Immunity Gummies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434065 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Immunity Gummies Market Size

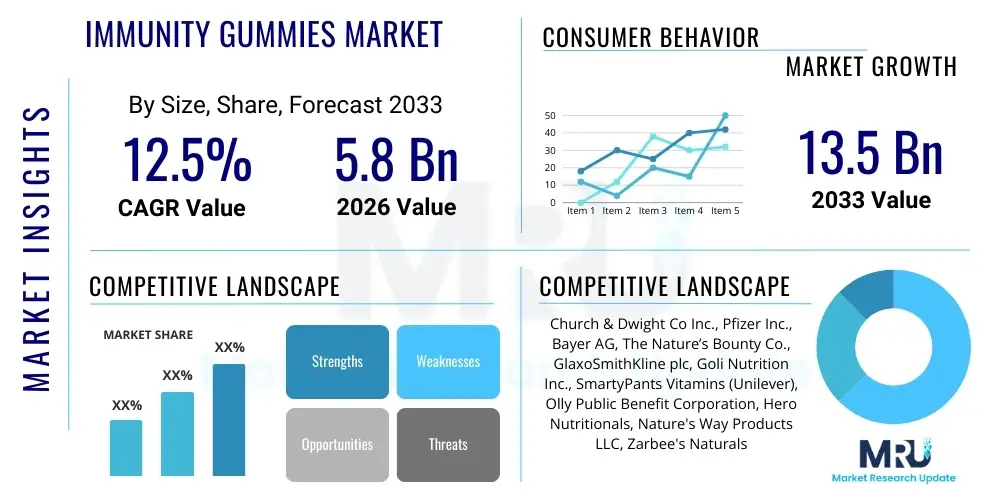

The Immunity Gummies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Immunity Gummies Market introduction

The global Immunity Gummies Market is defined by the production and distribution of nutraceutical products formulated as chewable, flavored confectionery items designed to enhance or support the body's natural immunological responses. This market segment has rapidly gained prominence, serving as a highly palatable alternative to conventional dietary supplements like tablets, capsules, and powders. The primary formulations integrate essential micronutrients, including Vitamin C, Vitamin D, and Zinc, alongside powerful botanical extracts such as Elderberry, often combined with complementary components like specialized prebiotics and probiotics aimed at optimizing gut-immune axis health. The strong consumer pivot towards preventive health maintenance, catalyzed globally by heightened awareness of infectious disease susceptibility, is the foundational driver establishing these gummies as a staple in daily wellness routines. Their intrinsic appeal lies in the convenience, ease of use, and superior flavor profiles, which significantly boost user adherence compared to traditional, often difficult-to-swallow pharmaceutical forms.

Product innovation in this market is intensely focused on achieving high efficacy without compromising the sensory experience. Advanced formulation science addresses the challenges of integrating sensitive active ingredients into a high-moisture, confectionery matrix. This requires sophisticated stabilization techniques, often leveraging complex encapsulation technologies to protect vitamins and fragile compounds from degradation during manufacturing and subsequent shelf life. Major applications extend beyond general daily immune support to include targeted solutions for specific demographics, such as high-potency formulations for active athletes or low-sugar, allergen-free options for children and individuals with metabolic concerns. Furthermore, the market benefits from functional convergence, where immunity blends are combined with ingredients addressing secondary concerns like improved sleep, enhanced cognition, or reduced stress, positioning the gummy format as a comprehensive wellness tool rather than just a single-function supplement. The ability to deliver multiple benefits in a single, enjoyable dose significantly differentiates immunity gummies from traditional single-vitamin supplements, further expanding their market utility and consumer base.

Market growth is intricately linked to macroeconomic trends, including increasing disposable income in developing nations and the pervasive influence of digital marketing on supplement purchasing decisions. The direct-to-consumer (DTC) model, facilitated by robust e-commerce infrastructure, allows emerging brands to rapidly gain market penetration by offering transparent product information and flexible subscription services. Key driving factors include the aging global population seeking age-appropriate immune support, the increasing prevalence of lifestyle-related nutritional deficiencies, and favorable regulatory shifts in certain jurisdictions that allow clearer communication of scientifically substantiated health benefits. The sustained consumer enthusiasm for easily consumable, effective nutritional support ensures that the immunity gummies segment remains one of the most dynamic and competitive spaces within the broader nutraceutical industry, necessitating continuous investment in both product science, supply chain resilience, and sophisticated consumer engagement strategies aligned with modern digital platforms.

Immunity Gummies Market Executive Summary

The Immunity Gummies Market is characterized by vigorous competition and rapid technological advancement, exhibiting strong double-digit growth potential across the forecast period. Strategically, leading companies are focusing on vertical integration to gain control over ingredient sourcing and supply chain security, essential for maintaining clean label status and traceability, which are paramount consumer requirements. Business trends highlight a strong emphasis on diversifying product lines to target specific health outcomes, moving beyond general immune support to include specialized products such as immune-boosting gummies tailored for digestive health (probiotic integration) or stress mitigation (adaptogens). Furthermore, mergers and acquisitions are frequent, allowing large pharmaceutical and wellness conglomerates to absorb niche, innovative brands known for specific delivery technologies or unique plant-based formulations, rapidly acquiring market share and intellectual property, thereby reshaping the competitive landscape towards large, multi-functional wellness portfolios.

Regional dynamics illustrate a significant shift in the global balance of power. While North America remains the dominant revenue driver due to its mature consumer base and high purchasing power, the epicenter of growth is undeniably moving towards the Asia Pacific region. Countries such as China, India, and Australia are witnessing escalating consumer expenditure on prophylactic health measures, driven by modernization and a rising middle class adopting Western health routines. This shift necessitates regional adaptation, requiring companies to tailor flavor profiles and ingredient sourcing to local preferences and regulatory standards. In contrast, European markets, although stable, demand stringent adherence to consumer protection and labeling regulations, fostering a market environment where scientific validation and clinical backing hold greater weight than aggressive marketing tactics, thereby favoring established companies with extensive research capabilities and rigorous quality assurance protocols.

Segmentation analysis underscores the market’s pivot towards premiumization and specialization. The plant-based segment, utilizing pectin instead of traditional gelatin, is experiencing disproportionately high growth, reflecting ethical consumer choices and the global shift towards vegan and vegetarian diets. Within distribution, the online channel is rapidly outpacing traditional retail. E-commerce platforms provide manufacturers with invaluable direct data on consumer behavior, enabling highly optimized, data-driven inventory management and personalized marketing campaigns. Trend analysis also confirms that the children’s immunity segment is a crucial growth accelerator, necessitating significant investment in developing palatable, sugar-reduced, and non-allergenic formulations that meet the strict criteria of discerning parents. Overall, the market's trajectory is defined by the intersection of consumer desire for convenient prevention and the industry's ability to deliver scientifically sound, ethically sourced, and sensorially appealing products through advanced manufacturing and distribution technologies.

AI Impact Analysis on Immunity Gummies Market

User inquiries concerning AI's role in the Immunity Gummies Market primarily focus on its capability to drive personalization and optimize the highly complex supply chains managing temperature-sensitive ingredients. Consumers frequently ask if AI-powered diagnostics could eventually lead to custom gummy formulations based on individual microbiome data or genetic markers, moving the market towards true precision nutrition. There is also considerable interest regarding how AI algorithms can ensure ingredient traceability and regulatory compliance across diverse international markets, mitigating risks associated with contamination or mislabeling. Key expectations include AI's utility in predicting flavor preferences for emerging markets and identifying potential ingredient interactions that could compromise stability or efficacy, areas where traditional R&D methods are often slow and resource-intensive, highlighting user demand for greater scientific precision and customized health solutions delivered through an accessible format.

Artificial Intelligence is profoundly influencing the entire product lifecycle, starting with the discovery and formulation phases. Machine Learning (ML) models are trained on massive chemical and biological datasets to rapidly screen thousands of potential immune-modulating compounds, significantly speeding up the identification of bioavailable and synergistic ingredient combinations suitable for gummy delivery. This allows manufacturers to quickly validate new claims, such as the efficacy of specific adaptogens or novel probiotic strains, thereby accelerating the pace of innovation. Furthermore, AI-driven process optimization tools are being integrated into manufacturing lines. These tools monitor critical variables—temperature, humidity, mixing time—in real-time, adjusting parameters automatically to ensure product uniformity and maximize the preservation of heat-sensitive components, thereby drastically reducing batch-to-batch variability and minimizing costly material waste. This predictive manufacturing capability is crucial for scaling complex, multi-ingredient formulations effectively.

Beyond the manufacturing floor, AI is revolutionizing market strategy and consumer interaction. Through deep learning analysis of vast unstructured data—social media sentiment, clinical trial results, and point-of-sale data—AI algorithms generate highly accurate demand forecasts, allowing companies to strategically scale production and inventory months in advance of seasonal fluctuations. This level of predictive accuracy is vital for maintaining freshness and reducing operational costs. In marketing, AI enables micro-segmentation, delivering personalized content that speaks directly to specific consumer needs, such as targeting new parents with content on pediatric immune support or older adults with information on high-dose Vitamin D formulations. This shift towards data-driven personalization improves conversion rates and enhances customer lifetime value, establishing AI as a core competitive differentiator in a crowded marketplace by providing consumers with hyper-relevant product choices and education.

- AI facilitates precision formulation based on demographic and efficacy data, accelerating R&D cycles. By simulating millions of ingredient interactions, AI identifies the optimal protective matrix and minimizes off-flavor profiles, particularly when incorporating potent botanicals.

- Machine learning optimizes cold chain logistics and inventory management for sensitive ingredients like probiotics, predicting ideal shipping routes and identifying risks of temperature excursions that could compromise product potency.

- Predictive analytics enhance demand forecasting, minimizing waste and preventing stockouts during seasonal peaks, allowing for dynamic adjustments to raw material procurement based on real-time epidemiological trends and public health data, ensuring supply chain resilience.

- AI-powered genomics and bioinformatics identify and validate novel, highly effective immune-boosting compounds, integrating data from traditional medicine databases with modern bioavailability studies to unlock new functional ingredients that meet efficacy and safety standards.

- Natural Language Processing (NLP) tools personalize consumer support and product recommendation through sophisticated chatbots, handling complex queries about dietary restrictions, ingredient sourcing, and specific allergen information with high accuracy and availability.

- Computer vision systems improve manufacturing quality control, ensuring uniformity and minimizing batch deviations by automatically detecting imperfections in shape, coating thickness, and color consistency, critical for brand perception and dosing accuracy in the consumer-facing product.

- AI assists in maintaining regulatory compliance by constantly monitoring changes in labeling laws across different jurisdictions, flagging potential conflicts in ingredient lists or health claim language before products reach the market, significantly reducing legal risks for global distribution.

DRO & Impact Forces Of Immunity Gummies Market

The trajectory of the Immunity Gummies Market is substantially determined by the interplay of key market drivers, significant inherent restraints, and compelling strategic opportunities, all molded by external macro-environmental forces. The primary engine of growth remains the pervasive shift in consumer philosophy towards proactive, rather than reactive, health management, coupled with the proven efficacy of the gummy format in overcoming compliance barriers associated with traditional supplements. This driver is amplified by global health crises which invariably heighten public anxiety regarding immune resilience, leading to sustained increases in prophylactic spending. Conversely, the market faces structural impediments related to formulation challenges, specifically managing the high sugar content often required for flavor, which presents a cognitive dissonance for health-conscious consumers. Furthermore, the fragmented and often ambiguous global regulatory environment regarding claims and dosage introduces operational complexity and risk for international brands, serving as a material restraint on seamless market expansion, compelling firms to prioritize compliance and transparency.

Drivers Detailed: The fundamental adoption driver is consumer desire for convenience and palatability, which transforms daily supplementation from a chore into an enjoyable ritual. This psychological advantage translates directly into high user retention and consistent purchase behavior. Furthermore, rising chronic disease rates and environmental stress have amplified the perceived need for continuous immune support, accelerating market penetration across all age groups. Significant investment in clinical research validating the efficacy of key ingredients, such as specialized beta-glucans and liposomal Vitamin C, provides crucial marketing evidence, bolstering consumer trust and differentiating premium products from lower-tier alternatives. The increasing focus on pediatric nutrition, with parental willingness to invest in supplements that guarantee compliance, is also a powerful long-term growth catalyst, pushing demand for innovative, zero-sugar, or naturally sweetened children’s formulations, supported by strong direct-to-consumer educational campaigns emphasizing safety and efficacy.

Restraints Detailed: Regulatory uncertainty presents a critical barrier; for instance, the European Food Safety Authority (EFSA) maintains strict criteria for approving health claims, often leading to restricted marketing language which curtails competitive differentiation and requires significant legal review time. Technically, the constraint of ingredient stability, particularly for highly volatile compounds like Omega-3 fatty acids sometimes included in immunity blends, necessitates expensive stabilization technologies that inflate production costs and lengthen development cycles. A major consumer restraint is the potential for overconsumption due to the product's appealing confectionery nature, posing risks of hypervitaminosis, which requires manufacturers to invest heavily in child-proof packaging and clear, prominent dosage warnings, adding to overall cost and manufacturing complexity. The high cost of high-quality, plant-based gelling agents compared to conventional gelatin also restrains wider adoption in price-sensitive markets.

Opportunities Detailed: Significant market opportunities lie in product differentiation, specifically through functional stacking—combining immune support with other benefits like sleep aid (melatonin), stress relief (CBD/Adaptogens), or beauty enhancement (collagen). Expanding into medical nutrition, developing gummies suitable for individuals with chronic conditions or specific absorption issues, presents a high-value niche. Geographically, untapped potential remains high in developing countries where the organized retail sector is rapidly expanding, and where awareness of specific micronutrient deficiencies is increasing, creating a fertile ground for market entry through localized product offerings tailored to indigenous dietary requirements. Furthermore, leveraging sustainable and circular economy practices in packaging (biodegradable or recycled materials) presents a substantial competitive advantage, resonating strongly with environmentally conscious consumers and creating brand loyalty that transcends mere product efficacy, positioning the brand as socially responsible.

Segmentation Analysis

The Immunity Gummies Market is meticulously segmented based on ingredient type, source, end-user, and distribution channel, providing a granular view of consumer preferences and market dynamics. This detailed segmentation is crucial for manufacturers to tailor their product offerings, marketing strategies, and geographical focus. The predominant ingredient types include essential micronutrients like Vitamins C and D, and botanical extracts such as Elderberry, which remains highly sought after for its perceived antiviral properties. Source segmentation differentiates between animal-based gelatin gummies and plant-based pectin or agar options, responding to the growing demand for vegan and vegetarian-friendly products. Understanding these segments reveals clear trends towards clean label formulations and functional diversification beyond basic immune support, with a notable move towards ingredients providing clinically demonstrated synergistic effects.

Analysis of the end-user segments indicates a robust foundation in the adult population, which prioritizes preventive health spending and complex multi-vitamin formulations, contrasted by the high-growth potential within the pediatric segment, where product compliance is heavily influenced by flavor, texture, and the absence of artificial additives. Furthermore, the distribution channel analysis highlights the increasing role of e-commerce, driven by convenience and the ability to offer subscription models, although traditional brick-and-mortar stores, particularly specialty pharmacies, remain vital for consumer validation, trust-building, and immediate purchase fulfillment. These segments do not operate in isolation; for instance, the demand for natural source gummies is intrinsically linked to the preferences of the adult end-user shopping primarily through online, specialized retailers, demonstrating the interconnected nature of market growth vectors and requiring sophisticated omnichannel strategies.

Strategic success within the immunity gummies market hinges upon the ability to identify and capitalize on underserved niche segments. Examples include the development of personalized nutritional stacks, utilizing consumer health data to formulate custom gummy regimens via direct-to-consumer models, or focusing exclusively on high-potency formulations aimed at athletes or individuals with compromised immune systems requiring clinical-grade ingredients. As the market matures, the competitive advantage will shift from mass-market production to hyper-specialization, leveraging advanced encapsulation and stabilization techniques to deliver complex, high-efficacy ingredient combinations without sacrificing the desirable gummy mouthfeel and shelf stability expected by the sophisticated modern consumer, demanding continuous technological refinement and regulatory foresight.

- By Ingredient Type:

- Vitamins (Vitamin C, Vitamin D, Vitamin B complex, Vitamin A, Vitamin E)

- Minerals (Zinc, Selenium, Magnesium, Iron)

- Botanical Extracts (Elderberry, Turmeric, Ginger, Echinacea, specific mushroom extracts like Reishi and Shiitake)

- Specialized Functional Components (Probiotics, Prebiotics, Omega Fatty Acids, L-Lysine)

- Others (Adaptogens like Ashwagandha, Coenzyme Q10, amino acids, specific antioxidant blends)

- By Source:

- Plant-based (Pectin, Agar-Agar, Carrageenan) - High growth rate driven by vegan and clean-label trends, requiring precise pH and temperature control during manufacturing.

- Animal-based (Gelatin) - Economical and widely used, provides excellent texture but is restrictive for ethical consumer groups.

- By End-User:

- Adults (The largest revenue segment, focused on high-efficacy and multi-functional products often purchased via subscriptions)

- Children (High growth segment, focused on low-sugar and high-compliance, non-allergenic formulations that appeal to parents)

- Senior Citizens (Niche segment requiring high bioavailability and easy-to-digest formats, often targeted through medical channels)

- By Distribution Channel:

- Offline (Pharmacies and Drug Stores, Supermarkets/Hypermarkets, Convenience Stores, Specialty Retailers - accounts for immediate and impulse purchases)

- Online (E-commerce portals - Amazon, Alibaba; Company-owned websites - Direct-to-Consumer (DTC) sales offering personalization and recurring revenue models)

Value Chain Analysis For Immunity Gummies Market

The foundational stage of the Immunity Gummies Market value chain involves the Upstream activities centered on meticulous raw material procurement and preparation. This includes sourcing high-purity Vitamins, minerals, and complex botanical extracts, many of which are commodity-traded yet require specific certification (e.g., organic, non-GMO, Halal/Kosher). Crucially, the procurement of gelling agents (pectin, gelatin) and natural sweeteners demands long-term contracts to ensure price stability and consistent quality. Given the global nature of ingredient sourcing, robust vendor management and multi-tiered quality verification are essential to mitigate risks associated with adulteration or heavy metal contamination, a significant concern in the nutraceutical space. Companies increasingly invest in blockchain technology to provide end-to-end traceability of key ingredients, thereby satisfying both consumer transparency demands and stringent regulatory requirements across diverse international markets, building foundational consumer trust.

The transformation phase, or Midstream activities, represents the core manufacturing process. This complex stage merges pharmaceutical precision with confectionery arts. Key processes include ingredient dosing, high-shear mixing, cooking to gelatinization point (requiring fine temperature and pH control, especially for pectin), molding, cooling, and the application of a final protective/anti-stick coating. Unlike simple pill manufacturing, gummy production is prone to issues like retrogradation, sugar crystallization, and ingredient settling, which can compromise dosage accuracy. Therefore, heavy capital expenditure is dedicated to specialized equipment, including high-precision depositing machines and climate-controlled drying tunnels. Quality control at this stage uses sophisticated sensory analysis (texture, mouthfeel, flavor) alongside analytical chemistry, such as High-Performance Liquid Chromatography (HPLC), to confirm the final product potency and stability against environmental factors, ensuring strict adherence to GMP standards.

The Downstream value chain focuses on market access and sales, primarily segmented into logistics, distribution, and marketing. Logistics involve careful inventory management, often requiring climate-controlled storage and transit to prevent gummies from melting or fusing, particularly critical when shipping to hot climates like the Middle East or Southeast Asia. Distribution channels are optimized for rapid turnover; indirect sales leverage the vast scale of hypermarkets and pharmacy chains, while direct (DTC) sales via e-commerce utilize targeted digital marketing and subscription models to build recurring revenue. Effective marketing focuses heavily on educational content regarding immune health and product efficacy, often employing SEO and AEO strategies to capture high-intent searches. Vertical integration into distribution or establishing exclusive distribution partnerships provides significant competitive leverage by ensuring efficient shelf placement, rapid market saturation in key geographic areas, and superior brand control throughout the final consumer interaction.

Immunity Gummies Market Potential Customers

The primary customer segment, constituting the largest revenue stream, is the Health-Conscious Adult (Ages 25-55) driven by proactive wellness goals and preventative maintenance. These individuals are typically well-educated, have sufficient disposable income, and are characterized by high digital engagement, actively seeking scientific validation (clinical studies, third-party certifications) for their supplement choices. They view immunity gummies as a lifestyle enhancement, valuing multi-functional formulations that also offer benefits like stress reduction or energy boost. They are highly responsive to convenience, often preferring online subscription models for automatic replenishment and brand messaging emphasizing natural, sustainable, and high-quality ingredient sourcing, such as non-GMO and organic certifications, making them key targets for premium product lines and functional stacking innovations.

The secondary, yet high-growth, segment comprises Parents of Young Children (Ages 3-12). This group's purchasing decision is centered around compliance, safety, and nutritional integrity. Parents are highly motivated to ensure their children receive adequate micronutrients, especially during school seasons when exposure to common illnesses increases. Key purchasing criteria for this demographic include formulations with demonstrably low or zero sugar content (using substitutes like xylitol or monk fruit), the exclusion of artificial colors and flavors, and verifiable allergen-free status (e.g., gluten and dairy free). Marketing outreach must prioritize trust building, often relying on endorsements from pediatricians, transparent labeling, and high-impact social media content that addresses common parenting concerns regarding picky eating and daily nutritional gaps, as parental confidence is paramount in this sector.

A significant niche customer group includes the Nutritionally Challenged or Medication-Fatigued Populations, spanning senior citizens, individuals with chronic conditions (e.g., celiac disease, malabsorption issues), or those experiencing physical difficulty swallowing tablets (dysphagia). For this population, the ease of ingestion offered by gummies is medically beneficial, often making it the only viable supplement delivery format. This segment demands specialized formulations, such as those with enhanced bioavailability technologies (liposomal delivery) and reduced complexity, focusing purely on essential, high-impact nutrients. This group is highly sensitive to product consistency and purity. Distribution to this group often involves collaboration with gerontologists, specialized healthcare providers, and pharmacy benefit managers, necessitating pharmaceutical-grade quality control and clearly communicated usage instructions specifically tailored for complex health needs and reduced mobility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Church & Dwight Co Inc., Pfizer Inc., Bayer AG, The Nature’s Bounty Co., GlaxoSmithKline plc, Goli Nutrition Inc., SmartyPants Vitamins (Unilever), Olly Public Benefit Corporation, Hero Nutritionals, Nature's Way Products LLC, Zarbee's Naturals (Johnson & Johnson), Sundown Naturals, Vitafusion, Garden of Life, ZOI Research, Jamieson Wellness Inc., Nutrafor, Rainbow Light Nutritional Systems, Nature Made, Life Extension, Webber Naturals, L'il Critters, Sisu Vitamins, Nordic Naturals, Himalaya Wellness, and Blackmores Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Immunity Gummies Market Key Technology Landscape

The successful commercialization of immunity gummies is critically dependent on sophisticated technologies that bridge the gap between confectionery science and nutraceutical requirements, primarily addressing the inherent incompatibility between heat-sensitive ingredients and high-moisture processing environments. The cornerstone innovation is advanced microencapsulation. This technology utilizes spray drying, fluid-bed coating, or extrusion techniques to create microscopic barriers around fragile compounds—such as Vitamin D, probiotics, and certain antioxidants—using food-grade polymers or lipids. This protective shell prevents chemical degradation during the high-temperature cooking phases of gummy manufacturing, shields the active component from adverse pH conditions in the stomach, and often facilitates sustained or targeted release, maximizing bioavailability and guaranteeing the label potency of the final product throughout its designated shelf life under varying environmental conditions.

Flavor and sensory management represents another technological frontier. Natural botanical ingredients frequently possess intense, bitter, or astringent notes (e.g., turmeric or certain B vitamins) that must be effectively neutralized to ensure palatability and, consequently, high user compliance. Manufacturers leverage proprietary flavor masking systems that employ volatile flavor components and synergistic combinations of high-intensity natural sweeteners (e.g., Stevia, Thaumatin, or allulose) combined with specific organic acids to balance the pH and sweetness profile, delivering an appealing mouthfeel without the adverse health implications of high conventional sugar content. This requires meticulous rheological control to achieve the desired chewiness and hardness, often through precise adjustments to the pectin/sugar ratio and the incorporation of hydrocolloids that stabilize the texture against heat and moisture migration during packaging and storage, crucial for product integrity in long supply chains.

Furthermore, the industry is increasingly adopting Continuous Manufacturing (CM) systems over traditional batch processing. CM integrates all production steps—from raw material feeding to final packaging—into a single, automated, and tightly monitored sequence. This technological shift significantly enhances efficiency, allowing for rapid changeovers between different formulations and reducing the physical footprint of the production line. Crucially, CM systems are inherently linked to Process Analytical Technology (PAT), which utilizes real-time sensors (like NIR or Raman spectroscopy) to monitor ingredient homogeneity and product quality instantaneously. This integrated monitoring system ensures that any drift from quality specifications is immediately corrected, minimizing waste, guaranteeing the stability of dosage, and providing robust, auditable data trails necessary for stringent regulatory compliance in global pharmaceutical and nutraceutical markets, thereby underpinning the ability to scale globally with consistent quality.

Regional Highlights

North America maintains its stronghold in the Immunity Gummies Market, primarily due to the deeply entrenched supplement consumption culture in the United States, where preventative health spending per capita is among the highest globally. The market dynamism here is characterized by consumer demand for rapid innovation, leading to quick adoption of cutting-edge formulations such as multi-functional gummies incorporating adaptogens (like Ashwagandha) or specialized mushroom extracts for cognitive and immune synergy. Distribution is highly optimized through sophisticated third-party logistics and seamless integration across major e-commerce platforms like Amazon and direct-to-consumer websites, facilitating immediate market access. High consumer awareness regarding specific micronutrient deficiencies (e.g., Vitamin D) further fuels demand, resulting in a mature and highly competitive landscape where brand trust, scientific validation, and appealing packaging are essential differentiators, compelling manufacturers to focus on premium, science-backed product lines.

Europe presents a scenario of slower but exceptionally stable growth, mandated by the rigorous regulatory oversight from bodies like the EFSA, which ensures high product quality and consumer trust. The European market, especially Germany, the UK, and the Nordics, demonstrates a strong preference for ethical consumption, driving high demand for plant-based (pectin) and certified organic immunity gummies, often requiring specific certifications like EU Organic and rigorous non-GMO labeling. European brands tend to focus heavily on clinical substantiation for even modest health claims, leading to a market that favors scientifically backed formulations over purely trend-driven products. Market penetration requires substantial investment in regulatory affairs to navigate the varied national labeling and compositional standards within the Union, making localized compliance an unavoidable strategic necessity for market entrants, particularly concerning permissible dosage limits and health claim language.

The Asia Pacific (APAC) region is indisputably the key growth engine, projected to surpass all other regions in expansion velocity. This surge is predicated on massive demographic shifts, including the rapid expansion of the middle class in China and India, coupled with increasing exposure to Western wellness trends via digital media. In countries like South Korea and Japan, existing high levels of health awareness drive demand for highly specialized, often technologically sophisticated, formulations focusing on specific demographic needs or functional blends often integrating traditional medicinal herbs into modern gummy formats. However, the region’s fragmented retail infrastructure and vast logistical challenges across diverse geographies necessitate localized manufacturing hubs and partnerships with powerful regional distributors capable of managing varied cultural consumer preferences and complex import regulations, requiring agile and culturally sensitive marketing strategies.

Latin America (LATAM) shows promising initial signs of rapid growth, particularly in major economies like Brazil and Mexico. Market growth is strongly correlated with rising urbanization rates and increasing discretionary spending. The adoption of immunity gummies is driven by the format’s convenience, appealing particularly to busy urban populations seeking hassle-free health solutions. Price sensitivity remains a substantial factor; hence, mass-market formulations focusing on core, cost-effective ingredients like Vitamin C and Zinc dominate the retail landscape, relying on high volume rather than premium pricing. The Middle East and Africa (MEA) market offers highly specific opportunities, primarily focused on the wealthy GCC nations (UAE, Saudi Arabia). Consumption here leans towards premium, imported, highly certified products, with Halal certification being a mandatory prerequisite for market access, significantly narrowing the list of eligible manufacturers and dictating specific sourcing and processing methods, demanding targeted investment in high-end retail and pharmacy channels within affluent urban hubs.

- North America (Dominant Market): High consumer awareness, established supplement market, and high disposable income drive market leadership. Focus on rapid innovation, personalized nutrition, and sophisticated e-commerce fulfillment systems. Highly competitive landscape demanding constant product differentiation through functional synergy and clean-label commitment.

- Asia Pacific (Fastest Growth): Fueled by urbanization, rising health consciousness, and massive market size in China and India. Growth requires adaptation to local flavors, managing diverse regulatory environments, and investing in localized manufacturing/distribution infrastructure. Strong emerging demand for natural and traditional ingredient blends combined with modern dosage forms.

- Europe (Stable and Highly Regulated): Strong preference for natural, organic, and vegan certified products. Growth is highly contingent on meeting stringent EU regulations (EFSA health claims), resulting in slower product cycles but higher consumer trust in verified efficacy. Key markets include Germany, UK, and Nordics focusing on sustainability.

- Latin America (Emerging Potential): Increasing adoption in urban centers (Brazil, Mexico) due to convenience and lifestyle changes. Price sensitivity dictates market strategy, favoring cost-effective, high-volume formulations utilizing core vitamins and minerals. Growth is dependent on expanding organized retail presence and improving economic stability across major nations.

- Middle East & Africa (Niche Opportunity): Growth focused on GCC countries prioritizing premium, clinically backed supplements. Halal certification is mandatory. Market entry requires navigating complex logistics and focusing efforts on urban, high-income distribution channels, often relying heavily on imported goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Immunity Gummies Market.- Church & Dwight Co Inc.

- Pfizer Inc.

- Bayer AG

- The Nature’s Bounty Co.

- GlaxoSmithKline plc

- Goli Nutrition Inc.

- SmartyPants Vitamins (Unilever)

- Olly Public Benefit Corporation

- Hero Nutritionals

- Nature's Way Products LLC

- Zarbee's Naturals (Johnson & Johnson)

- Sundown Naturals

- Vitafusion

- Garden of Life

- ZOI Research

- Jamieson Wellness Inc.

- Nutrafor

- Rainbow Light Nutritional Systems

- Nature Made

- Life Extension

- Webber Naturals

- L'il Critters

- Sisu Vitamins

- Nordic Naturals

- Himalaya Wellness

- Blackmores Limited

Frequently Asked Questions

Analyze common user questions about the Immunity Gummies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Immunity Gummies Market?

The Immunity Gummies Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period spanning from 2026 to 2033, driven primarily by increasing consumer focus on preventative health and wellness convenience.

Which ingredients are most commonly found in high-demand immunity gummies?

High-demand immunity gummies predominantly contain essential micronutrients such as Vitamin C, Vitamin D, and Zinc. Additionally, natural botanical extracts like Elderberry, Turmeric, and specialized mushroom extracts are increasingly popular due to their potent immune-modulating properties.

How does the plant-based segmentation (Pectin) impact the market?

The increasing consumer demand for vegan and vegetarian-friendly products is driving the rapid growth of the plant-based segment, utilizing Pectin instead of animal-based Gelatin. This trend expands the market reach and aligns with clean label and ethical sourcing preferences globally, commanding a premium price point.

Which region is expected to demonstrate the highest growth in the Immunity Gummies Market?

The Asia Pacific (APAC) region is forecasted to achieve the highest growth rate, fueled by rapid urbanization, rising disposable incomes in economies like India and China, and increasing consumer adoption of Western-style preventive health supplements and consumer preference for convenient dosage forms.

What are the primary technological challenges in immunity gummy manufacturing?

The main technological challenges include preventing the thermal degradation of heat-sensitive active ingredients (like certain vitamins and probiotics) during processing, which is addressed through advanced microencapsulation techniques and optimizing flavor masking for ingredients with inherently strong tastes while maintaining a low sugar content for health compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager