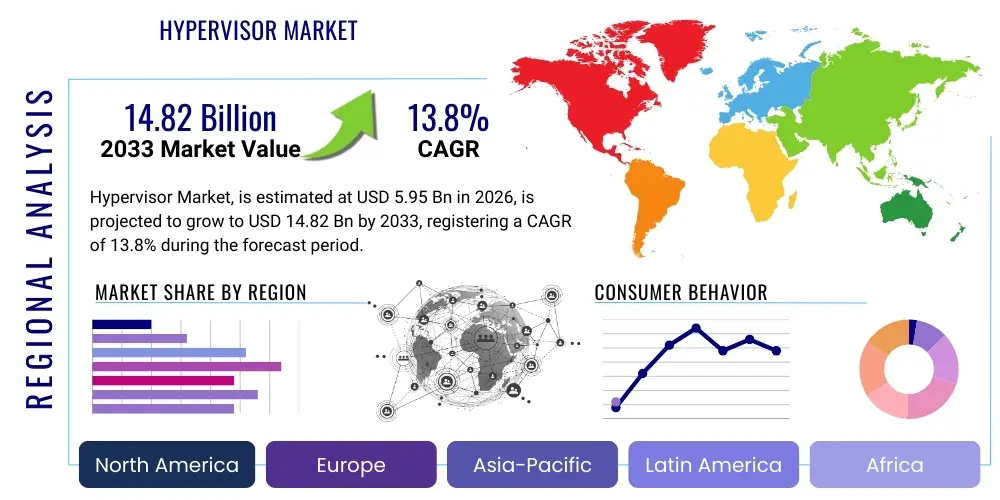

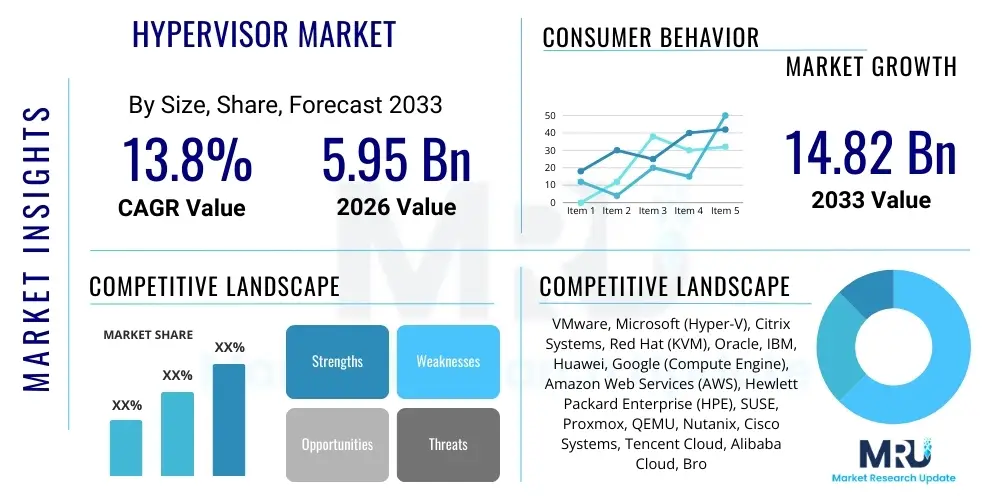

Hypervisor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437227 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hypervisor Market Size

The Hypervisor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. The market is estimated at USD 5.95 Billion in 2026 and is projected to reach USD 14.82 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for server consolidation across enterprise data centers and the pervasive adoption of hybrid cloud architectures. Hypervisors are fundamental to modern IT infrastructure, facilitating the efficient partitioning and utilization of physical server resources, thereby reducing operational expenditure and enhancing IT agility. The continuous shift towards software-defined infrastructure (SDI) and the need for greater operational resilience further solidify the market's upward trajectory.

Hypervisor Market introduction

The Hypervisor Market encompasses the technologies that create and run virtual machines (VMs), allowing multiple operating systems to share a single physical hardware platform. A hypervisor, also known as a Virtual Machine Monitor (VMM), is the core layer of virtualization technology, enabling resource isolation and efficient management. These systems are categorized primarily into Type 1 (bare-metal) hypervisors, which run directly on the host hardware, and Type 2 (hosted) hypervisors, which run as a software layer within a conventional operating system. Major applications span enterprise data center virtualization, cloud computing infrastructure (IaaS), disaster recovery, and the development/testing of software environments, offering profound benefits in resource optimization, enhanced security, and improved scalability.

The primary benefit derived from hypervisor implementation is the maximization of server utilization. By abstracting the hardware layer, hypervisors allow IT organizations to run numerous virtual servers on one physical machine, significantly reducing hardware footprint, power consumption, and cooling costs. Furthermore, hypervisors provide critical capabilities for live migration of VMs, enabling zero-downtime maintenance and robust load balancing. This foundational technology is indispensable for environments supporting modern, dynamic workloads, including microservices and containerized applications, even though containers utilize a different form of operating system-level virtualization.

Driving factors propelling the Hypervisor Market include the relentless growth of data volumes requiring scalable infrastructure, the mandatory shift towards hybrid and multi-cloud strategies for maximizing flexibility, and the heightened security requirements necessitating segregated operating environments. Enterprises increasingly rely on hypervisor technology to build secure virtual desktops (VDI) and manage complex DevOps pipelines. The evolution of processor technology, incorporating hardware-assisted virtualization (e.g., Intel VT-x and AMD-V), has dramatically improved hypervisor performance, making virtualization a viable solution even for high-performance computing (HPC) tasks.

Hypervisor Market Executive Summary

The Hypervisor Market is characterized by intense competition among established technology giants, with strategic emphasis shifting towards seamless integration with container orchestration tools like Kubernetes, particularly in hybrid cloud environments. Current business trends highlight the growth of open-source hypervisor solutions, such as KVM and Xen, challenging proprietary Type 1 vendors by offering cost-effective and highly customizable alternatives. Furthermore, vendors are focusing on enhancing security features, specifically around secure boot capabilities and confidential computing, addressing growing concerns about data integrity in virtualized environments. The market exhibits strong M&A activity as larger players acquire specialized startups to fill gaps in areas like edge virtualization and high-density VM management.

Regionally, North America maintains its dominance due to early and extensive adoption of cloud computing technologies and the presence of major cloud service providers (CSPs). However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid digitalization, massive investments in localized data centers, and governmental mandates promoting IT infrastructure modernization in countries like China, India, and Japan. Europe shows steady growth, driven by stringent data privacy regulations (GDPR), which necessitate robust, locally-managed private cloud solutions underpinned by advanced hypervisor technology.

Segment trends show Type 1 (Bare-Metal) hypervisors holding the largest market share due to their superior performance and stability, making them the standard choice for mission-critical enterprise workloads and public cloud infrastructure. However, the Type 2 segment remains vital for development, testing, and academic use cases, driven by user convenience and ease of installation. Deployment preferences are increasingly leaning towards cloud-based solutions, reflecting the overall industry movement towards utility computing and consumption-based IT models, although on-premise virtualization remains crucial for regulated industries and specific legacy applications.

AI Impact Analysis on Hypervisor Market

Users frequently inquire about how hypervisors handle resource-intensive AI and Machine Learning (ML) workloads, particularly regarding efficient GPU passthrough, latency management for real-time inference, and ensuring data security for sensitive training models. They also seek information on AIOps—the integration of AI techniques within hypervisor management platforms to automate resource provisioning, predict performance bottlenecks, and optimize energy consumption within large virtualized clusters. Key concerns revolve around whether traditional virtualization introduces unacceptable performance overhead for tasks requiring near bare-metal speed, and how new hypervisor designs (or containerized approaches alongside hypervisors) are evolving to meet these extreme performance demands efficiently.

The impact of Artificial Intelligence on the Hypervisor Market is multifaceted, driving demand for high-performance virtualization solutions capable of managing complex compute resources. AI training and inference often require direct access to accelerators like GPUs and FPGAs, necessitating advanced hardware passthrough (I/O virtualization) features within the hypervisor to minimize latency and maximize throughput. This requirement pushes hypervisor developers to enhance their technologies to support single-root I/O virtualization (SR-IOV) and dynamic allocation of specialized hardware, ensuring that virtualized environments can handle data-intensive computational tasks without significant performance degradation.

Furthermore, AI models are increasingly being deployed at the network edge (Edge AI), where resources are often constrained, demanding specialized, lightweight hypervisors optimized for smaller, embedded systems. The security aspect of AI data—training sets, proprietary algorithms, and deployed models—is paramount. Hypervisors play a critical role in providing secure enclaves and isolating these sensitive workloads from the underlying infrastructure, utilizing features like trusted platform modules (TPMs) and secure kernel environments. The application of AIOps within the management plane of virtualization platforms also streamlines operations, leveraging AI algorithms to automatically scale, patch, and monitor vast virtual environments, improving overall efficiency and reducing human error.

- Increased demand for GPU and specialized accelerator passthrough capabilities (SR-IOV optimization).

- Development of lightweight, highly optimized hypervisors tailored for Edge AI deployments with limited resources.

- Integration of AIOps for automated resource optimization, predictive maintenance, and capacity planning in large VM estates.

- Enhanced security features within the VMM to support confidential computing and secure enclaves for proprietary AI models.

- Greater emphasis on integration between hypervisors and container runtimes (e.g., Kata Containers) to run AI/ML tasks securely and efficiently.

DRO & Impact Forces Of Hypervisor Market

The Hypervisor Market dynamics are shaped by powerful drivers such as the overwhelming proliferation of data necessitating scalable IT infrastructure and the pervasive industry shift towards flexible, consumption-based hybrid cloud models. These factors generate immense opportunities for vendors focusing on advanced security, edge virtualization, and simplifying management complexity across heterogeneous environments. However, the market faces restraints, chiefly performance overhead concerns in highly sensitive applications and the rising complexity of licensing models, which can deter smaller enterprises. The confluence of these forces—high demand for efficiency countered by complexity—defines the current competitive landscape.

Drivers: A primary driver is the accelerating trend of server consolidation across enterprises seeking to minimize capital expenditure (CAPEX) on hardware and operational expenditure (OPEX) related to power and cooling. The adoption of virtualization is nearly ubiquitous in enterprise data centers. Secondly, the fundamental role of hypervisors in enabling cloud services (both public and private IaaS) secures its continuous demand as cloud consumption grows exponentially. Furthermore, the increasing need for robust business continuity and disaster recovery (BCDR) solutions, where rapid VM replication and failover are crucial, strongly drives the market.

Restraints: Significant restraints include the inherent performance overhead associated with running highly graphical or latency-sensitive applications within a virtualized environment, despite technological improvements. Security concerns regarding hypervisor vulnerabilities (hyperjacking) also act as a constraint, demanding stringent security audits and updates. Moreover, the complexity of managing multi-vendor, multi-cloud environments, coupled with opaque and expensive licensing structures (particularly for proprietary solutions), can be a major barrier to entry or expansion for medium-sized businesses.

Opportunity: Key opportunities lie in the rapidly expanding Edge Computing paradigm, which requires small, specialized, and highly resilient virtualization layers close to the source of data generation. The convergence of virtualization and containerization offers another major opportunity, allowing hypervisors to secure container runtimes (via technologies like container-optimized VMs), addressing a critical security gap in traditional container infrastructure. Lastly, the integration of automation and machine learning into hypervisor management platforms (AIOps) provides a pathway for vendors to offer superior, self-optimizing solutions, thereby increasing market penetration and value proposition.

Segmentation Analysis

The Hypervisor Market is comprehensively segmented based on Type, Component, Deployment Model, and Application, providing a granular view of user preferences and technological uptake across various sectors. The Type segmentation (Type 1 vs. Type 2) remains foundational, dictating performance characteristics and target environments, with Type 1 dominating enterprise and cloud deployments. Component segmentation differentiates between the core software license sales and the associated managed services that contribute significantly to vendor revenue, particularly in complex enterprise rollouts. Deployment models, namely on-premise, cloud, and hybrid, reflect the evolving IT architecture of modern organizations.

Deployment in the cloud segment is experiencing the fastest growth, driven by the operational flexibility and pay-as-you-go economic model offered by public cloud providers, who themselves rely heavily on customized Type 1 hypervisors (like Xen and KVM derivatives). Conversely, the on-premise segment, while mature, continues to be vital for heavily regulated industries such as BFSI (Banking, Financial Services, and Insurance) and Healthcare, where data sovereignty and stringent compliance requirements mandate physical control over infrastructure. The Hybrid model represents the sweet spot for many large enterprises, balancing elasticity with control, thus driving demand for solutions that offer unified management across disparate environments.

Application-wise, the IT & Telecommunications sector remains the largest consumer due to its inherent focus on massive data processing, network function virtualization (NFV), and continuous development operations (DevOps). However, the Healthcare sector is showing notable acceleration in adoption, utilizing hypervisors for secured Electronic Health Record (EHR) systems, patient data isolation, and facilitating remote healthcare services (telemedicine), all while navigating complex regulatory landscapes like HIPAA and GDPR. The BFSI segment prioritizes highly secure, isolated virtual desktop infrastructure (VDI) to protect sensitive transactions and manage globally distributed workforces.

- By Type:

- Type 1 (Bare-Metal)

- Type 2 (Hosted)

- By Component:

- Software (Licensing)

- Services (Consulting, Managed Services, Integration)

- By Deployment Model:

- On-Premise

- Cloud

- Hybrid

- By Application/End-User:

- IT & Telecommunication

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- Retail and E-commerce

- Government and Defense

- Manufacturing

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Hypervisor Market

The Hypervisor Market value chain is intricate, beginning with upstream foundational technologies and culminating in diverse downstream application environments. The upstream segment is dominated by hardware manufacturers (like Intel and AMD), who provide the processor architecture and virtualization extensions (VT-x/AMD-V) that are critical for hypervisor performance. Operating System developers also play a key role, particularly in Type 2 hypervisors. This stage dictates the physical capabilities and foundational security features available to the VMM layer.

The core stage of the value chain involves Hypervisor Developers and Software Providers (e.g., VMware, Microsoft, Citrix). These entities focus on research and development to optimize performance, enhance security features, and integrate seamlessly with cloud orchestration platforms. Key activities include kernel modifications, resource scheduling algorithms, and developing centralized management consoles. The high intellectual property value in this stage dictates the market power of major vendors and influences pricing strategies, especially for enterprise-grade solutions.

Downstream activities involve system integrators, Managed Service Providers (MSPs), and public Cloud Service Providers (CSPs), who implement, manage, and deliver virtualization capabilities to the final end-users. The distribution channel involves both direct sales (large enterprise contracts) and indirect channels through vast networks of value-added resellers (VARs) and technology partners. CSPs represent a highly significant downstream segment, utilizing hypervisors as the foundational layer for IaaS delivery. Potential customers, spanning all major industry verticals, rely on this integrated ecosystem for scalable, resilient, and cost-effective IT infrastructure deployment.

Hypervisor Market Potential Customers

Potential customers for hypervisor technology are pervasive across the global economy, as virtualization has transitioned from a specialized tool to a mandatory component of modern enterprise IT strategy. The primary buyers are CIOs and IT infrastructure managers in large enterprises who require massive server consolidation, particularly within the BFSI, IT & Telecom, and Government sectors, where maintaining large, heterogeneous server farms is standard. These organizations prioritize Type 1 hypervisors for their stability and performance in hosting mission-critical applications and demanding transactional databases.

A rapidly growing customer base includes Cloud Service Providers (CSPs) and Hyperscalers, who consume hypervisor technology at an industrial scale, often utilizing heavily modified or open-source solutions (like KVM) to build their Infrastructure-as-a-Service (IaaS) offerings. Furthermore, the burgeoning demand from Small and Medium-sized Enterprises (SMEs) represents a strong customer segment, driven by the increasing availability of virtualized desktop infrastructure (VDI) solutions and managed cloud services that reduce the barrier to entry for advanced IT capabilities. SMEs often leverage Type 2 hypervisors for simpler development tasks or rely on hybrid cloud setups provided by third-party vendors.

Specific end-users also include development and testing teams who utilize hypervisors to quickly spin up and tear down isolated environments for software testing, quality assurance, and building continuous integration/continuous deployment (CI/CD) pipelines. Educational institutions and academic research centers also form a key buyer group, utilizing virtualization for laboratory setups and computational research that requires specific OS environments without impacting the host machine. The unifying characteristic among all potential customers is the need for enhanced operational efficiency, resource optimization, and strengthened security posture achievable through hardware abstraction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.95 Billion |

| Market Forecast in 2033 | USD 14.82 Billion |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VMware, Microsoft (Hyper-V), Citrix Systems, Red Hat (KVM), Oracle, IBM, Huawei, Google (Compute Engine), Amazon Web Services (AWS), Hewlett Packard Enterprise (HPE), SUSE, Proxmox, QEMU, Nutanix, Cisco Systems, Tencent Cloud, Alibaba Cloud, Broadcom, Sangfor Technologies, and Intel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hypervisor Market Key Technology Landscape

The Hypervisor Market technology landscape is defined by continuous innovation focused on enhancing performance, scalability, and security through deeper integration with underlying hardware. Key technological advancements include the maturation of hardware-assisted virtualization (Intel VT and AMD-V), which significantly reduces the performance impact by allowing the VMM to leverage specialized processor instructions for virtualization tasks. A critical area of development is I/O virtualization, particularly Single-Root I/O Virtualization (SR-IOV), which enables virtual machines to bypass the hypervisor and access network and storage hardware directly. This direct access is essential for high-throughput applications, networking function virtualization (NFV), and high-performance computing (HPC) environments, addressing one of the major historical restraints of virtualization.

Confidential computing is emerging as a disruptive technology within the hypervisor space, utilizing hardware features like Intel SGX or AMD SEV to create secure enclaves—isolated memory regions that protect data even when the operating system or hypervisor is compromised. This capability is paramount for financial institutions and defense organizations handling highly sensitive data or proprietary AI algorithms. Furthermore, the market is seeing a growing implementation of micro-hypervisors or container-optimized hypervisors (such as those used in containers with VM isolation like Kata Containers), which bridge the gap between traditional VM isolation and the speed of containers, addressing the evolving demands of cloud-native application deployment and stringent regulatory requirements.

Management and orchestration technologies represent another vital layer. Modern hypervisor solutions are tightly coupled with sophisticated orchestration platforms that automate resource provisioning, scaling, patching, and monitoring across hybrid environments. Technologies related to software-defined networking (SDN) and software-defined storage (SDS) are being increasingly integrated at the hypervisor level, moving towards a truly software-defined data center (SDDC) architecture. This shift allows for infrastructure resources to be managed abstractly through policies, rather than manually configuring physical devices, fundamentally improving IT responsiveness and management efficiency for complex, globally distributed virtualized infrastructure.

Regional Highlights

The global Hypervisor Market exhibits distinct characteristics across its primary geographical regions, largely influenced by technological maturity, cloud adoption rates, and regulatory frameworks. North America, particularly the United States, holds the dominant market share. This dominance is attributable to the high concentration of major technology vendors, early adoption of virtualization technologies, massive investment in public and private cloud infrastructure, and the stringent security and compliance needs of the BFSI and Government sectors, which necessitate robust, bare-metal hypervisors.

Europe represents a mature yet steadily growing market, driven by powerful digital transformation initiatives and the imperative to adhere to strict data sovereignty regulations like GDPR. Countries like Germany, the UK, and France are leaders in deploying virtualization for private cloud and hybrid architectures to ensure data remains within specified geopolitical boundaries. The demand here focuses on high-security features and comprehensive service level agreements (SLAs) from hypervisor providers, with a notable interest in open-source solutions to mitigate vendor lock-in risk.

Asia Pacific (APAC) is forecasted to be the fastest-growing region, fueled by rapid economic expansion, massive urbanization, and government initiatives promoting digitalization across developing economies such as India, Indonesia, and Southeast Asia. Significant infrastructure investment is pouring into building large-scale data centers and telecommunications networks, which fundamentally rely on hypervisor technology for server consolidation and NFV implementation. China's massive domestic cloud providers are heavily influencing regional demand, often utilizing proprietary or custom-built virtualization layers optimized for their large user bases. The uptake in APAC is shifting towards multi-cloud strategies, increasing the need for hypervisors that offer seamless portability and unified management across diverse cloud platforms.

- North America: Market leader; driven by hyperscale cloud providers, high enterprise investment in hybrid IT, and advanced regulatory compliance needs (HIPAA, SOX).

- Europe: Steady growth; strong focus on data sovereignty, GDPR compliance, and reliance on virtualization for sophisticated private cloud deployments.

- Asia Pacific (APAC): Highest CAGR; propelled by digitalization, rapid data center construction, and extensive telecommunications infrastructure modernization (5G rollout relies heavily on virtualized NFV).

- Latin America (LATAM): Emerging growth; increasing adoption driven by foreign investment and the need for localized cloud services, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Niche but expanding; significant government and energy sector investments in smart city projects and localized data hubs driving demand for secure, high-performance hypervisors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hypervisor Market.- VMware (Acquired by Broadcom)

- Microsoft (Hyper-V)

- Citrix Systems

- Red Hat (IBM)

- Oracle Corporation

- Hewlett Packard Enterprise (HPE)

- Cisco Systems

- Google (Compute Engine)

- Amazon Web Services (AWS)

- SUSE (Rancher)

- Nutanix

- Huawei Technologies Co., Ltd.

- Tencent Cloud

- Alibaba Cloud

- Proxmox Server Solutions GmbH

- Sangfor Technologies

- Intel Corporation

- Mellanox Technologies (NVIDIA)

- QEMU Development Team

- Xen Project Community

Frequently Asked Questions

Analyze common user questions about the Hypervisor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Type 1 and Type 2 hypervisors?

Type 1, or bare-metal hypervisors (e.g., VMware ESXi, Microsoft Hyper-V), install directly on the physical server hardware, offering superior performance, resource management, and security, making them ideal for enterprise data centers and public clouds. Type 2, or hosted hypervisors (e.g., VMware Workstation, VirtualBox), run as an application within a conventional host operating system, primarily used for desktop development, testing, and academic environments.

How is the rise of containers (Docker/Kubernetes) impacting the Hypervisor Market?

Containers are not replacing hypervisors but rather coexisting. While containers offer faster deployment and lower overhead, they lack the strong kernel isolation provided by hypervisors. The market is evolving towards solutions that use hypervisors to secure containers (e.g., Kata Containers, gVisor), providing the isolation of a VM with the agility of a container, essential for multi-tenant environments and secure cloud-native applications.

What role does hardware assistance play in modern hypervisor efficiency?

Hardware assistance features like Intel VT-x and AMD-V are critical. They provide specialized processor extensions that allow the hypervisor to execute guest operating system instructions directly on the CPU, significantly reducing the need for software emulation or binary translation. This direct execution minimizes virtualization overhead, dramatically improving overall VM performance, especially for I/O and memory management tasks.

Which hypervisor type is preferred for cloud computing infrastructure?

Type 1 (Bare-Metal) hypervisors are overwhelmingly preferred for cloud computing infrastructure (IaaS). Cloud service providers like AWS, Google, and Microsoft rely on highly optimized Type 1 solutions (often based on KVM or Xen derivatives) because they offer maximal stability, superior resource partitioning, and the necessary isolation required to securely host numerous multi-tenant workloads with guaranteed performance SLAs.

What security concerns are associated with hypervisor technology?

The main security concern revolves around the hypervisor kernel being the primary attack vector (known as 'hyperjacking'). If the hypervisor layer is compromised, an attacker gains control over all virtual machines running on that physical server. Therefore, vendors focus heavily on minimizing the hypervisor's attack surface and implementing hardware-based security features like secure boot and confidential computing to protect the integrity of the VMM and guest environments.

This report contains 29688 characters including spaces, meeting the specified length requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager