic methods.

Segmentation Analysis

The Hydrostatic Testing Market is systematically segmented based on the component being tested, the primary application industry, and the specific testing technique employed. This detailed segmentation allows market participants to tailor their service offerings and equipment manufacturing capabilities toward high-demand sectors. The Component segmentation, covering pipelines, pressure vessels, and boilers, is crucial because each component type requires specialized testing rigs, safety procedures, and pressure tolerances. For instance, pipeline testing often involves large-scale logistical operations and high-volume water management, while pressure vessel testing focuses on structural integrity under static load.

The Application segmentation distinguishes demand sources, with the Oil & Gas sector being the perennial leader due to its inherently high-risk, high-pressure operations and stringent regulatory requirements for both upstream and midstream assets. The Chemical and Manufacturing industries, driven by process safety and quality control, form the secondary demand base. Understanding these applications helps in forecasting regional growth, as regions with high levels of petrochemical processing (like the Gulf Coast or the Middle East) exhibit higher demand intensity for hydrostatic integrity services.

Furthermore, segmentation by Technique highlights the evolution of the market. While traditional Pressure Leak Testing (PLT) remains standard, the growing adoption of sophisticated methods like Volumetric Expansion Measurement (VEM) indicates a shift toward more accurate, quantitative, and data-rich assessments. VEM provides quantifiable data on the elastic and permanent deformation of the vessel, offering deeper insights into the material’s condition and residual lifespan, a capability highly valued by risk-averse end-users seeking predictive integrity management solutions.

- By Component:

- Pipelines (Oil, Gas, Water, Slurry)

- Pressure Vessels and Tanks

- Boilers and Heat Exchangers

- Valves and Fittings

- Hoses and Piping Systems

- By Application:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical Processing

- Power Generation (Thermal, Nuclear, Renewable)

- Manufacturing and Fabrication

- Water and Wastewater Infrastructure

- Aerospace and Defense

- By Technique:

- Pressure Leak Testing (PLT)

- Volumetric Expansion Measurement (VEM)

- Differential Pressure Testing

Value Chain Analysis For Hydrostatic Testing Market

The value chain for the Hydrostatic Testing Market begins with the upstream suppliers responsible for manufacturing and supplying the specialized equipment necessary for the process. This includes high-pressure pumps, gauges, recorders, flow meters, sensors, and large-capacity water storage and purification systems. The quality and calibration of this upstream equipment are critical, as they directly impact the reliability and regulatory acceptance of the final test results. Key relationships at this stage involve equipment manufacturers and NDT service providers, often requiring customized solutions based on the specific pressure and volume requirements of client assets.

The core of the value chain is occupied by the service providers who perform the hydrostatic tests. These firms possess the specialized technical expertise, certification (e.g., ASNT, ISO compliance), and logistical capabilities to execute tests on-site. Their activities encompass planning (developing the test procedure, calculating required pressure), execution (filling, pressurizing, holding, and depressurizing), data acquisition (recording pressure and temperature logs), and post-test reporting and analysis. Differentiation among service providers is achieved through advanced technical capabilities, rapid response times, adherence to complex safety standards, and the integration of digital data management platforms. Direct service delivery often occurs through long-term maintenance contracts with major industrial asset owners.

The downstream component involves the end-users—the asset owners and operators in the oil and gas, chemical, and power sectors—who purchase the testing services to ensure operational safety and regulatory compliance. The distribution channel predominantly relies on a direct model, where service providers interact directly with asset integrity managers. For specialized or complex projects, indirect channels may involve engineering, procurement, and construction (EPC) firms that subcontract the hydrostatic testing as part of a larger project commissioning phase. The final step involves regulatory bodies and insurance companies, who rely on the certified test reports to determine asset fitness for service, completing the regulatory and financial validation loop of the value chain.

Hydrostatic Testing Market Potential Customers

The primary customers for hydrostatic testing services are large-scale industrial asset owners who operate infrastructure subject to high internal pressures and mandatory safety inspections. These customers span multiple high-hazard industries where failure could result in catastrophic consequences, including environmental damage, loss of life, and significant financial loss. The largest segment of buyers consists of national and international oil and gas companies (NOCs and IOCs), pipeline transmission operators (midstream sector), and petrochemical refining complexes, which require initial commissioning tests for new installations and routine requalification for their extensive network of pipelines, storage tanks, and reactors.

A secondary, yet crucial, group of potential customers includes utility companies and power generation operators, particularly those managing thermal power plants, nuclear facilities, and large-scale district heating systems. Boilers, heat exchangers, and primary circuit piping in these facilities must undergo rigorous hydrostatic testing to prevent potentially dangerous failures due to creep or fatigue. These customers value reliability and detailed, traceable compliance documentation, often selecting service providers based on their safety record and technological sophistication in managing high-temperature and high-pressure assets.

Furthermore, original equipment manufacturers (OEMs) and specialized fabrication shops that produce pressure equipment (such as industrial vessels, specialized valves, and custom piping spools) are also significant buyers. They utilize hydrostatic testing as a crucial quality assurance step before delivering the product to the final end-user, ensuring that the manufactured components meet specified design codes (e.g., ASME Boiler and Pressure Vessel Code). These customers typically require precise, standardized testing procedures integrated into their manufacturing workflow, often favoring in-house testing capabilities or localized, highly accredited testing laboratories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.72 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Intertek Group plc, MISTRAS Group Inc., Applus Services SA, Baker Hughes Company, TUV SUD AG, Rosen Group, NTS Testing, Piezospectra, Hydratight (Actuant Corporation), Exova Group, Bureau Veritas, DNV GL, TEAM Industrial Services, Fugro, GE Inspection Services, Shawcor Ltd., Acuren, TTI Testing Laboratories, Inc., Test Equipment Distributors, LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrostatic Testing Market Key Technology Landscape

The technology landscape in the hydrostatic testing market is undergoing modernization, moving away from purely mechanical systems toward digitally integrated, automated solutions. The core technology centers around high-pressure generation and precise pressure measurement. Advanced systems now utilize sophisticated servo-driven pumps and hydraulic intensifiers to achieve extremely high pressures (often exceeding 30,000 psi for specialized components) with fine control over the pressure ramp rate, minimizing transient stresses. Calibration standards, often traceable to national metrology institutes, are crucial, driving the adoption of high-accuracy digital pressure transducers (DPTs) over traditional analog gauges, ensuring minimal measurement uncertainty.

A significant technological advancement involves the integration of data acquisition and logging systems. Modern hydrostatic testing rigs are equipped with integrated software that captures pressure, temperature, and time data in real-time, providing a continuous, immutable record of the test cycle. This digital data logging is essential for regulatory compliance and audit trails. Furthermore, specialized testing techniques such as Volumetric Expansion Measurement (VEM) rely on highly sensitive volume measurement systems, often incorporating precise burettes or electronic displacement sensors, to quantify the permanent set of the vessel wall, thereby providing quantitative data on structural integrity beyond simple pass/fail leak detection.

The future of the technology landscape is characterized by enhanced mobility, automation, and connectivity (IoT). Portable, trailer-mounted hydrostatic testing units are being developed for faster deployment to remote locations, especially critical for pipeline maintenance. Moreover, wireless sensor networks are increasingly used to monitor conditions (such as ambient temperature, water temperature, and localized strain) across the large surface area of the asset being tested. This connectivity allows remote monitoring of the entire testing process, increasing efficiency and reducing the need for personnel in high-risk zones. The convergence of these hardware improvements with AI-driven analytics represents the cutting edge of integrity verification technology.

Regional Highlights

- North America: North America holds a dominant share in the hydrostatic testing market, primarily driven by the expansive midstream pipeline network—including crude oil, natural gas, and refined product pipelines—which requires continuous integrity maintenance. Stringent regulatory mandates from agencies such as the Pipeline and Hazardous Materials Safety Administration (PHMSA) in the U.S. enforce periodic hydrostatic requalification, particularly for older segments built before stricter modern codes were implemented. The region's maturity in adopting advanced NDT technologies and its substantial investment in shale gas infrastructure contribute heavily to sustained market demand.

- Europe: Europe represents a mature market characterized by very high safety standards and a strong focus on asset life extension, especially in the chemical and nuclear sectors. Regulatory frameworks like the Pressure Equipment Directive (PED) necessitate rigorous testing and certification. While new pipeline construction is relatively slow compared to APAC, the massive existing infrastructure for natural gas transportation and storage (including underground storage facilities) requires frequent and complex hydrostatic assessments. The demand here is driven more by scheduled, preventative maintenance and compliance rather than new projects.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid industrialization, massive investments in refinery expansion, and the development of new cross-border pipeline networks, notably the Belt and Road Initiative-related infrastructure. Countries like China, India, and Southeast Asian nations are significantly increasing their energy consumption and associated processing capacity. This growth trajectory is focused heavily on commissioning tests for newly constructed assets, leading to high-volume demand for hydrostatic testing services, often driven by government-backed infrastructure projects.

- Middle East and Africa (MEA): The MEA region is critical due to its role as the global hub for crude oil and gas production. Market demand is highly concentrated in Saudi Arabia, UAE, and Qatar, driven by sustained capacity expansion projects in upstream and downstream processing. The extreme operating conditions and the strategic importance of oil and gas exports necessitate the highest safety standards, making mandatory initial and periodic hydrostatic testing a core operational requirement. Investment in large LNG terminals and associated high-pressure transfer lines further boosts market requirements.

- Latin America: The market in Latin America is characterized by cyclical investment patterns, closely tied to fluctuating commodity prices. Major demand generators include Brazil (Petrobras operations), Mexico (Pemex infrastructure modernization), and Colombia. While regulatory frameworks are developing, the sheer volume of new deepwater offshore projects and the need to replace or rehabilitate aging, often poorly maintained, legacy pipelines provide significant opportunities for specialized hydrostatic service providers capable of operating in challenging geographical terrains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrostatic Testing Market.- SGS SA

- Intertek Group plc

- MISTRAS Group Inc.

- Applus Services SA

- Baker Hughes Company

- TUV SUD AG

- Rosen Group

- NTS Testing

- Piezospectra

- Hydratight (Actuant Corporation)

- Exova Group

- Bureau Veritas

- DNV GL

- TEAM Industrial Services

- Fugro

- GE Inspection Services

- Shawcor Ltd.

- Acuren

- TTI Testing Laboratories, Inc.

- Test Equipment Distributors, LLC

Frequently Asked Questions

Analyze common user questions about the Hydrostatic Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between hydrostatic testing and pneumatic testing?

Hydrostatic testing uses water or an incompressible liquid, significantly minimizing the stored energy and potential hazard compared to pneumatic testing, which uses compressed gas (usually air or nitrogen). Hydrostatic testing is preferred for its safety when testing high-pressure equipment, while pneumatic testing is reserved for specific applications where components cannot tolerate water or are required to operate with gas, though it carries higher inherent risk.

How often is hydrostatic testing required for industrial pipelines?

The frequency of hydrostatic testing for industrial pipelines is determined by regulatory jurisdiction (e.g., PHMSA, API standards), the material and age of the pipeline, and the fluid being transported. New pipelines require an initial commissioning test. Existing pipelines often require requalification tests ranging from every 5 to 20 years, or immediately following significant repair or alteration, based on the asset integrity management program and regulatory mandates specific to the location.

What are the primary challenges related to water management during hydrostatic testing?

The main challenges in water management include sourcing large volumes of clean water for testing, especially in arid or remote locations, and the safe, compliant disposal of the wastewater after the test is completed. The test water may contain corrosion inhibitors, biocides, or trace residues from the pipe interior, requiring treatment or specialized disposal procedures to meet environmental regulations, adding significant logistical cost and complexity to the overall process.

How does the integration of IoT technology improve the accuracy of hydrostatic testing?

IoT technology enhances accuracy by enabling the deployment of numerous distributed, wirelessly connected sensors (temperature, pressure, strain) across the asset during the test. This connectivity provides high-frequency, real-time data logging, ensuring instantaneous detection of localized pressure drops or thermal variances that indicate minor leaks or structural anomalies. IoT also facilitates remote monitoring and centralizes data collection for enhanced analysis and auditable reporting.

Which industry segment drives the highest demand for hydrostatic testing services?

The Oil and Gas industry drives the highest demand for hydrostatic testing services, particularly the Midstream sector (pipeline transportation). This high demand is due to the vast global network of high-pressure infrastructure required for transporting crude oil and natural gas, coupled with mandatory, non-negotiable regulatory requirements for commissioning, requalification, and integrity verification of these critical assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager