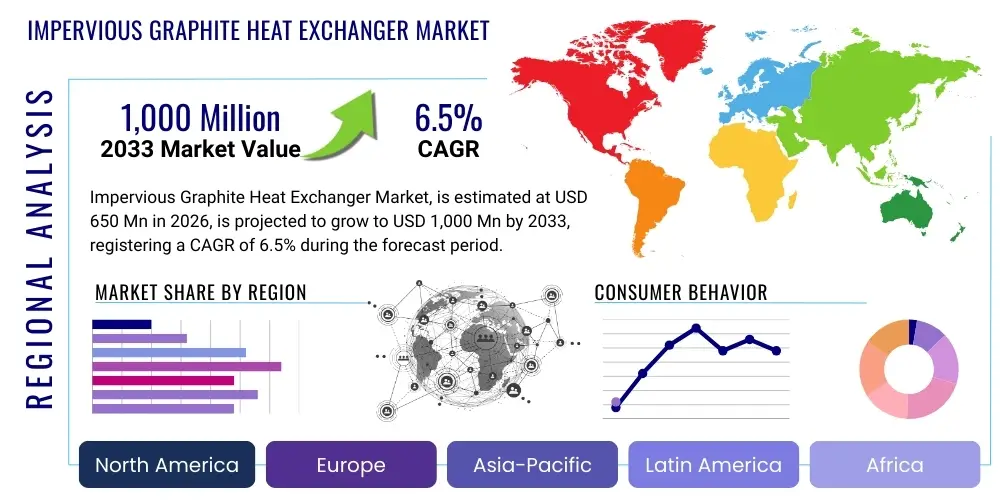

Impervious Graphite Heat Exchanger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438471 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Impervious Graphite Heat Exchanger Market Size

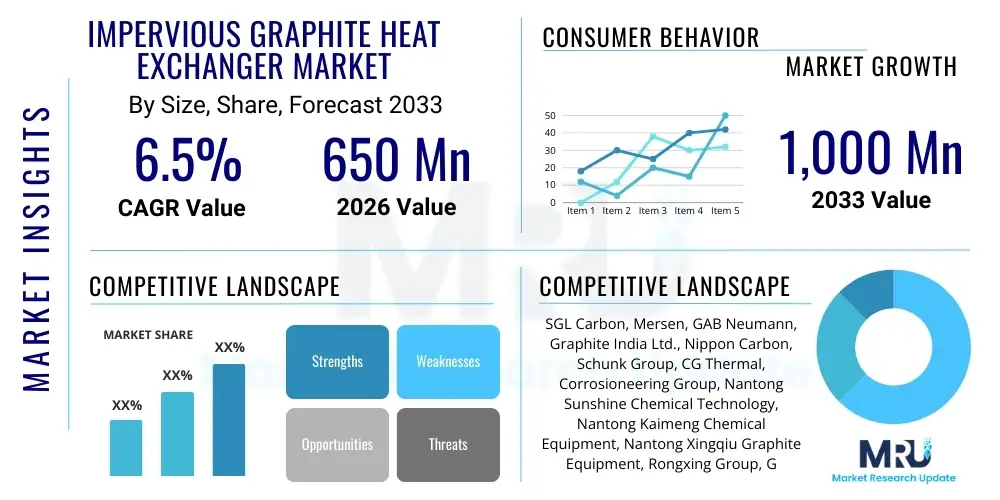

The Impervious Graphite Heat Exchanger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,000 Million by the end of the forecast period in 2033.

Impervious Graphite Heat Exchanger Market introduction

The Impervious Graphite Heat Exchanger Market is defined by its reliance on specialized materials engineered for extreme corrosive environments, predominantly within the chemical, petrochemical, and pharmaceutical sectors. Impervious graphite, created by impregnating porous graphite with synthetic resins (typically phenolic or polytetrafluoroethylene - PTFE), offers unparalleled resistance to highly aggressive chemicals such as hydrochloric acid, sulfuric acid, and phosphoric acid, particularly at elevated temperatures where metallic alternatives fail or require expensive exotic alloys. This unique combination of high thermal conductivity, low specific gravity, and exceptional chemical inertness establishes impervious graphite heat exchangers as essential components for processes involving acid recovery, cooling, heating, and condensation. The structural integrity and functional reliability of these exchangers are paramount in maintaining operational efficiency and safety in hazardous chemical processing plants globally, positioning them as a critical niche technology within industrial thermal management solutions.

Product descriptions of impervious graphite heat exchangers encompass various designs optimized for different operational demands, including shell and tube, block type, and plate and frame configurations. Shell and tube exchangers, while traditional, are often customized for large-scale production and robust performance. Block exchangers offer compact design and improved thermal efficiency, suitable for high-pressure applications. The major applications driving market demand include the production of fertilizers, synthetic fibers, steel pickling processes, and the purification of industrial wastewater. Their inherent advantages, such as superior thermal transfer properties compared to materials like glass or ceramics and greater chemical resistance than most metals, ensure their continuous adoption in demanding scenarios where reliability is non-negotiable. Furthermore, advancements in impregnation techniques are enhancing the mechanical strength and temperature limitations, broadening the product's applicability.

The primary benefits driving the sustained growth of the Impervious Graphite Heat Exchanger Market involve enhanced operational longevity and reduced maintenance costs in severely corrosive settings. Unlike traditional metallic exchangers that suffer from galvanic corrosion or pitting, impervious graphite remains structurally and chemically stable, drastically extending the service life of the equipment. Key driving factors include rigorous environmental regulations necessitating safer and more efficient acid handling and recovery systems, coupled with sustained capital expenditure growth in the chemical processing industry (CPI), particularly in emerging economies focused on expanding their petrochemical and fertilizer production capacities. These factors collectively solidify the market's trajectory towards steady expansion, underpinned by the indispensable nature of the material in highly specialized industrial niches.

Impervious Graphite Heat Exchanger Market Executive Summary

The Impervious Graphite Heat Exchanger Market is currently characterized by moderate yet stable growth, driven primarily by the cyclical nature of chemical industry investment and stringent regulatory requirements for handling corrosive media. Business trends highlight a strong focus on enhancing product durability through advanced impregnation polymers and developing modular, compact designs (such as enhanced block exchangers) to reduce installation footprints and capital investment for end-users. Key manufacturers are increasingly investing in localized production facilities, especially across Asia Pacific, to mitigate supply chain risks and cater directly to the rapidly industrializing markets in China, India, and Southeast Asia. Strategic collaborations emphasizing predictive maintenance services integrated with these specialized exchangers are also emerging as a significant competitive differentiator, moving the market towards a more service-oriented model alongside equipment sales. Furthermore, concerns regarding the operational lifespan and material handling complexities of graphite necessitate continuous innovation in anti-fouling technologies specific to graphite surfaces.

Regional trends indicate a pronounced shift in market dominance towards the Asia Pacific region, fueled by massive investments in chlor-alkali production, sulfuric acid plants, and fertilizer manufacturing complexes. This expansion is supported by government initiatives aimed at self-sufficiency in chemical production, particularly in China and India, making APAC the fastest-growing market globally. Conversely, mature markets in North America and Europe, while exhibiting slower growth, focus heavily on replacement demand, process optimization, and compliance with strict environmental health and safety (EHS) standards, driving demand for high-efficiency, lower-emission exchanger models. The Middle East and Africa (MEA) region shows increasing potential, particularly linked to petrochemical diversification projects and mining operations requiring specialized acid treatment equipment, albeit starting from a smaller base. These geographical variations reflect differential demand drivers, ranging from capacity expansion (APAC) to efficiency enhancement and regulatory compliance (Europe/North America).

Segment trends reveal that the Block Heat Exchanger segment is experiencing faster adoption due to its superior thermal efficiency, robustness under moderate pressure, and compact design, offering a compelling alternative to traditional Shell and Tube configurations, especially in retrofitting projects. In terms of application, the Sulfuric Acid and Phosphoric Acid production segments remain the largest consumers, given the essential role of graphite exchangers in concentration and cooling stages. The adoption of advanced polymers like fluoropolymer resins for impregnation is gaining traction, promising improved resistance to mechanical stress and higher operational temperatures, thereby pushing the average selling price (ASP) of premium heat exchanger units upward. Overall, the market remains specialized and oligopolistic, with growth highly correlated to global chemical commodity prices and infrastructure spending, necessitating focused marketing strategies tailored to niche industrial requirements.

AI Impact Analysis on Impervious Graphite Heat Exchanger Market

User questions regarding the influence of Artificial Intelligence (AI) on the Impervious Graphite Heat Exchanger Market primarily revolve around predictive maintenance schedules, optimizing heat transfer coefficients in complex chemical processes, and improving the material design and selection process. Users are keen to understand how AI algorithms can predict the specific timing of structural degradation, fouling accumulation, or resin failure—critical concerns given the high cost and downtime associated with graphite equipment replacement. Another major theme focuses on leveraging AI and machine learning (ML) to simulate fluid dynamics and thermal stresses within new graphite exchanger designs, reducing the need for lengthy and expensive physical prototyping. Furthermore, there is interest in using AI for optimizing chemical recipes and flow rates in real-time to maximize exchanger efficiency and minimize corrosive wear, thereby extending the operational life of these specialized assets.

The integration of AI into the operation and manufacturing of impervious graphite heat exchangers represents a significant step towards Industry 4.0 within the chemical sector. AI's immediate impact is most evident in predictive maintenance (PdM). By analyzing vast datasets derived from temperature sensors, flow meters, and chemical concentration monitors, ML models can detect subtle anomalies indicative of impending failure—such as minor resin deterioration or unexpected fouling layers—long before traditional condition monitoring techniques would register a problem. This capability allows operators to schedule precise, condition-based maintenance activities, minimizing unscheduled downtime, which is especially costly in continuous chemical processing environments where graphite exchangers are utilized.

In the design phase, AI-driven generative design and computational fluid dynamics (CFD) optimization are crucial for developing next-generation impervious graphite exchangers. AI algorithms can explore thousands of possible channel geometries, material thicknesses, and impregnation compositions based on target efficiency and pressure drop constraints, far surpassing human capacity for iterative design refinement. This leads to lighter, more thermally efficient, and structurally resilient products. Moreover, in supply chain management, AI optimizes the sourcing of high-purity raw graphite and complex impregnation resins, predicting price fluctuations and ensuring timely delivery, which is vital for maintaining steady production schedules for these highly specialized and slow-to-manufacture components.

- AI enables predictive maintenance modeling to forecast fouling and corrosion rates, significantly reducing unplanned shutdowns.

- Machine learning algorithms optimize the thermal and mechanical design parameters of new block and shell-and-tube configurations.

- Generative design tools accelerate R&D by simulating performance under extreme chemical and temperature variations.

- AI enhances quality control during the impregnation process by analyzing material porosity and resin cure levels in real-time.

- Optimized inventory management and supply chain transparency for critical raw materials (e.g., high-purity graphite powder and phenolic resins).

- Real-time process control adjustments using AI to maintain optimal flow rates and temperatures, maximizing heat transfer efficiency.

DRO & Impact Forces Of Impervious Graphite Heat Exchanger Market

The Impervious Graphite Heat Exchanger Market is primarily driven by the irreplaceable requirement for corrosion resistance in highly aggressive chemical processing environments, particularly involving hydrochloric and sulfuric acids, coupled with expansion in the global fertilizer and petrochemical industries. However, the market faces significant restraints stemming from the inherent fragility and high capital expenditure associated with graphite equipment, alongside competition from advanced metallic alloys (like Tantalum and exotic Nickel alloys) and specialized non-metallic alternatives (e.g., PTFE-lined equipment). Opportunities lie in technological advancements focusing on composite graphite materials, improving mechanical strength, and leveraging digitization for enhanced operational monitoring. The key impact forces are predominantly driven by regulatory shifts demanding stricter corrosion control and efficiency improvements in chemical waste handling and acid recovery processes globally.

Drivers: The fundamental driver is the necessity for materials that can withstand severe chemical environments where conventional stainless steels and even high-grade titanium alloys rapidly fail. The relentless growth in the fertilizer industry (driven by global population increase and agricultural demand) necessitates high volumes of sulfuric and phosphoric acid production, where graphite exchangers are indispensable for concentration and cooling. Furthermore, the global trend towards circular economy practices and acid recovery from industrial waste streams mandates the use of highly durable, chemically inert heat transfer equipment. Increasing safety standards and regulatory scrutiny in the chemical industry also favor graphite, as its chemical stability minimizes the risk of catastrophic material failure and subsequent chemical leaks.

Restraints: The high initial capital cost of impervious graphite heat exchangers compared to standard metallic options acts as a primary barrier to entry for smaller or budget-constrained facilities. Moreover, graphite's inherent mechanical fragility makes installation, transportation, and maintenance complex, requiring specialized handling and skilled labor, which contributes to higher operational expenditures. Competitive pressure from materials like PTFE, silicon carbide, and advanced corrosion-resistant metals presents a continuous threat, especially where process conditions allow for slight deviations in chemical tolerance or temperature. Concerns about long-term fouling and the difficulty of cleaning graphite surfaces without causing structural damage also restrain widespread adoption in certain highly viscous or crystallizing media.

Opportunities: Strategic opportunities for market expansion revolve around enhancing material science. Developing advanced impervious graphite composites that exhibit greater resistance to mechanical and thermal shock would significantly broaden application scope, particularly in dynamic or high-pressure chemical reactions. The proliferation of industrial IoT (IIoT) offers opportunities for manufacturers to integrate smart monitoring systems, providing real-time data on erosion and fouling, thereby maximizing the asset lifespan. Furthermore, geographic expansion into rapidly industrializing regions of Southeast Asia and Latin America, focusing on local partnerships for service and maintenance, presents substantial growth potential as new chemical capacities come online. Focus on specific niche applications, such as hydrogen fluoride production and bromine recovery, where graphite remains irreplaceable, also provides high-margin opportunities.

- Drivers: Superior corrosion resistance in mineral acid environments (HCl, H₂SO₄, H₃PO₄); continuous capacity expansion in fertilizer and petrochemical sectors; increasing global focus on acid recovery and environmental regulations.

- Restraints: High capital cost and mechanical fragility of graphite material; specialized maintenance requirements; competition from high-performance metallic alloys and non-metallic alternatives.

- Opportunity: Development of robust graphite composite materials; integration of IIoT for predictive maintenance; growth in niche applications like bromine and high-purity chemical production.

- Impact Forces: Regulatory standards enforcing higher purity and reduced emission in chemical processes; global commodity price volatility affecting capital expenditure in end-user industries.

Segmentation Analysis

The Impervious Graphite Heat Exchanger Market is extensively segmented based on design type, material of construction (impregnation polymer), and application, providing a granular view of market dynamics and specialized demand pockets. The segmentation highlights the critical differences in performance, cost, and suitability across various industrial requirements. Design type segmentation, including Block, Shell and Tube, and others, dictates the pressure handling capacity and thermal efficiency, with Block exchangers gaining prominence due to their compact footprint and modularity. Material segmentation is crucial, distinguishing units impregnated with Phenolic resin, which is cost-effective and suitable for mild oxidizing conditions, from those utilizing PTFE or PVDF, which offer superior resistance to aggressive oxidizers and higher temperatures, commanding a price premium.

The core application segmentation reveals the market’s reliance on specific, intensive chemical processes. The Chlor-Alkali and Sulfuric Acid production sectors are consistently the largest consumers, primarily utilizing graphite for cooling corrosive process streams like wet chlorine gas or concentrated acid. Secondary applications in metal finishing (pickling lines), pharmaceutical synthesis (handling corrosive reactants), and hazardous waste treatment also contribute significantly, often requiring smaller, highly customized units. Understanding these segment dynamics is vital for manufacturers to allocate R&D resources effectively, focusing on improving the resilience of impregnation materials for the most challenging high-volume applications and developing smaller, more flexible units for niche specialty chemical production.

- By Design Type:

- Block Heat Exchangers (Cubic/Cylindrical)

- Shell and Tube Heat Exchangers

- Modular Heat Exchangers (Segmental/Cartridge)

- Plate Heat Exchangers (Limited Application)

- By Impregnation Material:

- Phenolic Resin Impregnated Graphite

- PTFE/Fluoropolymer Impregnated Graphite

- Epoxy Resin Impregnated Graphite

- Others (e.g., Furan Resin)

- By Application:

- Sulfuric Acid Production and Concentration

- Phosphoric Acid Production

- Hydrochloric Acid Synthesis and Absorption

- Chlor-Alkali Industry (Wet Chlorine Gas Cooling)

- Metal Finishing and Pickling Lines

- Pharmaceutical and Specialty Chemical Manufacturing

- Chemical Waste Treatment and Acid Recovery

- By End-Use Industry:

- Chemical Processing Industry (CPI)

- Petrochemical and Refining

- Metallurgy and Mining

- Pharmaceuticals

- Food & Beverage (Specialty Applications)

Value Chain Analysis For Impervious Graphite Heat Exchanger Market

The value chain for the Impervious Graphite Heat Exchanger Market is highly specialized and complex, beginning with the sourcing of high-purity raw materials. Upstream activities involve the extraction and processing of petroleum coke or pitch coke to create raw porous graphite blocks. This initial stage requires meticulous quality control as the final product's thermal conductivity and porosity are fundamentally determined here. Only a few global suppliers specialize in the specific quality of graphite required for heat exchanger manufacturing. Following the creation of the porous graphite, the crucial step is the impregnation process, where specialized synthetic resins (phenolic, PTFE) are forced into the graphite pores under high pressure and temperature to render the material impervious to fluid penetration, transforming it into the final chemical-resistant material. This impregnation step is often proprietary and forms a core competitive advantage for major manufacturers.

Downstream activities involve the highly skilled machining and assembly of the impervious graphite components into the final heat exchanger unit—be it a shell and tube bundle or a cubic block assembly. This manufacturing stage requires specialized tooling to handle the brittle nature of graphite and minimize thermal stress points. Distribution channels are predominantly indirect, relying heavily on specialized engineering, procurement, and construction (EPC) firms, and professional distributors who possess deep technical knowledge of corrosive fluid handling and heat transfer applications. Direct sales often occur only for large, customized projects or high-volume replacement orders with established chemical majors. Technical support, commissioning, and specialized maintenance services form a critical part of the downstream value proposition, given the unique requirements for installing and servicing graphite equipment.

The value chain is characterized by high barriers to entry due to the specialized nature of the upstream material science and the required manufacturing expertise. The relationship between manufacturers and end-users is typically long-term and consultative, driven by the custom engineering required for each application. The efficiency of the indirect distribution channel, particularly the technical proficiency of local agents, significantly influences market penetration in regional territories. Optimization of the value chain focuses on reducing the lead time for custom fabrication and ensuring a stable supply of advanced impregnation resins, as these materials directly impact the chemical resistance profile and ultimately, the lifespan of the impervious graphite heat exchanger.

Impervious Graphite Heat Exchanger Market Potential Customers

The primary end-users and buyers of impervious graphite heat exchangers are large industrial facilities operating processes that generate or utilize highly corrosive chemical fluids, requiring reliable thermal management solutions. The chemical processing industry (CPI) constitutes the largest customer base, specifically firms engaged in bulk mineral acid production (sulfuric, hydrochloric, and phosphoric acids) where graphite's superior resistance at high concentrations and temperatures makes it indispensable. Within the CPI, fertilizer manufacturers are major buyers, as these exchangers are integral to concentrating phosphoric acid and managing heat in sulfuric acid plants. Additionally, companies involved in the production of high-purity chemicals, where metallic contamination must be strictly avoided, represent a lucrative, high-specification customer segment, often demanding PTFE-impregnated units for ultimate inertness.

Secondary potential customers include players in the petrochemical and refining sector, particularly those operating complex processes such as acid regeneration and handling aggressive scrubbing solutions. The metallurgy and mining industry, specifically in operations involving acid leaching (e.g., gold, copper, or rare earth metal recovery) and steel pickling lines, are substantial consumers. In these applications, graphite exchangers facilitate efficient acid heating or cooling necessary for surface treatment and metal dissolution processes. While initial capital cost is high, these customers prioritize the long-term operational reliability and minimal replacement cycles offered by impervious graphite over the frequent failure rates associated with cheaper, less chemically resistant alternatives, justifying the premium investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,000 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon, Mersen, GAB Neumann, Graphite India Ltd., Nippon Carbon, Schunk Group, CG Thermal, Corrosioneering Group, Nantong Sunshine Chemical Technology, Nantong Kaimeng Chemical Equipment, Nantong Xingqiu Graphite Equipment, Rongxing Group, GrafTech International, Qingdao Guanjie Chemical Equipment, HEBEI HENGSHUI JINGXING CHEMICAL INDUSTRY. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Impervious Graphite Heat Exchanger Market Key Technology Landscape

The technology landscape for impervious graphite heat exchangers is dominated by advancements in material science and thermal design optimization, aimed at overcoming the intrinsic limitations of graphite, primarily its mechanical weakness and susceptibility to thermal shocking. A critical technological area is the refinement of the impregnation process. Traditionally relying on phenolic resins, contemporary technology is shifting towards high-performance fluoropolymers, such as proprietary grades of PTFE, which offer superior resistance to strong oxidizing agents like nitric acid and halogens, thereby extending the application range of these exchangers. Manufacturers are employing vacuum and pressure cycling techniques to ensure complete saturation of the porous graphite structure, leading to higher impermeability and enhanced structural integrity. Furthermore, research into novel hybrid resin systems aims to strike a balance between superior chemical resistance and reduced production cost, making advanced graphite materials more economically viable for large-scale industrial use.

In terms of structural design, the market continues to see innovation in Block Heat Exchanger technology. Modern block designs utilize sophisticated drilling patterns and flow channel geometries (e.g., helical flow paths) optimized through Computational Fluid Dynamics (CFD) to maximize the overall heat transfer coefficient while minimizing pressure drop and mitigating potential thermal stress concentrations. This focus on process intensification allows for the creation of compact, high-efficiency units that are easier to install and maintain than large traditional shell and tube configurations. Another significant trend is the development of composite graphite materials, where graphite is combined with reinforcing agents, often carbon fibers or metallic inserts, to increase resistance to mechanical damage and vibration, a crucial improvement for equipment operating in dynamic environments like marine or offshore processing facilities.

The adoption of advanced manufacturing techniques is also reshaping the production landscape. Techniques such as precision CNC machining are used to achieve extremely tight tolerances on drilling patterns and sealing surfaces, essential for reliable operation under corrosive conditions and pressure differentials. Sealing technology itself is a point of innovation, with manufacturers moving towards improved gasket materials, such often proprietary encapsulated elastomers and flexible graphite foils, to ensure long-term, leak-free operation, particularly at elevated temperatures and pressures. These technological developments collectively focus on boosting the reliability (reducing failure rates), increasing the efficiency (improving U-values), and expanding the durability (extending lifespan) of impervious graphite heat exchangers, securing their competitive position against competing non-metallic materials like silicon carbide (SiC), which offers higher robustness but often lacks the specific, broad-spectrum chemical resistance and cost-effectiveness of impregnated graphite.

Regional Highlights

The Impervious Graphite Heat Exchanger Market exhibits distinct regional dynamics, heavily influenced by industrialization rates, environmental regulations, and local chemical production capacities. Asia Pacific (APAC) stands out as the largest and fastest-growing market globally. This dominance is attributable to massive governmental and private sector investments in the regional chemical processing infrastructure, particularly in China and India, which are rapidly expanding their capacities for fertilizer production (sulfuric and phosphoric acids) and chlor-alkali production. The strong emphasis on local manufacturing, coupled with the establishment of large-scale chemical parks, drives intense demand for reliable, high-volume corrosive fluid handling equipment, positioning APAC as the strategic center for future market growth and competitive manufacturing activities.

Europe and North America represent mature markets characterized by replacement demand, modernization, and regulatory compliance. In these regions, growth is steady but slower, focused less on new capacity expansion and more on process optimization, energy efficiency, and stringent safety standards. European chemical companies frequently upgrade their facilities to meet the latest REACH regulations and optimize energy consumption, driving demand for high-efficiency block exchangers. North America benefits from renewed investment in shale gas processing and related downstream chemical production, where existing infrastructure necessitates highly reliable corrosion-resistant equipment to ensure long operational uptime and adhere to demanding environmental protection agency (EPA) standards.

Latin America and the Middle East & Africa (MEA) are emerging markets offering significant growth potential, albeit from a lower baseline. In MEA, market expansion is intrinsically linked to diversification strategies in the Gulf Cooperation Council (GCC) states, moving beyond crude oil towards downstream petrochemicals and associated industrial clusters. These projects require substantial investments in chemical infrastructure, including acid recovery units. Latin America, particularly Brazil and Chile, presents opportunities driven by mining activities (acid leaching) and the associated sulfuric acid handling requirements, making specialized graphite exchangers vital for maintaining operational continuity in harsh operational settings.

- Asia Pacific (APAC): Dominates the market; fastest growth driven by chemical capacity expansion in China and India (fertilizer and chlor-alkali sectors); focus on local manufacturing and large-scale project investments.

- North America: Stable market driven by replacement cycles, optimization of existing facilities, and compliance with stringent EPA environmental regulations; growth linked to petrochemical downstream investment.

- Europe: Mature market characterized by steady replacement demand and technological upgrades focused on energy efficiency and compliance with EU chemical regulations (e.g., REACH); high demand for modular and compact designs.

- Middle East and Africa (MEA): Emerging market with potential linked to large-scale petrochemical diversification projects, particularly in Saudi Arabia and the UAE; increasing focus on industrial chemical production.

- Latin America: Growth driven primarily by mining and metallurgical activities, especially the handling and recycling of large volumes of corrosive leaching acids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Impervious Graphite Heat Exchanger Market.- SGL Carbon

- Mersen

- GAB Neumann

- Graphite India Ltd.

- Nippon Carbon

- Schunk Group

- CG Thermal

- Corrosioneering Group

- Nantong Sunshine Chemical Technology

- Nantong Kaimeng Chemical Equipment

- Nantong Xingqiu Graphite Equipment

- Rongxing Group

- GrafTech International

- Qingdao Guanjie Chemical Equipment

- HEBEI HENGSHUI JINGXING CHEMICAL INDUSTRY

- Toyo Tanso Co., Ltd.

- Sankei Giken Co., Ltd.

- The Heil Company (Now part of SGL Carbon)

- Thermal Transfer Systems GmbH

- Chemac Equipment Ltd.

Frequently Asked Questions

Analyze common user questions about the Impervious Graphite Heat Exchanger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using impervious graphite over metallic heat exchangers?

Impervious graphite offers exceptional resistance to virtually all non-oxidizing acids, alkalis, and solvents, especially at elevated temperatures where metallic alloys (like stainless steel or titanium) corrode rapidly. It also possesses high thermal conductivity, ensuring efficient heat transfer, and eliminates concerns regarding metal ion contamination in high-purity applications, making it ideal for processes like hydrochloric acid synthesis and sulfuric acid concentration.

What is the typical lifespan and maintenance requirement for impervious graphite exchangers?

The typical operational lifespan of a well-maintained impervious graphite heat exchanger can range from 5 to 15 years, depending heavily on process conditions (temperature, pressure, abrasion, and thermal cycling frequency). Maintenance primarily involves periodic inspection for fouling and leak detection. Due to the material's brittleness, maintenance requires specialized handling, and repairs typically focus on replacing damaged components or seals rather than extensive welding or patching.

Which design type of impervious graphite heat exchanger is currently most favored by the industry?

While the Shell and Tube design remains a standard for large-volume applications, the Block Heat Exchanger design (including cubic and cylindrical configurations) is increasingly favored. Block exchangers offer a more compact footprint, higher thermal efficiency per unit volume, and greater resistance to pressure differentials, making them suitable for high-efficiency modernizing projects and retrofitting in space-constrained chemical plants.

What factors restrain the growth of the Impervious Graphite Heat Exchanger Market?

The primary restraints include the high initial capital investment required compared to conventional materials, and the inherent mechanical fragility of graphite, which complicates transportation, installation, and necessitates highly specialized maintenance procedures. Furthermore, competition from robust non-metallic alternatives, such as advanced silicon carbide (SiC) or expensive exotic metal alloys, limits market expansion in certain process niches.

How does the choice of impregnation material impact the performance and application of the exchanger?

The impregnation material dictates the chemical limits and operational temperature range. Phenolic resin is cost-effective and suitable for general corrosive service but cannot withstand strong oxidizing agents. Fluoropolymer (PTFE/PVDF) impregnation, though more expensive, provides superior resistance to aggressive oxidizing acids (like concentrated nitric acid or wet chlorine gas) and allows for slightly higher operating temperatures, significantly broadening the application scope in highly critical chemical processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager