Hydroxypropyl Starch Ether Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437665 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Hydroxypropyl Starch Ether Market Size

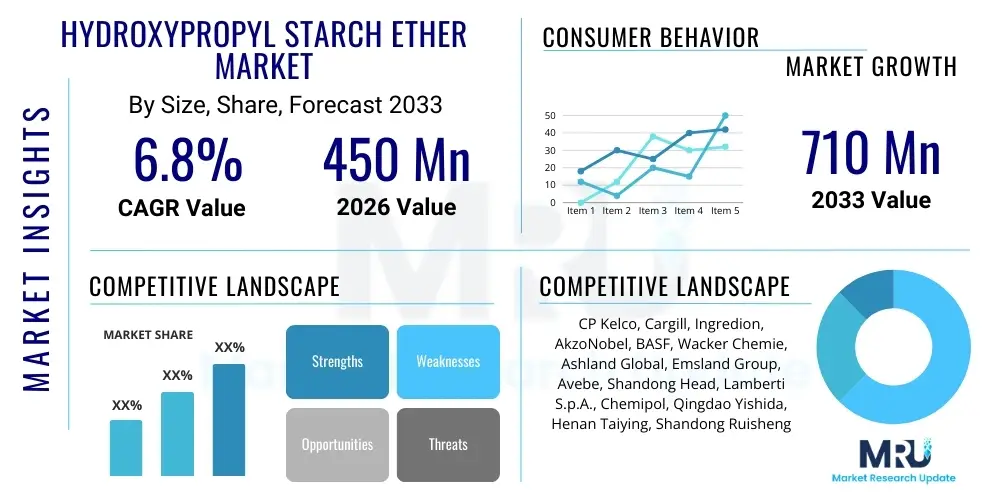

The Hydroxypropyl Starch Ether Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Hydroxypropyl Starch Ether Market introduction

The Hydroxypropyl Starch Ether (HPS) market encompasses the production, distribution, and utilization of modified starch derivatives characterized by excellent thickening, water retention, and anti-sag properties. HPS is synthesized by reacting starch, typically potato, corn, or cassava starch, with propylene oxide under alkaline conditions. This chemical modification results in an etherified starch polymer that significantly improves the workability and performance characteristics of water-based systems, primarily dry-mix mortars in the construction industry. The inherent stability and functional versatility of HPS enable its deployment across a broad spectrum of applications where precise rheology control is critical for material performance and ease of use.

HPS serves as a vital additive in modern construction materials, specifically playing a crucial role in enhancing the technical specifications of tile adhesives, plasters, renders, and self-leveling compounds. Its primary functions include adjusting the viscosity of fresh mortars, preventing the slippage of heavy tiles on vertical surfaces (improved anti-sag properties), and stabilizing the emulsion or suspension within the mix. Furthermore, HPS improves the open time and adjustability of cementitious materials, allowing construction professionals greater flexibility during application. The growing global investment in infrastructure, coupled with stringent quality standards for modern buildings requiring high-performance additives, heavily dictates the demand curve for Hydroxypropyl Starch Ether.

The market growth is largely fueled by several key factors, including the increasing urbanization rates in developing economies, the subsequent boom in residential and commercial construction, and the rising consumer preference for sustainable and high-quality building materials. HPS, being derived from renewable resources (starch), often aligns with green building initiatives. Major applications beyond construction include its limited use in specialized coatings, paints, and certain personal care products where its thickening and stabilizing capabilities are beneficial. The shift towards pre-mixed and dry-mix construction solutions globally further solidifies the essential position of HPS within the chemical additives sector.

- Product Description: Hydroxypropyl Starch Ether (HPS) is a chemically modified starch derivative used primarily as a rheological modifier, thickener, and stabilizer.

- Major Applications: Tile adhesives, cementitious plasters, renders, joint compounds, and self-leveling floor screeds within the construction sector.

- Benefits: Enhanced anti-sag properties, improved water retention, extended open time, better workability, and increased stability of mortar systems.

- Driving Factors: Rapid urbanization, infrastructure development, increased demand for high-performance dry-mix mortars, and technological advancements in starch modification.

Hydroxypropyl Starch Ether Market Executive Summary

The Hydroxypropyl Starch Ether market is poised for robust expansion, driven predominantly by the flourishing global construction industry, particularly in the Asia Pacific region. Business trends highlight a significant focus on developing high-purity, application-specific HPS grades that offer superior stability under varying temperature and pH conditions, catering to specialized applications like high-flex tile adhesives and exterior insulation finishing systems (EIFS). Key market players are prioritizing capacity expansion and strategic mergers and acquisitions to consolidate their regional presence and secure access to stable raw material supplies, such as high-quality potato or corn starch. Furthermore, the push towards sustainable chemical manufacturing practices is leading to increased research in optimizing production processes to reduce energy consumption and waste generation.

Regional trends indicate that Asia Pacific, spearheaded by China and India, maintains the largest market share due to unparalleled infrastructure development and housing projects. These countries represent massive consumption centers for dry-mix mortars, making them critical investment hubs for HPS manufacturers. While North America and Europe exhibit slower growth rates due to market maturity, these regions demand premium, specialized HPS products that comply with stringent environmental and performance regulations, focusing on longevity and reduced volatile organic compound (VOC) emissions in construction materials. Latin America and the Middle East and Africa (MEA) are emerging markets showing accelerating demand, supported by significant public and private investments in commercial infrastructure and housing initiatives.

Segment trends reveal that the construction grade application segment dominates the market in terms of volume and value, specifically driven by the growing preference for ready-to-use, factory-mixed dry mortars over traditional site-mixed formulas. Among source materials, potato starch is highly favored globally due to its molecular structure lending superior performance characteristics, though corn and tapioca starches remain significant, particularly in Asia. The thickening agent function segment holds the dominant position, reflecting the fundamental need for HPS to control the rheology and consistency of cementitious mixtures. Competitive strategy across all segments is increasingly focusing on technical service and formulation support, helping mortar manufacturers integrate HPS effectively to meet diverse regional building codes and application challenges.

AI Impact Analysis on Hydroxypropyl Starch Ether Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hydroxypropyl Starch Ether (HPS) market often center on three critical areas: optimization of the complex chemical synthesis process, predictive modeling for raw material sourcing and pricing, and the use of AI in quality control and application formulation. Users are keen to understand how machine learning algorithms can enhance reaction efficiency, minimize byproduct formation, and ensure product consistency across large batches. There is a strong expectation that AI can drastically reduce time-to-market for new HPS grades tailored to unique construction needs (e.g., extreme temperature mortars). Furthermore, concerns revolve around the transparency and accessibility of AI-driven supply chain data, especially concerning the fluctuating costs of native starch sources like potato and corn, which are subject to agricultural volatility.

AI is expected to significantly transform the manufacturing and application development landscape for HPS. In manufacturing, AI algorithms can analyze real-time sensor data from reactors, optimizing parameters such as temperature, pressure, and catalyst dosage to achieve the desired degree of substitution (DS) with maximum yield and purity, directly impacting production costs. For quality assurance, machine vision systems powered by AI can perform rapid, high-throughput inspection of physical characteristics and particle size distribution, far surpassing the speed and objectivity of traditional lab testing. This digital transformation improves both the consistency of the final HPS product and the efficiency of the production line.

In the application phase, AI and machine learning tools are instrumental in computational material science. Formulation scientists can use predictive modeling to simulate how different HPS grades interact with various cement types, polymers, and other additives in a dry-mix mortar. This capability reduces the reliance on extensive physical trial-and-error, speeding up the development of new, high-performance mortar formulations (e.g., self-healing concrete or ultra-high-performance concrete additives). By analyzing large datasets of field performance and laboratory test results, AI helps manufacturers proactively recommend the optimal HPS solution for specific regional climates or specialized construction projects, thereby enhancing customer loyalty and driving specialized product adoption.

- AI-driven optimization of starch etherification reaction kinetics, improving yield and purity.

- Predictive maintenance analytics for HPS production machinery, minimizing downtime.

- Machine learning models for forecasting native starch raw material prices and managing supply chain risks.

- Use of AI in computational material science to accelerate the formulation of high-performance dry-mix mortars.

- Automated, high-throughput quality control using AI-powered image processing for particle size and morphology analysis.

- Enhanced customer technical support through AI analyzing field data to provide tailored HPS dosage recommendations.

DRO & Impact Forces Of Hydroxypropyl Starch Ether Market

The dynamics of the Hydroxypropyl Starch Ether market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. A primary Driver is the massive global expansion of the construction sector, particularly the infrastructure and residential segments in emerging economies. The technological advantages offered by HPS, such as superior anti-sag properties and rheology control, align perfectly with the modern construction requirement for high-quality, efficient dry-mix mortar systems. Furthermore, regulatory support in developed regions promoting safer, low-VOC construction additives indirectly boosts demand for performance enhancers like HPS that enable high-quality material finishes.

Conversely, significant Restraints challenge sustained growth. The market faces volatility linked to the price and supply of raw materials, primarily native starches (potato, corn, cassava), which are agricultural commodities sensitive to weather patterns and geopolitical factors. Secondly, the production of HPS is energy-intensive, and rising energy costs, coupled with increasing environmental scrutiny regarding chemical processes, can inflate manufacturing overheads. Competition from alternative additives, such as specific cellulose ethers or synthetic polymers offering similar or enhanced functionalities in niche applications, also poses a constraint on market share expansion for HPS.

Opportunities for growth are substantial, mainly stemming from product innovation and geographical expansion. The development of specialized, highly dispersible HPS grades optimized for extremely niche applications, like 3D printing construction materials or highly flexible tile grouts, presents a significant revenue avenue. Additionally, penetrating untapped markets in Latin America and Africa, where the adoption of advanced dry-mix technology is still in early stages, offers long-term growth potential. The convergence of sustainable chemistry and digitalization in production further allows manufacturers to differentiate their offerings based on environmental footprint and consistent supply quality, capitalizing on the growing green building trend.

- Drivers: Rapid growth in global dry-mix mortar consumption; increased quality standards in construction demanding high performance additives; urbanization and infrastructure investment, especially in APAC.

- Restraints: Volatility and price fluctuations of native starch raw materials; competition from alternative thickeners; high energy requirements for the etherification process.

- Opportunity: Development of niche HPS grades for specialized construction applications (e.g., self-leveling floors, 3D printing); expanding market penetration in emerging construction economies.

- Impact Forces: The high demand for construction performance, coupled with raw material supply chain instability, creates intense pressure on manufacturers to maintain consistent quality while managing input costs.

Segmentation Analysis

The Hydroxypropyl Starch Ether market is rigorously segmented based on application, source, and function, providing granular insights into demand patterns and competitive landscapes. Segmentation by application clearly highlights the dominance of the Construction sector, which relies on HPS for essential performance modifications in cementitious systems. Within construction, specialized applications such as External Insulation Finishing Systems (EIFS) and high-flex tile adhesives are exhibiting faster growth due to thermal efficiency regulations and modern architectural requirements. The smaller, non-construction segments, including paints and coatings and specialized cosmetic applications, focus more on high-purity, low-dose HPS variants.

Source-based segmentation is crucial as the performance characteristics of HPS are highly dependent on the molecular structure and amylopectin-to-amylose ratio of the native starch used. Potato starch is often preferred for high-performance construction applications due to its inherent long chain structure which provides superior viscosity build-up and stability. However, corn starch remains a cost-effective and abundant alternative, particularly in regions with high corn cultivation. Tapioca and cassava starches are becoming increasingly utilized in Asia Pacific, driven by local availability and efforts to diversify the raw material base to mitigate supply chain risks associated with single-source reliance.

The market segmented by function underscores the core utility of HPS. The thickening agent function represents the largest market share, as viscosity control is the fundamental requirement for ensuring proper application and preventing segregation in dry-mix mortars. Water retention is the second major function, essential for ensuring full cement hydration and preventing premature drying, especially in hot climates. The anti-sag/anti-slip function, vital for vertical applications like wall plasters and tiling, is the fastest-growing functional segment, reflecting the increasing prevalence of large format and heavy tiles demanding specialized rheology modifiers.

- By Application:

- Construction (Tile Adhesives, Renders & Plasters, Self-Leveling Compounds, Joint Fillers)

- Paints and Coatings

- Detergents and Cleaning Agents

- Others (Cosmetics, Specialty Industrial)

- By Source:

- Potato Starch

- Corn Starch

- Cassava Starch (Tapioca)

- Other Native Starches

- By Function:

- Thickening Agent

- Water Retention Agent

- Anti-Sag / Anti-Slip Agent

- Rheology Modifier

Value Chain Analysis For Hydroxypropyl Starch Ether Market

The Hydroxypropyl Starch Ether value chain initiates with the upstream supply of native starch, derived predominantly from agriculture (potatoes, corn, tapioca). This raw material stage is characterized by high volatility, depending on crop yields, agricultural subsidies, and global commodity pricing. Key players in this stage include large agricultural cooperatives and commodity trading houses. The second stage involves the chemical processing of native starch through etherification using reagents like propylene oxide to produce HPS. This stage requires significant capital investment in reaction technology, quality control systems, and adherence to strict chemical safety standards. Manufacturers in this stage strive for high energy efficiency and optimized reaction kinetics to maximize the degree of substitution (DS) and product purity.

The midstream of the value chain is focused on formulation, blending, and distribution. HPS manufacturers often partner with technical distributors or specialized chemical wholesalers who possess deep knowledge of regional construction regulations and application requirements. Blending is crucial, as HPS is frequently sold as a performance-grade powder, sometimes pre-mixed with other additives like cellulose ethers or redispersible polymer powders (RDPs) to create customized construction additive packages. Effective midstream management relies on logistical efficiency and localized inventory management to serve the often-urgent needs of dry-mix mortar producers.

The downstream segment centers on the end-users, primarily dry-mix mortar producers, who incorporate HPS into their final products (tile adhesives, plasters). These producers, in turn, supply the material to construction contractors, builders, and retailers. Direct sales, though less common than distribution partnerships, are often utilized for large, strategic accounts requiring highly specialized or custom HPS grades. The entire chain is influenced by stringent performance requirements, where the failure of the additive to deliver consistent rheology or anti-sag properties can lead to significant construction defects and reputational damage. Therefore, technical support and consistent product quality assurance are critical drivers of value and supplier selection.

Hydroxypropyl Starch Ether Market Potential Customers

The primary customers for Hydroxypropyl Starch Ether are manufacturing entities within the global construction materials sector that specialize in producing dry-mix mortars and specialty construction chemicals. These manufacturers include global giants who produce a complete range of building materials, as well as specialized regional companies focused specifically on cementitious tile adhesives and self-leveling compounds. Their core requirement is a highly consistent, performance-enhancing additive that guarantees the workability, stability, and adhesive strength of their finished products under various environmental conditions. They require HPS suppliers who can offer technical assistance in optimizing dosages and ensuring compatibility with other additives, such as synthetic polymers and cement types.

Secondary, yet rapidly growing, customer bases include manufacturers in the paints and coatings industry. Here, HPS is used as an efficient, often more cost-effective, thickener and stabilizer for water-based architectural paints and industrial coatings. These customers seek HPS grades that offer improved brush drag, sag resistance, and color acceptance. Furthermore, formulators of specialized industrial applications, such as oilfield cementing additives or high-performance grouts, represent niche, high-value customer segments where the unique fluid-loss control and rheology modification capabilities of HPS are highly valued.

Potential customers are increasingly characterized by their focus on sustainability and operational efficiency. They demand suppliers who can provide HPS with robust certifications regarding sourcing (e.g., non-GMO starch) and manufacturing processes (low environmental impact). The shift towards pre-fabricated and modular construction also creates a distinct customer need for rapid-setting, high-early-strength mortars that require precise HPS formulations, pushing the potential customer profile toward innovative, technology-driven construction material developers willing to pay a premium for guaranteed performance enhancers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CP Kelco, Cargill, Ingredion, AkzoNobel, BASF, Wacker Chemie, Ashland Global, Emsland Group, Avebe, Shandong Head, Lamberti S.p.A., Chemipol, Qingdao Yishida, Henan Taiying, Shandong Ruisheng |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydroxypropyl Starch Ether Market Key Technology Landscape

The technological landscape of the Hydroxypropyl Starch Ether market is fundamentally characterized by advancements in starch modification chemistry and process optimization. The core technology remains the etherification reaction, typically conducted in a slurry or dry state using propylene oxide and alkaline catalysts. Recent innovations focus heavily on achieving a precise and uniform degree of substitution (DS) across the starch molecule. Manufacturers are employing advanced reactor designs, such as fluid-bed reactors or specialized continuous loop reactors, to ensure homogenous reaction conditions. This precision is vital because the DS level directly dictates the final product's performance characteristics, including viscosity build-up, shear thinning behavior, and water retention capacity in cementitious systems.

A second crucial area of technological development involves enhancing the dispersibility and solubility of the final HPS powder. Modern HPS grades are often surface-treated or engineered for rapid dissolution in cold water, which is paramount for ensuring hassle-free integration into dry-mix mortar formulations without clumping. Sophisticated drying techniques, including flash drying and spray drying, are utilized to achieve the optimal particle size distribution and morphology, guaranteeing excellent compatibility with other fine-powder ingredients like cement and sand. The adoption of advanced analytical techniques, such as Fourier-Transform Infrared Spectroscopy (FTIR) and Rheometry, for real-time quality control ensures that technological improvements translate directly into product consistency and reliable performance.

Furthermore, technology is playing a major role in sustainability efforts within the HPS industry. Manufacturers are increasingly exploring "green chemistry" approaches, including the use of renewable energy sources for production and optimizing catalyst systems to minimize chemical waste. Research into enzyme-assisted starch modification is ongoing, aiming to potentially replace traditional, harsh chemical processes with more benign and energy-efficient alternatives in the long term. These technological shifts not only improve the product's environmental profile but also address market demands for highly specialized, environmentally conscious additives, driving the overall competitiveness of the HPS market.

- Advanced Etherification Techniques: Utilization of specialized continuous reactors (e.g., loop reactors) to achieve high and consistent Degree of Substitution (DS).

- Process Optimization: Enhanced drying and grinding technologies (flash drying, jet milling) to control particle size and improve cold-water dispersibility.

- Analytical Instrumentation: Adoption of advanced rheometers and spectrometers for real-time monitoring of product viscosity and purity.

- Sustainable Chemistry: Research into enzyme-assisted synthesis and energy-efficient processes to reduce the carbon footprint of production.

- Product Engineering: Development of surface-modified HPS grades optimized for extreme pH and temperature stability in specialized construction materials.

Regional Highlights

The Asia Pacific (APAC) region stands out as the epicenter of the Hydroxypropyl Starch Ether market, dominating both production and consumption. This dominance is intrinsically linked to the unprecedented scale of infrastructure development, rapid urbanization, and massive governmental investments in residential and commercial construction across countries like China, India, and Southeast Asian nations. The high demand is driven by the vast and growing utilization of dry-mix mortars, replacing traditional site-mixed formulas to improve construction speed and quality. Furthermore, the availability of abundant raw materials, such as corn and tapioca starch, coupled with lower manufacturing overheads compared to Western regions, reinforces APAC’s position as a key global supplier.

Europe represents a mature but highly specialized market for HPS. Demand growth here is moderate, primarily driven by stringent quality standards and a strong emphasis on renovating existing structures to improve energy efficiency (e.g., EIFS applications). European manufacturers focus on producing premium, high-purity HPS grades that comply with strict REACH regulations and sustainability mandates. Innovation in this region revolves around developing specialized additives for green building materials and zero-emission construction projects. Germany, France, and the UK are key markets, requiring consistent supply and high technical support to meet demanding architectural specifications.

North America is characterized by consistent demand supported by robust residential construction and infrastructure maintenance activities. The market here values high-performance and reliable supply chains. While the overall volume is less than APAC, the region commands high pricing for specialized HPS products used in repair mortars, high-end tile installations, and sophisticated self-leveling applications. Latin America and the Middle East and Africa (MEA) are emerging growth territories. In MEA, the large-scale projects associated with urbanization and economic diversification (e.g., Saudi Arabia's Vision 2030) are fueling a sharp rise in demand for imported HPS and dry-mix technologies, positioning the region as a significant future consumer.

- Asia Pacific (APAC): Market leader driven by rapid urbanization, massive infrastructure spending (China, India), and local access to native starches (corn, tapioca).

- Europe: Mature market focused on premium, specialized grades; growth fueled by renovation projects, EIFS, and stringent environmental regulations (REACH compliance).

- North America: Stable demand driven by residential construction and high-performance repair mortars; emphasis on consistent quality and advanced technical support.

- Latin America & MEA: High growth potential due to increasing adoption of dry-mix technology in infrastructure and mega-projects, representing key future consumption centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydroxypropyl Starch Ether Market.- CP Kelco

- Cargill Incorporated

- Ingredion Incorporated

- Emsland Group

- Avebe U.A.

- Shandong Head Co., Ltd.

- Chemipol

- Qingdao Yishida Food Co., Ltd.

- Henan Taiying Chemical Industry Co., Ltd.

- Shandong Ruisheng Chemical Co., Ltd.

- BASF SE (As an end-user/formulator and potentially a niche producer)

- Wacker Chemie AG (As a major dry-mix partner, influencing HPS demand)

- Ashland Global Holdings Inc. (Focused on specialty cellulose derivatives, relevant competition)

- Lamberti S.p.A.

- Dow Chemical Company (Through related polymer and thickener segments)

- AkzoNobel N.V. (In coatings and specialty applications)

- Roquette Frères

- Tate & Lyle PLC

Frequently Asked Questions

Analyze common user questions about the Hydroxypropyl Starch Ether market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Hydroxypropyl Starch Ether (HPS) and its primary role in construction?

Hydroxypropyl Starch Ether (HPS) is a modified starch polymer derived from native starches like potato or corn. Its primary role in construction is acting as a rheology modifier and thickening agent in dry-mix mortars (like tile adhesives and plasters), enhancing anti-sag properties, improving workability, and controlling the consistency of the mixture during application, which is crucial for vertical surfaces and large format tiles.

How do the raw material sources impact the performance of HPS?

The raw material source significantly influences HPS performance. Potato starch, due to its naturally higher molecular weight and specific amylopectin structure, generally yields HPS with superior thickening efficiency and better anti-sag characteristics. Conversely, corn and tapioca starches are more cost-effective but may require higher dosages to achieve comparable viscosity levels, impacting overall formulation cost and performance balance.

Which regions are driving the highest demand for Hydroxypropyl Starch Ether?

The Asia Pacific (APAC) region, specifically China and India, is currently driving the highest demand for HPS. This immense market consumption is fueled by rapid, large-scale urbanization, extensive government investment in infrastructure, and the continuous shift within the region towards using pre-mixed, high-performance dry-mix construction materials for efficiency and quality assurance.

What are the key technical differences between HPS and Cellulose Ethers (HPMC) in mortar applications?

HPS and Cellulose Ethers (HPMC) are often used synergistically. HPMC provides crucial water retention and enhanced open time, while HPS excels primarily as a targeted rheology modifier that significantly boosts anti-sag/anti-slip properties and improves the shear thinning behavior of the mortar. HPS is typically used to refine the structural stability and ease of application, complementing HPMC’s hydration control.

What are the future growth opportunities for HPS beyond traditional construction?

Future growth opportunities for HPS lie in specialized applications such as 3D printing construction materials, where precise viscosity control is essential for layer stability. Other emerging areas include high-performance industrial coatings, specialized oilfield cementing fluids requiring fluid-loss control, and advancements in sustainable, low-VOC paint formulations seeking bio-based thickening alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager