Illite Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439052 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Illite Powder Market Size

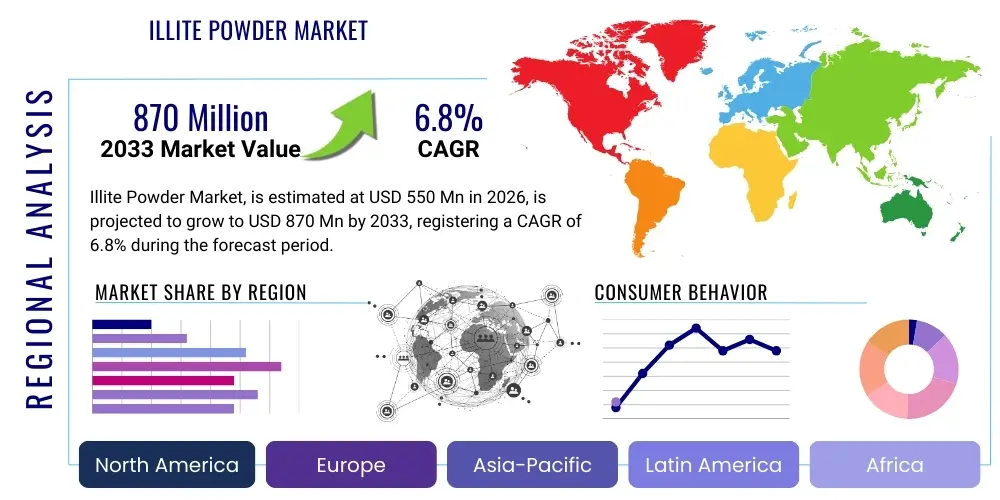

The Illite Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 870 Million by the end of the forecast period in 2033.

Illite Powder Market introduction

The Illite Powder Market encompasses the production, distribution, and consumption of illite, a non-expanding, potassium-rich clay mineral belonging to the mica group. Illite is recognized for its unique physicochemical properties, including high ion exchange capacity, significant surface area, and thermal stability, which make it highly valuable across numerous industrial applications. Derived primarily from sedimentary rocks, illite powder is processed into various grades of purity and particle size distribution to meet specific end-user requirements, ranging from micronized powders for advanced cosmetics to coarser grades utilized in construction materials.

Illite powder serves as a critical functional ingredient, particularly in the ceramics industry where it acts as a fluxing agent and plasticity enhancer, improving the strength and reducing the firing temperature of ceramic bodies. Furthermore, its application in cosmetics and personal care products is rapidly expanding due to its excellent absorption capabilities, detoxification properties, and ability to serve as a natural colorant and filler in masks, foundations, and skin treatments. The product is also extensively used as a functional filler in polymers, rubber, and paints, enhancing mechanical strength, dimensional stability, and fire resistance, thereby optimizing the performance characteristics of composite materials.

The primary driving factors supporting the market expansion include the increasing demand for natural and mineral-based ingredients in the cosmetic industry, stringent regulations favoring eco-friendly construction materials, and the continuous growth of the ceramics sector, especially in emerging economies. The inherent benefits of illite, such as its cost-effectiveness compared to synthetic fillers and its superior functional attributes compared to other common clays, position it as a preferred material in specialized industrial processes, ensuring sustained market relevance throughout the forecast period.

Illite Powder Market Executive Summary

The global Illite Powder Market demonstrates robust growth, driven by synergistic expansion across major application segments, particularly cosmetics, ceramics, and advanced functional fillers. Business trends indicate a strong movement toward high-purity, micronized illite grades, reflecting the increasing sophistication of formulation requirements in premium personal care and advanced polymer composites. Key manufacturers are focusing on enhancing processing technologies, such as advanced grinding and purification techniques, to secure consistent supply of specialized illite variants, thus addressing the demand for superior quality materials. Furthermore, strategic alliances and mergers focused on securing key mineral reserves and expanding regional processing capacities are defining the competitive landscape, emphasizing vertical integration to optimize cost and supply chain efficiency.

Regional dynamics highlight Asia Pacific (APAC) as the dominant and fastest-growing market, largely fueled by explosive infrastructure development in countries like China and India, leading to high consumption in construction and traditional ceramics. North America and Europe, while mature, exhibit strong demand for high-value applications, specifically within the premium cosmetic formulations and specialized polymer industries, adhering to stringent quality and sustainability standards. The shifting preference for natural beauty products, propelled by consumer awareness in Western markets, significantly underpins the demand for cosmetic-grade illite, counterbalancing slower growth observed in some traditional industrial sectors in these regions.

Segment trends confirm the ascendance of the Cosmetics & Personal Care segment as the primary revenue driver, attributable to illite's perception as a premium, natural ingredient for skin purification and detoxification. Concurrently, the 95% Purity grade sub-segment is experiencing above-average growth, reflecting the technical necessity for highly refined materials in complex chemical and formulation applications, demanding minimal impurities. The focus across segments remains centered on achieving supply chain resilience and ensuring ethical sourcing, crucial elements for sustaining market penetration and maintaining brand reputation in a commodity-sensitive yet specification-driven market environment.

AI Impact Analysis on Illite Powder Market

User queries regarding AI's influence on the Illite Powder Market primarily center on optimizing mining operations, predicting raw material quality, and streamlining supply chain logistics. Common concerns involve whether AI can reduce processing variability, potentially lowering operational costs and improving the consistency of high-purity illite grades crucial for sensitive applications like cosmetics and advanced ceramics. Users also frequently inquire about AI-driven predictive maintenance for grinding and classifying machinery, aiming to minimize downtime and maximize resource utilization in mineral processing plants. Overall, the expectation is that AI will introduce precision agriculture methodologies (when used in soil conditioning applications), enhance quality control through automated spectral analysis, and provide better forecasts for market demand based on real-time consumption data from key industrial sectors.

The application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is set to revolutionize the efficiency and sustainability profile of the illite powder value chain. Specifically, AI tools can analyze geological survey data and sensor readings from mining sites to create precise models for optimal extraction, minimizing waste and ensuring the selective removal of high-quality ore. In the processing stage, ML models integrated with spectroscopic equipment can continuously monitor the chemical composition and particle size distribution of the milled illite powder, automatically adjusting grinding parameters to maintain stringent purity and consistency specifications, thereby reducing human error and enhancing yield.

Furthermore, AI-powered demand forecasting and inventory management systems will significantly benefit producers and distributors. By integrating external variables such as construction indices, cosmetic industry trends, and regional economic indicators, these systems can accurately predict future demand peaks and troughs for specific illite grades, allowing companies to optimize stock levels, prevent shortages, and mitigate risks associated with commodity price volatility. This integration of digital intelligence is paramount for transitioning the market towards more responsive and efficient operational models, driving profitability across the entire supply chain ecosystem.

- AI-driven optimization of mining routes and extraction processes, leading to reduced operational costs and higher yields.

- Machine Learning models for real-time quality control, ensuring consistent purity and particle size distribution (AEO/GEO focus on quality and efficiency).

- Predictive maintenance analytics for mineral processing equipment, minimizing unexpected downtime.

- Enhanced supply chain visibility and optimized logistics planning using AI demand forecasting.

- Application of deep learning for rapid analysis of illite characteristics (e.g., thermal properties, ion exchange capacity) for new application development.

DRO & Impact Forces Of Illite Powder Market

The Illite Powder Market is shaped by a confluence of accelerating drivers (D), significant constraints (R), emerging opportunities (O), and dynamic impact forces that collectively dictate its trajectory over the forecast period. The fundamental driver remains the escalating global shift towards natural and clean-label cosmetic ingredients, where illite’s non-toxic, highly absorbent, and mineral-rich profile offers a compelling alternative to synthetic fillers. This trend is powerfully augmented by increasing urbanization and infrastructure spending, particularly in APAC, fueling demand in the construction and ceramics sectors. Conversely, the market faces constraints primarily related to the geographically concentrated availability of high-purity illite deposits, leading to reliance on specific source regions and exposure to geopolitical and logistical risks. Additionally, the challenge of maintaining consistent quality across various mined batches poses a technical restraint for high-specification end-users.

Opportunities for growth are plentiful, centering on the development of highly specialized, surface-modified illite derivatives engineered for high-performance applications, such as advanced filtration media for water purification and specialized components in battery technology (e.g., separators or electrode materials). Furthermore, expanding the use of illite in sustainable agriculture as a soil conditioner and slow-release fertilizer additive presents a large, untapped market segment, capitalizing on global sustainability initiatives. Innovation in micronization and nano-processing techniques is also opening avenues for illite’s integration into thin films and coatings, enhancing material properties in niche industrial applications.

Impact forces currently influencing the market include the fluctuating energy costs associated with the intensive grinding and drying processes required for producing fine illite powders, directly affecting operational profitability. Regulatory impact is also significant, with environmental protection agencies increasingly scrutinizing mining operations and waste disposal practices, forcing producers to invest in sustainable extraction methods. The competitive intensity remains high, driven by the presence of large mineral suppliers and continuous substitution threats from alternative functional fillers like kaolin, bentonite, and talc, compelling illite producers to focus rigorously on value-added services and grade differentiation to maintain market share and pricing power.

Segmentation Analysis

The Illite Powder Market segmentation provides a granular view of consumption patterns, driven by variations in product purity and diverse functional requirements across major end-use industries. The market is fundamentally segmented by Purity/Grade, differentiating between standard industrial grades and highly refined cosmetic or technical grades, which command significantly higher pricing due to specialized processing requirements. The second crucial segmentation is by Application, reflecting illite’s multifaceted utility ranging from bulk material enhancement in ceramics and construction to specialized functions in personal care formulations and high-performance material composites. This structure is essential for understanding where premiumization and volume growth are concentrated.

Analyzing the segmentation reveals that the 95% Purity segment is projected to experience accelerated growth, directly corresponding to rising quality standards in the cosmetic and functional filler sectors where minimal iron content and precise particle morphology are mandatory. Within the application matrix, the Cosmetics & Personal Care segment not only represents a high-value market but is also the most dynamic, propelled by consumer preferences for natural ingredients in face masks, cleansers, and specialized skincare. The traditional Ceramics and Functional Fillers segments, while mature, remain foundational for market volume, supported by global industrial output.

Geographic segmentation underscores the importance of regional supply chain proximity to demand centers. Asia Pacific leads due to high consumption in construction and ceramics, benefiting from extensive local manufacturing bases. Developed economies like North America and Europe, however, lead in demand for the premium, high-purity grades required for specialized, high-margin finished products, indicating a dichotomy in volume versus value focus across global markets. Strategic market expansion requires careful consideration of these segmentation dynamics to tailor product offerings and pricing strategies effectively.

- By Purity/Grade:

- 90% Purity

- 95% Purity

- Others (Less than 90% or highly specialized purity levels)

- By Application:

- Cosmetics & Personal Care (Face Masks, Foundations, Cleansers)

- Ceramics (Porcelain, Tiles, Sanitaryware)

- Functional Fillers (Plastics, Rubber, Paints & Coatings)

- Building Materials (Cement, Dry-mix Mortars)

- Filtration (Water Treatment, Oil Refinement)

- Agriculture (Soil Conditioners, Fertilizer Carriers)

Value Chain Analysis For Illite Powder Market

The value chain of the Illite Powder Market begins with upstream activities focused on the identification, exploration, and mining of suitable illite deposits. Upstream success hinges on geological surveys to ensure deposits yield raw material with desirable mineralogical purity and low levels of contaminants, such as quartz or feldspar. Once extracted, the raw clay is processed through crushing, grinding (micronization), drying, and often air or hydro-classification to achieve the requisite particle size distribution and moisture content demanded by different end-use applications. This processing stage is highly energy-intensive and critical for determining the final product’s quality, especially for cosmetic-grade illite.

Midstream operations involve the logistical movement, storage, and specialized packaging of the finished illite powder. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves suppliers selling high-volume industrial grades directly to large end-users, such as major ceramic manufacturers or construction companies, often under long-term supply contracts. Indirect distribution utilizes a network of regional specialty chemical and mineral distributors or agents who manage smaller orders, provide technical support, and handle logistics for diverse small-to-medium enterprises (SMEs) in the cosmetics or functional fillers sectors.

Downstream activities involve the final formulation and manufacturing processes where illite powder is incorporated. For example, in the cosmetic industry, formulators blend illite with active ingredients to create face masks or powders. In the construction sector, it is mixed into dry mortars or cement additives. The effectiveness of the downstream application heavily relies on the consistency and specific characteristics (e.g., color, absorption rate, thermal stability) achieved in the upstream processing stage. The efficiency of the entire chain is increasingly optimized through sophisticated quality tracking and customer-relationship management systems to ensure compliance with stringent industry standards globally.

Illite Powder Market Potential Customers

The diverse chemical and physical properties of illite powder make it indispensable across a spectrum of industries, translating into a varied profile of potential customers. The primary group of end-users are large-scale manufacturers in the cosmetics and personal care industry, including major global cosmetic brands and contract manufacturers focused on natural and organic skincare lines. These buyers are specifically seeking high-purity, contaminant-free illite suitable for direct dermal application, valuing properties like superior absorption, detoxification capabilities, and natural coloring. They are driven by consumer trends demanding clean-label, mineral-based ingredients, making them high-value customers for specialized illite producers.

Another major customer segment includes global and regional ceramic manufacturers, particularly those producing high-quality porcelain tiles, sanitaryware, and advanced technical ceramics. These customers purchase industrial-grade illite in bulk, utilizing its fluxing properties to lower firing temperatures, enhance product plasticity during molding, and improve the final mechanical strength and appearance of the fired body. Their purchasing decisions are primarily influenced by consistent supply volume, competitive pricing, and the illite’s chemical consistency that ensures reliable manufacturing processes. Similarly, construction material producers, including cement and dry-mix mortar companies, form a key bulk purchasing group, valuing illite for its rheological and water retention benefits in building mixtures.

Lastly, functional filler buyers, comprising companies specializing in polymer compounding, paint, and coating formulations, represent an important technical customer base. These users require illite to enhance physical properties such as stiffness, anti-sagging characteristics, and fire resistance in plastics, rubbers, and protective coatings. Additionally, water treatment and filtration system manufacturers are emerging customers, utilizing illite's ion exchange capabilities for pollutant removal. The common thread across all potential buyers is the demand for precise specifications, necessitating detailed technical data sheets and supply chain reliability from illite powder vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 870 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Imerys S.A., BASF SE, Thiele Kaolin Company, KaMin LLC, Ashapura Group, Quarzwerke GmbH, Sibelco N.V., Wyon Chemical, China Clay Corp., Lanco Group, Mineral Technologies Inc., Zemex Minerals, G&W Mineral Resources, KC Minerals, Unimin Corporation, EICSA (Minerales), Kyshtym Clay JSC, The Quartz Corp., R.T. Vanderbilt Holding Company, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Illite Powder Market Key Technology Landscape

The technology landscape governing the Illite Powder Market is centered on advanced mineral processing techniques necessary to transform raw clay into high-specification industrial powders. The most critical technological processes include micronization and classification. Micronization, achieved using high-efficiency mills such as jet mills or ball mills, is essential for reducing particle size down to the sub-micron level, which is crucial for maximizing surface area and improving dispersion in specialized applications like high-end cosmetics and polymer composites. Continuous technological improvements aim to reduce the energy consumption of these grinding processes while ensuring tight control over particle size distribution (PSD) for consistent product performance.

Furthermore, purification and beneficiation technologies play a vital role, especially for producing cosmetic and advanced technical grades where metal oxide impurities (particularly iron) must be minimized. Techniques such as magnetic separation, flotation, and chemical leaching are employed to enhance the whiteness and purity of the illite product. Producers are increasingly adopting spectroscopic analysis and automated quality control systems, often incorporating AI algorithms, to monitor the chemical fingerprint of the illite in real-time, ensuring that batch-to-batch consistency meets demanding client specifications. These purity-enhancing technologies are crucial differentiators in a market where subtle mineral variations profoundly impact end-product efficacy.

Another emerging area involves surface modification technology. Illite, like other clays, can be organically or chemically modified (e.g., calcination, surface coating with silanes or polymers) to tailor its compatibility with specific matrices, such as hydrophobic polymers or organic solvents. These surface-treated illite derivatives, often referred to as functionally enhanced fillers, offer superior dispersion, better mechanical reinforcement, and improved barrier properties compared to untreated illite. This innovation enables illite to penetrate high-growth, high-value markets, including lightweight automotive components and specialized packaging materials, solidifying the importance of continuous R&D investment in material science within the sector.

Regional Highlights

The Illite Powder Market exhibits distinct consumption patterns and growth dynamics across major geographical regions, influenced by localized industrial output, regulatory frameworks, and consumer preferences for natural products. Understanding these regional highlights is crucial for global manufacturers seeking strategic market penetration and optimized resource allocation. Asia Pacific (APAC) stands out as the predominant market, primarily due to the explosive growth in infrastructure, residential construction, and manufacturing activities across China, India, and Southeast Asian nations. The high demand for ceramics, tiles, and building materials creates substantial volume requirements for industrial-grade illite, solidifying APAC’s position both as a major consumer and a key processing hub for the mineral.

North America and Europe represent mature markets characterized by stringent quality standards and a high propensity for premium, high-value illite grades. In these regions, the demand is largely driven by the cosmetic and specialty filler industries. European regulations promoting sustainable and natural ingredients have accelerated the substitution of synthetic fillers with high-purity illite in skincare and personal hygiene products. North America, similarly, shows strong demand in the functional filler segment, where illite enhances performance characteristics in specialized polymer composites and sophisticated coatings. Growth rates are generally stable, driven by continuous innovation in end-product formulation rather than sheer volume expansion.

Latin America and the Middle East & Africa (MEA) are emerging markets offering significant future potential. Latin America’s growth is spurred by recovering construction sectors and developing cosmetic industries, while MEA exhibits potential tied to infrastructure projects and regional manufacturing expansion, particularly in the Arabian Gulf states. However, these regions often face challenges related to logistical costs and the lack of robust local processing capabilities, often relying on imports from APAC or Europe. Future growth in these regions will depend heavily on foreign investment in local processing facilities and enhanced trade agreements facilitating easier mineral importation.

- Asia Pacific (APAC): Dominates the market share due to massive consumption in the ceramics and building materials sectors, driven by rapid urbanization and industrialization in China and India. APAC is a key production and high-volume consumption region.

- North America: Focused on high-purity illite demand in premium cosmetic formulations and specialized functional filler applications (polymers, coatings), prioritizing quality and technological specifications over volume.

- Europe: Characterized by strong regulatory support for natural ingredients, driving robust adoption of cosmetic-grade illite. Significant market penetration in niche technical ceramics and specialized filtration applications.

- Latin America: Emerging market with increasing consumption in local construction projects and nascent growth in the regional personal care manufacturing sector.

- Middle East & Africa (MEA): Growth potential tied to large-scale infrastructure development projects and increasing reliance on imported specialty chemicals for localized manufacturing bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Illite Powder Market.- Imerys S.A.

- BASF SE

- Thiele Kaolin Company

- KaMin LLC

- Ashapura Group

- Quarzwerke GmbH

- Sibelco N.V.

- Wyon Chemical

- China Clay Corp.

- Lanco Group

- Mineral Technologies Inc.

- Zemex Minerals

- G&W Mineral Resources

- KC Minerals

- Unimin Corporation

- EICSA (Minerales)

- Kyshtym Clay JSC

- The Quartz Corp.

- R.T. Vanderbilt Holding Company, Inc.

- I-Minerals Inc.

Frequently Asked Questions

Analyze common user questions about the Illite Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of high-purity illite powder?

High-purity illite powder is predominantly utilized in the Cosmetics and Personal Care industry for formulating detoxifying face masks, foundations, and cleansers, owing to its superior absorption, high mineral content, and low impurity levels. It is also used in advanced technical ceramics and specialized functional fillers requiring precise chemical composition and particle size.

How does illite differ from other common clay minerals like kaolin or bentonite?

Illite is a non-swelling, non-expanding clay mineral belonging to the mica group, characterized by a fixed inter-layer potassium ion structure. Unlike bentonite, illite exhibits low cation exchange capacity (CEC) and minimal volume expansion upon hydration. Compared to kaolin, illite typically contains higher potassium levels, offering distinct fluxing properties essential for high-temperature applications like ceramics, and different textural properties favored in specific cosmetic formulations.

Which region dominates the global consumption of illite powder and why?

The Asia Pacific (APAC) region currently dominates the global consumption of illite powder. This dominance is driven primarily by the high volume demand from the regional ceramics manufacturing industry and the robust growth in the construction and building materials sectors, especially in fast-developing economies such as China and India where industrial output is significant.

What factors are driving the increased demand for cosmetic-grade illite?

The increased demand for cosmetic-grade illite is fueled by global consumer preference for natural, mineral-based, and 'clean label' ingredients in skincare and beauty products. Illite's inherent detoxifying, soothing, and absorbent qualities position it as a premium alternative to synthetic fillers, aligning perfectly with contemporary health and wellness trends in the personal care sector.

How do technological advancements influence the illite powder market pricing?

Technological advancements, particularly in micronization, purification, and surface modification techniques, directly increase the processing cost but significantly enhance the functional value of illite powder. This leads to premium pricing for high-specification grades (like 95% purity or nano-sized illite), while advancements in AI-driven process optimization aim to lower energy consumption and processing variability, potentially stabilizing or reducing costs for standard industrial grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager