In-Flight Wi-Fi Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435591 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

In-Flight Wi-Fi Services Market Size

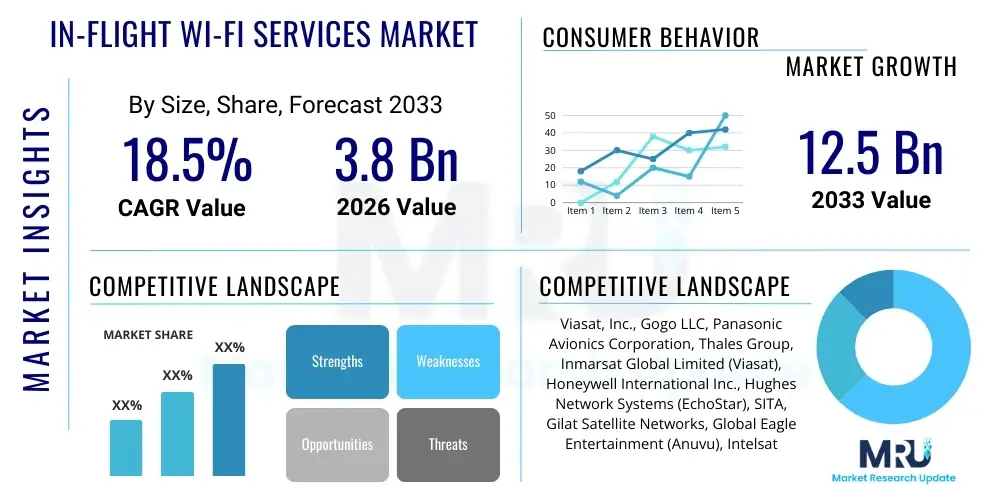

The In-Flight Wi-Fi Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

In-Flight Wi-Fi Services Market introduction

The In-Flight Wi-Fi Services Market encompasses the provision of broadband internet connectivity and related digital services to passengers and crew aboard commercial and private aircraft. This essential service transforms the passenger experience from basic transport into a connected, productive, and entertaining environment. The market is defined by the integration of sophisticated satellite communication technologies, such as Ku-band and Ka-band, or terrestrial Air-to-Ground (ATG) systems, linking the aircraft to global network infrastructure. The primary offering includes basic connectivity for email and messaging, advanced streaming capabilities for video and gaming, and specialized services for cockpit operations and maintenance data transmission. Key applications span across commercial passenger leisure, business productivity, and enhancing airline operational efficiency through real-time data exchange.

The product, in-flight connectivity (IFC), is highly critical for modern airline strategies as it significantly boosts ancillary revenue streams and enhances customer loyalty in a fiercely competitive aviation landscape. The service delivery model often involves complex partnerships between avionics hardware providers, satellite network operators, and service integrators that manage the end-to-end user experience. Benefits derived from widespread adoption include improved turnaround times due to faster data uploads, enhanced crew communication capabilities, and the potential for personalized services based on passenger behavior captured through the Wi-Fi portal. Furthermore, the mandatory requirements for seamless global travel connectivity, particularly among business travelers, solidify Wi-Fi as a fundamental utility rather than a luxury amenity, driving continuous investment and technological upgrades across the globe.

Key driving factors accelerating market expansion include the exponential increase in passenger demand for continuous digital accessibility, mirrored by their terrestrial habits; the retirement of older, non-connected aircraft fleets being replaced by next-generation, factory-equipped airliners; and the competitive necessity for airlines to differentiate their service offerings. The push toward utilizing real-time flight data for predictive maintenance and operational optimization also mandates high-bandwidth IFC solutions. Regulatory shifts supporting the use of personal electronic devices (PEDs) throughout all flight phases, coupled with the rollout of High Throughput Satellites (HTS) offering faster, more reliable, and cost-effective bandwidth, are collectively fueling the substantial growth trajectory observed across all aviation segments.

In-Flight Wi-Fi Services Market Executive Summary

The In-Flight Wi-Fi Services Market is experiencing transformative growth, primarily driven by robust global passenger traffic and the accelerated deployment of High-Throughput Satellite (HTS) technology, which significantly lowers bandwidth costs and improves reliability. Current business trends indicate a strong focus on strategic mergers and acquisitions among satellite operators and service providers aiming to consolidate market share and offer seamless, global coverage. Airlines are moving away from pay-per-use models toward tiered subscription or complementary access integrated into premium ticket classes, reflecting a shift in how Wi-Fi is valued by consumers. Furthermore, there is a pronounced emphasis on enhancing the quality of service (QoS) to support high-bandwidth applications like 4K streaming and virtual private network (VPN) access, which is crucial for retaining high-value business passengers and differentiating services in saturated markets.

Regionally, North America and Europe currently represent the most mature markets due to early adoption and high penetration rates among major carriers. However, the Asia Pacific (APAC) region is poised to exhibit the highest growth CAGR over the forecast period, fueled by rapid fleet expansion in China and India, increasing disposable income, and a strong cultural preference for mobile connectivity. The Middle East and Africa (MEA) region also contributes significantly, particularly through key carriers that use superior IFC offerings as a competitive differentiator on long-haul international routes. Regional infrastructure development, particularly the deployment of new ground stations and the licensing of satellite frequencies, plays a pivotal role in determining the speed and quality of regional market maturation and competition among major service providers.

Segment trends reveal that the Commercial Aviation segment remains the dominant end-user, accounting for the largest share of revenue, with low-cost carriers (LCCs) increasingly investing in basic connectivity to generate ancillary revenue. Technologically, the Satellite-based segment, specifically utilizing advanced Ka-band systems, is rapidly outpacing older Air-to-Ground (ATG) and Ku-band solutions due to its superior capacity and global reach, addressing the persistent latency issues faced by passengers. The bandwidth speed segmentation highlights a clear market demand shift toward broadband services capable of delivering speeds necessary for high-definition streaming and complex enterprise applications, indicating that future market success will be highly dependent on the ability of providers to consistently deliver high-speed, high-capacity networks that can scale with user demand fluctuations.

AI Impact Analysis on In-Flight Wi-Fi Services Market

Common user questions regarding AI’s influence on the In-Flight Wi-Fi Services Market revolve around how artificial intelligence can stabilize network performance, personalize the connectivity experience, and enhance in-flight entertainment (IFE) integration. Users frequently inquire about AI's potential to preemptively manage network congestion across different flight segments and efficiently allocate scarce satellite bandwidth among diverse user profiles (e.g., streaming vs. business VPNs). The core expectations center on AI providing a truly personalized digital journey, ranging from tailored Wi-Fi pricing offers based on user history to proactive technical support that resolves connectivity issues before they impact the passenger experience. Concerns often focus on data privacy and the security implications of using AI to analyze real-time usage patterns across highly secure aircraft systems.

AI is strategically employed to optimize the Quality of Service (QoS) delivery by performing real-time traffic shaping and prioritization. By analyzing flight paths, known congestion points, and current user loads, AI algorithms dynamically adjust satellite beam switching and ground station handovers, ensuring minimal latency and maximum throughput for critical applications. This capability is vital for mitigating the inherent challenges associated with mobile satellite communication. Furthermore, AI-driven predictive maintenance systems utilize connectivity data to monitor the health of critical avionics components, such as antenna systems and modems. By anticipating component failures, airlines can schedule proactive maintenance, thereby increasing system uptime and reducing costly operational disruptions related to connectivity outages, significantly improving the overall reliability metrics of the service.

Beyond network management, AI plays a crucial role in enhancing the commercial viability of IFC. AI algorithms personalize the passenger interface, recommending IFE content, ancillary products (like duty-free items or hotel bookings), and customized Wi-Fi packages, optimizing revenue generation for the airline. In the operational sphere, AI facilitates crew communication by automatically prioritizing critical operational data transfer over recreational traffic, particularly during critical phases of flight. The integration of Natural Language Processing (NLP) allows for sophisticated in-flight customer service chatbots accessible via the Wi-Fi portal, providing instant, multilingual support for connectivity issues or general flight inquiries, thereby reducing the workload on cabin crew and elevating passenger satisfaction scores significantly.

- AI enhances network efficiency through dynamic bandwidth allocation and real-time traffic prioritization.

- Predictive maintenance uses AI to monitor and anticipate failures in Wi-Fi system hardware, maximizing system reliability.

- Personalized pricing models and tailored content recommendations are driven by AI analyzing passenger behavior.

- AI-powered chatbots provide immediate customer support and resolution for connectivity issues in-flight.

- Improved operational data transfer integrity and speed are achieved by AI prioritizing critical aircraft communications.

DRO & Impact Forces Of In-Flight Wi-Fi Services Market

The In-Flight Wi-Fi Services Market is subject to substantial influence from diverse dynamic forces, primarily centered around escalating consumer expectations, technological innovation, high infrastructure costs, and complex regulatory environments. The dominant Driver is the entrenched passenger behavior demanding continuous connectivity, making Wi-Fi a non-negotiable part of the flying experience, thereby compelling airlines globally to upgrade or install new systems. Conversely, a major Restraint is the substantial capital expenditure required for installing and certifying sophisticated satellite communication hardware on legacy fleets, often coupled with the high recurring operational costs associated with procuring satellite bandwidth, especially in remote oceanic regions. These forces create a dynamic tension where opportunity lies in leveraging High Throughput Satellites (HTS) and emerging 5G technologies to overcome current capacity limitations, offering providers scalable, cost-effective solutions for widespread global deployment.

Key Impact Forces shaping the competitive landscape include rapid advancements in satellite technology, specifically the shift from geosynchronous equatorial orbit (GEO) satellites to Medium Earth Orbit (MEO) and Low Earth Orbit (LEO) constellations, promising significantly lower latency and greater capacity that can handle peak demand for streaming services. Market dynamics are also heavily influenced by regulatory rulings, such as spectrum allocation decisions and security compliance mandates from global bodies like the FAA and EASA, which dictate the pace of system deployment and technological choice. Competitive rivalry among core satellite operators (e.g., Inmarsat, Viasat, Hughes Network Systems) determines pricing and service capability thresholds, pushing the industry towards hybrid, multi-band solutions that ensure redundancy and global coverage consistency across diverse operational routes.

A significant Opportunity exists in expanding the use case of IFC beyond passenger entertainment to encompass crucial operational aspects, such as Electronic Flight Bag (EFB) synchronization, real-time weather updates, and enhanced air traffic control communications (e.g., ACARS over IP). This operational integration transforms connectivity from a passenger amenity into a critical operational tool, justifying increased investment. However, a powerful Restraint remains the technological challenge of integrating new high-speed systems with older aircraft infrastructure, often necessitating complex and lengthy Supplemental Type Certificate (STC) processes. Successfully navigating the capital intensity and integration complexity while consistently delivering high-quality, high-speed connectivity remains the central challenge that dictates which service providers will achieve long-term market dominance and profitability.

Segmentation Analysis

The In-Flight Wi-Fi Services Market is segmented primarily based on the underlying technology used for connectivity, the specific type of aircraft equipped, the end-user application (commercial versus private), and the allocated bandwidth speed. This segmentation is crucial for understanding the diverse needs of airlines and passengers across different operational profiles and geographical regions. Technology segmentation distinguishes between satellite-based systems (Ka-band and Ku-band) and terrestrial systems (Air-to-Ground or ATG), reflecting variations in coverage, data rates, and operational costs. The dominance of satellite technology, particularly Ka-band, in serving long-haul international routes contrasts with the cost-effective suitability of ATG for high-density domestic routes, defining distinct market segments. Analyzing these segments helps service providers tailor their offerings to maximize efficiency and profitability while addressing the unique requirements of various airline business models, from full-service legacy carriers to budget-focused low-cost airlines.

- By Technology:

- Air-to-Ground (ATG)

- Satellite-based (Ka-band, Ku-band, S-band)

- Hybrid (Combining Satellite and ATG)

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Business Jets

- By Application/End User:

- Commercial Aviation (Passenger & Crew)

- Business Aviation

- Military & Government

- By Bandwidth Speed:

- Low Bandwidth (<10 Mbps)

- Medium Bandwidth (10–30 Mbps)

- High Bandwidth (>30 Mbps)

Value Chain Analysis For In-Flight Wi-Fi Services Market

The In-Flight Wi-Fi Services value chain is extensive and highly specialized, beginning with upstream satellite technology providers and extending through intricate integration processes to the final delivery to the end-user (passenger). Upstream activities are dominated by satellite operators (e.g., SES, Intelsat, Viasat) who own and operate the orbital assets and ground infrastructure, providing the raw bandwidth capacity. Also critical are the avionics hardware manufacturers (e.g., Honeywell, Thales) that develop and supply highly specialized components such as radomes, fuselage-mounted antennas, modem units, and onboard servers, which must meet stringent aviation certification standards. The efficiency and reliability of these upstream components directly determine the quality and cost structure of the final service offering, necessitating strong strategic partnerships and rigorous R&D investment for technological superiority, especially concerning antenna size and weight optimization for aircraft efficiency.

The midstream segment involves the core service providers or network integrators (e.g., Gogo, Panasonic Avionics, SITA), who aggregate bandwidth, manage network routing, develop passenger portals, and handle the complex logistics of installation and maintenance across diverse fleets. These integrators act as the primary distribution channel, securing agreements with airlines (the direct customer) and deploying customized connectivity solutions tailored to specific route structures and aircraft types. Distribution channels are predominantly indirect, where the service provider sells the Wi-Fi package to the airline, which then either bundles it into ticket prices or sells access directly to the passenger. Direct channels, while rare, sometimes involve highly specialized business aviation solutions where the service provider contracts directly with the jet owner or fractional operator for tailored bandwidth services.

Downstream activities involve the airlines, who are the purchasers and implementers of the technology, responsible for marketing the service, setting pricing models, and managing the on-board passenger experience. End-users, the passengers and crew, consume the service. Successful value capture at this stage relies heavily on consistent service quality and integration with the in-flight entertainment (IFE) system. The interplay between upstream capacity providers and midstream integrators dictates the scalability and global footprint of the Wi-Fi service, emphasizing the need for robust vendor management and long-term service agreements to ensure continuity of coverage and technological refresh cycles essential for meeting ever-increasing consumer data demands.

In-Flight Wi-Fi Services Market Potential Customers

The primary and most significant segment of potential customers for In-Flight Wi-Fi services consists of Commercial Airlines, spanning legacy carriers, flag carriers, and the rapidly expanding fleet of Low-Cost Carriers (LCCs) worldwide. For legacy carriers operating extensive international networks, the demand is centered on reliable, high-speed connectivity to support high-value business travelers and offer competitive streaming IFE options on long-haul flights. LCCs, conversely, view Wi-Fi as a vital tool for generating incremental ancillary revenue and driving operational efficiency. The decision-makers within this segment include procurement heads, IT and digital transformation executives, and chief experience officers, all focused on the total cost of ownership (TCO) and the potential return on investment (ROI) derived from increased passenger spend and loyalty metrics.

The second crucial customer segment is Business and General Aviation. This group demands highly customized, guaranteed bandwidth for exclusive, high-security communications required by corporate executives and ultra-high-net-worth individuals (UHNWIs). For private jets and fractional ownership fleets, reliability, speed, and discretion are paramount, often leading these customers to select premium, dedicated Ka-band or MEO/LEO satellite solutions despite higher costs. Suppliers must address specific requirements for low-profile, aerodynamic antenna installations and guaranteed service level agreements (SLAs), differentiating their offerings from the mass-market solutions provided to commercial airlines. This segment often prioritizes dedicated cybersecurity features and global coverage without reliance on terrestrial proximity.

Finally, Government and Military entities represent a high-security, specialized customer base requiring robust, resilient connectivity for tactical and logistical operations. These customers necessitate connectivity solutions that are often ruggedized, highly encrypted, and capable of operating in adverse conditions or denied environments. While the volume of installations is lower than commercial aviation, the value per contract is substantially higher due to the strict performance and security mandates. Service providers targeting this segment must possess relevant government clearances, offer bespoke networking solutions, and ensure compliance with complex international defense and export regulations, positioning themselves as specialized communication partners rather than standard commercial service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viasat, Inc., Gogo LLC, Panasonic Avionics Corporation, Thales Group, Inmarsat Global Limited (Viasat), Honeywell International Inc., Hughes Network Systems (EchoStar), SITA, Gilat Satellite Networks, Global Eagle Entertainment (Anuvu), Intelsat S.A., SES S.A., Eutelsat Communications SA, ThinKom Solutions, Kontron, Safran S.A., ST Engineering, Lufthansa Technik, Collins Aerospace, Airbus (ACSS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

In-Flight Wi-Fi Services Market Key Technology Landscape

The In-Flight Wi-Fi Services market is defined by a dynamic technological landscape driven by the persistent pursuit of higher bandwidth and lower latency. Historically, the market relied on older Ku-band satellite technology and terrestrial Air-to-Ground (ATG) systems. Ku-band offered global coverage but was constrained by lower throughput and susceptibility to weather interference, limiting the ability to support modern streaming demands. ATG, conversely, provided high speed over landmasses but lacked oceanic and remote area coverage. The most significant technological leap is the widespread adoption of Ka-band systems and High Throughput Satellites (HTS), which offer capacities up to 20 times greater than conventional satellites. Ka-band is quickly becoming the standard for new installations, providing the necessary bandwidth to support high-density usage scenarios, although it requires more advanced and often larger onboard antenna systems, posing integration challenges for smaller aircraft or older fleets.

The immediate future of IFC technology is heavily invested in hybrid solutions and the emergence of non-geostationary orbit (NGSO) constellations, specifically Low Earth Orbit (LEO) satellites, championed by providers like Starlink and OneWeb. Hybrid systems intelligently switch between the best available network (e.g., ATG over land and Ka/Ku over water) to ensure seamless, reliable connectivity throughout the flight path. LEO technology represents a potential paradigm shift because its proximity to Earth drastically reduces data latency from hundreds of milliseconds to under 50 milliseconds, making real-time applications, such as video conferencing and multiplayer gaming, viable for the first time in the air. While LEO technology is still in the deployment and certification phase for aviation, its promise of fiber-like connectivity speeds positions it as the definitive technology driver for the latter half of the forecast period, requiring significant investment in new, electronically steered antennas (ESAs) that can track rapidly moving satellites.

Furthermore, technology development is focused not only on the satellite link but also on maximizing efficiency within the aircraft cabin network. Advances in Wireless Access Points (WAPs) and network compression techniques are crucial for efficiently distributing the available bandwidth among hundreds of simultaneously connected devices. The adoption of advanced avionics systems and modems that support Multi-band operation (Ka, Ku, and S-band switching) is key to ensuring global consistency and redundancy. Moreover, the integration of 5G technologies, initially for ground communication links and potentially for future ATG systems, is being explored to further optimize speed and efficiency when flying over densely populated areas. The successful convergence of HTS capacity, LEO low latency, and efficient onboard network management forms the technological cornerstone for achieving the industry goal of "home-like" connectivity in the sky, maintaining competitive differentiation in the global market.

Regional Highlights

- North America (NA): Represents the most mature and highly penetrated market for In-Flight Wi-Fi Services, characterized by high consumer expectations and intense competition among service providers. The region benefits from robust infrastructure, including extensive ATG networks complementing satellite coverage, particularly over the continental United States. Early adoption by major carriers (e.g., Delta, Southwest, United) has led to saturation, shifting the focus from initial installation to system upgrades, primarily migrating from older Ku-band and legacy ATG to Ka-band HTS and next-generation LEO trials to support high-definition streaming and enterprise applications. Market growth is driven primarily by bandwidth expansion and technological refreshment cycles.

- Europe: This region exhibits high demand but faces unique challenges due to regulatory fragmentation across multiple nation-states and varied aircraft modernization schedules. Adoption rates are strong, especially among major flag carriers and business jet operators. The market utilizes a mix of both ATG (over the European landmass) and satellite solutions for international routes. The competitive environment is characterized by airlines carefully selecting providers based on cost-efficiency and compliance with regional data protection regulations. The emergence of hybrid solutions that optimize connectivity across borders is a key trend, alongside the rising importance of LEO trials to address the need for high-speed connectivity within the dense European air traffic corridors.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, driven by massive fleet expansion, burgeoning middle-class travel, and high demand for mobile connectivity. Countries like China, India, and Southeast Asian nations are driving demand due to significant investment in new aircraft and the establishment of new LCCs. Challenges include complex governmental spectrum licensing processes and the vast geographical distances requiring comprehensive satellite coverage. The market is largely untapped in many secondary cities, offering substantial opportunity for new deployments, particularly focusing on Ka-band technology to service the high traffic volumes and long-haul connections throughout the region.

- Latin America (LATAM): A developing market characterized by lower penetration rates compared to North America and Europe. Growth is steady, fueled by increasing air travel and the modernization of regional fleets. The market dynamic is sensitive to macroeconomic factors and the high cost of satellite capacity over dense jungle or remote areas. Carriers in LATAM prioritize reliable, moderate-speed solutions that can be offered affordably to budget-conscious passengers, often relying on Ku-band for cost-efficiency, though strategic routes are beginning to adopt Ka-band systems.

- Middle East and Africa (MEA): This region is notable for its concentration of world-class, long-haul carriers (e.g., Emirates, Qatar Airways, Etihad) that utilize superior Wi-Fi and IFE as a critical service differentiator. The Middle Eastern carriers are early adopters of premium, high-capacity Ka-band solutions, often offering complimentary access to maintain a luxury passenger experience. The African market remains largely underdeveloped, with connectivity often limited to older technology or specific high-traffic corridors, presenting a high-potential future growth area contingent on infrastructure investment and improved satellite access costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the In-Flight Wi-Fi Services Market.- Viasat, Inc.

- Gogo LLC (Acquired by Intelsat, now focused on business aviation)

- Panasonic Avionics Corporation

- Thales Group

- Inmarsat Global Limited (Now part of Viasat, Inc.)

- Honeywell International Inc.

- Hughes Network Systems (EchoStar Corporation)

- SITA

- Gilat Satellite Networks

- Anuvu (Formerly Global Eagle Entertainment)

- Intelsat S.A.

- SES S.A.

- Eutelsat Communications SA

- ThinKom Solutions

- Kontron (S&T Group)

- Safran S.A.

- ST Engineering

- Lufthansa Technik

- Collins Aerospace (Raytheon Technologies)

- Astronics Corporation

Frequently Asked Questions

Analyze common user questions about the In-Flight Wi-Fi Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Ka-band and Ku-band Wi-Fi services?

Ka-band systems utilize higher frequencies, providing significantly greater bandwidth and speed capacity (High Throughput Satellites or HTS) suitable for streaming and high-demand applications. Ku-band offers broader, more established global coverage with lower capacity, often resulting in slower speeds, but is generally less costly to operate and install on older fleets. Ka-band is the current industry standard for new installations aiming for premium service quality.

How will Low Earth Orbit (LEO) satellite constellations impact in-flight connectivity?

LEO constellations, such as Starlink and OneWeb, are expected to revolutionize IFC by drastically reducing latency (delay) to near-terrestrial levels, making real-time applications like video calls and live gaming feasible in the air. While requiring new antenna technology (ESAs), LEO will offer vastly superior speeds and capacity, accelerating the migration away from older GEO-based systems, especially on long-haul routes.

Are Air-to-Ground (ATG) systems still relevant in the market?

Yes, ATG systems remain highly relevant, particularly for domestic flights over large landmasses like North America and Europe. ATG offers high capacity and lower installation costs for dense, short-haul routes. However, ATG provides no coverage over water, leading many airlines to adopt hybrid systems that automatically switch between ATG over land and satellite connectivity over oceanic regions to ensure seamless service.

What are the main restraints hindering the broader adoption of In-Flight Wi-Fi?

The primary restraints include the high initial capital expenditure (CapEx) required for hardware installation and certification (STC process), along with the elevated recurring operational costs for purchasing satellite bandwidth. Furthermore, integration complexity with existing aircraft systems, ensuring robust cybersecurity against threats, and resolving lingering performance issues (latency and speed) continue to pose significant adoption challenges for many airlines.

Which market application segment dominates the In-Flight Wi-Fi Services market?

The Commercial Aviation application segment, encompassing passenger leisure, business productivity, and crew operations, holds the dominant market share. Driven by the sheer volume of global passenger traffic and the imperative for airlines to generate ancillary revenue and enhance customer experience, commercial carriers represent the largest consumer base for connectivity services and associated IFE offerings globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager