Hyperimmune Globulin Injection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435960 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Hyperimmune Globulin Injection Market Size

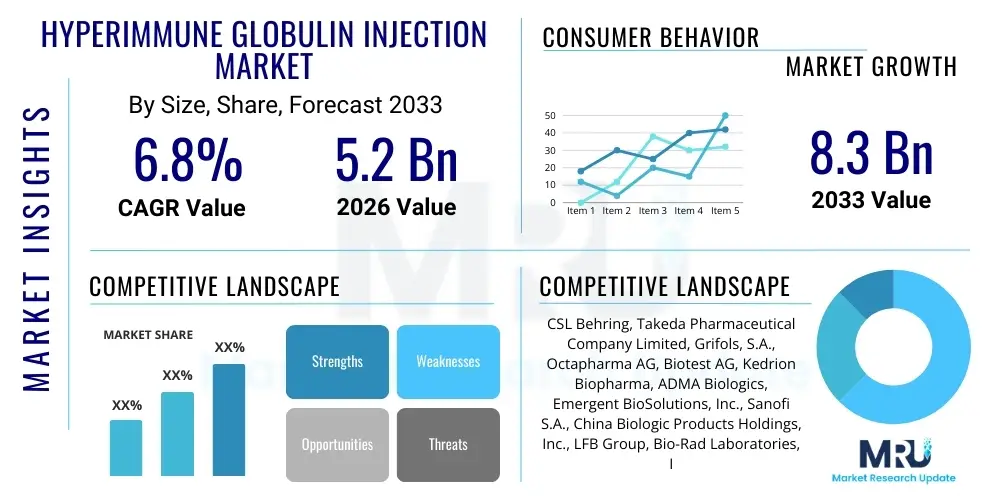

The Hyperimmune Globulin Injection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global prevalence of primary and secondary immunodeficiency disorders, coupled with substantial advancements in plasma fractionation technologies and the heightened adoption of these specialized therapies for prophylaxis against specific infectious diseases in vulnerable populations, such as neonates and immunocompromised patients. Furthermore, the rising awareness regarding the benefits of passive immunization, particularly in the face of emerging viral threats and complex autoimmune conditions, significantly contributes to the escalating demand for highly purified and pathogen-inactivated hyperimmune globulin products. The market growth trajectory is further supported by favorable regulatory pathways in developed economies accelerating product approvals.

Hyperimmune Globulin Injection Market introduction

The Hyperimmune Globulin Injection Market encompasses pharmaceutical products derived primarily from pooled human plasma containing high concentrations of specific antibodies (immunoglobulins) against targeted antigens. These specialized products, including Tetanus Immunoglobulin, Rabies Immunoglobulin, Hepatitis B Immunoglobulin, and Respiratory Syncytial Virus (RSV) Immunoglobulin, are administered via injection (intravenous or subcutaneous) to provide immediate, passive immunity to individuals who are unable to mount an effective immune response or require rapid protection following exposure to a serious infectious agent. The primary mechanism involves neutralizing the pathogen or toxin, offering therapeutic benefits across a broad range of clinical applications, distinct from standard intravenous immunoglobulin (IVIg) which is generally polyclonal.

These crucial biopharmaceuticals are utilized extensively in post-exposure prophylaxis, prevention of infections in transplant recipients, treatment of certain autoimmune conditions, and management of various hematological and neurological disorders. Key applications include preventing Tetanus following deep wounds, protecting infants against severe RSV infection (e.g., Palivizumab, though synthetically derived, competes in this space), and managing CMV infection in high-risk patients. The essential benefit of hyperimmune globulins lies in their high specificity and rapid onset of action, crucial for life-saving interventions when active vaccination is ineffective or immediate protection is necessary. Regulatory strictness regarding plasma screening and viral inactivation ensures high product safety, driving physician and patient confidence in their therapeutic value.

Driving factors for this specialized market include the increasing pool of immunocompromised patients due to cancer therapies and organ transplantation, rising global infectious disease outbreaks demanding immediate prophylaxis, and continuous technological refinements in plasma sourcing and purification processes that enhance product yield and purity. Furthermore, expanding indications for specific hyperimmune products, such as novel treatments being explored for emerging pathogens and complex autoimmune diseases, stimulate market research and development activities. Conversely, challenges related to plasma availability, high production costs, and stringent regulatory oversight concerning plasma safety standards influence market dynamics.

Hyperimmune Globulin Injection Market Executive Summary

The Hyperimmune Globulin Injection Market is characterized by high barriers to entry, driven by the reliance on human plasma sourcing, complex regulatory frameworks, and significant capital investment required for fractionation facilities. Current business trends indicate a strong focus on geographic diversification of plasma collection centers to ensure supply stability, particularly in response to the volatility observed during recent global health crises. Companies are heavily investing in increasing the yield and purity of fractionated products using advanced chromatographic techniques and implementing enhanced viral inactivation steps to meet escalating safety standards. Furthermore, strategic collaborations between plasma collectors and large pharmaceutical manufacturers are becoming crucial for optimizing the supply chain and expanding access to niche specific hyperimmune products, moving beyond the traditional reliance on IVIg products.

Regionally, North America and Europe dominate the market, benefiting from established healthcare infrastructure, favorable reimbursement policies, and a high concentration of plasma fractionation expertise and technology. However, the Asia Pacific region is rapidly emerging as the fastest-growing market due to increasing healthcare expenditure, rising awareness of passive immunization, and the expanding patient population requiring prophylactic treatments for infectious diseases. Key segment trends indicate that the application of specific hyperimmune globulins, particularly against emerging or complex viral threats like CMV and Hepatitis B, is seeing accelerated growth compared to standard IVIg used widely for immunodeficiency. Moreover, the shift towards greater acceptance of subcutaneous immunoglobulin (SCIg) delivery systems, which offer convenience and reduce the burden on hospital infusion centers, represents a significant evolution in patient care management, although IVIg remains the primary administration route due to high dose requirements.

The competitive landscape is consolidated, dominated by a few global players that control the majority of the world's plasma supply and fractionation capacity. These major corporations are concentrating on pipeline expansion, specifically developing hyperimmune products targeting specific pathogens identified as high global health priorities, such as certain multi-drug resistant bacterial strains or novel viral pathogens. Regulatory pressures often drive innovation in product safety, particularly regarding prion reduction and improved viral clearance mechanisms. Overall, the market remains fundamentally strong, supported by the irreplaceable therapeutic need for these plasma-derived products in severe deficiency and infectious disease settings, ensuring sustained long-term growth.

AI Impact Analysis on Hyperimmune Globulin Injection Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hyperimmune Globulin Injection Market often center on how AI can stabilize the inherently unpredictable plasma supply chain, improve the efficiency and yield of the complex plasma fractionation process, and accelerate the development of synthetic or recombinant alternatives to plasma-derived products. Key concerns revolve around the integration cost of sophisticated AI algorithms in highly regulated manufacturing environments and the ethical implications of using predictive analytics for patient stratification and treatment optimization. Users frequently seek information on AI's ability to enhance pharmacovigilance by analyzing vast datasets of adverse events related to immunoglobulin therapy and identifying novel biomarkers for better targeted hyperimmune product development, especially in infectious disease management where rapid response is critical. Expectations are high that AI can mitigate human errors and variability inherent in manual plasma processing, thereby increasing overall product consistency and safety, which is paramount in this high-value therapeutic area.

AI's primary influence is expected in operational optimization rather than direct therapeutic function. Specifically, Machine Learning (ML) algorithms are being deployed to predict regional and seasonal variations in plasma donation rates, allowing manufacturers to strategically adjust inventory levels and logistics, thereby minimizing supply shortages that frequently plague the market. Furthermore, in the fractionation process—a critical and energy-intensive step—AI can optimize chromatography protocols, predict optimal buffer concentrations, and minimize protein loss during purification, substantially increasing the final yield of high-purity immunoglobulins from a fixed amount of raw plasma. This operational efficiency is vital for improving profitability and reducing the environmental footprint of these manufacturing processes, which are traditionally resource-intensive. The use of image recognition AI in the quality control of plasma bags, ensuring better pre-processing screening for hemolysis and lipemia, also represents a growing application for defect reduction.

Beyond manufacturing, AI is revolutionizing research and development efforts by rapidly screening and analyzing genomic data related to pathogen strains and human immune responses. This capability allows researchers to quickly identify highly potent antibody subsets required for next-generation hyperimmune products targeting novel or rapidly mutating infectious agents. Moreover, in clinical settings, predictive AI models are being utilized to forecast patient response to passive immunization therapy based on individual clinical profiles and genetic markers, enabling personalized dosing and treatment regimens. While AI will not replace plasma-derived products soon, its integration will standardize quality, ensure supply robustness, and drive targeted therapeutic innovation, thus securing the long-term viability and efficiency of the Hyperimmune Globulin Injection Market.

- AI optimizes global plasma supply chain management by predicting donation trends and geographical needs.

- Machine Learning enhances plasma fractionation yield and purity through optimization of chromatographic processes.

- AI aids in rapid identification of novel antibody targets for specific hyperimmune product development.

- Predictive analytics supports patient stratification for personalized hyperimmune dosing and clinical trial design.

- Integration of AI improves quality control and pharmacovigilance for plasma-derived therapies.

DRO & Impact Forces Of Hyperimmune Globulin Injection Market

The Hyperimmune Globulin Injection Market is shaped by a complex interplay of positive and negative market forces. Key drivers include the escalating global burden of infectious diseases requiring immediate prophylactic intervention, the growing elderly population highly susceptible to severe infections, and substantial investment in healthcare infrastructure, particularly in emerging economies. Restraints center predominantly on the inherent dependence on human plasma donors, leading to supply volatility and high raw material costs, coupled with rigorous and lengthy regulatory approval processes essential for maintaining product safety and minimizing pathogen transmission risks. Opportunities arise from technological breakthroughs in recombinant and transgenic antibody production, potentially offering alternatives to traditional plasma sourcing, as well as the expansion of indications for existing hyperimmune products into niche neurological and inflammatory conditions. The market's overall impact forces reflect a high demand driven by critical clinical need, counterbalanced by persistent manufacturing and sourcing limitations, ensuring a continuous focus on technological innovation to stabilize the supply chain.

Segmentation Analysis

The Hyperimmune Globulin Injection Market is comprehensively segmented based on its source material, key therapeutic application, type of immunoglobulin product, and the end-user setting where these injections are administered. This segmentation allows for precise market sizing and strategic targeting, reflecting the varied clinical needs and manufacturing complexities across different product lines. The product segment is dominated by specific hyperimmune globulins tailored to individual pathogens (like Tetanus or Rabies), although Intravenous Immunoglobulin (IVIg) remains crucial due to its use in a broader range of immunodeficiency and autoimmune disorders, forming a significant baseline volume. Application segmentation highlights the increasing demand driven by prophylactic use in managing specific infectious diseases in high-risk groups, alongside specialized applications in treating complex neurological conditions where IVIg and hyperimmune variants play an increasingly recognized role.

- By Source:

- Human Plasma-Derived

- Recombinant / Synthetic

- By Application:

- Immunodeficiency (Primary & Secondary)

- Neurological Disorders (e.g., CIDP, Guillain-Barré Syndrome)

- Infectious Diseases (e.g., Tetanus, Rabies, Hepatitis B, RSV, CMV)

- Hematology

- Other Applications (e.g., Kawasaki Disease)

- By Type:

- Intravenous Immunoglobulin (IVIg)

- Subcutaneous Immunoglobulin (SCIg)

- Specific Hyperimmune Globulins (e.g., TIG, RIG, HBIG)

- By End-User:

- Hospitals

- Clinics

- Homecare Settings

Value Chain Analysis For Hyperimmune Globulin Injection Market

The value chain for hyperimmune globulin injections is highly complex, beginning with the upstream analysis dominated by the critical activity of plasma collection. This stage involves identifying suitable donors, rigorous screening, and the logistical challenges of maintaining cold chain integrity across a vast network of plasma collection centers. Regulatory compliance and ensuring the quality and safety of the source material are the most significant cost and complexity drivers at this initial stage. Major fractionation companies often own or tightly control these upstream operations to guarantee a consistent and high-quality raw material supply. Efficiency in plasma yield per liter is the primary metric driving competitiveness in the upstream segment, necessitating heavy investment in donor recruitment and retention programs.

The midstream phase involves manufacturing, specifically large-scale plasma fractionation (Cohn process or chromatography), purification, viral inactivation, and final formulation into the injectable product. This stage is characterized by high technical expertise requirements, substantial operational overhead, and stringent Good Manufacturing Practice (GMP) adherence. Innovation in this segment focuses on minimizing product loss, enhancing pathogen clearance redundancy, and improving the stability and shelf life of the final product. Differentiation in the midstream often comes from proprietary purification techniques that result in higher purity and specialized product characteristics, such as high concentration or low IgA content, essential for specific patient groups.

The downstream analysis covers distribution, marketing, and sales, reaching end-users primarily through specialized distribution channels. Due to the high value, specific temperature requirements, and critical therapeutic nature, distribution is often managed directly by the manufacturer or through highly specialized third-party logistics (3PL) providers capable of handling controlled substances. Direct distribution channels are prevalent in large institutional settings like hospitals, ensuring better inventory management and minimizing risks. Indirect channels, such as wholesalers and specialty pharmacies, service smaller clinics and the growing homecare segment, driven by the shift towards Subcutaneous Immunoglobulin (SCIg) administration, necessitating robust patient support and training programs to ensure safe and effective use outside of the clinical environment.

Hyperimmune Globulin Injection Market Potential Customers

The primary customers for Hyperimmune Globulin Injection products are institutions and healthcare entities responsible for treating acute infections, managing chronic immunodeficiency, or performing high-risk procedures like organ transplants. Hospitals, especially those with specialized units such as Intensive Care Units (ICUs), transplant centers, oncology wings, and emergency departments, represent the largest end-user segment due to the immediate need for post-exposure prophylaxis (e.g., Rabies, Tetanus) and the administration of high-dose IVIg therapy for severe autoimmune or primary immunodeficiency disorders. These settings require large volumes and consistent supply, making them central procurement targets for manufacturers.

Beyond hospitals, specialty clinics, including immunology clinics, hematology centers, and neurology practices, are significant purchasers, focusing on long-term management of chronic conditions such as Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) or primary humoral immunodeficiency. These customers often drive demand for personalized therapies and the growth of convenient options like SCIg, which can be administered in outpatient or home settings, reducing healthcare costs and improving patient quality of life. The increasing adoption of homecare settings, supported by favorable reimbursement trends, is transforming the buyer landscape, shifting purchasing power partially towards specialized home infusion pharmacies and patient support organizations that manage supply logistics for self-administered treatments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CSL Behring, Takeda Pharmaceutical Company Limited, Grifols, S.A., Octapharma AG, Biotest AG, Kedrion Biopharma, ADMA Biologics, Emergent BioSolutions, Inc., Sanofi S.A., China Biologic Products Holdings, Inc., LFB Group, Bio-Rad Laboratories, Inc., Bayer AG, Shanghai RAAS Blood Products Co., Ltd., Bharat Serums and Vaccines Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hyperimmune Globulin Injection Market Key Technology Landscape

The technological landscape of the Hyperimmune Globulin Injection market is defined by advancements aimed at enhancing the safety, purity, and availability of plasma-derived products, while simultaneously exploring non-plasma derived alternatives. The gold standard technology remains large-scale plasma fractionation, primarily utilizing modified Cohn's ethanol precipitation processes, continuously refined with high-performance chromatography techniques (e.g., ion-exchange and affinity chromatography) to improve product yield and purity. These purification steps are crucial for separating IgG antibodies from other plasma proteins and ensuring the removal of aggregates. Furthermore, the mandatory implementation of robust, multi-step viral inactivation and removal procedures, such as solvent/detergent treatment, low pH incubation, and nanofiltration, represents a fundamental technological requirement that drives operational complexity and cost, yet assures high safety profiles against enveloped and non-enveloped viruses, thereby maintaining consumer trust.

A critical emerging area of technological focus is the development and commercialization of recombinant hyperimmune globulins. Unlike plasma-derived products, which face supply constraints, recombinant technologies, often based on mammalian cell culture or transgenic systems, offer the potential for unlimited supply, standardized quality, and the ability to rapidly engineer highly specific, monoclonal or polyclonal-mimicking antibodies against emerging pathogens. Products like Palivizumab (an RSV hyperimmune substitute) demonstrate the commercial viability of this approach. While full-spectrum polyclonal replacement remains technologically challenging due to the complexity of the human immune response, advancements in gene editing and display technologies are accelerating the discovery of high-affinity neutralizing antibodies, which, once mass-produced recombinantly, could significantly disrupt specific segments of the market by offering plasma-free alternatives for high-priority diseases.

Delivery technology also plays a crucial role in market evolution. The development of high-concentration Subcutaneous Immunoglobulin (SCIg) formulations, often incorporating recombinant human hyaluronidase (facilitating larger volume absorption), is a major technological shift. These formulations allow for convenient, patient self-administration outside of the clinic, significantly improving patient compliance and quality of life. Innovations in formulation chemistry focus on maintaining protein stability and minimizing injection site reactions for these highly concentrated solutions. The integration of advanced diagnostics for better screening of high-titer plasma donors—utilizing rapid and highly sensitive molecular biology techniques—also ensures that the raw plasma feedstock maximizes the therapeutic potential of the final hyperimmune product, closing the loop between advanced diagnostics and biopharmaceutical manufacturing.

Regional Highlights

- North America: This region holds the largest market share, driven by robust healthcare spending, sophisticated plasma collection infrastructure, and favorable reimbursement policies for costly immunoglobulin therapies. The presence of major global manufacturers and high awareness regarding immunodeficiency treatment protocols ensure sustained demand. The US is a crucial hub for plasma sourcing and advanced clinical trials for new hyperimmune products.

- Europe: Characterized by stringent quality and safety standards mandated by regulatory bodies like the EMA, Europe is a mature market demonstrating high utilization rates. Countries like Germany, France, and the UK are key consumers, primarily driven by aging populations and standardized treatment guidelines for specific infectious diseases and primary immunodeficiencies. Efforts focus on optimizing national plasma self-sufficiency.

- Asia Pacific (APAC): Expected to exhibit the fastest growth, APAC's expansion is fueled by improving access to healthcare, rising disposable incomes, and increasing prevalence of infectious diseases. Countries like China and India are investing heavily in establishing plasma collection and fractionation capabilities to reduce reliance on imported products. Regulatory harmonization efforts are accelerating market entry for global players.

- Latin America (LATAM): This region offers moderate growth potential, constrained by varying healthcare access and economic stability. However, the high incidence of certain infectious diseases and increasing government initiatives to improve blood product safety are slowly driving market penetration, particularly in Brazil and Mexico, focusing on essential hyperimmune products like TIG and RIG.

- Middle East and Africa (MEA): Growth in MEA is primarily confined to high-income Gulf Cooperation Council (GCC) countries, which boast advanced healthcare systems and high patient treatment capacity. Challenges remain in broader Africa due to limited healthcare infrastructure and high cost, although philanthropic and international aid programs occasionally drive localized demand for critical specific globulins.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hyperimmune Globulin Injection Market.- CSL Behring

- Takeda Pharmaceutical Company Limited

- Grifols, S.A.

- Octapharma AG

- Biotest AG

- Kedrion Biopharma

- ADMA Biologics, Inc.

- Emergent BioSolutions, Inc.

- Sanofi S.A.

- China Biologic Products Holdings, Inc.

- LFB Group

- Bayer AG

- Shanghai RAAS Blood Products Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Bharat Serums and Vaccines Ltd.

- Kamada Ltd.

- Liminal BioSciences Inc.

- Instituto Grifols, S.A.

- Plasma Protein Therapeutics Association (PPTA) members

Frequently Asked Questions

Analyze common user questions about the Hyperimmune Globulin Injection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard IVIg and Hyperimmune Globulin Injections?

Standard IVIg is a polyclonal product containing a broad spectrum of antibodies from thousands of donors, used mainly for primary immune deficiency and autoimmune disorders. Hyperimmune Globulins (e.g., TIG, HBIG) are specialized products containing significantly higher titers of specific antibodies targeting a single pathogen or toxin, used for immediate passive immunization or prophylaxis.

What are the main constraints impacting the supply of Hyperimmune Globulins?

The central constraint is the reliance on human plasma sourcing, which is subject to geographical, regulatory, and logistical limitations, leading to supply volatility. Additional constraints include the high cost of complex plasma fractionation and the rigorous safety testing required for viral inactivation.

Is recombinant technology expected to replace plasma-derived hyperimmune products?

While recombinant technology offers a sustainable, non-plasma alternative for single-target therapies (like specific monoclonal antibodies), it is currently technologically challenging and economically difficult to replicate the broad, polyclonal antibody complexity found in plasma-derived Hyperimmune Globulins, meaning replacement is unlikely in the near term for complex indications.

Which geographical region shows the fastest growth potential for this market?

The Asia Pacific (APAC) region is projected to register the fastest CAGR, driven by rapid improvements in healthcare infrastructure, increased patient awareness regarding immune therapies, rising disposable incomes, and the expansion of local plasma collection and processing facilities, particularly in key markets like China and India.

How is AI being utilized to improve the manufacturing of hyperimmune globulins?

AI is employed to optimize the efficiency of the plasma fractionation process, maximizing product yield through better control of chromatographic conditions, and enhancing supply chain predictability by forecasting plasma donation volumes and regional demand fluctuations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager