Hydroxypropyl Distarch Phosphate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433582 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Hydroxypropyl Distarch Phosphate Market Size

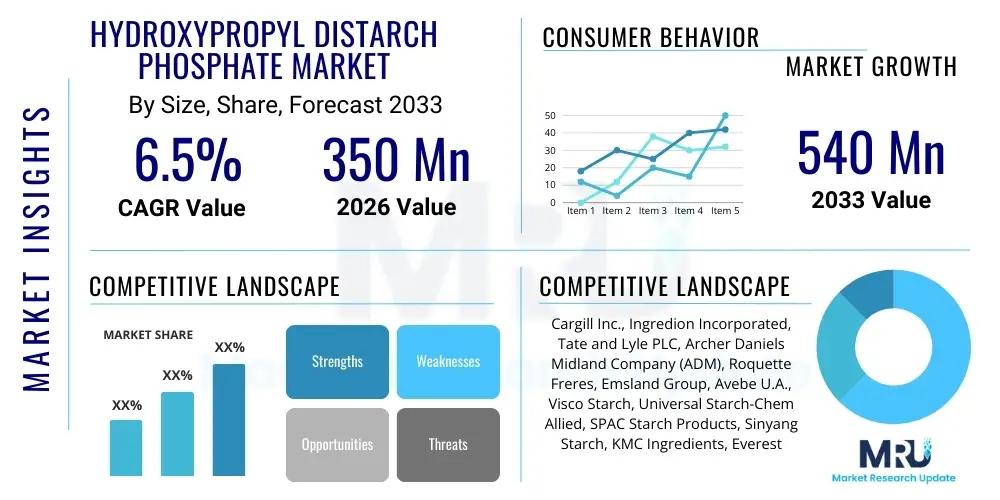

The Hydroxypropyl Distarch Phosphate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 540 Million by the end of the forecast period in 2033.

Hydroxypropyl Distarch Phosphate Market introduction

Hydroxypropyl Distarch Phosphate (HPDSP), commercially known as E1442, is a chemically modified food starch derived primarily from sources like waxy maize, potato, or tapioca. It functions primarily as a highly effective thickener, stabilizer, and emulsifier in a wide range of processed food and industrial applications. The modification involves treating starch with propylene oxide and a cross-linking agent such as sodium trimetaphosphate, which significantly enhances its stability against high temperatures, high shear rates, acidic conditions, and freeze-thaw cycles, making it superior to native starches. This crucial resistance is the fundamental driver of its adoption, especially in demanding applications such as retort-processed foods, ready meals, frozen desserts, and viscous sauces.

The principal applications of HPDSP span across the food and beverage industry, including dairy products (yogurts, puddings), bakery fillings, canned goods, condiments, and infant formulas, where it provides desirable texture, gloss, and prevents syneresis (water separation). Beyond food, it finds niche applications in pharmaceuticals as a disintegrant or binder, and in cosmetics as a viscosity modifier in creams and lotions. The increasing global demand for processed and convenience foods, coupled with rising consumer expectations for consistent product quality and texture, constitutes the primary driving force behind the market expansion of Hydroxypropyl Distarch Phosphate. Furthermore, its ability to mimic the mouthfeel of fat in low-fat formulations provides a distinct competitive advantage, aligning with current health and wellness trends.

Market growth is also significantly influenced by ongoing research and development aimed at sourcing HPDSP from non-genetically modified (non-GMO) and clean-label compliant raw materials, such as specific potato and tapioca varieties. Its high functional versatility allows manufacturers to reduce reliance on multiple stabilizing agents. The regulatory status, being generally recognized as safe (GRAS) by the FDA and approved by the European Food Safety Authority (EFSA), further facilitates its international trade and utilization across major global markets. The technological advancements in modification processes, which ensure a tailored degree of substitution (DS) for specific application performance, continue to sustain its indispensability in modern food chemistry and ingredient formulation.

Hydroxypropyl Distarch Phosphate Market Executive Summary

The Hydroxypropyl Distarch Phosphate market demonstrates robust growth driven by accelerating global demand for shelf-stable processed foods, particularly in fast-growing economies in the Asia Pacific region. Key business trends include intense focus on optimizing supply chains to manage volatility in raw material starch prices and a strategic shift by major producers towards vertically integrated operations to ensure quality control and consistent supply of non-GMO source materials. The emphasis on high-performance stabilizers that deliver clean label aesthetics (texture, appearance) without compromising nutritional profiles is shaping product innovation. Companies are investing in tailored starches offering specific functionalities, such as enhanced acid stability for fruit preparations or superior freeze-thaw resilience for frozen bakery goods, thereby solidifying their market positions through differentiated product portfolios.

Regionally, Asia Pacific (APAC) dominates the market, primarily due to the massive scale of processed food manufacturing, high population density, and rapidly changing dietary habits favoring ready-to-eat meals, particularly in China and India. Europe and North America represent mature markets characterized by stringent regulatory oversight regarding chemical modification levels, driving a strong preference for starches derived from organic or identity-preserved sources. Segmentation trends show the application segment of thickeners and stabilizers holding the largest share, reflecting HPDSP's core functionality. Furthermore, the segmentation by source highlights rising preference for Tapioca-based HPDSP, which is often perceived favorably in regions sensitive to corn-derived products, offering superior clarity and texture in specific matrices like fruit preparations and transparent sauces.

In terms of competitive landscape, the market is moderately consolidated, featuring several global ingredient giants alongside specialized regional producers. Strategic acquisitions and collaborative partnerships focused on technological exchange for process optimization are common strategies employed to maintain competitive edge. The market is increasingly being shaped by sustainability mandates, compelling manufacturers to adopt energy-efficient modification processes and minimize waste streams. Overall, the market trajectory is positive, underpinned by essential functional attributes and broad application versatility, though it faces challenges related to public perception of modified starches and fluctuating feedstock costs.

AI Impact Analysis on Hydroxypropyl Distarch Phosphate Market

Common user inquiries regarding AI's influence in the Hydroxypropyl Distarch Phosphate market often revolve around optimizing the complex starch modification process, predicting ingredient interaction, and improving formulation efficiency. Users seek to understand how AI can minimize batch variability, reduce raw material waste during synthesis, and accelerate the development of specialized HPDSP variants tailored for niche applications, such as high-protein or acidic food systems. A primary concern is the integration cost and the specialized data infrastructure required to leverage machine learning (ML) models effectively in traditional chemical processing environments. Expectations center on AI's ability to provide predictive analytics for shelf-life stability and texture perception, areas traditionally reliant on time-consuming empirical testing.

AI and advanced analytics are poised to revolutionize the manufacturing and application of HPDSP by providing precise control over the degree of substitution (DS) and cross-linking density. Machine learning algorithms can analyze multivariate inputs, including raw starch moisture content, reaction temperature, and reagent concentration, to predict the final functional properties (e.g., viscosity, shear thinning index) of the modified starch product before synthesis is complete. This predictive capability drastically reduces trial-and-error experimentation, ensuring that manufacturers meet specific customer specifications consistently and efficiently. Furthermore, AI-driven sensor technology in continuous reactors allows for real-time adjustments, significantly enhancing yield and maintaining stringent quality standards, particularly critical for pharmaceutical and infant food grades of HPDSP.

In the end-user market, AI is impacting formulation optimization by allowing food scientists to simulate millions of ingredient combinations. Using digital twins of food matrices (e.g., a complex sauce or a frozen dessert), AI can predict the optimal concentration of HPDSP required to achieve a desired mouthfeel or stability profile, minimizing unnecessary use of additives and potentially supporting cleaner label initiatives. This level of optimization aids formulators in navigating the complex interplay between HPDSP and other common ingredients like hydrocolloids, proteins, and emulsifiers, reducing time-to-market for new food products. Furthermore, AI tools are critical in analyzing consumer sensory data, translating preference metrics into tangible material properties that HPDSP manufacturers can target during product development.

- AI optimizes synthesis parameters (temperature, time, chemical concentration) to control the degree of substitution (DS) and cross-linking, ensuring batch consistency.

- Machine learning models predict the rheological behavior (viscosity and texture) of HPDSP in diverse food matrices, accelerating formulation development.

- AI-driven image analysis and spectroscopy are used for real-time quality control of raw starch feedstock, minimizing quality variations in the final HPDSP product.

- Predictive maintenance analytics, powered by AI, reduce equipment downtime in starch modification plants, enhancing operational efficiency and lowering manufacturing costs.

- Advanced analytics aid in optimizing supply chain logistics by forecasting demand fluctuations and managing the procurement of volatile raw starch materials.

DRO & Impact Forces Of Hydroxypropyl Distarch Phosphate Market

The market dynamics of Hydroxypropyl Distarch Phosphate are shaped by a complex interplay of strong drivers related to consumer lifestyle changes and functional requirements, moderate restraints primarily centered around regulatory perception and cost volatility, and significant opportunities emerging from non-traditional applications and technological innovation. The dominant driving force remains the global shift towards convenience foods, ready-to-eat meals, and frozen products, all of which require high-performance stabilizers capable of withstanding severe processing and storage conditions, a functional niche where HPDSP excels. Conversely, a major constraint is the prevailing consumer preference in developed economies for "clean label" ingredients, often prompting formulators to seek alternatives perceived as less chemically modified, despite HPDSP being approved and safe.

Key drivers include the indispensable role of HPDSP in achieving superior texture and shelf stability in demanding applications like retorted baby food and sterilized canned goods, coupled with its excellent acid and heat resistance, which few natural starches can match. This functionality provides a critical commercial advantage in food product longevity and quality maintenance. However, restraining forces are exerted by the fluctuating prices of staple starch crops (corn, potato, tapioca), which directly impact the manufacturing cost and profitability margins of HPDSP producers. Furthermore, strict regulatory scrutiny in regions like the European Union sometimes necessitates lengthy approval processes for new sources or modifications, potentially slowing market entry for innovative HPDSP variants.

Opportunities for market growth are abundant, particularly in expanding the utility of HPDSP into non-food sectors, such as biodegradable plastics, specialized drilling fluids, and advanced cosmetic formulations where its thickening and stabilizing properties are highly valued. The focus on developing functional foods and nutraceuticals also opens new avenues, as HPDSP can be engineered to encapsulate delicate bioactive compounds or provide specific textural attributes in high-fiber or high-protein supplement formulations. The core impact forces influencing the market trajectory are the regulatory environment, the rate of consumer shift towards convenience, and the sustained ability of manufacturers to optimize production processes to manage cost pressures while ensuring compliance with evolving sustainability standards. The balance between required high performance and the demand for natural-sounding labels will dictate future innovation strategies.

Segmentation Analysis

The Hydroxypropyl Distarch Phosphate market is systematically segmented based on Source, Application, and End-use Industry, reflecting the diversity of its functional properties and widespread utility. Segmentation by Source (Corn, Tapioca, Potato) is critical because the botanical origin significantly influences the physicochemical properties of the resultant HPDSP, such as gel strength, clarity, and paste viscosity, which are paramount for specific industrial applications. For instance, Tapioca-based HPDSP generally offers superior clarity, making it ideal for transparent sauces and fruit preparations, while Corn-based HPDSP is highly favored for its widespread availability and cost-effectiveness in general thickening applications. The rigorous analysis of these segments helps stakeholders understand supply dynamics and competitive pricing structures across different geographical regions.

The Application segmentation distinguishes HPDSP by its primary functional role within a product, categorized mainly as Thickeners, Stabilizers, Emulsifiers, and Binders. Its dual functionality as both a thickener (imparting viscosity) and a stabilizer (preventing phase separation or sedimentation) accounts for the largest market share. The End-use Industry segmentation, encompassing Food and Beverage, Cosmetics, and Pharmaceuticals, defines the regulatory hurdles and quality specifications required. The Food and Beverage sector remains the dominant consumer, driven by extensive use in processed foods, but the demand in the non-food segments, especially high-grade cosmetics requiring stable, non-irritating rheology modifiers, is growing at a robust pace.

Further granularity in segmentation often addresses the level of modification and processing technique (e.g., pregelatinized HPDSP vs. cook-up HPDSP), which determines whether the starch requires heat activation or is instantly dispersible in cold water. This technological differentiation is crucial for end-users like quick-service restaurants or manufacturers of instant mixes. The interplay between source and application dictates market value: higher value is generally assigned to non-GMO, organic source HPDSP used in premium, functional food products, whereas commodity-grade corn-based HPDSP serves bulk industrial needs. Understanding these cross-segment dynamics is essential for market penetration and strategic resource allocation.

- Source

- Corn

- Potato

- Tapioca

- Wheat

- Application

- Thickener

- Stabilizer

- Emulsifier

- Binder

- Texturizer

- End-use Industry

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Textiles

- Paper Industry

Value Chain Analysis For Hydroxypropyl Distarch Phosphate Market

The value chain for the Hydroxypropyl Distarch Phosphate market is structured around several distinct stages, commencing with upstream raw material sourcing and culminating in downstream distribution to diverse end-use industries. The upstream segment involves the cultivation and harvesting of source crops—primarily corn, potatoes, and tapioca—followed by the milling and refinement of crude starch. Price volatility and supply consistency in this initial phase are significant determinants of the final product cost. Effective vertical integration by major producers to secure consistent high-quality, non-GMO starch feedstock is a critical competitive advantage, mitigating risks associated with agricultural variability and commodity price fluctuations. The quality of the raw starch dictates the efficiency and yield of the subsequent chemical modification process, necessitating robust supplier qualification protocols.

The midstream component involves the complex chemical modification process, where refined native starch is reacted with propylene oxide and phosphate salts under carefully controlled conditions to introduce hydroxypropyl and phosphate cross-links. This manufacturing stage requires specialized reaction vessels, high energy inputs, and adherence to stringent quality and safety standards (e.g., controlling residual propylene oxide levels). Technological innovation here focuses on improving reaction efficiency, reducing energy consumption, and customizing the degree of modification to achieve specific functional outcomes demanded by end-users. The production facilities must be capable of handling both large bulk orders and specialized, small-batch, high-purity products required by the pharmaceutical sector.

The downstream flow is dominated by distribution channels, which include both direct sales to major food and ingredient conglomerates and indirect sales through specialized distributors and agents, particularly in fragmented or geographically challenging markets. Direct sales enable producers to offer tailored solutions and technical support, fostering strong customer relationships. Indirect channels, utilizing established networks, are crucial for reaching smaller manufacturers and localized markets efficiently. The final stage involves the incorporation of HPDSP into finished products (e.g., sauces, yogurts, tablets) by end-users. Technical service support, helping customers optimize HPDSP integration into complex formulations, plays a vital role in capturing market share and ensuring customer loyalty within this competitive value chain.

Hydroxypropyl Distarch Phosphate Market Potential Customers

The primary potential customers and end-users of Hydroxypropyl Distarch Phosphate are large-scale manufacturers operating within the Food and Beverage industry, specifically those specializing in products requiring extended shelf life, enhanced stability, and specific textural attributes under challenging conditions. This includes producers of frozen foods (e.g., ice creams, frozen desserts, ready meals), canned or retorted goods (e.g., soups, gravies, baby food), and condiments (e.g., mayonnaise, salad dressings, ketchup). These manufacturers rely heavily on HPDSP's ability to prevent syneresis during freeze-thaw cycles and maintain viscosity under high acid or high heat processing, thereby guaranteeing product quality and consistent consumer experience throughout the entire product lifecycle.

Beyond the dominant food sector, a rapidly growing customer base is found within the Cosmetics and Personal Care industry. Manufacturers of high-end skincare products, lotions, creams, and make-up utilize HPDSP as a viscosity modifier and emulsion stabilizer. Its non-irritating profile and ability to create a smooth, pleasant skin feel make it an attractive alternative to synthetic polymers. In this segment, the focus is typically on higher purity grades and reliable supply chains that meet strict cosmetic safety assessments, positioning these buyers as premium customers within the market structure.

A third critical customer segment is the Pharmaceutical industry, where HPDSP is employed as an excipient, specifically functioning as a disintegrant in tablet formulations or as a binder to improve tablet hardness and dissolution characteristics. The pharmaceutical sector demands the highest quality standards, requiring products that comply with pharmacopeial monographs (e.g., USP, EP) and certified good manufacturing practices (GMP). These customers prioritize purity, consistency, and comprehensive documentation regarding safety and efficacy, making them long-term, high-value purchasers who typically engage in direct contractual agreements with specialized HPDSP manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 540 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., Ingredion Incorporated, Tate and Lyle PLC, Archer Daniels Midland Company (ADM), Roquette Freres, Emsland Group, Avebe U.A., Visco Starch, Universal Starch-Chem Allied, SPAC Starch Products, Sinyang Starch, KMC Ingredients, Everest Starch (India) Pvt Ltd., Manildra Group, AGRANA Beteiligungs-AG, Samyang Genex, Zhucheng Dongxiao Biotechnology, Galam Group, Grain Processing Corporation (GPC), Siam Modified Starch Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydroxypropyl Distarch Phosphate Market Key Technology Landscape

The technological landscape of the Hydroxypropyl Distarch Phosphate market is defined by continuous advancements in starch modification, reaction control, and purification techniques aimed at optimizing functionality and ensuring safety compliance. The foundational technology involves the controlled cross-linking and substitution reactions, typically carried out in slurry or dry phase processes. Current innovations focus heavily on developing highly efficient, solvent-free, or green chemistry methods to reduce environmental impact and lower operational costs. For instance, manufacturers are exploring enzymatic pre-treatment of native starches to enhance reactivity before chemical modification, leading to more uniform substitution profiles and superior functional performance in the final HPDSP product. This ensures the starch performs optimally under extreme conditions encountered in modern food processing.

A significant area of technological focus is the precise control over the Degree of Substitution (DS) and the level of cross-linking. Advanced analytical techniques, such as High-Performance Liquid Chromatography (HPLC) and Nuclear Magnetic Resonance (NMR) spectroscopy, are integral for real-time monitoring of the reaction kinetics and confirming the exact chemical structure of the modified product. This precision is paramount for high-end applications, especially in pharmaceuticals and specialized infant nutrition, where minor deviations in functional parameters can affect product efficacy and safety. The goal is to produce tailored HPDSP products, where a specific DS provides maximum freeze-thaw stability while maintaining low viscosity, or high clarity while maximizing shear resistance.

Furthermore, technology related to raw material sourcing is evolving rapidly. There is increasing investment in breeding programs for specific starch crops (like waxy maize and high-amylose potato) to yield native starches with naturally enhanced properties that require less chemical modification. This aligns with the global 'clean label' movement, allowing manufacturers to market products derived from more traceable and sustainably managed sources. Technology also encompasses the development of pregelatinized (instant) HPDSP variants through drum drying or extrusion processes. These instant starches allow end-users to achieve full viscosity without cooking, significantly streamlining manufacturing processes in the ready-mix and cold-set applications, thereby driving wider adoption across the convenience food sector.

Regional Highlights

The market for Hydroxypropyl Distarch Phosphate exhibits distinct dynamics across key global regions, largely influenced by population size, dietary habits, economic development, and regulatory frameworks. Asia Pacific (APAC) stands out as the leading market both in terms of consumption and production capacity. This dominance is fueled by the region's vast and rapidly expanding processed food industry, especially in China, India, and Southeast Asian nations. The high demand for stable convenience foods, coupled with robust domestic production capabilities for staple starches (rice, tapioca), provides a cost advantage for regional manufacturers. Regulatory environments in APAC are generally supportive of food additives, facilitating high utilization rates of HPDSP in various product matrices, ranging from instant noodles and sauces to confectionery items.

North America and Europe constitute mature markets characterized by steady, moderate growth, high quality standards, and intense regulatory scrutiny. In these regions, HPDSP is an established ingredient, particularly valued for its functionality in demanding applications like frozen pizzas, high-protein yogurts, and low-fat dairy alternatives. However, the market faces pressure from the clean label trend, pushing manufacturers to develop HPDSP variants derived from non-GMO or organic sources, requiring higher technological investment. European regulations, governed by EFSA, maintain strict limits on residual chemicals and modification levels, driving producers to invest heavily in purification and quality assurance technologies to maintain market access.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets exhibiting high growth potential. LATAM, benefiting from a rich supply of native starches, is seeing increased penetration of HPDSP driven by urbanization and rising demand for packaged goods in countries like Brazil and Mexico. The MEA region is experiencing market development fueled by increasing foreign investment in local food processing facilities and rising disposable incomes. While these regions offer lucrative opportunities, they often present challenges related to complex import tariffs, varied local regulatory standards, and underdeveloped cold chains, which nevertheless increase the reliance on highly stable ingredients like HPDSP to ensure product longevity.

- Asia Pacific (APAC): Dominates the market due to massive processed food sector growth, abundant raw starch supply (tapioca, rice), and high adoption in convenience food manufacturing across China and India.

- North America: Characterized by stable demand in frozen and bakery goods; strong emphasis on non-GMO and specialized starches tailored for functional foods and low-fat formulations.

- Europe: Growth is driven by the highly standardized dairy and savory processing sectors; stringent EFSA regulations necessitate high purity grades and compliance with strict additive limits.

- Latin America (LATAM): Emerging high-growth region driven by urbanization and demand for shelf-stable goods; reliance on domestic corn and potato starch supplies.

- Middle East and Africa (MEA): Rapid expansion in modern retail and local food manufacturing; increasing reliance on functional additives to ensure product stability in challenging climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydroxypropyl Distarch Phosphate Market.- Cargill Inc.

- Ingredion Incorporated

- Tate and Lyle PLC

- Archer Daniels Midland Company (ADM)

- Roquette Freres

- Emsland Group

- Avebe U.A.

- Visco Starch

- Universal Starch-Chem Allied

- SPAC Starch Products

- Sinyang Starch

- KMC Ingredients

- Everest Starch (India) Pvt Ltd.

- Manildra Group

- AGRANA Beteiligungs-AG

- Samyang Genex

- Zhucheng Dongxiao Biotechnology

- Galam Group

- Grain Processing Corporation (GPC)

- Siam Modified Starch Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Hydroxypropyl Distarch Phosphate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Hydroxypropyl Distarch Phosphate (HPDSP) and what are its main uses?

HPDSP (E1442) is a highly functional modified food starch used primarily as a thickener, stabilizer, and texturizer. Its main advantage is superior resistance to high heat, acid, and freeze-thaw cycles, making it essential for producing shelf-stable processed foods, frozen desserts, sauces, and pharmaceutical tablets.

How does the source of starch (corn, potato, tapioca) affect HPDSP performance?

The botanical source dictates functional properties. Tapioca-based HPDSP provides high clarity and smooth texture, favored for fruit fillings and clear sauces. Potato-based HPDSP offers excellent swelling power. Corn-based HPDSP is cost-effective and widely used due to its abundance and versatility in general thickening applications.

Is Hydroxypropyl Distarch Phosphate considered safe for consumption?

Yes, HPDSP is globally recognized as safe (GRAS by FDA and approved as E1442 by EFSA). It is considered a food additive, and its use is strictly regulated worldwide to ensure levels of modification and residual chemical compounds remain within safe consumption limits.

What major factors are driving the growth of the HPDSP market?

Market growth is predominantly driven by the increasing global demand for processed, convenience, and ready-to-eat foods that require robust stabilization properties. The rising consumption of frozen food products, coupled with HPDSP's ability to maintain textural integrity under severe processing conditions, fuels its expansion.

How does the clean label movement impact the demand for Hydroxypropyl Distarch Phosphate?

The clean label trend poses a moderate restraint, as some consumers prefer ingredients perceived as less chemically modified. Manufacturers are responding by focusing on sourcing HPDSP from non-GMO and organic starches and optimizing processes to reduce the degree of chemical modification, aligning with consumer demand for transparency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager