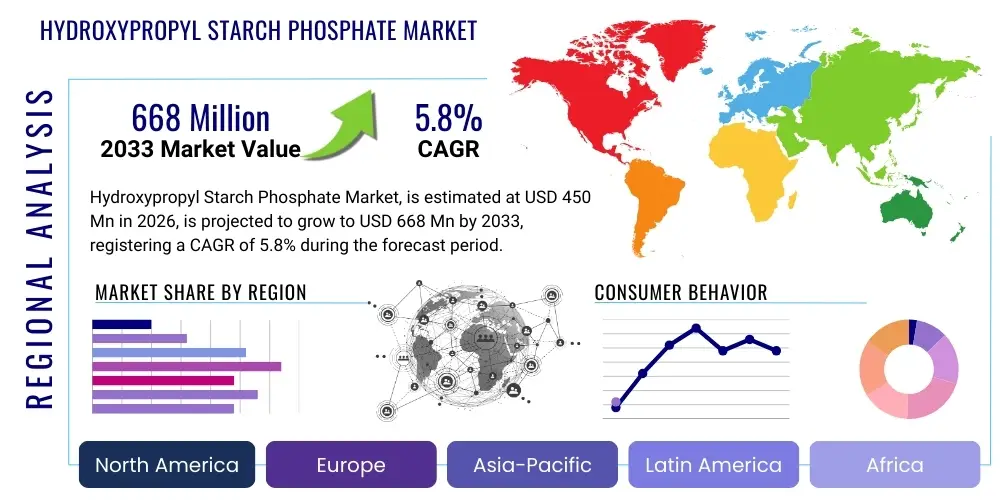

Hydroxypropyl Starch Phosphate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437434 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Hydroxypropyl Starch Phosphate Market Size

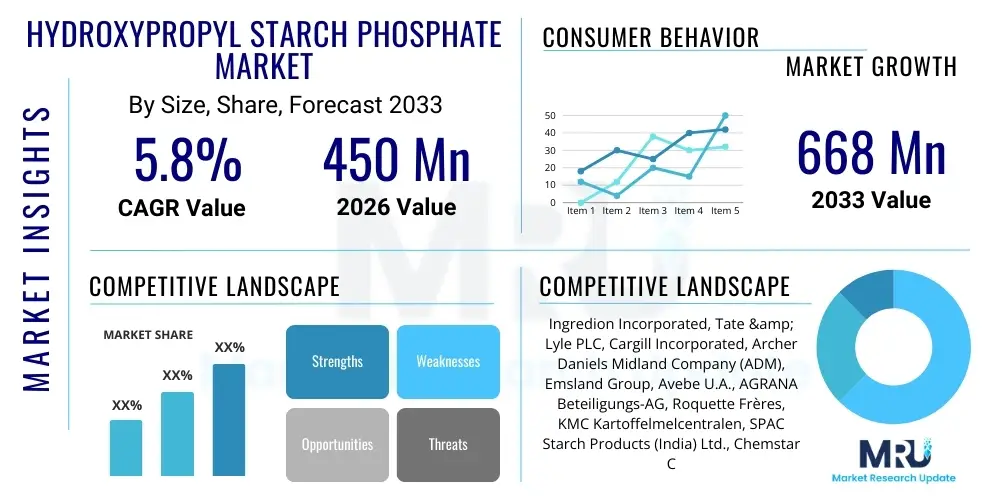

The Hydroxypropyl Starch Phosphate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Hydroxypropyl Starch Phosphate Market introduction

Hydroxypropyl Starch Phosphate (HPSP) is a chemically modified starch derivative widely utilized as a thickening agent, emulsion stabilizer, and texturizer across diverse industries, predominantly food and cosmetics. Derived typically from natural starches such as corn, potato, or tapioca, this ingredient undergoes phosphorylation and hydroxypropylation to enhance its functional properties, notably stability under harsh processing conditions like high heat, low pH, and high shear stress. This dual modification process imbues the starch with excellent freeze-thaw stability and superior viscosity retention, making it indispensable in modern product formulation.

The primary applications of HPSP span sophisticated cosmetic formulations, where it acts as a rheology modifier to improve texture, spreadability, and overall sensory experience in lotions, creams, and sunscreens, providing a desirable non-tacky feel. In the food sector, it is extensively used in dairy alternatives, sauces, dressings, and ready-to-eat meals to prevent syneresis, stabilize emulsions, and enhance mouthfeel. Its versatility in binding water and retaining structure positions it as a favored alternative to traditional synthetic stabilizers, aligning with the global movement towards ingredients perceived as natural or naturally derived.

Market expansion is fundamentally driven by the accelerating demand for processed and convenience foods globally, requiring high-performance stabilizers that maintain product integrity over extended shelf lives. Furthermore, the burgeoning personal care industry, characterized by continuous innovation and the introduction of advanced functional ingredients for enhanced product performance, significantly contributes to HPSP consumption. The benefits of using HPSP include superior texture stability, reduced ingredient separation, and compatibility with a wide range of cosmetic and food components, solidifying its role as a key functional additive.

Hydroxypropyl Starch Phosphate Market Executive Summary

The Hydroxypropyl Starch Phosphate market demonstrates robust growth, primarily propelled by favorable business trends emphasizing clean label ingredients and functional food stability. Manufacturers are increasingly focused on optimizing modification processes to achieve specific viscosity profiles required by high-end cosmetic formulations and demanding food applications like vegan dairy substitutes. Strategic mergers and acquisitions among key producers aim to consolidate raw material supply chains and expand geographical footprints, particularly in rapidly urbanizing regions that exhibit a high consumption rate of packaged goods. Innovation centers on developing sustainable sourcing methods and enzymatic modification techniques to lower the environmental impact and appeal to eco-conscious consumers.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by expanding middle-class populations, increased disposable incomes, and the massive scale of food processing and cosmetic manufacturing activities, notably in China and India. North America and Europe maintain significant market shares, characterized by stringent quality control standards and a mature consumer base demanding premium, high-stability personal care products. These regions also lead in the adoption of HPSP in sophisticated applications such as pharmaceutical excipients and nutraceutical formulations, reflecting high investment in R&D and advanced regulatory compliance.

Segmentation trends indicate that the cosmetic application segment, encompassing skin care and hair care, commands the largest market share due to the ingredient’s unique ability to enhance the sensory properties of emulsion-based products without stickiness. By source, tapioca-based HPSP is gaining traction owing to its desirable transparency and stability characteristics, particularly valued in premium cosmetic formulations and clear food systems. The starch modification technology segment is witnessing a shift towards greener chemical processes and higher efficiency reactors to meet growing volume demands while adhering to increasingly strict environmental regulations regarding chemical usage and wastewater management.

AI Impact Analysis on Hydroxypropyl Starch Phosphate Market

Common user questions regarding AI’s influence typically revolve around how artificial intelligence can accelerate product development cycles, predict raw material price volatility, and enhance quality control in the highly technical modification process of starches. Users are keen to understand if AI-driven predictive modeling can optimize the chemical reaction parameters (temperature, pH, reagent concentration) involved in phosphorylation and hydroxypropylation to consistently achieve desired molecular weights and substitution levels, thereby reducing batch-to-batch variation and minimizing resource waste. Key themes include concerns about the transparency of AI-driven supply chain decisions and expectations that machine learning could revolutionize the discovery of new, functionally superior starch derivatives suitable for novel applications, such as specialized drug delivery systems, accelerating time-to-market for innovative HPSP variants.

- AI-powered predictive maintenance optimizes starch processing equipment, minimizing downtime and increasing plant efficiency.

- Machine learning algorithms analyze starch modification parameters to ensure consistent HPSP functional properties (viscosity, stability) across large production batches.

- AI tools forecast raw material (native starch, propylene oxide, phosphate salts) price fluctuations and supply chain bottlenecks, enhancing procurement strategy.

- Cheminformatics utilizes AI to screen and design novel starch structures with enhanced functionalities for targeted cosmetic or food applications.

- Generative AI assists R&D teams in simulating and optimizing formulation compatibility between HPSP and complex matrices, speeding up prototype development.

DRO & Impact Forces Of Hydroxypropyl Starch Phosphate Market

The Hydroxypropyl Starch Phosphate market dynamics are shaped by a complex interplay of growth drivers, inherent constraints, emerging opportunities, and competitive impact forces. A primary driver is the pervasive trend of replacing synthetic stabilizers, such as certain carbomers or cellulose derivatives, with naturally derived, yet highly functional, ingredients like HPSP, driven by consumer preference for cleaner labels and perceived ingredient safety. Secondly, the rapid expansion and diversification of the cosmetic industry, especially in the anti-aging, sun care, and specialty skin treatment sectors, necessitate stabilizers that provide exceptional emulsion stability and sensory attributes, a requirement HPSP uniquely satisfies, fueling substantial demand.

However, the market faces significant restraints. The volatility in the price and supply of native starch, which serves as the core raw material (e.g., corn, potato), particularly during adverse weather events or geopolitical disruptions, poses a continuous challenge to manufacturing margins. Additionally, the complex and capital-intensive nature of the chemical modification process, requiring specialized equipment and strict adherence to safety and environmental protocols, limits the entry of new players and necessitates continuous capital investment for existing manufacturers to maintain compliance and competitiveness in the marketplace.

Opportunities for growth are substantial, particularly within the pharmaceutical sector where HPSP can serve as a highly effective binder, disintegrant, or controlled-release matrix component in oral solid dosage forms, leveraging its biocompatibility and favorable swelling properties. Geographical expansion into emerging markets in Africa and Latin America, coupled with increased application scope in the booming nutraceutical and functional beverage industries, provides manufacturers with diverse avenues for revenue diversification. The overall impact forces are moderate to high, characterized by high competition among established chemical manufacturers and the critical need for continuous product differentiation based on sourcing sustainability and functional performance parameters.

Segmentation Analysis

The Hydroxypropyl Starch Phosphate market is systematically segmented based on Source, Application, and Function, providing a granular view of market consumption patterns and growth pockets. Segmentation by Source allows stakeholders to analyze the performance and market acceptance of HPSP derived from corn, potato, tapioca, and wheat, recognizing that each source imparts slightly different functional characteristics, such as transparency, viscosity, and gel strength, crucial for targeted end-use. Segmentation by Application highlights the crucial demand areas, predominantly spanning cosmetics, food and beverages, and pharmaceuticals, with cosmetics currently dominating the usage volume due to the necessity of stable, high-performance textural agents in modern skincare.

- By Source:

- Corn

- Potato

- Tapioca

- Wheat

- Others (e.g., Rice)

- By Application:

- Cosmetics and Personal Care

- Skin Care (Creams, Lotions, Sunscreens)

- Hair Care

- Color Cosmetics

- Food and Beverages

- Sauces and Dressings

- Dairy and Dairy Alternatives

- Ready-to-Eat Meals

- Beverages and Juices

- Confectionery

- Pharmaceuticals (Excipients, Binders)

- Industrial Applications (Textiles, Paper)

- Cosmetics and Personal Care

- By Function:

- Stabilizer

- Thickener

- Emulsifier

- Texturizer

- Binder

Value Chain Analysis For Hydroxypropyl Starch Phosphate Market

The value chain for Hydroxypropyl Starch Phosphate begins with the upstream procurement phase, which involves sourcing and refining native starches—primarily corn, potato, or tapioca—from agricultural producers. Raw material consistency and cost efficiency are critical at this stage, as they directly influence the final product quality and manufacturing margins. Key upstream activities include milling, purification, and drying of the raw starch, followed by the procurement of essential modification agents such as propylene oxide and phosphorus oxychloride or phosphate salts, which are typically sourced from specialized chemical intermediate suppliers. Supply chain stability in this initial phase is paramount, requiring strong contractual relationships to mitigate volatility in commodity markets.

The core manufacturing process, or midstream activity, involves the chemical modification reactions (hydroxypropylation and phosphorylation) carried out in specialized batch or continuous reactors. This phase requires sophisticated chemical engineering expertise and stringent process control to ensure the correct degree of substitution and modification uniformity, which dictate the functional performance of the HPSP. Quality assurance and testing, including rheological analysis and microbiological screening, are embedded within this stage. Following synthesis, the modified starch is washed, neutralized, filtered, dried, and pulverized into the final powder form, ready for distribution.

Downstream activities involve the distribution channel, which utilizes both direct and indirect routes. Direct sales are often preferred for large-volume industrial customers, such as major multinational cosmetic manufacturers or packaged food conglomerates, enabling customized specifications and technical support. Indirect distribution relies on specialized chemical and food ingredient distributors who possess localized market expertise, warehousing capabilities, and provide smaller batch quantities to medium-sized or regional customers. End-users, including formulation laboratories and production plants, then integrate HPSP into their final consumer products. Efficiency in logistics and technical support provided by the channel partners significantly impacts the final adoption rate in end-user markets.

Hydroxypropyl Starch Phosphate Market Potential Customers

The primary consumers and buyers of Hydroxypropyl Starch Phosphate are complex formulation businesses requiring high-performance, stable, and texturizing agents. Cosmetic formulators represent the largest cohort of potential customers, spanning large global beauty conglomerates and niche artisanal skincare brands. These customers rely on HPSP to stabilize oil-in-water emulsions in high-end creams, lotions, and specialized treatment serums, seeking the superior sensory profile (smooth, non-greasy feel) it provides compared to traditional gum stabilizers. The growing demand for clean-label, water-resistant sunscreens and highly stable personal care products continuously drives consumption from this segment.

The second major category encompasses manufacturers within the processed food and beverage industry. This includes companies specializing in culinary sauces, salad dressings, savory dips, frozen desserts, and plant-based dairy alternatives. For these buyers, HPSP is essential for preventing phase separation (syneresis) during storage and freeze-thaw cycles, ensuring consistent texture, and improving the overall mouthfeel, particularly in low-fat or vegan formulations where natural thickening must compensate for the absence of fats or traditional gelling agents. The expansion of convenience food offerings globally translates directly into increased purchasing needs for HPSP.

A third, high-value customer segment is the pharmaceutical and nutraceutical industry. Pharmaceutical companies utilize HPSP as a specialized excipient in tablet formulations, acting as a binder to hold active ingredients together or as a disintegrant to ensure controlled release of the medication. Nutraceutical manufacturers incorporate HPSP into functional powders, nutritional drinks, and supplements to improve suspension stability and texture. These customers prioritize regulatory compliance, high purity, and consistency, often requiring customized, pharma-grade HPSP variants, making them valuable long-term buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingredion Incorporated, Tate & Lyle PLC, Cargill Incorporated, Archer Daniels Midland Company (ADM), Emsland Group, Avebe U.A., AGRANA Beteiligungs-AG, Roquette Frères, KMC Kartoffelmelcentralen, SPAC Starch Products (India) Ltd., Chemstar Corporation, ULTIMA FOOD PRODUCTS, Qingdao Echemi Technology Co., Ltd., Guangxi Qishan Starch Co., Ltd., Pure Food Ingredients, GPC (Grain Processing Corporation), Penford Corporation, Zhejiang Yanzhong Starch Co., Ltd., SMS Corporation, Samyang Genex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydroxypropyl Starch Phosphate Market Key Technology Landscape

The manufacturing technology landscape for Hydroxypropyl Starch Phosphate is defined by advancements in chemical modification techniques aimed at improving efficiency, yield, and sustainability. The predominant methods involve esterification with phosphate salts and etherification with propylene oxide, often performed sequentially or simultaneously. Key technological focus areas include optimizing reaction kinetics to precisely control the Degree of Substitution (DS) of both the hydroxypropyl and phosphate groups. Modern reactor designs utilize advanced mixing technologies and temperature control systems to ensure homogeneous modification across the starch granule, leading to superior functional consistency.

A significant technological trend is the shift towards greener and more sustainable production methods. This involves developing enzymatic modification processes that potentially reduce the reliance on harsh chemical reagents, lowering energy consumption, and minimizing wastewater treatment complexities. Furthermore, manufacturers are exploring continuous processing lines, moving away from traditional batch reactors, which allows for higher throughput, better scalability, and lower operational costs. Innovations in drying and milling technologies are also crucial to ensure the final HPSP powder has optimal particle size distribution and flowability, essential for its integration into automated customer formulation systems.

The quality control technology is increasingly sophisticated, employing techniques such as High-Performance Liquid Chromatography (HPLC), Gel Permeation Chromatography (GPC), and advanced rheometers to accurately measure molecular weight distribution, purity levels, and viscosity profiles. Process Analytical Technology (PAT) tools are being integrated into manufacturing lines to monitor critical quality attributes in real-time, allowing for immediate process adjustments and guaranteeing that the final product meets stringent regulatory standards set by bodies like the FDA (under modified food starches) and equivalent European or Asian regulatory agencies. This technological refinement is necessary to meet the escalating demands for consistency and safety from global CPG (Consumer Packaged Goods) clients.

Regional Highlights

The global Hydroxypropyl Starch Phosphate market exhibits distinct regional dynamics, dictated by consumption patterns, regulatory frameworks, and manufacturing capabilities. Asia Pacific (APAC) dominates the market in terms of production capacity and is projected to experience the highest growth rate during the forecast period. This accelerated expansion is attributed to the rapid industrialization of the food processing sector, the massive growth of the domestic and export-oriented cosmetic manufacturing industries in countries like China, South Korea, and India, and increasing consumer awareness regarding product quality and texture in packaged foods. Low production costs and favorable government policies supporting the chemical and food ingredient sector further bolster APAC’s leading position.

North America and Europe collectively represent the largest consumption hubs for high-value HPSP products, driven by stringent quality standards, high disposable income enabling premium cosmetic purchasing, and mature regulatory environments that favor approved modified starches. The North American market is characterized by robust demand from major global food and beverage companies prioritizing stability and texture in complex, ready-to-eat meals and plant-based substitutes. European consumption is highly influenced by the emphasis on natural, non-GMO sourcing and the utilization of HPSP in sophisticated clean-label formulations across both food and personal care industries.

Latin America and the Middle East & Africa (MEA) are emerging markets for HPSP. In Latin America, urbanization and the associated shift towards packaged and processed foods are generating new demand, while MEA markets, particularly the Gulf Cooperation Council (GCC) countries, are witnessing significant investment in domestic cosmetic production and the food service industry, spurred by changing dietary habits and population growth. While currently smaller in market share, these regions offer substantial untapped potential for manufacturers looking to expand their geographical reach and diversify their revenue streams in the coming years.

- Asia Pacific (APAC): Highest growth region; primary manufacturing hub; driven by China, India, and ASEAN countries due to massive growth in CPG and cosmetic sectors.

- North America: Leading consumer of high-grade HPSP; strong demand from specialized food applications and premium skin care; market driven by the US and Canada.

- Europe: Characterized by high regulatory standards; strong focus on sustainable sourcing and clean-label application in Germany, France, and the UK.

- Latin America (LATAM): Growing consumption in Brazil and Mexico, linked to increasing processed food penetration and cosmetic industry maturation.

- Middle East & Africa (MEA): Emerging market; demand growth linked to expanding food processing capabilities and high-end personal care imports/domestic production in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydroxypropyl Starch Phosphate Market.- Ingredion Incorporated

- Tate & Lyle PLC

- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Emsland Group

- Avebe U.A.

- AGRANA Beteiligungs-AG

- Roquette Frères

- KMC Kartoffelmelcentralen

- SPAC Starch Products (India) Ltd.

- Chemstar Corporation

- ULTIMA FOOD PRODUCTS

- Qingdao Echemi Technology Co., Ltd.

- Guangxi Qishan Starch Co., Ltd.

- Pure Food Ingredients

- GPC (Grain Processing Corporation)

- Penford Corporation

- Zhejiang Yanzhong Starch Co., Ltd.

- SMS Corporation

- Samyang Genex

Frequently Asked Questions

Analyze common user questions about the Hydroxypropyl Starch Phosphate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Hydroxypropyl Starch Phosphate and what are its main functions in product formulation?

Hydroxypropyl Starch Phosphate (HPSP) is a dual-modified food and cosmetic starch derived typically from corn or tapioca, created through phosphorylation and hydroxypropylation. Its primary functions are acting as a superior rheology modifier, stabilizer, and texturizer, improving emulsion stability (preventing separation), enhancing viscosity, and imparting a smooth, non-tacky sensory texture, especially crucial in high-shear and low-pH systems.

How does the sourcing of HPSP (e.g., tapioca vs. corn) affect its final application performance?

The native starch source significantly impacts HPSP performance. Tapioca-derived HPSP often yields a product with high clarity and excellent freeze-thaw stability, making it ideal for transparent cosmetic gels and clear food systems. Corn-derived HPSP is widely available and cost-effective, offering robust viscosity and opacity, commonly used in sauces and creamy lotions. Manufacturers select the source based on the desired transparency, stability, and sensory profile of the final product.

What are the key regulatory approvals or safety concerns associated with Hydroxypropyl Starch Phosphate?

HPSP is generally recognized as safe (GRAS) by the FDA in the United States and is approved in Europe under the modified food starch designation (E1442). It is considered safe for use as a stabilizer and texturizer in food, beverages, and cosmetics. Key regulatory concerns revolve around ensuring the minimal residual levels of modification agents, such as propylene oxide, meet international food safety and pharmaceutical purity standards, which necessitates strict quality control during manufacturing.

Which end-user segment is driving the largest demand for HPSP globally?

The Cosmetics and Personal Care segment currently constitutes the largest demand driver for Hydroxypropyl Starch Phosphate. Its exceptional performance in stabilizing complex emulsion systems, particularly in skin care products like creams, sunscreens, and specialized serums, while delivering a highly desirable, smooth, and non-greasy skin feel, solidifies its critical role in high-growth areas of the global beauty industry.

What technological advancements are shaping the future production of HPSP?

Future production is being shaped by advancements focused on sustainability and efficiency, including the implementation of enzymatic modification techniques to reduce reliance on harsh chemicals, the adoption of continuous processing systems for higher throughput and consistency, and the integration of Process Analytical Technology (PAT) for real-time quality assurance and optimization of the Degree of Substitution during the modification reaction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager