Iced Tea Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433280 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Iced Tea Market Size

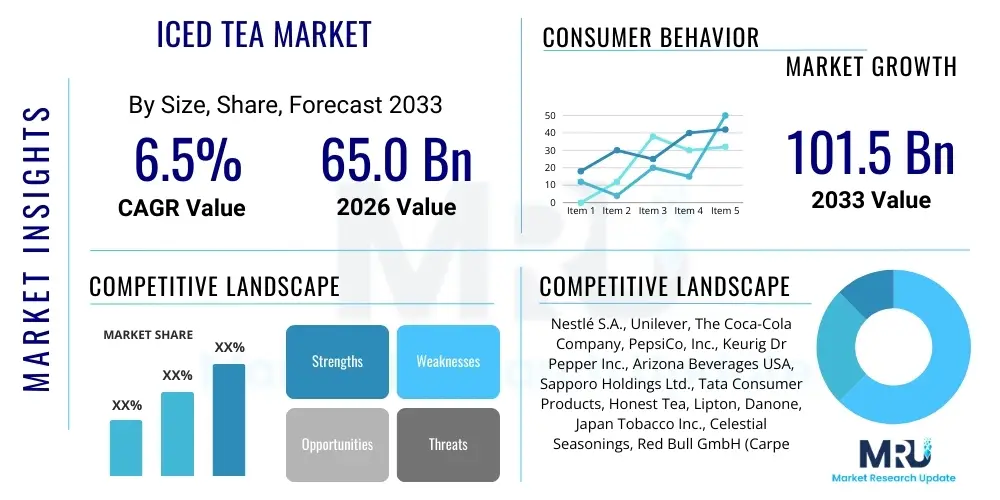

The Iced Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 101.5 Billion by the end of the forecast period in 2033.

Iced Tea Market introduction

The Iced Tea Market encompasses ready-to-drink (RTD) tea beverages, which are commercially prepared, packaged, and sold through various distribution channels globally. These products offer a convenient and refreshing alternative to traditional hot teas and carbonated soft drinks (CSDs). The primary components include tea extracts, water, sweeteners (or alternatives), and natural or artificial flavors. Iced tea serves as a major category within the global non-alcoholic beverage sector, appealing to consumers seeking hydration, flavor variety, and perceived health benefits associated with tea antioxidants.

Major applications of iced tea span across immediate consumption (on-the-go), meal accompaniment, and functional refreshment. Its versatility allows it to be marketed as a healthy alternative, especially when positioned as unsweetened or naturally sweetened with low-calorie options. The rapid expansion of flavors, ranging from traditional lemon and peach to exotic fruit infusions and herbal blends, continues to drive consumer interest and market penetration across diverse demographics, particularly among health-conscious millennials and Generation Z.

Key driving factors accelerating market growth include the global shift away from high-sugar CSDs toward 'better-for-you' beverages, increasing disposable income in emerging economies, and enhanced product innovation in terms of packaging and functional ingredients. Furthermore, manufacturers are leveraging digital marketing and strategic partnerships with retail chains to improve product visibility and availability, solidifying iced tea’s position as a stable and growing segment within the broader functional beverage landscape.

Iced Tea Market Executive Summary

The Iced Tea Market is characterized by intense competition and a continuous cycle of innovation driven by consumer demand for healthier, convenient, and exotic flavor profiles. Business trends indicate a significant consolidation among major beverage conglomerates acquiring or forming joint ventures with specialized tea brands to leverage established distribution networks and intellectual property. The focus on sustainability is becoming a non-negotiable business trend, with brands prioritizing recyclable packaging, ethical sourcing of tea leaves, and transparent supply chain practices to meet the expectations of environmentally conscious consumers, thereby enhancing brand loyalty and market share.

Regionally, Asia Pacific maintains its dominance in terms of consumption volume, primarily due to culturally ingrained tea-drinking habits and the rapid urbanization of countries like China and India, which increases demand for convenient RTD formats. North America and Europe, however, lead in terms of innovation and premiumization, with a strong emphasis on organic, specialty, and functional iced teas (e.g., those fortified with vitamins or probiotics). The rising penetration of organized retail and e-commerce platforms across all regions is streamlining distribution, making product access easier even in previously underserved rural markets.

Segment trends highlight the exceptional growth of the unsweetened and low-sugar segments, directly correlated with global anti-sugar initiatives and obesity awareness campaigns. Green tea and herbal tea bases are gaining substantial traction over traditional black tea, owing to their association with powerful antioxidants and digestive health benefits. Furthermore, packaging innovation is crucial; single-serve PET bottles and environmentally friendly aseptic cartons remain popular, while advancements in lightweight aluminum cans cater effectively to the younger, on-the-go demographic seeking quick refreshment.

AI Impact Analysis on Iced Tea Market

User inquiries regarding AI's impact on the Iced Tea Market frequently revolve around personalization, supply chain optimization, and consumer engagement strategies. Key themes include how AI can predict localized flavor trends, optimize ingredient sourcing to minimize waste and cost fluctuations (especially concerning global commodity prices for tea leaves and sugar), and develop hyper-personalized digital marketing campaigns. Users are also concerned with the application of machine learning in quality control, ensuring consistency in taste and ingredient composition across vast global production facilities, thereby mitigating potential brand reputation risks associated with product variation. Overall, the expectation is that AI will drive efficiency gains in production and transform consumer interaction through predictive analytics.

- AI-powered predictive modeling forecasts regional flavor preferences, informing timely product development cycles.

- Machine learning algorithms optimize supply chain logistics, minimizing spoilage, reducing shipping costs, and ensuring efficient inventory management for perishable ingredients.

- AI enhances personalized marketing through analysis of vast consumer data sets, enabling hyper-targeted promotions via social media and e-commerce channels.

- Advanced vision systems and sensors integrated with AI improve quality control during bottling and sealing processes, ensuring product safety and consistency.

- Natural Language Processing (NLP) analyzes customer reviews and feedback instantly, allowing brands to rapidly adjust formulations or address public perception issues.

- Automated dynamic pricing strategies, utilizing real-time sales data and competitive analysis, maximize revenue yield per unit sold across various retail channels.

DRO & Impact Forces Of Iced Tea Market

The market dynamics of Iced Tea are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. Key drivers include the overwhelming consumer shift towards non-carbonated, natural beverages, coupled with significant product innovation addressing functional needs such as energy and immunity. These factors are strongly supported by effective marketing emphasizing the 'natural' and 'healthy' aspects of tea. However, the market faces restraints primarily stemming from volatile raw material prices, particularly for high-quality tea leaves and sweeteners, which directly impact profit margins. Furthermore, intense competition from a burgeoning selection of alternative beverages, including flavored water and kombucha, fragments consumer attention and market share.

Opportunities for expansion lie predominantly in geographical market penetration into underserved regions, particularly in parts of Latin America and Africa where consumer preference for convenient, cold beverages is rapidly increasing. Technological advancements in aseptic packaging and preservation techniques also offer manufacturers the chance to extend shelf life without compromising product quality or taste. The rising popularity of ready-to-drink (RTD) alcoholic beverages, especially hard seltzers, also presents an indirect opportunity for co-marketing or the development of premium alcoholic iced tea products targeting adult consumers.

The core impact forces shaping this market include competition intensity, substitution threat, and buyer bargaining power. The threat of substitution is high due to the abundance of non-alcoholic alternatives. However, strong brand loyalty, driven by sustained quality and innovative flavor combinations, acts as a mitigating factor. Environmental, Social, and Governance (ESG) criteria are increasingly impactful forces, pressuring manufacturers to invest heavily in sustainable practices, leading to higher initial operational costs but securing long-term consumer trust and regulatory compliance, particularly in developed markets.

Segmentation Analysis

The Iced Tea Market is highly segmented, allowing manufacturers to target specific consumer needs ranging from health consciousness to flavor indulgence and convenience. Segmentation across product type, flavor, packaging, sweetener use, and distribution channel is crucial for strategic market positioning. The increasing consumer demand for diverse and personalized options means that the fastest-growing segments are often niche categories like functional iced teas and exotic herbal infusions. Analyzing these segments helps stakeholders understand shifting consumer spending patterns and allocate resources effectively for product innovation and regional expansion.

- Type: Black Tea, Green Tea, Herbal Tea (Rooibos, Chamomile), Fruit Tea (Hibiscus, Berry Infusions).

- Flavor: Lemon, Peach, Raspberry, Mint, Unflavored, Exotic/Seasonal Blends (e.g., Mango, Passion Fruit).

- Packaging: Bottles (PET, Glass), Cans (Aluminum), Cartons (Aseptic), Pouches/Bags, Fountains/Dispensers.

- Sweetener: Sweetened (Sugar/HFCS), Unsweetened, Diet/Sugar-free (Stevia, Erythritol, Sucralose).

- Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail (E-commerce), Foodservice (Restaurants, Cafes, Vending Machines).

Value Chain Analysis For Iced Tea Market

The value chain for the Iced Tea Market begins with upstream activities focused on sourcing and processing key raw materials. This involves the cultivation, harvesting, and initial processing (fermentation, drying) of high-quality tea leaves, which are predominantly sourced from major tea-producing regions such as China, India, Sri Lanka, and Kenya. Sourcing ingredients like water, sweeteners (sugar, honey, artificial alternatives), and flavorings represents another critical upstream stage. Efficiency and sustainability in sourcing raw materials directly impact the cost structure and the final product's quality, making long-term procurement contracts and ethical sourcing certifications vital components of upstream management.

The core manufacturing process involves extracting tea essence, blending it with water and other ingredients, pasteurization, and hot or cold filling into various packaging formats. This midstream phase is heavily reliant on automated machinery and rigorous quality control measures to ensure safety, consistency, and extended shelf life. Significant investment is often directed towards aseptic processing technologies to minimize the need for chemical preservatives. Downstream activities commence with primary and secondary packaging, followed by storage in climate-controlled warehouses, and efficient transportation tailored to regional distribution requirements.

Distribution channels are multifaceted, employing both direct and indirect strategies. Direct distribution involves delivering products to large centralized retailers or major foodservice accounts. Indirect distribution utilizes third-party logistics (3PL) providers, wholesalers, and specialized distributors to reach smaller convenience stores, independent retailers, and the burgeoning online retail sector. The prominence of e-commerce necessitates robust cold chain logistics capabilities and optimized last-mile delivery. The efficiency of the distribution network determines product availability and the speed with which perishable inventory reaches the consumer, critically influencing market share and profitability.

Iced Tea Market Potential Customers

The primary target audience for the Iced Tea Market is highly diverse, segmented by demographic, lifestyle, and consumption motivation. The core consumer base includes individuals aged 18 to 45 who prioritize convenience and hydration, often seeking alternatives to CSDs. This group encompasses office workers, students, and commuters who require readily available, single-serve beverages for on-the-go consumption. Within this segment, there is a strong preference for mainstream, widely available flavors like lemon and peach, packaged in easily portable formats like PET bottles and cans.

A rapidly growing segment comprises health-conscious consumers, including athletes, fitness enthusiasts, and individuals managing dietary restrictions such as diabetes. These buyers specifically target unsweetened, low-calorie, or functional iced teas enriched with vitamins, botanicals, or natural energy boosters. For this demographic, transparency regarding ingredients, organic certification, and the source of the tea leaves significantly influences purchasing decisions. They are more likely to seek premium, specialty brands found in health food stores, specialty coffee shops, or direct-to-consumer online channels.

Institutional and Foodservice buyers represent another critical customer group. This includes large-scale purchasers such as restaurants, hotels, catering services, hospitals, and educational facilities. These entities require bulk concentrates, fountain syrups, or large-format packaging to serve drinks economically on premises. Their purchasing is driven by cost efficiency, reliable supply, and brand recognition that complements their existing menus. Furthermore, emerging markets are attracting new consumers, typically younger individuals transitioning from traditional beverages to modern, Western-style refreshments, focusing initially on affordable and intensely flavored options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 101.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Unilever, The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper Inc., Arizona Beverages USA, Sapporo Holdings Ltd., Tata Consumer Products, Honest Tea, Lipton, Danone, Japan Tobacco Inc., Celestial Seasonings, Red Bull GmbH (Carpe Diem), Pure Leaf, Ito En Ltd., Republic of Tea, Monster Beverage Corporation, Dr. Pepper Snapple Group (now Keurig Dr Pepper), Suntory Beverage & Food Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Iced Tea Market Key Technology Landscape

The manufacturing process of ready-to-drink (RTD) iced tea relies heavily on advanced food processing and preservation technologies to ensure product stability, safety, and a long shelf life without compromising sensory quality. High-Temperature Short-Time (HTST) pasteurization and Ultra-High Temperature (UHT) processing are standard practices used to eliminate pathogens while minimizing the thermal impact on delicate tea flavors and functional compounds (like polyphenols). Furthermore, the adoption of aseptic filling technology is crucial, enabling the packaging of sterile products in non-refrigerated conditions, significantly reducing logistics costs and extending distribution reach globally.

In terms of ingredient formulation and processing, enzymatic hydrolysis is increasingly used to improve the clarity and stability of tea concentrates, preventing the formation of turbidity or sediment during storage, a common challenge in RTD tea manufacturing. Micro-filtration and nano-filtration techniques are also employed to precisely manage the molecular profile of the tea extract, ensuring consistent color, flavor, and texture across different batches. These filtration technologies are particularly vital for premium and specialty iced teas where clarity and a clean mouthfeel are highly valued by consumers.

Beyond processing, packaging technology is undergoing significant evolution driven by sustainability mandates. Innovations include the development of bio-based plastics (PLA, PHA) for bottles, lighter-weight aluminum cans with high recyclability rates, and advanced multi-layer aseptic cartons that maximize product protection while minimizing material waste. Furthermore, smart packaging technologies, such as QR codes providing blockchain-verified sourcing information or temperature sensors, are being integrated to enhance supply chain transparency and consumer confidence, aligning manufacturing capabilities with AEO requirements for detailed product information.

Regional Highlights

The global Iced Tea Market exhibits distinct consumption patterns and growth rates across major geographic regions, influenced by cultural preferences, climate, and economic development levels. Asia Pacific (APAC) dominates the market in terms of volume consumption, driven by high population density, traditionally ingrained tea consumption habits, and the rapid adoption of convenient RTD formats in urban centers across China, Japan, and Southeast Asia. The region’s growth is further fueled by the availability of affordable, localized flavors and the large-scale production capabilities of regional beverage giants.

North America and Europe represent the mature and highly lucrative markets, characterized by high Average Selling Prices (ASP) and a strong demand for premiumization. In these regions, growth is propelled by the continuous innovation in the 'better-for-you' category, including organic, unsweetened, and functional iced teas (e.g., detox or energy-boosting variants). Regulatory pressures regarding sugar content significantly shape product offerings in Western Europe, leading to rapid displacement of sugary beverages by naturally flavored, lower-calorie options, demonstrating sophisticated consumer preferences.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential growth territories. LATAM is characterized by a strong preference for cold beverages due to climate, presenting an opportunity for rapid market entry, particularly with fruit-flavored and sweet iced teas. In the MEA region, rising disposable incomes and expanding modern retail infrastructure are making imported and premium international iced tea brands increasingly accessible, although local production and flavor adaptation are necessary to overcome distribution challenges and cater to regional tastes.

- Asia Pacific (APAC): Largest market by volume; driven by urbanization, high tea consumption culture, and the availability of affordable RTD products in massive markets like China and India.

- North America: Leader in premiumization and functional beverages; significant growth in unsweetened and organic segments, heavily influenced by health trends.

- Europe: Growth concentrated in Western Europe due to stringent anti-sugar policies; strong consumer preference for exotic herbal infusions and sustainably sourced packaging.

- Latin America (LATAM): High potential due to warm climate and increasing disposable income; market development focused on establishing cold chain logistics and competitive pricing strategies.

- Middle East and Africa (MEA): Emerging market characterized by rising foreign investment and adoption of global beverage trends, with opportunities for both imported luxury brands and affordable local production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Iced Tea Market.- Nestlé S.A.

- Unilever

- The Coca-Cola Company

- PepsiCo, Inc.

- Keurig Dr Pepper Inc.

- Arizona Beverages USA

- Sapporo Holdings Ltd.

- Tata Consumer Products

- Honest Tea (Coca-Cola subsidiary)

- Lipton (Unilever/PepsiCo JV)

- Danone

- Japan Tobacco Inc. (JTI)

- Celestial Seasonings

- Red Bull GmbH (Carpe Diem)

- Pure Leaf (PepsiCo/Unilever JV)

- Ito En Ltd.

- Republic of Tea

- Monster Beverage Corporation

- Dr. Pepper Snapple Group (now Keurig Dr Pepper)

- Suntory Beverage & Food Ltd.

Frequently Asked Questions

Analyze common user questions about the Iced Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards unsweetened iced tea varieties globally?

The primary driver is heightened consumer awareness regarding the health risks associated with excessive sugar consumption, including obesity and Type 2 diabetes. This is reinforced by governmental taxation on sugar-sweetened beverages (SSBs) in many major economies, prompting manufacturers to rapidly innovate and promote zero-sugar or naturally sweetened alternatives using stevia or monk fruit extracts.

Which packaging format holds the largest market share in the ready-to-drink (RTD) iced tea segment?

PET (Polyethylene Terephthalate) plastic bottles currently dominate the RTD iced tea market share globally due to their cost-effectiveness, durability, re-sealability, and low weight, which reduces transportation costs. However, aluminum cans and sustainable aseptic cartons are gaining traction rapidly, especially in environmentally conscious markets, due to their superior recyclability rates.

How does the volatile pricing of raw materials impact the profitability of iced tea manufacturers?

Volatile pricing for raw materials, specifically high-quality tea leaves (black and green) and global sugar commodities, directly increases production costs and compresses profit margins. Manufacturers mitigate this by implementing hedging strategies, securing long-term supply contracts, and strategically passing moderate cost increases to the consumer through premiumization and innovative product positioning.

What role does functional iced tea play in the overall market growth forecast?

Functional iced teas, which include ingredients beyond basic tea and water—such as added vitamins, electrolytes, probiotics, or adaptogens—are a major growth catalyst. This segment appeals to consumers seeking specific health outcomes like immune support or gut health, enabling brands to charge a premium and capture the high-value 'wellness' market segment effectively.

Which region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) in the iced tea market?

While Asia Pacific currently leads in volume, Latin America (LATAM) and specific emerging markets in the Middle East and Africa (MEA) are forecast to exhibit the highest CAGRs during the forecast period. This accelerated growth is attributed to lower market penetration, improving infrastructure, increased foreign investment, and a sharp rise in consumer demand for convenient refreshment options in rapidly modernizing societies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager