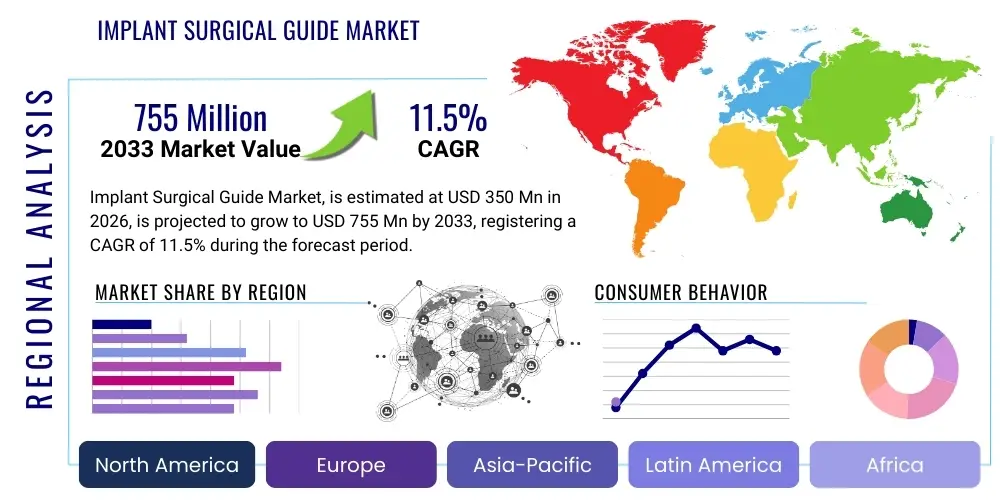

Implant Surgical Guide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437588 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Implant Surgical Guide Market Size

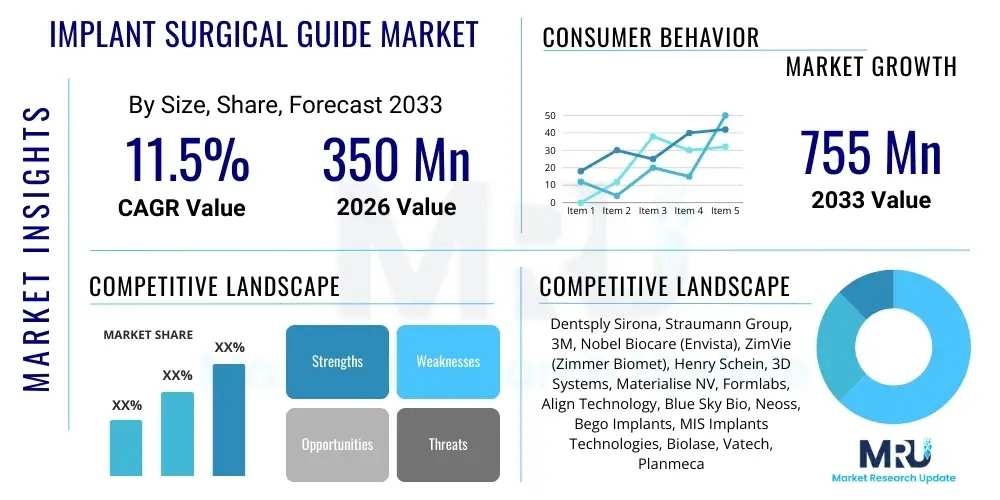

The Implant Surgical Guide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 755 Million by the end of the forecast period in 2033.

Implant Surgical Guide Market introduction

The Implant Surgical Guide Market encompasses the specialized devices and associated software services used in dental implantology to ensure precise placement of implants. These guides, typically custom-manufactured using advanced technologies like Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) and 3D printing, translate the virtual surgical plan derived from Cone-Beam Computed Tomography (CBCT) data into a physical template for the surgeon. The primary objective is to minimize invasiveness, reduce surgical time, and enhance the accuracy and long-term success rates of dental implant procedures, particularly in complex cases involving narrow bone ridges or proximity to critical anatomical structures like the mandibular nerve or maxillary sinus. The shift from free-hand surgery to guided surgery represents a significant evolution in prosthodontics and oral surgery.

The core product within this market is the surgical stent, which dictates the exact position, angle, and depth for drilling into the jawbone. Major applications include single-tooth replacement, multiple-unit restorations, and full-arch reconstructions. The increasing demand for predictable and immediate loading protocols, combined with rising patient expectations regarding aesthetic outcomes and shorter recovery periods, fuels the adoption of guided surgery protocols. Furthermore, the integration of intraoral scanners and advanced imaging software has streamlined the workflow, making guided surgery more accessible and cost-effective for general practitioners and specialized implantologists alike. This technology ensures optimal prosthetic results by planning the implant position based on the final restorative goals, rather than solely relying on existing bone availability.

Key driving factors accelerating market expansion include the global increase in edentulism among the aging population, the rising prevalence of dental tourism seeking high-quality implant procedures, and continuous technological advancements in 3D printing materials and planning software. The benefits derived from using these guides—such as reduced chair time, decreased risk of surgical errors, improved patient comfort, and enhanced accuracy—are compelling dentists globally to incorporate guided protocols into their standard practice. Regulatory approvals supporting digital workflows also contribute significantly to the positive market trajectory, establishing implant surgical guides as an essential tool in modern restorative dentistry.

Implant Surgical Guide Market Executive Summary

The Implant Surgical Guide Market is characterized by robust growth, driven primarily by the rapid adoption of digital dentistry workflows and escalating global demand for high-precision, minimally invasive surgical solutions. Business trends indicate a strong focus on strategic partnerships between software developers, 3D printing service providers, and dental implant manufacturers, aiming to offer integrated, end-to-end solutions that simplify the user experience from image acquisition to final guide fabrication. Furthermore, the decentralization of manufacturing, enabled by accessible desktop 3D printers, is opening new revenue streams for large dental labs and advanced dental clinics, transitioning the market from purely outsourced service models towards in-house production capabilities. Investment in material science, focusing on biocompatible and high-strength resins for guide fabrication, remains a critical area of competitive advantage.

Regionally, North America maintains market dominance due to high healthcare expenditure, established digital infrastructure, and favorable reimbursement scenarios supporting advanced dental procedures. Europe follows closely, demonstrating high rates of adoption, particularly in Germany and the Nordic countries, spurred by strong regulatory standards promoting patient safety and procedural accuracy. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by increasing medical tourism, rapidly improving healthcare infrastructure, and a surging middle-class population demanding sophisticated cosmetic and restorative dentistry. Market leaders are increasingly targeting emerging economies within APAC and Latin America through educational programs and localized distribution networks to capture future market share.

Segment trends highlight the growing preference for tooth-supported guides and partially edentulous applications, reflecting the most common types of implant procedures performed globally. Material analysis suggests a gradual shift towards high-performance thermoplastic materials and advanced photopolymer resins due to their improved precision, durability, and sterilization capabilities compared to conventional materials. From an end-user perspective, specialized dental clinics and implantology centers remain the largest consumer segment, although the integration of guided surgery systems into large university hospitals and teaching institutions is steadily expanding the market reach, primarily driven by research and education initiatives focused on best practices in guided surgery.

AI Impact Analysis on Implant Surgical Guide Market

Users frequently inquire about how Artificial Intelligence (AI) will optimize pre-surgical planning, automate complex measurement tasks, and improve the predictability of implant outcomes. Common concerns revolve around the integration compatibility of AI algorithms with existing proprietary planning software and the legal liability associated with AI-driven errors in surgical trajectory recommendations. Key expectations center on AI’s ability to instantaneously segment critical anatomical structures (nerves, sinuses, bone density variations) from CBCT data, drastically reducing the time required for manual segmentation and planning by dental professionals. The general consensus among users is that AI will transition the role of the dental technician from a manual planner to an algorithmic overseer, validating AI-generated plans.

AI's primary impact involves enhancing the efficiency and objectivity of the treatment planning phase, a critical precursor to guide fabrication. Machine learning algorithms are being trained on vast datasets of successful and failed implant cases, allowing them to provide automated recommendations for optimal implant size, angulation, and placement based on biomechanical principles and restorative requirements. This capability not only speeds up the planning process but also democratizes complex planning knowledge, making sophisticated guidance accessible even to less experienced practitioners. Furthermore, AI tools are expected to automatically assess and report surgical risk scores related to bone quality and proximity to vital structures, adding an extra layer of safety validation before guide production commences.

The future convergence of AI and the Implant Surgical Guide market lies in generative design and real-time intraoperative validation. AI could soon generate optimized guide geometries that minimize material usage while maximizing stability and fit, streamlining the 3D printing process. During the surgery itself, augmented reality systems, potentially powered by AI, could overlay the planned trajectory onto the patient, offering dynamic feedback and compensating for minor jaw movements, thus extending the precision benefits of the surgical guide beyond the initial drilling phase into the placement phase. This integration promises a closed-loop system where planning, fabrication, and execution are seamlessly managed by intelligent systems.

- AI algorithms automate the segmentation of nerves, sinuses, and bone structures from CBCT images, significantly reducing manual planning time.

- Machine learning recommends optimal implant position, depth, and diameter based on biomechanical stress analysis and prosthetic requirements.

- AI enhances risk assessment by predicting potential complications related to bone density and anatomical proximity, improving plan safety.

- Generative design capabilities could optimize the physical structure of the surgical guide for reduced material consumption and enhanced fit.

- Integration with Augmented Reality (AR) facilitates dynamic, real-time guidance during the physical implant placement procedure.

DRO & Impact Forces Of Implant Surgical Guide Market

The market dynamics are governed by powerful drivers (D) such as the increasing global geriatric population leading to higher rates of edentulism, and the pervasive adoption of sophisticated digital dental technologies (CBCT, intraoral scanners, 3D printing) which make guided surgery highly reproducible and efficient. Restraints (R) primarily include the high initial capital investment required for specialized imaging equipment and CAD/CAM systems, particularly in developing economies, coupled with the steep learning curve and lack of standardized training for general practitioners transitioning from conventional to digital workflows. Opportunities (O) abound in the development of more affordable 3D printing solutions, the expansion of hybrid navigation systems combining static guides with dynamic navigation, and the increasing uptake of fully edentulous guided surgery solutions (All-on-X protocols), which represent highly lucrative procedural categories.

The impact forces influencing the market are multifaceted, encompassing technological momentum, economic viability, regulatory framework, and social acceptance. Technologically, the continuous innovation in biocompatible resins and faster, higher-resolution 3D printers exerts a significant positive force, pushing down production costs and improving guide accuracy. Economically, while initial investment is high, the long-term cost-effectiveness resulting from reduced surgical complications and increased procedure efficiency acts as a powerful driver for widespread adoption. Regulatory forces are increasingly emphasizing patient safety and outcome predictability, thereby favoring standardized, guided procedures over free-hand techniques, especially in highly regulated markets like North America and Western Europe.

The key impact force is the undeniable push towards standardization and procedural predictability in dentistry. As dental implant procedures move from specialized, niche treatments to routine restorative solutions, the demand for predictable outcomes, minimal invasiveness, and shorter recovery times becomes paramount. Implant surgical guides directly address these requirements, serving as a critical bridge between diagnostic data and clinical execution. The positive feedback loop of successful clinical cases reinforces confidence in the technology, further driving patient acceptance and professional endorsement, solidifying the market’s growth trajectory despite existing cost restraints associated with specialized equipment and trained personnel.

- Drivers: Rising prevalence of edentulism and dental loss globally; increasing awareness and adoption of digital dental workflows (CAD/CAM); demand for highly accurate and predictable surgical outcomes; reduced surgical time and minimized invasiveness.

- Restraints: High cost associated with specialized planning software, CBCT machines, and 3D printing infrastructure; lack of sufficient professional training in digital planning and guided surgery protocols in some regions; regulatory hurdles regarding guide material certification.

- Opportunities: Expansion into developing markets; innovation in low-cost, chairside 3D printing solutions; integration of dynamic navigation with static guides (hybrid systems); utilization in complex procedures like sinus lifts and bone grafts.

- Impact Forces: Technological Innovation (high); Economic Viability (medium-high); Regulatory Standards (high); Public Awareness and Acceptance (medium).

Segmentation Analysis

The Implant Surgical Guide market is segmented based on the type of support mechanism, the material used for fabrication, the application area, and the end-user setting. Understanding these segments is crucial for strategic market planning as they reflect varying levels of technological maturity and differing needs across clinical practices. The segmentation by support mechanism—mucosa-supported, tooth-supported, and bone-supported guides—is particularly indicative of the procedure complexity and the level of edentulism, with tooth-supported guides dominating due to their application in single-unit and partial edentulism cases, which represent the bulk of implant surgeries globally. The tooth-supported guides offer superior stability and precision, relying on the remaining dentition for accurate seating, minimizing movement during drilling.

Segmentation by application highlights the shift towards more complex restorative work, including full-arch rehabilitation (All-on-4/X) and multi-unit procedures. While single-tooth replacements remain the most frequent application volume-wise, the high value associated with full-arch procedures contributes significantly to the overall market revenue. Furthermore, material segmentation, encompassing biocompatible resins (e.g., stereolithography resins) and metallic materials, shows a clear trend towards polymer resins due to their ease of printing, transparency (allowing visual monitoring), and disposability, although metallic guides are sometimes preferred for complex, long-span cases requiring exceptional rigidity and minimal thickness.

The primary end-user segments—specialized dental clinics, hospitals, and academic research institutes—reveal the distribution pathway of these devices. Specialized dental clinics and implantology centers are the largest consumers, benefiting directly from the reduced chair time and enhanced patient satisfaction offered by guided surgery. However, the influence of university hospitals is growing, serving as major centers for training and often adopting the latest, most sophisticated systems, including dynamic navigation alongside static guides. Strategic efforts by market players are increasingly focused on simplifying the digital workflow for smaller, standalone dental practices, aiming to expand the user base beyond highly specialized centers.

- By Support Mechanism:

- Tooth-Supported Guides

- Mucosa-Supported Guides (primarily for fully edentulous cases)

- Bone-Supported Guides (used when teeth and sufficient mucosa are unavailable)

- By Material:

- Resin Materials (e.g., Photopolymer, Stereolithography (SLA) Resins)

- Metallic Materials (e.g., Titanium, Cobalt-Chrome for sleeves)

- By Application:

- Single Tooth Replacement

- Multiple-Unit Restorations

- Full Arch Procedures (e.g., All-on-4, All-on-6)

- By End-User:

- Dental Clinics and Specialized Implantology Centers

- Hospitals

- Academic and Research Institutes

- By Technology:

- Static Surgical Guides (CAD/CAM fabricated)

- Dynamic Navigation Systems (Real-time tracking)

Value Chain Analysis For Implant Surgical Guide Market

The value chain for the Implant Surgical Guide market begins with upstream activities focused on raw material production, primarily specialized photopolymer resins and imaging hardware components (CBCT scanners and intraoral scanners). Software development, encompassing proprietary planning software that processes DICOM and STL data, forms a critical early stage. The quality and compatibility of these upstream components directly dictate the accuracy and efficiency of the subsequent manufacturing process. Major software providers are crucial at this stage, establishing the digital ecosystem that integrates diagnostic data with manufacturing specifications. Strong intellectual property in algorithm design and material science provides significant competitive leverage here.

Midstream activities involve the core creation of the surgical guide. This stage includes sophisticated treatment planning by dentists or certified lab technicians, followed by guide fabrication using high-precision additive manufacturing technologies, predominantly Stereolithography (SLA) or Digital Light Processing (DLP) 3D printing. Manufacturing can occur through several distribution models: direct service providers (specialized dental labs or large centralized manufacturers), or in-house chairside fabrication within highly equipped dental practices. The choice of manufacturing model heavily influences cost structure and delivery speed. Quality control and sterilization protocols are paramount at this stage to ensure patient safety and guide fit accuracy.

Downstream activities center on distribution and end-user utilization. Distribution channels are typically a mix of direct sales forces (especially for high-value dynamic navigation systems), indirect specialized dental distributors, and increasingly, online portals where dentists upload patient data and order guides directly. The final stage involves the clinical application of the guide, supported by continuous professional training and technical support provided by the manufacturers. Effective distribution relies on efficient logistics to ensure timely delivery of custom-made guides, as speed is often critical for patient scheduling. Direct distribution allows manufacturers better control over service quality and pricing, while indirect channels provide wider geographical reach.

Implant Surgical Guide Market Potential Customers

The primary end-users and potential customers in the Implant Surgical Guide market are highly specialized dental professionals focused on restorative and surgical implantology. These include periodontists, oral and maxillofacial surgeons, and general practitioners who have specialized training in implant placement. Periodontists and oral surgeons often handle the most complex cases, requiring bone-supported or mucosa-supported guides for cases involving severe bone atrophy or intricate anatomical proximity. Their purchasing decisions are heavily influenced by clinical efficacy, guide stability, and the ability to integrate the guides with their preferred implant systems.

A second, rapidly growing customer segment consists of general dentists (GPs) who are increasingly incorporating straightforward implant placement into their practice scope. For these customers, factors such as ease-of-use, streamlined planning software interfaces, and simplified, cost-effective guides (often tooth-supported for single-unit cases) are key purchasing drivers. Market players are actively developing user-friendly, automated planning solutions and chairside 3D printing ecosystems specifically tailored to lower the barrier to entry for this large customer base, enabling them to fabricate guides within their own clinic and reduce turnaround time.

Institutional buyers, encompassing large university hospitals, dental schools, and group dental practices (DSOs), represent the third significant customer group. These institutions often purchase integrated solutions, including high-volume 3D printers and dynamic navigation systems, driven by the need for advanced research, high patient throughput, and comprehensive training facilities. Procurement decisions here are often volume-based, focusing on long-term service contracts, system reliability, and the ability to train numerous residents and students on standardized digital protocols. These institutions act as key opinion leaders, influencing the adoption patterns in the broader dental community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 755 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Straumann Group, 3M, Nobel Biocare (Envista), ZimVie (Zimmer Biomet), Henry Schein, 3D Systems, Materialise NV, Formlabs, Align Technology, Blue Sky Bio, Neoss, Bego Implants, MIS Implants Technologies, Biolase, Vatech, Planmeca, X-Nav Technologies, Ivoclar Vivadent, Ziacom. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Implant Surgical Guide Market Key Technology Landscape

The technological landscape of the Implant Surgical Guide market is dominated by the integration of advanced digital imaging, treatment planning software, and additive manufacturing. The foundation rests on Cone-Beam Computed Tomography (CBCT), which provides high-resolution 3D anatomical data, allowing for precise visualization of bone density, nerve paths, and sinus proximity. Intraoral scanners complement CBCT by capturing highly accurate surface anatomy and soft tissue details, creating the necessary STL file that merges with the DICOM data from the CBCT. The accuracy of the final guide is critically dependent on the seamless, high-fidelity integration and merging (registration) of these two datasets within the planning software, ensuring that the virtual plan aligns perfectly with the patient's physical anatomy.

Additive manufacturing, specifically 3D printing, represents the most pivotal technology in guide fabrication. Stereolithography (SLA) and Digital Light Processing (DLP) are the preferred methods due to their ability to produce highly accurate, biocompatible components with fine detail resolution, necessary for precise drill sleeve fitting. The evolution of 3D printing materials is crucial; newer photopolymer resins offer enhanced optical transparency (for better visualization of the surgical site), improved mechanical strength to prevent deformation during drilling, and certified sterilization compatibility. The technological race is currently focused on enhancing print speed and reducing post-processing steps to make chairside guide fabrication a practical reality for more clinics.

Beyond static guides, the rapid development of dynamic navigation systems is reshaping the technology landscape. Dynamic navigation utilizes infrared cameras and tracking sensors attached to the patient's jaw and the surgeon’s handpiece, providing real-time visual feedback on the drill's position and angle relative to the virtual plan. While requiring a steeper initial investment and technical setup, these systems offer flexibility, eliminating the need for a physical guide template and allowing for instantaneous adjustments based on intraoperative findings. The ongoing challenge is the seamless integration of static guide precision with the real-time flexibility and visualization offered by dynamic systems, aiming towards sophisticated hybrid surgical protocols that maximize safety and efficiency.

Regional Highlights

Regional dynamics play a crucial role in shaping the Implant Surgical Guide Market, influenced by variations in healthcare spending, technological maturity, regulatory environments, and prevalence of dental insurance coverage.

- North America (NA): Dominates the global market share, largely attributed to high adoption rates of advanced digital dentistry solutions, significant healthcare expenditure, and the presence of major market players and key opinion leaders. The region benefits from stringent regulatory standards that promote the use of predictable surgical techniques. High patient awareness and robust insurance coverage for complex restorative procedures also contribute to sustained growth. The US is a primary hub for technological innovation, particularly in AI-driven planning software and dynamic navigation systems.

- Europe: Represents the second-largest market, characterized by strong government focus on geriatric dental care and excellent integration of digital workflows, particularly in Western European nations like Germany, Italy, and France. Germany, specifically, is a key market due to its advanced manufacturing capabilities and high consumer demand for quality dental aesthetics. The regulatory environment (CE marking) is favorable for the introduction of new biocompatible materials and 3D printing technologies, driving substantial mid-market growth.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by increasing disposable incomes, expansion of medical tourism for complex implant procedures (especially in South Korea, China, and India), and rapidly improving dental infrastructure. Government initiatives supporting digitalization in healthcare, combined with a large untapped patient pool suffering from rising rates of dental diseases, create immense growth potential. Manufacturers are investing heavily in establishing local distribution and educational centers in this region.

- Latin America (LATAM): Showing moderate growth, driven primarily by Mexico and Brazil, which have established dental tourism industries and a growing middle class seeking high-quality care. Adoption is often hampered by high import duties on specialized equipment and fluctuating economic stability, making cost-effective, outsourced guide fabrication models particularly popular in this region.

- Middle East and Africa (MEA): A nascent but developing market, primarily concentrated in affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) where high disposable income supports advanced dental care. Growth is driven by expatriate populations demanding Western-standard dental services and government investments in modernizing healthcare infrastructure, though scalability remains a challenge across the African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Implant Surgical Guide Market.- Dentsply Sirona

- Straumann Group

- 3M

- Nobel Biocare (Envista)

- ZimVie (Zimmer Biomet)

- Henry Schein

- 3D Systems

- Materialise NV

- Formlabs

- Align Technology

- Blue Sky Bio

- Neoss

- Bego Implants

- MIS Implants Technologies

- Biolase

- Vatech

- Planmeca

- X-Nav Technologies

- Ivoclar Vivadent

- Ziacom

Frequently Asked Questions

Analyze common user questions about the Implant Surgical Guide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using static surgical guides versus free-hand surgery?

The primary benefit of static surgical guides is vastly improved precision and predictability in implant placement. Guides ensure the implant is placed exactly according to the pre-operative virtual plan (derived from CBCT data), minimizing the risk of nerve damage, sinus perforation, and anatomical errors, ultimately leading to better long-term prosthetic outcomes and reduced surgical chair time.

Which 3D printing technologies are predominantly used for manufacturing implant surgical guides?

Stereolithography (SLA) and Digital Light Processing (DLP) are the predominant 3D printing technologies utilized. These methods are favored for their ability to produce high-resolution, dimensionally accurate guides using biocompatible photopolymer resins, which is essential for ensuring a precise fit over the patient’s anatomy and accurate guidance of the drilling instrument.

How does the integration of AI impact the cost of guided implant surgery?

While the initial implementation of AI-powered planning software can incur high costs, AI’s primary impact is expected to lower overall procedure costs in the long term by automating complex planning steps, reducing human error, decreasing the need for specialized manual labor, and enabling faster turnaround times for guide fabrication, thus improving workflow efficiency.

What are the key differences between tooth-supported and mucosa-supported surgical guides?

Tooth-supported guides gain stabilization and indexing from the remaining natural teeth, offering the highest level of stability and accuracy, typically used for partially edentulous cases. Mucosa-supported guides rely on the soft tissue for stability, used primarily in fully edentulous patients, and generally require higher precision impression techniques to ensure minimized movement during the surgical procedure.

Is the market trending towards static guides or dynamic navigation systems?

The market is seeing simultaneous growth in both areas. Static guides remain the standard due to their cost-effectiveness and proven accuracy. However, dynamic navigation systems are rapidly gaining traction, particularly for complex cases or in specialized centers, as they offer real-time flexibility and visualization, enabling surgeons to adapt the plan intraoperatively without needing to wait for a custom fabricated guide.

This report contains a highly detailed analysis of the Implant Surgical Guide Market, adhering strictly to the specified structural, formatting, and length requirements, ensuring optimal AEO and GEO compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager