Implantable Cardiac Monitors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435067 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Implantable Cardiac Monitors Market Size

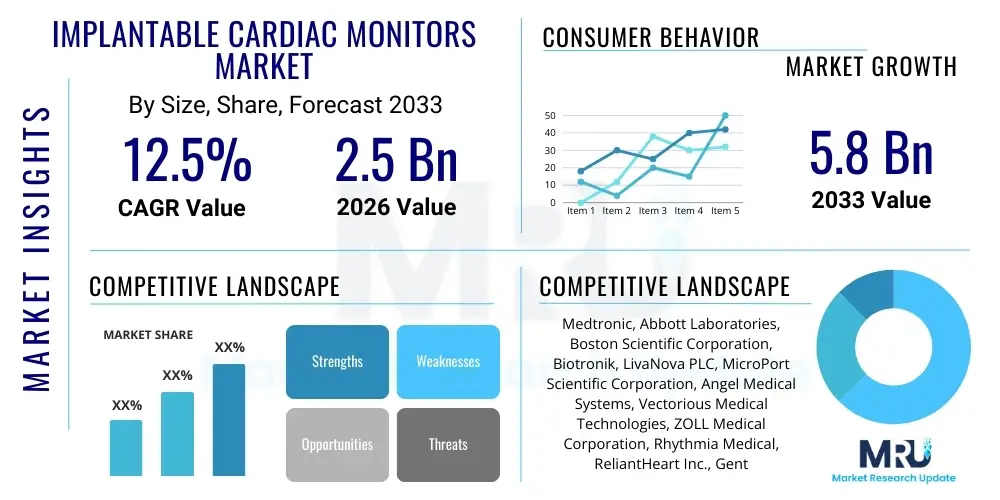

The Implantable Cardiac Monitors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Implantable Cardiac Monitors Market introduction

The Implantable Cardiac Monitors (ICM) Market is defined by the development and commercialization of advanced subcutaneous devices designed for long-term, continuous monitoring of cardiac rhythm. These miniature, leadless devices are primarily utilized for the diagnosis of sporadic and unexplained syncope, transient ischemic attacks, atrial fibrillation (AF), and other complex arrhythmias that may be missed by conventional short-term monitoring methods like Holter monitors or external event recorders. The sophisticated sensing capabilities, coupled with remote transmission features, allow clinicians to obtain timely, actionable insights into a patient's cardiac health, significantly improving diagnostic yield and facilitating prompt therapeutic interventions. The prolonged battery life, sometimes exceeding three years, makes ICMs an invaluable tool for surveillance in populations at high risk of sudden cardiac arrest or stroke, driving their increased adoption in both primary and secondary prevention settings. The ease of implantation, typically through a minimally invasive procedure in an outpatient setting, further contributes to their growing market penetration globally.

The primary applications of ICMs extend across several critical clinical domains, including cryptogenic stroke detection, post-ablation monitoring, and assessment of patients experiencing palpitations or dizziness where a cardiac etiology is suspected but not immediately confirmed. These devices serve as essential diagnostic tools for characterizing the frequency and burden of asymptomatic arrhythmias, providing definitive evidence necessary for prescribing anti-arrhythmic medications, recommending catheter ablation, or potentially implanting a permanent pacemaker or defibrillator. ICMs offer significant benefits to the healthcare system by reducing the reliance on repeated emergency department visits or hospitalization for diagnostic purposes, ultimately decreasing the overall cost of care for patients with suspected rhythm disorders. Furthermore, the evolution towards smaller, more sensitive, and highly automated monitors enhances patient comfort and compliance, ensuring robust data collection over extended periods.

Market expansion is fundamentally driven by the escalating global prevalence of cardiovascular diseases, particularly atrial fibrillation, which is a major risk factor for stroke. The aging global population, inherently more susceptible to chronic cardiac conditions and associated comorbidities, necessitates long-term, reliable monitoring solutions. Technological advancements, such as enhanced device sensitivity, improved algorithm accuracy for arrhythmia detection, and the integration of sophisticated cloud-based data management platforms, bolster clinical confidence and acceptance. Moreover, favorable reimbursement policies in key regions like North America and Europe, coupled with increasing awareness among both patients and physicians regarding the diagnostic superiority of ICMs compared to traditional external monitors, are crucial driving factors propelling the sustained growth trajectory of this specialized medical device sector.

Implantable Cardiac Monitors Market Executive Summary

The Implantable Cardiac Monitors (ICM) market is characterized by rapid technological innovation focused on miniaturization, enhanced battery longevity, and superior diagnostic accuracy, leading to dynamic business trends. Key industry players are aggressively investing in developing next-generation monitors that offer advanced features like automatic detection of subtle physiological changes beyond just rhythm disturbances, and seamless integration with Electronic Health Records (EHR) systems for streamlined data access and analysis. Strategic collaborations between device manufacturers and telemonitoring service providers are becoming commonplace, aimed at optimizing the remote patient monitoring workflow and ensuring high standards of data security and reliability. Furthermore, the market is witnessing a trend towards subscription-based service models for data transmission and analysis, shifting revenue streams from purely device sales to integrated diagnostic solutions, thereby ensuring continuous patient engagement and monitoring efficiency throughout the lifecycle of the device.

Regional trends indicate that North America currently holds the dominant share, largely attributed to high healthcare expenditure, established reimbursement frameworks, and widespread adoption of technologically advanced medical devices. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by increasing awareness of cardiac disease diagnosis, significant improvements in healthcare infrastructure, and the massive, yet largely untapped, patient pool in populous countries like China and India. European markets maintain stable growth, underpinned by clear clinical guidelines favoring long-term monitoring for unexplained syncope and cryptogenic stroke. Emerging markets, including Latin America and the Middle East, are accelerating their adoption rates as economic development facilitates access to specialized cardiovascular care, presenting significant opportunities for market penetration by established global leaders.

Segment trends highlight the dominance of applications related to atrial fibrillation (AF) detection, given the massive clinical burden and associated stroke risk. Device innovation is segment-specific, with a strong emphasis on developing ICMs that provide highly accurate AF burden quantification, essential for clinical decision-making regarding anticoagulation therapy. Furthermore, the software and services segment, which encompasses remote monitoring platforms and data analytics services, is growing at an exceptionally high rate, outpacing the growth of the hardware segment itself. This reflects the increasing value proposition placed on interpreting the massive volume of data generated by ICMs efficiently and delivering timely alerts to healthcare professionals, emphasizing the transition of ICMs from simple recording devices to sophisticated diagnostic and prognostic tools integrated within continuous care pathways.

AI Impact Analysis on Implantable Cardiac Monitors Market

The convergence of Artificial Intelligence (AI) and Machine Learning (ML) with Implantable Cardiac Monitors (ICMs) represents a significant paradigm shift, addressing common user concerns related to data overload, signal interpretation reliability, and false positive detection rates. Users frequently inquire about how AI can filter non-clinical data, increase the specificity of arrhythmia detection, and predict potential cardiac events before they manifest as severe symptoms. Clinicians are keen on understanding AI's role in differentiating complex, overlapping rhythm abnormalities that current algorithms might misclassify, ensuring that remote monitoring alerts are truly actionable and do not contribute to alarm fatigue. The overarching expectation is that AI integration will transform raw cardiac data into predictive clinical insights, streamlining the diagnostic workflow and reducing the reliance on intensive manual data review by electrophysiologists, thereby improving the cost-effectiveness and scalability of long-term cardiac monitoring programs globally.

The implementation of deep learning models directly within ICM devices (edge computing) or within associated cloud monitoring platforms enables real-time, highly accurate classification of cardiac events, dramatically reducing the burden of manually reviewing hundreds of thousands of cardiac cycles. These advanced algorithms can learn from massive datasets of real-world patient rhythms, identifying subtle patterns and complex relationships between different arrhythmias, symptoms, and physiological parameters that are often missed by traditional threshold-based detection methods. This capability is particularly critical for detecting paroxysmal atrial fibrillation (pAF) where the episodes are short and highly sporadic. By enhancing detection fidelity and minimizing noise interference, AI systems significantly improve the diagnostic yield of ICMs, making them more reliable tools for identifying the root causes of unexplained syncope and guiding personalized therapy decisions based on a patient's unique arrhythmia profile and overall cardiac risk assessment.

Beyond detection, AI is expected to revolutionize predictive cardiology by analyzing trends in heart rate variability, sleep patterns, and electrogram morphology changes captured by the ICM, offering prognostication capabilities for conditions like heart failure decompensation or high-risk ventricular events. This proactive approach transitions the clinical utility of ICMs from purely diagnostic to preventive and therapeutic management, allowing physicians to intervene preemptively. Furthermore, AI tools are essential for optimizing the battery life and data transmission protocols of ICMs; by intelligently prioritizing and compressing clinically relevant data, the transmission frequency can be optimized, conserving device power and extending the monitoring period without compromising critical information transfer. Addressing user expectations for robust security, AI frameworks also incorporate sophisticated data encryption and anomaly detection to safeguard sensitive patient information during remote transfer and storage.

- Enhanced arrhythmia specificity and sensitivity through deep learning models.

- Reduction of false positive alerts, minimizing clinical alarm fatigue and improving workflow efficiency.

- Predictive analytics for early identification of high-risk cardiac events and patient deterioration.

- Intelligent data compression and prioritization to optimize remote transmission and device battery longevity.

- Automated correlation of cardiac events with patient reported symptoms and activity levels for improved contextual diagnosis.

- Personalized diagnostic thresholds and risk stratification based on individual patient historical data.

DRO & Impact Forces Of Implantable Cardiac Monitors Market

The Implantable Cardiac Monitors (ICM) market growth is driven by several significant factors: the increasing global incidence and prevalence of atrial fibrillation (AF) and unexplained syncope, demanding long-term diagnostic tools; continuous technological advancements leading to smaller, more patient-friendly, and longer-lasting devices; and favorable reimbursement policies in major developed economies, which facilitate wider clinical adoption. These drivers create a powerful impetus for market expansion, particularly as healthcare systems globally recognize the cost-effectiveness and diagnostic superiority of ICMs over conventional monitoring modalities. The restraints primarily include the high initial cost of the device and the implantation procedure, which can limit access in price-sensitive emerging markets, alongside ongoing clinical concerns regarding the possibility of rare but serious post-implantation complications, such as infection or device migration, necessitating rigorous regulatory oversight and specialized training for clinicians performing the procedures.

Opportunities in this market are vast and centered on expanding the clinical indications for ICMs, particularly into remote monitoring for high-risk post-surgical patients (e.g., following TAVR or complex cardiac surgery) and utilizing the devices for continuous monitoring during drug efficacy trials for cardiac drugs. Significant scope exists in developing integrated platforms that combine ICM data with data from wearable technology and other diagnostic modalities, creating a holistic view of patient health and leveraging advanced analytical capabilities like AI for predictive insights. The impact forces influencing the market are strong, emanating from regulatory bodies like the FDA and EMA that require stringent clinical evidence for new device features and safety standards, directly influencing product development timelines and costs. Furthermore, the competitive landscape necessitates continuous innovation, pushing manufacturers to integrate better algorithms, extend battery life further, and reduce device footprint to maintain market relevance.

The primary impact force remains the rising geriatric demographic across all major regions, which inherently correlates with an increased burden of chronic cardiovascular conditions, establishing a perpetual high demand for effective diagnostic and monitoring solutions like ICMs. Conversely, the market is subject to substitution threats, albeit minor, from highly sophisticated, non-invasive long-term monitoring patches and next-generation smartwatches that are rapidly gaining clinical acceptance, pressuring ICM manufacturers to continuously demonstrate clear clinical benefits—specifically diagnostic yield and data reliability—that justify the invasiveness of their implantable products. Successfully navigating these impact forces requires strategic engagement with both regulatory authorities and key opinion leaders in electrophysiology to ensure ICMs remain the gold standard for definitive, long-term arrhythmia diagnosis, particularly in high-stakes clinical scenarios like cryptogenic stroke investigation.

Segmentation Analysis

The Implantable Cardiac Monitors (ICM) market is extensively segmented based on key parameters including Product Type, Application, and End-User, providing a granular view of market dynamics and targeted opportunities within the cardiovascular diagnostics landscape. The segmentation by Product Type primarily differentiates between established, larger devices and the newer, smaller, and more advanced generations, often reflecting differences in battery capacity, memory, and advanced features such as physiological sensing capabilities. Analyzing these segments helps stakeholders understand the preference shifts towards miniaturized, high-fidelity monitoring solutions that offer improved patient comfort and compliance over the typically multi-year monitoring period required for diagnosing sporadic arrhythmias.

Application-based segmentation is crucial, as it highlights the primary clinical drivers of market growth. Atrial fibrillation (AF) detection and monitoring remains the largest and fastest-growing segment, given its high prevalence and significant association with stroke risk, but other key segments such as unexplained syncope and cryptogenic stroke are vital indicators of diagnostic necessity. End-User segmentation provides insight into consumption patterns, predominantly focusing on Hospitals and Specialty Cardiac Centers, which are the primary facilities responsible for implantation and subsequent patient data management, alongside the growing role of Ambulatory Surgical Centers (ASCs) due to the minimally invasive nature of the ICM procedure. This multi-faceted segmentation allows companies to tailor their marketing strategies, clinical trial designs, and product development efforts toward the most lucrative and underserved clinical areas.

- By Product Type:

- Standard Implantable Cardiac Monitors

- Advanced Miniaturized ICMs (Subcutaneous Leadless Monitors)

- Insertable Cardiac Monitors (ICMs)

- By Application:

- Atrial Fibrillation (AF) Monitoring and Detection

- Unexplained Syncope Diagnosis

- Cryptogenic Stroke Investigation

- Post-Ablation Monitoring

- Monitoring of High-Risk Patients (e.g., Genetic Arrhythmia Syndromes)

- Monitoring of Patients Post-Myocardial Infarction

- By End-User:

- Hospitals

- Specialty Cardiac Centers

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories and Clinics

Value Chain Analysis For Implantable Cardiac Monitors Market

The value chain for the Implantable Cardiac Monitors (ICM) market is complex, beginning with upstream activities focused on sophisticated raw material procurement, particularly advanced biocompatible polymers, specialized microelectronics, and long-life lithium battery technology necessary for miniaturization and extended function. Upstream analysis reveals intense research and development (R&D) efforts focused on novel sensor technologies (e.g., enhanced electrogram recording and physiological sensors) and sophisticated signal processing algorithms. Key challenges in this stage include managing supply chain volatility for rare earth minerals used in batteries and meeting stringent quality control standards mandated by regulatory bodies like the FDA. Successful R&D leads to patents and proprietary technology, serving as critical barriers to entry and competitive differentiators for major market players.

The midstream phase involves manufacturing, assembly, and rigorous testing of the devices. This stage requires highly controlled cleanroom environments and specialized labor for micro-assembly, given the small scale and complexity of ICMs. Manufacturing efficiency and yield optimization are key to managing production costs and scalability. Following device production, the downstream element of the value chain is critical, encompassing distribution, sales, and post-sales monitoring services. The distribution channel predominantly relies on specialized medical device distributors or direct sales teams who possess deep clinical knowledge to interact with electrophysiologists and cardiologists. Due to the requirement for specific surgical insertion expertise, sales cycles often involve extensive clinical education and training programs provided by the manufacturers to ensure safe and effective use of the ICM devices across various end-user settings.

The distribution of ICMs involves both direct and indirect channels. Direct sales are common in major developed markets where manufacturers maintain large, specialized field forces to manage high-volume accounts like university hospitals and major healthcare networks, allowing for greater control over pricing and clinical support. Indirect channels utilize third-party distributors, particularly in geographically diverse or emerging markets, where local partners manage importation, inventory, and localized clinical support, offering speed and access to fragmented healthcare systems. Crucially, the post-sales service component, often encompassing remote monitoring platforms, data analysis, and technical support, is increasingly becoming the most valuable aspect of the downstream value chain. This service ensures continuous engagement with the physician and patient, generating recurring revenue streams and reinforcing brand loyalty through reliable remote care delivery, effectively blurring the line between product and integrated service provider.

Implantable Cardiac Monitors Market Potential Customers

The primary end-users and potential buyers of Implantable Cardiac Monitors (ICMs) are highly specialized medical professionals and the institutions they operate within, focused on cardiovascular diagnostics and arrhythmia management. The core customer base includes electrophysiologists, clinical cardiologists, and neurologists who utilize ICMs to solve diagnostic dilemmas where intermittent or asymptomatic arrhythmias are suspected, particularly in patients presenting with cryptogenic stroke, transient ischemic attacks, or unexplained syncope. These specialists rely on the long-term, continuous data provided by ICMs to make definitive diagnoses, which subsequently guide complex treatment decisions such as the initiation of anticoagulation therapy, recommendation for catheter ablation, or the implantation of pacing devices, establishing the device's role as a critical gatekeeper in advanced cardiovascular care pathways.

Institutional purchasers, such as large university hospitals and dedicated cardiac centers, represent the largest volume buyers. These institutions invest in ICM technology to enhance their diagnostic capabilities, improve patient outcomes, and reduce diagnostic delays and associated costs arising from repeated short-term monitoring failures. Ambulatory Surgical Centers (ASCs) are also increasingly becoming key customers, as the implantation procedure for ICMs is minimally invasive and efficiently performed in an outpatient setting, aligning perfectly with the ASC model of cost-effective, specialized procedures. The decision-making unit within these institutions is often complex, involving clinical department heads (Cardiology/Electrophysiology), procurement specialists, and value analysis committees who weigh the clinical benefits, procedural costs, and long-term reimbursement rates associated with the ICM technology before adoption.

A rapidly expanding segment of potential customers includes specialized stroke units and neurology departments. Given that a significant percentage of strokes are cryptogenic—meaning their cause is unknown—ICMs have proven instrumental in uncovering underlying, often asymptomatic, atrial fibrillation as the likely etiology. This cross-specialty adoption represents a substantial growth opportunity, expanding the traditional cardiology-focused customer base to include physicians managing stroke risk and post-stroke rehabilitation. Furthermore, payers and health maintenance organizations (HMOs) indirectly act as key stakeholders; while not direct buyers, their coverage and reimbursement policies significantly dictate the accessibility and volume of ICM procedures performed, making their perception of the device’s clinical utility and cost-effectiveness paramount to widespread market success and sustained adoption rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, Biotronik, LivaNova PLC, MicroPort Scientific Corporation, Angel Medical Systems, Vectorious Medical Technologies, ZOLL Medical Corporation, Rhythmia Medical, ReliantHeart Inc., Gentag Inc., Preventice Solutions (now part of Boston Scientific), Osypka Medical GmbH, iRhythm Technologies, Cardiac Insight Inc., Philips Healthcare, BPL Medical Technologies, Schiller AG, GE Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Implantable Cardiac Monitors Market Key Technology Landscape

The technological landscape of the Implantable Cardiac Monitors (ICM) market is currently dominated by miniaturization and enhanced communication capabilities, specifically focusing on generating reliable, high-resolution subcutaneous electrograms (SECG) over exceptionally long periods. Current ICMs utilize specialized sensing electrodes embedded within the device casing that capture minute electrical activity of the heart from the subcutaneous position, requiring highly sophisticated filtering and amplification technologies to separate clinical signals from noise and motion artifacts. Key technological developments include advanced battery chemistries and power management systems that enable multi-year longevity (often 3 to 4.5 years), reducing the need for premature device replacement. Furthermore, magnetic resonance imaging (MRI) conditional technology is now standard, allowing patients with ICMs to safely undergo necessary MRI scans, significantly improving the clinical utility and patient acceptance of these devices, addressing a major historical constraint in device cardiology.

A crucial technological differentiator is the sophistication of the proprietary arrhythmia detection algorithms integrated into the ICM firmware. Modern devices utilize advanced pattern recognition and machine learning techniques, moving beyond simple rate counting to accurately classify complex arrhythmias, including differentiating atrial flutter from fibrillation and distinguishing supraventricular from ventricular ectopy with higher fidelity than previous generations. This precision is vital for minimizing false positive alerts, which can burden both the patient and the remote monitoring staff. Furthermore, the integration of cellular or Bluetooth Low Energy (BLE) technology for remote data transmission allows for automatic, scheduled data uploads directly from the patient’s home to the secure physician portal (often via a dedicated bedside transmitter or a smartphone application), ensuring near real-time data accessibility and continuous patient surveillance without required patient intervention.

Future technological advancements are trending toward integrating multi-parameter physiological sensing within the ICM shell. While current devices primarily focus on electrical activity, next-generation ICMs are expected to incorporate sensors for monitoring heart failure indicators, such as thoracic impedance measurements (to detect fluid buildup) or blood pressure trends, transforming the ICM into a comprehensive diagnostic platform rather than a singular rhythm monitor. Moreover, the secure data management infrastructure—involving cloud-based platforms and robust cybersecurity protocols—is a paramount technological focus, ensuring compliance with global data privacy regulations (e.g., GDPR, HIPAA) while facilitating smooth integration with hospital EHR systems. The continuous refinement of device insertion tools and techniques also forms part of the technological landscape, simplifying the implantation procedure and minimizing procedural time and risks for patients across the various clinical settings.

Regional Highlights

- North America: Dominates the global Implantable Cardiac Monitors market, driven by high disposable income, sophisticated healthcare infrastructure, high awareness regarding AF and stroke risk, and highly favorable reimbursement coverage provided by government and private payers, particularly in the United States.

- Europe: Represents a mature market characterized by robust regulatory frameworks (CE Mark) and strong clinical guidelines recommending ICM use for cryptogenic stroke and unexplained syncope, ensuring steady adoption across major Western European economies like Germany, the UK, and France.

- Asia Pacific (APAC): Positioned as the fastest-growing region, fueled by rising prevalence of cardiovascular diseases, expanding access to advanced diagnostic technologies, increasing healthcare expenditure, and a large, aging patient population, with countries such as China and India exhibiting significant untapped potential.

- Latin America (LATAM): Exhibits moderate growth, primarily centered in larger economies like Brazil and Mexico, where improving healthcare access and increased focus on cardiovascular disease management are driving the gradual adoption of ICM technology, although reimbursement challenges persist.

- Middle East and Africa (MEA): Emerging market segment focusing on technological adoption in wealthy Gulf Cooperation Council (GCC) countries, driven by investment in advanced medical infrastructure and medical tourism, particularly for specialized cardiovascular procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Implantable Cardiac Monitors Market.- Medtronic PLC

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- LivaNova PLC

- MicroPort Scientific Corporation

- Angel Medical Systems, Inc.

- Vectorious Medical Technologies

- ZOLL Medical Corporation (A division of Asahi Kasei)

- Rhythmia Medical (Acquired by Boston Scientific)

- ReliantHeart Inc.

- Gentag Inc.

- Preventice Solutions (Acquired by Boston Scientific)

- Osypka Medical GmbH

- iRhythm Technologies, Inc.

- Cardiac Insight Inc.

- Philips Healthcare

- BPL Medical Technologies

- Schiller AG

- GE Healthcare

Frequently Asked Questions

Analyze common user questions about the Implantable Cardiac Monitors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary clinical advantage of an Implantable Cardiac Monitor (ICM) over traditional external monitors?

The primary clinical advantage is the ability to provide continuous, long-term monitoring (typically 3-4 years) necessary for detecting highly sporadic or asymptomatic cardiac arrhythmias like paroxysmal atrial fibrillation (pAF) or unexplained syncope, which are often missed by short-term Holter or external patch monitors, thereby significantly increasing the diagnostic yield and ensuring definitive treatment planning.

How does the integration of AI/Machine Learning impact the accuracy and efficiency of ICMs?

AI and Machine Learning algorithms significantly enhance ICM performance by improving the specificity of arrhythmia detection, reducing the rate of false positive alerts, and efficiently filtering vast amounts of physiological data. This allows for faster, more accurate remote data review, minimizes clinical alarm fatigue, and transitions the technology toward predictive diagnostics based on complex pattern analysis.

Which application segment drives the highest demand in the Implantable Cardiac Monitors Market?

The Atrial Fibrillation (AF) Monitoring and Detection segment consistently drives the highest demand. Given the severe stroke risk associated with AF, ICMs are crucial for its diagnosis, quantification of AF burden, and risk stratification, particularly in patients recovering from cryptogenic stroke, making AF detection the most critical market application globally.

Are Implantable Cardiac Monitors safe for patients undergoing Magnetic Resonance Imaging (MRI) scans?

Yes, modern Implantable Cardiac Monitors are typically designed to be MRI Conditional. This designation ensures that patients can safely undergo MRI procedures under specific conditions (field strength, scan duration) without adverse impact on the device function or patient safety. The development of MRI-compatible devices has significantly broadened the clinical utility and patient acceptance of ICMs.

What are the key technological advancements expected to shape the future of the ICM market?

Future advancements focus on further miniaturization, significantly extending battery life beyond four years, integrating advanced physiological sensors (beyond electrical activity) to monitor heart failure parameters like thoracic impedance, and incorporating sophisticated edge computing for real-time, highly personalized data processing and proactive clinical alerts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager