Imaging Radar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434872 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Imaging Radar Market Size

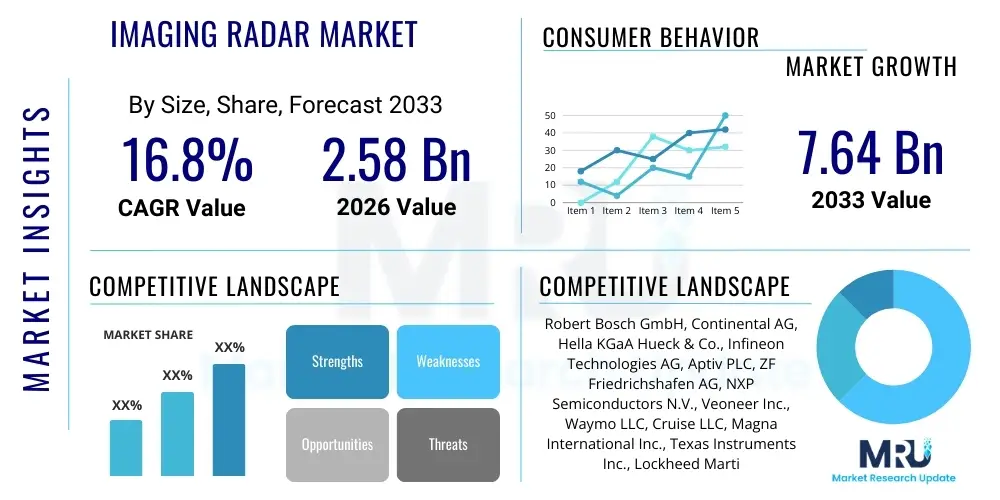

The Imaging Radar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2026 and 2033. The market is estimated at USD 2.58 Billion in 2026 and is projected to reach USD 7.64 Billion by the end of the forecast period in 2033.

Imaging Radar Market introduction

Imaging Radar represents a significant technological leap beyond traditional radar systems, offering high-resolution, dense point cloud data that rivals LiDAR (Light Detection and Ranging) systems but maintains superior performance in adverse weather conditions such as fog, heavy rain, or snow. Unlike conventional radar which provides coarse angular resolution and limited vertical information, imaging radar utilizes advanced techniques like Massive MIMO (Multiple-Input Multiple-Output) and synthetic aperture radar (SAR) principles, often operating in the 77 GHz and 79 GHz bands, to generate detailed 3D maps of the environment. This enhanced perception capability is critical for realizing Level 3 and Level 4 autonomous driving systems, providing robust object classification, tracking, and separation necessary for complex decision-making processes in vehicles.

The product is fundamentally defined by its ability to create images based on radar returns, moving beyond simple detection and ranging. Key components include advanced transceivers, sophisticated digital signal processors (DSPs), and highly integrated antenna arrays. Major applications span several high-growth sectors, primarily focusing on automotive safety and autonomy, but also extending into advanced surveillance systems, drone navigation, and industrial automation where precise, all-weather sensing is mandatory. The core benefit derived from deploying imaging radar is redundant and reliable perception, crucial for mission-critical systems where environmental interference cannot compromise safety or operational integrity.

Driving factors propelling this market include the global push toward fully autonomous vehicles (L4/L5), stringent regulatory requirements mandating advanced driver-assistance systems (ADAS) implementation, and continuous technological advancements leading to miniaturization and cost reduction of high-frequency components. Furthermore, the inherent resilience of radar technology compared to camera or LiDAR systems in inclement weather positions imaging radar as a necessary, foundational sensor modality. The integration capability of imaging radar with other sensors (sensor fusion) further enhances overall perception stacks, guaranteeing the necessary redundancy and performance required for widespread deployment across passenger and commercial transportation sectors.

Imaging Radar Market Executive Summary

The Imaging Radar Market is poised for accelerated expansion driven primarily by foundational shifts in the automotive and industrial sectors toward automated processes. Business trends indicate a strong move toward consolidation and strategic partnerships between traditional Tier 1 automotive suppliers, semiconductor manufacturers specializing in high-frequency chips (like SiGe and CMOS), and dedicated radar startup companies focused on proprietary algorithms and high-resolution techniques. Major manufacturers are prioritizing the development of 4D imaging radar—providing range, azimuth, elevation, and velocity data—which represents the industry benchmark for autonomous vehicle sensing. Furthermore, the market is characterized by increasing R&D investment aimed at overcoming processing bottlenecks associated with handling the massive data throughput generated by these high-resolution systems, leading to advancements in dedicated ASIC development for real-time processing.

Regionally, the market is bifurcated, with North America and Europe leading in research and early deployment, especially concerning regulatory approval for higher levels of vehicle autonomy. Asia Pacific, spearheaded by China and South Korea, is rapidly emerging as the largest consumption base, driven by aggressive domestic electric vehicle (EV) and autonomous vehicle development strategies and large-scale public infrastructure projects requiring advanced surveillance capabilities. Segment trends show that the 77 GHz frequency band dominates current market share due to its established regulatory framework and balance between resolution and range, but the 79 GHz band is gaining traction for ultra-high-resolution, short-range applications. The Automotive sector remains the primary end-user, though defense and industrial applications are demonstrating robust growth, signaling diversification in market adoption.

The overall market trajectory is defined by the convergence of software and hardware innovation. The competitive advantage is increasingly shifting from purely hardware specification (like the number of Tx/Rx channels) to the proprietary signal processing and machine learning algorithms utilized to reconstruct and interpret the radar data cloud. The challenge for market participants remains striking a balance between system performance, manufacturing scalability, and achieving a price point that facilitates mass-market adoption in mid-to-high-end vehicles. Successful market penetration hinges on achieving widespread acceptance of imaging radar as a primary, rather than supplementary, perception sensor, necessitating continuous improvement in resolution and reliability.

AI Impact Analysis on Imaging Radar Market

Common user questions regarding AI's impact on Imaging Radar center around how machine learning can transform raw radar data into actionable intelligence, specifically addressing concerns about real-time object classification reliability, predictive path planning, and the efficiency of processing the immense data volumes generated by 4D radar arrays. Users are keen to understand if AI can effectively mitigate false positives, improve the differentiation between closely spaced objects (like pedestrians near guardrails), and handle complex scenarios (e.g., cut-ins, sudden braking) more robustly than traditional signal processing methods. The primary expectation is that AI will unlock the true potential of imaging radar, shifting it from a high-resolution sensor to an intelligent decision-making input, fundamentally improving safety and paving the way for full autonomy.

AI, particularly through deep neural networks (DNNs) and advanced computer vision techniques adapted for point clouds, is fundamentally redefining the post-processing pipeline for imaging radar. Traditional radar processing relies on clustering and heuristics, which often struggle with complex scene interpretation and precise classification. By leveraging AI, raw radar tensors can be directly fed into algorithms trained on massive datasets, enabling highly accurate object classification (e.g., distinguishing a bicycle from a motorcycle) and semantic segmentation of the environment. This shift moves the system beyond merely detecting ‘a large object’ to precisely identifying ‘a truck moving at 60 mph in the adjacent lane,’ which is essential for safe autonomous operation.

Furthermore, AI is crucial for sensor fusion, where data from imaging radar must be seamlessly integrated and correlated with information from cameras and LiDAR. Machine learning models are employed to weigh the confidence levels of each sensor output in varying environmental conditions (e.g., prioritizing radar data in heavy fog) and generate a unified, high-fidelity environmental model. This fusion capability, powered by AI, ensures redundancy and integrity of the perception stack, significantly improving the overall safety and reliability of ADAS and autonomous driving systems (ADS). The future competitiveness of imaging radar providers will be heavily dependent on their proprietary AI algorithms for perception and decision-making.

- AI enhances real-time object classification and segmentation accuracy of radar point clouds.

- Deep learning models improve noise reduction and mitigate radar clutter, minimizing false positives.

- Machine learning algorithms are essential for efficient processing of high-throughput 4D radar data.

- AI-driven sensor fusion optimizes redundancy by intelligently integrating radar, camera, and LiDAR inputs.

- Predictive analysis using AI enables the radar system to forecast movement trajectories of detected objects.

DRO & Impact Forces Of Imaging Radar Market

The Imaging Radar Market is strongly influenced by a robust set of driving forces centered on the pursuit of higher safety standards and the realization of Level 4 autonomy, countered by significant technological restraints related to processing complexity and cost. Opportunities are abundant, primarily revolving around expanding application areas beyond standard automotive use cases into sophisticated defense systems and advanced traffic management solutions. The overall impact force is highly positive, driven by mandatory regulatory adoption of ADAS features like Automatic Emergency Braking (AEB) and the increasing consumer demand for safer, more feature-rich vehicles, ensuring sustained market investment and growth.

Key drivers include the imperative for all-weather, high-reliability sensing in autonomous systems, a performance gap that cameras and standard LiDAR struggle to fill completely. Regulations globally, particularly in North America and Europe, are tightening safety mandates, forcing OEMs to deploy advanced sensor suites that utilize imaging radar for enhanced long-range detection and tracking. However, the primary restraints involve the extremely high computational burden required to process the massive array data necessary for generating high-resolution images, necessitating expensive and complex dedicated hardware (ASICs). Furthermore, the lack of industry-wide standardization for imaging radar data formats and interfaces slightly impedes integration speed across different OEM platforms, posing a moderate challenge to rapid mass production scalability.

Opportunities reside in the potential for imaging radar to completely displace lower-resolution radar systems in both automotive and non-automotive sectors. Specifically, the emergence of advanced Frequency Modulated Continuous Wave (FMCW) imaging radar offers exceptional velocity resolution, opening new avenues in industrial robotics, logistics automation, and sophisticated perimeter surveillance systems where high-precision motion tracking is required. The impact forces show that regulatory pressure and technological maturation—especially the integration of CMOS technology to reduce chip costs—are acting as significant tailwinds, overriding initial cost concerns and positioning imaging radar as a core technology for future automated platforms. The market equilibrium is expected to tilt further toward growth as high-volume manufacturing starts driving down the per-unit cost significantly over the forecast period.

Segmentation Analysis

The Imaging Radar Market segmentation provides a granular view of its structure based on key differentiating factors such as the type of component utilized, the operating frequency band, the application area, and the range capability. Analyzing these segments helps stakeholders understand where technological investment is most concentrated and which end-use sectors are driving current and future demand. The Component segment, particularly the Transceiver and Processor categories, dictates the performance and cost metrics of the final product, showcasing intense competition among semiconductor providers. The Frequency Band split clearly illustrates the current industry preference for 77 GHz systems due to regulatory and performance maturity, while the Application segment confirms the Automotive sector's dominance, though other segments are rapidly gaining momentum.

The classification by Range—Short Range (SRR), Medium Range (MRR), and Long Range (LRR)—is crucial for system integrators, as different ranges fulfill specific ADAS functions (e.g., parking assist requires SRR, highway cruising requires LRR). The convergence of radar capabilities means many modern systems are evolving into LRR capable of simultaneously executing MRR and SRR tasks via sophisticated sensor arrays. This trend toward consolidated, higher-performance units impacts manufacturing strategies and dictates purchasing patterns across the OEM landscape. Understanding these segmentation dynamics is vital for market positioning and targeting specific technology investments necessary for future growth and competitive advantage.

- Component

- Transceiver Modules

- Antenna Modules

- Digital Signal Processors (DSPs)/ASICs

- Control Units

- Frequency Band

- 24 GHz (Legacy/Short Range)

- 77 GHz (Dominant/Long Range)

- 79 GHz (Emerging/Ultra-High Resolution)

- Application

- Automotive (ADAS and Autonomous Driving)

- Surveillance and Security

- Defense and Aerospace

- Industrial and Logistics

- Healthcare and Monitoring

- Range

- Short Range Radar (SRR)

- Medium Range Radar (MRR)

- Long Range Radar (LRR)

Value Chain Analysis For Imaging Radar Market

The value chain for the Imaging Radar Market is highly complex, beginning with upstream semiconductor and component manufacturing, extending through system integration and software development, and culminating in downstream deployment within vehicles or infrastructure. Upstream analysis highlights the critical reliance on specialized semiconductor foundries capable of producing high-performance, high-frequency chips, primarily utilizing Silicon Germanium (SiGe) or advanced CMOS processes for the transceiver components. These manufacturers hold significant leverage due to the high barrier to entry and specialized expertise required. Key activities in the upstream segment also include the development of proprietary antenna array designs and radar algorithms, which are often patented and differentiate core competitors.

Moving downstream, the chain involves Tier 1 automotive suppliers (like Bosch, Continental, Hella) or specialized defense contractors who integrate the radar chipsets, processors, and proprietary software into a functioning, calibrated sensor unit. This integration stage involves significant R&D for packaging, thermal management, and robust housing necessary for harsh operating environments. The distribution channel is predominantly indirect, utilizing established relationships where Tier 1 suppliers deliver integrated radar modules directly to Original Equipment Manufacturers (OEMs) in the automotive, defense, or industrial sectors. Direct sales often occur only for highly specialized, low-volume applications, such as dedicated defense projects or cutting-edge R&D platforms.

The crucial point in the downstream process is the integration and calibration of the imaging radar system within the final product’s perception stack, which involves complex sensor fusion software development tailored to specific vehicle architectures. The increasing sophistication of the radar data requires tighter collaboration between the chip manufacturers, the sensor integrators, and the end-user OEMs, blurring traditional boundaries. Control over proprietary software for interpreting the high-resolution point cloud is becoming the central value driver, often outweighing the value of the raw hardware components, reinforcing the market’s shift towards software-defined sensing solutions.

Imaging Radar Market Potential Customers

The primary and largest volume segment of potential customers for Imaging Radar technology lies within the global Automotive industry, specifically Original Equipment Manufacturers (OEMs) focused on producing passenger vehicles, commercial trucks, and specialized delivery platforms. These customers are the primary buyers, seeking reliable, high-resolution radar systems to implement mandatory ADAS features (such as adaptive cruise control, lane change assist, and emergency braking) and enable increasingly advanced levels of autonomous driving (L3, L4, and L5). Their purchasing decisions are driven by safety ratings, regulatory compliance, and the competitive advantage offered by superior autonomous capabilities.

A secondary, high-value customer base exists within the Defense and Aerospace sector. Government defense organizations, military contractors, and aerospace manufacturers require imaging radar for sophisticated applications, including ground surveillance, missile guidance systems, tactical drone navigation, and high-precision situational awareness in challenging operational environments. These customers demand extremely rugged, high-performance systems with stringent reliability and security certifications, typically procuring systems through direct contracts or specialized integration partners who can meet unique military specifications and requirements.

Beyond the automotive and defense giants, emerging potential customers include industrial automation firms, robotics manufacturers, and smart infrastructure providers. Industrial customers utilize imaging radar for safety monitoring in factory settings, precise navigation of autonomous guided vehicles (AGVs) in warehouses, and sophisticated machine control applications where dusty, smoky, or moist conditions prohibit reliance on visual sensors. Additionally, municipalities and transportation authorities are becoming customers for smart city applications, using imaging radar for advanced traffic monitoring, intersection safety, and infrastructure protection, valuing its all-weather performance capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.58 Billion |

| Market Forecast in 2033 | USD 7.64 Billion |

| Growth Rate | 16.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Hella KGaA Hueck & Co., Infineon Technologies AG, Aptiv PLC, ZF Friedrichshafen AG, NXP Semiconductors N.V., Veoneer Inc., Waymo LLC, Cruise LLC, Magna International Inc., Texas Instruments Inc., Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Israel Aerospace Industries (IAI), Metawave Corporation, Uhnder Inc., Vayyar Imaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Imaging Radar Market Key Technology Landscape

The technological landscape of the Imaging Radar Market is rapidly evolving, moving away from traditional pulsed radar to highly advanced Frequency Modulated Continuous Wave (FMCW) systems, which are foundational for 4D imaging capabilities. FMCW radar offers superior velocity resolution in addition to range and azimuth, which is vital for distinguishing static objects from moving targets and calculating precise speed vectors—a necessity for autonomous driving. The shift towards Massive MIMO (Multiple-Input Multiple-Output) arrays is the core enabler of high resolution. By utilizing large arrays of transmit and receive channels (e.g., 12T/16R or higher), the system can synthesize a much larger virtual antenna aperture, dramatically improving angular resolution and enabling the generation of dense point clouds that can delineate objects with high fidelity, minimizing the reliance on LiDAR for shape recognition.

A critical technological battleground is centered on the underlying semiconductor process. While Silicon Germanium (SiGe) has historically been dominant for high-frequency transceivers in the 77 GHz range, continuous advancements in Radio Frequency CMOS (RF-CMOS) technology are challenging this dominance. RF-CMOS offers significantly higher integration potential, allowing the entire radar system-on-chip (SoC), including digital processing and multiple transceiver channels, to be fabricated on a single, cost-effective silicon die. This advancement is crucial for meeting the stringent cost targets required for mass deployment in consumer vehicles, driving down the unit cost of imaging radar systems and increasing accessibility across lower-to-mid-range vehicle segments.

Furthermore, significant innovation is focused on enhancing the software and algorithmic layers, specifically Synthetic Aperture Radar (SAR) and advanced beamforming techniques. SAR principles, traditionally used in aerospace, are being adapted for automotive radar to achieve ultra-high angular resolution by integrating vehicle motion into the signal processing chain. Coupled with AI-driven point cloud processing and advanced interference mitigation algorithms—essential for ensuring performance when multiple radar units operate simultaneously in dense traffic—these software innovations are differentiating competitive offerings. The convergence of highly integrated hardware, high-performance computing (ASICs/DSPs), and sophisticated machine learning algorithms forms the central pillar of the modern imaging radar technological ecosystem.

Regional Highlights

Regional dynamics in the Imaging Radar Market are largely dictated by regulatory timelines for autonomous vehicle deployment and the concentration of major automotive and semiconductor manufacturing hubs. North America stands as a leader in terms of technological innovation and early commercial adoption, primarily driven by substantial investment in self-driving technology companies like Waymo and Cruise, and robust defense spending. The region is characterized by high consumer acceptance of ADAS technologies and a proactive regulatory environment supporting road testing of Level 3 and Level 4 vehicles, requiring extensive deployment of advanced sensing solutions like imaging radar.

Europe demonstrates high growth, fueled by stringent safety regulations imposed by organizations like Euro NCAP, which heavily incentivize the inclusion of sophisticated safety features requiring high-resolution radar (e.g., improved pedestrian and cyclist detection). Germany, in particular, hosts many of the world’s largest Tier 1 suppliers and premium automotive OEMs, positioning the region as a significant manufacturing and R&D powerhouse for automotive radar systems. European companies are leading the charge in developing high-performance 77 GHz and 79 GHz solutions compliant with the continent's specific regulatory and safety frameworks, driving market expansion.

Asia Pacific (APAC) represents the fastest-growing market, largely due to explosive growth in electric vehicle (EV) production and government support for smart mobility and autonomous infrastructure, particularly in China and South Korea. China is investing heavily in domestic autonomous driving solutions and V2X (Vehicle-to-Everything) communication, creating massive demand for reliable, cost-effective radar sensors. Furthermore, defense and surveillance applications in APAC contribute significantly, with countries like Japan and India prioritizing modernizing their defense systems with advanced sensing and monitoring capabilities, ensuring APAC's pivotal role in shaping future market consumption and volume scaling.

- North America: Leading in autonomous vehicle deployment and high-level R&D, focusing on long-range, high-resolution 4D radar for L4/L5 systems.

- Europe: Driven by strict Euro NCAP safety standards and the presence of major Tier 1 suppliers (Germany, France), emphasizing pedestrian protection and ADAS implementation.

- Asia Pacific (APAC): Highest volume growth region, spurred by vast EV manufacturing, government-backed smart city projects, and domestic technological leadership in China and South Korea.

- Latin America & MEA: Emerging markets showing gradual adoption, primarily focused on commercial fleet safety systems and foundational ADAS features, with slower uptake of premium imaging radar solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Imaging Radar Market.- Robert Bosch GmbH

- Continental AG

- Hella KGaA Hueck & Co.

- Infineon Technologies AG

- Aptiv PLC

- ZF Friedrichshafen AG

- NXP Semiconductors N.V.

- Veoneer Inc.

- Waymo LLC

- Cruise LLC

- Magna International Inc.

- Texas Instruments Inc.

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Israel Aerospace Industries (IAI)

- Metawave Corporation

- Uhnder Inc.

- Vayyar Imaging

- Arbe Robotics Ltd.

Frequently Asked Questions

Analyze common user questions about the Imaging Radar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is 4D Imaging Radar and how does it differ from traditional radar?

4D Imaging Radar systems provide four dimensions of data: range, azimuth (horizontal angle), elevation (vertical angle), and velocity. Unlike traditional 3D radar which lacks fine elevation information, 4D systems generate a dense, high-resolution point cloud, enabling precise object height measurement and superior environmental reconstruction essential for L3/L4 autonomous driving.

Why is 77 GHz the preferred frequency band for automotive imaging radar?

The 77 GHz frequency band is favored globally due to regulatory allocation (globally standardized by the ITU), its ability to offer a balance between long range detection (up to 200-300 meters) and high resolution, and reduced antenna size compared to lower frequency alternatives. This combination makes it ideal for long-range ADAS functions like Adaptive Cruise Control and highway autonomy.

How does the Imaging Radar Market address sensor interference and crosstalk?

Interference and crosstalk are mitigated through advanced technological strategies, primarily utilizing Frequency Modulated Continuous Wave (FMCW) techniques which employ complex chirp patterns and unique coding. Furthermore, sophisticated software algorithms, powered by signal processing and AI, analyze received signals to identify and filter out non-native radar returns, ensuring clear and reliable perception even in high-density traffic environments.

Will imaging radar replace LiDAR or cameras in autonomous vehicles?

Imaging radar is not expected to replace LiDAR or cameras but rather serve as a core component in a redundant, fused sensor suite. Radar provides robust, all-weather velocity data and range accuracy; LiDAR offers extremely high angular resolution and 3D geometric details; and cameras provide critical color and semantic information. Imaging radar’s high resolution bridges the performance gap, enhancing system redundancy and safety.

What are the primary restraints affecting the growth and mass adoption of imaging radar?

The primary restraints are the high complexity and cost associated with the processing hardware. Generating and analyzing the high-resolution data requires powerful, dedicated ASICs (Application-Specific Integrated Circuits) and digital signal processors (DSPs), which significantly increase the unit cost compared to standard radar. Scaling production while maintaining performance standards and reducing cost remains a crucial challenge for mass-market penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- 4D Imaging Radar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Imaging Radar Market Statistics 2025 Analysis By Application (Automotive, Aerospace & Defense, Industrial, Security & Surveillance, Traffic Monitoring and Management), By Type (Short-Range Radar (SSR), Mid-Range Radar and Long-Range Radar (MRR/LRR)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Imaging Radar Sensor Market Statistics 2025 Analysis By Application (Automotive, Aerospace & Defense, Industrial, Security & Surveillance, Traffic Monitoring and Management), By Type (Short-Range Radar (SSR), Mid-Range Radar and Long-Range Radar (MRR/LRR)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Through-Wall Imaging Radar Market Statistics 2025 Analysis By Application (Police & SWAT Units, Search & Rescue Team, Firefighters), By Type (Handheld Type, Tripod Mounted Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Imaging Radar Sensor Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Government, Industrial), By Application (Aerospace & Defense, Industrial, Secruity & Surveillance, Traffic Monitoring and Management), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager