Implantable Spinal Cord Stimulation Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433113 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Implantable Spinal Cord Stimulation Device Market Size

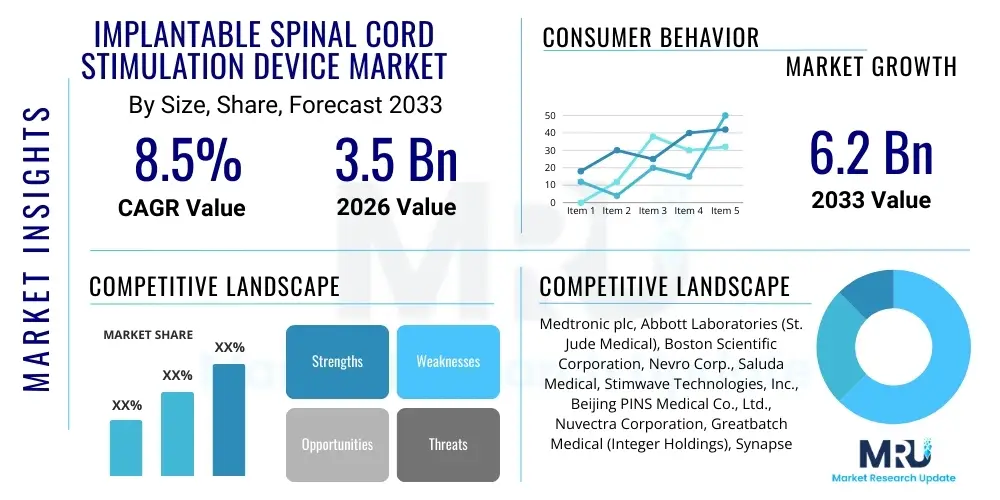

The Implantable Spinal Cord Stimulation Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Implantable Spinal Cord Stimulation Device Market introduction

The Implantable Spinal Cord Stimulation (SCS) Device Market encompasses specialized medical technologies designed to manage chronic neuropathic pain that is refractory to conventional medical treatments. These devices deliver low-level electrical impulses directly to the spinal cord, modulating pain signals before they reach the brain. The technology offers a critical therapeutic option for patients suffering from conditions such as failed back surgery syndrome (FBSS), complex regional pain syndrome (CRPS), and chronic intractable back and limb pain. The core product categories include rechargeable and non-rechargeable systems, utilizing different stimulation paradigms like tonic, burst, and high-frequency stimulation.

The principal applications for SCS devices revolve around enhancing the quality of life for chronic pain sufferers, offering a less invasive alternative to surgical interventions or high dependency on opioid analgesics. The increasing global prevalence of chronic pain conditions, coupled with an aging population susceptible to degenerative spinal diseases, serves as a foundational driver for market expansion. Furthermore, regulatory approvals expanding the indications for SCS therapy, particularly into non-pain applications or early intervention stages, are boosting adoption rates among pain specialists and neurosurgeons. The devices provide significant cost-effectiveness over long periods compared to continuous pharmacological management.

Driving factors in this market are intrinsically linked to technological innovation. Advances in battery longevity, miniaturization, and the introduction of advanced stimulation algorithms—such as closed-loop systems that adapt stimulation based on real-time neural feedback—are enhancing efficacy and patient outcomes. The growing awareness among both clinicians and patients regarding the potential for SCS to drastically reduce opioid use, addressing the ongoing global opioid crisis, further fuels market demand. Benefits include durable pain relief, improved functional mobility, and reduced reliance on systemic medications, positioning SCS as a cornerstone in comprehensive chronic pain management strategies.

Implantable Spinal Cord Stimulation Device Market Executive Summary

The Implantable Spinal Cord Stimulation Device Market demonstrates robust growth, driven primarily by favorable business trends focused on miniaturization and personalized medicine. Key market participants are heavily investing in Research and Development (R&D) to launch next-generation stimulators featuring enhanced battery performance and compatibility with magnetic resonance imaging (MRI). The shift towards less invasive implantation procedures and the development of sophisticated programming capabilities that allow for targeted pain relief are defining competitive differentiation. Strategic partnerships between device manufacturers and specialized pain clinics are accelerating market penetration and improving physician training on complex stimulation techniques, thereby broadening access to this advanced therapeutic option.

Regionally, North America maintains its dominance due to high healthcare expenditure, sophisticated infrastructure, and favorable reimbursement policies supporting SCS procedures, particularly in the United States. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment, fueled by rising disposable incomes, increasing awareness of chronic pain management options, and improving healthcare access in countries like China and India. European countries continue stable growth, focusing on clinical data generation to support long-term efficacy and cost-effectiveness in public healthcare systems. Regulatory harmonization and fast-track approval processes for innovative devices will be crucial for sustained global expansion across all geographic segments.

Segment trends highlight a strong preference for rechargeable SCS systems due to their extended device lifespan and reduced need for replacement procedures, offering better long-term value for patients. Furthermore, the technological segment is rapidly moving away from conventional tonic stimulation towards advanced wave forms like high-frequency (HF10) and burst stimulation, which offer superior paresthesia-free pain relief. The utilization segment is increasingly dominated by Failed Back Surgery Syndrome (FBSS) and Complex Regional Pain Syndrome (CRPS) applications, though expansion into painful diabetic neuropathy is a significant area for future growth, validating the therapeutic versatility of implantable SCS technology.

AI Impact Analysis on Implantable Spinal Cord Stimulation Device Market

User queries regarding the impact of Artificial Intelligence (AI) on Implantable Spinal Cord Stimulation Devices predominantly focus on how AI can personalize therapy, enhance device safety, and improve clinical workflow efficiency. Common questions center on the integration of machine learning for optimized pain signal interpretation, the development of closed-loop stimulation systems driven by predictive algorithms, and the role of AI in streamlining surgical planning and postoperative adjustment. Users are concerned with the precision and reliability of AI-driven adaptive stimulation protocols and the potential for AI to reduce programming time and minimize trial-and-error phases inherent in current manual programming methods. There is a strong expectation that AI will transition SCS therapy from a static, manually adjusted treatment to a highly dynamic, personalized pain management solution, ultimately improving long-term patient outcomes and cost-effectiveness.

- AI algorithms enable precise, real-time sensing of neural signals, facilitating dynamic adjustment of stimulation parameters (closed-loop systems).

- Machine learning optimizes programming complexity, significantly reducing the time required for clinicians to find the ideal therapy settings for individual patients.

- Predictive analytics can forecast pain fluctuations and adjust stimulation proactively, minimizing breakthrough pain episodes.

- AI supports advanced surgical planning by analyzing patient anatomy and recommending optimal lead placement locations, improving procedural success rates.

- AI-driven data analysis helps manufacturers identify potential device malfunctions or suboptimal performance patterns quickly, enhancing post-market surveillance and device safety.

DRO & Impact Forces Of Implantable Spinal Cord Stimulation Device Market

The market is primarily driven by the escalating prevalence of chronic neuropathic pain conditions globally, coupled with technological breakthroughs in neuromodulation techniques offering superior efficacy. Restraints include the high initial cost of the devices and the associated implantation procedures, along with stringent regulatory hurdles and competition from alternative, less invasive pain management therapies. Opportunities abound in expanding therapeutic indications beyond conventional chronic pain, such as treating peripheral artery disease or refractory angina, and improving patient compliance through smart, user-friendly remote programming systems. The primary impact forces include rapid technological innovation (pushing product replacement cycles) and evolving reimbursement policies which significantly influence patient access and adoption rates in major markets.

Drivers are strongly rooted in demographic shifts, notably the aging population, which is more prone to spinal and neurological conditions requiring advanced pain management. Furthermore, the documented risks and societal burden associated with long-term opioid use have positioned SCS as a highly attractive, non-pharmacological alternative. Companies focusing on developing systems compatible with full-body MRI scans have a competitive edge, as this feature addresses a major clinician concern regarding device compatibility and enhances patient safety post-implantation. Increased clinical evidence supporting the long-term efficacy and cost-benefit of SCS compared to conservative treatments also drives physician confidence and referral volumes.

Key restraints, besides cost, involve the necessity for a surgical procedure and the associated risks of infection or lead migration, which can sometimes lead to explantation. Addressing these surgical risks through minimal invasiveness techniques and advanced lead anchoring systems is critical for market acceptance. Opportunities lie in targeting emerging markets where chronic pain treatment infrastructure is developing rapidly, and where market penetration rates are still relatively low. Furthermore, integrating advanced diagnostics and remote patient monitoring capabilities into SCS platforms allows for continuous therapeutic management and potential early intervention if pain recurs, transforming the device from a static implant into a connected health solution.

Segmentation Analysis

The Implantable Spinal Cord Stimulation Device market is comprehensively segmented based on product type, technology, application, and end-user, allowing for nuanced analysis of market dynamics and targeted strategic development. Product segmentation distinguishes between rechargeable and non-rechargeable internal pulse generators (IPGs), reflecting trade-offs between longevity and initial implantation size. Technology segmentation tracks the shift from traditional tonic stimulation towards advanced modalities like burst, high-frequency, and adaptive closed-loop systems, which represent the cutting edge of neuromodulation efficacy. Application analysis focuses predominantly on managing Failed Back Surgery Syndrome (FBSS), Complex Regional Pain Syndrome (CRPS), and ischemic conditions, while end-users are primarily categorized into hospitals and specialized ambulatory surgical centers (ASCs).

- Product Type:

- Rechargeable Spinal Cord Stimulators

- Non-Rechargeable Spinal Cord Stimulators

- Technology:

- Traditional (Tonic) Stimulation

- Burst Stimulation

- High-Frequency Stimulation (e.g., 10kHz)

- Closed-Loop/Adaptive Stimulation Systems

- Application:

- Failed Back Surgery Syndrome (FBSS)

- Complex Regional Pain Syndrome (CRPS)

- Ischemic Conditions (e.g., Peripheral Vascular Disease)

- Refractory Angina Pectoris

- Others (e.g., Chronic Neuropathic Pain, Diabetic Neuropathy)

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Implantable Spinal Cord Stimulation Device Market

The value chain for the Implantable Spinal Cord Stimulation Device Market begins with upstream activities involving highly specialized R&D, focusing on biocompatible materials, miniaturized electronics, and complex software algorithms for stimulation control. Key suppliers provide advanced components such as microprocessors, battery cells (lithium-ion for rechargeable units), and specialized surgical leads. Manufacturing requires strict adherence to ISO 13485 and stringent medical device regulations, ensuring precision engineering and sterility. Upstream competition is defined by technological patents and expertise in neuromodulation science, establishing high barriers to entry for new component suppliers.

The downstream segment involves marketing, distribution, and critical post-sales support, which are heavily relationship-driven. Distribution channels are complex, relying on a mix of direct sales forces and specialized medical distributors capable of handling high-value, regulated medical devices. Direct sales ensure deep clinical training and support for implanting physicians (neurosurgeons and pain specialists), which is essential given the complexity of the programming required. Indirect channels, primarily focused on logistics and inventory management, streamline the supply chain to hospitals and Ambulatory Surgical Centers (ASCs).

The end-user interaction defines success, focusing heavily on patient selection and post-implantation care. The distribution channel must facilitate seamless delivery to surgical facilities. Specialized training and support for physicians, often provided directly by manufacturers' clinical specialists, are integral components of the value proposition, ensuring optimal device programming and long-term therapeutic success. The involvement of third-party payers (insurance providers) in the final stage significantly impacts adoption, making robust clinical evidence and clear reimbursement coding essential elements in the value chain execution.

Implantable Spinal Cord Stimulation Device Market Potential Customers

The primary end-users and buyers of Implantable Spinal Cord Stimulation Devices are healthcare facilities specializing in chronic pain management and neurosurgery. These include large hospital systems, academic medical centers offering advanced neuro-modulation therapies, and increasingly, specialized Ambulatory Surgical Centers (ASCs) focused on minimally invasive spine procedures. Hospitals represent the largest segment due to their capacity to handle complex surgeries and manage multi-disciplinary chronic pain programs. The purchasing decisions within these institutions are influenced by clinical efficacy data, device cost-effectiveness, long-term support provided by the manufacturer, and compatibility with existing surgical imaging and monitoring systems.

A crucial secondary customer segment includes pain management specialists, neurologists, and orthopedic surgeons who act as referring physicians and often perform the trial and implantation procedures. While they may not directly purchase the inventory, their adoption decisions heavily influence which devices are stocked and used by the procuring institutions. These clinicians prioritize devices that offer superior long-term paresthesia coverage, sophisticated programming capabilities (like remote adjustment), and demonstrated clinical results in refractory patient populations, particularly those suffering from debilitating conditions like Complex Regional Pain Syndrome (CRPS) or peripheral nerve injury.

The ultimate beneficiaries, the patients themselves, are increasingly informed consumers in this market. While they are not the direct purchasers, patient advocacy and demand for highly effective, opioid-sparing treatments drive institutional adoption. Potential patients are those experiencing chronic, intractable pain for more than six months who have failed conservative treatment options, including physical therapy, pharmacology, and nerve blocks. Target patient groups often suffer from conditions such as Failed Back Surgery Syndrome (FBSS), painful diabetic neuropathy, and post-herpetic neuralgia, requiring a high-quality, durable therapeutic solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Abbott Laboratories (St. Jude Medical), Boston Scientific Corporation, Nevro Corp., Saluda Medical, Stimwave Technologies, Inc., Beijing PINS Medical Co., Ltd., Nuvectra Corporation, Greatbatch Medical (Integer Holdings), Synapse Biomedical, Cirtec Medical, NeuroSigma, Nalu Medical, Inc., Melodi Health, Cyberonics (LivaNova) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Implantable Spinal Cord Stimulation Device Market Key Technology Landscape

The technological landscape of the Implantable Spinal Cord Stimulation Device Market is characterized by intense innovation focused on optimizing power efficiency and therapeutic output. Traditional SCS systems relied on tonic stimulation, which often induced paresthesia (a tingling sensation) to mask pain. Modern systems are rapidly adopting advanced waveform technologies, such as Burst and High-Frequency (HF) stimulation, which offer effective pain relief without inducing paresthesia, significantly enhancing patient comfort and device efficacy. The shift toward smaller, more energy-efficient rechargeable batteries and MRI-conditional or full-body MRI-safe devices is also a critical technological development, addressing long-standing clinical concerns regarding patient safety and device longevity.

The most significant advancement involves the integration of closed-loop systems, which utilize sensors to detect spinal cord activity (evoked potentials or physiological biomarkers) in real-time. These systems leverage AI and sophisticated algorithms to automatically adjust the stimulation amplitude or frequency based on the patient's immediate neural feedback and physiological needs. This adaptive functionality ensures optimal therapeutic dosing, prevents over-stimulation, and conserves battery life, ultimately translating to a more personalized and consistent pain management experience compared to open-loop, manually programmed systems. Companies are heavily competing in developing proprietary algorithms that fine-tune this closed-loop response for different pain etiologies.

Furthermore, technological progress is evident in the hardware design, particularly the development of percutaneous leads with increased contact points (e.g., 16 or 32 contacts) that allow for highly focused, three-dimensional stimulation fields. The miniaturization of the Internal Pulse Generator (IPG) and the introduction of entirely battery-free, micro-implantable devices are also transforming implantation procedures, making them less invasive and suitable for outpatient settings. Remote programming capabilities via secure wireless networks and tablet interfaces offer patients and clinicians greater flexibility in managing therapy adjustments post-implantation, increasing the convenience and overall management efficiency of these sophisticated devices.

Regional Highlights

- North America: Dominates the global market, accounting for the largest revenue share, primarily due to high adoption rates of advanced SCS technologies, well-established reimbursement systems (especially Medicare coverage for FBSS and CRPS), and the presence of major industry leaders (e.g., Medtronic, Abbott, Boston Scientific). The region's high prevalence of chronic pain and significant investment in pain management infrastructure drive continuous market growth.

- Europe: Represents a mature market characterized by stringent regulatory environments (MDR compliance) and strong clinical acceptance of SCS therapy, particularly in Western European countries like Germany, the UK, and France. Growth is moderate, supported by public healthcare investments and efforts to standardize chronic pain treatment protocols across the continent.

- Asia Pacific (APAC): Exhibits the highest projected Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, increasing medical tourism, and growing awareness of neuromodulation techniques. Countries like Japan, Australia, China, and India are key contributors, driven by a large patient pool and rising disposable incomes allowing access to premium medical treatments.

- Latin America (LATAM): Growth is steady but constrained by lower healthcare spending and less favorable reimbursement scenarios compared to North America and Europe. Key market development occurs in Brazil and Mexico, focusing on optimizing existing SCS technologies rather than rapid adoption of the very latest innovations.

- Middle East and Africa (MEA): This region is an emerging market, with growth concentrated in wealthier Gulf nations (UAE, Saudi Arabia) which possess advanced healthcare systems. Market expansion is driven by government initiatives to diversify healthcare services and reduce reliance on overseas treatment options, though overall market size remains smaller.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Implantable Spinal Cord Stimulation Device Market.- Medtronic plc

- Abbott Laboratories (St. Jude Medical)

- Boston Scientific Corporation

- Nevro Corp.

- Saluda Medical

- Stimwave Technologies, Inc.

- Beijing PINS Medical Co., Ltd.

- Nuvectra Corporation (Acquired assets)

- Integer Holdings (Greatbatch Medical)

- Synapse Biomedical

- Cirtec Medical

- NeuroSigma

- Nalu Medical, Inc.

- Melodi Health

- Cyberonics (LivaNova)

- Axonics, Inc.

- Soterix Medical

- NeuroPace, Inc.

- MicroTransponder, Inc.

- ReNeuron Group plc

Frequently Asked Questions

Analyze common user questions about the Implantable Spinal Cord Stimulation Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Implantable Spinal Cord Stimulation Devices?

The primary driver is the increasing prevalence of chronic, intractable neuropathic pain, particularly Failed Back Surgery Syndrome (FBSS) and Complex Regional Pain Syndrome (CRPS). Furthermore, the rising need for non-opioid pain management solutions significantly boosts SCS adoption as a sustainable therapeutic alternative.

How are closed-loop SCS systems superior to traditional systems?

Closed-loop systems utilize real-time neural feedback, often employing AI algorithms, to automatically adjust stimulation intensity. This adaptive approach ensures optimal pain coverage, minimizes energy consumption, and prevents over-stimulation, offering superior personalization and efficacy compared to static, traditional systems.

Which technology segment holds the most potential for growth in the SCS market?

High-Frequency (HF) and Burst stimulation technologies, along with emerging closed-loop adaptive systems, hold the most significant growth potential. These technologies offer paresthesia-free pain relief, addressing a major drawback of conventional low-frequency stimulation and enhancing patient comfort.

What are the main regional barriers to market entry in the Implantable SCS Device sector?

Key barriers include the high capital investment required for device manufacturing and R&D, stringent and lengthy regulatory approval processes, securing favorable reimbursement coverage across different national healthcare systems, and the intensive training required for specialized implanting physicians.

What specific chronic conditions are the fastest-growing applications for SCS devices?

While FBSS remains the largest application, painful diabetic neuropathy (PDN) is rapidly emerging as a significant growth area. Expanding clinical evidence supporting SCS use in treating PDN, particularly to manage intractable limb pain and potentially improve tissue viability, is accelerating its adoption.

The comprehensive analysis of the Implantable Spinal Cord Stimulation Device Market underscores its critical role in chronic pain management, positioned at the intersection of advanced neuromodulation technology and personalized healthcare. The market's resilience is built upon continuous technological leaps, including the shift to paresthesia-free stimulation and closed-loop adaptive therapy, which collectively enhance patient outcomes and broaden the scope of treatable conditions. Despite existing restraints related to cost and procedural risks, the robust market opportunities presented by global chronic pain prevalence, coupled with the push toward opioid reduction, solidify a strong growth trajectory. Strategic focus on emerging markets like APAC and continued R&D investment in AI integration will define the competitive landscape over the forecast period, driving the market toward achieving the projected USD 6.2 Billion valuation by 2033.

Furthermore, regional variations in healthcare spending and regulatory policies create segmented market opportunities. North America will continue to lead due to established infrastructure and high procedural volumes, while APAC offers explosive growth potential driven by improving healthcare access and rising awareness. For manufacturers, succeeding requires not only producing highly efficacious devices but also mastering the complex clinical support ecosystem, ensuring that advanced programming and patient selection criteria are rigorously applied to maximize therapeutic success. The future of the SCS market lies in integrating these devices into a broader digital health ecosystem, allowing for remote monitoring and AI-driven predictive maintenance, transforming chronic pain management into a continuous, data-informed process.

The importance of robust clinical trials demonstrating long-term cost-effectiveness and superior pain reduction cannot be overstated, as payer scrutiny remains high across developed economies. Companies that successfully navigate the complex interplay between innovation, regulatory approval, and favorable reimbursement will capture the largest market share. The drive towards miniaturization, energy efficiency, and MRI compatibility will remain key technological differentiators, attracting both clinicians and patients seeking less restrictive and more durable solutions for their intractable pain conditions. This dynamic environment confirms the SCS market as a high-value sector within the broader medical device industry, dedicated to improving the quality of life for millions suffering from chronic neuropathic pain globally.

The evolution of surgical techniques is also significantly influencing market dynamics, favoring percutaneous lead placement over paddle leads, reducing invasiveness and recovery time. This shift supports the growing trend of performing these implant procedures in Ambulatory Surgical Centers (ASCs), lowering overall healthcare costs and increasing procedural throughput. As device battery life extends and recharge cycles become less frequent, the patient experience improves, contributing positively to satisfaction scores and overall therapy adherence. Manufacturers are strategically positioning their portfolios to address these converging clinical, technical, and economic demands, focusing R&D efforts particularly on addressing the chronic, refractory pain associated with diabetic neuropathy—a burgeoning patient population worldwide with limited non-surgical options.

The regulatory pathway, especially in Europe following the implementation of the Medical Device Regulation (MDR), poses both challenges and opportunities. While requiring higher standards of clinical evidence, successful navigation of MDR can confer a significant competitive advantage by validating device safety and efficacy to a high degree. In parallel, the utilization of real-world evidence (RWE) gathered from patient registries and connected devices is becoming crucial for supporting post-market surveillance and demonstrating long-term value to payers. This data-driven approach supports faster indication expansion and ensures that technological advancements translate into measurable clinical benefits across diverse patient demographics and pain profiles.

Finally, the growing specialization in neuromodulation centers worldwide reflects the complexity and high expertise required for effective SCS therapy. Manufacturers are deeply involved in continuous education and training programs for clinicians, ensuring that the sophisticated capabilities of high-frequency and closed-loop systems are fully leveraged. This commitment to clinical support is a non-negotiable component of the market strategy, directly influencing physician confidence and subsequent device utilization rates. The commitment to minimizing hardware complications, such as lead migration or infection, through innovative materials and streamlined surgical kits, remains a continuous focus for competitive differentiation in this high-stakes medical device sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager