IC Trays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434120 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

IC Trays Market Size

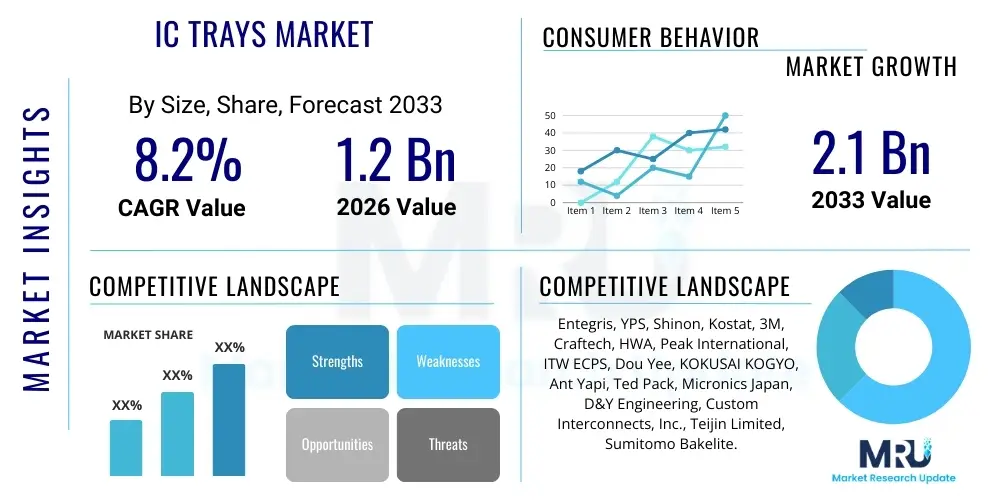

The IC Trays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% CAGR between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global demand for sophisticated semiconductor components used in AI, 5G infrastructure, and advanced automotive electronics, necessitating high-precision handling and testing solutions.

IC Trays Market introduction

The IC Trays Market is integral to the semiconductor supply chain, providing essential packaging and handling solutions for integrated circuits (ICs) during critical stages such as testing, burn-in, assembly, and transport. IC trays are precision-molded carriers designed to protect delicate microelectronic components from electrostatic discharge (ESD), physical damage, and thermal stress. These trays ensure component alignment and stability, which is crucial for automated handling systems used extensively in high-volume manufacturing environments. The materials used, predominantly high-performance engineering plastics like Polyphenylene Sulfide (PPS), Polyetherimide (PEI), and Polyether Ether Ketone (PEEK), are selected for their high temperature resistance, dimensional stability, and customizable anti-static properties.

The primary function of IC trays spans across the entire back-end process of semiconductor manufacturing. During the testing phase, specialized burn-in trays are utilized to subject ICs to elevated temperatures and power cycling to screen for early failures, a critical quality control measure. Furthermore, handling trays facilitate the seamless transition of components between different automated equipment, maintaining traceability and reducing the risk of contamination. The increased complexity and miniaturization of advanced IC packages, such as Ball Grid Array (BGA), Chip Scale Package (CSP), and Quad Flat No-Lead (QFN), mandate extremely tight dimensional tolerances in tray design, driving innovation in precision molding techniques.

Key driving factors supporting market expansion include the proliferation of IoT devices, rapid adoption of 5G technology requiring high-density chips, and the automotive industry’s shift toward advanced driver-assistance systems (ADAS) and electric vehicles (EVs). These applications demand chips with extremely high reliability, which directly increases the reliance on high-quality, specialized IC trays capable of enduring rigorous testing protocols. The benefits provided by these trays—superior protection, compatibility with high-speed automated processes, and enhanced thermal performance—position them as indispensable components supporting the continuous advancements in microelectronics technology worldwide.

IC Trays Market Executive Summary

The IC Trays Market is experiencing significant upward momentum, closely correlated with the global semiconductor fabrication cycles and the accelerating push towards advanced packaging technologies. Business trends indicate a marked shift towards higher-performance materials, such as PEEK and specialized PEI compounds, capable of withstanding the extreme temperatures generated during high-speed, multi-site testing of increasingly powerful ICs, particularly those designed for data centers and AI computing. Mergers, acquisitions, and strategic partnerships among major tray manufacturers and specialized material suppliers are defining the competitive landscape, focused on securing raw material access and expanding high-precision molding capacity to meet exacting customer specifications in the Outsources Semiconductor Assembly and Test (OSAT) sector.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by the concentration of leading semiconductor manufacturing, assembly, and testing operations in countries such as China, Taiwan, South Korea, and Japan. This region not only accounts for the largest consumption volume but is also a pivotal hub for technological innovation in tray design and materials science. North America and Europe, while smaller in volume, represent critical markets for specialized, high-margin trays used in military, aerospace, and advanced R&D applications, demanding stringent quality certifications and lower volume, highly customized solutions. The ongoing geopolitical trends influencing semiconductor supply chain resilience are prompting strategic investments in tray manufacturing capacity expansion outside traditional Asian hubs, particularly in North America and Europe, to mitigate risk.

Segment trends reveal that the Testing and Burn-in segment maintains the highest revenue share due to the intense scrutiny required for mission-critical components, especially those used in autonomous vehicles and high-performance computing (HPC). By material, PPS remains the workhorse material for general applications, offering a balance of cost and performance. However, PEI and PEEK are rapidly gaining market share, driven by the escalating requirements for thermal stability and mechanical strength in next-generation high-pin-count devices. The persistent demand for environmental sustainability is also influencing segmentation, prompting increasing investment in recyclable and reusable tray materials and robust cleaning methodologies to minimize environmental impact without compromising ESD protection or dimensional integrity.

AI Impact Analysis on IC Trays Market

Common user questions regarding AI's impact on the IC Trays Market revolve around enhanced manufacturing efficiency, the reliability of trays for AI hardware components, and the integration of smart systems into packaging processes. Users frequently inquire about how AI-driven quality inspection systems affect dimensional tolerance requirements for trays, whether predictive maintenance powered by machine learning can optimize tray replacement cycles, and the specific material demands posed by high-thermal AI chips (GPUs, specialized ASICs). The consensus concern centers on whether the current tray infrastructure can reliably support the rapid transition to high-power, high-density AI accelerators that generate significantly more heat during burn-in and testing phases, thereby demanding revolutionary advancements in thermal-resistant and precision-engineered trays.

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fundamentally reshaping both the manufacturing process of IC trays and the characteristics of the components they carry. On the manufacturing side, AI-powered visual inspection systems enhance quality control, ensuring that the dimensional accuracy of trays meets the micro-level specifications required for handling advanced ICs, thereby drastically reducing defects and improving throughput compatibility with high-speed handling equipment. This level of precision is non-negotiable for components used in sensitive AI hardware where any deviation in placement can lead to costly operational failures down the line. Furthermore, AI optimizes molding processes by predicting material flow and shrinkage, leading to faster prototyping and shorter time-to-market for specialized tray designs.

From a demand perspective, the exponential growth of AI infrastructure—including data centers, edge computing devices, and specialized AI processors—directly fuels the demand for high-performance IC trays. These AI chips (e.g., dedicated NPUs and sophisticated GPUs) require intensive testing, often involving higher thermal loads and extended burn-in times, pushing the material limits of traditional tray polymers. This trend necessitates the adoption of ultra-high-performance materials like high-grade PEEK and proprietary composite blends that can manage temperatures exceeding 200°C while maintaining stringent ESD protection and dimensional stability. AI is thus driving a premiumization trend within the tray market, demanding customized solutions rather than standardized offerings.

- AI-driven visual inspection improves tray dimensional quality control.

- Predictive maintenance models extend tray lifespan and optimize replacement schedules.

- Increased thermal demands from AI processors necessitate ultra-high-temperature tray materials (PEEK).

- Automation in IC assembly, guided by AI, requires enhanced compatibility and precision in tray indexing features.

- AI simulations accelerate the design and prototyping of specialized trays for novel packaging formats (e.g., 2.5D/3D integration).

DRO & Impact Forces Of IC Trays Market

The IC Trays Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth. Key drivers include the relentless global digitization accelerated by 5G deployment, the massive scaling of data centers, and the pervasive integration of IoT devices, all of which require increased production of advanced, high-density ICs that rely heavily on specialized trays for handling and testing. Restraints primarily involve the substantial initial investment required for precision molding equipment and the environmental challenges associated with disposing of high-performance polymer materials, which are often difficult to recycle. Opportunities lie in the rapidly evolving advanced packaging landscape, such as Fan-Out Wafer-Level Packaging (FO-WLP) and chiplet architectures, demanding novel, highly customized tray designs with extremely tight tolerances.

The primary impact forces stem from technological volatility within the semiconductor industry. As chip designs become more complex and operating temperatures rise, tray manufacturers face constant pressure to innovate materials that offer superior heat resistance, enhanced mechanical strength, and flawless ESD properties without significantly increasing production costs. Furthermore, the global semiconductor supply chain volatility, particularly related to raw material prices for engineering plastics (e.g., PPS and PEI), represents a crucial impact force influencing pricing strategies and inventory management across the market. Companies that successfully navigate these material science challenges and offer robust recycling programs gain a significant competitive edge, appealing to environmentally conscious OEMs and OSAT providers.

Another significant factor is the trend toward increased automation in IC testing and assembly houses. The adoption of high-speed automatic handlers requires trays with impeccable indexing accuracy to ensure zero downtime during high-volume operations. Therefore, the market growth is intrinsically linked to capital expenditure cycles within the OSAT sector. Tray manufacturers must continuously invest in state-of-the-art precision injection molding machinery and rigorous quality assurance protocols to guarantee batch-to-batch consistency. The market exhibits characteristics of a high-barrier-to-entry industry due to the necessity of proprietary material formulations and highly specialized manufacturing expertise, maintaining profitability for established market leaders.

Segmentation Analysis

The IC Trays Market is systematically segmented across several critical parameters, including Material Type, Application, and Package Type. The material segmentation (PPS, PEI, PEEK, and others) reflects the operational requirements of the end-user, with PPS dominating general applications due to its cost-effectiveness, while PEI and PEEK cater to high-temperature and high-reliability testing needs. Application segmentation distinguishes between Testing & Burn-in, Handling & Transport, and Shipping, with Testing & Burn-in remaining the most demanding and lucrative segment. Finally, segmentation by Package Type (BGA, QFN, SOIC, etc.) highlights the diversity of IC formats requiring specific tray geometries, ensuring that tray design aligns perfectly with the physical dimensions and interface requirements of the device being handled or processed.

- By Material Type:

- Polyphenylene Sulfide (PPS)

- Polyetherimide (PEI)

- Polyether Ether Ketone (PEEK)

- Others (Composite materials, specialized blends)

- By Application:

- Testing and Burn-in

- Handling and Transport

- Shipping and Storage

- By Package Type:

- Ball Grid Array (BGA)

- Quad Flat No-Lead (QFN)

- Small Outline Integrated Circuit (SOIC)

- Quad Flat Package (QFP)

- Chip Scale Package (CSP)

- Others (DRAM, MEMS, Sensors)

- By End-User:

- Outsourced Semiconductor Assembly and Test (OSAT) Providers

- Integrated Device Manufacturers (IDMs)

- Foundries

- Electronics Contract Manufacturers (ECMs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For IC Trays Market

The value chain for the IC Trays Market is characterized by high integration and specialization, beginning with specialized raw material suppliers and culminating at the end-user device manufacturers. Upstream analysis focuses on chemical companies that produce high-performance engineering plastics, such as suppliers of PPS, PEI, and PEEK resins, ensuring these materials meet the stringent electrical conductivity, thermal stability, and mechanical requirements, especially regarding static dissipation (ESD). The ability to procure consistent, high-purity, carbon-filled or proprietary resin compounds is critical for tray manufacturers, who transform these materials using high-precision injection molding techniques. This stage is capital-intensive and requires significant technical expertise in tooling design to achieve the micron-level tolerances demanded by modern ICs.

Downstream analysis centers on the distribution and end-use stages. Once manufactured, IC trays are supplied through both direct and indirect distribution channels. Direct sales are common for large volume, customized orders supplied directly to major OSAT providers and Integrated Device Manufacturers (IDMs) who maintain long-term supply contracts, ensuring seamless integration with their automated handling equipment. Indirect channels involve distributors or specialized semiconductor equipment resellers who manage smaller, varied orders or supply to smaller contract manufacturers. The final users, including OSATs like ASE Technology and Amkor Technology, are the most critical consumers, utilizing the trays for high-throughput testing and packaging operations before the components are shipped to Original Equipment Manufacturers (OEMs) for final device integration.

The efficiency of the value chain is heavily reliant on technological collaboration. Innovations in IC package design necessitate immediate adjustments in tray geometry, often requiring rapid iterative design collaboration between the IC designers, the OSAT providers, and the tray manufacturers. This close loop ensures that the trays remain compatible with the latest chip architectures and high-speed handlers. Furthermore, the push for environmental compliance is compelling tray manufacturers to integrate sustainable practices, such as developing reusable trays and implementing robust cleaning services, adding an important service layer to the traditional manufacturing value chain. The complexity of the value chain means that intellectual property related to proprietary material blends and tooling design offers significant competitive differentiation.

IC Trays Market Potential Customers

The primary consumers, or potential customers, in the IC Trays Market are entities deeply embedded in the back-end processing of semiconductors, where precision handling and quality assurance are paramount. The largest customer segment comprises Outsourced Semiconductor Assembly and Test (OSAT) providers. Companies like ASE, Amkor, and SPIL rely on billions of specialized IC trays annually to conduct critical burn-in testing, final electrical testing, and subsequent handling and shipping of ICs for their fabless and IDM clients. Due to the high-throughput nature of OSAT operations, these customers prioritize cost-effectiveness, tray durability, and guaranteed compatibility with their high-speed automated handlers.

Integrated Device Manufacturers (IDMs) and Semiconductor Foundries represent another significant customer base. Although many IDMs outsource portions of their back-end processing, those retaining internal testing and assembly capabilities, particularly for proprietary or high-security chips, maintain substantial internal demand for IC trays. Foundries, especially those focusing on advanced nodes, require specialized trays for initial testing phases before handing off components for external packaging. These customers often demand the highest level of material purity and dimensional accuracy, driven by internal quality standards and the high value of the components being processed.

Beyond the core semiconductor players, potential customers also include Electronics Contract Manufacturers (ECMs) and Original Equipment Manufacturers (OEMs) specializing in high-reliability products, such as aerospace and defense equipment suppliers. While these entities might procure packaged ICs, they often require trays for in-house handling, specialized application testing, or secure storage. The decision criteria for these niche customers emphasize certification, traceability, and the ability of the tray to perform reliably under extreme or unusual environmental conditions, often requiring custom-designed trays made from the most advanced materials like PEEK or specific proprietary composite blends.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Entegris, YPS, Shinon, Kostat, 3M, Craftech, HWA, Peak International, ITW ECPS, Dou Yee, KOKUSAI KOGYO, Ant Yapi, Ted Pack, Micronics Japan, D&Y Engineering, Custom Interconnects, Inc., Teijin Limited, Sumitomo Bakelite. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IC Trays Market Key Technology Landscape

The technology landscape of the IC Trays Market is characterized by continuous refinement in material science and precision manufacturing, essential for keeping pace with semiconductor advancements. A primary focus is the development of next-generation high-temperature polymer composites. Traditional materials like PPS are reaching their performance limits for advanced burn-in applications, spurring investment in proprietary PEEK and specialized high-glass transition temperature (Tg) PEI formulations. These advanced materials must maintain exceptional dimensional stability (measured in microns) across extreme thermal cycling events (often 150°C to 250°C) to ensure the ICs remain perfectly indexed for automated probing and testing, preventing catastrophic failures during critical quality control steps.

Precision molding technology is another cornerstone of innovation. Achieving the tight dimensional tolerances required for small-pitch BGA or QFN packages necessitates highly sophisticated injection molding machines, optimized tool design, and real-time monitoring of molding parameters. Advanced technologies such as multi-cavity precision tooling, coupled with computer-aided engineering (CAE) simulations for stress and warpage analysis, are critical to ensuring batch-to-batch consistency and minimizing material waste. Furthermore, surface treatment technologies, including proprietary coatings and specialized additive compounding, are used to enhance Electrostatic Discharge (ESD) protection, a non-negotiable requirement to prevent static damage to sensitive components during handling.

Finally, the growing integration of trays within automated manufacturing ecosystems drives the need for technologies focused on enhanced handling features and durability. Tray designs are increasingly incorporating features that facilitate high-speed robotics, such as precise alignment markers and ergonomic designs for handler grippers. Furthermore, longevity and recyclability are technological priorities. Manufacturers are developing robust cleaning and verification processes, utilizing ultrasonic technology and specialized chemicals, to extend the usable lifespan of high-value trays, thereby improving the overall Total Cost of Ownership (TCO) for OSATs and aligning with industry-wide sustainability objectives.

Regional Highlights

The global IC Trays Market exhibits stark regional disparities in both production and consumption, heavily mirroring the geographical distribution of semiconductor manufacturing capabilities.

- Asia Pacific (APAC): Dominance in Manufacturing and Consumption

- North America: Focus on Specialty and High-Performance Applications

- Europe: Automotive, Industrial, and Advanced Research Demand

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Opportunities

APAC stands as the undisputed epicenter of the IC Trays Market, driven by the overwhelming presence of global OSAT leaders, vast memory fabrication sites, and leading foundries situated in Taiwan, China, South Korea, and Japan. The region accounts for the highest volume consumption due to its large-scale, high-throughput assembly and testing operations. China’s continuous massive investment in domestic semiconductor capabilities under strategic national initiatives further accelerates demand, particularly for high-volume, cost-competitive trays. South Korea and Taiwan remain global leaders in memory and advanced logic manufacturing, driving demand for specialized, high-reliability trays for handling complex packages like high-bandwidth memory (HBM) and advanced logic chips. This concentration of activity makes APAC the key market for both volume production and technological adoption of advanced tray materials.

The competitive landscape in APAC is intense, characterized by strong local players alongside global material science leaders. The regional focus is heavily skewed toward optimizing supply chain logistics and cost efficiency, given the high volumes traded. The accelerated pace of 5G rollout and the exponential growth of consumer electronics manufacturing in Southeast Asia further solidifies APAC’s commanding market share. Consequently, any shifts in semiconductor trade policies or regional capacity expansions directly and immediately impact the global IC Trays market dynamics, making it the primary focus for market tracking and strategic planning.

North America represents a mature, high-value market segment, although its consumption volume is lower compared to APAC. Demand is concentrated in highly specialized areas, including defense, aerospace, advanced microprocessors (CPUs/GPUs), and innovative silicon startups focused on AI and quantum computing. These segments require custom-engineered trays often made from premium materials like PEEK to meet stringent regulatory standards, extreme temperature requirements, and highly sensitive ESD protection protocols. The focus here is less on volume and more on guaranteed reliability, technological leadership, and certification compliance, leading to higher average selling prices (ASPs) for trays in this region.

Key drivers include significant domestic investment in semiconductor manufacturing prompted by government initiatives (like the CHIPS Act), which promises to increase localized back-end processing capabilities. This geographical diversification is expected to spur domestic demand for high-end testing trays. Furthermore, major Integrated Device Manufacturers (IDMs) and leading OSAT players with North American operations serve as crucial demand centers, often driving the initial adoption of new tray material technologies and advanced recycling programs.

The European market for IC trays is primarily driven by the region’s strength in the automotive sector (including autonomous driving and electric vehicle components), industrial automation, and highly advanced research institutes. European demand places a premium on long-term reliability and specialized compliance, particularly for automotive-grade ICs that require rigorous qualification processes using highly stable burn-in trays. Germany, France, and the UK are key markets, characterized by established equipment suppliers and sophisticated R&D centers.

Sustainability regulations in Europe are notably strict, pushing tray manufacturers toward developing robust closed-loop systems for tray re-use, cleaning, and recycling. While overall semiconductor manufacturing volumes are smaller than in APAC, the complexity and quality requirements for industrial and medical electronics ensure steady demand for high-specification PEI and PEEK trays. The growth is intrinsically tied to the regional success in power electronics and specialized sensor technology critical for the ongoing digital transformation of manufacturing processes.

LATAM and MEA currently hold smaller shares of the global IC Trays market but represent emerging opportunities. Growth in these regions is correlated with the expansion of local electronics assembly operations, telecommunications infrastructure build-out (especially 5G), and increased penetration of consumer electronics. While the demand is currently focused on standard, cost-effective PPS trays for basic handling and shipping applications, strategic long-term investments in IT infrastructure and nascent manufacturing ecosystems suggest future growth potential. MEA’s demand is heavily influenced by large-scale energy and government IT projects requiring reliable microelectronic components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IC Trays Market.- Entegris

- YPS Corporation

- Shinon Global Co., Ltd.

- Kostat Corporation

- 3M Company

- Craftech Industries, Inc.

- HWA (Taiwan)

- Peak International (ITW ECPS)

- Dou Yee Enterprises

- KOKUSAI KOGYO CO., LTD.

- Ant Yapi (Turkey)

- Ted Pack Co., Ltd.

- Micronics Japan Co., Ltd.

- D&Y Engineering

- Custom Interconnects, Inc.

- Teijin Limited (Material Supplier Focus)

- Sumitomo Bakelite Co., Ltd. (Material and Product Focus)

- Precision Engineered Products (PEP)

- Techcon Systems

- M.S. Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the IC Trays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the IC Trays Market?

Market growth is primarily driven by the increasing global demand for semiconductors fueled by 5G deployment, the proliferation of IoT devices, and significant expansion in high-performance computing (HPC) and automotive electronics, all requiring precision handling and rigorous testing supported by specialized IC trays.

Which material type dominates the IC Trays Market and why is PEI demand rising?

Polyphenylene Sulfide (PPS) remains the dominant material due to its balance of thermal resistance and cost-effectiveness for general applications. However, Polyetherimide (PEI) demand is rapidly rising because its superior thermal stability and mechanical strength are essential for high-temperature burn-in testing of advanced IC packages used in AI hardware and data centers.

What role do IC trays play in the Outsourced Semiconductor Assembly and Test (OSAT) sector?

OSAT providers are the largest consumers, using IC trays extensively for critical back-end processes, including high-speed automated handling, intense thermal burn-in testing, and final electrical testing, ensuring IC quality and integrity before shipping to device manufacturers.

How does the miniaturization of IC packages affect tray manufacturing requirements?

Miniaturization and the move to advanced packaging (BGA, QFN) drastically increase the requirements for dimensional precision. Trays must achieve micron-level tolerances and superior flatness to ensure perfect alignment with automated testing equipment and minimize component damage during high-speed operation.

Which geographic region holds the largest market share for IC trays and what are its drivers?

The Asia Pacific (APAC) region holds the largest market share due to the concentration of global semiconductor manufacturing and OSAT facilities in Taiwan, China, and South Korea, driving massive volume demand for both standard and specialized tray solutions required for mass production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager