Implantable Remote Patient Monitoring Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432139 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Implantable Remote Patient Monitoring Device Market Size

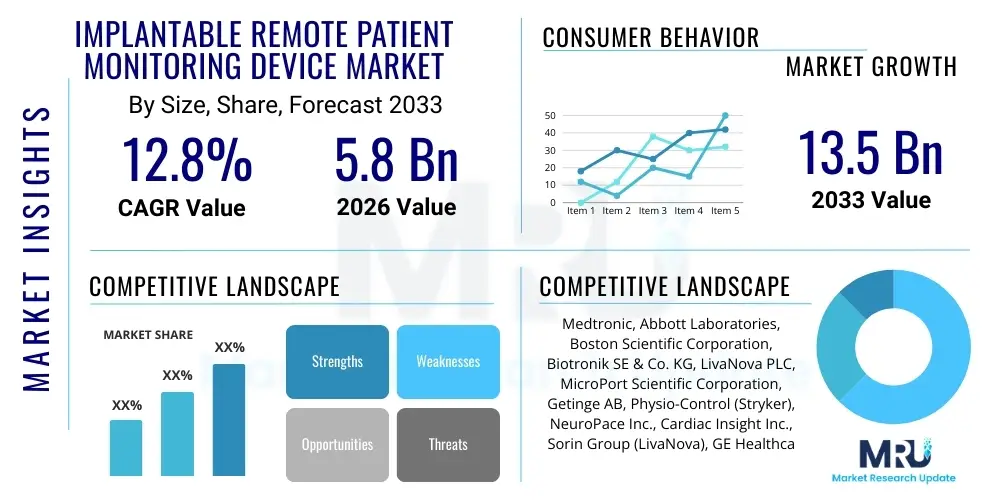

The Implantable Remote Patient Monitoring Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033. This significant expansion is primarily driven by the escalating global burden of chronic diseases, particularly cardiovascular and neurological disorders, coupled with increasing technological advancements that allow for miniature, power-efficient, and highly accurate implantable devices capable of continuous, real-time data transmission.

Implantable Remote Patient Monitoring Device Market introduction

The Implantable Remote Patient Monitoring (RPM) Device Market encompasses specialized medical technologies designed to be permanently or semi-permanently placed inside the human body, facilitating continuous collection and transmission of physiological data to healthcare providers outside the clinical setting. These devices range from cardiac rhythm management systems, such as implantable cardiac monitors (ICMs) and pacemakers with remote capabilities, to neurostimulators and pressure sensors used for managing conditions like chronic heart failure, epilepsy, and diabetes. The primary product description centers on highly miniaturized electronics, biocompatible materials, sophisticated sensing mechanisms, and secure wireless communication modules compliant with stringent medical data privacy regulations (e.g., HIPAA and GDPR).

Major applications of these devices span cardiology, where they monitor arrhythmias and heart failure progression; neurology, focusing on deep brain stimulation parameters and seizure activity detection; and various other fields, including continuous glucose monitoring and intraocular pressure surveillance. The increasing utility across diverse clinical areas is positioning these implants as crucial tools for preventative medicine and optimizing individualized patient care plans. These systems drastically reduce the necessity for frequent in-person clinic visits, thereby improving patient adherence and reducing the overall cost burden associated with long-term chronic disease management while ensuring timely intervention during critical health events.

Key driving factors accelerating market adoption include the aging global population which naturally correlates with higher incidences of chronic ailments requiring continuous surveillance, and the demonstrable benefits of remote monitoring in reducing re-hospitalization rates, thereby enhancing patient outcomes and satisfaction. Furthermore, regulatory bodies, especially in developed economies, are increasingly supportive of digital health initiatives and reimbursement policies that specifically incentivize the use of RPM technologies, validating the clinical and economic value proposition offered by these advanced implantable solutions.

Implantable Remote Patient Monitoring Device Market Executive Summary

The Implantable Remote Patient Monitoring Device Market is undergoing a rapid technological transformation, characterized by the convergence of bio-sensing technology, advanced data analytics, and ultra-low-power electronics. Current business trends indicate a strong move toward device longevity and enhanced cybersecurity features to protect sensitive patient data transmitted wirelessly from the implant to external receivers or cloud platforms. Strategic collaborations between medical device manufacturers and AI/Software-as-a-Medical-Device (SaMD) companies are crucial, aiming to translate massive amounts of generated physiological data into actionable clinical insights, moving beyond simple data logging toward predictive diagnostics.

Regional trends reveal that North America, particularly the United States, holds the dominant market share due to its sophisticated healthcare infrastructure, high awareness regarding advanced medical treatments, and favorable reimbursement landscape established by major payers like Medicare. However, the Asia Pacific (APAC) region is projected to experience the highest growth rate, fueled by improving healthcare accessibility, increasing government investment in digital health, and the expansion of key market players into emerging economies like China and India, where the burden of chronic diseases is rapidly rising and seeking scalable, efficient monitoring solutions.

Segment trends demonstrate the cardiac monitoring segment maintaining its leadership, driven by the widespread use of implantable cardioverter defibrillators (ICDs) and pacemakers with integrated RPM capabilities, essential for high-risk patients. Simultaneously, the neurological segment, encompassing implants for deep brain stimulation (DBS) and vagus nerve stimulation (VNS), is exhibiting accelerating growth due to continuous innovation in adaptive stimulation techniques and non-invasive programming. End-user trends show hospitals remaining the primary purchasing entity, though the shift towards ambulatory surgical centers (ASCs) and specialized cardiology clinics for device implantation and follow-up management is becoming increasingly pronounced, driven by cost-efficiency and patient convenience.

AI Impact Analysis on Implantable Remote Patient Monitoring Device Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) enhance the utility and effectiveness of implantable RPM devices, particularly concerning predictive analytics, anomaly detection, and minimizing false alerts. Common user concerns revolve around the accuracy of automated diagnostics, the security and privacy implications of transferring complex AI-processed data, and the regulatory pathway for AI-enabled implanted devices. There is a high expectation that AI will dramatically improve battery life management, personalize therapeutic adjustments in closed-loop systems (like artificial pancreases or adaptive neurostimulators), and ultimately transition healthcare from reactive intervention to proactive prevention based on continuous physiological trend analysis.

The integration of AI models directly into the firmware of implantable devices or into the supporting cloud infrastructure allows for real-time analysis of vital signs and biometrics transmitted from the patient. This sophistication enables the identification of subtle, pre-symptomatic patterns that human clinicians might overlook, such as minor changes in heart rate variability or subtle shifts in intracranial pressure that precede a major adverse event. For instance, in cardiac RPM, AI algorithms can accurately filter out noise and classify arrhythmias with greater precision than traditional algorithms, thereby reducing the volume of data requiring physician review and drastically cutting down on the incidence of nuisance alarms that lead to clinician burnout or alert fatigue.

Furthermore, AI facilitates the development of truly closed-loop systems, which represent the pinnacle of automated medical intervention. In these systems—such as advanced insulin pumps paired with continuous glucose monitoring (CGM) implants—AI acts as the decision-making engine, dynamically adjusting drug delivery or stimulation parameters based on real-time physiological feedback, thereby achieving optimal therapeutic goals autonomously. This level of personalized, continuous adjustment minimizes patient risk and maximizes therapeutic efficacy, transforming the paradigm of chronic disease management and offering patients a superior quality of life while reducing the need for constant manual adjustments and frequent clinical oversight.

- AI enables predictive analytics to forecast adverse events (e.g., heart failure decompensation) days or weeks in advance.

- Machine learning optimizes battery management in implants by intelligently modulating data transmission frequency based on risk assessment.

- AI algorithms improve diagnostic accuracy by differentiating critical physiological signals from background noise and artifacts.

- Closed-loop systems leverage AI for autonomous, personalized therapeutic adjustments in real-time, such as adaptive neurostimulation.

- Generative AI tools are being used to synthesize clinical pathways and assist healthcare providers in interpreting complex, multi-parameter implant data sets efficiently.

DRO & Impact Forces Of Implantable Remote Patient Monitoring Device Market

The market for Implantable Remote Patient Monitoring devices is primarily driven by the imperative to manage the rising prevalence of chronic conditions and the need for cost-effective monitoring solutions that prevent costly hospitalizations. Restraints, however, include significant regulatory hurdles, the high upfront cost of implantation procedures and the associated devices, and ongoing concerns related to data security and patient privacy in wirelessly connected medical implants. Opportunities are substantial, centered on the expansion into non-cardiac fields like peripheral vascular disease and oncology monitoring, coupled with advancements in biodegradable materials and ultra-miniaturization, promising less invasive procedures. These forces collectively exert a strong, positive impact on market expansion, despite persistent challenges in establishing robust, globally harmonized reimbursement frameworks.

Key drivers strongly pushing market adoption include technological miniaturization, which has enabled the creation of smaller, less invasive devices with enhanced sensing capabilities and multi-year battery life, making implantation procedures simpler and more acceptable to patients. Furthermore, supportive governmental policies and evolving digital health infrastructure worldwide are facilitating the secure and efficient transfer of patient data, creating a compelling case for RPM adoption among major healthcare systems seeking efficiency improvements. The demonstrable impact of RPM in reducing mortality and morbidity rates for specific high-risk populations, validated through extensive clinical trials, serves as a powerful accelerator for both patient acceptance and regulatory approval.

Conversely, significant restraints hinder growth. The initial capital expenditure for hospitals establishing RPM infrastructure, including secure data management platforms and specialized clinical staff training, can be prohibitive, especially in emerging markets. Moreover, the stringent and lengthy regulatory approval processes for Class III implanted medical devices, particularly those incorporating novel AI or sensing technologies, often delay market entry. Public perception regarding the vulnerability of implanted devices to cyber threats also poses a substantial constraint; though manufacturers invest heavily in encryption and security protocols, persistent media reports about potential hacks necessitate continuous vigilance and robust consumer education to maintain trust and safeguard adoption rates.

Segmentation Analysis

The Implantable Remote Patient Monitoring Device Market is meticulously segmented based on product type, clinical application, and end-user, reflecting the diverse technological capabilities and varied clinical needs addressed by these systems. Segmentation analysis is critical for understanding market dynamics as the growth rate varies significantly between established segments, such as cardiac rhythm management, and rapidly emerging areas, like advanced neurological stimulation and implantable pressure sensors. This structural breakdown helps stakeholders pinpoint high-growth niches, assess competitive intensity within specific therapeutic areas, and tailor product development and marketing strategies to meet the specific requirements of distinct end-user groups, ranging from large academic medical centers to decentralized community clinics focusing on specialized chronic care management.

Product segmentation remains dominated by traditional cardiovascular implants but is rapidly diversifying to include sophisticated drug delivery systems and physiological sensors, indicating a shift toward multi-parameter monitoring capabilities. Application-wise, cardiology holds sway, but neuro-monitoring is quickly gaining traction due to the development of adaptive Deep Brain Stimulation (DBS) devices that require constant remote fine-tuning. End-user analysis highlights the centralization of sophisticated device management in hospitals, though the expanding role of home healthcare agencies and specialized clinics in monitoring post-discharge patients suggests a future decentralization of routine follow-up care enabled by reliable remote connectivity and automated alerts.

The interplay between these segments demonstrates a clear trend toward convergence; for instance, devices are increasingly combining multiple functionalities, such as a pacemaker implant that also offers continuous pulmonary artery pressure monitoring to proactively manage heart failure. Understanding the granular demand within each segment—such as the preference for single-chamber versus dual-chamber devices, or the requirement for specific data transmission standards (e.g., Bluetooth LE vs. proprietary radio frequency)—is essential for accurately projecting future market share and investment priorities across the competitive landscape.

- By Product Type:

- Implantable Cardiac Monitors (ICMs)

- Implantable Cardioverter Defibrillators (ICDs)

- Pacemakers (Single Chamber, Dual Chamber, Biventricular)

- Neurostimulators (DBS, VNS, SCS)

- Implantable Pressure Sensors (e.g., Pulmonary Artery Pressure)

- Implantable Continuous Glucose Monitors (CGMs)

- By Application:

- Cardiology (Arrhythmias, Heart Failure, Post-Infarction Monitoring)

- Neurology (Epilepsy, Parkinson’s Disease, Chronic Pain Management)

- Endocrinology (Diabetes Management)

- Other Applications (Gastroenterology, Urology)

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings and Specialized Remote Monitoring Centers

Value Chain Analysis For Implantable Remote Patient Monitoring Device Market

The value chain for the Implantable Remote Patient Monitoring Device Market is complex and involves several specialized stages, beginning with fundamental research and development (R&D) focused on advanced bio-materials, sensor miniaturization, and low-power circuit design. Upstream analysis focuses heavily on key suppliers providing specialized components, including application-specific integrated circuits (ASICs), long-life lithium-ion batteries, and highly regulated biocompatible casings (e.g., titanium or specialized polymers). The rigorous regulatory environment dictates that material sourcing and component manufacturing must adhere to ISO 13485 standards and specific FDA quality system regulations, adding substantial complexity and cost at the input stage compared to general electronics manufacturing.

Midstream activities involve the highly precise manufacturing and assembly of the implantable devices, rigorous sterilization processes, and comprehensive quality assurance testing, followed by clinical trials required for market approval. Downstream analysis focuses on distribution and logistics, involving specialized distributors who handle temperature-sensitive or high-value medical devices and manage inventory within the hospital and clinic networks. The distribution channel is often bifurcated into direct sales teams deployed by major original equipment manufacturers (OEMs) who interact directly with specialized electrophysiologists and neurosurgeons, and indirect channels relying on third-party medical distributors who handle logistics and regional market penetration, particularly in geographically fragmented areas.

A crucial modern element in the value chain is the data services platform. Post-sale, the actual value derived from RPM implants is generated through secure data transmission, cloud hosting, and the analytical services provided, often necessitating continuous service contracts with healthcare providers. This shift transforms the product from a one-time sale device into an ongoing service model, directly impacting the long-term revenue streams for manufacturers. The effectiveness of the entire value chain hinges not only on device performance but also on the reliability of the secure communication infrastructure and the efficacy of the direct and indirect clinical support provided for data interpretation and alert management.

Implantable Remote Patient Monitoring Device Market Potential Customers

The primary end-users and buyers of Implantable Remote Patient Monitoring Devices are highly specialized healthcare institutions and clinicians managing large populations of patients with chronic, life-threatening, or high-risk conditions requiring continuous physiological surveillance. These institutions include large academic medical centers (AMCs) and specialized hospitals, which serve as the initial sites for complex device implantation procedures, driven by the need for state-of-the-art technology to support advanced patient care protocols. Within these settings, the immediate buyers are often the hospital procurement departments, influenced heavily by recommendations from cardiology, neurology, and endocrinology department heads, who evaluate device efficacy, long-term costs, and compatibility with existing electronic health record (EHR) systems.

Secondary but increasingly important customers include Ambulatory Surgical Centers (ASCs) and dedicated specialty clinics, such as cardiology and pain management centers, which focus on less complex implant procedures and intensive post-operative follow-up. These centers are often seeking cost-efficient solutions and devices that facilitate high patient throughput and minimal logistical burden, capitalizing on the reduced need for traditional in-person follow-up enabled by RPM. The adoption in these settings is critical for market decentralization and increasing access to technology outside major metropolitan areas, making them pivotal targets for sales and marketing efforts.

Furthermore, third-party remote monitoring service providers and integrated health systems (IHSs) represent a growing customer base. These entities purchase devices and associated monitoring services in bulk to manage extensive patient cohorts across multiple geographical locations. For IHSs, the core interest lies in demonstrating improved quality metrics, such as reduced readmission rates and better population health outcomes, which directly impact their reimbursement rates and operational efficiency. The potential customers are highly sophisticated, prioritizing clinical evidence, data security compliance, seamless integration, and total cost of ownership over the device lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, LivaNova PLC, MicroPort Scientific Corporation, Getinge AB, Physio-Control (Stryker), NeuroPace Inc., Cardiac Insight Inc., Sorin Group (LivaNova), GE Healthcare, Philips Healthcare, Dexcom, Insulet Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Implantable Remote Patient Monitoring Device Market Key Technology Landscape

The technology landscape governing the Implantable Remote Patient Monitoring market is defined by three pillars: ultra-low power consumption, advanced sensor fidelity, and secure wireless connectivity. Core technological innovation is centered on developing proprietary power management integrated circuits (PMICs) and highly efficient energy harvesting systems (e.g., kinetic or thermal energy conversion) to extend device longevity far beyond the current decade-long expectation, thereby minimizing the need for replacement procedures. Furthermore, materials science breakthroughs, specifically in bioresorbable polymers and flexible electronics, are paving the way for temporary or biodegradable implants that dissolve safely within the body after their monitoring function is complete, significantly reducing long-term complication risks associated with permanent foreign bodies.

A second critical area is the evolution of communication protocols. While older devices relied on proprietary radiofrequency transmissions, newer generations are increasingly adopting standardized, secure low-energy protocols like Bluetooth Low Energy (BLE) or Near Field Communication (NFC) to facilitate easier and more ubiquitous data transmission to external readers, smartphones, or dedicated home monitoring units. This standardization allows for greater interoperability between different devices and third-party health applications, aligning with broader digital health ecosystems. Security architecture, involving sophisticated end-to-end encryption (often leveraging AES-256), robust authentication protocols, and physical tamper-proof mechanisms, remains paramount to ensure compliance with global data privacy mandates and prevent unauthorized access to implanted devices.

Finally, the integration of multi-parameter sensing capabilities represents a major technological leap. Modern implants are moving beyond single-variable monitoring (e.g., just heart rate) to incorporate complex data collection, such as impedance measurements for fluid status, micro-electrical fields for tissue perfusion, or real-time chemical sensing (biosensors) for metabolic markers. These advanced sensing platforms, coupled with on-board processing capabilities and machine learning acceleration, enable devices to perform sophisticated real-time signal processing and preliminary diagnostic filtering at the source, reducing the bandwidth requirements and maximizing the efficiency of the remote monitoring system while delivering highly complex clinical data.

Regional Highlights

- North America (NA): This region maintains market dominance due to early and aggressive adoption of advanced medical technologies, high healthcare expenditure, and a well-established regulatory framework (FDA) that supports the commercialization of complex RPM devices. The presence of major global market leaders and a highly sophisticated network of electrophysiology centers contribute significantly to the large market share. Favorable reimbursement coverage for remote monitoring services, particularly through Medicare and major private insurers, acts as a primary economic driver, cementing the region's position as the leading consumer and innovator in this space.

- Europe: Europe represents the second-largest market, characterized by strong governmental focus on improving patient quality of life and controlling healthcare costs through preventative digital solutions. The implementation of the Medical Device Regulation (MDR) has created temporary regulatory challenges, yet it is expected to enhance device quality and data safety in the long term. Countries such as Germany, France, and the UK exhibit high penetration rates, driven by universal healthcare systems that prioritize efficiency and long-term chronic disease management protocols utilizing RPM technology.

- Asia Pacific (APAC): Projected to be the fastest-growing regional market, APAC's expansion is attributed to the rapidly increasing elderly population, rising disposable incomes, and significant investment by governments in healthcare infrastructure modernization. While market penetration is currently lower than in the West, massive patient volumes in countries like China and India, coupled with increasing awareness and acceptance of digital health solutions, provide vast untapped growth potential. Regulatory streamlining and the expansion of private sector healthcare delivery are crucial factors accelerating adoption here.

- Latin America (LATAM): Growth in LATAM is more moderate but steady, centered primarily in economically stable countries like Brazil and Mexico. Market expansion is often hampered by fluctuating currency values, fragmented healthcare systems, and limitations in public sector budget allocation for advanced medical devices. However, the private healthcare sector in key urban centers is rapidly adopting high-end RPM implants to match international standards of care and attract medical tourism.

- Middle East and Africa (MEA): This region shows emerging growth, heavily concentrated in the Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) where substantial government wealth is being channeled into constructing state-of-the-art medical cities and specialized cardiac centers. Adoption is driven by strategic initiatives to reduce reliance on medical treatment abroad and elevate the local standard of care, often facilitated by direct purchasing agreements with major US and European device manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Implantable Remote Patient Monitoring Device Market.- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- LivaNova PLC

- MicroPort Scientific Corporation

- NeuroPace Inc.

- Cardiac Insight Inc.

- GE Healthcare

- Philips Healthcare

- Dexcom

- Insulet Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Integer Holdings Corporation

- Zoll Medical Corporation (Asahi Kasei Group)

- Nevro Corp.

- Senseonics Holdings, Inc.

- Vascular Dynamics, Inc.

- Tandem Diabetes Care, Inc.

- Viatris Inc. (Formerly Mylan)

Frequently Asked Questions

Analyze common user questions about the Implantable Remote Patient Monitoring Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary clinical benefits of using implanted RPM devices over traditional monitoring?

Implanted Remote Patient Monitoring (RPM) devices provide continuous, objective, and real-time physiological data that significantly enhances early detection of clinical deterioration, such as impending heart failure exacerbation or recurrent arrhythmias. This continuous surveillance allows for timely, proactive clinical intervention, demonstrably reducing the frequency of emergency room visits, lowering the incidence of costly hospital readmissions, and improving overall long-term patient survival and quality of life by enabling highly personalized therapeutic adjustments outside the clinical setting.

How do cybersecurity risks affect the adoption rate of connected implantable devices?

Cybersecurity remains a critical concern, as the wireless connectivity required for RPM introduces potential vulnerabilities to data breaches or unauthorized device manipulation. Manufacturers address this by implementing stringent, multi-layered security protocols, including robust encryption, dedicated secure servers, and authentication mechanisms. While these risks necessitate continuous vigilance and compliance with evolving regulatory standards (e.g., FDA guidance on medical device cybersecurity), the documented clinical benefits typically outweigh security concerns, driving steady market adoption among risk-managed healthcare providers.

Which chronic diseases are driving the highest demand for implantable RPM devices?

The highest demand is currently driven by cardiovascular diseases, specifically complex arrhythmias, chronic heart failure (CHF), and post-myocardial infarction monitoring, utilizing devices such as Implantable Cardioverter Defibrillators (ICDs) and specialized pulmonary artery pressure sensors. Demand is also rapidly accelerating in neurology for conditions like Parkinson's disease and chronic pain management through adaptive neurostimulators, and in endocrinology for continuous glucose monitoring in diabetes care.

What is the regulatory outlook for novel AI-enabled implantable RPM devices?

The regulatory outlook is characterized by increasing scrutiny and the need for rigorous clinical validation, particularly concerning the Software as a Medical Device (SaMD) components and integrated AI algorithms responsible for automated diagnostic decisions. Regulatory bodies like the FDA are establishing new, adaptive frameworks (e.g., the Pre-Certification Program) to safely and efficiently evaluate the safety and efficacy of continuously learning algorithms, ensuring that rapid technological evolution does not compromise patient safety or data integrity.

How is the reimbursement landscape influencing market growth across different geographies?

Reimbursement policies are a primary driver of market growth, particularly in North America and Western Europe, where specific CPT codes and governmental policies (like Medicare in the US) offer attractive compensation for remote monitoring services, justifying the initial investment for healthcare providers. In contrast, adoption in emerging markets is often constrained by the absence of specific reimbursement codes for RPM services, leading manufacturers to focus on demonstrating long-term cost savings through reduced hospitalization rates to influence local health ministries and private payers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager