Incontinence Skin Care and Body Wash Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435044 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Incontinence Skin Care and Body Wash Market Size

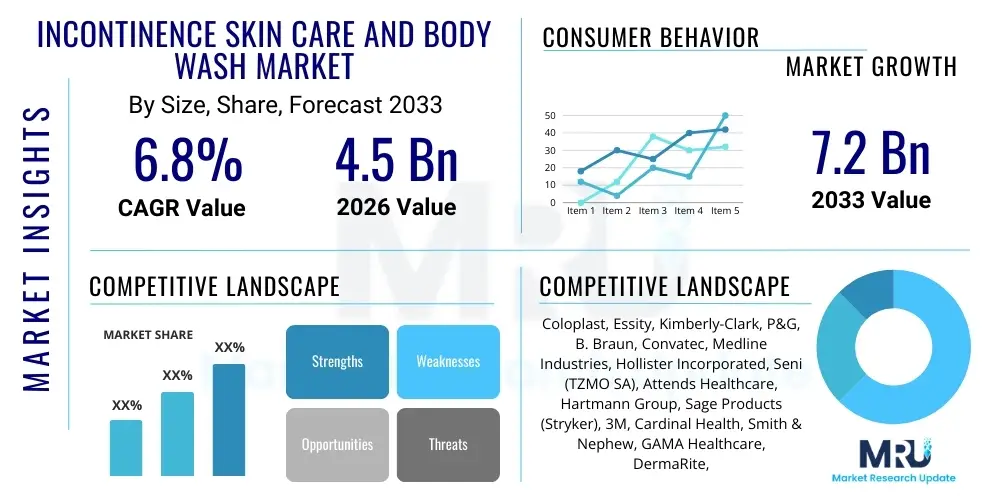

The Incontinence Skin Care and Body Wash Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth is fundamentally driven by the global aging population, coupled with increasing awareness regarding the prevention of incontinence-associated dermatitis (IAD) and pressure ulcers in institutional and home care settings. The market's resilience is further supported by innovations in pH-balanced and barrier-forming formulations designed for sensitive and compromised skin integrity.

Incontinence Skin Care and Body Wash Market introduction

The Incontinence Skin Care and Body Wash Market encompasses specialized hygienic and prophylactic products designed for individuals experiencing urinary or fecal incontinence. These products are crucial for maintaining skin integrity, preventing secondary infections, and ensuring comfort, particularly among the elderly and those with mobility impairments. Key product categories include no-rinse cleansers, barrier creams, moisturizing lotions, and protective wipes, all formulated to counteract the detrimental effects of prolonged moisture exposure and high pH levels associated with incontinence. The primary goal of these formulations is to establish an effective skin barrier while gently cleansing without the harshness of traditional soap and water, thereby mitigating the risk of Incontinence-Associated Dermatitis (IAD) and subsequent skin breakdown.

Major applications of incontinence skin care products are predominantly found in long-term care facilities, hospitals, and increasingly, in the expanding sector of home healthcare. The benefits derived from using these specialized products include enhanced patient comfort, significant reduction in healthcare costs associated with treating skin complications like pressure injuries, and improved quality of life for incontinent individuals. These products often incorporate advanced ingredients such as dimethicone, zinc oxide, and specific moisturizing agents designed to hydrate the skin while simultaneously providing a hydrophobic shield against irritants. The shift toward evidence-based wound and skin care protocols further solidifies the essential nature of these products in modern clinical practice.

Driving factors for market expansion include the substantial demographic shift toward an aging population globally, which naturally increases the prevalence of incontinence. Furthermore, technological advancements leading to the development of more sophisticated, clinically proven formulations—such as those offering sustained release moisturizing and antifungal properties—are stimulating demand. Increased public and professional education regarding the necessity of proactive skin protection, alongside favorable reimbursement policies in developed economies for medically necessary skin barrier products, also contribute significantly to the market's robust trajectory. The transition from traditional washing methods to integrated, specialized skin care regimens in institutional settings represents a fundamental paradigm shift fueling market dynamics.

Incontinence Skin Care and Body Wash Market Executive Summary

The Incontinence Skin Care and Body Wash Market demonstrates robust growth, primarily propelled by global demographic trends, specifically the rising proportion of the geriatric population, and the corresponding necessity for advanced dermatological care in chronic care management. Business trends indicate a strong move toward innovation, with manufacturers focusing heavily on developing 3-in-1 products (cleansing, moisturizing, and barrier protection) and sustainable, patient-friendly delivery systems such as foam cleansers and disposable wipes. Regionally, North America and Europe maintain market dominance due to established healthcare infrastructures and high penetration rates of advanced skin care protocols in long-term care, while the Asia Pacific region is projected to exhibit the fastest growth, driven by rapidly improving healthcare access and increased awareness in populous nations. Segment trends show that the Barrier Creams and Ointments segment holds a significant share owing to their clinical effectiveness in IAD prevention, and the End-User shift toward Home Care Settings is accelerating, demanding convenient, easy-to-use, and over-the-counter accessible products.

AI Impact Analysis on Incontinence Skin Care and Body Wash Market

User inquiries regarding AI's influence in the Incontinence Skin Care and Body Wash Market typically revolve around optimizing patient care protocols, predicting skin breakdown risk, and enhancing supply chain efficiency. Common user questions focus on how AI can automate product ordering based on patient severity levels, whether predictive analytics can identify high-risk patients for IAD before visible symptoms appear, and if AI-powered diagnostics can personalize skin care regimens. The collective concern centers on integrating sophisticated, often expensive, AI tools into low-margin, high-volume care settings, while the expectation is that AI will significantly reduce incidence rates of IAD, standardize care quality across diverse facilities, and optimize inventory management for specialized barrier products. This indicates a strong user interest in using AI not for product formulation, but for clinical application and operational efficiency within the care ecosystem surrounding incontinence management.

- AI-powered predictive modeling for assessing individual patient risk of Incontinence-Associated Dermatitis (IAD) based on mobility, moisture levels, and existing comorbidities.

- Optimization of inventory and supply chain logistics for specialized skin care products within large hospital networks and nursing homes, utilizing demand forecasting algorithms.

- Development of smart sensor technologies integrated into adult diapers or absorbent products that monitor skin pH and moisture, signaling care staff via an AI-driven interface when immediate cleansing or barrier application is required.

- Personalization of skin care protocols by analyzing patient data sets (age, skin type, severity of incontinence) to recommend the most effective combination of cleansers and barrier creams.

- Automated compliance monitoring in long-term care facilities, ensuring timely and correct application of incontinence skin care products as per established clinical guidelines, reducing human error.

- Enhancement of educational modules and training simulations for caregivers using AI and virtual reality, standardizing the application techniques for barrier products to maximize efficacy.

DRO & Impact Forces Of Incontinence Skin Care and Body Wash Market

The Incontinence Skin Care and Body Wash Market dynamics are shaped by powerful Drivers, structural Restraints, and evolving Opportunities, which collectively constitute the Impact Forces influencing future growth trajectories. The primary driving force is the unavoidable demographic trend of global population aging, necessitating specialized care for common geriatric conditions like incontinence. This is significantly amplified by continuous product innovation, particularly the development of non-sensitizing, pH-neutral, and scientifically advanced barrier formulations that offer superior clinical outcomes in preventing IAD. Alongside this, increased awareness campaigns targeting professional caregivers and the general public are fostering a proactive approach to skin health management, thereby stimulating consistent demand across institutional and home care sectors.

Conversely, the market faces significant Restraints, notably the persistent challenge of price sensitivity in developing economies and the overall reluctance of certain healthcare systems or private payers to fully reimburse specialized barrier products, often leading to the usage of cheaper, less effective alternatives. Additionally, a lack of standardized clinical protocols for IAD prevention across all geographies hinders consistent product adoption. The complexity of educating a rotating staff of caregivers, particularly in home care settings, about the precise application and usage frequency of multiple skin care products also presents an operational barrier that limits optimal product efficacy and market penetration.

Opportunities for expansion are abundant, particularly in emerging markets where healthcare infrastructure is rapidly developing and disposable incomes are rising, translating into greater adoption of high-quality imported products. Furthermore, the integration of specialized incontinence products into robust subscription and e-commerce models is streamlining consumer access, especially within the growing home care segment. Product portfolio expansion into niche areas, such as pediatric incontinence skin care or solutions tailored specifically for bariatric patients, presents lucrative pathways for manufacturers. The primary Impact Forces driving the market forward include the global demand for infection control, the cost imperative to reduce hospital-acquired conditions (like pressure ulcers linked to IAD), and continuous material science advancements in protective film technologies.

Segmentation Analysis

The Incontinence Skin Care and Body Wash market is comprehensively segmented based on product type, end-user, and distribution channel, reflecting the diversity of clinical needs and care environments. Product segmentation is crucial as it distinguishes between prophylactic (barrier creams, moisturizing lotions) and cleansing (no-rinse body washes, wipes) categories, each serving a distinct function in managing incontinence-associated skin risks. The fastest-growing product segments often include those offering multifunctional benefits, such as 3-in-1 foam cleansers that eliminate the need for water, thereby streamlining care procedures and reducing caregiver workload in resource-constrained settings.

End-user segmentation highlights the structural differences between institutional purchasing power (hospitals, nursing homes) and individual consumer purchasing behavior (home care settings). While institutional sales prioritize bulk procurement and clinical effectiveness evidenced by clinical trials, the home care segment emphasizes user convenience, ease of application, and availability through retail and online channels. The rising trend of aging-in-place initiatives globally is significantly fueling the growth of the home care segment, requiring manufacturers to adapt packaging and marketing strategies to directly address the consumer and informal caregiver market. Understanding these dynamics is essential for strategic market positioning and product development.

- By Product Type:

- Wash Creams and Cleansing Foams

- Barrier Creams and Protectants (Zinc Oxide-based, Dimethicone-based)

- Moisturizing Lotions and Conditioners

- Pre-moistened Wipes and Cloths (No-Rinse)

- Perineal Skin Cleansers

- By End-User:

- Hospitals and Acute Care Settings

- Nursing Homes and Long-Term Care Facilities (LTCFs)

- Home Care Settings (Direct Consumer Use)

- Ambulatory Surgical Centers

- By Distribution Channel:

- Institutional Sales (Direct Procurement, Bulk Purchasing)

- Retail Pharmacies and Drug Stores

- E-commerce Platforms (Online Retailers)

- Supermarkets and Hypermarkets

Value Chain Analysis For Incontinence Skin Care and Body Wash Market

The value chain for the Incontinence Skin Care and Body Wash Market begins with robust upstream analysis, which involves the sourcing and procurement of specialized raw materials. Key components include pharmaceutical-grade emollients (such as mineral oils and petrolatum), specialized skin protectants (like dimethicone and zinc oxide), surfactants, and stabilizing agents crucial for creating pH-balanced, non-irritating formulations. The quality and consistent supply of these raw materials, often governed by stringent cosmetic and medical device regulatory standards, directly impact final product efficacy and cost. Manufacturers must focus on securing long-term contracts with specialized chemical suppliers who can guarantee purity and compliance, mitigating risks associated with supply volatility and ingredient contamination.

Midstream activities encompass research and development, manufacturing, and packaging. R&D efforts are focused on creating novel formulations, such as spray-on barrier films or enhanced three-in-one products, optimizing skin protection while minimizing application time. Manufacturing involves high-volume production under controlled cleanroom environments to ensure sterility and stability. Effective packaging, which must be easy for elderly users or busy caregivers to handle, yet robust enough for institutional dispensing, is a critical factor in perceived product value. Quality control and regulatory adherence are paramount at this stage, especially given the products' frequent classification as medical devices or specialized cosmetics, requiring extensive clinical validation.

Downstream analysis focuses heavily on the intricate distribution channel structure. The market utilizes both direct and indirect channels. Direct distribution (institutional sales) involves manufacturers engaging directly with large hospital groups or nursing home chains, often requiring dedicated sales teams and clinical educators to secure formulary acceptance. Indirect distribution involves working through specialized medical distributors, retail pharmacies, and, increasingly, dedicated e-commerce platforms. The shift toward e-commerce is particularly disruptive, offering wider geographical reach and direct-to-consumer access, bypassing traditional gatekeepers. Successful downstream strategy requires optimizing channel mix to balance high-volume institutional contracts with high-margin retail sales, ensuring products are readily available at the point of need for both professional and informal caregivers.

Incontinence Skin Care and Body Wash Market Potential Customers

The primary end-users and buyers in the Incontinence Skin Care and Body Wash Market are diverse, ranging from large institutional purchasers managing vast patient populations to individual consumers making proactive personal healthcare decisions. Hospitals and Long-Term Care Facilities (LTCFs) represent significant B2B customers, purchasing products in bulk based on clinical necessity, cost-effectiveness in preventing complications (like pressure ulcers), and adherence to evidence-based practice guidelines. For these institutional buyers, the purchase decision is often centralized, involving procurement departments, wound care specialists, and geriatric nurses who prioritize clinical efficacy, ease of use, and demonstrable cost savings related to reduced IAD incidence.

The second major segment consists of professional and informal caregivers in the rapidly growing Home Care setting. Professional home health agencies purchase products for clients based on physician recommendations and care plan requirements. Informal caregivers, typically family members of the incontinent individual, are increasingly becoming key decision-makers. This segment values products that are user-friendly, non-irritating, readily available via retail or online pharmacies, and provide maximum protection with minimal application effort. Price sensitivity may be higher in this segment unless the product is perceived as indispensable for maintaining the patient's dignity and preventing painful skin complications.

Finally, individual consumers who manage their mild or moderate incontinence independently constitute a growing pool of potential customers. This group primarily interacts with the market through retail and e-commerce channels, seeking discrete, convenient, and cosmetically elegant products. This demand often dictates packaging design and formulation—favoring unscented, non-greasy products that integrate seamlessly into daily hygiene routines. Effective market penetration requires targeted advertising that addresses the sensitivity surrounding incontinence while highlighting the preventative health benefits of using specialized cleansers and barrier protections over standard personal care products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coloplast, Essity, Kimberly-Clark, P&G, B. Braun, Convatec, Medline Industries, Hollister Incorporated, Seni (TZMO SA), Attends Healthcare, Hartmann Group, Sage Products (Stryker), 3M, Cardinal Health, Smith & Nephew, GAMA Healthcare, DermaRite, Clinisupplies, Ontex, SCA Personal Care. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Incontinence Skin Care and Body Wash Market Key Technology Landscape

The technological evolution within the Incontinence Skin Care and Body Wash Market is centered on enhancing barrier function, improving ease of application, and ensuring formulations are clinically optimized for compromised skin. A major area of technological focus is the development of advanced polymer technologies, specifically the creation of breathable, long-lasting barrier films that adhere effectively to the skin without feeling greasy or impeding the function of absorbent products. These next-generation barrier technologies utilize silicone or specialty dimethicone blends that form a transparent, water-repellent shield, significantly reducing the frequency of reapplication required by traditional zinc oxide pastes, thereby improving patient comfort and reducing caregiver time.

Another crucial technological advancement is the introduction of surfactant-free and pH-neutral cleansing technologies. Traditional soap and water can strip the skin’s natural acid mantle, making it vulnerable to bacterial colonization and irritation. Modern body wash formulations, particularly the no-rinse foam cleansers and wipes, incorporate ultra-mild non-ionic surfactants, coupled with humectants and emollients, to gently lift contaminants while preserving the skin’s natural pH (typically between 5.0 and 5.5). This technological shift toward physiological pH preservation is critical in clinical settings for minimizing the severity and occurrence of Incontinence-Associated Dermatitis (IAD), offering a significant clinical advantage over older product generations.

Furthermore, nanotechnology and encapsulation techniques are beginning to influence product delivery. Encapsulation allows for the sustained, targeted release of active ingredients, such as moisturizers, anti-inflammatory agents, or mild antimicrobials, ensuring continuous protection over a longer duration between changes. This is particularly valuable in products designed for overnight use or for patients in critical care environments. The integration of high-purity, naturally derived ingredients, such as specialized botanical extracts with proven anti-inflammatory properties, combined with synthetic efficacy enhancers, represents the cutting edge, satisfying both the demand for scientifically proven efficacy and the growing consumer preference for 'clean label' and sensitive skin formulations. This confluence of material science and dermatological technology is defining the current product pipeline.

Regional Highlights

Regional dynamics play a crucial role in shaping the Incontinence Skin Care and Body Wash Market, reflecting variations in demographic structure, healthcare expenditure, regulatory environments, and cultural acceptance of specialized care. North America, particularly the United States, represents the largest and most mature market segment, characterized by high penetration of specialized products in institutional settings, advanced wound care protocols, and robust reimbursement mechanisms. The region benefits from a large aging population and high awareness among healthcare professionals regarding IAD prevention, driving continuous adoption of premium barrier creams and no-rinse cleansers. High healthcare spending per capita further solidifies its market leadership, although cost-containment pressures drive competition.

Europe follows closely, showing high maturity, particularly in Western European countries like Germany, the UK, and France. These markets are distinguished by comprehensive national health systems that increasingly emphasize proactive skin care as a method to reduce the financial burden of treating pressure injuries and IAD. Regulatory standards, such as those imposed by the European Medicines Agency (EMA), ensure high product quality and clinical validation. However, Southern and Eastern European nations represent areas of opportunity, where greater awareness and infrastructure investment could significantly accelerate market uptake of specialized barrier products compared to traditional hygiene methods.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market. This exponential growth is underpinned by the rapidly expanding geriatric population in countries like Japan, China, and India, coupled with increasing government investment in public health and long-term care facilities. While the institutional market is developing, the primary driver is the sheer volume of potential consumers and the rapid expansion of e-commerce channels which facilitate access to products previously unavailable through traditional retail. Challenges remain concerning the vast disparity in healthcare access between rural and urban areas, yet the increasing urbanization and rising middle class are creating fertile ground for market expansion, particularly within the home care product segment.

- North America: Dominates the market share due to advanced healthcare infrastructure, high awareness of IAD prevention, stringent wound care protocols, and significant expenditure on specialized geriatric care.

- Europe: Characterized by mature markets with strong focus on proactive care through national health services; growth is driven by reducing hospital-acquired conditions and standardized clinical guidelines.

- Asia Pacific (APAC): Exhibits the highest growth potential, fueled by the massive aging populations in key economies (China, Japan) and rapid expansion of home care and e-commerce distribution channels.

- Latin America (LATAM): Growth is primarily concentrated in major economies like Brazil and Mexico, driven by improving economic conditions and increased accessibility to institutional care, though price sensitivity remains a constraint.

- Middle East and Africa (MEA): A nascent market with growth concentrated in Gulf Cooperation Council (GCC) countries, propelled by investment in modern hospitals and private healthcare sectors serving expatriate and high-income populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Incontinence Skin Care and Body Wash Market.- Coloplast

- Essity

- Kimberly-Clark Corporation

- The Procter & Gamble Company (P&G)

- B. Braun Melsungen AG

- Convatec Group Plc

- Medline Industries, LP

- Hollister Incorporated

- TZMO SA (Seni)

- Attends Healthcare Products Inc.

- Paul Hartmann AG (Hartmann Group)

- Sage Products LLC (A Stryker Company)

- 3M Company

- Cardinal Health

- Smith & Nephew plc

- GAMA Healthcare Ltd.

- DermaRite Industries, LLC

- Clinisupplies Ltd.

- Ontex Group NV

- SCA Personal Care

Frequently Asked Questions

Analyze common user questions about the Incontinence Skin Care and Body Wash market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Incontinence-Associated Dermatitis (IAD) and how do specialized skin care products prevent it?

Incontinence-Associated Dermatitis (IAD) is a painful form of irritant contact dermatitis caused by prolonged exposure of skin to urine and feces, resulting in moisture, friction, and chemical irritation. Specialized incontinence skin care products prevent IAD by utilizing pH-balanced cleansers to gently remove irritants without stripping the skin's natural barrier, followed by the application of barrier creams or ointments (often containing zinc oxide or dimethicone) that create a hydrophobic, protective layer resistant to moisture and enzymatic breakdown, thus maintaining skin integrity.

Which product segment holds the highest growth potential in the Incontinence Skin Care Market?

The Barrier Creams and Protectants segment, particularly advanced film-forming barriers and multifunctional 3-in-1 products (cleanse, moisturize, protect), exhibits the highest growth potential. This growth is driven by clinical mandates in long-term care settings focused on prevention-based care, coupled with technological innovations that deliver sustained protection with fewer applications. Additionally, the proliferation of convenient no-rinse cleansing foams and specialized wipes is seeing rapid adoption due to their efficiency and ease of use for caregivers in both institutional and home care environments.

How does the shift to home care settings impact the distribution and packaging of incontinence products?

The pronounced shift toward home care settings necessitates significant adjustments in distribution and product design, favoring consumer accessibility and user-friendliness over institutional bulk packaging. Distribution channels increasingly rely on e-commerce platforms and retail pharmacies to reach individual consumers directly. Packaging must prioritize smaller, manageable sizes, clear instructions for informal caregivers, and discreet design. Furthermore, manufacturers are investing in formulations that are easy to apply and less messy, catering to the needs of individuals managing their care or being assisted by family members.

What role does clinical evidence play in the competitive landscape of the Incontinence Skin Care Market?

Clinical evidence is paramount and highly influential in the competitive landscape, especially for securing institutional contracts. Hospitals and nursing homes require products to demonstrate superior efficacy in randomized controlled trials (RCTs) for IAD reduction and overall skin health improvement before inclusion in their formularies. Companies that consistently invest in clinical studies and can provide robust data validating their pH neutrality, barrier effectiveness, and reduction in secondary complications gain a substantial competitive edge and justify premium pricing, positioning their products as medically necessary preventative tools rather than just standard hygiene items.

Are specialized incontinence skin care products considered medical devices or cosmetics, and how does this affect regulation?

The classification varies based on the product’s intended use and specific claims. Barrier products, especially those making preventative claims against skin breakdown or specific conditions, are often regulated as Class I or Class II medical devices in jurisdictions like the US (FDA) and EU (MDR), subjecting them to stringent testing, manufacturing controls, and pre-market authorization. Cleansers and moisturizers may fall under cosmetic regulations unless they contain therapeutic active ingredients. This regulatory complexity requires manufacturers to maintain dual compliance and invest heavily in quality management systems to navigate global market entry efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager