Indirect Fired Air Heater Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432373 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Indirect Fired Air Heater Market Size

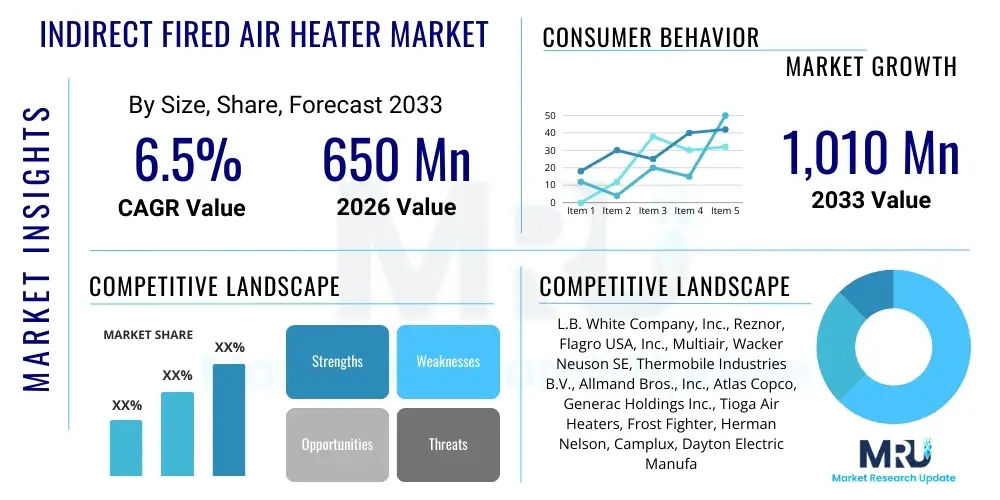

The Indirect Fired Air Heater Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $650 Million in 2026 and is projected to reach $1,010 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by increasing regulatory demands for improved air quality in temporary heating environments, particularly in the construction and rental sectors across developed economies. The increasing adoption of highly efficient, portable heating solutions that prevent combustion byproducts from entering occupied spaces is a key factor driving this substantial valuation increase.

Indirect Fired Air Heater Market introduction

The Indirect Fired Air Heater Market encompasses equipment designed to provide clean, warm air for applications such as space heating, curing, drying, and ventilation, without introducing combustion gases into the heated environment. These systems operate by drawing in fresh air, heating it indirectly via a sealed heat exchanger, and then distributing the warm air. The primary product description centers on highly efficient burners (fueled primarily by natural gas, propane, or diesel) coupled with robust heat exchangers, ensuring thermal separation. Major applications span construction sites needing temporary temperature control for workers and materials, industrial maintenance, agricultural drying processes (e.g., grain), and large-scale commercial event heating where safety and air quality are paramount. The inherent benefits include superior safety due to zero exposure to carbon monoxide (CO) or unburned hydrocarbons, high operational efficiency, and versatility across diverse climatic conditions.

Driving factors for this market expansion include stringent worker safety regulations mandating clean air environments, the burgeoning growth of infrastructure projects globally requiring reliable curing temperatures, and the expanding equipment rental industry which favors durable, high-efficiency heating units for temporary use. Furthermore, technological advancements focusing on improved fuel economy and reduced emissions are making indirect fired heaters a preferred choice over older, less efficient direct fired alternatives. The market is also seeing increased demand driven by cold storage warehousing and military applications that require rapid, clean heating capability without compromising indoor air quality.

The core technology involves precision engineering of the heat exchanger unit to maximize heat transfer efficiency while maintaining structural integrity under high thermal stress. This commitment to engineering excellence is crucial for ensuring the longevity and reliability of these high-value capital goods. The continuous need for non-toxic heating solutions in sensitive environments, such as food processing and hospitals, further solidifies the foundational demand for indirect fired air heaters.

Indirect Fired Air Heater Market Executive Summary

The Indirect Fired Air Heater Market is characterized by robust business trends focusing on digitalization and energy transition, specifically integrating IoT for remote monitoring and shifting towards cleaner fuel sources like natural gas and renewable biofuels. Key business trends include the consolidation of rental fleets, driving demand for heavy-duty, easily maintained units, and significant investment in modular designs that allow for flexible capacity configuration. Regionally, North America and Europe dominate the market due to established safety standards and high activity levels in construction and oil & gas, while the Asia Pacific region is demonstrating the fastest growth propelled by rapid industrialization and modernization of agricultural practices demanding sophisticated drying solutions. Segment trends indicate that natural gas and propane-fueled units are rapidly gaining share over diesel due to lower operating costs and environmental benefits, and the rental segment remains the largest consumer, valuing portability and rapid deployment capabilities. Manufacturers are prioritizing enhanced insulation and thermal efficiency to meet stringent energy consumption targets, thereby driving the competitive landscape toward innovation in heat recovery and combustion optimization.

AI Impact Analysis on Indirect Fired Air Heater Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Indirect Fired Air Heater Market typically revolve around operational efficiency, maintenance predictability, and integration with wider smart construction ecosystems. Users frequently ask: "How can AI reduce fuel consumption in my heater fleet?" "Will AI predict component failure before it happens?" and "Can machine learning optimize the drying processes in variable environmental conditions?" The core themes emerging from these inquiries are centered on achieving proactive maintenance, optimizing complex combustion processes in real-time, and utilizing AI-driven diagnostics to minimize costly downtime, thereby maximizing equipment uptime and return on investment (ROI). Furthermore, there is strong interest in how AI can automate compliance reporting related to emissions and safety standards.

The implementation of AI and Machine Learning (ML) algorithms is poised to fundamentally revolutionize the operational dynamics of indirect fired air heaters. By analyzing massive datasets collected from integrated IoT sensors—including temperature gradients, fuel flow rates, flue gas composition, and fan speeds—AI can construct predictive models for system performance. This capability moves maintenance from scheduled intervals to condition-based actions, identifying subtle degradation in components such as the heat exchanger or burner nozzle long before catastrophic failure occurs. This predictive capability significantly extends the operational lifespan of the equipment and drastically reduces overall ownership costs. Furthermore, AI can fine-tune the air-fuel ratio based on ambient temperature and humidity, optimizing combustion for peak energy efficiency and ensuring compliance with stringent emission regulations.

Beyond maintenance and efficiency, AI’s impact extends into supply chain management and inventory optimization for rental companies. Machine learning models can accurately forecast demand spikes based on weather patterns, regional construction permits, and historical utilization data, ensuring that the right number of units are strategically positioned across various depots. This optimization reduces logistics costs and improves customer service responsiveness. Additionally, AI algorithms are being developed to assist in the initial design phase, simulating various heat exchanger geometries and material combinations to enhance thermal efficiency and durability, accelerating the introduction of next-generation heating technology optimized for specific fuel types.

- AI-driven predictive maintenance forecasts component failure, maximizing equipment uptime.

- Machine Learning optimizes combustion control in real-time, achieving up to 15% improvement in fuel efficiency.

- IoT integration linked with AI enables remote diagnostics and automated performance adjustment based on environmental variables.

- AI algorithms assist in strategic inventory management and demand forecasting for the rental sector.

- Automated reporting generated by AI ensures compliance with environmental and safety regulations (e.g., emission tracking).

DRO & Impact Forces Of Indirect Fired Air Heater Market

The dynamics of the Indirect Fired Air Heater Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting as significant impact forces. A primary driver is the pervasive and non-negotiable requirement for superior indoor air quality in temporary heating applications, particularly in human-occupied environments like construction sites and event venues, which strongly favors indirect heating technology over pollutant-emitting direct-fired options. Concurrently, the increasing scale and pace of global infrastructure development, coupled with extended construction seasons in cold climates, fuels consistent demand for high-capacity, reliable heating units. However, these market expansion forces are mitigated by significant restraints, chiefly the relatively high initial capital expenditure associated with purchasing indirect fired units compared to simpler direct fired counterparts, alongside volatility in fossil fuel prices (diesel and propane) which affects operational budgets for end-users. The market is compelled to address these restraints by capitalizing on key opportunities, such as the development of heaters compatible with renewable natural gas (RNG) and other biofuels, alongside integrating sophisticated telematics and monitoring systems that justify the higher initial cost through substantial long-term operational savings and improved asset utilization rates.

Impact forces currently reshaping the competitive landscape include the swift adoption of stringent environmental protection laws, especially in Western Europe and North America, which necessitates lower NOx and CO emissions from all industrial and commercial equipment, thereby accelerating the replacement cycle of older, less compliant heaters. Furthermore, the rising consumer demand for rental services, driven by capital preservation strategies across industrial and commercial sectors, mandates that manufacturers focus heavily on durability, ease of maintenance, and high portability in their product designs. This rental-centric demand emphasizes equipment resilience against harsh handling and continuous operation. The convergence of safety regulations (the primary driver) and technological advancements (the primary opportunity) dictates that manufacturers must continuously innovate in burner efficiency, heat exchange surface area, and corrosion resistance to maintain market relevance and competitive edge.

Another crucial impact force involves standardization efforts across international borders. As global supply chains become more interconnected, the standardization of connection points, fuel types, and safety certifications simplifies deployment and reduces logistical complexity for multinational rental corporations. The market’s future growth is heavily reliant on manufacturers successfully navigating the transition away from high-carbon fuels while simultaneously delivering cost-effective and highly reliable heating performance. The continuous pursuit of "clean heat" defines the long-term strategic direction, pitting the technological complexity of indirect heating against the economic pressures faced by end-users. Opportunities related to integrated energy solutions, such as pairing indirect heaters with solar or battery systems for auxiliary power, are emerging as key differentiators in high-value, remote application segments.

Segmentation Analysis

The segmentation analysis of the Indirect Fired Air Heater Market provides a granular view of market dynamics based on distinct criteria, helping stakeholders identify high-growth areas and tailored product strategies. The primary segmentation dimensions are based on the core power source (Fuel Type), the thermal output requirement (Capacity), the area of deployment (Application), and the nature of the buyer (End-Use). Analyzing these segments reveals that efficiency and environmental compatibility are the overarching factors influencing buyer preference. For instance, the transition away from diesel towards natural gas/propane is most pronounced in densely regulated urban construction zones, directly reflecting legislative pressure and infrastructure availability. Understanding the interplay between capacity segments and application needs—where high-capacity units are essential for industrial drying while mid-range units serve the general construction rental market—is critical for accurate market forecasting and product portfolio planning.

The market segments are defined by clear functional differences. Fuel type dictates operating costs and environmental impact, while capacity determines the physical size and scale of heat delivery, ranging from small, portable units used in temporary workshops to large, stationary systems for industrial warehouses. The Application segmentation clearly defines the primary demand vectors, with the construction segment historically being the largest consumer due to the necessity of concrete curing and frost protection, followed closely by the industrial and rental segments. The End-Use categorization distinguishes between commercial operators (like rental fleets and small businesses) and heavy industrial users (such as oil & gas or mining), whose purchasing decisions are influenced by asset life cycle and specialized ruggedization requirements.

Strategic success in this market relies on anticipating segment shifts. For example, the increasing mechanization of agriculture in emerging markets is creating a robust, underserved opportunity within the agricultural application segment for specialized, moisture-controlled indirect heating solutions vital for grain drying and livestock housing. Similarly, advancements in electric heating elements, while currently limited by power infrastructure, represent an emerging segment opportunity, particularly for low-to-mid capacity requirements where zero local emissions are critical. Manufacturers must therefore develop modular product lines capable of easily adapting to different fuel sources and capacity needs to capture diverse demand across these segments effectively.

- By Fuel Type:

- Natural Gas

- Propane

- Diesel/Fuel Oil

- Kerosene

- Electric (Emerging)

- By Capacity (BTU/hr):

- Less than 100,000 BTU/hr (Small/Portable)

- 100,000 - 500,000 BTU/hr (Medium/Construction)

- Above 500,000 BTU/hr (Large/Industrial)

- By Application:

- Construction and Infrastructure

- Industrial Manufacturing and Maintenance

- Warehousing and Logistics

- Agriculture (Grain Drying, Livestock)

- Rental and Temporary Heating

- By End-Use:

- Commercial

- Industrial

- Residential/Specialized

Value Chain Analysis For Indirect Fired Air Heater Market

The value chain for the Indirect Fired Air Heater Market begins with rigorous upstream activities involving the sourcing of high-specification raw materials, primarily specialized steel alloys for the heat exchangers (requiring high corrosion and heat resistance), electronic controls, and high-efficiency burner systems. Upstream analysis focuses heavily on supplier stability and quality control, as the heat exchanger's integrity is the core determinant of the heater's safety and lifespan. Manufacturing involves complex assembly and welding processes, demanding skilled labor and specialized fabrication techniques to ensure the airtight separation between combustion gases and circulating clean air. Efficiency gains at this stage are achieved through optimized production layouts and the use of robotic welding to ensure consistency and speed in the fabrication of the pressure vessel and combustion chamber. Quality assurance testing, particularly leakage and combustion efficiency testing, forms a critical checkpoint before the product enters the distribution phase.

The downstream segment is dominated by two primary distribution channels: direct sales to large industrial customers and original equipment manufacturers (OEMs), and indirect distribution through a complex network of authorized dealers and, most importantly, rental equipment companies. The rental channel is immensely powerful, often serving as the primary buyer for construction and commercial segments, valuing equipment longevity and modularity. Direct channels are utilized for highly specialized, fixed installations where customization is necessary. The service component is critical downstream; after-sales support, including preventative maintenance, repair services, and the supply of certified spare parts (particularly for burners and sensors), establishes long-term customer relationships and generates significant recurring revenue for manufacturers and their dealer networks. Successful downstream strategies prioritize accessibility to parts and rapid deployment logistics.

This structure is highly optimized for servicing the dynamic construction and rental sectors. The indirect distribution channel leverages the extensive geographical reach and inventory capacity of major rental corporations, reducing the need for manufacturers to maintain vast, localized inventories. Consequently, product development often incorporates features requested specifically by rental operators, such as ruggedized enclosures, integrated forklift pockets, and standardized control interfaces for ease of use across multiple brands. The reliance on indirect channels means margins are shared, but market penetration is dramatically accelerated, making strong dealer relationships a competitive necessity. Manufacturers must continuously balance the cost of specialized, high-performance components sourced upstream with the price sensitivity of the high-volume downstream rental market.

Indirect Fired Air Heater Market Potential Customers

The primary consumers and buyers (End-Users) of indirect fired air heaters are highly diversified, but share a common critical need for reliable, clean, and often temporary heat supply. The most significant customer segment comprises equipment rental companies, which purchase large fleets of standardized, durable units for seasonal leasing to construction and commercial clients. These customers prioritize total cost of ownership (TCO), durability, ease of transport, and minimal maintenance requirements. Their purchasing decisions are driven by fleet rotation schedules, projected demand based on macroeconomic trends (especially construction spending), and the need for units that comply with a wide array of regional safety and environmental standards. The partnership between manufacturers and major rental players is a defining characteristic of market dynamics.

The second major group consists of construction and infrastructure development firms. These end-users utilize indirect fired heaters for crucial, non-negotiable applications such as protecting fresh concrete from freezing, controlling humidity for drying paints and coatings, and maintaining comfortable working conditions during winter months. While many construction firms rent their equipment, large enterprises often purchase high-capacity, specialized units for continuous, long-duration projects. Their demand is highly inelastic when heating is essential for project timelines, making performance and reliability paramount over upfront cost. Specialized sub-segments within this group include oil and gas exploration companies operating in arctic or remote climates, requiring specialized, explosion-proof, ruggedized units.

Further potential customers include industrial manufacturers, especially those involved in surface finishing, aerospace, and food processing, where heated air is required for drying or curing processes but contaminants cannot be tolerated. Agricultural operations, particularly large-scale grain and seed dryers, represent a growing niche, seeking high-efficiency heaters to manage large volumes of crops post-harvest, minimizing spoilage. Lastly, the commercial sector, including large event organizers, military logistical support, and specialized warehousing facilities, constitutes a consistent demand base, seeking portable solutions for temporary climate control. Marketing strategies must therefore be tailored to address the high TCO sensitivity of rental companies, the reliability demands of industrial users, and the regulatory compliance requirements of construction professionals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 Million |

| Market Forecast in 2033 | $1,010 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L.B. White Company, Inc., Reznor, Flagro USA, Inc., Multiair, Wacker Neuson SE, Thermobile Industries B.V., Allmand Bros., Inc., Atlas Copco, Generac Holdings Inc., Tioga Air Heaters, Frost Fighter, Herman Nelson, Camplux, Dayton Electric Manufacturing Co., Sureflame, Hotsy, Dryair Manufacturing Inc., Toromont Industries Ltd., Airrex USA, Trane Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indirect Fired Air Heater Market Key Technology Landscape

The technological landscape of the Indirect Fired Air Heater Market is rapidly evolving, driven by twin demands for enhanced thermal efficiency and reduced environmental footprint. Core innovations center on advanced heat exchanger design and materials science. Manufacturers are increasingly utilizing corrosion-resistant stainless steel alloys that allow for thinner walls and increased surface area, thus improving heat transfer rates and overall efficiency (often achieving over 85% thermal efficiency) while simultaneously extending the operational lifespan of the unit against corrosive combustion byproducts. The optimization of the combustion chamber itself, employing forced draft burners and sophisticated air-fuel mixing technologies, ensures more complete and cleaner fuel burn, crucial for minimizing harmful emissions like carbon monoxide and nitrogen oxides (NOx), directly addressing mounting regulatory pressure globally. The development of modulating burners, which dynamically adjust output based on ambient conditions and required temperature, is another key advancement contributing to significant fuel savings compared to traditional on/off systems.

A second major technological front is the integration of digital controls and connectivity, moving the market towards "smart heating." Modern indirect fired heaters are equipped with Internet of Things (IoT) sensors for remote monitoring of critical operational parameters, including fuel levels, temperature set points, internal component diagnostics, and geographic location (GPS tracking). This connectivity is vital for the rental market, allowing fleet managers to track asset utilization, monitor performance in real-time, and execute preventive maintenance remotely. Furthermore, sophisticated control panels now feature integrated safety interlocks and fault code diagnostics, simplifying troubleshooting and reducing the need for specialized technicians on site. The adoption of telematics minimizes non-productive downtime and improves the overall asset management strategy for large operators.

Looking ahead, emerging technologies focus on energy diversification and circular economy principles. This includes developing flexible heating systems capable of seamlessly switching between traditional fossil fuels (diesel, natural gas) and newer, sustainable options like renewable diesel or biogas, ensuring future-proofing against shifting energy policies. Another critical area is heat recovery technology. By capturing waste heat from flue gases that would otherwise be exhausted, manufacturers are developing condensation technology in certain applications to pre-heat incoming fresh air, further pushing thermal efficiencies towards 90% or higher. This continuous pursuit of marginal gains in efficiency and operational intelligence defines the competitive edge in the high-capacity industrial heater segment, ensuring that new products offer compelling total cost of ownership advantages over legacy equipment.

Regional Highlights

- North America (NA): North America represents the largest and most mature market for indirect fired air heaters, primarily driven by substantial activity in the construction, oil and gas, and equipment rental sectors across the US and Canada. The region experiences prolonged cold seasons, necessitating reliable, high-output heating solutions for continuous operation. Stringent safety standards, particularly concerning indoor air quality (preventing CO exposure), mandate the use of indirect fired technology in enclosed job sites. The market here is characterized by high adoption rates of large-capacity, diesel and propane-fueled units, though there is a noticeable trend towards natural gas where infrastructure permits, driven by lower fuel costs and reduced emissions focus. The heavy presence of major international rental companies further solidifies the demand structure.

- Europe: Europe is a highly regulated market, leading the way in adopting eco-friendly heating solutions. Growth is primarily spurred by rigorous environmental legislation (such as EU directives on NOx and particulate matter emissions) that favors clean-burning fuels and high-efficiency heat recovery systems. Western Europe, particularly Germany, the UK, and Scandinavia, demonstrates strong demand from civil engineering projects and specialized industrial manufacturing. The emphasis here is not just on safety, but sustainability; therefore, the market shows a strong, early interest in biofuel-compatible and highly energy-efficient indirect fired heaters integrated with advanced remote monitoring systems. The retrofit market, replacing older, less efficient units, also contributes significantly to demand.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth over the forecast period, fueled by massive investments in infrastructure (China, India, Southeast Asia) and modernization of agricultural practices. While lower-cost direct fired heaters still hold significant share, increasing urbanization and the imposition of environmental protection policies in key industrial hubs are driving the shift toward indirect fired solutions, particularly in high-value industrial applications (e.g., curing composite materials or specialized drying). Key drivers include industrial expansion and the necessity for controlled climate environments in manufacturing, though infrastructural limitations for natural gas supply may temporarily sustain the demand for high-quality, mobile diesel units.

- Latin America (LATAM): The Latin American market remains nascent but offers significant potential, mainly centered on resource extraction (mining, oil & gas) and specific construction projects in high-altitude or southern regions (e.g., Chile, Argentina) that experience significant cold weather periods. Market growth is dependent on economic stability and increased foreign investment in large infrastructure projects. Demand is fragmented, often characterized by the need for robust, durable equipment that can withstand challenging logistics and often relies on imported units. Cost sensitivity remains high, favoring basic, high-reliability models that minimize downtime in remote locations.

- Middle East and Africa (MEA): The MEA market, surprisingly, utilizes indirect fired heaters primarily for specialized drying applications (e.g., paint curing in automotive finishing) and for providing cooling/climate control when integrated with HVAC systems in high-humidity or moderate cold desert environments. The major demand driver in the Middle East is the robust oil and gas sector, which requires non-sparking, explosion-proof indirect heating for temporary maintenance shelters and specialized processes. Africa’s demand is concentrated in mining operations and disaster relief, favoring highly portable, self-contained units powered by universally accessible fuels like diesel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indirect Fired Air Heater Market.- L.B. White Company, Inc.

- Reznor

- Flagro USA, Inc.

- Multiair

- Wacker Neuson SE

- Thermobile Industries B.V.

- Allmand Bros., Inc.

- Atlas Copco

- Generac Holdings Inc.

- Tioga Air Heaters

- Frost Fighter

- Herman Nelson

- Camplux

- Dayton Electric Manufacturing Co.

- Sureflame

- Hotsy

- Dryair Manufacturing Inc.

- Toromont Industries Ltd.

- Airrex USA

- Trane Technologies

Frequently Asked Questions

Analyze common user questions about the Indirect Fired Air Heater market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between direct and indirect fired air heaters?

The primary difference lies in air purity. Direct fired heaters introduce all combustion byproducts (including CO, CO2, and moisture) directly into the heated space, maximizing efficiency but compromising air quality. Indirect fired heaters use a sealed heat exchanger, exhausting combustion gases separately through a flue, ensuring only clean, breathable air enters the environment, which is crucial for human-occupied spaces and sensitive materials.

Which fuel type is dominating the Indirect Fired Air Heater Market and why?

Diesel/Fuel Oil traditionally dominated due to portability and universal accessibility, especially on remote construction sites. However, Natural Gas and Propane are rapidly gaining dominance, particularly in North America and Europe, due to lower operational costs, cleaner combustion (fewer emissions), and increasing regulatory pressure favoring less polluting heating solutions.

What safety features are mandatory for indirect fired air heaters?

Mandatory safety features include flame monitoring and lockout controls, high-limit temperature shutdowns to prevent overheating of the heat exchanger, robust heat exchanger integrity testing (to prevent gas leakage), and pressure relief systems. Modern units often incorporate advanced features like airflow sensors and integrated safety diagnostics to ensure proper ventilation and functioning.

How is IoT technology improving the efficiency of rental indirect fired heaters?

IoT integration allows rental companies to remotely monitor fuel consumption, usage hours, location (via GPS), and diagnostic fault codes in real-time. This technology is crucial for optimizing logistics, scheduling preventative maintenance accurately, preventing theft, and providing customers with consumption data, significantly improving fleet asset utilization and reducing unexpected service calls.

What is the typical lifespan and maintenance requirement for a commercial indirect fired heater?

A high-quality commercial indirect fired heater typically has a lifespan of 10 to 15 years, heavily dependent on the quality of the heat exchanger material (usually stainless steel). Maintenance primarily involves annual burner servicing, cleaning the heat exchanger surfaces to maintain thermal efficiency, and periodic checks of fuel delivery systems and electronic controls. Predictive maintenance based on sensor data is minimizing reactive repairs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager