Hygienic and Aseptic Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434078 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hygienic and Aseptic Valves Market Size

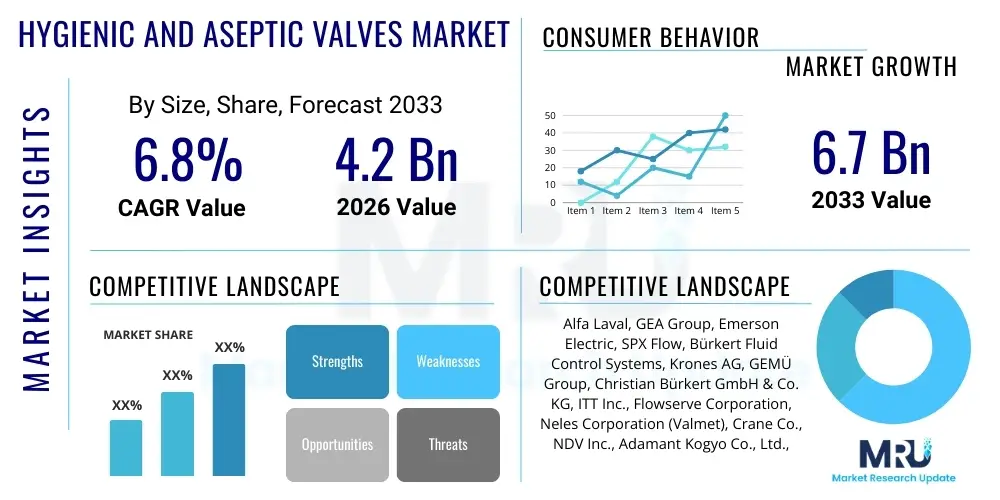

The Hygienic and Aseptic Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Hygienic and Aseptic Valves Market introduction

The Hygienic and Aseptic Valves Market encompasses specialized fluid control devices engineered specifically for processes requiring ultra-clean conditions, primarily within the pharmaceutical, biotechnology, food and beverage, and cosmetic industries. These valves are designed to prevent contamination, ensuring product purity, and comply strictly with stringent regulatory mandates such as FDA, EHEDG, and 3-A Sanitary Standards. Key products include diaphragm, ball, butterfly, sampling, and regulating valves constructed from high-grade stainless steel (typically 316L) with surfaces polished to specific Ra values to eliminate crevices where microorganisms could harbor. The primary applications involve sterile media handling, fermentation processes, clean-in-place (CIP) and sterilization-in-place (SIP) systems, blending, filling, and accurate dosing of sensitive ingredients.

The core benefit derived from utilizing hygienic and aseptic valves is the maintenance of product integrity and safety, which is paramount in regulated sectors. These valves minimize downtime associated with cleaning and inspection while providing exceptional reliability and leak prevention. Driving factors for market expansion include the rapidly increasing global demand for processed foods and beverages, the surging investment in biopharmaceutical manufacturing—especially in vaccine and therapeutic protein production—and the continuous push towards automated, standardized production facilities globally. Furthermore, strict governmental oversight regarding product safety and the mandatory implementation of Good Manufacturing Practices (GMP) globally mandate the adoption of these specialized fluid control solutions.

Hygienic and Aseptic Valves Market Executive Summary

The Hygienic and Aseptic Valves Market demonstrates robust growth, primarily fueled by significant capital expenditure in bioprocessing infrastructure and the continuous modernization of aging food and beverage production facilities, particularly across developing economies. Business trends indicate a strong shift towards modular and single-use systems in biopharma, though traditional reusable stainless steel valves remain indispensable for core permanent installations like fermentation and bulk storage. Manufacturers are focusing heavily on developing smart valves equipped with advanced diagnostics and Industrial Internet of Things (IIoT) capabilities to facilitate predictive maintenance and enhance operational efficiency, addressing the rising complexity of automated processing lines. Mergers and acquisitions remain a key strategy for market leaders seeking to consolidate technological expertise, expand geographic reach, and acquire niche specialization in specific valve types, such as aseptic sampling or high-purity diaphragm valves, ensuring comprehensive portfolio offerings that meet varying industry needs.

Regionally, North America and Europe currently dominate the market due to the mature pharmaceutical and stringent regulatory environments, high capacity for biologics manufacturing, and significant investment in sustainable and automated processing technologies. However, the Asia Pacific region, led by China and India, is projected to exhibit the fastest growth rate, driven by rapid urbanization, increasing consumer awareness regarding food safety, massive expansion of local biopharmaceutical capabilities, and governmental support for domestic manufacturing hubs. Segment trends highlight that the Diaphragm Valves segment maintains the largest market share due to its superior sealing characteristics and inherent suitability for sterile applications, while the Aseptic Valves category, specifically designed for completely sterile environments (e.g., UHT processing), is projected to experience accelerated growth due to rising demand for shelf-stable food and injectable drugs. Material-wise, 316L stainless steel remains the foundational choice, although specialized alloys and high-performance elastomers for sealing are seeing increased usage to handle aggressive CIP chemicals and high temperatures.

AI Impact Analysis on Hygienic and Aseptic Valves Market

Common user questions regarding AI’s influence on the hygienic valve sector revolve around how Artificial Intelligence can enhance predictive maintenance schedules, optimize cleaning cycles (CIP/SIP), and improve overall process reliability without compromising sterility. Users frequently inquire about the integration of AI algorithms with sensor data collected from smart valves to detect minute variations in pressure, temperature, or actuator performance, predicting potential mechanical failures far in advance of traditional scheduled checks. There is also significant interest in AI’s role in optimizing inventory management for specialized parts and streamlining compliance documentation by automating data logging and anomaly detection. These themes underscore a collective expectation that AI will transition the industry from reactive maintenance and standardized scheduling to a truly proactive, condition-based operational model, thereby minimizing contamination risk and maximizing uptime in critical production environments.

AI's primary impact on the Hygienic and Aseptic Valves Market is fundamentally focused on enhancing operational efficiency and reliability, transforming maintenance protocols from preventative to predictive. By processing vast datasets generated by integrated sensors—monitoring stem position, seal integrity, vibration profiles, and media flow characteristics—AI algorithms can identify subtle deviations indicative of imminent wear or failure. This predictive capability allows plant operators to schedule non-intrusive maintenance during planned downtime, effectively eliminating unexpected breakdowns that could lead to costly batch losses or extended periods of non-compliance. Furthermore, AI is being deployed to optimize the parameters for CIP and SIP procedures; for instance, determining the minimum required chemical concentration and exposure time based on real-time contamination levels, reducing utility consumption and shortening cycle times while ensuring complete sterilization.

- AI-Powered Predictive Maintenance: Utilizing machine learning models to analyze valve performance data, forecasting component wear, and preventing critical failures in aseptic lines.

- Optimized Cleaning Cycles: Implementing AI to dynamically adjust CIP/SIP duration and parameters based on real-time sensor feedback, enhancing sterilization effectiveness and reducing water/chemical waste.

- Enhanced Quality Control: Using computer vision and AI to inspect surface finishes (Ra value checks) and weld integrity during manufacturing and deployment, ensuring stringent hygienic design standards are met.

- Automated Compliance Documentation: AI systems automating the logging and analysis of valve operation cycles, pressure tests, and maintenance records, simplifying regulatory audits and demonstrating adherence to GMP.

- Smart Inventory Management: Predicting the need for spare parts (diaphragms, seals) based on anticipated usage and operational strain, optimizing stock levels for critical components.

DRO & Impact Forces Of Hygienic and Aseptic Valves Market

The market is predominantly driven by the stringent regulatory framework imposed on the pharmaceutical and food sectors globally, compelling manufacturers to invest continuously in high-purity fluid handling equipment to prevent cross-contamination and ensure product safety. Another key driver is the accelerated growth of the biotechnology and biosimilars segment, which inherently requires advanced aseptic processing technologies. Restraints primarily include the high initial capital investment required for high-grade stainless steel valves and sophisticated automation systems, coupled with complex maintenance procedures requiring specialized training. Opportunities are emerging through the development of single-use valve technologies, especially in biopharma, and expansion into emerging markets where modernization of industrial processing capabilities is rapidly accelerating. The impact forces indicate a shift toward high-pressure, high-temperature applications requiring more durable sealing materials, driven by the need for faster, more effective sterilization methods.

Drivers: The increasing global population and the resultant elevated demand for packaged and processed foods necessitate robust, high-throughput production lines that rely heavily on reliable hygienic valves. Simultaneously, the expanding pipelines of injectable drugs, complex biologics, and sensitive prophylactic products in the pharmaceutical industry mandate zero-tolerance for contamination, making specialized aseptic valves mandatory. These industry demands are directly supported by regulatory bodies like the FDA and EMA, whose tightening standards push manufacturers to continuously upgrade equipment. Furthermore, the efficiency gains realized through automated CIP/SIP systems, which rely on precise valve control, contribute significantly to operational cost reduction and increased throughput, providing a financial incentive for adoption.

Restraints: The primary restraint is the premium cost associated with hygienic and aseptic valves compared to standard industrial valves, attributed to the need for costly materials (316L stainless steel), specialized surface finishing techniques (electropolishing), and rigorous certification processes. Technical complexity also poses a challenge; installing and maintaining aseptic valve clusters requires specialized engineering expertise, which can be scarce in certain regions. Moreover, the inherent sensitivity of elastomeric seals and diaphragms to certain aggressive cleaning agents or extremely high temperatures limits their operational lifespan, contributing to higher maintenance and replacement costs, particularly in continuous processing environments where downtime is expensive.

Opportunities: Significant growth opportunities exist in the development of modular and portable processing skids, particularly those integrated with hygienic mini-valves for small-scale and personalized medicine manufacturing. The rapid adoption of plant-based foods and alternative protein sources, which require specialized sanitary processing under strict control, presents a new application field. Furthermore, innovation in material science—such as developing new polymer compounds that offer higher chemical resistance and longer life cycles under SIP conditions—provides avenues for product differentiation. The increasing digitalization of the factory floor, allowing for smart integration of valves into comprehensive IIoT networks, also opens up markets for value-added services like remote diagnostics and predictive analytics subscriptions.

Segmentation Analysis

The Hygienic and Aseptic Valves Market segmentation provides a detailed framework for understanding market dynamics across different product types, functions, applications, and end-user industries. The market is primarily segmented based on the mechanism of the valve (Diaphragm, Single Seat, Double Seat, Ball, Butterfly), distinguishing between components based on operational need, fluid characteristics, and sterilization requirements. Further segmentation based on material (316L Stainless Steel, specialized alloys) is crucial due to the regulatory necessity for non-reactive contact surfaces. The depth of segmentation reflects the diverse and exacting demands of end-user sectors, which range from high-volume beverage processing to low-volume, high-value cell and gene therapy manufacturing.

The core of market activity resides within the Diaphragm and Double Seat valve categories. Diaphragm valves are favored for high-purity processes due to their ability to provide hermetic separation between the process media and the operating mechanism, ensuring absolute sterility—a critical requirement in aseptic drug manufacturing. Double Seat (Mixproof) valves dominate large-scale food and dairy processing, enabling the simultaneous handling of two different media in adjacent lines without risk of cross-contamination, thus maximizing pipeline utilization and operational flexibility. Understanding the end-use application, whether it is sterile processing, filling and dosing, or utility service (e.g., purified water systems), is vital for manufacturers tailoring specific valve solutions that meet flow rates, pressure ratings, and ease of automated cleaning specifications required by the client.

- By Type:

- Diaphragm Valves

- Single Seat Valves

- Double Seat (Mixproof) Valves

- Ball Valves

- Butterfly Valves

- Sampling Valves

- Others (Check Valves, Regulating Valves)

- By Operation:

- Manual Valves

- Pneumatic Valves (Actuated)

- Motorized/Electric Valves

- By Material:

- 316L Stainless Steel

- Specialized Alloys

- Elastomers and Polymers (PTFE, EPDM, PEEK)

- By End-Use Industry:

- Food & Beverage (Dairy, Brewing, Soft Drinks, Prepared Foods)

- Pharmaceutical & Biotechnology (Biologics, API Manufacturing, Vaccine Production)

- Cosmetics & Personal Care

- Chemicals (Fine Chemicals)

Value Chain Analysis For Hygienic and Aseptic Valves Market

The value chain for hygienic and aseptic valves begins with upstream activities focused heavily on sourcing high-quality raw materials, primarily medical-grade stainless steel (316L), and specialized high-performance elastomers and polymers (e.g., PTFE, EPDM) for seals and diaphragms. Upstream suppliers are scrutinized not only for material quality but also for consistency and traceability, as material defects can compromise the valve's hygienic performance. Key manufacturing processes involve precision casting, machining, welding, and critically, surface finishing (polishing and electro-polishing) to achieve the ultra-smooth surfaces required (Ra values typically below 0.8 µm). Research and development activities focus on optimizing fluid dynamics within the valve body to eliminate dead legs and improve drainability, which is vital for efficient CIP/SIP performance.

Downstream analysis focuses on distribution and integration. Given the technical complexity and application-specific nature of these valves, distribution relies heavily on specialized industrial distributors and technical sales representatives who possess deep knowledge of sanitary process engineering and regulatory compliance. Direct distribution is common for large-scale, customized projects, where manufacturers work closely with Engineering, Procurement, and Construction (EPC) firms involved in setting up new production facilities. Indirect channels, such as authorized local distributors, handle smaller volume sales, maintenance spare parts, and aftermarket service. The critical final step involves installation, commissioning, and validation services, often provided by the manufacturer or certified third parties, ensuring the valves are correctly integrated and validated according to GAMP (Good Automated Manufacturing Practice) and regulatory requirements before operational use.

Hygienic and Aseptic Valves Market Potential Customers

The potential customer base for hygienic and aseptic valves spans multiple regulated industries where product purity and avoidance of cross-contamination are non-negotiable prerequisites. Primary buyers include major pharmaceutical companies specializing in biologics, vaccines, and sterile injectable medications, who require the highest level of aseptic control in their upstream (fermentation, cell culture) and downstream (purification, filling) processes. Biotechnology firms, particularly those engaged in gene and cell therapy manufacturing, represent a rapidly growing segment requiring small-scale, highly precise aseptic components.

Within the Food & Beverage sector, dairy processors, breweries, soft drink manufacturers, and specialized infant formula producers are massive end-users. Dairy processing, specifically, relies heavily on Double Seat Mixproof valves for complex routing and separation of products from cleaning agents. Furthermore, the burgeoning prepared foods and functional ingredients sectors, which handle sensitive, high-value components, require reliable hygienic control. Equipment manufacturers (OEMs) who build integrated processing systems (e.g., fillers, homogenizers, UHT systems) also constitute a significant customer group, purchasing valves for incorporation into their final machinery sold to end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alfa Laval, GEA Group, Emerson Electric, SPX Flow, Bürkert Fluid Control Systems, Krones AG, GEMÜ Group, Christian Bürkert GmbH & Co. KG, ITT Inc., Flowserve Corporation, Neles Corporation (Valmet), Crane Co., NDV Inc., Adamant Kogyo Co., Ltd., W. W. Grainger, Inc., Samson AG, M&S Armaturen GmbH, Tuchenhagen GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hygienic and Aseptic Valves Market Key Technology Landscape

The technology landscape of the Hygienic and Aseptic Valves Market is defined by a continuous focus on improving seal integrity, enhancing cleanability, and integrating smart functionalities for digital process control. A core technological advancement is the widespread adoption of radial diaphragm seal technology in aseptic valves, which minimizes dead volume and ensures highly reliable hermetic separation between the fluid and the atmosphere. Materials science innovation is also critical, specifically the development of advanced EPDM, PTFE, and composite elastomers that offer extended longevity and resistance to high-temperature steam sterilization (SIP) and chemically aggressive Clean-in-Place (CIP) solutions, addressing a significant pain point regarding operational lifespan.

In terms of operational technology, the integration of automation through sophisticated actuators (pneumatic and electro-pneumatic) equipped with position feedback and diagnostic capabilities is becoming standard. These smart actuators allow for precise flow control and provide real-time data back to the centralized control systems (SCADA/DCS), facilitating optimized batch processing and automated validation reports. Furthermore, Double Seat (Mixproof) valve technology continues to evolve, incorporating advanced lifting and balancing systems to ensure zero leakage even under high differential pressures, enabling increased production safety and efficiency in complex matrix piping systems common in large dairies and breweries.

The emerging technological focus centers on connectivity and modularity. Manufacturers are increasingly incorporating IO-Link protocols and embedding sensors directly into valve bodies to monitor parameters like temperature, vibration, and seat wear. This push toward IIoT connectivity enables predictive maintenance models and remote diagnostics, crucial for maintaining operational uptime in critical biopharma applications. Simultaneously, modular valve designs, such as block-and-bleed configurations built from a single piece of machined metal, reduce the number of potential leakage points and simplify maintenance and sterilization validation, supporting flexible manufacturing setups and reducing the overall footprint of process equipment.

Regional Highlights

North America maintains a dominant share in the Hygienic and Aseptic Valves Market, driven by the presence of a vast and highly regulated pharmaceutical and biotechnology industry, particularly within the United States. The region benefits from substantial investment in R&D for novel biotherapeutics and stringent adherence to FDA mandates, compelling manufacturers to utilize premium aseptic equipment. Furthermore, the early adoption of smart factory technologies and high rates of automation across food processing facilities contribute significantly to market value. The trend toward domestic manufacturing and supply chain resilience following global disruptions further solidifies the need for new, state-of-the-art processing lines equipped with advanced hygienic valve systems.

Europe represents the second-largest market, characterized by the robust presence of large multinational food and beverage conglomerates and a highly mature pharmaceutical sector governed by European Medicines Agency (EMA) and EHEDG (European Hygienic Engineering & Design Group) standards. Germany, France, and the UK are key contributors, focusing heavily on innovation in sustainable processing and energy efficiency, which translates into demand for high-performance, long-lasting aseptic valves. The strict EU directives concerning food safety and traceability continue to enforce modernization efforts in manufacturing plants, driving consistent replacement cycles and upgrades of existing valve infrastructure to meet the latest hygienic design specifications.

The Asia Pacific (APAC) region is poised for the highest growth trajectory throughout the forecast period. This rapid expansion is primarily attributed to large-scale infrastructure investments in pharmaceutical manufacturing, notably in China and India, aiming to serve both domestic demand and global export markets for generics and biosimilars. Rising disposable incomes and increasing consumer awareness regarding food safety and packaged food quality are simultaneously driving the expansion and modernization of the regional Food & Beverage processing industry. Local governments are actively promoting GMP compliance, creating a massive, untapped market for hygienic and aseptic solutions, though price sensitivity remains a key factor influencing procurement decisions compared to Western markets.

- North America: Dominant market share due to stringent FDA regulations, high concentration of biopharma companies, and heavy investment in highly automated, high-purity fluid handling systems.

- Europe: Mature market characterized by robust regulatory bodies (EMA, EHEDG) and strong demand from the dairy, brewing, and high-quality pharmaceutical industries, focusing on sustainable and energy-efficient valve solutions.

- Asia Pacific (APAC): Fastest-growing region driven by rapid industrialization, massive expansion of generic and biosimilar drug manufacturing in China and India, and increasing consumer focus on food safety standards.

- Latin America (LATAM): Growth driven by modernization of the food and beverage industry, particularly in Brazil and Mexico, responding to urbanization and demand for packaged consumer goods.

- Middle East & Africa (MEA): Emerging market showing steady growth, primarily focused on establishing domestic pharmaceutical production capacity and upgrading dairy and bottled water facilities to meet international hygiene standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hygienic and Aseptic Valves Market.- Alfa Laval AB

- GEA Group Aktiengesellschaft

- SPX Flow, Inc.

- Emerson Electric Co.

- Bürkert Fluid Control Systems

- GEMÜ Group

- ITT Inc.

- Flowserve Corporation

- Christian Bürkert GmbH & Co. KG

- Krones AG

- Neles Corporation (Valmet)

- Crane Co.

- NDV Inc.

- Adamant Kogyo Co., Ltd.

- W. W. Grainger, Inc.

- Samson AG

- M&S Armaturen GmbH

- Tuchenhagen GmbH

- Metso Outotec Corporation

- Schlumberger Limited (Cameron International)

Frequently Asked Questions

Analyze common user questions about the Hygienic and Aseptic Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between hygienic and aseptic valves?

Hygienic valves are designed for easy cleaning (CIP/SIP capable) and prevent microbial growth, used primarily in general food and beverage processing. Aseptic valves meet stricter standards, offering a completely hermetic seal (preventing ingress of external contaminants) and often include a sterile barrier, mandatory for pharmaceutical processes and ultra-high temperature (UHT) applications where absolute sterility is required.

Which regulatory standards govern the design and use of these valves?

The key standards include the FDA (Food and Drug Administration) requirements, especially for materials in contact with food/drugs; 3-A Sanitary Standards (U.S. dairy industry focused); EHEDG (European Hygienic Engineering & Design Group) guidelines for design; and ASME BPE (BioProcessing Equipment) standards, particularly critical for pharmaceutical manufacturing.

What role does surface finish (Ra value) play in hygienic valve performance?

The Ra (Roughness average) value dictates the smoothness of the wetted internal surfaces. A lower Ra value (e.g., 0.8 µm or 0.4 µm for aseptic) is critical because rough surfaces can create micro-crevices where bacteria can accumulate, resist cleaning, and lead to biofilm formation, compromising product purity and making validation difficult.

Why are Double Seat (Mixproof) valves essential in the dairy industry?

Double Seat Mixproof valves are essential because they use two independent seals and a leakage chamber between them to completely separate two different media (e.g., milk and cleaning solution) without risk of cross-contamination, allowing safe, simultaneous routing in complex piping matrices, maximizing uptime and production capacity.

How is the adoption of single-use technology impacting the demand for traditional stainless steel hygienic valves?

Single-use (disposable) valves are gaining traction, especially in clinical-scale biopharma and modular processing, offering zero cross-contamination risk and eliminating CIP/SIP costs. However, traditional stainless steel valves remain indispensable for high-volume, long-term critical applications like fermentation, large-scale utility systems (WFI, purified water), and permanent infrastructure due to their durability and long-term cost efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager