Ice Axes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432294 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ice Axes Market Size

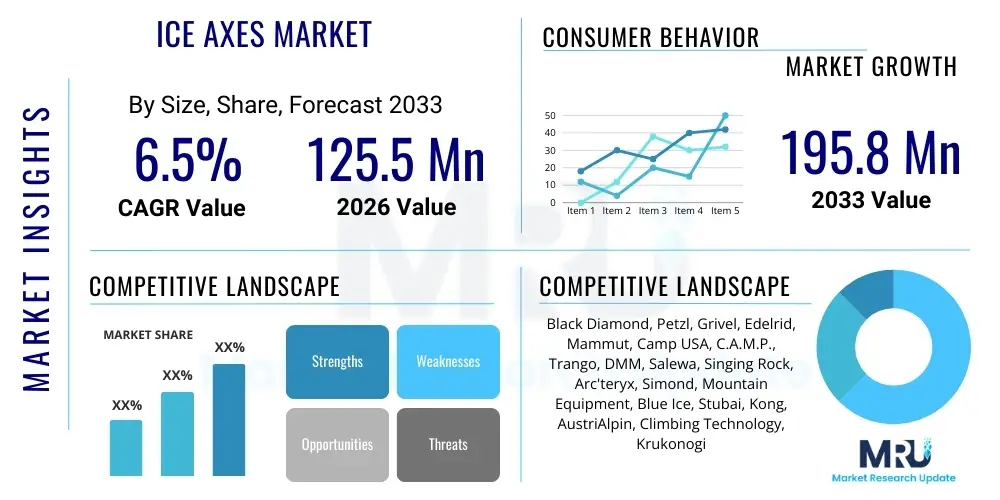

The Ice Axes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $125.5 Million USD in 2026 and is projected to reach $195.8 Million USD by the end of the forecast period in 2033.

Ice Axes Market introduction

The Ice Axes Market encompasses the manufacturing, distribution, and sale of specialized mountaineering equipment essential for safety and movement in snow and ice environments. Ice axes are multi-functional tools used for climbing, self-arrest (stopping a slip or fall), balance, cutting steps, and anchoring. The market is defined by continuous innovation in materials science, focusing on reducing weight while maximizing strength and durability. Key product variations include general mountaineering axes, technical climbing tools, and hybrid designs, each tailored to specific outdoor activities such as alpine climbing, glacier travel, and ice waterfall scaling. The core functionality remains consistent: providing a critical point of contact and security on frozen terrain, making it non-negotiable gear for serious mountaineers and winter hikers.

Major applications for ice axes span recreational and professional domains. Recreationally, the primary users are hikers traversing high-altitude trails, ski mountaineers, and amateur climbers learning essential alpine skills. Professionally, they are vital for mountain guides, search and rescue teams (SAR), military specialized units operating in cold weather conditions, and scientific expeditions requiring access to remote, glaciated regions. The increasing global interest in adventure tourism and extreme sports, coupled with rising disposable incomes in emerging economies, are significant driving factors accelerating market expansion. Moreover, stringent safety regulations and increasing awareness about the necessity of proper gear for high-risk activities further bolster demand.

The benefits associated with high-quality ice axes are primarily centered on enhanced safety and operational efficiency. Modern axes utilize aerospace-grade aluminum and specialized steel alloys (e.g., chromoly steel) for optimal performance. The ergonomic design of shafts and picks aims to minimize user fatigue while maximizing penetration and holding power. Driving factors include technological advancements leading to lighter, more versatile equipment; the growing popularity of mountaineering and backcountry skiing; and increased public investment in outdoor recreation infrastructure. Conversely, the market faces restraints such as the high cost of premium equipment and seasonality limiting purchase cycles, though ongoing material innovation and customization opportunities provide long-term growth prospects.

Ice Axes Market Executive Summary

The Ice Axes Market is experiencing moderate to robust growth, driven primarily by favorable business trends in outdoor recreation and adventure tourism sectors. Key business trends indicate a shift toward high-performance, modular, and sustainable products. Manufacturers are focusing on integrating features like adjustable handles and interchangeable heads to cater to diverse climbing disciplines, thereby increasing the average selling price (ASP) of specialized tools. Market consolidation among leading brands is observed, alongside strategic partnerships aimed at optimizing distribution channels, particularly through specialized online outdoor retailers and professional guide associations. The overall market trajectory suggests sustained demand for premium, certified safety equipment.

Regional trends highlight North America and Europe as established leaders, benefiting from long-standing mountaineering cultures and high levels of consumer awareness regarding safety standards (such as UIAA certification). The Asia Pacific (APAC) region, particularly countries like China and India, is emerging as a critical growth engine, fueled by rapidly expanding middle-class populations seeking experiential adventure activities and improved access to high-altitude areas. Latin America, specifically the Andes region, presents localized but significant demand. Supply chain robustness remains a focus, with manufacturers increasingly diversifying sourcing strategies to mitigate geopolitical and logistical risks associated with specialized metal components.

Segmentation trends reveal strong performance in the Technical Climbing segment, reflecting the growing professionalization of high-altitude sport climbing and ice climbing disciplines. The General Mountaineering segment, however, maintains the largest volume share, benefiting from broader consumer adoption. By Material, composite and advanced aluminum alloys are gaining traction over traditional steel, appealing to weight-conscious users and fast-and-light practitioners. Distribution channels show a clear preference for E-commerce and specialized brick-and-mortar outdoor stores, emphasizing the need for expert guidance during the purchase process. Sustainability in manufacturing processes, including the use of recycled materials and energy-efficient production, is becoming a decisive factor for environmentally conscious consumers.

AI Impact Analysis on Ice Axes Market

Common user questions regarding AI's influence on the Ice Axes Market typically revolve around whether artificial intelligence can enhance safety features, personalize gear selection, or optimize manufacturing processes. Users often inquire about AI-driven material stress testing, predictive maintenance for gear integrity, and the development of 'smart' axes with integrated sensors for real-time environmental data collection (e.g., temperature, gradient, snow stability). The core concerns focus on balancing technological integration with the necessity for lightweight, reliable, and mechanical simplicity inherent to life-saving equipment. Expectations center on AI primarily influencing the upstream design and manufacturing efficiency, rather than dramatically altering the physical tool itself, ensuring traditional reliability is maintained while leveraging digital advancements for superior product development and personalized consumer insights.

- AI-driven topology optimization for design: AI algorithms can simulate loads and stresses to design lighter yet stronger axes, minimizing material use while maximizing structural integrity.

- Predictive supply chain management: Utilizing AI to forecast demand patterns, optimize inventory levels for seasonal peaks, and manage the complex logistics of specialized material sourcing.

- Enhanced material failure analysis: AI models can process vast amounts of sensor data from testing facilities to predict material fatigue and failure points far more accurately than traditional methods.

- Personalized product recommendations: AI tools employed by online retailers analyze user profile, intended use (alpine vs. technical), and skill level to recommend the optimal axe length, curvature, and weight.

- Smart manufacturing optimization: AI deployment in production lines to minimize waste, improve quality control checks on critical components (pick hardness, shaft welding), and boost production efficiency.

DRO & Impact Forces Of Ice Axes Market

The Ice Axes Market is fundamentally shaped by the dynamics of extreme sports participation, technological refinement, and inherent market limitations. Key Drivers include the exponential growth in global adventure tourism, especially high-altitude trekking and winter sports, which necessitate mandatory safety equipment. Technological advancements, such as the introduction of lightweight carbon composite shafts and sophisticated metal alloys, continuously enhance product appeal and performance. Opportunities lie in expanding into untapped emerging markets in Asia and Latin America, developing specialized educational programs that mandate certified equipment, and creating customized or modular gear systems that adapt to various terrain types. Conversely, Restraints include the high initial investment required for premium equipment, the seasonal nature of usage, and economic downturns that often curb consumer spending on non-essential, high-cost recreational goods. The impact forces indicate a competitive environment where product differentiation through innovation and adherence to stringent international safety standards (like the UIAA and CEN) are paramount for market success.

Market dynamics are heavily influenced by the interplay between product innovation (a positive impact force) and regulatory compliance (a stabilizing force). The rapid adoption of 'fast and light' philosophies in mountaineering is driving demand for ultra-light equipment, pushing manufacturers to invest heavily in R&D to maintain strength-to-weight ratios, which sustains market growth. However, the market faces the perennial challenge of counterfeit or substandard products, particularly in online channels, which poses a threat to consumer safety and reputable brands. Manufacturers must continuously educate consumers about the importance of certified gear. Furthermore, climate change impacts, leading to more volatile and dangerous alpine conditions, ironically increase the need for reliable safety equipment, thereby acting as a complex, indirect driver.

The impact forces assessment reveals that supplier power is moderate, as specialized alloys (aluminum, steel) are globally sourced but often customized for specific brands. Buyer power is moderate to high, particularly in the General Mountaineering segment where product choices are abundant and price sensitivity is higher. For technical axes, buyer loyalty to specific brands known for reliability is strong, reducing price elasticity. The threat of new entrants is low due to the substantial capital investment required for manufacturing, testing, and gaining essential safety certifications. Substitutes, primarily through alternative safety gear like ski poles used for support (not self-arrest), pose a limited threat, confirming the ice axe's status as indispensable for self-arrest capabilities. Competitive rivalry is intense, focused on design, proprietary material formulas, and achieving the highest certifications.

Segmentation Analysis

The Ice Axes Market segmentation provides a detailed structural breakdown based on criteria such as product type, application, material, and distribution channel, enabling stakeholders to understand key consumer preferences and market focus areas. Product type segmentation distinguishes between general mountaineering axes, which prioritize simple, robust design and self-arrest capabilities, and technical axes (ice tools), which are ergonomically designed for vertical ice climbing, featuring aggressive picks and optimized shaft curves. This differentiation is critical as it dictates pricing strategy and target audience, with technical tools commanding significantly higher ASPs due to complex manufacturing and specialized performance requirements. Application analysis further refines this view, separating recreational users from professional guides and specialized rescue services, whose procurement needs often involve bulk orders and stricter adherence to operational specifications.

Material segmentation is a crucial area of competitive differentiation. While traditional carbon steel remains relevant for pick components due to its hardness and durability, the shaft material spectrum has broadened significantly. Aluminum alloys dominate the lightweight, budget-friendly segment, suitable for glacier travel and occasional use. Conversely, high-grade materials like carbon fiber composites and specialized aluminum alloys are utilized in premium, technical axes to maximize shock absorption and reduce overall carry weight, catering to the elite mountaineer segment. Distribution channel segmentation reflects the high-touch nature of the product, where specialized retailers offering expert advice remain vital, although the efficiency and global reach of e-commerce platforms continue to drive sales volume, particularly for replacement and standard gear.

- Product Type

- General Mountaineering Axes

- Technical Climbing Axes (Ice Tools)

- Hybrid Axes

- Application

- Recreational Mountaineering

- Professional/Expedition Use

- Search and Rescue (SAR)

- Military and Tactical Operations

- Material

- Aluminum Alloy

- Steel (Carbon/Chromoly)

- Composite Materials (Carbon Fiber/Kevlar)

- Distribution Channel

- Specialty Outdoor Stores (Physical Retail)

- E-commerce and Online Retail

- Departmental Stores

- Direct Sales (B2B/Institutional)

Value Chain Analysis For Ice Axes Market

The Value Chain for the Ice Axes Market starts with critical upstream analysis centered on raw material procurement, primarily high-grade specialized metals (aluminum, steel alloys) and composite fibers (carbon). Procurement demands strict quality control, as material integrity directly relates to the axe's life-saving functionality. This stage involves complex global sourcing and proprietary material treatments (e.g., heat treatment of steel picks). Manufacturing follows, encompassing forging, stamping, casting, machining, and assembly, requiring high precision and specialized tooling to meet rigorous safety standards (UIAA). R&D and design optimization are embedded throughout this process, focusing on ergonomic improvements and material science breakthroughs. High fixed costs are associated with setting up and maintaining certified manufacturing processes.

The midstream focuses on logistics and distribution channels. Due to the specialized nature of the product, distribution relies heavily on indirect channels, primarily through specialized outdoor wholesalers and retailers who possess the expertise to advise consumers on the correct size, type, and usage. Direct sales (B2B) are prominent for institutional clients like military, SAR teams, and large guiding companies, offering tailored pricing and maintenance contracts. E-commerce platforms act as essential channels for reach and volume, although conversion rates benefit significantly from integrated digital content providing expert advice and demonstrating proper usage, bridging the gap between online sales and the necessary specialized knowledge.

Downstream analysis involves marketing, sales, and post-sales support. Marketing strategies often leverage partnerships with professional athletes, mountain guides, and high-profile expeditions, focusing on brand trust, reliability, and heritage. Post-sales services, including repair, re-sharpening, and component replacement (for modular axes), are crucial for customer retention and brand credibility. The overall value chain emphasizes maintaining quality assurance and compliance at every stage, acknowledging that failure at any point can have severe safety implications, making quality control a core value driver.

Ice Axes Market Potential Customers

The potential customer base for the Ice Axes Market is diverse, ranging from novice enthusiasts engaging in structured alpine hiking to highly specialized professionals tackling the world's most challenging frozen routes. End-users fall primarily into the categories of mountaineers, hikers, skiers, and institutional bodies. Novice mountaineers and adventure tourists constitute a high-volume segment, typically purchasing general mountaineering axes as a mandatory safety requirement for guided glacier tours or basic snow travel courses. This segment prioritizes ease of use, durability, and competitive pricing, often preferring established, recognizable brands offered through indirect retail channels.

The technical climbing segment represents the highest value per purchase. These customers—experienced ice climbers, alpine specialists, and elite mountaineers—demand premium, specialized ice tools with optimized weight, advanced geometry, and proprietary material compositions. They are highly informed, brand-loyal, and frequently purchase through specialty stores or direct channels, relying on specific features like shaft curve, pick aggressiveness, and modularity. These buyers prioritize performance over price and often replace or upgrade components annually based on their specific project requirements.

Institutional buyers, including mountain rescue services (SAR), governmental agencies, military units, and accredited mountain guiding schools, form a stable B2B customer base. These entities require bulk quantities, often with specific technical modifications or branding, and demand rigorous compliance documentation and long-term supply contracts. Their purchasing decisions are driven by official standards, reliability, and total cost of ownership (TCO), including maintenance and replacement costs, making them crucial consumers for premium, ultra-reliable equipment designed for repeated, intense use in critical situations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125.5 Million USD |

| Market Forecast in 2033 | $195.8 Million USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Black Diamond, Petzl, Grivel, Edelrid, Mammut, Camp USA, C.A.M.P., Trango, DMM, Salewa, Singing Rock, Arc'teryx, Simond, Mountain Equipment, Blue Ice, Stubai, Kong, AustriAlpin, Climbing Technology, Krukonogi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ice Axes Market Key Technology Landscape

The technology landscape of the Ice Axes Market is primarily driven by advanced material science and precision engineering aimed at maximizing performance and safety compliance. Key innovations center around optimizing the weight-to-strength ratio. This involves the application of hydroforming techniques to shape high-grade aluminum shafts, creating complex curves that enhance grip and pendulum swing dynamics while maintaining structural rigidity. Furthermore, proprietary heat treatment processes are critical for the chromoly steel or specialized alloy picks, ensuring they achieve the optimal balance of hardness (for penetrating ice) and ductility (to prevent brittle fracture under extreme loads). Laser cutting and advanced CNC machining ensure precise geometry and fit between components, especially in modular systems where interchangeability of heads and picks is essential for technical users. These technologies collectively reduce manufacturing tolerances, enhancing the overall reliability of life-saving equipment.

The market has seen a significant focus on ergonomic design facilitated by Computer-Aided Design (CAD) and Finite Element Analysis (FEA). CAD allows manufacturers to meticulously design the axe's geometry, especially the curvature of the shaft (classified as B-type or T-type based on strength), to optimize balance, striking power, and self-arrest effectiveness. FEA simulations are crucial for virtually testing the equipment under extreme load conditions, such as severe falls or deep anchors, ensuring compliance with UIAA (Union Internationale des Associations d'Alpinisme) standards before physical prototyping. This reduces development cycles and enhances confidence in the product's functional safety envelope. The integration of vibration-dampening materials within the shaft, often achieved through specialized polymer coatings or internal dampeners, is another technological advancement aimed at improving user comfort during prolonged climbing and striking activities.

A recent, albeit niche, technological development involves the integration of low-power sensor technology, although full commercial adoption is still limited. These 'smart' features are typically focused on testing prototypes or high-end professional tools, incorporating sensors to measure impact forces, temperature gradients, or even GPS location for tracking during rescue operations. While the simplicity of the mechanical design remains paramount for reliability, manufacturers are also exploring sustainable material technologies. This includes using recycled or partially bio-based polymers for components like the head-protectors and wrist leashes, aligning technological innovation with growing demands for environmentally responsible outdoor gear manufacturing practices.

Regional Highlights

- North America: This region, particularly the U.S. and Canada, represents a mature and technologically advanced market. Growth is driven by the popularity of ice climbing in areas like the Rockies and the Northeast, and extensive backcountry skiing. High consumer awareness regarding certified gear and willingness to pay premiums for lightweight, high-performance equipment (technical axes) sustain the market. The presence of major manufacturers and rigorous product liability standards contribute to continuous innovation and demand for quality.

- Europe: Europe is the historical epicenter of mountaineering, with established markets in the Alpine countries (France, Italy, Switzerland, Austria, Germany). Demand is consistently strong across all segments, influenced by large guide associations and mandatory safety education systems. The regional market is characterized by high brand loyalty and adherence to stringent CEN and UIAA safety standards. Southern and Eastern Europe show accelerating demand for general mountaineering axes as adventure tourism expands into new mountain ranges.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by the increasing affluence and growing interest in mountaineering and high-altitude tourism in countries bordering the Himalayas (Nepal, India) and rapidly developing outdoor cultures in China, South Korea, and Japan. While traditional equipment dominated previously, there is a swift transition towards modern, imported, or locally manufactured, UIAA-certified gear, indicating significant future market potential for both entry-level and professional tools.

- Latin America: Focused primarily on the Andean cordillera, the market here is stable but niche. Demand is heavily concentrated in countries like Chile, Argentina, and Peru, supported by local guiding services and international expeditions. Economic volatility can restrain consumer purchases, but institutional buyers (e.g., national parks, specialized police rescue teams) provide a baseline of demand for durable, heavy-duty equipment.

- Middle East and Africa (MEA): This region holds the smallest share, with localized demand stemming from mountain ranges in Morocco, Lebanon, and South Africa. Growth is slow but steady, primarily driven by international tourists and localized trekking industries seeking certified safety gear for high-altitude non-glacial routes or volcanic terrains, where the ice axe serves as an anchor and walking aid.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ice Axes Market.- Black Diamond

- Petzl

- Grivel

- Edelrid

- Mammut

- Camp USA

- C.A.M.P.

- Trango

- DMM

- Salewa

- Singing Rock

- Arc'teryx

- Simond

- Mountain Equipment

- Blue Ice

- Stubai

- Kong

- AustriAlpin

- Climbing Technology

- Krukonogi

Frequently Asked Questions

Analyze common user questions about the Ice Axes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a B-rated and T-rated ice axe?

B-rated (Basic) axes are typically suitable for general mountaineering and glacier travel, offering adequate strength for self-arrest. T-rated (Technical) axes possess significantly higher strength ratings for the shaft and pick, designed to withstand greater load forces associated with vertical ice climbing and hard anchoring techniques, making them necessary for advanced terrain.

Which material is preferred for modern ice axes to balance weight and strength?

High-grade aluminum alloys are predominantly used for lightweight shafts in general mountaineering axes. For technical tools, manufacturers often use specialized chromoly steel for the picks, combined with advanced aluminum or carbon fiber composites for the shaft, achieving superior strength while minimizing overall weight for high-performance applications.

How is the size or length of an ice axe determined for a climber?

For general mountaineering, the traditional method dictates that the axe head should reach the ankle bone when the user holds the axe by the head with the arm hanging straight down. However, modern alpine techniques often favor shorter axes (50-60 cm) for better balance and usability on steeper slopes, making the optimal length dependent on the climber's height and intended application.

What are the key drivers expected to accelerate market growth through 2033?

The market is primarily driven by the expanding global participation in adventure tourism, particularly high-altitude trekking and backcountry skiing. Further acceleration comes from continuous technological innovation resulting in lighter, more durable gear, alongside increased consumer education regarding the necessity of UIAA-certified safety equipment.

Is E-commerce a reliable distribution channel for buying highly specialized ice axes?

Yes, E-commerce is increasingly reliable, especially when facilitated by specialty outdoor retailers who provide detailed product specifications, virtual sizing guides, and technical support. While physical specialty stores remain important for expert consultation, online channels offer unparalleled access to niche brands and comprehensive inventory.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager