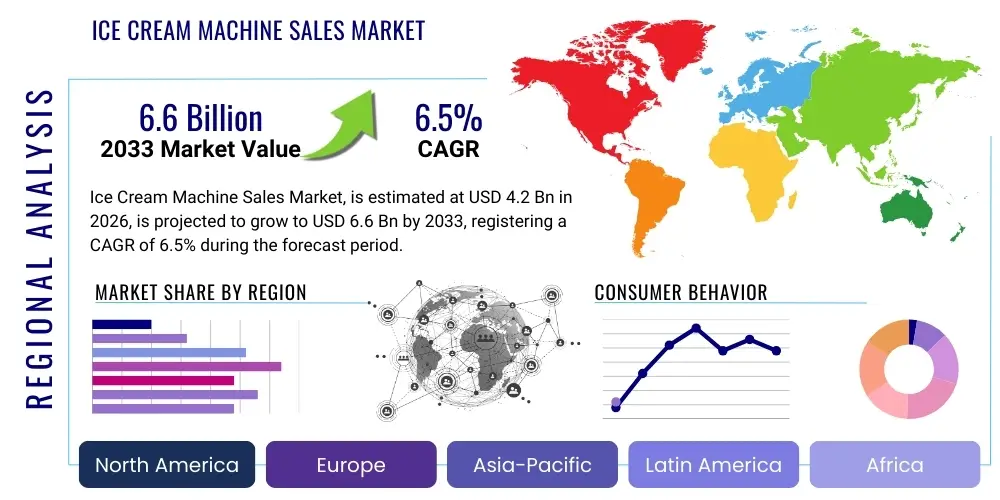

Ice Cream Machine Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438447 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Ice Cream Machine Sales Market Size

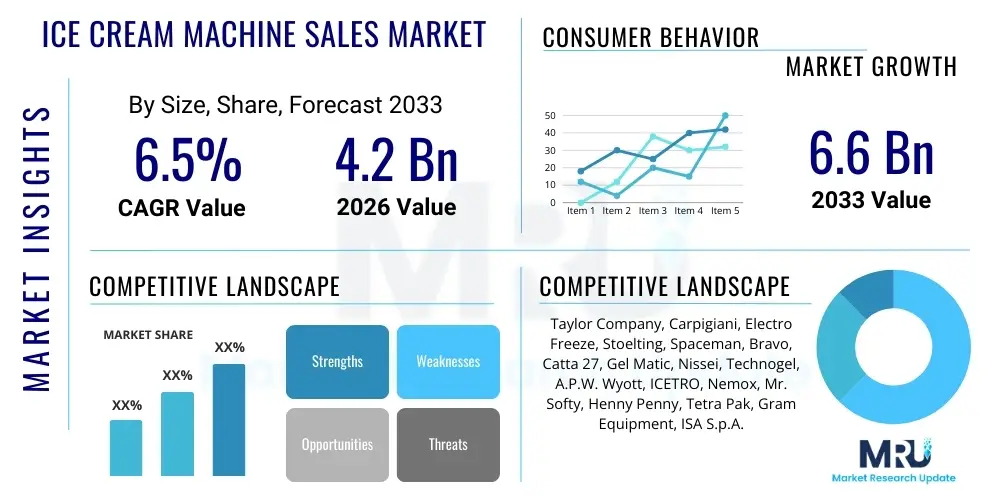

The Ice Cream Machine Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $6.6 Billion by the end of the forecast period in 2033.

Ice Cream Machine Sales Market introduction

The Ice Cream Machine Sales Market encompasses the manufacturing, distribution, and sale of specialized equipment used for producing frozen desserts, primarily ice cream, gelato, sorbet, and frozen yogurt. These machines range from compact countertop units designed for small retail operations to large, industrial batch freezers used in mass production facilities. Key products include soft-serve machines, which are ubiquitous in quick-service restaurants (QSRs) and convenience stores due to their high output and consistency, and hard-serve (batch) freezers, favored by artisanal shops for creating dense, high-quality gelato and traditional ice cream. The performance metrics, such as capacity, freezing speed, ease of cleaning (CIP systems), and energy efficiency, heavily influence purchasing decisions across the market spectrum.

The growth of the market is intrinsically linked to global consumer trends, particularly the increasing demand for ready-to-eat desserts and premium, personalized frozen treats. The rapid expansion of international food service chains, alongside the proliferation of independent artisanal ice cream parlors and specialized dessert cafes, acts as a primary driving factor. Furthermore, technological innovation focused on enhancing machine efficiency and incorporating smart features, such as automated fault detection and remote monitoring, is bolstering replacement cycles and new installations. Health consciousness is also subtly impacting the market, as machines capable of processing dairy alternatives (like oat milk or almond milk) or producing low-fat frozen yogurt see increased adoption.

Major applications of these machines span commercial food service, institutional catering, and large-scale industrial processing. Benefits derived from modern equipment include superior product consistency, significant reduction in labor costs through automation, improved hygiene standards mandated by regulatory bodies (HACCP compliance), and enhanced energy efficiency contributing to lower operational expenditure. The key driving factors remain the globalization of Western dessert culture, rising disposable incomes in emerging economies, and continuous innovation in refrigeration technology and machine design, ensuring consistent quality and high throughput capacity for businesses operating at various scales.

Ice Cream Machine Sales Market Executive Summary

The Ice Cream Machine Sales Market exhibits robust expansion driven primarily by global franchising activities and heightened consumer spending on experiential dining and dessert consumption. Key business trends indicate a strong shift toward automation and digitalization, where manufacturers are integrating IoT capabilities for predictive maintenance, recipe management, and operational analytics. The commercial sector, particularly QSRs and specialized ice cream shops, remains the dominant revenue generator, consistently demanding high-capacity, durable, and easy-to-clean soft-serve machines to manage high volume traffic and maintain strict hygiene protocols. Meanwhile, the industrial segment is focusing on continuous freezers capable of massive throughput for packaged goods production, emphasizing energy recovery systems and minimizing operational footprint.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, the Westernization of dietary preferences, and a burgeoning middle class in countries like China and India demonstrating a high affinity for novelty desserts. North America and Europe, while mature markets, maintain dominance in terms of technological adoption and stringent quality control standards, driving demand for premium batch freezers and multi-flavor dispensing systems. These developed regions also lead the adoption of sustainable technologies, prioritizing equipment utilizing natural refrigerants (like R290) and boasting superior energy efficiency ratings, aligning with global environmental regulations.

Segmentation trends highlight the increasing preference for multi-functional machines that can produce various frozen products (ice cream, shakes, slushies) from a single unit, offering flexibility to small and medium-sized enterprises (SMEs). Within the product type segment, batch freezers are gaining traction in the artisanal space due to the rising consumer demand for high-fat, handcrafted ice cream and gelato, often positioning these products at a premium price point. Furthermore, the after-sales service segment, including maintenance contracts and spare parts, is becoming a critical differentiation factor for leading market players, ensuring machine uptime and customer loyalty in a competitive landscape.

AI Impact Analysis on Ice Cream Machine Sales Market

Common user questions regarding AI's impact on the Ice Cream Machine Sales Market frequently revolve around how artificial intelligence can optimize production processes, improve flavor consistency, and reduce waste. Users are keen to understand if AI-driven systems can autonomously manage ingredient mixing ratios, predict maintenance requirements, and even personalize consumer experiences through smart dispensing. The consensus in these inquiries suggests a strong expectation for AI to move beyond simple automation to sophisticated process optimization and predictive analytics. Key themes include the implementation of machine learning models to analyze throughput data, optimize freezing cycles based on real-time ambient temperature and ingredient density, and ultimately maximize efficiency and yield for high-volume operators.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from compressors, motors, and cooling systems, anticipating component failures before they occur, thus minimizing downtime and extending machine lifespan.

- Automated Quality Control: Implementing computer vision and AI-driven sensors to monitor texture, viscosity, and overrun (air incorporation) during the freezing process, automatically adjusting parameters to maintain perfect product consistency regardless of batch size.

- Recipe Optimization and Management: AI platforms managing complex ingredient inventories, advising operators on optimal mixing sequences, and adapting recipes instantly based on current raw material properties (e.g., milk fat content variation).

- Personalized Flavor Dispensing: Integrating AI with point-of-sale systems to analyze customer preferences and trends, enabling sophisticated machines to mix and dispense customized, on-demand flavor combinations and topping ratios.

- Energy Consumption Optimization: AI systems dynamically adjusting cooling cycles and power usage based on production schedules and electricity costs, leading to significant reductions in operational energy expenditure.

DRO & Impact Forces Of Ice Cream Machine Sales Market

The Ice Cream Machine Sales Market is governed by a robust interplay of driving forces and structural constraints. Key drivers include the exponential growth of the global QSR and fast-casual dining sectors, which require reliable, high-capacity soft-serve machines to support standardized menus and rapid service. Additionally, the increasing consumer preference for premium, artisanal, and healthier frozen desserts—such as low-sugar or plant-based options—drives demand for advanced batch freezers capable of handling specialized ingredients and achieving superior product texture. Regulatory requirements pertaining to food safety, hygiene (e.g., thermal sanitization systems), and energy efficiency also force operators to upgrade older equipment, fueling replacement sales cycles globally. These structural demands ensure continuous capital expenditure in modern equipment.

However, the market faces significant restraints, primarily the high initial capital investment required for commercial-grade and industrial ice cream machines. Sophisticated batch freezers and continuous freezers represent substantial expenditures, often posing a barrier to entry for smaller, independent food service operators in developing nations. Furthermore, the reliance on specialized maintenance technicians and the cost of proprietary spare parts can add significantly to the total cost of ownership (TCO), particularly for highly automated European or American-made machinery. Economic downturns or inflationary pressures that impact consumer discretionary spending on desserts can also temporarily dampen the market demand.

Opportunities in the market center on capitalizing on untapped geographical markets in Southeast Asia, Africa, and specific regions of Latin America where modern frozen dessert culture is rapidly expanding alongside rising incomes. Technological innovation provides another crucial opportunity, specifically through the development of highly modular, customizable, and energy-efficient machines compatible with sustainable refrigerants (e.g., R290, CO2). The growing trend toward automation in kitchen environments presents an opportunity for manufacturers to integrate robotics and smart dispensing systems, reducing labor requirements and increasing operational reliability. The shift towards smaller, highly efficient, and versatile countertop models for coffee shops and small bakeries also expands the target customer base significantly, moving beyond traditional ice cream parlors.

Segmentation Analysis

The Ice Cream Machine Sales Market is comprehensively segmented based on product type, operational capacity, degree of automation, and end-user application. Segmentation is crucial for manufacturers to target specific business models, ranging from high-street QSR chains needing rapid output soft-serve solutions to high-end artisanal shops prioritizing precision and quality using advanced batch freezers. The market structure reflects the diversity in frozen dessert preparation methods and consumption patterns across the globe, requiring tailored equipment specifications for different end-user environments. Analyzing these segments helps identify faster-growing niches, such as the increasing demand for customized medium-capacity machines suitable for small-scale franchise operations.

By dissecting the market along these lines, stakeholders can better understand regional preferences, for instance, the dominance of hard-serve batch freezers in European gelato markets versus the overwhelming presence of soft-serve units in North American fast-food environments. Capacity segmentation (small, medium, large/industrial) dictates pricing strategies and technological complexity; small units focus on portability and ease of use, while large industrial units focus on continuous production optimization and integration with full factory lines. End-user classification—ranging from highly regulated institutional settings (hospitals, schools) to high-throughput commercial ventures (restaurants, dedicated parlors)—further defines necessary features such as compliance, sanitation protocols, and durability requirements.

- Product Type: Soft Serve Machines, Hard Serve Machines (Batch Freezers), Continuous Freezers, Combination/Multi-Functional Units.

- Operational Capacity: Small Capacity (Under 20 Liters/Hour), Medium Capacity (20-60 Liters/Hour), Large Capacity (Above 60 Liters/Hour).

- End-User: Commercial Food Service (QSRs, Restaurants, Cafes, Dedicated Ice Cream Parlors), Retail (Supermarkets, Convenience Stores), Institutional (Schools, Hospitals, Corporate Cafeterias), Industrial/Manufacturing (Packaged Ice Cream Producers).

- Refrigeration Type: Air-Cooled Systems, Water-Cooled Systems.

- Automation Level: Manual/Semi-Automatic, Fully Automatic.

Value Chain Analysis For Ice Cream Machine Sales Market

The value chain for the Ice Cream Machine Sales Market begins with upstream activities involving the sourcing of highly specialized raw materials, primarily high-grade stainless steel for components that contact food, advanced compressors, cooling coils, and sophisticated electronic control systems. Key upstream suppliers include manufacturers of commercial refrigeration components and precision engineering firms. Quality control at this stage is paramount, as the durability and hygiene of the machine are directly dependent on the material specifications. Manufacturers rely heavily on strategic procurement relationships to secure high-efficiency, compliant refrigeration components, especially those utilizing environmentally friendly refrigerants, ensuring the final product meets increasingly strict global energy standards.

Midstream activities involve the design, assembly, and testing of the ice cream machines. Leading manufacturers invest heavily in R&D to enhance freezing efficiency, minimize noise pollution, and incorporate user-friendly features like touch-screen interfaces and automated cleaning cycles (Heat Treatment or Pasteurization modes). This stage includes meticulous assembly processes, often involving skilled labor due to the precise integration of hydraulic, electrical, and refrigeration systems. Downstream activities involve distribution, marketing, sales, and comprehensive after-sales support. Given the complexity and capital expense of the equipment, sales often involve direct relationships with large industrial buyers or reliance on specialized commercial kitchen equipment distributors.

Distribution channels are multifaceted, comprising direct sales teams for large international chains (maximizing control and customization), specialized food service equipment dealers (providing local expertise and installation support), and increasingly, e-commerce platforms for smaller, standardized countertop models. Direct distribution allows manufacturers to maintain higher margins and direct feedback loops, crucial for continuous product improvement. Indirect channels, primarily through local dealers, are essential for penetrating regional markets, offering necessary maintenance and repair services (Field Service Engineers) which are integral to the total value proposition. The after-sales market, including spare parts and regular service contracts, forms a significant and high-margin component of the overall value chain, ensuring equipment uptime for customers and recurring revenue for manufacturers.

Ice Cream Machine Sales Market Potential Customers

Potential customers, or end-users/buyers, in the Ice Cream Machine Sales Market are highly diverse, spanning the entire food service and food manufacturing ecosystem, categorized primarily by volume needs and specialization. The largest segment includes commercial entities such as international quick-service restaurant (QSR) chains that require high-volume, reliable soft-serve machines for standardized products. Dedicated ice cream and gelato parlors, both independent and franchised, form a premium customer base, often purchasing advanced batch freezers to produce artisanal, high-quality, and often customizable products, necessitating machines with superior control over overrun and temperature consistency.

Furthermore, institutional buyers, including large universities, corporate cafeterias, healthcare facilities, and military bases, represent stable customers requiring durable and simple-to-operate machines that can handle moderate volume while adhering strictly to high hygiene and sanitation standards. The retail sector, comprising supermarkets and convenience stores, often utilizes compact, self-service soft-serve or frozen yogurt dispensers as an added value proposition to increase foot traffic and improve impulse purchase rates. This segment prioritizes ease of maintenance and minimal staff training.

The industrial segment, encompassing large-scale food processors like Unilever, Nestlé, and independent packaged ice cream manufacturers, purchases the most technologically advanced and highest-capacity equipment, specifically continuous freezers and homogenization units, integrated into automated production lines. These buyers prioritize throughput, energy efficiency (lowering cost per gallon produced), and seamless integration with packaging machinery. The emerging customer segment includes specialty coffee shops, bakeries, and small food trucks looking for modular, compact, and multi-functional units capable of producing small batches of frozen desserts or shakes to complement their primary offerings, emphasizing versatility and low counter footprint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $6.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Taylor Company, Carpigiani, Electro Freeze, Stoelting, Spaceman, Bravo, Catta 27, Gel Matic, Nissei, Technogel, A.P.W. Wyott, ICETRO, Nemox, Mr. Softy, Henny Penny, Tetra Pak, Gram Equipment, ISA S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ice Cream Machine Sales Market Key Technology Landscape

The technological landscape of the Ice Cream Machine Sales Market is characterized by continuous innovation focused on operational efficiency, sanitation, and product quality consistency. A critical development is the widespread adoption of Heat Treatment (Pasteurization) or standby modes, allowing machines to maintain ingredients at safe temperatures for extended periods (up to 14 days) without manual cleaning, significantly reducing labor time and ensuring regulatory compliance. Furthermore, modern machines increasingly utilize Variable Frequency Drives (VFDs) and advanced electronic controls to optimize motor speed and power consumption based on load, contributing substantially to energy savings and reduced wear and tear on mechanical components, providing compelling Total Cost of Ownership (TCO) advantages to operators.

Another dominant technological trend is the integration of advanced diagnostic and IoT (Internet of Things) capabilities. Newer models are equipped with Wi-Fi connectivity and remote monitoring systems, allowing operators or manufacturers to track performance metrics, troubleshoot issues remotely, and manage inventory and recipe profiles across multiple locations centrally. This level of digitalization is transforming preventative maintenance from reactive repairs to predictive service schedules, maximizing operational uptime for high-volume customers like QSR chains. Moreover, the industry is transitioning away from traditional HFC refrigerants toward natural, low Global Warming Potential (GWP) alternatives, such as R290 (Propane), driven by stringent environmental regulations, particularly in Europe and North America, necessitating redesigns of compressor and heat exchanger components.

In terms of product quality, the technology landscape emphasizes precision freezing mechanisms. Sophisticated batch freezers now feature advanced control systems that monitor the viscosity and temperature profile of the mix in real-time, allowing operators to achieve exact overrun percentages and crystal structures, essential for producing high-quality gelato and artisan ice cream with optimal texture and shelf life. Additionally, multi-barrel and customized dispensing systems are becoming prevalent, enabling simultaneous production of different flavors or products (e.g., combining soft serve with frozen beverages), maximizing machine utilization and menu flexibility within limited kitchen space, which is highly valued in the competitive commercial food service environment globally.

Regional Highlights

The market dynamics for Ice Cream Machine Sales vary significantly across key geographical regions, reflecting differences in consumer culture, regulatory environments, and economic development levels. North America remains a dominant market segment, characterized by high penetration of QSRs and the strong demand for technologically advanced, high-capacity soft-serve machines, often incorporating advanced self-cleaning and diagnostic features. The focus here is on maximizing throughput and minimizing labor costs in high-wage environments. Europe, conversely, shows a robust demand for high-end batch freezers, driven by the strong artisanal gelato and pastry tradition, emphasizing quality, precision, and energy efficiency, often adhering to the strictest environmental refrigerant standards.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and the increasing exposure of large populations to Western dessert trends. Countries like China and India are witnessing an explosion in food service outlets and localized ice cream chains, driving massive demand for both imported and domestically manufactured medium-capacity machines. The MEA and Latin American regions represent emerging opportunities, where the market is rapidly maturing, characterized by increasing franchise expansion and a growing need for durable, robust machines that can operate reliably under diverse climatic conditions and potentially fluctuating power supplies.

- North America (NA): High volume consumption, dominance of soft-serve machines (QSR focus), strong adoption of IoT and automation technologies, early adopters of predictive maintenance services.

- Europe: Leading market for high-precision batch freezers (gelato specialization), stringent regulatory requirements driving demand for R290 (natural refrigerant) models, high demand for sophisticated energy-saving equipment.

- Asia Pacific (APAC): Highest projected growth rate, driven by population size and expanding middle class, rapid franchise expansion, increasing adoption of imported technology, diverse demand spanning soft serve, frozen yogurt, and traditional hard-serve.

- Latin America (LATAM): Growing commercial market led by multinational food service investment, focus on durable, medium-capacity machines that balance initial cost and operational reliability, increasing interest in frozen beverage dispensers.

- Middle East and Africa (MEA): Market growth linked to tourism and luxury food service sectors, demand for premium machines in major urban centers, challenging climate necessitates specialized water-cooled systems for optimal performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ice Cream Machine Sales Market.- Taylor Company

- Carpigiani

- Electro Freeze

- Stoelting

- Spaceman

- Bravo

- Catta 27

- Gel Matic

- Nissei

- Technogel

- A.P.W. Wyott

- ICETRO

- Nemox

- Mr. Softy

- Henny Penny

- Tetra Pak

- Gram Equipment

- ISA S.p.A.

Frequently Asked Questions

Analyze common user questions about the Ice Cream Machine Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between soft serve and batch freezer machines?

Soft serve machines continuously freeze and dispense a lower-viscosity mix with high overrun (air content), ideal for QSRs. Batch freezers, or hard-serve machines, freeze a mix quickly in a batch to create denser, premium ice cream or gelato with lower overrun, requiring aging and hardening before serving.

Which region is expected to demonstrate the fastest growth in the Ice Cream Machine Sales Market?

The Asia Pacific (APAC) region is projected to experience the fastest growth due to rapid economic development, increasing disposable income, and the aggressive expansion of both local and international food service chains specializing in frozen desserts across major emerging economies.

What is the role of IoT technology in modern ice cream machines?

IoT integrates smart connectivity features into machines, enabling remote diagnostics, predictive maintenance scheduling, automated software updates, and centralized performance monitoring, significantly reducing downtime and optimizing operational efficiency for large operators.

What are the key factors driving equipment replacement cycles in developed markets?

Equipment replacement is primarily driven by mandates for increased energy efficiency, the adoption of new environmentally friendly refrigerants (like R290), and the need to comply with evolving food safety and hygiene regulations that favor machines with advanced automated cleaning systems.

What is the average useful lifespan of a commercial ice cream machine?

The useful lifespan of a high-quality, commercial-grade ice cream machine typically ranges between 10 to 15 years, provided regular and professional preventative maintenance is conducted, especially on critical components like compressors and seals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager