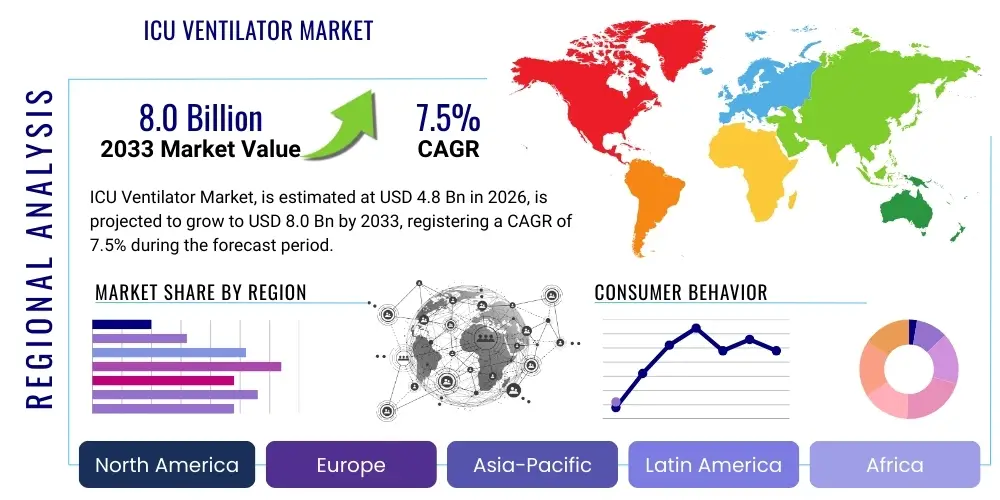

ICU Ventilator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437329 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

ICU Ventilator Market Size

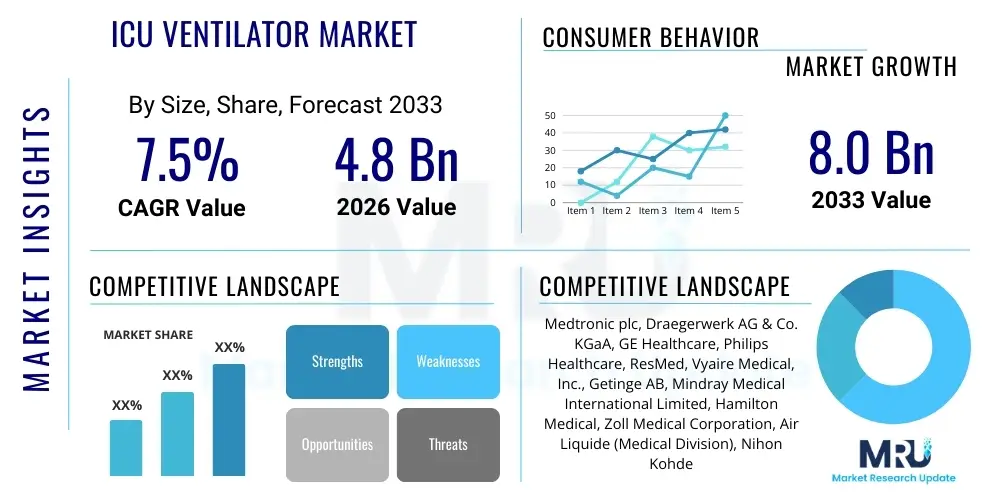

The ICU Ventilator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $4.8 Billion in 2026 and is projected to reach $8.0 Billion by the end of the forecast period in 2033.

ICU Ventilator Market introduction

The ICU Ventilator Market encompasses devices designed for providing mechanical ventilation to patients in critical care settings who are unable to breathe adequately on their own. These complex medical devices assist in gas exchange by moving breathable air, often enriched with oxygen, into and out of the lungs. The core function of an ICU ventilator is to sustain life during acute respiratory failure stemming from conditions such as severe pneumonia, Acute Respiratory Distress Syndrome (ARDS), chronic obstructive pulmonary disease (COPD) exacerbations, or post-operative recovery. Modern ventilators offer sophisticated modes of ventilation, enabling personalized therapy based on continuous patient feedback and physiological parameters, significantly improving patient outcomes and reducing hospital stay durations, thereby solidifying their indispensability in high-acuity care units globally.

The product description spans a wide range, from high-fidelity, trolley-mounted critical care ventilators used in tertiary hospitals to increasingly portable and turbine-driven models, which facilitate intrahospital transport and deployment in temporary critical care units. Major applications center on life support in surgical recovery rooms, neonatal intensive care units (NICUs), and general adult Intensive Care Units (ICUs). The principal benefits derived from these devices include precise control over tidal volume, respiratory rate, Positive End-Expiratory Pressure (PEEP), and inspired oxygen fraction (FiO2), crucial for preventing ventilator-induced lung injury (VILI). Furthermore, the integration of advanced monitoring capabilities allows clinicians to instantaneously assess lung mechanics and hemodynamics, tailoring ventilation support in real-time to optimize patient comfort and clinical efficiency.

Driving factors fueling market expansion are multifaceted, primarily driven by the escalating global prevalence of chronic respiratory illnesses such as COPD and asthma, coupled with the rising incidence of severe acute respiratory infections, exemplified dramatically by recent pandemics. The demographic shift towards an aging global population, which is inherently more susceptible to acute respiratory distress and requires prolonged critical care, also significantly boosts demand. Furthermore, continuous technological advancements, particularly the development of user-friendly interfaces, lung-protective ventilation strategies, and the incorporation of remote monitoring capabilities, enhance the appeal and adoption rate of new ventilator systems, particularly in developed healthcare systems striving for lower mortality rates and improved quality of care delivery.

ICU Ventilator Market Executive Summary

The ICU Ventilator Market is characterized by robust growth, propelled primarily by increasing infrastructure investment in critical care facilities across emerging economies and continuous innovation focusing on portability and automation in developed markets. Current business trends indicate a strong competitive landscape dominated by established multinational corporations that emphasize integrated respiratory solutions, often bundling ventilators with monitoring systems and sophisticated disposables. There is a palpable shift toward turbine-based ventilators, eliminating the reliance on centralized air compressors and making devices more versatile for varied hospital settings, including pandemic response units. Strategic mergers, acquisitions, and collaborations focused on expanding geographical reach and acquiring specialized software or sensor technologies are defining the competitive approach adopted by market leaders, aiming to offer holistic, data-driven solutions for respiratory management.

Regional trends reveal that North America and Europe retain the largest market shares due to high healthcare expenditure, sophisticated technological adoption, and well-established reimbursement policies supporting the purchase of high-cost critical care equipment. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by expanding healthcare access, governmental initiatives to upgrade public health infrastructure, and a burgeoning medical tourism sector demanding world-class critical care technology. Countries like China, India, and Japan are investing heavily in establishing new ICUs and replacing legacy equipment, creating significant opportunities for market participants. Meanwhile, Latin America and the Middle East & Africa (MEA) represent nascent markets where growth is sporadic but accelerating, primarily concentrated around urban tertiary care centers and driven by infectious disease burden.

Segmentation trends highlight a growing preference for High-End/Critical Care Ventilators, reflecting the need for sophisticated modes for complex patient management. Within end-users, Hospitals & Clinics remain the dominant segment, though the Home Care Settings segment is experiencing substantial acceleration due to the increasing feasibility of transferring patients requiring long-term, low-acuity ventilation from expensive hospital beds to less costly home environments, supported by compact and user-friendly portable ventilators. In terms of mode, the adoption of Non-Invasive Ventilation (NIV) is surging. NIV minimizes the risks associated with intubation, such as ventilator-associated pneumonia (VAP), and is increasingly employed for managing acute exacerbations of chronic conditions, leading manufacturers to focus heavily on developing optimized NIV masks and interfaces to enhance patient compliance and effectiveness.

AI Impact Analysis on ICU Ventilator Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the ICU Ventilator Market primarily revolve around three key areas: personalized ventilation settings, predictive analytics for complication prevention, and workflow automation. Users are keen to understand how AI algorithms can move beyond static protocols to dynamically adjust ventilation parameters (like PEEP and FiO2) in real-time based on continuous physiological data streams, aiming for 'closed-loop' ventilation systems that minimize human error and optimize lung protection. Furthermore, there is significant interest in AI's capability to predict the onset of critical events, such as weaning failure, extubation readiness, or the development of ARDS, allowing for proactive clinical interventions. Finally, stakeholders seek assurance that AI integration will streamline clinical workflows, reduce the cognitive load on overworked ICU staff, and integrate disparate data sources from monitors, labs, and electronic health records (EHRs) to create a comprehensive patient profile assisting in automated decision support.

The integration of AI and Machine Learning (ML) is fundamentally transforming the design and operation of next-generation ICU ventilators, shifting the focus from simple mechanical assistance to intelligent, adaptive respiratory support. AI algorithms are being leveraged to analyze vast amounts of data—including blood gas results, respiratory mechanics, and waveform patterns—to identify subtle changes indicative of impending patient deterioration long before they become clinically apparent. This predictive capability is vital in the high-stakes environment of the ICU, enabling medical teams to adjust sedation levels, modify ventilation modes, or prepare for necessary interventions like tracheostomy with greater foresight. This technological evolution not only improves mortality rates but also addresses the critical issue of prolonged ventilation dependence by facilitating more accurate and timely weaning protocols, substantially reducing the overall length of stay in the critical care unit.

However, the successful deployment of AI in this highly regulated medical domain requires addressing challenges related to data security, model explainability (XAI), and clinical validation across diverse patient populations. Manufacturers must ensure that AI-driven decisions are transparent and understandable to clinicians to build trust and ensure accountability. Furthermore, the development of robust, vendor-neutral platforms that allow seamless integration of AI applications across different hospital IT systems and ventilator brands is crucial for widespread adoption. As regulatory bodies like the FDA establish clearer guidelines for AI in critical life support devices, the market is expected to accelerate its transition towards fully autonomous or semi-autonomous ventilation systems, thereby driving premium pricing and market differentiation for companies leading in AI research and development.

- AI-driven Closed-Loop Ventilation Systems: Automated adjustment of tidal volume, PEEP, and respiratory rate based on real-time lung mechanics and physiological feedback.

- Predictive Analytics for Weaning Success: Algorithms assess patient readiness for extubation, drastically reducing time on mechanical ventilation and risk of reintubation.

- Early Detection of Complications: ML models analyze trend data to predict Ventilator-Associated Pneumonia (VAP) or barotrauma, enabling proactive therapy adjustments.

- Data Integration and Decision Support: AI correlates ventilator data with EHRs, lab results, and patient monitoring systems to provide holistic clinical recommendations.

- Optimized Alarm Management: Reduction of false or nuisance alarms by intelligently filtering non-critical events, improving clinician response time to genuine crises.

DRO & Impact Forces Of ICU Ventilator Market

The ICU Ventilator Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory and competitive intensity. The primary market drivers include the irreversible growth of the aging population globally, which requires consistent, high-acuity respiratory care, and the structural upgrades mandated in critical care infrastructure worldwide, spurred by increased preparedness against future pandemics and the growing incidence of chronic respiratory diseases like COPD. These drivers create a stable, non-cyclical demand base for both replacement units and new installations. Technological advances, especially the move towards highly versatile, portable, and smart ventilators equipped with lung-protective modes (e.g., APRV, PRVC), further stimulate procurement cycles among leading hospitals aiming to meet superior standards of care. Manufacturers are heavily investing in these advanced features to justify premium pricing and sustain high growth margins in a competitive environment.

Conversely, the market faces significant restraints, most notably the high initial capital expenditure associated with purchasing advanced, high-fidelity ICU ventilators. This cost barrier is particularly pronounced in developing nations and smaller healthcare facilities, often delaying or restricting the adoption of the latest technology. Furthermore, the stringent and evolving regulatory frameworks, especially concerning medical device certification and software validation (e.g., AI integration), impose substantial development costs and market entry hurdles, slowing down the pace of innovation introduction. Another considerable restraint is the necessity for highly trained clinical staff to operate and manage these complex machines, leading to operational costs related to specialized training and potential human errors if appropriate expertise is lacking. Addressing the need for simplified user interfaces and enhanced automated features is a direct response by manufacturers to mitigate this skill-gap restraint.

Opportunities for exponential market growth lie predominantly in expanding the application scope of portable ventilators, moving beyond traditional ICU settings into emergency medical services (EMS), home care, and sub-acute facilities, driven by the desire to alleviate ICU bed shortages. Furthermore, the integration of advanced remote monitoring and telehealth capabilities presents a lucrative avenue for vendors, allowing specialists to manage ventilation settings for geographically distant patients, improving efficiency and access. The shift towards personalized medicine also opens opportunities for developing customized ventilation interfaces and software tailored to specific patient demographics (e.g., pediatric vs. bariatric), creating niche, high-value segments. The ongoing investment in developing cost-effective, durable, and repairable ventilators specifically targeted at emerging markets represents a critical long-term opportunity for sustainable global market penetration.

Segmentation Analysis

The ICU Ventilator Market is extensively segmented based on key differentiators including product complexity, operational mechanism, and the clinical setting where they are deployed. Understanding these segments is crucial for strategic market positioning, as each category addresses unique requirements in critical care. The segmentation reflects the varied needs ranging from high-acuity, continuous support required in tertiary ICUs to more intermittent, easily deployable solutions needed for transport and post-acute care. Analysis across these axes reveals shifts in adoption patterns, such as the increased penetration of portable and turbine-driven technologies across all end-user categories, driven by operational flexibility and rising patient mobility requirements.

Product type segmentation is essential as high-end ventilators command higher margins but face slower replacement cycles, while portable and basic ventilators offer higher volume sales and cater to broader market needs including sub-acute and home care. Mode of ventilation segmentation highlights the trade-offs between invasiveness and effectiveness, with a notable trend favoring non-invasive methods due to their reduced complication rates. End-user analysis confirms hospitals as the core market but underscores the rising importance of home care settings as healthcare systems globally seek sustainable ways to manage long-term respiratory support patients outside the costly critical care environment, pushing demand for robust, easy-to-use devices optimized for non-clinical user operation.

- By Product Type:

- Portable Ventilators

- High-End/Critical Care Ventilators

- Basic Ventilators

- By Mode:

- Invasive Ventilation (IV)

- Non-Invasive Ventilation (NIV)

- By End User:

- Hospitals & Clinics (Tertiary, Secondary)

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings & EMS

- By Technology:

- Conventional Mechanical Ventilators

- Advanced Microprocessor-Controlled Ventilators

Value Chain Analysis For ICU Ventilator Market

The value chain for the ICU Ventilator Market begins with upstream activities centered on the procurement and manufacturing of highly specialized components, which include precision flow sensors, gas mixers, microprocessors, high-durability patient interfaces (masks, tubing), and critical components like turbines and specialized valves. Key upstream suppliers include technology companies providing advanced sensors and software developers creating proprietary control algorithms and user interfaces. Due to the life-critical nature of the product, quality control, regulatory compliance in component sourcing, and reliable supply chain management are paramount in this phase. Manufacturers often maintain deep, strategic partnerships with specialized component suppliers to ensure consistency and technological superiority, creating barriers to entry for new market participants lacking established supply networks for certified medical-grade parts.

The mid-stream phase involves the core activities of design, assembly, and rigorous testing of the final ventilator product, followed by packaging and inventory management. This phase is characterized by significant R&D investment, particularly in miniaturization, battery life improvement, and the incorporation of networking capabilities. Direct and indirect distribution channels play a critical role in bridging the gap between manufacturing and the end-user. Direct sales channels, where manufacturers interface directly with large hospital networks, are common for high-value critical care systems, allowing for personalized negotiation, servicing contracts, and specialized technical support directly from the OEM. This channel ensures maximum control over product branding and client relationships, crucial for institutional buyers who require complex service level agreements.

The downstream phase encompasses sales, installation, post-sale training, maintenance, and the crucial supply of consumables and disposables (e.g., filters, circuits, humidifiers). Indirect distribution channels utilize specialized medical device distributors, local agents, and Group Purchasing Organizations (GPOs), particularly effective for penetrating smaller hospitals, clinics, and international markets where manufacturers lack a direct physical presence. The consumables market represents a significant, recurring revenue stream post-sale, often tying end-users to specific brands due to proprietary connector designs or technical compatibility. Successful value chain management hinges on efficient logistics for spare parts and reliable technical support, as ventilator downtime directly impacts patient care quality and hospital operational efficiency, making service quality a key differentiator in purchasing decisions.

ICU Ventilator Market Potential Customers

The primary end-users and buyers in the ICU Ventilator Market are diverse institutional entities responsible for delivering critical care and long-term respiratory support. Hospitals and specialized Clinics constitute the largest customer base, ranging from large public tertiary care centers that demand the highest-end, feature-rich ventilators for complex cases (e.g., cardiac surgery, neurotrauma) to smaller community hospitals requiring robust, reliable, and perhaps less technologically complex devices for general ICU use. These institutional purchasers are often driven by centralized procurement processes, adherence to international clinical guidelines, and the availability of capital expenditure budgets. Their purchasing decisions are heavily influenced by device reliability, longevity, ease of integration with existing Patient Data Management Systems (PDMS), and the reputation of the manufacturer's clinical support team.

A rapidly expanding customer segment includes Ambulatory Surgical Centers (ASCs) and specialized critical transport teams (Air and Ground EMS). While ASCs typically require ventilators for short-duration post-anesthesia recovery or minor emergency stabilization, transport teams demand highly robust, compact, lightweight, and battery-operated portable ventilators capable of maintaining ICU-level performance in dynamic, resource-limited environments. These buyers prioritize durability, minimal setup time, and extended battery life. The growing focus on disaster preparedness and pandemic response by governmental agencies globally also positions public health bodies and military field hospitals as major periodic purchasers, often opting for standardized, easy-to-deploy models that can handle mass casualty scenarios.

The Home Care Settings segment, supported by Home Healthcare Agencies, is becoming increasingly critical, representing patients requiring long-term mechanical ventilation (LT MV) due to chronic conditions like neuromuscular diseases (e.g., ALS) or persistent dependency following acute care stays. These customers are driven by the need for user-friendly, quiet, and reliable devices that can be managed by non-specialized caregivers or family members. Manufacturers are responding to this need by developing dedicated home-use ventilators with simplified interfaces, enhanced remote connectivity features for telemedicine support, and robust alarm systems tailored for non-clinical environments, positioning this segment as a crucial high-growth area for portable device manufacturers seeking long-term recurring revenue streams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.8 Billion |

| Market Forecast in 2033 | $8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Draegerwerk AG & Co. KGaA, GE Healthcare, Philips Healthcare, ResMed, Vyaire Medical, Inc., Getinge AB, Mindray Medical International Limited, Hamilton Medical, Zoll Medical Corporation, Air Liquide (Medical Division), Nihon Kohden Corporation, Schiller AG, Dixion Vertrieb, Airon Corporation, Fisher & Paykel Healthcare, Avanos Medical, Teleflex Incorporated |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ICU Ventilator Market Key Technology Landscape

The technology landscape of the ICU Ventilator Market is rapidly advancing, moving away from purely pneumatically controlled systems towards sophisticated microprocessor-driven platforms that integrate advanced computing power and connectivity. A crucial development is the widespread adoption of turbine technology, which utilizes a high-speed internal blower to generate pressurized air, rendering the ventilator independent of external compressed air sources. This turbine-based design enhances portability and deployment flexibility, a necessity for transport ventilation and disaster response units. Furthermore, the focus on lung-protective ventilation strategies has driven innovations in advanced ventilation modes such as Adaptive Support Ventilation (ASV), Proportional Assist Ventilation (PAV+), and Pressure Regulated Volume Control (PRVC), which aim to synchronize with the patient's spontaneous breathing efforts and minimize shear stress on delicate lung tissue, thereby reducing the incidence of VILI and improving recovery kinetics.

Connectivity and data integration are paramount in modern ICU settings, driving the incorporation of IoT capabilities into ventilators. Contemporary devices are equipped with Wi-Fi or Ethernet modules, allowing seamless integration with Hospital Information Systems (HIS) and Electronic Health Records (EHRs). This interoperability facilitates automatic documentation, remote monitoring by respiratory therapists, and centralized data analysis, contributing significantly to improved clinical decision-making and operational efficiency. The development of sophisticated flow sensors and gas analysis modules capable of providing real-time capnography and oxygen consumption data allows for tighter titration of ventilation settings. This detailed, continuous physiological feedback loop is essential for implementing closed-loop AI systems, representing the pinnacle of current technology aiming for fully autonomous adaptive control of mechanical support.

Innovation extends significantly into non-invasive ventilation (NIV) interfaces and humidification systems. Manufacturers are continually developing lighter, more comfortable, and better-sealing masks and helmets for NIV to improve patient tolerance and compliance, which is often the limiting factor for NIV success. Heated and humidified high-flow nasal cannula (HFNC) therapy, while technically distinct, is often integrated or offered alongside ventilator platforms as a crucial transition tool for weaning patients off mechanical ventilation. Furthermore, the focus on infection control has accelerated the adoption of single-use, specialized breathing circuits and advanced filtration systems (HMEs and viral filters) incorporated directly into the ventilator pathway, ensuring patient and machine safety and reducing the risk of healthcare-associated infections like VAP, cementing filtration and disposability as critical aspects of current technological design.

Regional Highlights

- North America: Dominates the market share due to high healthcare expenditure, early adoption of technologically advanced ventilators (especially AI-integrated and networked systems), and a significant prevalence of COPD and associated respiratory morbidities. The presence of stringent regulatory standards (FDA) ensures market focus on high-quality, clinically validated devices. Significant demand is driven by rapid technological turnover and expansive critical care capacity, focusing heavily on personalized lung-protective ventilation.

- Europe: Represents a mature market characterized by robust critical care infrastructure, high institutional purchasing power (especially in Germany, France, and the UK), and strong government focus on emergency preparedness. The region demonstrates high adoption rates for advanced monitoring features and Non-Invasive Ventilation (NIV) equipment, driven by guidelines promoting reduced hospital stays and minimizing infection risks associated with invasive procedures.

- Asia Pacific (APAC): Expected to be the fastest-growing region, powered by massive investments in modernizing healthcare infrastructure across China, India, and Southeast Asia. Market expansion is driven by a massive population base, rising disposable income leading to increased access to private healthcare, and a significant unmet need for critical care beds and ventilators, favoring both affordable basic units and high-end systems in metropolitan centers.

- Latin America (LATAM): Growth is steady but concentrated in large urban centers in countries like Brazil and Mexico. The market is often price-sensitive, balancing the need for advanced features with budget constraints. Demand is typically driven by public health initiatives aimed at combating infectious disease outbreaks and improving access to intensive care services, often relying on global tenders and distributor networks.

- Middle East and Africa (MEA): This region offers lucrative opportunities in high-spending Gulf Cooperation Council (GCC) countries, where modern medical infrastructure development is prioritized, leading to the procurement of premium, high-fidelity ICU systems. In contrast, the African segment is characterized by strong demand for rugged, reliable, and cost-effective basic or portable ventilators suitable for challenging logistical environments and lower-resource settings, often supported by humanitarian aid and international health organizations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ICU Ventilator Market.- Medtronic plc

- Draegerwerk AG & Co. KGaA

- GE Healthcare

- Philips Healthcare

- ResMed

- Vyaire Medical, Inc.

- Getinge AB

- Mindray Medical International Limited

- Hamilton Medical

- Zoll Medical Corporation

- Air Liquide (Medical Division)

- Nihon Kohden Corporation

- Schiller AG

- Dixion Vertrieb

- Airon Corporation

- Fisher & Paykel Healthcare

- Avanos Medical

- Teleflex Incorporated

Frequently Asked Questions

Analyze common user questions about the ICU Ventilator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major factors are driving the growth of the ICU Ventilator Market?

Market growth is primarily driven by the increasing global prevalence of chronic obstructive pulmonary disease (COPD) and acute respiratory distress syndrome (ARDS), coupled with the demographic shift toward an aging population susceptible to severe respiratory illnesses. Furthermore, continuous technological advancements, especially in developing portable, user-friendly, and lung-protective ventilation modes, significantly contribute to increased adoption and market expansion globally.

How is technological innovation affecting the functional capabilities of ICU ventilators?

Technological innovation is leading to the integration of advanced microprocessor control, AI-driven closed-loop systems, and enhanced connectivity (IoT). These innovations enable real-time, personalized ventilation adjustments, superior data analysis for predictive critical event detection, and seamless integration with hospital EHRs, minimizing patient complications and optimizing clinical workflow efficiency in critical care settings.

Which segment, Invasive or Non-Invasive Ventilation, is experiencing the fastest market growth?

The Non-Invasive Ventilation (NIV) segment is currently experiencing rapid growth due to increasing clinical evidence supporting its effectiveness in managing respiratory failure while minimizing the risks associated with intubation, such as Ventilator-Associated Pneumonia (VAP). This shift is supported by the development of highly effective, comfortable NIV interfaces and masks that improve patient compliance.

What are the primary challenges restraining the widespread adoption of advanced ICU ventilators?

The main restraints include the high initial capital investment required for advanced, critical care ventilators, which poses a barrier for smaller facilities and developing nations. Additionally, the need for specialized, highly trained clinical staff to operate and maintain complex systems, alongside stringent and time-consuming regulatory approval processes for new technologies, also limits rapid market penetration.

Which geographical region is expected to show the highest CAGR in the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by significant government and private investment in expanding and modernizing healthcare infrastructure, increasing critical care bed capacity, and rising awareness regarding the benefits of sophisticated respiratory support technology across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager