Hydroxychloroquine Sulfate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433925 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hydroxychloroquine Sulfate Market Size

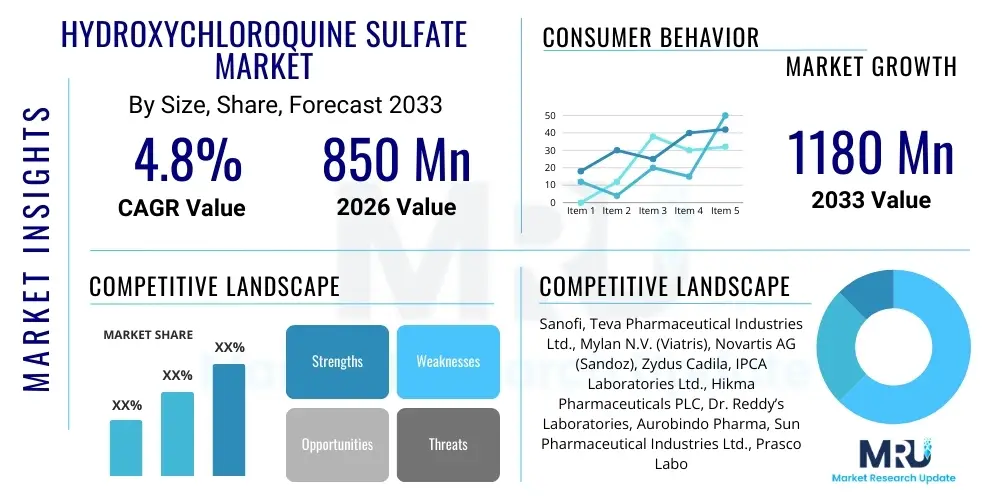

The Hydroxychloroquine Sulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1180 Million by the end of the forecast period in 2033.

Hydroxychloroquine Sulfate Market introduction

The Hydroxychloroquine Sulfate market encompasses the global manufacturing, distribution, and consumption of this established medication, primarily recognized for its efficacy in treating chronic autoimmune disorders. Hydroxychloroquine Sulfate (HCQ), a derivative of chloroquine, functions as an antimalarial and an immunomodulatory agent. Its main use lies in the long-term management of Systemic Lupus Erythematosus (SLE) and Rheumatoid Arthritis (RA), where it helps reduce inflammation, alleviate joint pain, minimize the risk of organ damage, and decrease overall disease activity. The compound has been a cornerstone in rheumatology for decades, offering a relatively favorable safety profile compared to stronger immunosuppressants, especially for early or less severe cases. Market stability is supported by consistent patient populations requiring lifelong maintenance therapy for these debilitating conditions.

Product description highlights its role as a disease-modifying antirheumatic drug (DMARD). HCQ is typically administered orally in tablet form, requiring stringent adherence and regular ophthalmic monitoring due to potential retinal toxicity, although this risk is generally low at standard maintenance doses. Major applications extend beyond rheumatology to include certain dermatological conditions, such as chronic discoid lupus and photo-aggravated eruptions. The market structure involves both branded products (like Plaquenil) and numerous generic formulations, which dominate volume sales, particularly in established markets. Recent external factors, notably the COVID-19 pandemic, temporarily impacted supply chains and demand patterns, though the core demand remains driven by rheumatological prescriptions.

Key benefits driving market stability include its proven effectiveness in preventing lupus flares, improving patient quality of life, and its cost-effectiveness, especially in generic form. Driving factors for future growth are tied to the increasing global prevalence of autoimmune diseases, enhanced diagnostic capabilities leading to earlier treatment initiation, and expanding healthcare access in developing economies. However, the market faces constraints related to intense generic competition, stringent regulatory requirements, and continuous pharmacovigilance needed to manage known side effects. Sustained research into off-label uses and combination therapies provides additional niche opportunities for specialized market growth within the established therapeutic boundaries.

Hydroxychloroquine Sulfate Market Executive Summary

The Hydroxychloroquine Sulfate market exhibits stable growth, primarily anchored by persistent demand from the rheumatology sector, particularly for the long-term treatment of SLE and RA. Business trends indicate a continued shift toward high-volume generic production, pressuring pricing structures but ensuring broad accessibility. Pharmaceutical companies are focusing on optimizing supply chain efficiency and securing reliable sourcing of the active pharmaceutical ingredient (API) to manage potential disruptions. Strategic mergers and acquisitions among generic manufacturers aim to consolidate market share and leverage economies of scale. Furthermore, investment in formulation improvements, though limited for this mature drug, focuses on enhancing bioavailability and reducing gastrointestinal side effects, maintaining a subtle competitive edge.

Regional trends reveal that North America and Europe currently represent the largest revenue generators, driven by high prevalence rates of autoimmune diseases and well-established reimbursement systems. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare infrastructure, rising awareness regarding autoimmune disorders, and a large, aging population base increasingly susceptible to these chronic conditions. Latin America and the Middle East & Africa (MEA) are also emerging as significant consumers, although market penetration is often constrained by varying levels of healthcare expenditure and regulatory complexity. Regional strategies increasingly involve localized manufacturing partnerships to navigate import duties and accelerate time-to-market.

Segmentation trends confirm that the Lupus Erythematosus application segment maintains market dominance due to HCQ’s foundational role in its management, often prescribed indefinitely. The generic drug segment holds the commanding lead in terms of volume, while the branded segment maintains a small, high-value niche based on established market recognition and specific patient preferences in some regions. The hospital pharmacy distribution channel remains critical, particularly for new patient initiations and centralized dispensing, but retail pharmacies are essential for maintenance therapy refills. Overall, the market remains highly dependent on clinical guidelines established by organizations such as the American College of Rheumatology, which consistently affirm the irreplaceable utility of HCQ in managing core autoimmune conditions.

AI Impact Analysis on Hydroxychloroquine Sulfate Market

Common user questions regarding AI's impact on the Hydroxychloroquine Sulfate market primarily revolve around three areas: how AI can accelerate drug repurposing studies (especially following the pandemic interest), whether AI can personalize HCQ dosing to minimize ocular toxicity risks, and how machine learning might optimize the complex global API supply chain to prevent shortages. Users are concerned about the cost-effectiveness of integrating sophisticated AI models into rheumatology practice but simultaneously anticipate benefits in improved patient safety and treatment efficacy prediction. The consensus expectation is that AI will not fundamentally alter HCQ's status as a standard treatment but will significantly enhance the peripheral aspects of its usage, from research and development (R&D) to precision medicine and distribution logistics, ultimately improving the drug's overall value proposition in chronic disease management.

- AI-driven personalized dosing models reduce the risk of long-term retinal toxicity, thereby improving patient compliance and extending treatment longevity.

- Machine learning algorithms optimize API procurement and inventory management, enhancing supply chain resilience and reducing manufacturing costs for generic producers.

- Natural Language Processing (NLP) accelerates pharmacovigilance by rapidly analyzing vast electronic health record (EHR) data for subtle adverse event signals associated with long-term HCQ use.

- AI platforms aid in identifying novel biomarkers for treatment response in SLE and RA patients, refining patient selection for HCQ therapy.

- Predictive analytics tools forecast regional demand fluctuations, allowing manufacturers to proactively adjust production cycles and distribution networks, optimizing inventory holding costs.

DRO & Impact Forces Of Hydroxychloroquine Sulfate Market

The Hydroxychloroquine Sulfate market is shaped by a confluence of driving factors, restrictive elements, and emerging opportunities, all mediated by significant impact forces inherent to the pharmaceutical industry. The primary driver remains the rising global incidence and prevalence of chronic autoimmune diseases such as lupus and rheumatoid arthritis, which necessitate lifelong therapeutic regimens where HCQ serves as a cornerstone treatment due to its established efficacy and manageable side-effect profile. Concurrently, increasing healthcare expenditure and improved diagnostic capabilities in emerging markets significantly expand the addressable patient population. However, the market faces substantial restraints, notably the intense price erosion caused by the dominance of multiple generic versions. Regulatory hurdles, particularly regarding API sourcing and manufacturing compliance, coupled with the necessity for regular patient monitoring (e.g., ophthalmology exams), add complexity and cost to the treatment pathway, potentially limiting uptake in resource-constrained settings.

Opportunities for market growth primarily lie in exploring off-label or novel therapeutic uses, especially within niche inflammatory or immunological disorders where HCQ’s immunomodulatory properties could be beneficial. Furthermore, strategic partnerships aimed at penetrating underserved markets, particularly in regions with high unmet needs for affordable chronic disease management, represent significant commercial prospects. The development of fixed-dose combination therapies that pair HCQ with other DMARDs or biologics, designed to improve synergy and patient adherence, also presents a distinct avenue for value creation beyond the standard monotherapy product. Innovation in delivery systems, though challenging for an oral solid dosage form, could marginally enhance patient experience.

The impact forces within this market are strongly dictated by competitive dynamics and regulatory pressures. Generic competition acts as a powerful downward force on pricing and profitability, ensuring that cost-effectiveness remains a key attribute for patients and payers. Regulatory forces, including stringent Good Manufacturing Practice (GMP) requirements and periodic safety reviews by agencies like the FDA and EMA, mandate continuous investment in quality control, acting as a barrier to entry for smaller manufacturers but ensuring product safety. Furthermore, payer scrutiny and formulary management significantly influence prescribing patterns, favoring HCQ due to its low cost compared to expensive biologic agents, thus reinforcing its sustained demand despite its maturity as a pharmaceutical product. The overall net effect of these forces suggests a large, stable market characterized by high volume and low, but consistent, profitability.

Segmentation Analysis

The Hydroxychloroquine Sulfate market is comprehensively segmented based on its application, type (formulation), and distribution channel, providing detailed insights into consumption patterns and market dynamics. The segmentation by application clearly reflects the clinical necessity and primary therapeutic focus of the drug, distinguishing between its foundational use in rheumatology (Lupus Erythematosus and Rheumatoid Arthritis) and its more restricted use in malaria prevention and treatment, as well as niche dermatological indications. Analysis of the product type segment differentiates between branded and generic formulations, highlighting the overwhelming market dominance of generic drugs due to widespread patent expiration and their inherent cost advantage, which is crucial for long-term chronic treatments. Distribution channels segment the route of sale, emphasizing the critical role of institutional purchasers like hospitals versus community-based retail channels, both of which serve distinct phases of patient care—initiation versus long-term maintenance.

- By Application:

- Lupus Erythematosus

- Rheumatoid Arthritis

- Malaria Treatment and Prophylaxis

- Other Applications (e.g., Porphyria Cutanea Tarda)

- By Type:

- Branded Drugs (e.g., Plaquenil)

- Generic Drugs

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Hydroxychloroquine Sulfate Market

The value chain for the Hydroxychloroquine Sulfate market begins with the complex upstream analysis involving the sourcing and synthesis of the raw chemical ingredients, primarily the active pharmaceutical ingredient (API), which often originates from specialized chemical manufacturers, predominantly located in Asia. This initial stage is crucial as the purity, availability, and cost of the API directly influence the final product cost and supply chain stability. Rigorous quality control and adherence to global manufacturing standards (GMP) are paramount at this stage. Midstream operations involve the formulation of the raw API into the finished dosage form (tablets) by pharmaceutical companies, including large generic manufacturers and a few branded companies. This step encompasses blending, compression, coating, and primary packaging, requiring significant capital investment in highly regulated manufacturing facilities.

The distribution channel analysis addresses the logistics of moving the finished product from the manufacturer to the end-user. Direct channels involve large-scale transactions between manufacturers and major purchasers, such as government health systems or Group Purchasing Organizations (GPOs), particularly for high-volume contract sales. Indirect distribution, which accounts for the majority of the market, involves wholesalers and distributors who act as intermediaries, stocking and delivering products to hospitals, retail pharmacies, and specialized clinics. Wholesalers play a vital role in managing inventory levels and ensuring timely delivery across diverse geographic locations, thereby optimizing the reach and accessibility of the medication to patients undergoing long-term treatment. Robust cold chain logistics are typically not required, simplifying the distribution process compared to biologics, but security and anti-counterfeiting measures are essential.

Downstream analysis focuses on prescribing physicians (rheumatologists, dermatologists, infectious disease specialists) and dispensing pharmacies, ultimately concluding with the patient. Reimbursement policies, which vary significantly by region and payer type, heavily influence the pricing strategy at the point of sale. Given the drug’s mature status and generic availability, competition is fierce, relying heavily on distribution efficiency and competitive tendering. The value chain is characterized by high fragmentation in the generic manufacturing segment but consolidation among the major distributors, illustrating the critical role efficient logistics plays in maintaining market share for this essential medication.

Hydroxychloroquine Sulfate Market Potential Customers

The primary end-users and buyers of Hydroxychloroquine Sulfate are predominantly individuals diagnosed with chronic autoimmune diseases, requiring long-term, often indefinite, pharmacological intervention. The largest patient demographic consists of individuals suffering from Systemic Lupus Erythematosus (SLE), where HCQ is indispensable for preventing disease flares and reducing cumulative organ damage. A substantial secondary customer base includes patients with Rheumatoid Arthritis (RA) who require DMARD therapy to slow disease progression and manage symptoms, often utilizing HCQ either as monotherapy or in combination with other agents. Due to the chronic nature of these diseases, patient retention is extremely high, translating into stable, recurring demand for the medication over many years.

Institutional buyers represent the major purchasing entities, including hospital systems, which acquire inventory for both inpatient use and outpatient dispensing through their associated pharmacies. Government healthcare programs, particularly those focused on public health initiatives and malaria control in endemic regions, also constitute significant large-volume buyers. Furthermore, specialized rheumatology and dermatology clinics frequently purchase stock directly or through preferred distributors to ensure immediate access for patients initiating treatment. The decision-making process for these institutional customers is heavily influenced by cost-effectiveness ratios, tender pricing, and supply reliability, favoring generic manufacturers who can consistently provide high-quality products at competitive prices.

The patient as a consumer relies heavily on the prescribing physician’s recommendations and coverage provided by health insurance plans or government subsidies. Given the critical nature of the therapy, patient compliance is generally high, making the product demand inelastic concerning minor price fluctuations, though sensitivity to large co-pays remains a factor, particularly in markets lacking universal healthcare coverage. The overall customer base is characterized by chronic illness management, ensuring sustained volume demand, while the payer base seeks maximum value through generic procurement strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1180 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi, Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Novartis AG (Sandoz), Zydus Cadila, IPCA Laboratories Ltd., Hikma Pharmaceuticals PLC, Dr. Reddy’s Laboratories, Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Prasco Laboratories, Rising Pharmaceuticals, Torrent Pharmaceuticals, Cipla Ltd., Wockhardt Ltd., Apotex Inc., Glenmark Pharmaceuticals, Amneal Pharmaceuticals Inc., Lannett Company Inc., Alkem Laboratories Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydroxychloroquine Sulfate Market Key Technology Landscape

The technological landscape surrounding the Hydroxychloroquine Sulfate market is primarily focused on optimizing manufacturing processes, enhancing supply chain tracking, and utilizing digital tools for patient management rather than radical product innovation, given the drug's established chemistry. In manufacturing, continuous processing techniques and advanced particle engineering are employed by leading generic firms to ensure high batch consistency, reduce production cycle times, and improve the dissolution profiles of the tablets, thus maintaining high bioavailability standards required by regulatory bodies. Furthermore, sophisticated analytical techniques, such as High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry, are crucial for rigorous quality assurance, ensuring the purity and potency of both the API and the finished dosage form, a necessity underscored by recent global supply disruptions.

Digital technologies play a critical role in pharmacovigilance and adherence monitoring. Remote patient monitoring systems and specialized mobile applications are increasingly being used to remind patients of dosing schedules and to collect real-world evidence (RWE) regarding treatment outcomes and potential side effects. This data collection is vital, particularly for long-term safety concerns like retinopathy, where AI-assisted screening tools are being integrated into ophthalmology practices to detect early signs of toxicity more efficiently and accurately than traditional manual assessments. These technological integrations improve the overall safety profile of the drug when used chronically.

The supply chain relies heavily on enterprise resource planning (ERP) systems and serialization technologies (track-and-trace). Serialization, mandated in many major markets, ensures individual packages of HCQ can be traced throughout the distribution network, significantly mitigating the risk of counterfeiting, which is a particular concern for high-demand, high-volume generic drugs. Blockchain technology is emerging as a potential tool to further secure the transparency and immutability of the supply chain data, offering enhanced confidence in the drug's origin and integrity, thereby solidifying trust between manufacturers, distributors, and healthcare providers in a complex global procurement environment.

Regional Highlights

The Hydroxychloroquine Sulfate market exhibits distinct characteristics across major global regions, driven by varying disease prevalence, healthcare infrastructure maturity, and regulatory environments.

- North America (United States and Canada): This region is characterized by high per capita healthcare spending and a significant population suffering from RA and SLE. The market is mature, dominated by generic prescriptions, and features rigorous regulatory oversight (FDA). Demand is stable, anchored by established reimbursement pathways. Key market activities focus on robust supply chain management to ensure continuous access, especially after recent demand spikes.

- Europe (Germany, France, UK, Italy, Spain): European demand is consistent, supported by universal or strong national health systems that prioritize cost-effective chronic disease management. Generic competition is fierce, influenced heavily by national tender processes that favor the lowest-cost high-quality suppliers. The EMA’s centralized regulatory framework facilitates product registration, but pricing remains highly localized and competitive.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the fastest-growing market, primarily due to the vast patient pool, increasing accessibility to specialized rheumatology care, and rapidly improving healthcare expenditure, particularly in emerging economies like India and China. India serves as a critical global hub for generic API manufacturing, significantly influencing global pricing and supply stability. Market growth is also boosted by rising awareness of autoimmune conditions.

- Latin America (LATAM) (Brazil, Mexico, Argentina): This region offers moderate growth potential, constrained by economic volatility and uneven distribution of specialized medical services. Demand is strongly dependent on public health procurement and government tender processes, prioritizing affordability. Regulatory harmonization across various nations remains a challenge, impacting market entry strategies.

- Middle East and Africa (MEA): The MEA market is fragmented, with established demand in the Gulf Cooperation Council (GCC) states driven by high-quality healthcare and substantial government budgets. In Africa, HCQ demand is often dual-faceted: required for autoimmune diseases and foundational for malaria prophylaxis and treatment, though distribution challenges persist in low-income sub-Saharan countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydroxychloroquine Sulfate Market.- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris)

- Novartis AG (Sandoz)

- Zydus Cadila

- IPCA Laboratories Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy’s Laboratories

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Prasco Laboratories

- Rising Pharmaceuticals

- Torrent Pharmaceuticals

- Cipla Ltd.

- Wockhardt Ltd.

- Apotex Inc.

- Glenmark Pharmaceuticals

- Amneal Pharmaceuticals Inc.

- Lannett Company Inc.

- Alkem Laboratories Ltd.

Frequently Asked Questions

Analyze common user questions about the Hydroxychloroquine Sulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the long-term demand for Hydroxychloroquine Sulfate?

The enduring demand for Hydroxychloroquine Sulfate is primarily driven by its irreplaceable role as a first-line, disease-modifying anti-rheumatic drug (DMARD) for the long-term management of chronic autoimmune diseases, specifically Systemic Lupus Erythematosus (SLE) and Rheumatoid Arthritis (RA).

How does generic competition influence the Hydroxychloroquine Sulfate market?

Generic competition profoundly influences the market by ensuring product availability and substantially reducing pricing structures globally, making HCQ a highly cost-effective treatment option, which secures its preference among payers and healthcare systems worldwide.

Which application segment holds the largest share in the HCQ market?

The Lupus Erythematosus application segment holds the largest market share due to the foundational and often indefinite use of Hydroxychloroquine Sulfate in minimizing disease activity, preventing flares, and reducing cumulative organ damage associated with SLE.

What are the main risks associated with the supply chain of Hydroxychloroquine Sulfate?

The main risks stem from heavy reliance on a few concentrated sources for the Active Pharmaceutical Ingredient (API), primarily in Asia, leading to potential vulnerabilities regarding quality control, export restrictions, and geopolitical disruptions that can trigger global shortages.

What role does technology play in mitigating the risk of ocular toxicity linked to HCQ?

Technology, particularly AI-assisted diagnostic imaging tools and specialized ophthalmology screening software, plays a critical role by enhancing the early detection of retinopathy, allowing clinicians to adjust dosing or discontinue treatment before irreversible vision loss occurs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager