Image Guided Surgery Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435899 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Image Guided Surgery Devices Market Size

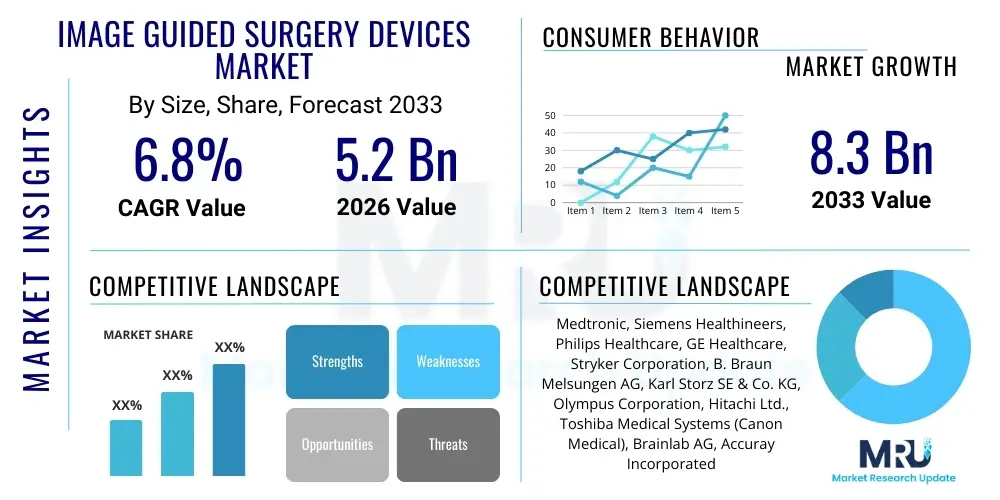

The Image Guided Surgery Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Image Guided Surgery Devices Market introduction

The Image Guided Surgery (IGS) Devices Market encompasses advanced medical technologies designed to provide real-time visualization and precise navigational tools during surgical procedures. These systems integrate various imaging modalities—such as CT, MRI, Ultrasound, and Fluoroscopy—with sophisticated tracking and planning software, enabling surgeons to perform minimally invasive procedures with unprecedented accuracy. The core product offering includes navigation systems, robotic-assisted surgical platforms, and specialized diagnostic imaging equipment optimized for intraoperative use. The complexity and precision offered by IGS are fundamentally transforming conventional surgery by minimizing tissue damage, reducing recovery times, and significantly enhancing patient outcomes, positioning these devices as foundational components in modern operating rooms globally.

Major applications of Image Guided Surgery span highly complex surgical domains, including neurosurgery for tumor resection and deep brain stimulation, orthopedic surgery for joint replacement and spinal fusion, cardiac surgery for valve repair and ablation procedures, and interventional oncology for targeted biopsy and tumor destruction. The primary benefits derived from the adoption of IGS devices include improved surgical trajectory planning, enhanced visualization of critical anatomical structures, and real-time verification of procedure completion, which collectively lead to lower complication rates and decreased need for revision surgeries. Furthermore, the inherent minimally invasive nature of IGS-assisted procedures contributes substantially to shorter hospital stays and quicker return to normal activities for patients.

The market is primarily driven by the escalating global incidence of chronic diseases, particularly cancer and cardiovascular disorders, which necessitate complex surgical interventions requiring high precision. Concurrently, technological advancements, including the integration of artificial intelligence (AI) for image processing and the development of high-resolution intraoperative imaging modalities, are continuously expanding the functional capabilities of IGS systems. Government and private sector investments in healthcare infrastructure modernization, particularly in emerging economies, coupled with increasing demand for minimally invasive procedures due to patient preference and clinical efficacy, further propel the sustained growth trajectory of the Image Guided Surgery Devices Market.

Image Guided Surgery Devices Market Executive Summary

The Image Guided Surgery Devices Market is undergoing rapid expansion, primarily fueled by substantial advancements in computational power and imaging technology, leading to the development of more intuitive and accurate surgical navigation platforms. Business trends indicate a strong move toward consolidated operating room solutions, where major device manufacturers are integrating multiple modalities (e.g., CT, robotic arms, tracking systems) into a single, seamless platform to enhance workflow efficiency and surgical capabilities. Strategic collaborations between technology firms, medical device manufacturers, and leading academic institutions are accelerating the pace of innovation, focusing on developing machine learning algorithms for automatic registration and segmentation, which are critical for enhancing surgical precision and reducing operative time. Furthermore, the increasing adoption of hybrid operating rooms globally represents a significant business opportunity, allowing for flexible configuration and use of various imaging systems during complex procedures, ensuring market resilience and sustained investment in research and development.

Regionally, North America maintains market dominance due to high healthcare expenditure, established reimbursement policies supporting advanced surgical interventions, and the early adoption of cutting-edge medical technologies. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive government investments in improving healthcare access, the rapid expansion of medical tourism, and a burgeoning patient population demanding advanced surgical solutions, particularly in countries like China, India, and Japan. European markets demonstrate stable growth, primarily focused on refining existing technologies and adhering to stringent regulatory standards concerning device efficacy and patient safety. Growth in Latin America and the Middle East & Africa (MEA) is accelerating, driven by the increasing establishment of high-quality specialty hospitals capable of performing advanced procedures.

Segmentation trends reveal that the neurosurgery segment holds the largest market share, attributed to the inherent complexity and precision required for brain and spinal cord procedures, making Image Guided Systems indispensable tools. The intraoperative CT and intraoperative MRI segments are experiencing robust growth, as these modalities offer superior soft tissue contrast and real-time feedback crucial for tumor resection verification. Meanwhile, the optical tracking systems segment is rapidly expanding due to their high accuracy, cost-effectiveness, and ease of integration into various surgical environments. The hospital end-user segment remains the primary revenue generator due to the high capital cost associated with IGS systems, though the adoption by Ambulatory Surgery Centers (ASCs) is steadily increasing, driven by the decentralization of elective surgical procedures and pressure to reduce healthcare costs.

AI Impact Analysis on Image Guided Surgery Devices Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Image Guided Surgery Devices Market frequently center on themes of automation, enhanced diagnostic capabilities, and the future role of the surgeon. Common questions explore how AI-driven image segmentation and registration can minimize human error during planning, whether machine learning algorithms can predict intraoperative shifts or complications, and the extent to which AI will personalize surgical workflows. Users are keen to understand the shift from purely navigational tools to truly intelligent systems that offer real-time cognitive assistance. The underlying concern revolves around integrating complex AI models safely and effectively within regulated clinical settings while ensuring that the data generated is secure and ethically managed. Overall expectations are high, anticipating that AI will significantly boost surgical efficiency, improve outcome predictability, and potentially lower overall procedure costs by optimizing resource utilization and reducing revision rates.

- AI enables highly precise, automated image segmentation, significantly accelerating pre-operative planning and reducing the manual burden on radiologists and surgeons.

- Machine learning models enhance intraoperative tracking accuracy by predicting and compensating for soft tissue deformation and anatomical shifts in real time.

- Deep learning algorithms assist in processing high-volume intraoperative imaging data (e.g., CT, MRI) to detect subtle pathological changes or verify complete tumor resection instantaneously.

- AI facilitates personalized surgical pathways by analyzing patient-specific data, optimizing device positioning, trajectory angles, and minimizing exposure to radiation or anesthetic risks.

- Robotic-assisted IGS systems leverage AI for autonomous or semi-autonomous execution of repetitive or high-precision micro-tasks, such as drilling or suturing, enhancing overall procedural efficiency.

- Predictive analytics tools, powered by AI, correlate intraoperative data with large surgical outcome databases, offering surgeons prognostic guidance and decision support during critical moments.

DRO & Impact Forces Of Image Guided Surgery Devices Market

The Image Guided Surgery (IGS) Devices Market is powerfully driven by the imperative for enhanced surgical precision and the global shift towards minimally invasive surgical techniques, positioning it for robust expansion. Key drivers include the escalating prevalence of target diseases such as cancer, neurological disorders, and severe orthopedic injuries requiring highly accurate intervention, alongside continuous technological miniaturization and integration that improves system portability and functionality. However, the market faces significant restraints, primarily stemming from the substantially high capital expenditure required for purchasing and installing IGS systems, which poses a barrier to adoption for smaller hospitals or facilities in developing regions, coupled with complex regulatory approval processes which can delay market entry for novel devices. The convergence of these forces creates a dynamic environment where investment in training, ensuring accessibility of advanced infrastructure, and demonstrating clear cost-benefit analysis become paramount for market penetration and sustained growth. The technological complexity also necessitates specialized training, which acts as a secondary restraint on rapid widespread adoption.

Opportunities in this highly specialized market are abundant, centered on the expansion of IGS into emerging surgical fields, notably in personalized medicine and intervention cardiology, where real-time navigation can dramatically improve outcomes. The development of portable, low-cost intraoperative imaging devices that can integrate seamlessly with existing surgical infrastructure presents a significant opportunity to penetrate untapped markets and smaller clinical settings. Furthermore, integrating augmented reality (AR) and virtual reality (VR) technologies with IGS platforms offers a pathway to superior training and enhanced visualization overlays for complex procedures, promising to reduce cognitive load on surgeons. These opportunities require substantial R&D investment but offer the potential for high returns by addressing critical unmet needs in surgical precision and accessibility. The shift towards outpatient surgery models also provides an opportunity for streamlined, faster IGS devices suitable for ASCs.

The impact forces currently shaping the IGS devices sector are strongly positive, primarily driven by technological momentum (T), high patient acceptance of minimally invasive procedures (P), and supportive reimbursement policies in key mature markets (E). The rapid convergence of imaging, robotics, and computational power acts as a multiplier effect, consistently pushing the boundaries of surgical feasibility. These forces ensure that investments in R&D remain high and that the replacement cycle for older, less sophisticated equipment accelerates. However, the regulatory environment (R) acts as a moderate dampener, requiring rigorous testing and clinical validation, ensuring that only highly reliable and safe devices reach the market. Overall, the market exhibits high inertia for growth, where the benefits of enhanced patient safety and improved surgical efficacy overwhelmingly outweigh the initial costs and implementation complexities, leading to sustained, predictable market expansion despite financial hurdles.

Segmentation Analysis

The Image Guided Surgery Devices Market is intricately segmented based on device type, clinical application, and end-user, reflecting the diverse requirements across various surgical disciplines and healthcare settings. Analysis across these segments is crucial for manufacturers to target investments and tailor product development strategies, ensuring devices meet the specific demands of specialized procedures. The dominant segmentation factor remains the device type, as technological innovation in imaging modalities dictates the utility and precision offered by the overall IGS system, with advancements in combined modalities gaining significant traction. Clinical application segmentation reveals areas of high investment (Neurosurgery, Orthopedics) versus emerging fields (Interventional Cardiology), while end-user dynamics dictate pricing strategies and service provision models, reflecting a nuanced balance between high capital cost requirements and demand for high-volume procedural throughput.

The market is characterized by intense competition across device types, where continuous improvement in image resolution, faster processing times, and enhanced navigational accuracy are key differentiators. The complexity of regulatory compliance varies significantly across modalities; for instance, introducing novel intraoperative CT devices requires extensive clinical trials compared to updates in basic optical tracking software. Furthermore, regional factors play a substantial role in segmentation performance, with high-end, complex systems (e.g., intraoperative MRI) finding greater penetration in developed economies with robust infrastructure, while simpler, modular systems see greater acceptance in cost-sensitive emerging markets. Understanding these segmentation drivers allows for targeted marketing and efficient resource allocation, maximizing return on investment for key market players.

- By Device:

- Endoscopes (Rigid and Flexible)

- Intraoperative Computed Tomography (CT)

- Intraoperative Magnetic Resonance Imaging (MRI)

- Ultrasound Systems

- Positron Emission Tomography (PET)

- Single-Photon Emission Computed Tomography (SPECT)

- X-ray Fluoroscopy/Angiography Systems

- Electromagnetic Tracking Systems

- Optical Tracking Systems (Active and Passive)

- By Application:

- Neurosurgery and Spine Surgery

- Orthopedic Surgery (Joint Reconstruction, Trauma)

- Cardiac Surgery and Vascular Procedures

- Oncology Surgery (Liver, Lung, Kidney)

- Gastroenterology

- Otolaryngology (ENT)

- Urology and Gynecology

- By End-User:

- Hospitals (Large-scale and Academic)

- Ambulatory Surgery Centers (ASCs)

- Specialty Clinics and Diagnostic Centers

Value Chain Analysis For Image Guided Surgery Devices Market

The value chain for the Image Guided Surgery Devices Market begins with upstream activities focused on highly specialized R&D, centered on core competencies such as advanced sensor technology (optical and electromagnetic), sophisticated image processing software development, and the manufacturing of high-resolution imaging components (e.g., high-field magnets for iMRI, dedicated CT scanners). Key upstream players include specialized component suppliers (optics, tracking sensors, high-performance computing units) and software firms providing proprietary algorithms for image registration and fusion. Significant capital investment is required at this stage due to the highly technical nature of the components and the lengthy regulatory pathways for medical devices. Efficiency in the upstream segment directly impacts the precision and reliability of the final surgical platform, making material sourcing and intellectual property protection critical factors.

The mid-stream segment involves the assembly, integration, and verification of complex IGS systems. Major device manufacturers acquire components and integrate them into coherent systems, often involving proprietary navigation software and robotic interfaces. Quality control and rigorous testing are paramount to ensure the system’s navigational accuracy meets stringent clinical standards. The complexity of integration requires highly skilled engineering teams. Following successful manufacturing, the downstream phase focuses on distribution, installation, post-sale service, and specialized clinical training for surgical teams. The distribution channel is often highly centralized due to the high-cost, high-complexity nature of the equipment, primarily utilizing direct sales forces and authorized, technically proficient distributors capable of providing rapid maintenance and software updates. Technical support and specialized clinical application training are integral parts of the downstream value proposition.

Distribution channels are heavily skewed toward direct engagement, particularly for high-value intraoperative imaging systems like iMRI and mobile CT scanners, facilitating detailed negotiations, installation logistics, and comprehensive service contracts directly with large hospital networks and academic centers. Indirect channels, involving third-party medical equipment distributors, are more commonly used for consumables, simpler tracking systems, or penetration into fragmented regional markets where localized support is crucial. The high average selling price of IGS devices necessitates strong financing and leasing options, which are often provided or facilitated by the original equipment manufacturer (OEM). The effectiveness of the value chain is measured by the speed of technology transfer from R&D to clinical deployment and the reliability of post-installation support, ensuring high uptime critical for continuous surgical workflow.

Image Guided Surgery Devices Market Potential Customers

The primary end-users and buyers of Image Guided Surgery devices are institutional entities requiring high-precision surgical capabilities, reflecting the significant capital investment and infrastructure necessary to support these advanced systems. Large academic and teaching hospitals represent the largest customer segment, driven by their engagement in complex, high-volume procedures, commitment to surgical innovation, and responsibility for training future surgical professionals. These institutions prioritize systems offering the broadest range of modalities and the highest level of integration, often serving as early adopters for novel technologies and acting as crucial validation sites for next-generation platforms. Their purchasing decisions are heavily influenced by clinical outcomes data, total cost of ownership, and comprehensive service agreements that guarantee maximum system availability.

Ambulatory Surgery Centers (ASCs) constitute a rapidly growing segment of potential customers, particularly those specializing in orthopedic, spine, and ENT procedures. As surgical procedures migrate from inpatient settings to outpatient centers, ASCs are increasingly investing in more streamlined, portable, and cost-effective IGS devices, such as optical or electromagnetic tracking systems optimized for specific, high-volume elective surgeries. ASCs prioritize systems that offer quick setup times, minimal footprint, and demonstrable efficiency gains to maintain high patient throughput and reduce operational expenses. Their purchasing calculus places a strong emphasis on return on investment (ROI) derived from reduced complication rates and enhanced procedural speed, focusing mainly on systems designed for minimally invasive approaches.

Specialty clinics, including advanced cancer treatment centers and dedicated neurosurgical institutes, represent another vital customer base. These specialized facilities require state-of-the-art imaging capabilities, such as dedicated PET or advanced robotic navigation systems, to perform highly specific, intricate interventions like targeted radiation delivery or biopsy procedures. Government and military hospitals also represent a consistent purchasing demographic, particularly valuing rugged, reliable IGS platforms capable of deployment in diverse environments or integrated into advanced trauma centers. Overall purchasing decisions across all segments are complex, involving multidisciplinary teams, and are heavily influenced by the availability of supportive infrastructure, surgeon familiarity, and favorable long-term financial models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Siemens Healthineers, Philips Healthcare, GE Healthcare, Stryker Corporation, B. Braun Melsungen AG, Karl Storz SE & Co. KG, Olympus Corporation, Hitachi Ltd., Toshiba Medical Systems (Canon Medical), Brainlab AG, Accuray Incorporated, Shimadzu Corporation, Hologic, Inc., Zimmer Biomet, Intuitive Surgical, Inc., ConMed Corporation, Dornier MedTech, XACT Robotics, NeuroLogica Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Image Guided Surgery Devices Market Key Technology Landscape

The technological landscape of the Image Guided Surgery Devices Market is defined by the integration of high-fidelity imaging with sophisticated navigational software and robotic platforms, aimed at maximizing surgical accuracy while minimizing procedural invasiveness. A cornerstone technology is the development of advanced tracking systems, encompassing both optical (camera-based systems using active or passive markers) and electromagnetic methods. Optical tracking systems offer high spatial accuracy and non-ferromagnetic environments but require a direct line of sight between the tracking camera and the surgical instrument, which can be challenging in crowded operating rooms. Conversely, electromagnetic systems provide continuous tracking without line-of-sight limitations but can be susceptible to interference from nearby metallic objects, requiring specific shielding measures and specialized instrumentation for optimization.

Another pivotal area of innovation lies in intraoperative imaging technology, particularly the evolution of specialized Mobile CT (mCT) and Intraoperative MRI (iMRI) units. These systems are designed to be moved directly into the sterile field or integrated into hybrid operating rooms, allowing surgeons to acquire updated, high-resolution images during the procedure, facilitating real-time assessment of resection margins or implant placement and immediately addressing intraoperative complications like brain shift. The convergence of these imaging modalities with surgical navigation relies heavily on robust image registration algorithms, which mathematically align pre-operative planning scans with real-time intraoperative data, demanding high computational power and specialized graphics processing units (GPUs) to maintain speed and accuracy essential for seamless surgical workflow integration. This technology is critical for minimizing the effect of tissue deformation that occurs post-incision.

Furthermore, the rapid incorporation of Augmented Reality (AR) and Mixed Reality (MR) visualization tools is reshaping the interaction between the surgeon and the image data. AR technology overlays critical anatomical information, such as tumor boundaries or planned trajectories, directly onto the patient's body or the surgeon's field of view via specialized glasses or head-mounted displays. This capability enhances depth perception and allows the surgeon to maintain focus on the operative site while simultaneously accessing critical navigational information, moving beyond traditional 2D monitor displays. Coupled with AI-driven analytics for real-time risk assessment and automated workflow adjustments, the technology landscape is rapidly shifting towards cognitive surgical assistants that not only guide but also intelligently augment human decision-making, promising significant leaps in surgical safety and efficacy.

Regional Highlights

- North America: This region holds the largest market share, driven by extensive healthcare infrastructure, significant R&D investment, and favorable reimbursement policies for advanced surgical technologies. The U.S. remains the central hub for innovation and adoption, particularly in neurosurgery and complex orthopedic procedures. High awareness of minimally invasive techniques among both providers and patients, coupled with the presence of major industry players and academic medical centers that champion IGS research, ensures continued market leadership. The mature market focuses on replacing legacy systems with AI-enabled and integrated hybrid operating room solutions.

- Europe: Characterized by stable, moderate growth, European market dynamics are heavily influenced by stringent regulatory standards (e.g., MDR compliance) and cost containment efforts by public health systems. Key adopting countries include Germany, the U.K., and France, where IGS is rapidly integrating into orthopedic and oncology workflows. The market emphasizes developing modular, interoperable systems that can be easily adopted across various hospital sizes while adhering to strict clinical safety and efficacy requirements imposed by national health services.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising disposable incomes, expanding medical tourism, and aggressive government initiatives aimed at upgrading public healthcare facilities in countries like China, India, and South Korea. While capital constraints exist, the sheer volume of the patient population needing complex surgery drives demand. Manufacturers are increasingly focusing on establishing local manufacturing and training centers to reduce costs and enhance regional market penetration, particularly for advanced tracking and C-arm fluoroscopy systems suitable for high-volume settings.

- Latin America: This region presents emerging opportunities, although market growth is hampered by fluctuating economic conditions and fragmented healthcare spending. Brazil and Mexico are leading the adoption, primarily driven by private hospital networks and specialized clinics seeking to match global standards in complex surgery, particularly spinal and neurosurgical interventions. The market entry strategy often focuses on cost-effective, refurbished, or simpler IGS solutions to overcome capital hurdles.

- Middle East and Africa (MEA): Growth in MEA is concentrated in Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which are investing heavily in world-class medical cities and specialist hospitals, making them prime targets for high-end IGS technologies like intraoperative MRI. The establishment of dedicated centers of excellence aims to reduce dependence on medical travel abroad. Conversely, adoption in Africa remains nascent, limited primarily to major urban centers and supported mostly through international aid and private sector initiatives focused on basic diagnostic imaging and tracking tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Image Guided Surgery Devices Market.- Medtronic

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Stryker Corporation

- B. Braun Melsungen AG

- Karl Storz SE & Co. KG

- Olympus Corporation

- Hitachi Ltd.

- Toshiba Medical Systems (Canon Medical)

- Brainlab AG

- Accuray Incorporated

- Shimadzu Corporation

- Hologic, Inc.

- Zimmer Biomet

- Intuitive Surgical, Inc.

- ConMed Corporation

- Dornier MedTech

- XACT Robotics

- NeuroLogica Corp.

Frequently Asked Questions

Analyze common user questions about the Image Guided Surgery Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Image Guided Surgery (IGS) market?

The primary driver is the increasing global prevalence of complex chronic diseases, such as cancer and cardiovascular disorders, demanding surgical interventions that require higher precision and minimally invasive approaches, which IGS devices facilitate through real-time visualization.

Which technology segment is expected to show the fastest growth rate in IGS devices?

Optical Tracking Systems and Intraoperative CT/MRI devices are expected to show robust growth. Optical tracking is preferred for its high accuracy and compatibility in various procedures, while intraoperative imaging provides critical real-time feedback, increasingly enhanced by AI integration.

What are the main financial restraints impacting the widespread adoption of IGS devices?

The primary financial restraints are the significantly high initial capital expenditure required for purchasing complex IGS systems and the ongoing costs associated with maintenance, specialized consumables, and the necessary infrastructure upgrades for installation.

How does Artificial Intelligence (AI) enhance the function of Image Guided Surgery systems?

AI enhances IGS systems by enabling rapid, accurate image segmentation and registration, compensating for anatomical shifts in real-time, and providing predictive analytics for complication assessment, thereby boosting surgical precision and efficiency.

Which geographical region dominates the Image Guided Surgery Devices Market in terms of revenue?

North America currently dominates the market due to its advanced healthcare infrastructure, high adoption rates of cutting-edge surgical technology, and favorable government and private payer reimbursement policies that support high-cost medical devices.

The global shift towards preventative medicine and the increasing elderly population contribute significantly to the sustained demand for IGS devices, necessitating accurate navigation during delicate procedures such as stent placement and cardiac ablations. The inherent complexity associated with spinal and cranial surgeries makes IGS systems indispensable, driving specialized segment growth. Furthermore, continuous investment by technology leaders in developing smaller, faster, and more integrated systems, often leveraging cloud computing for large data transfer and analysis, ensures that the functional capabilities of IGS platforms constantly improve, validating the high investment costs for healthcare providers. The integration of 5G connectivity is also beginning to facilitate remote guidance and telementoring, expanding the reach of expert surgeons.

Despite the high costs, the long-term economic benefits derived from IGS adoption—specifically, reduced length of hospital stay, lower readmission rates due to fewer surgical errors, and accelerated patient recovery—provide a strong economic justification, particularly within value-based healthcare models prevalent in mature markets. This economic argument is powerful and supports continued governmental and institutional investment in advanced surgical suites. Market competition remains intense, forcing manufacturers to innovate not only in hardware and software but also in service models, including leasing arrangements, pay-per-use agreements, and comprehensive training packages, addressing the financial barriers faced by medium-sized institutions and emerging market players.

A deep dive into the application segment reveals that Orthopedic Surgery holds a substantial market share, second only to Neurosurgery, driven by the increasing volume of total knee and hip replacement procedures performed globally, where robotic and navigational assistance is becoming the standard of care to ensure precise alignment and optimal long-term outcomes. Oncology surgery, covering interventions in the liver, lungs, and pancreas, is rapidly adopting IGS to ensure complete tumor excision while preserving maximum healthy tissue, often utilizing fusion imaging techniques combining MRI or PET with real-time ultrasound. The precision offered by IGS is critical here, directly correlating with survival rates and quality of life for cancer patients.

In terms of device segmentation, the X-ray Fluoroscopy segment, including advanced C-arm systems with 3D reconstruction capabilities, remains foundational due to its versatility, affordability relative to iMRI, and widespread use in interventional radiology, cardiac procedures, and orthopedic trauma care. However, the future growth is clearly demarcated by the integration capabilities of navigation systems, particularly those using advanced optical tracking, which are non-invasive and highly accurate, forming the backbone for most robotic surgical platforms. Manufacturers are continuously working on minimizing the device footprint and improving system mobility, ensuring that advanced visualization capabilities are available across diverse procedural settings, including catheterization labs and smaller operating rooms.

The competitive landscape is dominated by a few global conglomerates offering comprehensive portfolios that span imaging, navigation, and robotics, allowing them to provide turnkey solutions for hybrid operating rooms. These market leaders invest heavily in vertical integration and strategic acquisitions to incorporate specialized AI and tracking technologies developed by smaller, agile firms. Smaller, niche companies often focus on specialized components, such as high-definition endoscopes or proprietary registration software, and thrive by partnering with the larger entities. Intellectual property (IP) protection, especially surrounding core navigation algorithms and proprietary sensor designs, is a critical element of competitive advantage and market sustainability.

Regulatory scrutiny over IGS devices is intensifying globally, particularly concerning software as a medical device (SaMD) and cybersecurity protocols. As IGS systems become more interconnected—relying on hospital networks, cloud storage for patient data, and AI updates—ensuring the integrity and security of the patient data and the functional reliability of the software becomes a major regulatory hurdle. Compliance with global standards (e.g., FDA clearance, CE Mark) requires substantial investment in validation and post-market surveillance studies, emphasizing the necessity for rigorous testing before commercial deployment, thus influencing both product development timelines and subsequent market entry strategies across different geographical regions.

The impact of economic volatility, particularly in emerging markets, influences healthcare spending priorities, often leading to delayed capital investments in high-cost systems like IGS devices. However, the long-term demographic trends—specifically, population aging and the resultant rise in degenerative conditions requiring surgical correction—provide strong counter-cyclical resilience to the market. Furthermore, advancements in health technology assessment (HTA) methodologies are increasingly crucial, as market players must demonstrate not just clinical efficacy, but also superior cost-effectiveness compared to traditional surgery to secure favorable purchasing decisions from consolidated buying groups and governmental agencies, pushing the focus from technology alone to demonstrable patient value.

In the context of technology development, the trend toward open architecture platforms is gaining momentum. Historically, many IGS systems operated as closed ecosystems, limiting compatibility with third-party instruments or imaging devices. The shift towards open platforms allows hospitals greater flexibility in integrating IGS with their existing infrastructure and preferred surgical instruments, fostering a more competitive environment and potentially reducing the total cost of ownership. This openness is particularly appealing to large hospital systems that operate multiple brands of surgical equipment and prioritize standardization and interoperability across their clinical sites, influencing procurement decisions significantly towards vendors supporting open standards and robust application programming interfaces (APIs).

Education and training remain bottleneck factors. The successful integration of IGS devices requires specialized training not only for surgeons but also for operating room nurses, technicians, and biomedical engineers who manage the complex equipment. Manufacturers who offer comprehensive, immersive training programs, often utilizing VR/AR simulators, gain a significant competitive edge, as these tools help reduce the learning curve and accelerate surgeon proficiency, thereby maximizing the return on the hospital’s capital investment. The shortage of highly trained professionals capable of operating and maintaining these systems, particularly in less-developed regions, presents both a market challenge and a long-term service opportunity for key vendors to establish dedicated training academies globally.

The Image Guided Surgery Devices Market is intrinsically linked to the broader evolution of digital health ecosystems. Data captured by IGS devices—including intraoperative images, navigation logs, and procedural metrics—are increasingly being integrated into Electronic Health Records (EHRs) and large clinical databases. This integration facilitates big data analysis, contributing to quality improvement initiatives, surgical benchmarking, and the development of next-generation AI models. Ensuring seamless, secure data flow between the IGS system and the hospital's IT infrastructure is becoming a key purchase requirement, emphasizing the role of robust software solutions and cybersecurity compliance in market success and system adoption.

Considering the long-term strategic trajectory, the market is moving towards fully autonomous navigation systems, where the surgeon sets the parameters and the robotic-IGS system executes complex, micro-scale movements with superhuman precision, especially in fields like retinal surgery or cochlear implantation. While full autonomy is still years away, the iterative progress in sensor fusion, adaptive control systems, and machine learning ensures that each successive generation of IGS device offers more intelligent assistance and tighter integration with robotic execution. This technological pathway promises to fundamentally redefine the threshold of surgical feasibility, allowing for procedures currently deemed too risky or complex using conventional manual techniques, thereby creating substantial future market opportunity.

In the end-user segment, the expansion of Ambulatory Surgery Centers (ASCs) is compelling manufacturers to develop IGS solutions that are highly scalable, rapidly deployable, and require minimal dedicated space, contrasting with the often room-sized requirements of older iMRI or high-field CT systems. The economic pressure on ASCs to optimize turnover time means system reliability and rapid setup/calibration are prized features. This demand creates a favorable environment for simpler, highly accurate systems, such as advanced 3D ultrasound or streamlined optical tracking platforms, which can be quickly integrated and decommissioned between procedures without sacrificing the precision required for orthopedic or ENT procedures commonly performed in these outpatient settings.

Overall, the Image Guided Surgery Devices Market stands at the nexus of medical device innovation and digital transformation, propelled by clinical necessity, driven by technological leaps, and shaped by complex economic and regulatory forces. Success in this market is determined not just by the technological superiority of the device itself, but also by the vendor’s ability to offer comprehensive integration services, reliable post-sale support, and effective professional training, ensuring that the high potential of these life-saving technologies is fully realized in clinical practice worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager