Identity Resolution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437640 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Identity Resolution Market Size

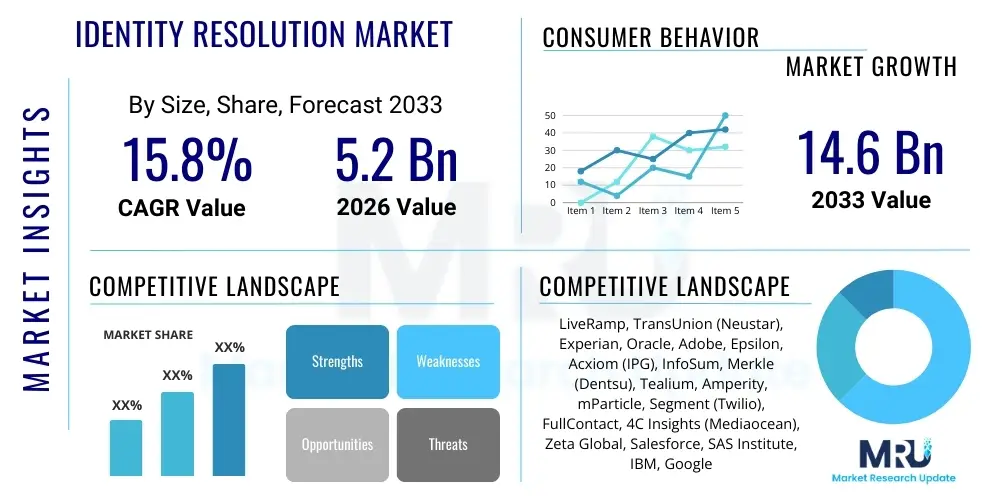

The Identity Resolution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 14.6 Billion by the end of the forecast period in 2033.

Identity Resolution Market introduction

The Identity Resolution Market encompasses the sophisticated technologies and services designed to accurately link, match, and reconcile disparate data points pertaining to individual consumers across various digital and offline touchpoints. This process creates a unified, persistent, and comprehensive customer profile, crucial for effective marketing, fraud prevention, and operational efficiency. Identity resolution solutions leverage advanced algorithms, machine learning, and deterministic and probabilistic matching techniques to overcome data silos and the fragmentation caused by multiple devices, anonymized web activity, and evolving privacy standards. The core value proposition lies in enabling businesses to recognize a single customer regardless of the channel they use, thereby enhancing customer experience and driving measurable business outcomes.

Key products within this market include identity graph platforms, customer data platforms (CDPs) with built-in resolution capabilities, and specialized matching software offered both as cloud-based services and on-premise deployments. Major applications span across highly personalized marketing campaigns, multi-channel attribution, robust fraud detection in financial services, and compliance management under strict data governance regulations like GDPR and CCPA. The ability to maintain a 'golden record' of the customer identity is increasingly viewed not just as a marketing tool but as a foundational infrastructure requirement for modern digital businesses operating in competitive environments.

The market growth is primarily driven by the exponential increase in consumer data volume and velocity, the obsolescence of third-party cookies, and the heightened demand for hyper-personalized customer interactions. Furthermore, the rising adoption of omni-channel strategies across sectors such as Retail, BFSI, and Telecommunications necessitates accurate identity linking to ensure seamless transitions and consistent service delivery. The benefits extend beyond revenue generation, contributing significantly to reducing operational costs associated with redundant data and improving security posture through enhanced risk assessment capabilities based on consolidated identity information.

Identity Resolution Market Executive Summary

The Identity Resolution Market is witnessing rapid structural evolution, fundamentally driven by shifts in consumer privacy expectations and regulatory mandates worldwide, coupled with massive technological advancements in data processing and Artificial Intelligence. Business trends indicate a strong move toward privacy-enhancing technologies and decentralized identity solutions, with enterprises prioritizing first-party data strategies over reliance on third-party cookies, thus making sophisticated resolution technologies indispensable. This transition is accelerating the integration of identity resolution capabilities directly into core enterprise infrastructure, particularly within Customer Data Platforms (CDPs) and Data Management Platforms (DMPs). The competitive landscape is characterized by strategic partnerships between data providers and technology vendors aimed at offering more comprehensive and accurate identity graphs across both deterministic and probabilistic methodologies.

Regionally, North America maintains market dominance due to early adoption of advanced marketing technologies, the presence of major technological hubs, and high digital advertising spend, particularly in the U.S. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid digitization, a booming e-commerce sector, and a massive mobile-first consumer base demanding personalized experiences. Europe is focusing heavily on regulatory compliance, with GDPR requirements driving investment in high-standard identity management solutions that prioritize consumer consent and data transparency, creating a niche demand for privacy-by-design resolution frameworks.

Segmentation trends reveal that solutions emphasizing real-time identity linking and cross-device identification are gaining significant traction, reflecting the need for immediate action based on current customer behavior. The services segment, particularly managed services and consulting for identity hygiene and compliance, is also expanding rapidly as complexity increases. Vertically, the BFSI sector remains a primary consumer, driven by stringent security requirements for fraud prevention and Know Your Customer (KYC) processes, while the Retail and E-commerce segment leverages identity resolution overwhelmingly for marketing attribution and optimization of the customer journey, indicating diverse sectoral drivers for adoption.

AI Impact Analysis on Identity Resolution Market

Common user questions regarding AI's impact on Identity Resolution frequently revolve around how artificial intelligence enhances matching accuracy, scales cross-device linking, and manages consent under complex privacy regulations. Users are keenly interested in whether AI can reliably perform probabilistic matching in cookieless environments and how machine learning algorithms improve the refresh rate and stability of centralized identity graphs. Concerns often center on the explainability (XAI) of AI-driven matching decisions and the potential for algorithmic bias when consolidating diverse demographic data. The collective expectation is that AI will be the primary engine for navigating data fragmentation, ensuring higher precision in identity linkage, and enabling true real-time personalization at scale while addressing the complexities introduced by evolving global privacy frameworks.

The integration of deep learning and reinforcement learning models fundamentally transforms the capabilities of identity resolution platforms, moving beyond traditional rule-based or simple statistical matching. AI algorithms are now capable of analyzing vast, unstructured datasets—including behavioral patterns, clickstream data, and anonymized identifiers—to infer connections with greater certainty than purely deterministic methods. This is particularly vital in environments where persistent identifiers are scarce, such as mobile applications or streaming platforms. By continuously learning from successful match outcomes and incorporating feedback loops, AI systems dynamically adjust their confidence scoring, significantly reducing both false positive and false negative match rates, thereby enhancing the overall fidelity of the customer profile.

Furthermore, AI plays a crucial role in operationalizing identity resolution within the enterprise ecosystem. Machine learning models are deployed to automate data governance tasks, such as anomaly detection, data cleansing, and deduplication prior to identity linking, ensuring the input data quality is maximized. This automation reduces manual intervention and allows identity resolution engines to scale effortlessly with the exponential growth of transactional and behavioral data. The application of Natural Language Processing (NLP) within identity resolution is also advancing, allowing platforms to match customer records based on subtle variations in names, addresses, or organizational affiliations often found in disparate source systems, thus cementing AI's role as a core innovation catalyst in this market.

- AI enhances probabilistic matching accuracy, crucial for cookieless environments and cross-device identification.

- Machine learning optimizes real-time identity graph updates and stability through dynamic confidence scoring.

- Deep learning models process unstructured data (behavioral patterns) to infer complex identity links.

- Automated data quality management and cleansing tasks are streamlined using AI and NLP techniques.

- AI supports enhanced compliance by monitoring and flagging identity links that conflict with consent preferences.

- Adoption of Explainable AI (XAI) addresses concerns regarding algorithmic bias and matching transparency.

DRO & Impact Forces Of Identity Resolution Market

The Identity Resolution Market is propelled by powerful macro and micro forces, primarily centered on the necessity for accurate customer recognition in the digital age. Key drivers include the rapid decline of third-party cookies, forcing brands to invest heavily in first-party data strategies where robust identity resolution is the core enabling technology. The global shift toward omni-channel customer engagement demands unified customer views, escalating the need for persistent cross-device identification capabilities. Simultaneously, the proliferation of data sources (IoT devices, wearables, social platforms) creates overwhelming data fragmentation, requiring sophisticated solutions to synthesize this information effectively. These drivers collectively amplify the demand for high-fidelity identity graphs that can deliver personalization at scale while navigating complex privacy environments.

Restraints, however, pose significant challenges to market expansion. Foremost among these is the escalating complexity of global data privacy regulations (e.g., GDPR, CCPA, LGPD), which mandate consumer consent and strict data handling protocols, increasing the operational burden and compliance costs for identity resolution providers. High implementation costs and the technical complexity associated with integrating identity resolution platforms into legacy IT infrastructures, especially for mid-sized organizations, act as a barrier to entry. Furthermore, consumer distrust regarding data usage and the potential for data breaches necessitate significant investment in security and transparency, slowing adoption among risk-averse enterprises.

Opportunities in the market are largely defined by emerging technological frontiers and underserved verticals. The opportunity to leverage blockchain technology for decentralized, user-controlled identities presents a significant long-term growth avenue, potentially resolving many current privacy concerns. The expansion into niche applications such as supply chain visibility and government services (digital citizen identity) opens new revenue streams. The most immediate opportunity lies in developing specialized, vertical-specific identity resolution solutions—for instance, robust healthcare patient matching or financial crime investigation tools—that offer superior accuracy and compliance tailored to specific industry needs, thereby driving specialized market penetration and offsetting general restraints.

The immediate impact forces are dominated by the regulatory pendulum swing, where governmental actions dictate acceptable resolution methodologies, and technological acceleration, driven by AI advancements that fundamentally enhance matching capabilities and scalability. Regulatory pressures force immediate adaptation and innovation toward privacy-by-design solutions, while AI enhances efficiency and accuracy, creating a strong market pull. The combination of mandatory privacy standards and superior technological capability acts as a filter, favoring vendors who can offer both compliance assurance and high performance.

Segmentation Analysis

The Identity Resolution Market is primarily segmented based on Component, Deployment, Application, and Industry Vertical, reflecting the diverse ways organizations utilize these technologies to unify customer data. Component segmentation distinguishes between the foundational software or platform solutions that provide the core linking algorithms and the various services, such as consulting, integration, and managed services, essential for successful deployment and maintenance. Deployment options cater to security and scalability needs, dividing the market between highly controlled on-premise solutions and flexible, scalable cloud-based models. This granular segmentation allows vendors to target specific enterprise needs, ranging from sophisticated data analytics requirements to critical compliance mandates.

Application segmentation highlights the functional use cases driving adoption, with personalized marketing, fraud detection, and regulatory compliance being the most prominent areas demanding robust identity resolution capabilities. The effectiveness of personalized marketing campaigns hinges entirely on accurate identity linkage across channels, making it a major revenue driver. Conversely, fraud detection, particularly in the BFSI sector, requires extremely high accuracy and real-time processing to mitigate financial losses. The Industry Vertical segment demonstrates differential adoption rates, with sectors handling large volumes of sensitive customer data—such as Banking, Retail, and Healthcare—showing the highest penetration rates, driven by sector-specific needs for security, personalization, and operational efficiency.

The growth dynamics within these segments indicate that the Cloud deployment segment is poised for the fastest expansion due to its inherent scalability, cost-efficiency, and ease of integration, aligning well with modern digital transformation initiatives. Among applications, the segment focused on regulatory compliance and risk management is growing rapidly, reflecting the increasing penalties associated with data misuse and the need for proactive identity governance. This detailed segmentation provides a roadmap for market participants to identify lucrative niches and tailor their offerings to address specific pain points across different organizational structures and operational contexts.

- By Component:

- Solutions (Platform/Software)

- Services (Professional Services, Managed Services)

- By Deployment:

- On-Premise

- Cloud

- By Application:

- Personalized Marketing & Advertising

- Fraud Detection & Risk Management

- Customer Experience Management

- Regulatory Compliance & Governance

- Attribution & Analytics

- By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail & E-commerce

- Telecommunications & IT

- Healthcare & Life Sciences

- Media & Entertainment

- Government & Public Sector

Value Chain Analysis For Identity Resolution Market

The Identity Resolution market value chain initiates with upstream activities focused on data acquisition and aggregation. This stage involves data brokers, public data sources, and internal enterprise systems that feed raw, disparate, and often inconsistent data streams into the resolution ecosystem. Key participants at this stage are responsible for ensuring the breadth and freshness of the underlying identifiers, including postal addresses, email hashes, device IDs, and behavioral data. The quality and volume of data input directly dictate the potential accuracy of the subsequent resolution process. Technological innovation here focuses on secure, privacy-compliant data ingestion and initial standardization.

The midstream phase constitutes the core of identity resolution, involving specialized software vendors and platform providers who apply advanced matching algorithms (deterministic, probabilistic, and AI-driven) to cleanse, match, and stitch these identifiers together, resulting in a cohesive identity graph. This stage requires significant computational power and intellectual property focused on high-speed data processing and continuous graph maintenance. Professional services, including system integration and consulting, are integral here, assisting clients in customizing the matching logic and integrating the resulting unified identity into their operational platforms, such as CDPs or marketing clouds. The efficiency of this stage significantly impacts the final utility and real-time capability of the resolution output.

The downstream activities involve the distribution channel and the utilization of the resolved identity. Distribution predominantly occurs through direct sales to large enterprises and indirect channels, including partnerships with marketing agencies, system integrators (SIs), and value-added resellers (VARs) who embed identity resolution capabilities into broader data management or advertising technology solutions. The end-users—ranging from Chief Marketing Officers using the output for personalized campaigns to Chief Risk Officers leveraging it for fraud scoring—are the final beneficiaries. The effectiveness of the resolved identity is measured by its impact on business outcomes, such as conversion rates, customer lifetime value (CLV), and successful fraud mitigation, closing the feedback loop on data quality and matching efficacy.

Identity Resolution Market Potential Customers

The primary purchasers and end-users of Identity Resolution solutions are organizations that heavily rely on understanding individual consumer behavior across multiple interaction channels and require a unified customer view for strategic decision-making. These include large multinational corporations across the retail and e-commerce sector, seeking to optimize personalized customer journeys, enhance cross-channel attribution, and improve inventory management based on high-fidelity identity data. The financial services and insurance (BFSI) industry represents a major customer base, driven by the critical need for robust fraud detection, stringent KYC compliance, and effective anti-money laundering (AML) operations, where accurate identity verification is non-negotiable.

Additionally, telecommunications companies and media and entertainment entities are significant adopters, utilizing identity resolution to manage complex subscription models, track viewership across streaming platforms and devices, and deliver highly targeted advertising inventory. Healthcare providers and pharmaceutical companies are increasingly investing in these solutions to ensure accurate patient matching, reduce administrative errors, and manage longitudinal patient records securely and compliantly. While large enterprises currently constitute the largest segment of buyers, small and medium-sized enterprises (SMEs) operating in digitally native environments are emerging as a fast-growing customer base, increasingly utilizing cloud-based, subscription-model identity resolution services to level the playing field in personalized digital engagement without massive upfront investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 14.6 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LiveRamp, TransUnion (Neustar), Experian, Oracle, Adobe, Epsilon, Acxiom (IPG), InfoSum, Merkle (Dentsu), Tealium, Amperity, mParticle, Segment (Twilio), FullContact, 4C Insights (Mediaocean), Zeta Global, Salesforce, SAS Institute, IBM, Google |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Identity Resolution Market Key Technology Landscape

The technological core of the Identity Resolution Market revolves around sophisticated data matching techniques and the architectural deployment of unified identity graphs. Deterministic matching remains the gold standard, leveraging high-confidence linkages based on exact, verifiable personal identifiable information (PII) like email addresses or phone numbers, primarily used in regulated environments like BFSI. However, the rapidly changing privacy landscape and the fragmentation of digital presence necessitate heavy reliance on probabilistic matching, which uses advanced statistical models and machine learning to infer relationships between anonymous data points (e.g., IP addresses, device types, time stamps) and calculate a confidence score for identity linkage, crucial for cross-device tracking in marketing applications.

The backbone technology is the Identity Graph itself, which acts as a centralized database of connected, standardized identifiers that are continuously updated in real-time or near real-time. Modern identity graphs are increasingly integrated within Customer Data Platforms (CDPs) to make the resolved identity immediately actionable for marketing and operations teams. Crucially, the rise of privacy-enhancing technologies (PETs), such as differential privacy and secure multi-party computation (SMPC), is enabling data collaboration and identity linking across different organizations without exposing raw PII, directly addressing regulatory challenges and boosting confidence in data sharing ecosystems.

Furthermore, cloud-native architectures are now standard, enabling the massive scalability required to manage petabytes of streaming data and perform complex matching operations globally. Artificial Intelligence and Machine Learning algorithms are employed extensively not only for probabilistic matching accuracy but also for maintaining the hygiene and stability of the identity graph over time, predicting identifier decay, and automating data governance rules. The convergence of these technologies—AI-driven matching, cloud scalability, and privacy-preserving data collaboration tools—defines the competitive edge in the current Identity Resolution landscape.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature digital advertising ecosystem, high adoption of martech stacks, and the presence of leading technology vendors. Regulatory complexity, particularly the California Consumer Privacy Act (CCPA), acts as a catalyst, forcing U.S. enterprises to invest in sophisticated, compliant identity management solutions. The market here focuses heavily on precision targeting, attribution modeling, and mitigating digital ad fraud, with robust investment in high-fidelity identity graphs and cross-device linking capabilities.

- Europe: The European market is heavily shaped by the General Data Protection Regulation (GDPR), prioritizing privacy-by-design and consent management integration within identity resolution platforms. While adoption is high, the focus is distinct; enterprises seek solutions that guarantee demonstrable compliance and transparency in data processing. Growth is steady, fueled by the retail, financial services, and telecommunications sectors needing unified customer views that respect strict European data sovereignty and consumer rights requirements.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by rapid digital transformation, burgeoning mobile commerce, and a vast, diverse consumer base. Countries like China, India, and Southeast Asian nations are experiencing massive growth in internet penetration and e-commerce, creating huge demand for scalable, localized identity resolution solutions. Investment is accelerating in cloud-based platforms that can handle the unique data formats and language complexities across this geographically fragmented market.

- Latin America (LATAM): The LATAM market is in an emergent growth phase, driven by increasing digitization and rising digital marketing spend. Implementation of localized privacy regulations, such as Brazil's LGPD, is mimicking the effect of GDPR, compelling larger regional organizations, especially in BFSI and retail, to modernize their identity management infrastructure. The region shows strong potential for cloud-based, cost-effective identity solutions due to lower infrastructure maturity compared to North America.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in technologically advanced hubs, particularly the GCC countries. The market is propelled by large government digital transformation projects and major financial institutions investing in advanced security protocols, including fraud detection applications powered by identity resolution. The rapid development of smart city initiatives also contributes to the demand for consolidated, secure digital identity services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Identity Resolution Market.- LiveRamp

- TransUnion (Neustar)

- Experian

- Oracle Corporation

- Adobe Inc.

- Epsilon (Publicis)

- Acxiom (Interpublic Group)

- InfoSum

- Merkle (Dentsu)

- Tealium

- Amperity

- mParticle

- Segment (Twilio)

- FullContact

- 4C Insights (Mediaocean)

- Salesforce

- IBM Corporation

- Zeta Global

- SAS Institute

- Google LLC

Frequently Asked Questions

Analyze common user questions about the Identity Resolution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between deterministic and probabilistic identity resolution?

Deterministic identity resolution relies on confirmed, exact matches of PII (e.g., matching verified email addresses) to link customer records with 100% confidence. Probabilistic resolution uses advanced algorithms and machine learning to infer connections between anonymous data points (device IDs, IP addresses) and assigns a confidence score, essential for cross-device linking in cookieless environments where exact matches are unavailable.

How does the decline of third-party cookies affect the Identity Resolution Market?

The deprecation of third-party cookies is a primary growth driver, compelling organizations to shift reliance to first-party data strategies. This increases the demand for robust Identity Resolution platforms, which stitch together disparate first-party identifiers into a persistent, actionable identity graph, ensuring continued personalization and measurement without external tracking mechanisms.

What role do Customer Data Platforms (CDPs) play in Identity Resolution?

CDPs are critical infrastructure that often include built-in or integrated Identity Resolution engines. CDPs ingest and unify customer data from various sources using resolution techniques, creating a "golden record" identity, which is then activated across marketing, sales, and service channels for personalized customer experience management.

Which industry vertical is the largest adopter of Identity Resolution solutions?

The Banking, Financial Services, and Insurance (BFSI) vertical is traditionally the largest adopter, driven by mission-critical applications such as preventing financial fraud, fulfilling rigorous Know Your Customer (KYC) compliance mandates, and accurately managing risk profiles based on consolidated identity information.

What are the primary regulatory challenges impacting Identity Resolution technology?

Major regulatory challenges include complying with global standards like GDPR (Europe) and CCPA (USA), which mandate consumer consent management, the right to erasure, and data transparency. Providers must ensure their resolution methodologies are privacy-by-design and can instantaneously enforce consumer identity preferences across all linked data points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager