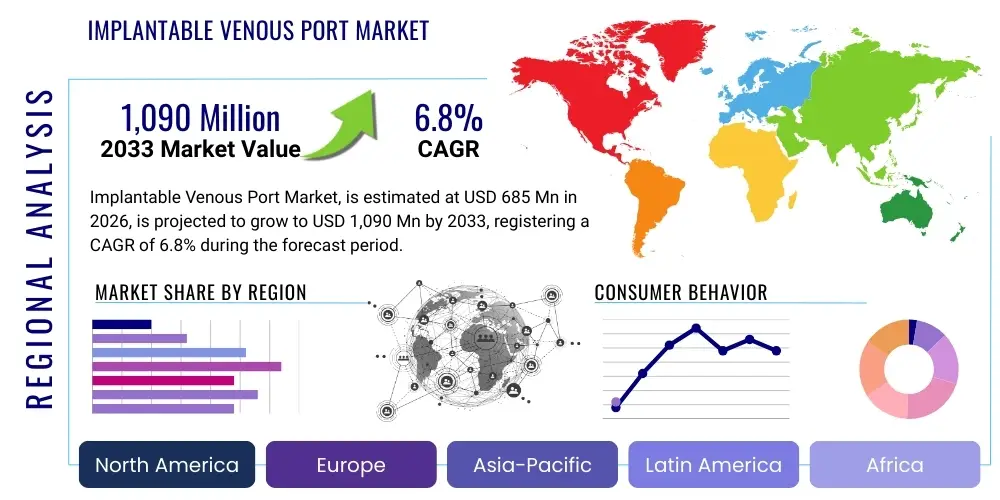

Implantable Venous Port Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434817 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Implantable Venous Port Market Size

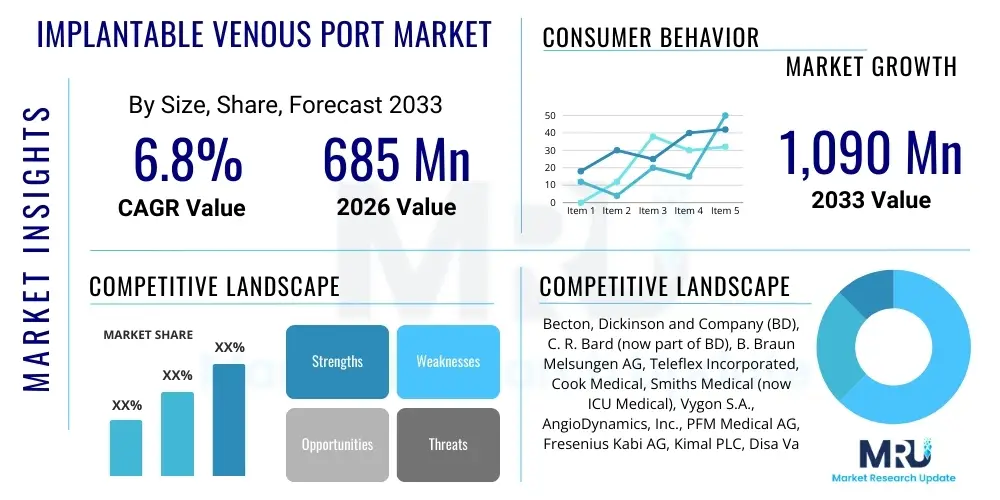

The Implantable Venous Port Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 685 Million in 2026 and is projected to reach USD 1,090 Million by the end of the forecast period in 2033.

Implantable Venous Port Market introduction

The Implantable Venous Port Market encompasses devices designed for long-term intermittent vascular access, primarily used for administering treatments such as chemotherapy, blood products, parenteral nutrition, and repeated blood sampling. These ports are surgically implanted under the skin, connecting to a central vein, and offer significant advantages over traditional peripheral intravenous lines, including reduced infection risk, improved patient comfort, and preservation of peripheral vasculature. The fundamental design involves a reservoir (port body) with a self-sealing septum and an attached catheter, enabling secure and reliable access for months or even years. This long-term reliability makes them indispensable in the management of chronic diseases, particularly oncology and hematology.

Product descriptions typically highlight ports categorized by materials—titanium or high-grade polymer—and lumen count, primarily single or dual lumen configurations depending on clinical requirements such as simultaneous incompatible fluid infusion. Major applications are heavily skewed towards chemotherapy administration for cancer patients, where multiple cycles of treatment necessitate robust vascular access. Benefits include a lower incidence of phlebitis and extravasation, enhanced quality of life for patients undergoing chronic treatments, and reduced need for repeated painful venipunctures. Furthermore, technological advancements focusing on smaller profile designs, MRI compatibility, and anti-microbial coatings are continually enhancing the efficacy and safety profile of these devices.

Driving factors fueling this market include the global rise in cancer incidence, which is the single largest application segment for venous ports. The increasing prevalence of other chronic conditions requiring long-term IV therapies, such as severe autoimmune disorders, infectious diseases requiring extended antibiotic treatment, and chronic kidney disease demanding frequent access, further contributes to market expansion. Additionally, the growing geriatric population, often burdened with multiple comorbidities, and improvements in healthcare infrastructure, particularly in emerging economies leading to better diagnosis and treatment access, are critical macro-drivers stimulating demand for secure and effective vascular access solutions.

Implantable Venous Port Market Executive Summary

The global Implantable Venous Port Market exhibits robust growth driven primarily by demographic shifts, escalating cancer rates, and continuous innovation in material science and design ergonomics. Business trends highlight a strong competitive landscape characterized by strategic mergers, acquisitions, and partnerships aimed at expanding geographic reach and enhancing product portfolios, particularly in specialized anti-microbial and power-injectable ports. Key manufacturers are focusing on differentiating their offerings through reduced complication rates, ease of insertion, and patient-centric designs. Furthermore, the shift toward polymer-based ports is noticeable due to their cost-effectiveness and favorable imaging properties compared to traditional titanium options, influencing procurement decisions across hospital networks and outpatient centers.

Regional trends indicate North America and Europe maintaining their dominance owing to established healthcare systems, high diagnosis rates, and significant healthcare expenditure per capita, alongside early adoption of advanced medical devices. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by rapidly improving healthcare access, increasing awareness regarding chronic disease management, and substantial growth in medical tourism and government investment in cancer care facilities. Emerging economies within APAC are witnessing a surge in the middle-class population demanding higher quality medical interventions, driving local production and distribution partnerships.

Segment trends underscore the supremacy of chemotherapy applications, though home healthcare and ambulatory care settings are increasingly utilizing ports, leading to greater demand for smaller, more discreet devices. In terms of product segmentation, the single lumen port segment currently holds the largest share due to its versatility and standard application profile, but dual lumen ports are gaining traction in complex clinical scenarios requiring simultaneous administration of medications. End-user segmentation reveals that hospitals remain the primary consumers; however, specialized oncology clinics and ambulatory surgical centers are projected to exhibit faster adoption growth, reflecting the decentralization of chronic disease management and the push towards outpatient treatment models.

AI Impact Analysis on Implantable Venous Port Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Implantable Venous Port Market frequently revolve around optimizing port placement procedures, predicting potential complications, and enhancing overall patient management efficiency. Common concerns include how AI can assist surgeons in selecting the optimal vascular access route, minimizing procedural risks such as pneumothorax or catheter migration, and utilizing machine learning algorithms to analyze electronic health records (EHR) for identifying high-risk patients who would benefit most from port insertion. Users also express expectations concerning AI integration for real-time monitoring of port function post-implantation and early detection of infections or occlusions, thereby significantly improving the long-term patency and safety of these essential medical devices. The underlying theme is leveraging AI to move from reactive management to predictive, personalized vascular access care.

- AI-powered image guidance systems enhancing surgical precision during port placement, reducing procedure time and complication rates.

- Machine learning algorithms analyzing patient data (co-morbidities, treatment regimen) to predict the necessity and longevity of vascular access device use.

- Predictive modeling for identifying patients at high risk of port-related complications, such as infection or thrombosis, enabling proactive intervention protocols.

- AI-assisted inventory management and supply chain optimization for venous port components in large hospital networks.

- Development of smart ports integrated with minimal sensor technology that use AI to monitor flow rates, pressure changes, and detect early signs of occlusion or rupture.

- Automated analysis of post-procedural radiographic images to confirm optimal catheter tip positioning.

- Personalized treatment planning based on AI analysis of tumor characteristics and chemotherapy schedules, dictating port specifications (e.g., lumen size, material).

DRO & Impact Forces Of Implantable Venous Port Market

The Implantable Venous Port Market is significantly impacted by strong drivers, including the demographic shift towards an aging population and the global increase in the incidence and prevalence of cancers requiring long-term systemic therapies. Opportunities emerge from technological advancements, such as the development of power-injectable ports necessary for high-speed CT scans, and the integration of anti-microbial technologies to combat device-related bloodstream infections, a major clinical challenge. Restraints primarily involve the high upfront cost associated with insertion procedures, reimbursement challenges in developing regions, and the continuous, albeit low, risk of complications like thrombosis, infection, and catheter displacement, which necessitates strict adherence to maintenance protocols and expert surgical skills. These market forces collectively shape investment decisions, R&D priorities, and the overall trajectory of adoption across diverse healthcare settings.

Segmentation Analysis

The Implantable Venous Port Market is primarily segmented based on product type, material, application, and end-user, providing a granular view of demand dynamics across the healthcare ecosystem. Product type segmentation distinguishes between single and dual lumen configurations, reflecting the complexity of the required treatment regimen. Material segmentation highlights the shift between traditional titanium devices and more recent polymer or plastic ports, influenced by cost, weight, and imaging compatibility considerations. Application segmentation overwhelmingly focuses on oncology, recognizing the critical role ports play in chemotherapy, although non-oncology applications like chronic infections and nutrition support are expanding. Finally, end-user segmentation tracks consumption patterns across hospitals, which are the largest users, and increasingly, ambulatory surgical centers and specialty clinics, reflecting the evolution towards decentralized care models.

- By Product Type:

- Single Lumen Ports

- Dual Lumen Ports

- By Material:

- Titanium Ports

- Polymer Ports (Plastic Ports)

- By Application:

- Chemotherapy

- Antibiotic/IV Administration

- Blood Transfusion

- Parenteral Nutrition

- Others (e.g., Dialysis Access)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (Oncology Centers)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC Countries, South Africa)

Value Chain Analysis For Implantable Venous Port Market

The value chain for the Implantable Venous Port Market begins with upstream activities, predominantly focusing on the sourcing and processing of high-quality raw materials, specifically medical-grade titanium alloys, specialized polymers (such as polysulfone and silicone), and PEEK materials crucial for constructing the port body, catheter, and septum. Manufacturers invest heavily in R&D and precision engineering to meet stringent regulatory requirements (FDA, CE Mark) for biocompatibility, structural integrity, and long-term implantable safety. Upstream suppliers are characterized by specialized chemical companies and precision metal fabricators who must adhere to high standards of quality control, as component failure poses significant clinical risks. Innovation at this stage is focused on developing anti-thrombotic and anti-microbial coatings.

The midstream segment involves the core manufacturing, assembly, sterilization, and packaging processes. This stage is dominated by large medical device companies that leverage economies of scale and highly automated cleanroom manufacturing facilities. Key activities here include catheter extrusion, molding of the port housing, and final assembly, often incorporating proprietary technologies like specialized septum designs that ensure reliable, multiple punctures without leakage. Strict quality assurance procedures and regulatory compliance documentation are integral to this stage before the product moves to distribution. The competitiveness in this stage revolves around cost-efficient production and minimizing post-market complications.

Downstream activities center on distribution channels and end-user engagement. Direct sales channels are frequently employed for large institutional buyers (major hospital networks) where specialized sales teams provide clinical training and support to interventional radiologists, oncologists, and surgeons. Indirect channels involve distributors and wholesalers who manage regional logistics and reach smaller hospitals or ambulatory surgical centers. The final customers are healthcare providers who purchase and implant the devices. Marketing efforts are highly technical, emphasizing clinical data regarding complication rates, device longevity, and ease of insertion. The efficiency of the distribution network, particularly in ensuring sterile delivery and timely restocking, directly influences market penetration and patient access to these critical devices.

Implantable Venous Port Market Potential Customers

The primary end-users and potential buyers of implantable venous ports are institutions and medical professionals specializing in chronic disease management requiring consistent, long-term intravenous access. Hospitals, particularly large tertiary and quaternary care facilities with comprehensive oncology, hematology, and critical care departments, represent the largest customer segment due to the high volume of complex patient procedures requiring ports for chemotherapy and other intensive treatments. Within hospitals, the decision-makers include procurement managers, interventional radiologists, vascular access teams, and surgical oncologists who specify and approve the purchase of these devices based on clinical performance and contractual agreements.

Beyond traditional hospital settings, Ambulatory Surgical Centers (ASCs) and specialized oncology or infusion clinics represent a rapidly expanding customer base. As treatments for cancer and other chronic conditions increasingly shift to outpatient settings to reduce costs and improve patient convenience, these centers are integrating port insertion and maintenance services into their core offerings. These smaller institutions prioritize devices that are easy to insert, have low complication rates, and are compatible with high-pressure injection needed for diagnostic imaging, aligning with the fast-paced, outpatient environment. The rising adoption in ASCs is a critical focus area for market growth.

Furthermore, government procurement agencies and integrated healthcare networks (IHNs) constitute significant potential customers, often purchasing large volumes via tenders or long-term contracts. These entities seek standardized, cost-effective, and high-quality solutions to cover large patient populations. In emerging markets, non-governmental organizations (NGOs) focused on public health and cancer treatment initiatives also act as important customers, driving demand for robust and affordable polymer-based ports to facilitate widespread treatment access, particularly in underserved regions. The procurement decision is increasingly influenced by value-based healthcare metrics focusing on long-term safety and cost-of-care reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685 Million |

| Market Forecast in 2033 | USD 1,090 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company (BD), C. R. Bard (now part of BD), B. Braun Melsungen AG, Teleflex Incorporated, Cook Medical, Smiths Medical (now ICU Medical), Vygon S.A., AngioDynamics, Inc., PFM Medical AG, Fresenius Kabi AG, Kimal PLC, Disa Vascular, Argon Medical Devices, Inc., Access Vascular, Inc., Nipro Corporation, Cardinal Health, Inc., Medcomp, Perouse Medical, Galt Medical Corp., Merit Medical Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Implantable Venous Port Market Key Technology Landscape

The technological landscape of the Implantable Venous Port Market is characterized by continuous refinement aimed at improving safety, efficacy, and patient comfort. A key innovation has been the widespread adoption of power-injectable ports. These devices are designed with materials and structural integrity capable of withstanding the high-pressure injection rates required for modern CT scanning and diagnostic imaging, eliminating the need for temporary peripheral IV lines during critical diagnostic procedures. The introduction of specific identifiers (like tactile features or distinct port colors) helps clinicians easily distinguish these specialized ports from standard non-power-injectable variants, enhancing procedural safety and minimizing risk of damage.

Material science remains a critical area of advancement, particularly concerning anti-microbial technologies. Manufacturers are increasingly integrating silver ions, chlorhexidine, or other anti-infective agents into the catheter and port body materials, aiming to significantly reduce the incidence of catheter-related bloodstream infections (CRBSIs), which are a major cause of morbidity, mortality, and increased healthcare costs. Furthermore, improvements in polymer technology have resulted in lighter, more comfortable ports that are radiolucent and minimize interference with MRI and other imaging techniques, making them highly desirable for long-term use in oncology patients who require frequent follow-up scans.

Another area of focus involves ergonomic design and insertion techniques. Smaller profile ports are being developed to facilitate less invasive surgical procedures and improve aesthetic outcomes, crucial for patient compliance and psychological well-being. Coupled with this, the adoption of advanced insertion guidance technologies, such as intracavitary ECG guidance for tip confirmation, has increased procedural accuracy and reduced reliance on traditional fluoroscopy or chest X-rays, thereby improving workflow efficiency in the operating room and minimizing patient exposure to radiation. These technological integrations underscore the industry’s commitment to safer, more precise, and infection-resistant vascular access solutions.

Regional Highlights

- North America: Dominates the market share due to highly established healthcare infrastructure, high prevalence of chronic diseases (especially cancer), favorable reimbursement policies for long-term vascular access procedures, and the early and rapid adoption of advanced devices like power-injectable and anti-microbial ports. The U.S. is the largest contributor, driven by significant R&D investment and the presence of major market players.

- Europe: Represents the second largest market, characterized by stringent regulatory standards (e.g., MDR compliance) which ensure high product quality and safety. Market growth is stable, supported by increasing geriatric population and public health spending on chronic care across Western European countries like Germany, France, and the UK.

- Asia Pacific (APAC): Exhibits the highest projected CAGR, primarily fueled by the massive patient pool, improvements in diagnostic capabilities, rapid expansion of hospital infrastructure in countries like China and India, and increasing health awareness. Government initiatives aimed at modernizing healthcare and controlling infections are boosting the demand for high-quality, long-term access devices.

- Latin America (LAMEA): Growing slowly but steadily, driven by increasing access to private healthcare and gradual adoption of advanced medical treatments. Economic volatility and fragmented healthcare systems pose restraints, but rising foreign investment in clinical infrastructure is creating pockets of high demand, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Growth is localized, concentrated in the Gulf Cooperation Council (GCC) countries due to high healthcare expenditure and medical tourism. The region shows potential as chronic disease burden rises, necessitating better long-term vascular access solutions, though access remains limited in many African sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Implantable Venous Port Market.- Becton, Dickinson and Company (BD)

- C. R. Bard (now part of BD)

- B. Braun Melsungen AG

- Teleflex Incorporated

- Cook Medical

- Smiths Medical (now ICU Medical)

- Vygon S.A.

- AngioDynamics, Inc.

- PFM Medical AG

- Fresenius Kabi AG

- Kimal PLC

- Disa Vascular

- Argon Medical Devices, Inc.

- Access Vascular, Inc.

- Nipro Corporation

- Cardinal Health, Inc.

- Medcomp

- Perouse Medical

- Galt Medical Corp.

- Merit Medical Systems

Frequently Asked Questions

Analyze common user questions about the Implantable Venous Port market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the growth of the Implantable Venous Port Market?

The market growth is primarily driven by the increasing global incidence of chronic diseases, particularly cancer, which necessitates long-term chemotherapy administration. Other key factors include the aging population demographic and technological advancements leading to safer and more durable ports, such as power-injectable and anti-microbial designs, enhancing patient safety and quality of life.

Which product segment holds the largest share in the Implantable Venous Port Market?

The single lumen port segment currently holds the largest market share. Single lumen devices are widely used for standardized long-term IV therapies, offering versatility and simplicity. However, dual lumen ports are rapidly gaining traction due to their necessity in complex clinical scenarios requiring simultaneous administration of incompatible fluids.

How is technological innovation affecting the Implantable Venous Port Market?

Technological innovation is focused on improving device functionality and reducing complications. This includes the development of power-injectable ports compatible with high-speed imaging, integration of anti-microbial coatings to prevent bloodstream infections, and the use of advanced polymer materials for lighter, MRI-compatible designs, all of which enhance patient outcomes and procedural efficiency.

What are the primary restraints hindering the market expansion?

Major restraints include the inherent risk of device-related complications such as catheter-related bloodstream infections (CRBSIs), thrombosis, and mechanical failures, which necessitate strict maintenance protocols. Furthermore, the high upfront cost of port insertion procedures and inconsistent reimbursement policies in developing economies also limit broader adoption.

Why is the Asia Pacific region expected to exhibit the highest growth rate?

The Asia Pacific region is poised for the fastest growth due to rapidly improving healthcare infrastructure, increasing healthcare expenditure by both public and private sectors, and a substantial, expanding patient base suffering from chronic diseases. Rising awareness and greater access to advanced medical treatments are key accelerators in large economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager