Ilipe Butter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432289 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Ilipe Butter Market Size

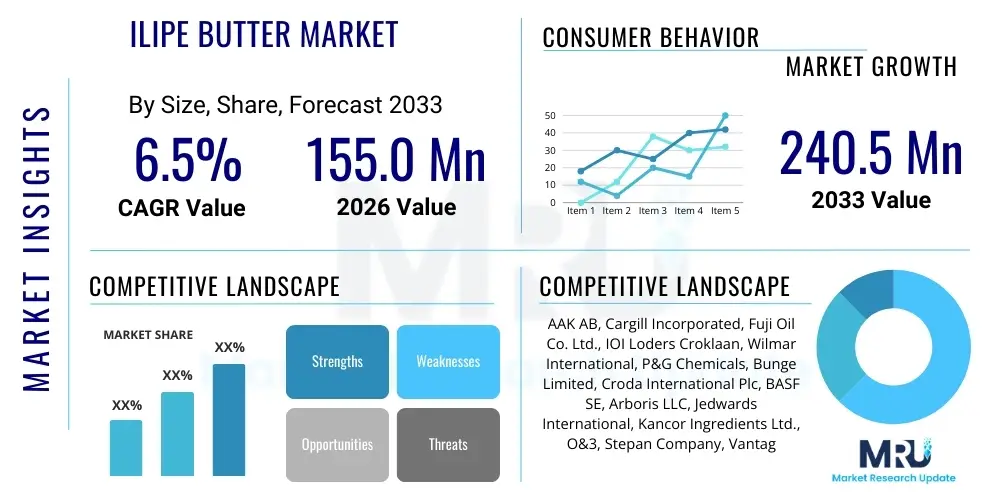

The Ilipe Butter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 240.5 Million by the end of the forecast period in 2033.

Ilipe Butter Market introduction

Ilipe Butter, derived from the nuts of the Shorea stenoptera tree native to Borneo, is a highly valued, specialty vegetable fat known for its exceptional emollient properties and unique fatty acid profile, dominated by high levels of stearic and oleic acids. This composition grants the butter a higher melting point compared to many other vegetable fats, making it ideal for formulating stable cosmetic and pharmaceutical products. Historically utilized in traditional medicine and regional cooking, Ilipe Butter has transitioned into a globally sought-after ingredient, particularly within the premium skincare and functional food sectors, driven by consumer preference for natural, efficacious, and ethically sourced components. Its use primarily spans high-end moisturizing creams, lip balms, hair conditioning products, and as a natural structuring agent in chocolate and confectionary alternatives, capitalizing on its solid consistency at room temperature and smooth mouthfeel.

The primary driving factors for the expanding Ilipe Butter market include the global clean beauty movement, which emphasizes ingredients that are minimally processed and naturally derived, and the growing recognition of its superior skin barrier function repair capabilities. Furthermore, regulatory shifts favoring natural emulsifiers and stabilizers in food production, particularly in niche markets like vegan and specialty chocolate manufacturing, have bolstered demand. However, the market faces inherent challenges related to sustainable sourcing, as Shorea stenoptera is a wild-harvested species, creating fluctuations in supply and raising ethical concerns regarding deforestation and fair trade practices. Manufacturers are increasingly focused on establishing traceable and certified supply chains to mitigate these risks and meet stringent consumer transparency expectations.

Ilipe Butter's versatility is a core aspect of its market appeal. In cosmetics, it functions not only as a deep moisturizer but also as a natural substitute for mineral oils and synthetic waxes, aligning with industry trends toward petrochemical-free formulations. In the food industry, its physical properties closely mimic cocoa butter, allowing it to be used as a high-quality cocoa butter equivalent (CBE) in applications requiring thermal stability and bloom resistance, although regulatory approval for its use varies across different global jurisdictions. The ongoing research into its specific triglyceride structure promises further opportunities for targeted applications in dermatology and nutraceuticals, solidifying its position as a high-value botanical asset.

Ilipe Butter Market Executive Summary

The Ilipe Butter Market is characterized by robust growth anchored in the premium segments of the cosmetic and pharmaceutical industries, complemented by niche adoption in specialty food manufacturing. Key business trends indicate a strong focus on supply chain resilience and ethical sourcing, with multinational corporations investing heavily in Fair Trade and certification programs to ensure long-term, sustainable access to the raw material. Technological advancements in refinement and extraction, such as cold pressing and supercritical fluid extraction (SFE), are enhancing the purity and functional attributes of the final product, allowing for its integration into highly sophisticated formulations. The market is witnessing consolidation among refiners aiming to control quality from the source, while finished product manufacturers are leveraging Ilipe Butter’s natural profile for marketing differentiation, particularly appealing to the environmentally conscious consumer demographic.

Regionally, Europe and North America remain the primary consumption hubs, driven by well-established clean beauty and organic food markets with high disposable income willing to pay a premium for natural specialty ingredients. The European Union, with its rigorous cosmetic ingredient regulations, provides a challenging but profitable environment for certified Ilipe Butter products. Conversely, the Asia Pacific (APAC) region is critical not only as the main source of raw material (Indonesia and Malaysia) but also as a rapidly emerging consumer market, especially in Japan and South Korea, which are leading global innovations in natural skincare. Efforts to stabilize the supply chain involve collaborations between APAC cooperatives and Western buyers, focusing on sustainable forest management and regenerative agriculture practices to safeguard the future supply.

Segmentation trends reveal that the cosmetic application segment, encompassing skincare, haircare, and decorative cosmetics, accounts for the largest market share, owing to Ilipe Butter’s superior moisturizing and stabilizing characteristics. Within the form segment, refined Ilipe Butter dominates due to its neutral color and odor, making it versatile for incorporation into complex formulas, although unrefined, ethically sourced variants command a higher premium in niche artisanal markets. The increasing awareness among industrial buyers regarding the functional advantages over common alternatives like Shea or Mango butter is expected to accelerate adoption across various industrial applications, ensuring stable, segment-specific growth throughout the forecast period.

AI Impact Analysis on Ilipe Butter Market

Common user questions regarding AI's influence on the Ilipe Butter market primarily revolve around optimizing the inherently complex, wild-harvested supply chain, ensuring product authenticity, and predicting market volatility. Users are intensely interested in how AI can verify the geographic origin of the nuts (traceability), manage yield predictions under climate change pressures, and automate quality control processes to detect adulteration, which is a significant concern for high-value botanical fats. Furthermore, end-user manufacturers seek AI solutions for advanced formulation development, where machine learning can quickly analyze complex ingredient interactions to optimize stability, texture, and efficacy, significantly reducing R&D cycles. The core expectation is that AI will introduce unprecedented levels of transparency and efficiency into a market traditionally plagued by opacity and logistical bottlenecks inherent to sourcing rare, natural commodities.

The implementation of AI and machine learning models is transforming the procurement phase, moving beyond traditional auditing methods. Satellite imagery combined with AI algorithms is now being utilized to monitor the health and distribution of Shorea stenoptera trees, helping to predict harvest yields and plan logistics more effectively, thereby reducing post-harvest loss and ensuring timely delivery to processing centers. This predictive analytical capability is crucial for managing price stability, as Ilipe Butter pricing is highly sensitive to annual yield variations. By applying deep learning to historical climate and production data, suppliers can offer more reliable contracts to large industrial buyers, stabilizing the forward market for this ingredient. AI-driven predictive maintenance on extraction equipment also ensures high operational uptime, critical for maintaining product consistency during seasonal peaks.

In the downstream market, AI is integral to quality assurance and consumer interaction. Spectroscopy and other analytical techniques are being paired with machine learning to create digital fingerprints of authentic Ilipe Butter, instantly flagging potential contaminants or substitutes during incoming material inspection, thereby protecting brand integrity. For finished product development, generative AI models are assisting cosmetic scientists in formulating novel products, simulating thousands of ingredient combinations to meet specific performance criteria (e.g., maximum occlusivity with minimal greasiness) before physical testing begins. This analytical power significantly accelerates time-to-market for innovative products leveraging Ilipe Butter’s unique physical and chemical properties, fundamentally changing the landscape of high-performance natural formulation.

- Enhanced Supply Chain Traceability: AI platforms track wild-harvested material from the source forest to the processing plant, verifying ethical sourcing claims and improving transparency.

- Predictive Yield Modeling: Machine learning analyzes environmental data (weather, satellite imagery) to forecast Shorea stenoptera nut yields, optimizing procurement strategies and mitigating price volatility.

- Automated Quality Control (AQC): Vision systems and analytical sensors, powered by AI, rapidly detect adulteration or inconsistencies in fatty acid profiles, ensuring adherence to high-purity standards.

- Optimized Formulation and R&D: Generative AI assists cosmetic and food scientists in simulating ingredient interactions, accelerating the development of stable, high-efficacy products containing Ilipe Butter.

- Demand Forecasting: Advanced algorithms analyze global cosmetic and natural food trends to provide accurate demand forecasts, allowing processors to adjust production capacity proactively.

DRO & Impact Forces Of Ilipe Butter Market

The Ilipe Butter market is shaped by a confluence of powerful drivers, significant restraints, and emerging opportunities, collectively defining its trajectory and resilience. A primary driver is the accelerating consumer shift towards natural and highly functional ingredients, viewing Ilipe Butter as a premium, sustainable alternative to synthetic emollients and established botanical butters like Shea or Cocoa. Its superior stability and melt profile offer distinct functional advantages in high-end cosmetic formulations, driving industrial adoption. Conversely, the market is severely restrained by reliance on wild harvesting, leading to highly volatile supply chains susceptible to climate variability, political instability in sourcing regions, and ecological pressures. This supply inconsistency often translates into high price fluctuations, making it challenging for smaller manufacturers to integrate it reliably into mass-market products.

Key opportunities lie in developing advanced, sustainable cultivation techniques—potentially leveraging agroforestry models—to stabilize supply and reduce pressure on wild populations, thereby addressing the core restraint. Furthermore, expanding the application scope into high-value specialty sectors, such as targeted drug delivery systems and advanced medical dermatological treatments, offers pathways for premiumization and market diversification. The dominant impact force shaping the market structure is the bargaining power of buyers, especially large cosmetic conglomerates who demand verifiable traceability and consistent quality, exerting pressure on refiners and suppliers to invest heavily in ethical certification and quality infrastructure. The threat of substitutes, while present (e.g., other CBEs), is partially mitigated by Ilipe Butter’s unique emolliency and melting point, providing a functional niche difficult to replicate perfectly.

Moreover, regulatory scrutiny concerning sustainability and deforestation acts as a double-edged force. While strict regulations may initially restrain sourcing, they simultaneously drive market consolidation towards suppliers compliant with high ethical standards (e.g., RSPO-like certification for tree nuts), ultimately creating a more sustainable and trustworthy market in the long term. Innovations in extraction technology, moving towards solvent-free methods like cold pressing or SFE, enhance the purity and consumer appeal of the butter, reinforcing its premium positioning. The balance between maintaining ethical sourcing practices and meeting rapidly growing global demand remains the central challenge, requiring collaborative efforts between local communities, government bodies, and international buyers to ensure the market's enduring viability and integrity.

Segmentation Analysis

The Ilipe Butter market is comprehensively segmented based on its functional characteristics, primary industrial applications, and distribution methodologies, allowing for nuanced analysis of consumer demand patterns and supply chain dynamics. Key segmentation criteria include Application (Cosmetics & Personal Care, Food & Beverages, Pharmaceuticals), Form (Refined, Unrefined), and Distribution Channel (Direct Sales, Distributors/Wholesalers). This structure enables stakeholders to target specific high-growth sectors, particularly within the cosmetic industry where Ilipe Butter is valued for its non-greasy feel and exceptional stability, and to optimize logistics based on the required level of processing—refined butter being preferred for mass-market standardization, while unrefined butter caters to niche organic and artisanal brands seeking maximum nutrient retention and natural properties.

- By Application:

- Cosmetics & Personal Care

- Food & Beverages (Cocoa Butter Equivalents, Confectionery)

- Pharmaceuticals & Nutraceuticals

- By Form:

- Refined Ilipe Butter

- Unrefined (Crude) Ilipe Butter

- By Distribution Channel:

- Direct Sales (Business-to-Business)

- Distributors/Wholesalers

- Retail (Specialty Stores, E-commerce)

- By End-User Industry:

- Skincare Manufacturers

- Haircare Manufacturers

- Artisan Food Producers

- Compounding Pharmacies

Value Chain Analysis For Ilipe Butter Market

The Ilipe Butter value chain begins with the critical upstream segment: the harvesting and collection of Shorea stenoptera nuts, primarily sourced through wild harvesting by local communities in Southeast Asia (Indonesia and Malaysia). This phase is characterized by seasonality, high logistical complexity in remote forest areas, and immense dependence on fair compensation and sustainable practices to prevent overexploitation. The raw nuts are then transported to local collection points where initial sorting and drying occur. Maintaining the integrity of the material during this initial transfer is crucial to prevent mold or rancidity, a significant challenge given the climatic conditions. The efficiency and ethics embedded at this upstream stage directly influence the cost and quality of the final butter.

The midstream processing phase involves extraction and refinement. Extraction methods range from traditional mechanical pressing (yielding unrefined butter) to advanced techniques like supercritical CO2 or solvent extraction, which yield higher volumes and are often followed by comprehensive refinement processes (bleaching, deodorization, fractionation) to create standardized refined Ilipe Butter required by large industrial buyers. Refineries, often located closer to major ports or in consuming regions (Europe, North America), must adhere to stringent international food and cosmetic safety standards. The choice of refinement level dictates the butter’s final application, impacting its color, odor, and functional stability, thus creating distinct price points within the market.

Downstream analysis focuses on distribution channels and end-user integration. Direct sales (Business-to-Business, B2B) are prevalent for large volume orders from major cosmetic and food manufacturers, allowing for customized specifications and stronger contractual ties regarding supply certainty and quality control. Indirect distribution involves specialized ingredient distributors and wholesalers who cater to smaller, artisanal producers and compounding pharmacies, providing smaller batch sizes and specialized technical support. Given the premium nature of Ilipe Butter, distribution channels often incorporate cold-chain or climate-controlled warehousing to preserve quality. Effective inventory management and minimizing transit time are paramount to mitigate degradation risks before the butter is incorporated into final consumer products, highlighting the importance of robust distribution partnerships.

Ilipe Butter Market Potential Customers

The primary customers for Ilipe Butter are high-end cosmetic and personal care manufacturers specializing in natural, organic, and highly functional skincare products. These customers prioritize ingredients that offer superior moisturizing efficacy, sensory elegance, and verifiable ethical sourcing credentials, aligning perfectly with Ilipe Butter’s profile as an excellent natural emollient and stabilizer. They utilize it heavily in formulations such as intensive repair creams, anti-aging treatments, natural lip care products, and high-quality body butters where texture and long-lasting moisture retention are key differentiators. The growing consumer demand for clean beauty lines free from parabens, phthalates, and synthetic waxes further strengthens the purchasing power of this segment, making them the most influential buyers in the market.

A significant secondary customer segment includes specialty food producers, particularly those involved in artisanal chocolate manufacturing, vegan confectionery, and premium baked goods. For these buyers, Ilipe Butter serves as a premium Cocoa Butter Equivalent (CBE) or alternative fat, valued for its unique melting curve and ability to improve texture and shelf stability without the need for artificial stabilizers. While regulatory constraints limit its large-scale use in standard confectionary in some regions, its application in niche, high-priced, ethically positioned food products is increasing. Furthermore, compounding pharmacies and nutraceutical companies represent a growing customer base, utilizing the butter in dermatological preparations, topical drug bases, and oral supplements where its stability and high melting point facilitate targeted ingredient delivery.

The customer base is further stratified by their demand for refinement levels. Major industrial buyers focused on mass-market standardization typically procure large volumes of fully refined, deodorized Ilipe Butter to ensure formula consistency and minimize color or odor interference. Conversely, smaller, organic, and artisanal brands often seek unrefined, cold-pressed Ilipe Butter, accepting slight variations in natural characteristics in exchange for higher levels of retained micronutrients, aligning with a "less-is-more" ingredient philosophy. Meeting the diverse quality and volume requirements across these varied end-user groups necessitates flexible supply chain management and clear communication regarding the butter’s specific technical attributes and sourcing provenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 240.5 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AAK AB, Cargill Incorporated, Fuji Oil Co. Ltd., IOI Loders Croklaan, Wilmar International, P&G Chemicals, Bunge Limited, Croda International Plc, BASF SE, Arboris LLC, Jedwards International, Kancor Ingredients Ltd., O&3, Stepan Company, Vantage Specialty Chemicals, Green Mountain Soap, Tropical Wholefoods, Natural Sourcing, Shay & Co, and AkzoNobel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ilipe Butter Market Key Technology Landscape

The technological landscape in the Ilipe Butter market is primarily focused on optimizing efficiency and ensuring product purity across the extraction and refinement stages, addressing the high-value nature of the raw material. Traditional hot pressing methods, while economical, can compromise the delicate fatty acid structure. Consequently, advanced physical processing technologies like cold pressing are increasingly favored for producing premium, unrefined grades, minimizing thermal degradation and preserving beneficial phytochemicals. The most significant technological shift involves the adoption of Supercritical Carbon Dioxide (SFE) extraction, which is a solvent-free method yielding extremely pure, high-quality butter with superior oxidative stability. SFE technology allows refiners to customize the extraction parameters, targeting specific triglyceride fractions desirable for specialized cosmetic or pharmaceutical applications, significantly boosting the functional potential and market value of the resultant butter.

Refinement technologies are also crucial for meeting industrial specifications. Fractionation, a process that separates the butter into liquid and solid components based on differing melting points, is used to tailor Ilipe Butter for specific applications, such as creating a highly stable emollient fraction or a highly crystalline fat for confectionery use. This targeted physical modification allows manufacturers to leverage Ilipe Butter in complex formulations that require precise texture and thermal behavior. Furthermore, advanced deodorization techniques (often low-pressure steam stripping) are employed to remove undesirable odors and colors present in crude butter while minimizing the impact on the desired fatty acid profile, a delicate balance that modern, precisely controlled systems are designed to achieve.

Beyond processing, quality assurance technologies are foundational to market integrity. High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC) are standard for detailed analysis of the fatty acid composition, ensuring the product meets specifications and is free from adulterants like palm oil or cheaper fats. Alongside these chemical analyses, spectroscopic methods (e.g., Near-Infrared Spectroscopy, NIR) coupled with AI are deployed for rapid, non-destructive quality checks during the production line, providing real-time data on purity and consistency. Traceability systems, often utilizing blockchain technology integrated with IoT devices at the sourcing stage, are also becoming standard practice to provide end-to-end transparency, addressing the ethical sourcing demands driven by global consumer awareness and regulatory pressure.

Regional Highlights

The global Ilipe Butter market exhibits distinct regional dynamics driven by both supply capability and end-user demand sophistication. The Asia Pacific (APAC) region is indispensable as the primary sourcing hub, specifically Indonesia and Malaysia, where the Shorea stenoptera tree naturally thrives. While historically focused on raw material export, APAC is emerging as a significant processing and refining center, with local producers improving infrastructure to capture more value addition within the region. Furthermore, rising middle-class disposable income and increasing Westernization of beauty standards are fueling internal consumption, particularly in South Korea and China, creating a growing regional demand for premium natural ingredients in localized cosmetic products.

Europe holds the dominant position in terms of consumption value and market maturity. The European Union’s strong commitment to natural ingredients, the robust clean beauty movement, and stringent chemical regulations (like REACH) favor high-quality, traceable botanical ingredients such as Ilipe Butter. Germany, France, and the UK are major importers, driving demand across high-end cosmetic manufacturing and specialized food applications where consumers are willing to pay a significant premium for sustainability and functional efficacy. This region dictates global standards for ethical sourcing, compelling suppliers worldwide to adopt advanced certification schemes.

North America, led by the United States, represents the second-largest consumption market. The demand here is characterized by rapid innovation in indie beauty brands and a strong preference for ingredients with demonstrable, scientific backing. Ilipe Butter is frequently marketed with claims related to its high stearic acid content for enhanced skin barrier function. The relatively relaxed regulatory environment in food applications compared to Europe allows for broader, though still niche, adoption as a specialty fat. Latin America and the Middle East & Africa (MEA) currently represent smaller but rapidly expanding markets, characterized by increasing demand from local cosmetic formulators looking to differentiate their products with unique, exotic botanical ingredients, providing a fertile ground for future market expansion.

- Europe: Dominant high-value consumer market; drives global standards for traceability and ethical sourcing; strong presence in premium cosmetics and specialty food manufacturing.

- North America: Large, innovative consumer base, particularly in the indie and scientific skincare sectors; increasing adoption as a high-performance natural alternative.

- Asia Pacific (APAC): Essential sourcing and raw material hub (Indonesia, Malaysia); rapidly growing regional consumption in local cosmetic and personal care markets.

- Latin America (LATAM): Emerging market with focus on localized production of natural cosmetics and increasing interest in botanical fats.

- Middle East & Africa (MEA): Growth driven by luxury personal care segments and development of local processing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ilipe Butter Market.- AAK AB

- Cargill Incorporated

- Fuji Oil Co. Ltd.

- IOI Loders Croklaan

- Wilmar International

- P&G Chemicals

- Bunge Limited

- Croda International Plc

- BASF SE

- Arboris LLC

- Jedwards International

- Kancor Ingredients Ltd.

- O&3

- Stepan Company

- Vantage Specialty Chemicals

- Green Mountain Soap

- Tropical Wholefoods

- Natural Sourcing

- Shay & Co

- AkzoNobel

Frequently Asked Questions

Analyze common user questions about the Ilipe Butter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ilipe Butter primarily used for, and what are its key functional advantages?

Ilipe Butter is predominantly used in the cosmetics industry for high-end moisturizing creams, lip balms, and hair conditioners due to its high emolliency and superior stability. Its key advantage is a high melting point (comparable to cocoa butter), which provides excellent thermal stability and a pleasant, non-greasy texture, making it an ideal natural thickener and stabilizer.

How do sustainability concerns impact the sourcing and price volatility of Ilipe Butter?

As Ilipe Butter is derived from wild-harvested Shorea stenoptera nuts, the market faces significant supply volatility tied to deforestation risks and climate change effects. Sustainability certifications (Fair Trade, organic) are critical for reducing price volatility and ensuring ethical sourcing, increasingly becoming mandatory for large industrial buyers.

What is the main difference between Refined and Unrefined Ilipe Butter in market application?

Refined Ilipe Butter is bleached, deodorized, and neutralized, making it standardized and neutral in color/odor, ideal for complex cosmetic formulations where consistency is paramount. Unrefined (crude) Ilipe Butter retains more natural color, aroma, and inherent micronutrients, commanding a premium in niche, artisanal, and organic product markets.

Is Ilipe Butter considered a Cocoa Butter Equivalent (CBE) in the food industry?

Yes, Ilipe Butter is recognized as a high-quality Cocoa Butter Equivalent (CBE) due to its similar fatty acid profile, particularly high stearic acid content, and its sharp melting behavior. It is primarily utilized in high-end specialty chocolates and vegan confectionery to improve heat resistance and prevent fat bloom, though its use is often regulated by local food standards.

Which geographical regions are the largest producers and consumers of Ilipe Butter?

The primary producing regions are in Southeast Asia, notably Indonesia and Malaysia, which supply the raw Shorea stenoptera nuts. The largest consumer markets by value are Europe and North America, driven by established demand for high-performance natural ingredients in their respective cosmetic and specialty food sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager