Indium and Indium Alloy Foils Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435065 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Indium and Indium Alloy Foils Market Size

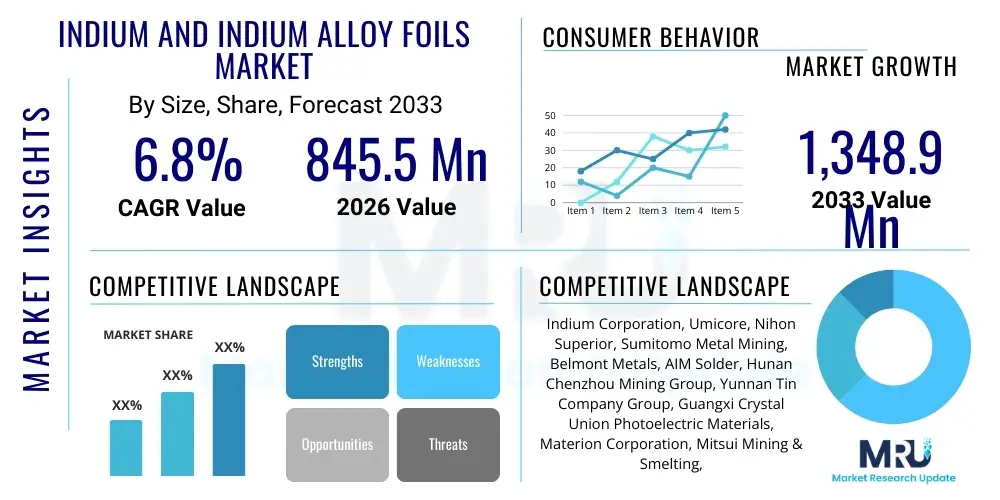

The Indium and Indium Alloy Foils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 845.5 Million in 2026 and is projected to reach USD 1,348.9 Million by the end of the forecast period in 2033.

Indium and Indium Alloy Foils Market introduction

The Indium and Indium Alloy Foils Market encompasses the production, processing, and application of high-purity metallic indium and its alloys—such as Indium-Tin (InSn) and Indium-Silver (InAg)—formed into thin, flexible sheets or films. These foils are essential intermediary products primarily valued for their exceptionally low melting points, superior thermal conductivity, ductility, and resistance to cryogenic temperatures. Indium is often utilized as a pure element (typically 99.999% or higher purity) for specialized sealing applications, particularly in vacuum systems and cryogenics, where its ability to conform to surface irregularities ensures an airtight seal at extremely low temperatures.

The core application driving demand for these foils is the electronics industry, where they serve as critical components in thermal management solutions and high-performance solders. Indium-based thermal interface materials (TIMs) are increasingly replacing traditional greases in high-power semiconductor devices, CPUs, and GPUs due to their stable, non-migrating properties and high thermal dissipation capacity, crucial for maintaining optimal performance in advanced computing architectures. Furthermore, indium alloys are fundamental in the production of CIGS (Copper Indium Gallium Selenide) thin-film photovoltaic cells, offering a pathway toward more cost-effective and flexible solar energy solutions, representing a significant long-term growth vector for the market.

Key driving factors include the relentless miniaturization of electronic devices, necessitating efficient heat dissipation in confined spaces, and the global push toward renewable energy sources, specifically solar power. The benefits derived from using indium foils—such as enhanced device reliability, improved system longevity due to stable thermal performance, and compliance with high-purity standards required in semiconductor fabrication—cement their status as irreplaceable materials in advanced technological manufacturing processes. The market's complexity stems from the specialized manufacturing processes required to achieve the necessary thickness tolerances and ultra-high purity levels demanded by end-users in sensitive environments.

Indium and Indium Alloy Foils Market Executive Summary

The Indium and Indium Alloy Foils Market is characterized by robust growth, primarily fueled by sustained demand from the advanced semiconductor and renewable energy sectors. Business trends indicate a heightened focus on upstream integration and securing stable raw material supply, as indium is a byproduct of zinc refining, leading to inherent price volatility and supply chain complexities. Companies are investing heavily in refining technologies to achieve 5N (99.999%) and 6N (99.9999%) purity grades, a critical competitive differentiator, especially for applications in advanced packaging and cryogenic sealing. The competitive landscape is moderately consolidated, with a few specialized material producers dominating high-ppurity segments, focusing on custom foil specifications tailored to specific client needs.

Regionally, the Asia Pacific (APAC) continues its dominance, driven by the massive concentration of semiconductor manufacturing, display fabrication (LCDs and OLEDs), and CIGS solar panel production facilities, particularly in China, South Korea, and Taiwan. North America and Europe, while smaller in volume, exhibit strong growth in high-value, niche applications such as aerospace, defense electronics, and superconducting materials, often demanding extremely customized foil configurations and rigorous quality control standards. These regions are also leading in R&D for advanced thermal solutions, pushing the boundaries of Indium alloy compositions for next-generation computing hardware.

Segment trends highlight the rapidly expanding application of Indium alloy foils in thermal interface materials (TIMs), surpassing traditional solders in growth rate due to the increasing thermal density of modern microprocessors. The purity segment, particularly 5N and above, is experiencing the fastest revenue growth, reflecting the strict material requirements of leading-edge semiconductor processes like 3D NAND and high-performance computing (HPC). Thickness segmentation shows a preference for ultra-thin foils (below 50 micrometers), crucial for maximizing the heat transfer efficiency in compact device designs and minimizing overall thermal resistance in complex stacked architectures.

AI Impact Analysis on Indium and Indium Alloy Foils Market

Common user questions regarding AI's influence on the Indium and Indium Alloy Foils Market center on two primary themes: the direct increase in material demand driven by AI hardware, and the utilization of AI/ML tools to optimize material production and supply chain resilience. Users frequently inquire about how the exponential growth in data centers, AI accelerators (GPUs, ASICs), and specialized high-performance computing (HPC) systems translates into specific material needs for thermal management. They also question the potential for AI algorithms to mitigate the inherent volatility and supply risk associated with Indium, a critical raw material. The prevailing expectation is that AI will act as both a massive demand generator for high-specification indium alloy foils used in advanced thermal interface solutions and an enabler for more efficient, high-purity foil manufacturing processes, particularly in defect detection and process control.

The operational efficiency aspect of AI is crucial. AI-driven predictive maintenance and quality assurance systems can monitor parameters during the rolling and annealing processes of indium foils, ensuring consistent thickness and minimal defects—vital requirements for semiconductor and vacuum sealing applications. Furthermore, the immense energy consumption and heat generation of AI servers necessitate extremely high-performance thermal management solutions, directly driving the adoption of indium foil TIMs, which offer superior wet-out and thermal conductivity compared to conventional materials. The transition to advanced packaging techniques (like chiplets and 2.5D/3D integration) requires highly reliable thermal interfaces, where the metallic characteristics of indium foils provide an essential performance edge, pushing market specifications toward higher thermal transfer coefficients (W/mK).

This dual impact positions AI as a powerful catalyst for market growth and maturity. The demand surge from sectors building the AI infrastructure (e.g., NVIDIA, AMD, Google, Amazon Web Services) ensures sustained high-volume consumption of high-purity indium alloys. Simultaneously, AI tools implemented by manufacturers (e.g., Indium Corporation, Umicore) enhance process control, leading to higher yields of ultra-high purity foils, which helps stabilize the cost structure and quality consistency required by highly sensitive downstream customers. The synergy between high-demand applications and optimized production techniques forms the core theme of AI's influence on this niche material market.

- AI-driven hardware acceleration increases demand for high-performance Indium alloy Thermal Interface Materials (TIMs).

- Advanced cooling requirements in data centers and HPC clusters favor metallic Indium foils over conventional thermal greases.

- AI algorithms are deployed for process optimization, defect detection, and ensuring ultra-high purity (5N/6N) during foil manufacturing.

- AI-enhanced supply chain analytics help forecast and manage the price volatility and availability of Indium, a critical byproduct material.

- Increased adoption of advanced semiconductor packaging (3D stacking) relies on the ductility and reliability of Indium foils for thermal dissipation.

DRO & Impact Forces Of Indium and Indium Alloy Foils Market

The dynamics of the Indium and Indium Alloy Foils Market are governed by a critical interplay between technological progress in electronics (Driver), the fundamental scarcity of the raw element (Restraint), and expanding applications in specialized high-growth sectors (Opportunity). The primary driver is the pervasive and increasing need for high-efficiency thermal management in miniaturized and high-power density electronics, particularly in the semiconductor, aerospace, and defense industries, where thermal runaway is a critical failure mode. However, the market faces significant constraints due to the inherent geological characteristics of indium; it is only available as a byproduct of zinc refining, leading to supply instability and high price sensitivity based on zinc production cycles. This supply limitation forces downstream users to explore alternative materials, representing a core restraint on unfettered market expansion. Conversely, opportunities arise from the proliferation of advanced vacuum sealing technology (requiring pure indium gaskets for extreme environments like fusion reactors or deep space missions) and the growing adoption of CIGS thin-film solar technology, which offers a vast, long-term consumption base outside traditional electronics.

Impact forces within this market are shaped by both external economic factors and internal technological breakthroughs. The bargaining power of suppliers is moderate to high, primarily due to the limited number of producers capable of achieving 5N+ purity levels required by high-tech sectors, giving specialized refiners leverage over material specifications and cost. The threat of substitutes is persistent but low in highly specialized, cryogenic environments where Indium's specific physical properties (superconductivity and extreme ductility at low temperatures) are unmatched by materials like gold, silver, or lead alloys. However, for less demanding thermal applications, substitutes like polymer-matrix phase-change materials pose a viable alternative, influencing pricing pressure in certain market segments. Industry rivalry is competitive, focused less on broad price competition and more on developing proprietary alloy compositions, achieving tighter tolerance controls (e.g., thickness uniformity), and providing technical support to navigate complex integration challenges faced by semiconductor clients.

Technological advancement acts as a positive force, driving demand by enabling applications that previously were impossible. For instance, the transition to high-frequency 5G and 6G infrastructure requires thermal solutions that can handle instantaneous heat spikes, favoring Indium foils. Furthermore, regulatory forces, specifically those pushing for reduced reliance on toxic materials (like lead in solders), inadvertently boost the demand for Indium and its alloys as environmentally safer alternatives. The market is thus poised between the upward pressure from technological necessity and the downward pressure imposed by raw material scarcity, necessitating continuous innovation in recycling and material efficiency to sustain projected growth rates throughout the forecast period.

Segmentation Analysis

The Indium and Indium Alloy Foils Market is primarily segmented based on the critical characteristics that determine product suitability for high-technology applications: Purity Level, Foil Thickness, Alloy Composition, and End-Use Application. Purity segmentation (3N, 4N, 5N, 6N) is the most critical differentiator, as the sensitivity of semiconductor processes dictates the minimum acceptable metal purity, directly influencing pricing and manufacturing complexity. Foil thickness segmentation ranges from ultra-thin sheets (less than 50 micrometers), utilized in advanced semiconductor thermal pads for minimal bond line thickness, to thicker gaskets (hundreds of micrometers) used for durable vacuum seals. Alloy composition segments primarily distinguish between pure indium, used for specialized sealing, and various alloys like Indium-Tin (InSn), commonly used for low-temperature soldering and thermal management applications, and specialized alloys developed for cryogenic or high-stress environments.

The End-Use Application segment provides the clearest view of market demand allocation. Semiconductor and electronics manufacturing constitute the largest consumer base, driven by the persistent need for effective heat dissipation in CPUs, memory modules, and specialized processing units. The Solar Energy sector, particularly CIGS thin-film technology, represents a fast-growing, high-volume segment, utilizing indium as a fundamental component of the photovoltaic absorber layer. Other significant applications include specialized sealing for high-vacuum equipment (e.g., Particle accelerators, R&D equipment), aerospace, and medical imaging devices (MRI, CT scanners) where reliable low-temperature performance is non-negotiable. Geographic segmentation highlights the demand center concentration, with APAC dominating both manufacturing and consumption.

- By Purity Level:

- 3N (99.9%)

- 4N (99.99%)

- 5N (99.999%) - High-Growth Segment

- 6N (99.9999%) and above - Ultra-High Purity

- By Foil Thickness:

- < 50 Micrometers (Ultra-Thin)

- 50 µm to 150 µm (Standard Thin)

- > 150 Micrometers (Thick Gaskets/Seals)

- By Alloy Composition:

- Pure Indium Foils

- Indium-Tin Alloys (InSn)

- Indium-Silver Alloys (InAg)

- Other Specialized Indium Alloys (e.g., InBi, InGa)

- By End-Use Application:

- Semiconductors and Electronics (Thermal Management/Soldering)

- Solar Energy (CIGS Technology)

- Cryogenic and Vacuum Sealing

- Aerospace and Defense

- Medical Devices

- Display Technology (Sputtering Targets Precursors)

Value Chain Analysis For Indium and Indium Alloy Foils Market

The value chain for Indium and Indium Alloy Foils begins fundamentally in the upstream sector with mining and primary refining. Indium is not mined as a standalone resource but is extracted primarily as a byproduct during the electrolytic refining of zinc, and to a lesser extent, lead and copper ores. This dependency on base metal production inherently limits primary indium supply. The subsequent refining process is critical, involving specialized solvent extraction and zone refining techniques to elevate purity levels from commercial grade (3N) to ultra-high purity grades (5N or 6N), a complex, energy-intensive, and capital-demanding process performed by highly specialized refiners. Secure long-term contracts with zinc smelters are essential for maintaining supply stability in this upstream segment, influencing raw material costs significantly throughout the entire chain.

The midstream segment involves the physical transformation of high-purity ingots into foils. This step utilizes precision manufacturing processes such as vacuum melting, hot and cold rolling, slitting, and annealing, requiring strict environmental control to prevent contamination. Manufacturers must possess advanced metallurgical expertise to control grain structure, ensure uniform thickness, and maintain surface quality, particularly for ultra-thin foils used in advanced packaging. The distribution channel is often direct-to-manufacturer (indirect distribution through specialized chemical distributors is less common for ultra-high purity foils) due to the highly customized specifications and stringent quality controls required by high-tech customers. Direct channels ensure maximum transparency, traceability, and technical support regarding material handling and integration.

The downstream analysis focuses on the integration and consumption phase. Potential customers include large-scale semiconductor fabricators (Fabs), OSAT (Outsourced Semiconductor Assembly and Test) providers, CIGS solar panel manufacturers, and specialized cryogenic equipment builders. The market is buyer-driven at this stage, with procurement decisions heavily influenced by material certification, thermal performance data, and reliability testing. Final product integration, whether as a thermal pad applied to a CPU or as a gasket in a UHV (Ultra-High Vacuum) system, completes the value chain, where the performance of the indium foil directly impacts the operational lifespan and reliability of the high-value end-device. The specialized nature of the product minimizes the role of indirect distribution, emphasizing a highly technical and tailored sales process.

Indium and Indium Alloy Foils Market Potential Customers

The primary potential customers and end-users of Indium and Indium Alloy Foils are sophisticated industrial entities operating within high-technology manufacturing ecosystems, where material purity, thermal efficiency, and mechanical reliability are paramount. Semiconductor manufacturers and packaging houses represent the largest and most critical buyer group. These customers utilize indium alloy foils as high-performance Thermal Interface Materials (TIMs) for advanced CPUs, GPUs, FPGAs, and 3D stacked memory modules, seeking to dissipate extreme heat fluxes generated by AI and HPC applications. The decision criteria for these buyers focus intensely on thermal conductivity (W/mK), consistent bond line thickness (BLT), and long-term stability under thermal cycling.

A rapidly expanding customer base is found within the Renewable Energy sector, specifically producers of Copper Indium Gallium Selenide (CIGS) thin-film solar panels. CIGS technology offers advantages in flexibility and efficiency, and these manufacturers require large volumes of indium in various forms, including foil precursors, for the deposition process. Furthermore, specialized vacuum and cryogenic technology firms—including those supplying research facilities, particle accelerators, and satellite components—are essential buyers of pure indium foils. These firms rely on the exceptional ductility and low-temperature sealing capability of indium gaskets to ensure hermetic seals in environments operating near absolute zero or under extreme vacuum conditions, where conventional elastomeric seals fail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 845.5 Million |

| Market Forecast in 2033 | USD 1,348.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Indium Corporation, Umicore, Nihon Superior, Sumitomo Metal Mining, Belmont Metals, AIM Solder, Hunan Chenzhou Mining Group, Yunnan Tin Company Group, Guangxi Crystal Union Photoelectric Materials, Materion Corporation, Mitsui Mining & Smelting, Shenzhen Huaqiao Technology, Japan Metal & Chemicals, Dowa Metals & Mining, PAM-XIAMEN |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indium and Indium Alloy Foils Market Key Technology Landscape

The technological landscape of the Indium and Indium Alloy Foils Market is dominated by processes centered around achieving ultra-high purity and precise dimensional control, both critical for high-reliability applications. The initial and most foundational technology is Ultra-High Purity Refining, primarily utilizing zone refining and electrolytic methods. Zone refining is indispensable for reaching 5N and 6N purity levels, which is crucial for minimizing electrical and thermal resistivity in semiconductor applications. Any metallic impurity at these levels can severely degrade device performance, driving continuous investment into multi-stage refining processes and real-time elemental analysis using techniques like ICP-MS (Inductively Coupled Plasma Mass Spectrometry) to ensure material integrity.

Following refining, the transformation of ingots into foils relies on advanced metallurgical processing, particularly Precision Rolling and Slitting technologies. To achieve the required thinness (often less than 50 µm) while maintaining thickness uniformity across the entire width of the foil, manufacturers employ specialized cold rolling mills with sophisticated gauge control systems. These systems utilize laser or X-ray sensors to measure and adjust thickness tolerances in real time. Defect-free surfaces are paramount for optimal thermal contact and sealing integrity, requiring cleanroom environments and advanced surface inspection technologies, often supplemented by AI-driven vision systems for microscopic defect detection and automated rejection of non-conforming materials. The development of proprietary annealing processes is also key, as annealing determines the final mechanical properties, such as ductility and softness, essential for the foil to conform effectively to irregular surfaces.

Furthermore, alloy development and composite material integration represent emerging technology areas. Researchers are continuously optimizing Indium alloy compositions (e.g., varying ratios of In, Sn, Ag, and Bi) to achieve tailored melting points, improved shear strength, or enhanced thermal cycling reliability for specific end-use environments, such as aerospace temperature extremes. Specialized bonding techniques, including diffusion bonding and vacuum soldering processes, are also part of the technical ecosystem, allowing the seamless integration of these foils onto copper or aluminum heat sinks. The convergence of ultra-high purity material science with nanometer-level precision manufacturing remains the core technological challenge and competitive advantage in this sophisticated materials market.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned leader in the Indium and Indium Alloy Foils Market, commanding the largest market share due to its status as the global hub for electronics manufacturing, semiconductor fabrication (foundries and OSAT), and display panel production (OLED/LCD). Countries like China, South Korea, Taiwan, and Japan are home to the largest consumers of high-purity Indium foils for thermal management and advanced packaging. Furthermore, APAC dominates the global production of CIGS thin-film solar cells, ensuring strong sustained demand. The region benefits from both high consumption and significant raw material refining and processing capacity, leading to competitive pricing structures and streamlined supply chains.

- North America: North America represents a critical, high-value market focused on specialized, niche applications requiring the absolute highest purity levels and customization. Key drivers include the defense and aerospace industries, demanding Indium foils for specialized radiation shielding and cryogenic sealing in missile guidance systems and spacecraft. The region is also a major consumer for advanced packaging R&D and high-performance computing (HPC) data center infrastructure, utilizing Indium alloy TIMs for flagship CPUs and AI accelerators. Innovation centers here drive the demand for next-generation alloy compositions and extremely tight dimensional tolerances.

- Europe: The European market is characterized by strong demand from industrial sealing applications, particularly in large-scale physics research (e.g., CERN, fusion reactors) and high-vacuum equipment manufacturing. The automotive electronics sector, driven by stricter thermal requirements for electric vehicle battery management systems and autonomous driving sensors, is an emerging growth area for Indium alloy thermal foils. Europe maintains significant expertise in specialized material science and precision engineering, focusing on sustainability and circular economy principles, leading to higher adoption rates of Indium recycling technologies.

- Latin America, Middle East, and Africa (LAMEA): While smaller in scale, the LAMEA region shows potential growth tied to infrastructure development and nascent solar energy projects. Demand is primarily driven by imported electronics and limited local manufacturing capacity, with most consumption focused on industrial maintenance, specialized soldering, and regional electronics repair centers. Key opportunities exist in utility-scale solar installations and specialized oil and gas exploration equipment requiring reliable sealing materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indium and Indium Alloy Foils Market.- Indium Corporation

- Umicore

- Nihon Superior Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Belmont Metals Inc.

- AIM Solder

- Hunan Chenzhou Mining Group Co., Ltd.

- Yunnan Tin Company Group Limited

- Guangxi Crystal Union Photoelectric Materials Co., Ltd.

- Materion Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Shenzhen Huaqiao Technology Co., Ltd.

- Japan Metal & Chemicals Co., Ltd. (JMC)

- Dowa Metals & Mining Co., Ltd.

- PAM-XIAMEN (Powerway Advanced Material Co., Ltd.)

- Fusion Inc.

- Alpha Assembly Solutions (MacDermid Enthone Industrial Solutions)

- TANAKA Kikinzoku Kogyo K.K.

- SCM Metal Products Inc.

- QS Advanced Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Indium and Indium Alloy Foils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the increased adoption of Indium alloy foils in modern electronics?

The primary driver is the necessity for high-efficiency thermal management in miniaturized, high-power density semiconductor devices. Indium alloy foils serve as superior Thermal Interface Materials (TIMs), offering low thermal resistance and excellent conformability, crucial for cooling CPUs, GPUs, and advanced 3D packaging architectures effectively.

How does the purity level of Indium foils affect their application and market value?

Purity level, typically 5N (99.999%) or 6N (99.9999%), directly correlates with application sensitivity and market price. Ultra-high purity Indium is mandatory for high-reliability semiconductor and cryogenic sealing applications, where minute impurities can significantly degrade electrical, thermal, and mechanical performance, thus commanding premium pricing.

What are the main risks associated with the Indium supply chain?

The main risk is supply instability and price volatility, as Indium is obtained solely as a byproduct of zinc refining. Its supply is inelastic relative to demand, meaning fluctuations in global zinc production cycles directly impact Indium availability and cost, posing continuous challenges for procurement managers.

Beyond electronics, which emerging application segments utilize Indium and Indium Alloy Foils?

Key emerging segments include the Solar Energy sector, specifically Copper Indium Gallium Selenide (CIGS) thin-film photovoltaic cells, and the advanced aerospace and defense industries, where pure Indium foils are used for robust, low-temperature, and vacuum-tight seals and gaskets in critical instruments and propulsion systems.

What differentiates Indium alloy foils from traditional thermal management materials like thermal grease?

Indium alloy foils offer superior long-term stability, higher thermal conductivity, and do not suffer from pump-out or dry-out issues common with thermal greases. As a metallic TIM, Indium provides a consistent, highly reliable thermal pathway across interfaces, maintaining performance integrity even after extreme thermal cycling or long operational periods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager