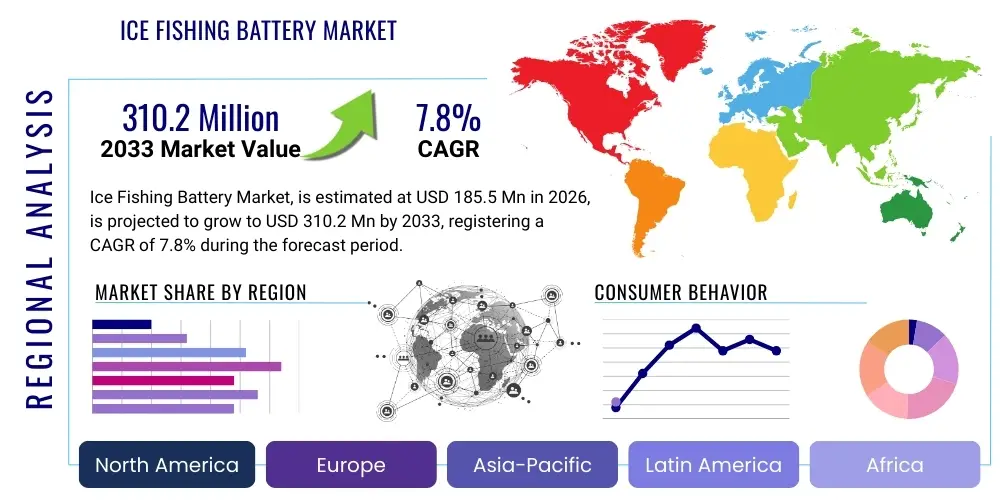

Ice Fishing Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438971 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Ice Fishing Battery Market Size

The Ice Fishing Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $310.2 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating technological adoption within the ice fishing industry, where advanced electronics, such as high-definition sonar systems and integrated GPS units, demand reliable, long-lasting, and lightweight power solutions, favoring the shift from traditional sealed lead-acid (SLA) batteries to modern lithium-ion chemistries.

Ice Fishing Battery Market introduction

The Ice Fishing Battery Market encompasses portable, high-performance energy storage devices specifically engineered to power essential electronic equipment used during ice fishing expeditions in sub-zero temperatures. These specialized batteries are designed to offer superior cold weather performance, high energy density, and minimal weight, crucial factors for mobility and extended use on frozen waterways. The product typically features chemistries like Lithium Iron Phosphate (LiFePO4) due to its enhanced cold tolerance and safety profile compared to standard lithium-ion variants.

Major applications for these batteries include powering advanced fish-finding electronics (flasher units, high-resolution sonar/chart plotters), underwater viewing systems (cameras), and ancillary equipment such as portable lighting, communication devices, and heating vests. The fundamental benefit provided by these modern battery solutions is extended operational runtime and significant weight reduction, enhancing the angler's efficiency and comfort. Reliability in freezing conditions is paramount, differentiating these specialized batteries from general-purpose power banks.

Driving factors for market expansion include the increasing consumer disposable income dedicated to recreational activities, coupled with significant advancements in ice fishing technology that necessitate substantial power reserves. The integration of high-draw, multi-functional electronic units capable of real-time mapping and structural analysis requires battery systems with higher ampere-hour (Ah) capacities and robust Battery Management Systems (BMS) to ensure consistent, safe, and prolonged power delivery, accelerating the transition away from older, heavier power sources.

Ice Fishing Battery Market Executive Summary

The Ice Fishing Battery Market is defined by a rapid technological transition toward high-density lithium chemistries, predominantly LiFePO4, displacing legacy Sealed Lead-Acid (SLA) technology due to demands for lower weight and extended cycle life, which represents the most dominant business trend influencing investment and product development. Current business trends indicate intense competition focused on optimizing Battery Management Systems (BMS) for cold weather performance and offering highly durable, ruggedized casings capable of surviving harsh environmental conditions. Furthermore, companies are leveraging direct-to-consumer (D2C) e-commerce channels to bypass traditional distribution complexities and connect directly with specialized angling communities, enhancing profitability and brand loyalty through technical content and specialized support.

Regional trends clearly highlight North America, specifically the US and Canada, as the dominant geographical segment, accounting for the largest share of market revenue due to the deep-rooted cultural prevalence of ice fishing and high adoption rates of advanced sonar technology. However, Scandinavian countries and Russia are exhibiting rapid growth potential, driven by improving economic conditions and increased accessibility to high-quality fishing gear. The market in these developing regions often sees a faster leapfrog adoption, moving directly to premium lithium solutions rather than phasing through older technologies, presenting significant opportunities for international manufacturers specializing in cold-weather lithium battery packs.

Segmentation trends indicate that the Capacity segment (10 Ah – 20 Ah) holds the highest market share, correlating directly with the power requirements of popular mid-to-high-tier fish finder units, which require reliable power for continuous operation throughout a full day of fishing. Furthermore, the Application segment sees Fish Finders dominating demand, although Underwater Cameras are gaining traction as visual confirmation becomes a preferred method for identifying species and structure. The shift in battery type underscores the premiumization of the market, where consumers are increasingly willing to pay a higher upfront cost for the long-term reliability, lighter weight, and superior lifespan offered by lithium solutions, solidifying LiFePO4 as the future standard for this niche market.

AI Impact Analysis on Ice Fishing Battery Market

User inquiries regarding AI's influence in the Ice Fishing Battery Market center primarily on smart integration, predictive maintenance, and optimized energy usage for integrated sonar and GPS systems. Consumers are keen to understand if AI-driven Battery Management Systems (BMS) can dynamically adjust charging and discharging profiles based on real-time temperature fluctuations and predicted usage patterns, maximizing both battery lifespan and runtime efficiency in extreme cold. Key concerns revolve around the cybersecurity implications of connected smart batteries and the reliability of complex software in sub-zero environments, while expectations include features like automated power-down sequences for non-critical peripherals and predictive alerts regarding potential battery failures based on historical data analysis. The collective user interest suggests a future where batteries transition from simple power sources to intelligent components within a networked fishing system, significantly enhancing the overall user experience and equipment lifespan.

- AI-driven Battery Management Systems (BMS) will optimize charging cycles and discharge rates based on ambient temperature and load history, extending cold-weather runtime.

- Predictive analytics integrated into the battery platform will anticipate potential hardware failures or capacity degradation, alerting users before critical field failure occurs.

- AI processing within advanced fish finders (e.g., distinguishing fish species or interpreting complex bottom structure) will increase the instantaneous power draw, driving demand for batteries with higher peak current outputs and faster response times.

- Integration with GPS and mapping software allows for optimized power distribution, prioritizing essential navigation and safety functions when battery reserves are low.

- Automated self-monitoring and balancing capabilities using machine learning algorithms will improve cell health equalization, boosting the overall longevity and safety of high-capacity lithium packs.

DRO & Impact Forces Of Ice Fishing Battery Market

The Ice Fishing Battery Market is simultaneously propelled by increasing demand for technologically advanced, lightweight portable electronics and constrained by significant environmental and cost barriers inherent to specialized battery technology. Primary drivers include the continuous innovation in sonar and GPS units requiring high, sustained power and the consumer preference for highly portable, lightweight gear necessary for maneuvering across ice. Conversely, key restraints are the higher upfront manufacturing costs associated with robust, cold-weather-optimized lithium chemistry (LiFePO4) and the regulatory hurdles concerning the transportation and recycling of lithium batteries, especially in remote fishing locations. Opportunities lie prominently in the development of modular, smart battery systems that incorporate solar charging capabilities and enhanced connectivity features for telemetry and remote diagnostics, while competitive impact forces are driven by the need for companies to achieve economies of scale and prove long-term cold performance reliability, distinguishing premium brands from lower-cost alternatives.

Drivers: The explosive growth in the sophistication of ice fishing electronics, particularly high-definition live sonar and mapping units, necessitates batteries that provide reliable, extended power delivery without sacrificing portability. Anglers are increasingly using multiple electronic devices simultaneously (flasher, GPS, camera), exponentially increasing the required ampere-hour (Ah) capacity. The substantial weight reduction offered by lithium batteries compared to traditional SLA (often 70% lighter) is a major incentive, as ease of transportation is critical when hauling heavy gear across ice surfaces, directly fueling consumer upgrades. Furthermore, the rise of ice fishing tournaments and competitive angling drives the demand for professional-grade, high-reliability power sources.

Restraints: The primary restraint is the significant initial cost associated with premium lithium batteries, which can be several times higher than comparable SLA units, forming a barrier to entry for budget-conscious recreational anglers. Secondly, while LiFePO4 performs better than standard Li-ion, all battery chemistries suffer efficiency losses in extreme cold; maintaining optimal performance requires sophisticated thermal management, adding complexity and cost. Furthermore, consumer perception and safety concerns regarding lithium battery failure (thermal runaway) in remote, non-controlled environments necessitate conservative and expensive design choices, impacting mass market adoption.

Opportunity: Key opportunities are centered around technological innovation, including the development of integrated battery systems that feature quick-change modular designs and seamless solar recharging integration, catering to multi-day remote expeditions. The trend towards 'smart fishing' opens avenues for batteries with built-in IoT capabilities, allowing users to remotely monitor battery health, location, and remaining runtime via smartphone apps. There is a burgeoning opportunity in the retrofit market, providing specialized lithium battery kits designed to seamlessly upgrade older, still functional SLA-based fish finder units, offering a cost-effective pathway to modernization for existing equipment owners.

Impact Forces: The market is influenced by the competitive dynamics driven by intellectual property related to proprietary Battery Management Systems (BMS) optimized for cold temperatures, which acts as a strong competitive differentiator. Regulatory standards regarding battery safety and transport (especially air travel) impose critical constraints and shape manufacturing requirements globally. Supplier negotiation power is moderate, heavily reliant on the volatile global price of lithium raw materials. Overall market momentum is powerfully sustained by the high value placed on reliability and performance by the dedicated ice fishing community, making brand reputation for enduring quality a paramount force in consumer decision-making.

Segmentation Analysis

The Ice Fishing Battery Market segmentation provides critical insights into purchasing behaviors, usage intensity, and technological preferences across the angling community. The market is fundamentally segmented by Battery Type, where the shift from older SLA technology to Lithium Iron Phosphate (LiFePO4) is the most impactful trend, driven by the desire for lower weight and higher cycle life. Application segmentation reveals the concentrated demand from high-power electronics like sonar, while the Capacity segmentation dictates the size and cost structure of the units, directly correlating with the duration and intensity of fishing trips. Understanding these segments is vital for manufacturers aiming to align product offerings with the specific needs of recreational versus professional anglers, optimizing marketing strategies and inventory management for the dominant capacity brackets.

The dominance of the LiFePO4 segment highlights a willingness among consumers to invest in premium technology that ensures safety and longevity in harsh environments. While the SLA segment remains relevant for entry-level or backup power solutions due to its lower initial cost, the long-term trend strongly favors lithium chemistries due to superior performance characteristics in cold environments and significantly reduced environmental impact over the battery's lifespan. Capacity analysis shows that power requirements are steadily increasing year-over-year, forcing manufacturers to innovate in energy density to provide high capacity (e.g., 20Ah+) without increasing physical size or weight excessively, ensuring compatibility with compact fishing sleds and gear transportation methods.

Furthermore, segmentation by distribution channel shows a strong reliance on specialized outdoor and sporting goods retailers, although the shift toward sophisticated e-commerce platforms is accelerating, particularly for niche, high-end battery manufacturers who emphasize technical customer support and educational content. This dual distribution strategy allows established brands to maintain broad physical presence while leveraging digital platforms for direct engagement and specialized product launches. The increasing adoption of integrated systems, where the battery is sold as part of a complete electronics package (e.g., fish finder and specialized battery combo), also creates distinct sales channels and partnership opportunities between battery manufacturers and electronics providers.

- Battery Type:

- Lithium-Ion (Li-ion) / Lithium Iron Phosphate (LiFePO4)

- Sealed Lead-Acid (SLA) / Absorbed Glass Mat (AGM)

- Capacity (Ah):

- Up to 10 Ah (Typically for flashers and small devices)

- 10 Ah – 20 Ah (Standard for high-power sonar units)

- Above 20 Ah (For multi-day use or complex multi-unit setups)

- Application:

- Fish Finders and Sonar Systems (Dominant segment)

- Underwater Cameras and Viewing Systems

- Lighting and Auxiliary Equipment (Heaters, USB charging)

- End User:

- Recreational Anglers

- Professional Guides and Tournament Participants

Value Chain Analysis For Ice Fishing Battery Market

The value chain for the Ice Fishing Battery Market begins with the upstream sourcing of critical raw materials, primarily lithium, cobalt, nickel, and graphite, which are subject to significant global geopolitical and supply chain volatility, particularly affecting the LiFePO4 segment due to specialized cathode requirements. Manufacturers then engage in complex cell production, followed by the integration of proprietary Battery Management Systems (BMS) and assembly into ruggedized, cold-weather-specific battery packs, which represents a high-value-add stage due to the intellectual property involved in optimizing cold performance. Quality control and rigorous safety testing are critical steps before the product moves into the distribution phase, ensuring compliance with stringent safety regulations required for winter sports equipment.

Downstream analysis focuses heavily on efficient logistics and channel management. The distribution channel is bifurcated into direct sales via manufacturer e-commerce sites, which allows for higher margins and direct customer feedback, and indirect distribution through a network of specialized outdoor sporting goods retailers and large national chain stores. Specialty retailers often serve as crucial touchpoints, providing expert advice specific to ice fishing gear integration, which is essential for complex electronics setups. Logistics must account for the seasonal nature of the market, necessitating high inventory build-up prior to the winter season and robust reverse logistics for warranty and recycling processes.

Direct sales (e-commerce) thrive on SEO-optimized content, technical specifications, and user reviews, catering directly to technically proficient anglers seeking high-performance products. Indirect channels leverage the established trust and wide geographical reach of major retailers like Cabela's, Bass Pro Shops, and regional sporting suppliers, where the battery is often purchased as an accessory alongside the primary electronic unit (fish finder or camera). Successful value chain management requires strong control over raw material procurement to mitigate cost fluctuations and rapid innovation in BMS technology to maintain a competitive edge in cold-weather performance, ensuring that the final product meets the extreme reliability demands of the end-user.

Ice Fishing Battery Market Potential Customers

Potential customers for Ice Fishing Batteries are categorized primarily as dedicated recreational ice anglers, professional fishing guides, and participants in competitive ice fishing tournaments, all seeking portable power solutions that offer extreme reliability and endurance in sub-zero environments. The demographic generally shows a high propensity to spend on advanced technology that directly enhances their efficiency and comfort on the ice. Recreational anglers prioritize ease of use, safety, and sufficient capacity for a full day of fishing (typically 10-15 Ah units), viewing the upgrade to lithium as a significant quality-of-life improvement due to the weight reduction associated with transporting gear.

Professional users, including guides and tournament participants, represent the premium segment of the market, demanding the highest capacity (20 Ah and above) and absolute guaranteed performance, often running multiple high-draw devices like dual-screen sonar/GPS units and high-output underwater cameras simultaneously for extended periods. Their buying decisions are driven by total cost of ownership (TCO), focusing on cycle life, warranty, and proven durability, rather than initial purchase price. These buyers require batteries with robust communication protocols, often integrated with their electronic systems, for real-time monitoring of power reserves, making them prime targets for the most advanced, smart battery solutions.

Furthermore, an emerging segment includes general outdoor enthusiasts and campers who utilize these ruggedized, cold-weather lithium batteries as multi-purpose power stations for remote charging of laptops, drones, and communication equipment during winter excursions. This secondary market expansion relies on the inherent durability and cold performance developed for ice fishing, offering manufacturers a way to extend the product lifecycle beyond the primary winter season. Marketing efforts must therefore segment between the core fishing community, who value technical integration with brands like Humminbird and Vexilar, and the broader outdoor consumer, who prioritize versatility and general safety features of the power unit.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $310.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dakota Lithium, RELiON, Battle Born Batteries, Power-Sonic, Ampere Time, Renogy, Vexilar, Marcum Technologies, Humminbird, Lowrance, Optima Batteries, UPG (Universal Power Group), ExpertPower, Mighty Max Battery, Bioenno Power, Epoch Batteries, Lithium Pros, Duracell, Interstate Batteries, Norsk Lithium. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ice Fishing Battery Market Key Technology Landscape

The technology landscape of the Ice Fishing Battery Market is dominated by the migration to Lithium Iron Phosphate (LiFePO4) chemistry, valued specifically for its superior thermal stability, extended cycle life (often exceeding 2,000 cycles), and enhanced safety profile compared to traditional lithium-ion formulations, which are less suited for high-current applications in freezing temperatures. Crucially, contemporary design emphasizes ruggedization, incorporating IP-rated, sealed plastic or composite casings that protect internal components from moisture, ice, and physical shock common in the harsh outdoor environment. The continuous refinement of cell manufacturing processes aims to increase energy density while maintaining strict performance consistency across a wider temperature range, ensuring reliable power delivery from 0°C down to -20°C.

Central to modern ice fishing battery technology is the integrated Battery Management System (BMS), a sophisticated electronic component that monitors voltage, current, temperature, and cell balance, providing critical protection against overcharging, over-discharging, and short-circuiting, essential for the safety and longevity of the unit. Advanced BMS systems are now being optimized with algorithms specifically tailored for cold-weather operation, intelligently adjusting parameters to minimize the impact of temperature on capacity loss and improving the battery's ability to handle high peak loads required by modern chirp sonar technology. Furthermore, connectivity features, such as Bluetooth integration with smartphone apps, allow users to access real-time state-of-charge, health diagnostics, and firmware updates for the BMS, enhancing the overall user experience and proactive maintenance capabilities.

Another significant technological focus lies in rapid and smart charging solutions. Manufacturers are developing quick-charging protocols that allow batteries to reach 80% capacity in significantly shorter periods, utilizing optimized charger circuits that safely manage heat dissipation, even when charging in cold ambient conditions. Additionally, the development of standardized, high-current connectors (e.g., specialized marine-grade terminals or proprietary plugs) ensures reliable electrical contact and prevents power loss or overheating, which are common issues when drawing high amperage in wet or corrosive environments. These technological improvements collectively establish the current benchmark for reliability and performance, serving as crucial competitive differentiators within the market.

Regional Highlights

- North America (United States and Canada): This region dominates the global Ice Fishing Battery Market, driven by a deeply ingrained ice fishing culture, expansive frozen water bodies, and the highest concentration of manufacturers and early adopters of advanced electronics. The high disposable income and strong consumer preference for premium, lightweight gear (specifically LiFePO4 batteries) solidify its leading position. The US Midwest and Canadian provinces represent the epicenter of demand, where season length and participation rates are exceptionally high.

- Europe (Scandinavian Countries and Russia): Europe represents a significant, high-growth market, particularly in countries like Finland, Sweden, and Norway, which possess extensive winter resources and a tradition of ice angling. While overall market size is smaller than North America, adoption rates of lithium technology are accelerating quickly. Market growth is spurred by improving economic conditions and increased consumer spending on recreational winter sports gear, although logistical challenges related to distribution across wide territories remain a constraint.

- Asia Pacific (APAC): The APAC region, although currently a smaller segment, shows emerging potential, primarily centered in Japan and parts of Northern China where winter recreational activities are growing. This market is characterized by a strong demand for compact, high-efficiency equipment suitable for smaller ice setups and often requires batteries that integrate well with locally produced electronic brands. Future growth will be dictated by the expansion of organized recreational fishing and infrastructure development in colder climate zones.

- Latin America, Middle East, and Africa (MEA): These regions currently hold negligible market share due to the lack of extensive, sustained freezing conditions necessary for ice fishing. Demand is minimal and highly niche, often restricted to imported specialty gear used by expatriate communities or in rare high-altitude, cold climate pockets. Market activity here is focused mainly on potential use in other cold-weather auxiliary applications, rather than core ice fishing power solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ice Fishing Battery Market.- Dakota Lithium

- RELiON

- Battle Born Batteries

- Power-Sonic

- Ampere Time

- Renogy

- Vexilar

- Marcum Technologies

- Humminbird

- Lowrance

- Optima Batteries

- UPG (Universal Power Group)

- ExpertPower

- Mighty Max Battery

- Bioenno Power

- Epoch Batteries

- Lithium Pros

- Duracell

- Interstate Batteries

- Norsk Lithium

Frequently Asked Questions

Analyze common user questions about the Ice Fishing Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the best battery type for ice fishing electronics?

Lithium Iron Phosphate (LiFePO4) batteries are considered the optimal choice for ice fishing electronics due to their lightweight design, significantly higher energy density, and superior performance stability in cold temperatures compared to traditional Sealed Lead-Acid (SLA) or AGM batteries.

How does extreme cold affect the performance and runtime of ice fishing batteries?

Extreme cold reduces the available capacity and discharge voltage of all battery chemistries. LiFePO4 batteries are designed with specialized internal resistance to minimize this effect, but performance can still degrade; housing the battery in an insulated pack can help maintain optimal efficiency and maximize runtime.

What capacity (Ah) is typically needed to power a modern fish finder for a full day?

Most modern mid-range to high-power fish finders and sonar units require a minimum capacity in the range of 10 Ah to 15 Ah for reliable, continuous operation throughout a typical 8-10 hour fishing day. Users running multiple or high-draw devices should opt for 20 Ah or higher capacity units.

Are lithium batteries safe to use and charge in sub-zero temperatures?

LiFePO4 batteries are inherently safer than standard lithium-ion, but charging them below freezing (0°C/32°F) is generally not recommended by manufacturers without a dedicated cold-weather charging BMS, as it can cause irreversible damage and reduce lifespan. Discharging is usually safe, but charging requires temperate conditions.

What is a Battery Management System (BMS) and why is it essential for ice fishing batteries?

A BMS is an integrated electronic circuit that monitors and manages the battery's internal state. It is essential for ice fishing batteries because it protects the cells against overcharging, deep discharging, overheating, and balances cell voltage, ensuring safety, reliability, and maximizing the battery's long-term service life in harsh environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager