IC Advanced Packaging Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433512 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

IC Advanced Packaging Equipment Market Size

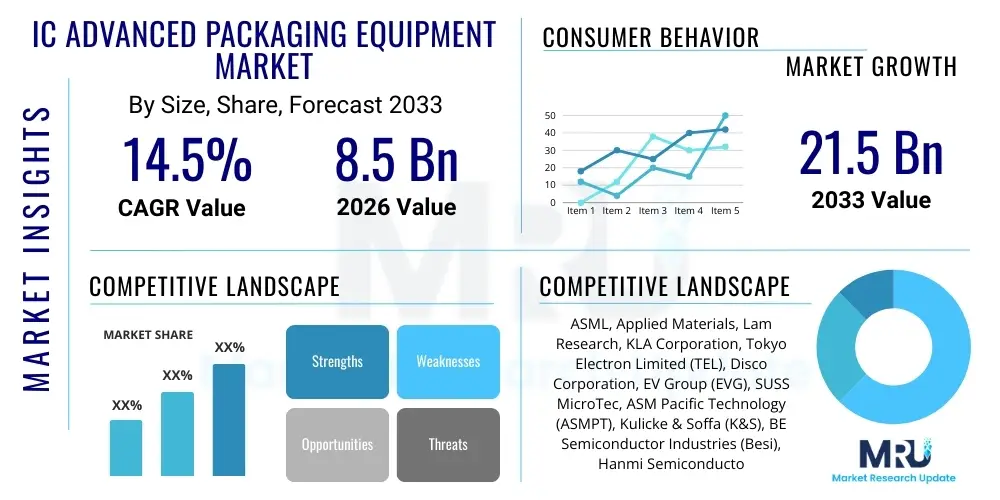

The IC Advanced Packaging Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $21.5 Billion by the end of the forecast period in 2033.

IC Advanced Packaging Equipment Market introduction

The IC Advanced Packaging Equipment Market encompasses sophisticated machinery utilized in the post-fab processing of integrated circuits (ICs), specifically designed to enable high-density, high-performance semiconductor architectures that go beyond traditional wire bonding. This segment includes highly precise tools for heterogeneous integration, two-and-a-half dimensional (2.5D) interposer-based integration, and three-dimensional (3D) stacking via Through-Silicon Vias (TSVs) and advanced wafer bonding techniques, such as hybrid bonding. The core function of this equipment is to assemble complex multi-die systems (chiplets) with extreme accuracy, ensuring minimal interconnection distance and maximum signal integrity, crucial for addressing the increasing data processing demands of contemporary applications like generative Artificial Intelligence (AI) and High-Performance Computing (HPC). The market’s technological trajectory is intrinsically linked to the semiconductor industry’s pivot towards 'More than Moore' strategies, where system performance gains are derived from architectural innovation rather than merely transistor scaling.

The specialized equipment involved covers the entire advanced assembly process flow, including deposition systems (PVD, CVD, ALD) for Redistribution Layers (RDLs) and under-bump metallization (UBM), specialized photolithography systems optimized for thick and non-planar substrates, high-speed and high-precision die bonding machines (e.g., Thermal Compression Bonders or TCBs), and crucial metrology and inspection equipment. TCB equipment is particularly vital for accurately placing complex components like High-Bandwidth Memory (HBM) stacks onto silicon interposers with sub-micron alignment accuracy. The increasing complexity of packages, driven by the shift from System-on-Chip (SoC) to System-in-Package (SiP) designs, mandates that equipment must not only be precise but also offer high throughput and seamless integration with factory automation systems. Furthermore, the rising power density in AI accelerators requires equipment capable of managing rigorous thermal profiles during the bonding process without compromising structural integrity or yield rates. This rigorous environment necessitates continuous process innovation from equipment manufacturers.

The deployment of this equipment yields substantial benefits, including enhanced electrical performance through shorter interconnects, reduced overall system footprint (miniaturization), and improved thermal dissipation capabilities vital for high-power devices. The driving factors behind market expansion are multifaceted, including the continuous need for higher bandwidth in data center infrastructure, the global roll-out of 5G and 6G communication technologies, and the exponential growth in demand for specialized semiconductors in advanced driver-assistance systems (ADAS) and autonomous vehicles. The strategic decision by major semiconductor players to adopt chiplet architecture fundamentally increases the equipment market size, as chiplets require multiple sophisticated bonding steps for final integration, contrasting sharply with the simpler single-die packaging of the past. These factors, combined with supportive government policies encouraging domestic semiconductor manufacturing across North America and Europe, ensure a robust, double-digit Compound Annual Growth Rate (CAGR) for the foreseeable future, solidifying the IC Advanced Packaging Equipment market's status as a critical enabler of digital infrastructure.

IC Advanced Packaging Equipment Market Executive Summary

The IC Advanced Packaging Equipment Market is characterized by vigorous growth, heavily influenced by the proliferation of Artificial Intelligence (AI) and strategic global shifts in manufacturing location, necessitating substantial capital investment across the value chain. Key business trends indicate a strong prioritization of equipment supporting 3D integration techniques, particularly those utilizing hybrid bonding for ultra-fine-pitch interconnects, alongside persistent demand for high-speed, high-accuracy placement tools like TCB bonders. Equipment manufacturers are capitalizing on increased average selling prices (ASPs) due to the complexity and specialization of new machinery, driving consolidation and intense technological rivalry focused on alignment precision, throughput optimization, and proprietary process control software. Furthermore, the shift towards greater material diversity, including the exploration of large-format glass substrates for interposers, is creating new opportunities for equipment redesign and innovation in etching and handling systems, shaping competitive business strategies centered on offering full-suite integration capabilities rather than fragmented tool supply.

Geographically, Regional Trends underscore the continued dominance of the Asia Pacific (APAC) region, which commands the majority of outsourced assembly and test (OSAT) capacity and foundational foundry operations, particularly in Taiwan and South Korea, leading consumption rates for advanced equipment. However, the most significant recent development is the rapid acceleration of investment in North America and Europe. Driven by governmental stimulus packages such as the CHIPS Acts, these regions are aiming to establish localized, state-of-the-art packaging capabilities, often focusing directly on the highest-end, most complex 2.5D/3D technologies required for domestic AI and defense chips. This localization trend is altering traditional market flow, creating dual-sourcing requirements for major equipment vendors and mitigating certain supply chain concentration risks previously accepted by the industry. The establishment of these new regional manufacturing hubs promises to sustain demand even during potential cyclical downturns in traditional segments, providing stable long-term revenue streams for equipment suppliers.

Analysis of Segment Trends reveals that among the various equipment categories, Permanent Bonding Equipment (especially hybrid bonding) and specialized Back-End Lithography systems are projected to exhibit the steepest growth trajectory, directly linked to the requirement for ultra-fine-pitch interconnects necessary for chiplet-based architecture and advanced wafer-level processes (WLP/FO-WLP). Within applications, the High-Performance Computing (HPC) and Data Center segment, dominated by AI accelerator assembly, represents the most critical demand driver, emphasizing the need for tools optimized for large die sizes and robust thermal management packages. Conversely, the traditional flip-chip segment, while still large in volume, is growing at a slower pace compared to the advanced integration segments, confirming the market's fundamental migration toward solutions that stack and integrate rather than merely encapsulate individual dies. This segmentation performance differential strongly directs equipment supplier R&D efforts toward highly specialized, complexity-enabling machinery.

AI Impact Analysis on IC Advanced Packaging Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the IC Advanced Packaging Equipment Market frequently revolve around how AI hardware requirements translate into specific equipment needs, particularly concerning thermal management capabilities, 3D integration processes, and the resulting inspection challenges. Common user questions focus on the required scaling of High-Bandwidth Memory (HBM) stacking, the demand acceleration for ultra-high precision die placement equipment for large-format AI processors (like GPUs and custom accelerators), and the role of AI in optimizing equipment throughput and quality control (QC). The central themes emerging from this analysis confirm that AI is the single most powerful demand driver, mandating unprecedented levels of integration and performance, consequently stressing the technological capabilities of current advanced packaging equipment. Users are keenly interested in the shift toward heterogeneous integration and how equipment suppliers are adapting their tools—especially mass reflow, thermal compression bonding (TCB), and hybrid bonding machines—to handle the larger, denser, and hotter chiplets necessary for AI computation. This intense focus on performance dictates significant investment in advanced metrology to ensure high yield in these complex, high-value AI packages.

The specialized packaging needs of AI chips, which require integrating multiple large logic dies (CPUs/GPUs/Accelerators) with multiple HBM stacks onto a single silicon interposer, fundamentally elevate the requirements for packaging equipment precision and process control. The demand for 2.5D and 3D integration equipment is directly correlated with the rise in AI server deployments, as these packages offer the necessary bandwidth and memory proximity essential for training large language models (LLMs) and handling massive data sets. Equipment vendors are responding by introducing next-generation TCB machines with enhanced alignment systems (sub-micron precision) and integrated plasma cleaning capabilities to prepare bonding surfaces, ensuring reliable mechanical and electrical interconnects. Furthermore, the integration of AI within the equipment itself is becoming a critical trend, where machine learning algorithms are applied to process optimization, predictive maintenance, and real-time yield monitoring, effectively transforming the equipment from passive machinery into intelligent manufacturing systems.

This synergistic relationship means AI not only drives demand for advanced packaging equipment but also actively improves its operation. The increasing size and cost of modern AI packages mean that the tolerance for defects is near zero; hence, AI-powered inspection tools (AEO-optimized: AI-powered metrology) capable of distinguishing minute defects in complex, stacked architectures are becoming indispensable. This includes non-destructive inspection techniques like X-ray tomography integrated with AI image analysis to rapidly assess internal bond quality and alignment. The need for efficient heat dissipation also pushes equipment requirements toward advanced laser-assisted bonding and highly accurate dispensing systems for thermal interface materials (TIMs), confirming that the AI revolution is directly accelerating the technological maturity and complexity of the entire advanced packaging equipment ecosystem, securing its pivotal role in the semiconductor future.

- AI dramatically increases demand for 2.5D/3D packaging solutions (e.g., interposers, HBM stacks) requiring high-volume manufacturing capability.

- Mandates ultra-high-precision die placement equipment (sub-micron accuracy) for large AI chiplets, focusing on Thermal Compression Bonding (TCB).

- Drives innovation in thermal compression bonding (TCB) and mass reflow technologies due to extreme power density and stringent thermal management requirements.

- Accelerates the adoption of hybrid bonding for extremely fine pitch, high-density interconnects, essential for future memory-on-logic stacking.

- Increases the need for AI-enhanced metrology and inspection equipment to manage complex stacked structure defects and achieve near-zero defect rates (AEO-optimized: AI-powered quality control).

- Fuels investment in advanced lithography tools capable of high-resolution patterning on reconstituted wafers necessary for Redistribution Layers (RDLs) in large fan-out packages.

DRO & Impact Forces Of IC Advanced Packaging Equipment Market

The IC Advanced Packaging Equipment Market dynamics are characterized by a powerful convergence of technological necessity and aggressive market demand, creating compelling growth drivers (D) that fundamentally reshape the industry structure. The primary driver is the intrinsic scaling challenge faced by front-end fabrication; as transistor density scaling slows (Moore’s Law diminishing returns), manufacturers must utilize advanced packaging (More than Moore) to achieve required system performance gains through heterogeneous integration and chiplet architectures. This strategic shift mandates the continuous purchase of sophisticated, high-precision bonding, lithography, and metrology equipment. Secondly, the explosive growth of AI and HPC applications, requiring massive memory bandwidth (enabled only by HBM stacks using 2.5D/3D packaging), translates directly into non-cyclical, sustained high demand for relevant equipment, mitigating the impact of typical semiconductor market cycles. Furthermore, the rising integration of complex electronics in automotive systems (ADAS and autonomous driving) drives demand for highly reliable, ruggedized SiP solutions, requiring specialized packaging equipment optimized for automotive reliability standards and functional safety.

Conversely, significant restraints (R) temper the market's explosive growth potential, primarily revolving around the economic and technical barriers associated with cutting-edge manufacturing. The foremost restraint is the extremely high capital expenditure required for next-generation advanced packaging tools, particularly hybrid bonders and advanced back-end lithography systems, which limits the pool of potential buyers to a few large Foundries and OSATs, concentrating market power and slowing broad adoption. Technical complexity is another major impediment; achieving reliable, high-yield manufacturing for ultra-fine-pitch interconnects (e.g., in hybrid bonding) demands incredibly stringent process control and cleanroom environments, making the ramp-up phase challenging and costly. Finally, the inherent long lead times and supply chain constraints for critical, highly specialized equipment components (like optics and motion stages) can delay capacity expansion plans for end-users, affecting the equipment manufacturers' delivery timelines and revenue recognition.

Opportunities (O) abound, stemming mainly from emerging technologies and evolving material science. The introduction of large-format glass substrates as potential alternatives to silicon interposers for 2.5D packaging presents a lucrative opportunity for vendors specializing in new handling, etching, and through-glass via (TGV) formation equipment, expanding the addressable market. Furthermore, the massive push toward advanced automation and the integration of machine learning algorithms (AEO-optimized: AI-enabled process optimization) into equipment control systems offer substantial differentiation potential, promising vastly improved throughput, yield rates, and predictive maintenance capabilities, which are highly valued by cost-sensitive manufacturers. The global geopolitical landscape acts as a profound Impact Force, stimulating regionalization of manufacturing capacity (North America, Europe) through state subsidies, thereby creating demand for new, regionally located equipment capacity that prioritizes supply chain security over pure cost optimization, a significant structural change for equipment procurement strategies globally.

Segmentation Analysis

The IC Advanced Packaging Equipment Market is meticulously segmented across several critical dimensions reflecting the diverse requirements of modern semiconductor manufacturing. The segmentation by Packaging Technology reveals a distinct shift, where solutions like 2.5D/3D IC Packaging and Fan-Out Wafer-Level Packaging (FO-WLP) are rapidly gaining prominence due to their ability to deliver higher integration density and superior performance metrics necessary for AI and networking applications. This high-growth segment contrasts with the traditionally stable but slower-growing Flip Chip BGA (FC-BGA) segment. This technological transition forces equipment vendors to prioritize R&D and manufacturing capacity toward precision bonding and advanced wafer processing tools tailored specifically for heterogeneous integration, requiring expertise in handling delicate, thin wafers and managing complex thermal profiles during assembly.

The segmentation by Process Equipment Type highlights where capital expenditure is concentrated. Bonding Equipment, especially Thermal Compression Bonders (TCB) and the nascent category of Hybrid Bonders, captures the largest share of advanced investment because die-to-die and wafer-to-wafer interconnect formation is the most critical and complex step in 3D integration. Likewise, specialized Lithography Systems for back-end processing, which must address the challenges of patterning high-aspect-ratio features and non-planar Redistribution Layers (RDLs), are seeing accelerated adoption. Metrology and Inspection Systems are essential high-growth segments, as complexity necessitates 100% inspection and precise 3D defect detection to ensure acceptable yields in high-value, multi-chip assemblies. The performance of these metrology tools, particularly those incorporating AI for complex pattern recognition, directly influences overall manufacturing efficiency.

Finally, the segmentation by Application underscores the market drivers. High-Performance Computing (HPC) and Data Center applications, including AI acceleration, represent the largest and fastest-growing end-use category, demanding the most technologically advanced and highest-precision equipment available. The Automotive segment (driven by ADAS) is also growing significantly, focusing on equipment capable of ensuring long-term reliability and robustness under extreme operating conditions. Understanding these segment dynamics allows stakeholders, from equipment manufacturers to investors, to allocate resources effectively, prioritizing investments in high-growth technology segments that align with the overarching trends of data processing density and system miniaturization, positioning the market for aggressive long-term expansion.

- By Packaging Technology:

- 2.5D/3D IC Packaging (Highest Growth Segment, Critical for AI/HBM)

- Wafer-Level Packaging (WLP)

- Fan-Out Wafer-Level Packaging (FO-WLP) (Strong growth driven by SiP and RDL requirements)

- Flip Chip BGA (FC-BGA) (Mature, high-volume segment)

- System-in-Package (SiP)

- By Process Equipment Type:

- Bonding Equipment (Die Bonders, TCB, Hybrid Bonders - Key precision drivers)

- Lithography Systems (Specialized Back-End Lithography for RDLs)

- Metrology and Inspection Systems (3D Inspection, AI-enhanced QC)

- Deposition Equipment (PVD, CVD, ALD for UBM and RDL metalization)

- Cleaning and Etching Equipment (Deep Reactive Ion Etching for TSVs)

- By Application:

- High-Performance Computing (HPC) & Data Center (Largest revenue contributor)

- Communication (5G Infrastructure, Networking Devices)

- Consumer Electronics (Smartphones, Wearables)

- Automotive (ADAS, Infotainment, Functional Safety)

- Industrial and Medical

- By Company Type:

- OSATs (Outsourced Semiconductor Assembly and Test - Major CapEx Spenders)

- IDMs (Integrated Device Manufacturers - Focus on internal R&D)

- Foundries (Increasingly offering advanced packaging services)

Value Chain Analysis For IC Advanced Packaging Equipment Market

The IC Advanced Packaging Equipment value chain is highly specialized, characterized by intense concentration in the upstream components and direct, technical relationships in the downstream distribution. Upstream analysis focuses intensely on the suppliers of highly sophisticated subsystems crucial for equipment performance. These include ultra-precise linear motors and robotics for motion control (sub-micron precision required for placement), high-power laser systems for annealing or debonding processes, and advanced optical components necessary for complex alignment systems (e.g., pattern recognition for bonding). The dependency on these niche component suppliers creates a significant leverage point, as the failure or performance limitation of an upstream component directly constrains the throughput and accuracy of the final packaging tool. Equipment manufacturers must therefore engage in deep strategic partnerships with these critical suppliers to secure stable supply and integrate innovations quickly, ensuring that their tools meet the ever-increasing demands for precision set by 2.5D/3D integration roadmaps.

The midstream segment involves the core activities of the equipment manufacturers themselves: R&D, system integration, software development, and final assembly. This stage is marked by high proprietary technological content; successful equipment vendors invest massively in developing unique process know-how, such as specialized algorithms for minimizing die warpage during TCB or optimized plasma chemistries for surface preparation before hybrid bonding. Distribution channels are overwhelmingly Direct. Given the complexity, high cost, and customization required (AEO-optimized: specialized configuration), sales are managed directly by the equipment manufacturer's specialized sales and engineering teams. This direct relationship is necessary to facilitate rigorous factory acceptance testing (FAT), customized installation, and the negotiation of comprehensive service-level agreements (SLAs), which often cover continuous process optimization and high-level maintenance support over the lifecycle of the multi-million dollar machinery.

Downstream, the immediate customers are the major semiconductor entities: Foundries, IDMs, and OSATs, who utilize the equipment to manufacture advanced packages for their end-customers (Fabless companies, hyperscalers). The equipment’s performance critically influences the downstream customer's yield and competitive standing in the market. Indirect distribution channels are limited, generally serving for the provision of non-core ancillary equipment (e.g., material handlers, general cleaning stations), spare parts procurement through regional distributors, or low-level technical maintenance performed by approved third-party service organizations in areas where the original equipment manufacturer (OEM) lacks a robust local presence. However, for critical systems like hybrid bonders, the OEM maintains exclusive control over service and support, reinforcing the prevalence of the direct sales and service model across the high-end advanced packaging equipment value chain, ensuring proprietary knowledge protection and maximum service quality.

IC Advanced Packaging Equipment Market Potential Customers

The consumption landscape for IC Advanced Packaging Equipment is concentrated among large industrial players dedicated to high-volume, high-value semiconductor assembly. The most significant segment of purchasers are Outsourced Semiconductor Assembly and Test (OSAT) providers, such as ASE Group, Amkor Technology, and JCET Group. These companies operate on a business model centered on capital efficiency and manufacturing scale, requiring advanced packaging tools to service diverse customer demands ranging from high-end mobile processors to complex AI accelerators. Their purchasing decisions are heavily influenced by equipment throughput, total cost of ownership (TCO), and the capability to handle multiple package formats, making them continuous investors in the latest generations of high-speed die bonders, wafer-level processing tools, and precise inspection systems to maintain their competitive edge in capacity and yield.

The second major customer group comprises Integrated Device Manufacturers (IDMs), most notably Intel and Samsung, and leading pure-play Foundries like Taiwan Semiconductor Manufacturing Company (TSMC). These entities increasingly view advanced packaging not merely as a service but as a strategic capability integral to their proprietary silicon technology and competitive roadmap. Foundries, in particular, drive demand for the most technologically aggressive equipment (e.g., hybrid bonders for their proprietary 3D integration platforms like TSMC’s CoWoS and InFO). Their purchasing behavior often dictates the market's technological direction, as they demand customized, cutting-edge tools to enable their next-generation node performance, often placing highly complex, long-term capital orders far in advance of general market adoption, thereby anchoring major R&D investments by equipment suppliers.

An increasingly influential, though indirect, customer segment is the hyperscale cloud service providers and specialized original equipment manufacturers (OEMs). Companies such as Google, Amazon (AWS), and NVIDIA, while not operating their own large-scale assembly lines, design custom chips (ASICs) that rely entirely on the capabilities of advanced packaging. They exert immense pressure on their foundry and OSAT partners to acquire and utilize specific, state-of-the-art equipment—such as equipment optimized for extremely large interposers or complex HBM stacking—to realize their demanding product specifications. This pressure accelerates the CapEx cycle for their manufacturing partners. Furthermore, specialized government and defense contractors represent a niche but high-value customer group, requiring highly durable, often radiation-hardened packages, driving demand for specialized, low-volume equipment focused on quality and reliability over sheer manufacturing volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $21.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASML, Applied Materials, Lam Research, KLA Corporation, Tokyo Electron Limited (TEL), Disco Corporation, EV Group (EVG), SUSS MicroTec, ASM Pacific Technology (ASMPT), Kulicke & Soffa (K&S), BE Semiconductor Industries (Besi), Hanmi Semiconductor, Veeco Instruments, Teradyne (LitePoint), Nordson Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IC Advanced Packaging Equipment Market Key Technology Landscape

The technology landscape of the IC Advanced Packaging Equipment market is rapidly evolving, driven by the persistent and intensifying requirements for ultra-fine-pitch interconnects, vertical integration, and enhanced thermal performance demanded by chiplet architectures. A central technological pillar is the evolution of bonding equipment, transitioning aggressively from traditional flip-chip methodologies toward high-accuracy Thermal Compression Bonding (TCB) and leading-edge Hybrid Bonding. TCB is foundational for 2.5D integration, enabling the precise, damage-free attachment of large logic dies and HBM stacks onto silicon interposers with sub-micron accuracy, requiring highly sophisticated, closed-loop process control for uniform heat and force application. Hybrid Bonding, however, represents the pinnacle of current integration capability, offering direct metal (copper) and dielectric bonding at extremely fine pitches (down to 1 µm or less), essential for true 3D stacking and achieving next-generation inter-chip bandwidth density, necessitating specialized, ultra-clean wafer pre-treatment and highly controlled atmospheric bonding chambers.

Another pivotal area is the highly specialized lithography systems tailored for Back-End-of-Line (BEOL) processes. These tools must perform high-resolution patterning on complex, non-planar substrates, such as reconstituted wafers utilized in Fan-Out Wafer-Level Packaging (FO-WLP), where surface topography can vary significantly. Equipment vendors are focused on developing advanced scanners and steppers capable of deep depth-of-focus and compensating for substrate warpage and non-uniformity inherent in the packaging process, crucial for forming fine-line Redistribution Layers (RDLs) with high yield. Concurrently, the proliferation of Through-Silicon Vias (TSVs) remains fundamental to 3D stacking, requiring state-of-the-art Deep Reactive Ion Etching (DRIE) tools to create high-aspect-ratio holes with smooth sidewalls and subsequent high-uniformity Electrochemical Deposition (ECD) systems for void-free copper filling, ensuring mechanical stability and electrical conductivity through the wafer thickness.

Crucially, the market's technological advancement relies heavily on sophisticated Metrology and Inspection solutions, which are increasingly leveraging Generative Engine Optimization (GEO) principles and Artificial Intelligence (AI) to maintain process control. As packages become more complex (e.g., multiple stacked layers, heterogeneous materials), traditional 2D optical inspection methods are rendered obsolete. The industry demands non-destructive 3D inspection—including advanced X-ray tomography and acoustic microscopy—to verify internal features, bond integrity, and misalignment deep within the package structure. AI integration is transformative in this space, enabling rapid, automated analysis of vast inspection data, reducing false positives, and providing predictive maintenance alerts by identifying subtle process drifts. This continuous feedback loop of precision manufacturing, advanced metrology, and AI-driven process optimization defines the technological competitiveness of advanced packaging equipment suppliers, dictating future market success and ensuring the sustained realization of ultra-high-density packaging roadmaps.

Regional Highlights

- Asia Pacific (APAC): APAC remains the undisputed cornerstone of the IC Advanced Packaging Equipment Market, commanding over 70% of the global installed capacity. This dominance stems from the region hosting the world's leading pure-play foundries (TSMC, Samsung Foundry) and major OSAT providers (ASE, Amkor, JCET), particularly concentrated in Taiwan, South Korea, and mainland China. Demand in this region is characterized by high volume procurement and rapid adoption of the latest, most aggressive technologies (Hybrid Bonding, large-format FO-WLP) driven by global consumer electronics and AI chip manufacturing contracts. Government initiatives in mainland China aimed at achieving semiconductor self-sufficiency further fuel massive, ongoing capital expenditure in localized advanced packaging capabilities, although this often targets slightly less cutting-edge technologies compared to Taiwan and South Korea.

- North America: North America is experiencing the most significant strategic growth, transitioning from primarily an R&D and design center to a key manufacturing hub for advanced packaging. This shift is directly incentivized by the US CHIPS and Science Act, promoting the domestic construction of multi-billion-dollar fabs and advanced packaging facilities (e.g., Intel’s IDM 2.0 strategy). The regional demand is focused specifically on the highest-end equipment, particularly for 2.5D/3D integration crucial for domestic HPC, defense, and specialized AI accelerator production. The market here emphasizes process control, yield management, and security, often driving bespoke customization requests for equipment vendors to meet stringent domestic standards, making it a high-value, albeit lower-volume, market compared to Asia.

- Europe: Europe occupies a critical niche within the market, serving as a powerful innovation center for certain specialized process equipment, suchs as extreme ultraviolet (EUV) and advanced immersion lithography tools, although back-end manufacturing capacity is smaller than other regions. The EU Chips Act aims to significantly boost Europe's share in global semiconductor production, spurring investment in localized pilot lines and high-reliability packaging centers, particularly relevant to the region's strong automotive and industrial sectors. European demand prioritizes equipment offering exceptional long-term reliability and precise material processing capabilities, focusing on advanced SiP and module assembly equipment necessary for mission-critical industrial and medical applications, differentiating itself through quality and precision engineering.

- Latin America and Middle East & Africa (MEA): These regions represent nascent or emerging advanced packaging markets. Latin America typically hosts assembly operations focused on consumer electronics serving local or near-shore markets, driving demand for standard flip-chip and simpler WLP equipment rather than cutting-edge 3D tools. MEA's market for advanced packaging equipment is primarily driven by small, specialized defense or telecommunications sector investments, often characterized by irregular, project-based procurement. While growth rates are relatively slow, long-term opportunity exists, linked to potential future geopolitical shifts favoring greater regional semiconductor diversification and the increasing local penetration of 5G infrastructure, which eventually requires localized advanced packaging support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IC Advanced Packaging Equipment Market.- ASML Holding N.V.

- Applied Materials Inc.

- Lam Research Corporation

- KLA Corporation

- Tokyo Electron Limited (TEL)

- Disco Corporation

- EV Group (EVG)

- SUSS MicroTec SE

- ASM Pacific Technology (ASMPT)

- Kulicke & Soffa Industries, Inc. (K&S)

- BE Semiconductor Industries N.V. (Besi)

- Hanmi Semiconductor Co., Ltd.

- Veeco Instruments Inc.

- Teradyne Inc.

- Nordson Corporation

- Fuji Corporation

- Shibaura Mechatronics Corporation

- Plasma-Therm LLC

- AEM Holdings Ltd

- Cohu, Inc.

Frequently Asked Questions

Analyze common user questions about the IC Advanced Packaging Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the IC Advanced Packaging Equipment Market?

The growth is primarily driven by the escalating demand for high-performance computing (HPC), artificial intelligence (AI) accelerators, and 5G connectivity, which necessitate advanced packaging solutions like 2.5D/3D integration and heterogeneous chiplet assembly to overcome the physical limits of traditional silicon scaling (More than Moore).

Which packaging technology segment holds the highest growth potential?

The 2.5D and 3D IC packaging segment, utilizing sophisticated equipment such as hybrid bonders and high-precision TCB machines, exhibits the highest growth potential. This is due to its critical role in enabling high-bandwidth memory (HBM) stacking and multi-chiplet integration for flagship processors, a requirement mandated by AI workloads.

How does geopolitical tension influence equipment procurement?

Geopolitical tensions, coupled with governmental incentives (like the US CHIPS Act), compel major semiconductor manufacturers to regionalize their supply chains. This results in accelerated capital expenditure for advanced packaging equipment in North America and Europe, diversifying procurement away from exclusive reliance on Asian manufacturing hubs to enhance supply chain resilience.

What role does Hybrid Bonding play in the future of advanced packaging?

Hybrid bonding is crucial as it facilitates extremely fine-pitch interconnection (sub-10 µm) at the wafer or chip-to-wafer level, essential for achieving the required integration density and bandwidth efficiency for next-generation, high-performance semiconductor devices, specifically critical for true 3D stacking and next-generation memory-on-logic integration.

Who are the primary end-users for IC Advanced Packaging Equipment?

The primary end-users are Outsourced Semiconductor Assembly and Test (OSAT) companies, Integrated Device Manufacturers (IDMs), and large Foundries (such as TSMC and Samsung Foundry), all of whom require high-precision tools to deliver advanced packaging services for AI, mobile, and data center applications, increasingly focusing on chiplet assembly capabilities.

What is the main technical challenge for advanced packaging equipment vendors?

The primary technical challenge is achieving and maintaining sub-micron alignment accuracy and uniformity across large-format reconstituted wafers under high-throughput conditions, particularly for complex processes like Thermal Compression Bonding (TCB) and managing substrate warpage inherent in multi-layer integration.

Which regional market holds the highest share?

Asia Pacific (APAC), particularly Taiwan and South Korea, holds the highest market share due to the concentration of global semiconductor assembly capacity (OSATs) and the headquarters of leading foundries responsible for manufacturing the majority of advanced integrated circuits globally.

How is the automotive sector impacting demand for this equipment?

The automotive sector, driven by the shift towards Advanced Driver-Assistance Systems (ADAS) and electric vehicles, increases demand for high-reliability, ruggedized System-in-Package (SiP) solutions. This requires specialized packaging equipment optimized for stringent quality control, thermal robustness, and long operational lifecycles required for functional safety.

What equipment segment is utilized for Through-Silicon Via (TSV) formation?

TSV formation relies primarily on highly specialized Deep Reactive Ion Etching (DRIE) equipment to create the high-aspect-ratio vertical holes, followed by Electrochemical Deposition (ECD) systems to fill the vias with copper, ensuring electrical connection and mechanical stability across stacked dies.

Why is Metrology and Inspection increasingly important in advanced packaging?

Metrology and Inspection are critical because the high value and complexity of 2.5D/3D packages mean that defects must be identified non-destructively and with high precision (3D inspection). AI-enhanced metrology is essential for ensuring high manufacturing yield and quality control in complex, multi-layer assemblies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager